false

0001559998

0001559998

2024-02-21

2024-02-21

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report:

February

21, 2024

Gaucho

Group Holdings, Inc.

(Exact

name of registrant as specified in its charter)

| Delaware |

|

001-40075 |

|

52-2158952 |

State

of

Incorporation |

|

Commission

File Number |

|

IRS

Employer

Identification No. |

112

NE 41st Street, Suite 106

Miami,

FL 33137

Address

of principal executive offices

212-739-7700

Telephone

number, including area code

Former

name or former address if changed since last report

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| |

☐ |

Written

communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

|

| |

☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

|

| |

☐ |

Pre-commencement

communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405)

or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol(s) |

|

Name

of each exchange on which registered |

| Common

Stock |

|

VINO |

|

The

Nasdaq Stock Market LLC |

Item

1.02 Termination of a Material Definitive Agreement.

As

previously disclosed in Gaucho Group Holdings, Inc.’s (the “Company,” “we,” “us” or “our”)

Current Report on Form 8-K filed November 9, 2022, the Company entered into a Common Stock Purchase Agreement (the “Purchase Agreement”)

and a Registration Rights Agreement (the “Registration Rights Agreement”) each dated November 8, 2022 with Tumim Stone Capital

LLC (“Tumim”), pursuant to which the Company had the right to sell to Tumim up to the lesser of (i) $44,308,969.30 worth

of newly issued shares (the “Shares”) of the Company’s common stock, par value $0.01 per share (the “Common Stock”),

and (ii) the Exchange Cap (as defined therein) (subject to certain conditions and limitations), from time to time during the term of

the Purchase Agreement (such transaction, the “ELOC”). For a full description of the Purchase Agreement and Registration

Rights Agreement, please refer to our Current Report on Form 8-K and the exhibits attached thereto as filed with the SEC on November

9, 2022. All terms not defined herein shall refer to the defined terms in the Purchase Agreement and Registration Rights Agreement.

Since

November 8, 2022, the Company received approximately $937,157 of gross proceeds from draw-downs and issued 901,562 shares of common stock

to Tumim pursuant to the ELOC.

Pursuant

to Section 8.2 of the Purchase Agreement, Tumim has the right to terminate this Agreement effective upon ten (10) Trading Days’

prior written notice to the Company, if: (a) any condition, occurrence, state of facts or event constituting a Material Adverse Effect

has occurred and is continuing; (b) a Fundamental Transaction shall have occurred; (c) the Initial Registration Statement and any New

Registration Statement is not filed by the applicable Filing Deadline therefor or declared effective by the Commission by the applicable

Effectiveness Deadline (as defined in the Registration Rights Agreement) therefor, or the Company is otherwise in breach or default in

any material respect under any of the other provisions of the Registration Rights Agreement, and, if such failure, breach or default

is capable of being cured, such failure, breach or default is not cured within 10 Trading Days after notice of such failure, breach or

default is delivered to the Company; (d) while a Registration Statement, or any post-effective amendment thereto, is required to be maintained

effective pursuant to the terms of the Registration Rights Agreement and Tumim holds any Registrable Securities, the effectiveness of

such Registration Statement, or any post-effective amendment thereto, lapses for any reason (including, without limitation, the issuance

of a stop order by the Commission) or such Registration Statement or any post-effective amendment thereto, the Prospectus contained therein

or any Prospectus Supplement thereto otherwise becomes unavailable to Tumim for the resale of all of the Registrable Securities included

therein in accordance with the terms of the Registration Rights Agreement, and such lapse or unavailability continues for a period of

20 consecutive Trading Days or for more than an aggregate of 60 Trading Days in any 365-day period, other than due to acts of Tumim;

(e) trading in the Common Stock on the Trading Market (or if the Common Stock is then listed on an Eligible Market, trading in the Common

Stock on such Eligible Market) shall have been suspended and such suspension continues for a period of three (3) consecutive Trading

Days; or (f) the Company is in material breach or default of this Agreement, and, if such breach or default is capable of being cured,

such breach or default is not cured within 10 Trading Days after notice of such breach or default is delivered to the Company.

On

February 22, 2022, the Company received notice from Tumim Stone Capital of its election to terminate the ELOC. While the notice to terminate

stated that it was effective immediately, Section 8.2 of the Purchase Agreement requires at least 10 Trading Days prior written notice.

Therefore, the Company will treat the ELOC as being terminated by Tumim effective March 7, 2024. No early termination penalties are incurred

by either party under the ELOC.

The

Company believes that this notice of termination is in response to the Company’s lawsuit filed in the United States District Court

for the District of Delaware alleging 3i, LP, 3i Management LLC, and Maier Joshua Tarlow (“3i”) engaged in an unlawful securities

transaction with the Company as an unregistered dealer under U.S. securities laws. Mr. Tarlow is the manager of the general partner of

Tumim. For additional details, please see our Current Report on Form 8-K as filed with the SEC on February 20, 2024.

Item

2.04. Triggering Events that Accelerate or Increase a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement.

As

previously reported on our Current Report on Form 8-K filed on February 21, 2023, the Company entered into a Securities Purchase Agreement

(the “Purchase Agreement”) with 3i, LP (“3i”), pursuant to which the Company sold to 3i a series of senior secured

convertible notes of the Company in the aggregate original principal amount of $5,617,978 (the “Notes”), and a series of

common stock purchase warrants of the Company, which warrants shall be exercisable into an aggregate of 337,710 shares of common stock

of the Company for a term of three years (the “Warrants,” and together with the Purchase Agreement and Notes, the “Note

Documents”). For the full description of the Note Documents, please refer to our Current Report on Form 8-K and the exhibits attached

thereto as filed with the SEC on February 21, 2023. All terms not defined herein shall refer to the defined terms in the Note Documents.

On

February 21, 2024, the Company received an Event of Default Redemption Notice from 3i providing notice of Events of Default arising under

the Note Documents and demanding immediate payment of the Event of Default Redemption Price equal to a minimum of $3,437,645.74.

Upon

an Event of Default, the interest rate on the outstanding principal will automatically be increased from 7% to 18% per annum, and 3i

may require the Company to redeem all or any portion of the Note at a price equal to the greater of (i) the product of (A) the amount

to be redeemed multiplied by (B) the redemption premium of 115%, and (ii) the product of (X) the conversion rate in effect at such time

as 3i delivers an Event of Default redemption notice, multiplied by (Y) the product of (1) the redemption premium of 115% multiplied

by (2) the greatest closing sale price of the common stock on any trading day during the period commencing on the date immediately preceding

such Event of Default and ending on the date the Company makes the entire payment required to be made under the Note Documents.

Additionally,

3i may, at its option, convert the Note into shares of common stock of the Company at an alternate conversion price. The remedies provided

in the Note are cumulative and in addition to all other remedies available to 3i at law or in equity (including a decree of specific

performance and/or other injunctive relief).

In

addition to the remedies provided under the Note Documents, 3i also holds a security interest in all of the assets of the Company, including

intellectual property and the Company’s ownership interests in each of its subsidiaries, pursuant to that certain Security and

Pledge Agreement and Intellectual Property Security Agreement each dated February 21, 2023 (together, the “Security Agreement”).

Upon the occurrence of an Event of Default under the Note, the collateral agent appointed under the Security Agreement may exercise all

of the rights and remedies of a secured party upon default under the New York Uniform Commercial Code, and may, among other things, (i)

take absolute control of the collateral and receive, for the benefit of 3i, all payments made thereon, give all consents, waivers, and

ratifications in respect thereof and otherwise act with respect thereto as through it were the outright owner thereof, (ii) require each

grantor to make the collateral available to the collateral agent, and (iii) sell, lease, license, or dispose of the Collateral.

As

with the termination of the ELOC described in Item 1.02, the Company believes that this Event of Default Redemption Notice from 3i is

in response to the Company’s lawsuit filed in the United States District Court for the District of Delaware alleging that 3i engaged

in an unlawful securities transaction with the Company as an unregistered dealer under U.S. securities laws. 3i is considered a “dealer”

within the meaning set forth in Section 3(a)(5)(A) the Securities Exchange Act of 1934 (“Exchange Act”) and, therefore, violated

Section 15(a) by engaging in interstate securities transactions with the Company absent effective dealer registration. Because of 3i’s

violations of Section 15(a) of the Exchange Act, the Company is seeking to have certain contracts between it and 3i declared void and

transactions effectuated thereunder rescinded pursuant to Section 29(b) of the Exchange Act. Please see our Current Report on Form 8-K

as filed with the SEC on February 20, 2024.

Item

7.01 Regulation FD Disclosure.

The

information set forth in Item 1.01 and Item 2.04 of this Current Report on Form 8-K is incorporated herein by reference into this Item

2.03 in its entirety.

The

information furnished with this Item 7.01 shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange

Act of 1934 (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless

of any general incorporation language in such filing.

Item

8.01 Other Events.

On

February 27, 2024, Gaucho Group Holdings, Inc. issued a press release regarding the notice of default pursuant to the Note Documents.

The full text of the press release is furnished hereto as Exhibit 99.1 and incorporated herein by reference.

The

information furnished with this Item 8.01 and Exhibit 99.1 attached hereto shall not be deemed “filed” for purposes of Section

18 of the Exchange Act, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in

any filing under the Securities Act or the Exchange Act, regardless of any general incorporation language in such filing.

Item

9.01 Financial Statements and Exhibits.

(d)

Exhibits

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized, on the 27th day of February 2024.

| |

Gaucho

Group Holdings, Inc. |

| |

|

|

| |

By: |

/s/

Scott L. Mathis |

| |

|

Scott

L. Mathis, President & CEO |

Exhibit

99.1

PRESS

RELEASE – FOR IMMEDIATE RELEASE

Gaucho

Responds to Notice of Default

Gaucho

Received Notice of Default from Convertible Promissory Noteholder

Miami,

FL / February 27, 2024 / Gaucho Group Holdings, Inc. (NASDAQ: VINO), a company that includes a growing collection of e-commerce

platforms with a concentration on fine wines, luxury real estate, and leather goods and accessories (the “Company” or “Gaucho

Holdings”), today announced that on February 21, 2024, the Company received an Event of Default Redemption Notice from 3i, LP providing

notice of Events of Default arising under the Senior Secured Convertible Note issued February 21, 2023 by the Company to 3i, LP, the

Securities Purchase Agreement, Registration Rights Agreement, Security Agreement, and Pledge Agreements between the Company and 3i, LP

dated as of the same date (the “Note Documents”). 3i, LP demanded immediate payment of the Event of Default Redemption Price

equal to a minimum of $3,437,645.74.

It

is the Company’s position that the Note Documents are illegal, due to 3i, LP’s failure to register as a dealer within the

meaning set forth in Section 3(a)(5)(A) the Securities Exchange Act of 1934 (“Exchange Act”). Therefore, 3i, LP, violated

Section 15(a) by engaging in interstate securities transactions with the Company absent effective dealer registration. Because of these

violations of Section 15(a), the Company has filed a lawsuit against 3i in the United States District Court for the District of Delaware

seeking to have the Note Documents between it and 3i, LP declared void and transactions effectuated thereunder rescinded pursuant to

Section 29(b) of the Exchange Act. The Company believes that the Notice of Default is a retaliatory response to the Company’s lawsuit

against 3i.

Dealer

registration pursuant to Section 15(a) of the Exchange Act has become a focus of regulatory enforcement and private litigation in recent

years. Federal and state courts across the country have been tasked to examine whether parties who enter into various securities transactions

with issuers, frequently structured by a securities purchase agreement, convertible note and/or warrant, are “engaged in the business

of buying and selling securities … for such person’s own account,” and, therefore, are dealers that must be registered

with the U.S. Securities and Exchange Commission and a recognized self-regulatory organization, such as FINRA, before effecting, inducing

or attempting to induce an interstate securities transaction. Numerous courts that have examined similar fact patterns have almost unanimously

reached the same conclusion: the unregistered person acted in violation of Section 15(a)’s registration requirement. Upon demonstrating

a violation of Section 15(a), courts have imposed civil penalties, awarded disgorgement and/or cancelled all outstanding transactions.

For more information, see “SEC’s Dealer Crackdown Wins in Court, Alarming Investment Firms”.

“Our

focus continues to provide transparency and to protect the long-term value for our Company and our stockholders. We believe that unregistered

dealer litigation provides an opportunity to protect our retail investment community from future unlawful dilution,” said Scott

Mathis, CEO and Chairman of the Gaucho Board of Directors.

About

Gaucho

For

more than ten years, Gaucho Group Holdings, Inc.’s (gauchoholdings.com) mission has been to source and develop opportunities in

Argentina’s undervalued luxury real estate and consumer marketplace. Our company has positioned itself to take advantage of the

continued and fast growth of global e-commerce across multiple market sectors, with the goal of becoming a leader in diversified luxury

goods and experiences in sought after lifestyle industries and retail landscapes. With a concentration on fine wines (algodonfinewines.com

& algodonwines.com.ar), hospitality (algodonhotels.com), and luxury real estate (algodonwineestates.com) associated with our proprietary

Algodon brand, as well as the leather goods, ready-to-wear and accessories of the fashion brand Gaucho – Buenos Aires™ (gaucho.com),

these are the luxury brands in which Argentina finds its contemporary expression.

Cautionary

Note Regarding Forward-Looking Statements

The

information discussed in this press release includes “forward looking statements” within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical facts,

included herein concerning, among other things, changes to exchange rates and their impact on the Company, planned capital expenditures,

future cash flows and borrowings, pursuit of potential acquisition opportunities, our financial position, business strategy and other

plans and objectives for future operations, are forward looking statements. Although we believe that the expectations reflected in these

forward-looking statements are reasonable, they do involve certain assumptions, risks and uncertainties and are not (and should not be

considered to be) guarantees of future performance. Refer to our risk factors set forth in our reports filed on EDGAR. The Company disclaims

any obligation to update any forward-looking statement made here.

Media

Relations:

Gaucho

Group Holdings, Inc.

Rick

Stear

Director

of Marketing

212.739.7669

rstear@gauchoholdings.com

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

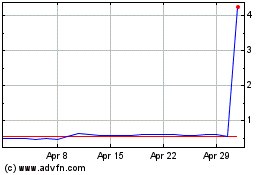

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Sep 2024 to Oct 2024

Gaucho (NASDAQ:VINO)

Historical Stock Chart

From Oct 2023 to Oct 2024