Gladstone Commercial Corporation Provides a Business Update

August 19 2020 - 4:30PM

Gladstone Commercial Corporation (Nasdaq: GOOD) (“we” or “Gladstone

Commercial”) is providing the following business update regarding

portfolio performance during this time of market volatility related

to the global COVID-19 pandemic.

- Approximately 99% of August cash

base rent has been paid and collected. August rental collections

remain consistent with 99% of July cash base rents that were paid

and collected and 98% of June, May and April cash base rents that

were paid and collected. The remaining 1-2% of cash base rents are

associated with the previously agreed upon deferral agreements. All

deferred amounts are to be paid back by the respective tenants

commencing in July 2020 and ending in March 2021.

- Our strong performance was reflected in our results for the

second quarter ended June 30, 2020. Core FFO available to common

shareholders and Non-controlling OP Unitholders for the three

months ended June 30, 2020, was $14.2 million,

or $0.41 per share, a 3.3% increase when compared to the

three months ended March 31, 2020. Portfolio occupancy

remains at approximately 97%, as of August 19, 2020.

- Our leasing initiatives continue to be successful in the

COVID-19 environment. On August 4, 2020 we announced that we

executed five-year lease extensions with two tenants, renewing John

Bean Technologies Corporation, who occupies 100% of our 67,200

square foot flex building in the Philadelphia area, and

extending Continental Broadband Pennsylvania, LLC, who

occupies 100% of our 26,080 square foot data center building in

the Pittsburgh area. On July 13, 2020 we announced that

we executed a six-year lease extension with Conduent

State Healthcare, LLC at our 42,213 square foot office

building in Richmond, VA, maintaining the building’s 100%

occupancy until September 2026. GAAP rents increased 3.2%

because of these three lease extensions.

- Year-to-date we have completed ten (10) renewals and expansions

totaling 471,584 square feet at an increased GAAP rent of

8.0%.

- We continue to execute our capital recycling program with a

goal of selectively disposing of non-core assets and redeploying

the capital into accretive acquisitions. On July 1, 2020 we sold

our Maple Heights, Ohio property for $11.4 million,

resulting in a net gain of $1.2 million.

- We have continued to raise additional capital through our

at-the-market programs to fund acquisitions and operating needs.

Since July 1, 2020 we have issued 117,000 shares of common stock

for net proceeds of $2.2 million and 102,000 shares of Series E

perpetual preferred stock for net proceeds of $2.3 million.

- We continue to have ample liquidity

and a strong capital structure. As of August 19, 2020, our current

available liquidity is in excess of $35 million via our revolving

credit facility and cash on hand.

We may receive additional rent relief requests

during the COVID-19 pandemic. However, we are unable to quantify

the outcomes of potential future negotiation of relief packages,

the success of any tenant’s financial prospects or the amount of

relief requests that we will ultimately receive or grant.

About Gladstone Commercial (Nasdaq:

GOOD)

Gladstone Commercial is a real estate investment

trust focused on acquiring, owning and operating net leased

industrial and office properties across the United States. As

of June 30, 2020, Gladstone Commercial’s real estate portfolio

consisted of 122 properties located in 28 states, totaling

approximately 15.1 million square feet. For additional information

please visit www.gladstonecommercial.com

For Broker Submittals:

| South

Central: |

Midwest/Northeast: |

| Buzz Cooper |

Matt Tucker |

| Senior Managing Director |

Senior Managing Director |

| (703) 287-5815 |

(703) 287-5830 |

|

Buzz.Cooper@gladstonecompanies.com |

Matt.Tucker@gladstonecompanies.com |

| |

|

| Southeast /

West: |

|

| Brandon

Flickinger |

|

| Managing Director |

|

| (703) 287-5819 |

|

|

Brandon.Flickinger@gladstonecompanies.com |

|

Investor or Media Inquiries:

| Bob Cutlip |

|

| President – Gladstone

Commercial Corporation |

| (703) 287-5878 |

|

|

Bob.Cutlip@gladstonecompanies.com |

|

All statements contained in this press release, other than

historical facts, may constitute “forward-looking statements”

within the meaning of Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as “anticipates,” “expects,” “intends,”

“plans,” “believes,” “seeks,” “estimates” and variations of these

words and similar expressions are intended to identify

forward-looking statements. Readers should not rely upon

forward-looking statements because the matters they describe are

subject to known and unknown risks and uncertainties that could

cause the Gladstone Commercial’s business, financial condition,

liquidity, results of operations, funds from operations or

prospects to differ materially from those expressed in or implied

by such statements. Such risks and uncertainties are disclosed

under the caption “Risk Factors” of the company’s Annual Report on

Form 10-K for the fiscal year ended December 31, 2019, as filed

with the SEC on February 12, 2020 and certain other filings we make

with the SEC. Gladstone Commercial cautions readers not to place

undue reliance on any such forward-looking statements which speak

only as of the date made. The company undertakes no obligation to

publicly update or revise any forward-looking statements, whether

as a result of new information, future events or otherwise.

For Investor Relations inquiries related to any of the monthly

dividend paying Gladstone funds, please visit

www.gladstonecompanies.com.

SOURCE: Gladstone Commercial Corporation

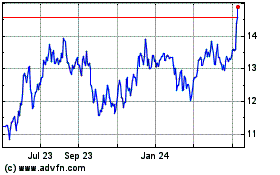

Gladstone Commercial (NASDAQ:GOOD)

Historical Stock Chart

From Oct 2024 to Nov 2024

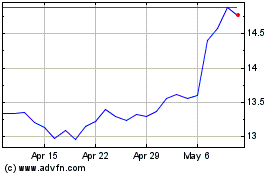

Gladstone Commercial (NASDAQ:GOOD)

Historical Stock Chart

From Nov 2023 to Nov 2024