UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE

14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed

by the Registrant |

☒ |

| Filed

by a Party other than the Registrant |

☐ |

Check

the appropriate box:

| ☒ |

Preliminary

Proxy Statement |

| ☐ |

Confidential,

for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive

Proxy Statement |

| ☐ |

Definitive

Additional Materials |

| ☐ |

Soliciting

Material Pursuant to §240.14a-12 |

Glucotrack,

Inc.

(Name of Registrant as Specified In Its Charter)

| |

|

|

| |

(Name

of Person(s) Filing Proxy Statement, if other than the Registrant) |

|

Payment

of Filing Fee (Check the appropriate box):

| ☒ |

No

fee required. |

| |

|

| ☐ |

Fee

paid previously with preliminary materials. |

| |

|

| ☐ |

Fee

computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

301

Rte 17 North, Suite 800

Rutherford, NJ 07070

NOTICE

OF SPECIAL MEETING OF STOCKHOLDERS

To Be Held On [ ], 2024

To

the Stockholders of Glucotrack, Inc:

Notice

is hereby given that a special meeting of stockholders (the “Special Meeting”) of Glucotrack, Inc., a Delaware corporation

(the “Company”), will be held at 301 Rte 17 North, Suite 800, Rutherford, New Jersey 07070 on [ ], 2024, at [ ]

a.m. (Eastern time), for the following purposes (which are more fully described in the Proxy Statement, which is attached and made a

part of this Notice):

| 1. | To

approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of

shares of common stock issuable by the Company upon conversion of the Note (as defined below)

and the Warrants (as defined below) (the “Note and Warrant Share Issuance Proposal”); |

| | | |

| 2. | To

adopt and approve a proposal to adjourn the Special Meeting to a later date or dates, if

necessary, to permit further solicitation and vote of proxies if it is determined by the

Company that more time is necessary or appropriate to approve one or more proposals at the

Special Meeting (the “Adjournment Proposal”); and |

| | | |

| 3. | To

transact such other business as may properly come before the Special Meeting. |

The

Board of Directors unanimously recommends that stockholders vote “FOR” the Note and Warrant Share Issuance Proposal and the

Adjournment Proposal. The Board of Director’s reasons for seeking approval of each of the proposals are set forth in the attached

Proxy Statement. The Company does not expect a vote to be taken on any other matters at the Special Meeting or any adjournment or postponement

thereof.

Stockholders

of record at the close of business on [ ], 2024 are entitled to notice of, and to attend and to vote at, the Special Meeting and any

postponement or adjournment thereof.

You

are cordially invited to attend the Special Meeting in person. Whether or not you expect to attend, our Board of Directors respectfully

requests that you vote your stock in the manner described in the Proxy Statement. You may revoke your proxy in the manner described in

the Proxy Statement at any time before it has been voted at the meeting.

| By

Order of the Board of Directors of |

|

| Glucotrack,

Inc. |

|

| Sincerely, |

|

| |

|

|

|

Paul Goode

Chief Executive Officer |

|

Rutherford,

New Jersey

[ ], 2024

TABLE

OF CONTENTS

GLUCOTRACK,

INC.

PROXY

STATEMENT

FOR THE SPECIAL MEETING OF STOCKHOLDERS

To Be Held On [ ], 2024

The

following information is furnished to each stockholder in connection with the foregoing Notice of Special Meeting of Stockholders of

Glucotrack, Inc., a Delaware corporation, to be held at 301 Rte 17 North, Suite 800, Rutherford, New Jersey 07070 on [ ],

2024, at [ ] a.m. (Eastern time). The enclosed proxy is for use at the special meeting of stockholders (the “Special

Meeting”) and any postponement or adjournment thereof. Unless the context requires otherwise, references to “Glucotrack,”

“the Company,” “we,” “our,” and “us” in this Proxy Statement refer to Glucotrack,

Inc.

In

accordance with the Bylaws of the Company (as they may be amended, supplemented or otherwise modified from time to time, the “Bylaws”),

the Special Meeting has been called for the following purposes:

| 1. | To

approve, for purposes of complying with Nasdaq Listing Rule 5635(d), the full issuance of

shares of common stock issuable by the Company upon conversion of the Note (as defined below)

and the Warrants (as defined below) (the “Note and Warrant Share Issuance Proposal”); |

| | | |

| 2. | To

adopt and approve a proposal to adjourn the Special Meeting to a later date or dates, if

necessary, to permit further solicitation and vote of proxies if it is determined by the

Company that more time is necessary or appropriate to approve one or more proposals at the

Special Meeting (the “Adjournment Proposal”); and |

| | | |

| 3. | To

transact such other business as may properly come before the Special Meeting. |

Stockholders

of record at the close of business on [ ], 2024 are entitled to notice of, and to attend and to vote at, the Special Meeting and any

postponement or adjournment thereof. We intend to mail this Proxy Statement, together with a proxy card, on or about [ ], 2024 to all

stockholders entitled to vote at the Special Meeting.

Questions

and Answers about the Special Meeting and Voting

| Q: | Who

may attend the Special Meeting? |

| | |

| A: | Attendance

at the Special Meeting will be limited to those persons who were stockholders, or held Glucotrack

stock through a broker, bank or other nominee, at the close of business on [ ], 2024,

the Record Date for the Special Meeting. To attend the Special Meeting, you will need to

pre-register as instructed on your Proxy Card or Voter Instruction Card and print out the

attendance ticket. You will be required to show the attendance ticket as well as photo identification

to enter the Special Meeting. |

| | |

| Q: | Who

may vote at the Special Meeting? |

| | |

| A: | Our

Board of Directors set [ ], 2024 as the Record Date for the Special Meeting. If you owned

shares of our common stock at the close of business on [ ], 2024, you may attend and vote

at the Special Meeting. Each stockholder is entitled to one vote for each share of common

stock held on all matters to be voted on. As of July 30, 2024, there were 5,531,164 shares

of our common stock outstanding and entitled to vote at the Special Meeting. |

| | |

| Q: | How

do I vote my shares if I hold my shares through a broker rather than directly? |

| | |

| A: | If

your shares are registered directly in your name with our transfer agent, Equiniti Trust

Company, LLC, you are considered, with respect to those shares, a stockholder of record.

As a stockholder of record, you have the right to vote in person at the Special Meeting. |

If

your shares are held in a brokerage account, bank or by another nominee or trustee, you are considered the beneficial owner of shares

held in “street” name. In that case, the proxy materials have been forwarded to you by your broker, bank or other holder

of record who is considered, with respect to those shares, the stockholder of record. As the beneficial owner, you have the right to

direct your broker, bank or other holder of record on how to vote your shares by using the voting instructions included in the proxy

materials. As the beneficial owner, you are also invited to attend the Special Meeting, but because the beneficial owner is not the stockholder

of record, you may not vote these shares in person at the Special Meeting unless you obtain a “legal proxy” from the broker,

bank, nominee, or trustee that holds your shares, giving you the right to vote the shares at the Special Meeting.

As

indicated above, if your shares are held in “street” name by a broker, bank, or other nominee, they should send you instructions

that you must follow in order to have your shares voted at the Special Meeting. If you hold shares in your own name, you may vote by

proxy in any one of the following ways:

| ● | Via

the Internet by accessing the proxy materials on the secured website www.proxyvote.com

and following the voting instructions on that website; |

| | | |

| ● | Via

telephone by calling toll free 1-800-690-6903 and following the recorded instructions; or |

| | | |

| ● | By

completing, dating, signing and returning the Proxy Card. |

The

Internet and telephone voting procedures are designed to authenticate stockholders’ identities by use of a control number to allow

stockholders to vote their shares and to confirm that stockholders’ instructions have been properly recorded. Voting via the Internet

or telephone must be completed by 11:59 PM EDT on [ ], 2024. Of course, you can always come to the meeting and vote your shares in person.

If you submit or return a Proxy Card without giving specific voting instructions, your shares will be voted as recommended by our board

of directors, as permitted by law.

| Q: | How

will my shares be voted? |

| | |

| A: | All

shares which are entitled to vote and represented by a properly completed, executed and delivered

proxy received before the Special Meeting and not revoked will be voted at the Special Meeting

as instructed by you in a proxy delivered before the Special Meeting. If you do not indicate

how your shares should be voted on a matter, the shares represented by your proxy will be

voted “FOR” the Note and Warrant Issuance Proposal and the Adjournment Proposal,

and with regard to any other matters that may be properly presented at the Special Meeting

and all matters incident to the conduct of the meeting. All votes will be tabulated by the

inspector of election appointed for the meeting, who will separately tabulate affirmative

and negative votes, abstentions and broker non-votes. |

| | |

| Q: | Is

my vote confidential? |

| | |

| A: | Yes,

your vote is confidential. The only persons who have access to your vote are the inspector

of election, individuals who help with processing and counting your votes, and persons who

need access for legal reasons. Occasionally, stockholders provide written comments on their

proxy cards, which may be forwarded to the Company’s management and the Board. |

| | |

| Q: | What

is the quorum requirement for the Special Meeting? |

| | |

| A: | One

third (1/3) of our outstanding shares of capital stock entitled to vote, as of the record

date, must be present at the Special Meeting in person or by proxy in order for us legally

to hold the Special Meeting and conduct business. This is called a quorum. Your shares will

be counted as present at the Special Meeting if you: |

| ● | Are

present and entitled to vote in person at the Special Meeting; or |

| | | |

| ● | Properly

submitted a Proxy Card or Voter Instruction Card. |

If

you are present in person or by proxy at the Special Meeting but withhold your vote or abstain from voting on any or all proposals, your

shares are still counted as present and entitled to vote for purposes of establishing a quorum. Broker non-votes are not counted for

determining whether a quorum exists. Broker non-votes occur when a person holding shares in street name, such as through a brokerage

firm, does not provide instructions as to how to vote those shares, but the broker submits that person’s proxy nonetheless. The

proposals listed in this Proxy Statement state the votes needed to approve the proposed actions.

| Q: | What

proposals will be voted on at the Special Meeting? |

| | |

| A: | The

following proposals will be voted on at the Special Meeting: |

| ● | The

approval, for purposes of complying with Nasdaq Listing Rule 5635(d), of the full issuance

of shares of common stock issuable by the Company upon conversion of the Note and the Warrants

(the “Note and Warrant Share Issuance Proposal”); and |

| | | |

| ● | To

adjourn the Special Meeting to a later date or dates, if necessary, to permit further solicitation

and vote of proxies if it is determined by the Company that more time is necessary or appropriate

to approve one or more proposals at the Special Meeting (the “Adjournment Proposal”). |

| Q: | What

are the recommendations of the Board of Directors? |

| | |

| A: | The

Board of Directors unanimously recommends that you vote: |

| ● | “FOR”

the Note and Warrant Share Issuance Proposal; and |

| | | |

| ● | “FOR”

the Adjournment Proposal. |

| Q: | What

does it mean to vote by proxy? |

| | |

| A: | When

you vote “by proxy,” you grant another person the power to vote stock that you

own. If you vote by proxy in accordance with this Proxy Statement, you will have designated

proxy holders for the Special Meeting. |

Any

proxy given pursuant to this solicitation and received in time for the Special Meeting will be voted in accordance with your specific

instructions. If you provide a proxy, but you do not provide specific instructions on how to vote on each proposal, the proxy holder

will vote your shares “FOR” the Note and Warrant Issuance Proposal and the Adjournment Proposal. With respect to any other

proposal that properly comes before the Special Meeting, the proxy holders will vote in their own discretion according to their best

judgment, to the extent permitted by applicable laws and regulations.

| Q: | What

are the voting rights of stockholders? |

| | |

| A: | Each

share of our common stock outstanding on the Record Date entitles its holder to cast one

vote on each matter to be voted on. No dissenters’ rights are provided under the Delaware

General Corporation Law, our articles of incorporation or our Bylaws with respect to any

of the proposals described in this Proxy Statement. |

| | |

| Q: | How

many votes are required to approve each proposal? |

| | |

| A: | Note

and Warrant Issuance Proposal. The approval of the Note and Warrant Issuance Proposal

requires that a quorum exist and that the affirmative vote of the majority of shares present

in person or represented by proxy at the Special Meeting and entitled to vote on the subject

matter shall be required to approve the Note and Warrant Issuance Proposal. Abstentions are

not considered votes cast and will therefore have no effect on the Note and Warrant Issuance

Proposal. Under applicable Nasdaq Stock Market listing rules, brokers are not permitted to

vote shares held for a customer on “non-routine” matters (such as the Note and

Warrant Issuance Proposal) without specific instructions from the customer. Therefore, broker

non-votes are not considered votes cast and will also have no effect on the outcome of the

Note and Warrant Issuance Proposal. |

As

further described under the heading “Proposal 1” in this Proxy Statement, and subject to the terms and conditions set forth

in the Purchase Agreement (as defined herein), John A. Ballantyne Revocable Trust DTD 8/1/2017 and the Company have executed a Note (as

defined herein) and three Warrants (as defined herein), pursuant to which, among other things, such stockholder agreed

to purchase the Note and the Warrants from the Company for an aggregate amount of Four Millions Dollars ($4,000,000).

Adjournment

Proposal. For the Adjournment Proposal to be approved, the number of votes cast in favor of approval of the Adjournment Proposal

must represent a majority of all those outstanding shares that (a) are present or represented by proxy at the Special Meeting, and (b)

are cast either affirmatively or negatively on the proposal. Abstentions and broker non-votes (if any) will not be counted FOR or AGAINST

the proposal and will have no effect on the proposal.

| Q: | Can

I access these proxy materials on the Internet? How long will they be available? |

| | |

| A: | Yes.

The Notice of Special Meeting and Proxy Statement are available for viewing, printing, and

downloading at www.proxyvote.com. All materials will remain posted on www.proxyvote.com

at least until the conclusion of the meeting. |

| | |

| Q: | How

can I revoke or change my vote after submitting it? |

| | |

| A: | If

you are a stockholder of record, you can revoke your proxy before your shares are voted at

the Special Meeting by: |

| ● | Filing

a written notice of revocation bearing a later date than the proxy with our Chief Executive

Officer at Glucotrack, Inc., 301 Rte 17 North, Rutherford, New Jersey 07070, at or

before the taking of the vote at the Special Meeting; |

| | | |

| ● | Duly

executing a later-dated proxy relating to the same shares and delivering it to our Chief

Executive Officer at Glucotrack, Inc., 301 Rte 17 North, Rutherford, New Jersey 07070,

at or before the taking of the vote at the Special Meeting; |

| | | |

| ● | Attending

the Special Meeting and voting in person (although attendance at the Special Meeting will

not in and of itself constitute a revocation of a proxy); or |

| | | |

| ● | If

you voted by telephone or via the Internet, voting again by the same means prior to 11:59

PM EDT on [ ], 2024 (your latest telephone or Internet vote, as applicable, will be counted

and all earlier votes will be disregarded). |

If

you are a beneficial owner of shares, you may submit new voting instructions by contacting your bank, broker, or other holder of record.

You may also vote in person at the Special Meeting if you obtain a legal proxy from them and register to attend the Special Meeting as

described in the answers to previous questions.

| Q: | Where

can I find the voting results of the Special Meeting? |

| | |

| A: | We

plan to announce the preliminary voting results at the Special Meeting. We will publish the

results in a Current Report on Form 8-K filed with the SEC within four business days after

the Special Meeting. |

| | |

| Q: | Who

is paying for this Proxy Statement and the solicitation of my proxy, and how are proxies

solicited? |

| | |

| A: | Proxies

are being solicited by the Board of Directors for use at the Special Meeting. The Company’s

officers and other employees, without additional remuneration, also may assist in the solicitation

of proxies in the ordinary course of their employment. The Company also has engaged Broadridge

as the Company’s proxy solicitor to assist in the solicitation of proxies for the Special

Meeting. The Company has agreed to pay Broadridge a fee of approximately $8,465, as well

as reasonable and customary documented expenses. The Company has also agreed to indemnify

Broadridge and its affiliates against certain claims, liabilities, losses, damages and expenses. |

In

addition to the use of the mail and the Internet, solicitations may be made personally or by email or telephone, as well as by public

announcement. The Company will bear the cost of this proxy solicitation. The Company may also request brokers, dealers, banks and their

nominees to solicit proxies from their clients where appropriate and may reimburse them for reasonable expenses related thereto.

| Q: | Who

can help answer my questions? |

| | |

| A: | If

you have questions about how to vote or direct a vote in respect of your shares or about

the proposals, or if you need additional copies of the Proxy Statement or Proxy Card, you

may contact Broadridge at: |

Broadridge

P.O.

Box 1341

Brentwood,

New York 11717

Telephone:

1-800-579-1639

Email:

sendmaterial@proxyvote.com

You

may also contact the Company at:

Glucotrack,

Inc.

301

Rte 17 North, Ste. 800

Rutherford,

New Jersey 07070

Telephone:

(201) 842-7715

Attention:

Corporate Secretary

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The

following table sets forth certain information regarding the beneficial ownership of our common stock as of [ ], 2024, unless otherwise

noted below, for the following:

| ● | each

person or entity known to own beneficially more than 5% of our outstanding common stock as

of the date indicated in the corresponding footnote; |

| | | |

| ● | each

of our named executive officers; |

| | | |

| ● | each

director; and |

| | | |

| ● | all

current directors and executive officers as a group. |

Applicable

percentage ownership is based on 5,531,164 shares of our common stock outstanding as of July 30, 2024, unless otherwise noted below,

together with applicable options and warrants for each stockholder. Beneficial ownership is determined in accordance with the rules of

the SEC, based on factors including voting and investment power with respect to shares. Common stock subject to options currently exercisable,

or exercisable within 60 days after [ ], 2024, and warrants currently vested, or vesting within 60 days after [ ],

2024, are deemed outstanding for the purpose of computing the percentage ownership of the person holding those securities but are not

deemed outstanding for computing the percentage ownership of any other person. Unless otherwise indicated, the address for each listed

stockholder is c/o Glucotrack, Inc., 301 Rte 17 North, Ste. 800, Rutherford, NJ 07070.

| Name of Beneficial Owner | |

| |

Amount and

Nature of

Beneficial Ownership | | |

Percent

of Ownership | |

| Named Executives and Directors | |

| |

| | | |

| | |

| Drinda Benjamin | |

(1) | |

| 31,643 | | |

| * | |

| Allen E. Danzig | |

| |

| 8,469 | | |

| * | |

| Dr. Robert Fischell | |

(2) | |

| 11,568 | | |

| * | |

| Paul Goode | |

(3) | |

| 160,887 | | |

| 2.9 | % |

| James Cardwell | |

| |

| - | | |

| - | |

| Erin Carter | |

| |

| 27,203 | | |

| * | |

| Luis Malave | |

| |

| 22,437 | | |

| * | |

| Shimon Rapps | |

(4) | |

| 210,691 | | |

| 3.9 | % |

| Andrew Sycoff | |

(5) | |

| 228,336 | | |

| 4.1 | % |

| Vincent Wong | |

| |

| - | | |

| * | |

| Mark Tapsak | |

(6) | |

| 43,133 | | |

| * | |

| James Thrower | |

(7) | |

| 51,159 | | |

| * | |

| Andrew Balo | |

| |

| - | | |

| * | |

| | |

| |

| | | |

| | |

| All directors and Named Executive Officers as a group (13 persons) | |

| |

| 795,526 | | |

| 13.7 | % |

| | |

| |

| | | |

| | |

| Over 5% Shareholders | |

| |

| | | |

| | |

| John A Ballantyne Rev Trust 08/01/2017 | |

(8) | |

| 1,020,312 | | |

| 18.7 | % |

| Alma Diversified Holdings LLC | |

(9) | |

| 515,187 | | |

| 9.5 | % |

*

Less than 1.0%.

| (1) | Ownership

includes (i) 793 shares of Common Stock owned individually and (ii) 30,850 Options deemed

vested within 60 days of August 9, 2024. |

| | | |

| (2) | Ownership

includes (i) 10,266 shares of Common Stock owned individually, (ii) 663 owned jointly by

Dr. Fischell and his wife; and (iii) 639 Options deemed vested within 60 days of August 9,

2024. |

| | | |

| (3) | Ownership

includes (i) 25,152 shares of Common Stock owned individually, (ii) 105,735 Options deemed

vested within 60 days of August 9, 2024, and (iii) 30,000 shares of Common Stock deemed to

be owed pursuant to IP Purchase Agreement. |

| | | |

| (4) | Ownership

includes only 6,701 shares of Common Stock owned individually. SDR Diversified Holdings,

LLC, an entity owned by Leah Rapps, the wife of Shimon Rapps, owns 201,870 shares of common

stock. Leah Rapps has voting control and investment power over SDR Diversified Holdings,

LLC. Ms. Rapps also owns 2,120 shares in her personal name. Mr. Rapps disclaims beneficial

ownership in the shares and warrants held by his wife and by SDR Diversified Holdings, LLC. |

| | | |

| (5) | Ownership

includes: (i) 67,037 shares of common stock owned by Mr. Sycoff; and (ii) 23,299 common stock

owned by Andrew Garrett, Inc. (iii) 138,000 warrants vested by Andrew Garrett, Inc. Mr. Sycoff

has voting power and investment control over the shares of common stock held by Andrew Garrett,

Inc. Alma Diversified Holdings LLC, an entity owned by Sharon Sycoff, the wife of Mr. Sycoff

owns 515,187 shares of common stock. Sharon Sycoff has voting power and investment control

over the shares and warrants held by Alma Diversified Holdings LLC and Mr. Sycoff disclaims

beneficial ownership in the shares and warrants held by Alma Diversified Holdings LLC. |

| | | |

| (6) | Ownership

includes: (i) 11,887 shares of common stock owned directly (ii) 300 shares of common stock

owned by Stephen Tapsak, son of Mark Tapsak, and iii) 31,246 Options deemed vested within

60 days of August 9, 2024. |

| | | |

| (7) | Ownership

includes (i) 1,587 shares of Common Stock owned individually and (ii) 49,572 Options deemed

vested within 60 days of August 9, 2024. |

| | | |

| (8) | Ownership

includes: (i) 279 shares of common stock owned individually and (ii) 1,020,033 owned by John

A. Ballantyne Revocable Trust 08/01/2017. The address of John A. Ballantyne Rev Trust 08/01/2017

is 7410 Claire Drive South, Fargo ND 58104. John A. Ballantyne has voting and investment

control over the shares held by John A. Ballantyne Rev Trust 08/01/2017. |

| | | |

| (9) | Ownership

includes 515,187 directly by Alma Diversified Holdings LLC. The address of Alma Diversified

Holdings LLC is 1294 Albany Post Rd, Gardiner NY 12525. |

PROPOSAL

1

TO

APPROVE, FOR PURPOSES OF COMPLYING WITH NASDAQ LISTING RULE 5635(D), THE FULL ISSUANCE OF SHARES OF COMMON STOCK ISSUABLE BY THE COMPANY

UPON CONVERSION OF THE NOTE AND THE WARRANTS

Stockholders

of the Company’s Common Stock are being asked to approve this Note and Warrant Share Issuance Proposal to approve the conversion

of the Company’s Note and the exercise of the Warrants as contemplated in the Note and Warrant Purchase Agreement.

Background

and Overview

Note

and Warrant Purchase Agreement

On

July 30, 2024, the Company entered into a Note and Warrant Purchase Agreement (the “Purchase Agreement”) with John A. Ballantyne

Revocable Trust DTD 8/1/2017 (the “Purchaser”), pursuant to which the Company sold, in a private placement, (i) a secured

convertible promissory note (the “Note”) in the aggregate principal amount of $4,000,000, initially convertible into up to

4,000,000 shares of the Company’s common stock, par value $0.001 per share (the “Common Stock”) at a conversion price

of $1.00 (the shares of Common Stock issuable upon conversion of the Note, collectively, the “Conversion Shares”), and (ii)

warrants (the “Warrants”) to purchase up to an aggregate of 4,842,330 shares of Common Stock (the “Warrant Shares,”

and together with the Warrants and Conversion Shares, the “Securities”), subject to adjustments as provided in the Warrants.

The sale and issuance of the Note and the Warrants by the Company pursuant to the Purchase Agreement is hereinafter referred to as the

“Private Placement,” and the related transactions, the “Transaction.”

The

Purchase Agreement contains customary representations, warranties, conditions and obligations by each party, including our agreement

to hold a Special Meeting for the purpose of obtaining Stockholder Approval of the Transaction, certain events giving rise to a default

under the Note, and the Purchaser’s right to participate in the purchase of any future offering or sale of Securities being offered

by the Company or its subsidiaries up to an amount to maintain its pro rata interest in the Company, assuming conversion of the Note

and exercise of the Warrants. Pursuant to the Note, the parties agreed to a certain payment by the Company upon the occurrence of a “Sale

Transaction” as defined in the Purchase Agreement, a grant by the Company and its subsidiaries of a security interest in all of

their respective assets and rights as collateral for the obligations due under the Note, and an automatic conversion of the Note if Stockholder

Approval is obtained and the closing price of the Common Stock exceeds $5.00 per share for a period of five consecutive trading days,

subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions of the

Common Stock that occur after the date of the Purchase Agreement.

Effective

July 30, 2024, the Private Placement (the “Closings” and each a “Closing”) occurred in three tranches (each a

“Tranche”): (i) the Closing of the first Tranche consisted of the issuance to the Purchaser of a Warrant to acquire 2,133,334

shares of our Common Stock (the “First Closing”), (ii) the Closing of the second Tranche consisted of the issuance to the

Purchaser of a Warrant to acquire 1,523,810 shares of our Common Stock (the “Second Closing”), and (iii) the Closing of the

third Tranche consisted of the issuance to the Purchaser of a Warrant to acquire 1,185,186 shares of our Common Stock (the “Third

Closing”). The Securities issuable pursuant to the Private Placement and the Transaction will be issued after the date that the

Company has received Stockholder Approval (defined below) of the Transaction and the Common Stock underlying the Securities has been

registered with the U.S. Securities and Exchange Commission (the “SEC”) for resale, subject to the satisfaction of customary

closing conditions.

The

Company has agreed to call a Special Meeting of its stockholders to approve the Transaction, including, without limitation,

the issuance of all of the Conversion Shares and Warrant Shares in excess of 19.99% of the issued and outstanding Common Stock (the “Limitation”)

on the Closing Date (the “Stockholder Approval”). The Company has also agreed to register the Securities underlying both

the Note and the Warrants subsequent to the consummation of the Private Placement.

Why

We are Seeking Stockholder Approval of the Conversion of the Note and Warrants Proposal

Pursuant

to Nasdaq Rule 5635(d), stockholder approval is required prior to the issuance of securities in a transaction, other than a public offering,

involving the sale, issuance or potential issuance by the Company of common stock (or securities convertible into or exercisable for

common stock), which equals 20% or more of the common stock or 20% or more of the voting power outstanding before the issuance, at a

price less than the lower of: (i) the closing price immediately preceding the signing of the binding agreement, or (ii) the average closing

price of the common stock for the five trading days immediately preceding the signing of the binding agreement for the transaction.

In

light of this rule, the Purchase Agreement provides that, unless the Company obtains the approval of its stockholders as required by

Nasdaq, the Company is prohibited from issuing any shares of common stock pursuant to the terms of the Note if the issuance of such shares

of common stock would exceed 19.99% of the Company’s outstanding shares of common stock as of July 30, 2024, or if such issuance

would otherwise exceed the aggregate number of shares of common stock which the Company may issue without breaching its obligations under

the rules and regulations of Nasdaq. Furthermore, until the Company has obtained Stockholder approval, the Company may not issue upon

exercise of Warrants a number of Warrant Shares, which, when aggregated with any Conversion Shares issued (i) pursuant to the conversion

of the Note pursuant to the Purchase Agreement, (ii) upon prior exercise any other Warrant issued pursuant to the Purchase Agreement

and (iii) pursuant to any warrants issued to any registered broker-dealer as a fee in connection with the issuance of securities pursuant

to the Purchase Agreement, would exceed 19.99% of the Company’s outstanding shares of Common Stock as of July 30, 2024, on an as-converted

basis, subject to adjustment for reverse and forward stock splits, stock dividends, stock combinations and other similar transactions

of the Common Stock that occur after the date of the Purchase Agreement (such number of shares, the “Issuable Maximum”).

If

the Company does not obtain Stockholder Approval at the Special Meeting, the Company shall call a meeting as often as reasonably practicable

to seek Stockholder Approval until the earlier of the date that either the Stockholder Approval is obtained or the Note is no longer

outstanding and the Warrants have expired.

In

consideration of the Purchaser’s agreement to purchase the Note, and subject to the terms and conditions set forth in the Purchase

Agreement, the Purchaser executed the Note and Warrants with the Company, pursuant to which the Company agreed, among other things, to

issue the Note to the Purchaser for a purchase price of an aggregate of $4,000,000 and Warrants to purchase up to 4,842,330 shares of

Common Stock. The Note balance is convertible into an equal number of Conversion Shares at $1.00 per share. Each whole warrant is exercisable

to purchase one share of the Company’s Common Stock.

The

Conversion Shares issuable pursuant to the Transaction will be issued after the Company has obtained Stockholder Approval of the Note

and Warrant Issuance Proposal and the Company has declared effective with the SEC, a registration statement registering the Common Stock

underlying the Securities.

We

are currently limited to issuing up to [ ] shares of Common Stock (19.99% of the stock outstanding at the time of the issuance of the

Common Stock). Upon receipt of Stockholder Approval, we will be able to issue the maximum number of shares of Common Stock that can be

issued.

We

cannot determine what the actual net proceeds of the Transaction will be until the Warrants are either exercised or expire, but as discussed

above, the conversion price of the Note is $1.00, and the Warrants are exercisable at $1.875 per share, $2.625 per share, and $3.375

per share for the First Closing, Second Closing, and Third Closing, respectively.

Warrants

The

Warrants are exercisable at an exercise price of $1.00 per share and will be exercisable on the date twelve months from the date that

the Company has received Stockholder Approval of the Transaction and the Common Stock underlying such Warrants has been registered with

the SEC for resale (the “Initial Exercise Date”), subject to certain ownership limitations and will expire on the tenth anniversary

of the Initial Exercise Date. The Warrants may be exercised for cash, provided that, if there is no effective registration statement

available registering the exercise of the warrants, the warrants may be exercised on a cashless basis.

The

Purchasers may not have the right to any shares of Common Stock otherwise issuable pursuant to the terms of the Warrant if, after giving

effect to the exercise of a Warrant, the Purchaser together with its affiliates would beneficially own in excess of 9.99% of the outstanding

shares of the Company’s Common Stock immediately after giving effect to the issuance of shares of Common Stock issuable upon exercise

of this Warrant (the “Beneficial Ownership Limitation”). The Purchaser may from time to time may increase or decrease the

Beneficial Ownership Limitation provisions in the Warrant, provided that the Beneficial Ownership Limitation in no event exceeds 9.99%

of the number of shares of the Common Stock outstanding immediately after giving effect to the issuance of shares of Common Stock upon

exercise of the Warrant. Any increase in the Beneficial Ownership Limitation will not be effective until the 61st day after

delivery of a notice to the Company.

Additional

Information

This

summary is intended to provide you with basic information concerning the Purchase Agreement, the Note, and the Warrants. The full text

of the Purchase Agreement was included as an exhibit to our Current Report on Form 8-K filed with the SEC on July 1, 2024, and the full

text of the Note and Warrants was included as exhibits to our Current Report on Form 8-K filed with the SEC on July 31, 2024.

Effect

on Current Stockholders if the Note and Warrant Issuance Proposal is Approved

Each

additional share of Common Stock that would be issuable to the Purchaser would have the same rights and privileges as each share of our

currently outstanding Common Stock. The issuance of shares of Common Stock to the Purchaser pursuant to the terms of the Note and the

Warrants will not affect the rights of the holders of our outstanding Common Stock, but such issuances will have a dilutive effect on

the existing stockholders, including the voting power and economic rights of the existing stockholders, and may result in a decline in

our stock price or greater price volatility. Further, any sales in the public market of our shares of Common Stock issuable to the Purchaser

could adversely affect prevailing market prices of our shares of Common Stock.

If

approved, the Note is convertible into an aggregate of 4,000,000 shares of the Company’s Common Stock and the outstanding Warrants

are exercisable for an aggregate of 4,842,330 shares of Common Stock.

Effect

on Current Stockholders if the Note and Warrant Issuance Proposal is Not Approved

The

Company is not seeking the approval of its stockholders to authorize its entry into the Purchase Agreement, the Warrants and any related

documents, as the Company has already done so and such documents already are binding obligations of the Company. The failure of the Company’s

stockholders to approve the Note and Warrant Issuance Proposal will not negate the existing terms of the documents, which will remain

binding obligations of the Company.

If

the stockholders do not approve this proposal, the Company will be unable to issue 20.0% or more of the Company’s outstanding shares

of Common Stock as of July 30, 2024 to the Purchaser pursuant to the terms of the Purchase Agreement and the Note. Further, the Company

is required to obtain Stockholder Approval of the

Note

and Warrant Issuance Proposal with respect to the transactions contemplated by the Purchase Agreement and the Note, including the issuance

of Conversion Shares and Warrant Shares. Accordingly, if approval of the Note and Warrant Issuance Proposal is not obtained, the Company

will be unable to issue the Conversion Shares and Warrants, and may need to seek alternative sources of financing, which financing may

not be available on advantageous terms, or at all, and which may result in the incurrence of additional transaction expenses.

The

Company’s ability to successfully implement its business plans and ultimately generate value for its stockholders is dependent

upon its ability to raise capital and satisfy its ongoing business needs. If the Company is required to satisfy its obligations under

the Purchase Agreement and the Warrants in cash rather than common stock, the Company likely will not have the capital necessary to fully

satisfy its ongoing business needs, the effect of which will materially and adversely impact future operating results, and result in

a delay in or modification or abandonment of our business plans. Additionally, it will be necessary for the Company to acquire additional

financing in order to satisfy its obligations under the Purchase Agreements and the Warrants in cash, which financing may not be available

on advantageous terms, or at all, and which in any event will result in the incurrence of additional transaction expenses.

Further,

pursuant to the Purchase Agreement, if the Company does not obtain stockholder approval of the Note and Warrant Issuance Proposal at

the Special Meeting, the Company will be obligated to continue to seek Stockholder Approval of the Note and Warrant Issuance Proposal

until the earlier of the date that either the Stockholder Approval is obtained or the Note is no longer outstanding and the Warrants

have expired. As such, failure to obtain stockholder approval of the Note and Warrant Issuance Proposal at the Special Meeting will require

the Company to incur the costs of holding one or more additional stockholder meetings until it obtains such approval.

Required

Vote of Stockholders

The

approval of the Note and Warrant Issuance Proposal requires that a quorum exist and that the affirmative vote of the majority of shares

present in person or represented by proxy at the Special Meeting and entitled to vote on the subject matter shall be required to approve

the Note and Warrant Issuance Proposal. Abstentions are not considered votes cast and will therefore have no effect on the Note and Warrant

Issuance Proposal. Under applicable Nasdaq Stock Market listing rules, brokers are not permitted to vote shares held for a customer on

“non-routine” matters (such as the Note and Warrant Issuance Proposal) without specific instructions from the customer. Therefore,

broker non-votes are not considered votes cast and will also have no effect on the outcome of the Note and Warrant Issuance Proposal.

Recommendation

of our Board of Directors

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL, FOR PURPOSES OF COMPLYING

WITH NASDAQ LISTING RULE 5635(D), OF THE FULL ISSUANCE OF SHARES OF COMMON STOCK ISSUABLE BY THE COMPANY UPON CONVERSION OF THE NOTE

AND THE WARRANTS.

PROPOSAL

2

ADJOURNMENT

PROPOSAL

Holders

of Company Common Stock are being asked to authorize the holder of any proxy solicited by the Board of Directors to vote in favor of

granting discretionary authority to the Board of Directors to adjourn the Special Meeting to another time and place for the purpose of

soliciting additional proxies. If the stockholders approve this proposal, the Board of Directors could adjourn the Special Meeting and

any adjourned session of the Special Meeting and use the additional time to solicit additional proxies, including the solicitation of

proxies from stockholders who have previously voted.

This

Adjournment Proposal will be presented to stockholders at the Special Meeting to seek their approval of an adjournment to another time

or place, if necessary or appropriate, to solicit additional proxies if there are not sufficient votes at the time of the Special Meeting

to approve the presented proposals or to constitute a quorum.

If,

at the Special Meeting, the number of shares present or represented and voting to approve the presented Proposals is not sufficient to

approve such Proposals, or if a quorum is not present, the Board of Directors currently intends to move to adjourn the Special Meeting

to enable the Board of Directors to solicit additional proxies for the approval of the presented Proposals.

Required

Vote of Stockholders

The

approval of the Adjournment Proposal requires that holders of a majority of the shares voted vote “FOR” this Adjournment

Proposal. Abstentions and broker non-votes (if any) will essentially be no votes.

Recommendation

of our Board of Directors

THE

BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” APPROVAL OF THE ADJOURNMENT PROPOSAL.

HOUSEHOLDING

MATTERS

The

SEC has adopted rules that permit companies to deliver a single copy of proxy materials to multiple stockholders sharing an address unless

a company has received contrary instructions from one or more of the stockholders at that address. This means that only one copy of the

proxy materials may have been sent to multiple stockholders in your household. If you would prefer to receive separate copies of the

proxy materials either now or in the future, please contact our Corporate Secretary either by calling (201) 842-7715 or by mailing a

request to Attn: Corporate Secretary, 301 Rte 17 North, Ste. 800, Rutherford, NJ 07070. Upon written or oral request to the Corporate

Secretary, the Company will provide a separate copy of the proxy materials. In addition, stockholders at a shared address who receive

multiple copies of proxy materials may request to receive a single copy of proxy materials in the future in the same manner as described

above.

STOCKHOLDER

PROPOSALS

Only

proper proposals under Rule 14a-8 of the Exchange Act which are timely received will be included in the proxy materials for our next

annual meeting. In order to be considered timely, such proposal must be received by our Chief Financial Officer at the address provided

herein for our corporate offices in New Jersey no later than September 30, 2024. We suggest that stockholders submit any stockholder

proposal by certified mail, return receipt requested.

Our

Bylaws require stockholders to provide advance notice to the Company of any stockholder director nomination(s) and any other matter a

stockholder wishes to present for action at an annual meeting of stockholders (other than matters to be included in our proxy statement,

which are discussed in the previous paragraph). In order to properly bring business before an annual meeting, our Bylaws require, among

other things, that the stockholder submit written notice thereof complying with our Bylaws to our Chief Financial Officer, at the above

address, not less than 90 days nor more than 120 days prior to the anniversary of the preceding year’s annual meeting. Therefore,

the Company must receive notice of a stockholder proposal submitted other than pursuant to Rule 14a-8 (as discussed above) no sooner

than December 1, 2024, and no later than December 31, 2024. If a stockholder fails to provide timely notice of a proposal to be presented

at our 2024 Annual Meeting of Stockholders, the proxy designated by our Board will have discretionary authority to vote on any such proposal

that may come before the meeting.

| By

Order of the Board of Directors of |

|

| Glucotrack,

Inc. |

|

| Sincerely, |

|

| |

|

|

|

| Paul

Goode |

|

| Chairman

of the Board |

|

Rutherford,

New Jersey

[ ], 2024

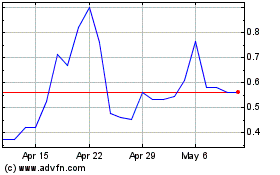

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Feb 2025 to Mar 2025

GlucoTrack (NASDAQ:GCTK)

Historical Stock Chart

From Mar 2024 to Mar 2025