Funko Provides Additional COVID-19 Business Update

April 02 2020 - 5:00PM

Business Wire

Funko, Inc. ("Funko,” or the “Company”) (Nasdaq: FNKO), a

leading pop culture consumer products company, today announced that

due to the uncertainty of the COVID-19 crisis, it is taking the

following actions to enhance its financial flexibility:

- Beginning on April 5th, Funko will furlough a significant

portion of its employees. Affected employees will maintain their

health benefits, and subject to local regulations, will also be

able to access unemployment benefits;

- Implementing salary reductions across the executive team as

well as members of upper level management;

- Executing reductions in operating expenses and non-product

development capital expenditures; and

- Proactively managing working capital, including reducing

incoming inventory to align with anticipated sales.

In addition to these actions, Funko is evaluating further

options to increase flexibility and retain liquidity. Since

December 31, 2019, the Company repaid all outstanding borrowings on

its $75 million revolving credit facility and subsequently drew

down approximately $29 million. As of March 31, 2020, the Company

expects to have over $50 million of cash on hand and $46 million of

availability on its revolving credit facility.

“During this uncertain and unprecedented time, it is essential

we take actions to best position Funko for our employees, partners

and shareholders,” stated Brian Mariotti, Chief Executive Officer.

“We are making difficult decisions that we believe will put us in a

position of strength to navigate this crisis and support the

long-term health of our Company.”

About Funko

Headquartered in Everett, Washington, Funko is a leading pop

culture consumer products company. Funko designs, sources and

distributes licensed pop culture products across multiple

categories, including vinyl figures, action toys, plush, apparel,

housewares and accessories for consumers who seek tangible ways to

connect with their favorite pop culture brands and characters.

Learn more at https://funko.com/, and follow us on Twitter

(@OriginalFunko) and Instagram (@OriginalFunko).

Financial Disclosure Advisory

The Company reports its financial results in accordance with

U.S. generally accepted accounting principles. All financial data

in this press release is preliminary and represents the most

current information available to the Company’s management, as

financial closing procedures for the quarter ended March 31, 2020

are not yet complete. These estimates are not a comprehensive

statement of the Company’s financial results for the quarter ended

March 31, 2020 and actual results may differ materially from these

estimates as a result of the completion of normal quarter-end

accounting procedures and adjustments, including the execution of

the Company’s internal control over financial reporting, the

completion of the preparation and review of the Company’s financial

statements for the quarter ended March 31, 2020 and the subsequent

occurrence or identification of events prior to the formal issuance

of the first quarter financial results.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. All statements contained in this press release that do not

relate to matters of historical fact should be considered

forward-looking statements, including statements regarding our

anticipated financial results for the first quarter of 2020, the

anticipated impact of the COVID-19 outbreak on our business, and

our ability to cut costs and mitigate disruption. These

forward-looking statements are based on management’s current

expectations. These statements are neither promises nor guarantees,

but involve known and unknown risks, uncertainties and other

important factors that may cause our actual results, performance or

achievements to be materially different from any future results,

performance or achievements expressed or implied by the

forward-looking statements, including, but not limited to, the

following: risks related to the ongoing COVID-19 outbreak; our

ability to execute our business strategy; our ability to maintain

and realize the full value of our license agreements; the ongoing

level of popularity of our products with consumers; changes in the

retail industry and markets for our consumer products; our ability

to maintain our relationships with retail customers and

distributors; our ability to compete effectively; fluctuations in

our gross margin; our dependence on content development and

creation by third parties; our ability to manage our inventories;

our ability to develop and introduce products in a timely and

cost-effective manner; our ability to obtain, maintain and protect

our intellectual property rights or those of our licensors;

potential violations of the intellectual property rights of others;

risks associated with counterfeit versions of our products; our

ability to attract and retain qualified employees and maintain our

corporate culture; our use of third-party manufacturing; risks

associated with our international operations; changes in effective

tax rates or tax law; foreign currency exchange rate exposure; the

possibility or existence of global and regional economic downturns;

our dependence on vendors and outsourcers; risks relating to

government regulation; risks relating to litigation, including

products liability claims and securities class action litigation;

any failure to successfully integrate or realize the anticipated

benefits of acquisitions or investments; reputational risk

resulting from our e-commerce business and social media presence;

risks relating to our indebtedness and our ability to secure

additional financing; the potential for our electronic data or the

electronic data of our customers to be compromised; the influence

of our significant stockholder, ACON, and the possibility that

ACON’s interests may conflict with the interests of our other

stockholders; risks relating to our organizational structure;

volatility in the price of our Class A common stock; and risks

associated with our internal control over financial reporting.

These and other important factors discussed under the caption “Risk

Factors” in our annual report on Form 10-K for the year ended

December 31, 2019 and our other filings with the Securities and

Exchange Commission could cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release. Any such forward-looking statements represent

management’s estimates as of the date of this press release. While

we may elect to update such forward-looking statements at some

point in the future, we disclaim any obligation to do so, even if

subsequent events cause our views to change. These forward-looking

statements should not be relied upon as representing our views as

of any date subsequent to the date of this press release.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20200402005804/en/

Investor Relations: Andrew Harless Funko Investor

Relations investorrelations@funko.com

Media: Jessica Piha-Grafstein Funko Public Relations

jessicap@funko.com

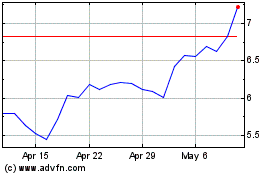

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Aug 2024 to Sep 2024

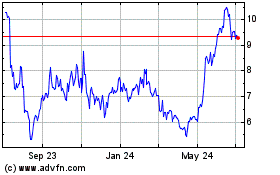

Funko (NASDAQ:FNKO)

Historical Stock Chart

From Sep 2023 to Sep 2024