Freshpet, Inc. (“Freshpet” or the “Company”) (Nasdaq: FRPT) today

reported financial results for its first quarter ended March

31, 2024.

First Quarter 2024 Financial

Highlights Compared to Prior Year Period

- Net sales of $223.8 million, an increase of 33.6%.

- Gross margin of 39.4%, compared to the prior year period of

30.3%.

- Adjusted Gross Margin of 45.3%, compared to the prior year

period of 38.5%.

- Net income of $18.6 million, compared to

the prior year period net loss of

$24.8 million.

- Adjusted EBITDA of $30.6 million, compared to the prior

year period of $3.0 million.1

"Our strong first quarter results provide solid

evidence that we can deliver our long-term financial goals– and we

are now determined to prove that we can achieve this level of

performance consistently over time,” commented Billy Cyr,

Freshpet’s Chief Executive Officer. “The strength of the

Freshpet business model and consumer proposition continue to drive

the robust net sales growth investors have come to expect from us,

and our intense focus on operational improvements is delivering the

margin expansion we knew we could achieve with additional scale.

While we are very bullish on our prospects for continued profit

improvement, our focus now is on delivering consistently strong

performance. If we continue to do well, we will create

significant shareholder value while fulfilling our mission to

nourish pets, people and the planet."

First Quarter 2024

Net sales increased 33.6% to $223.8 million

for the first quarter of 2024 compared to $167.5 million for

the prior year period. The increase in net sales was primarily

driven by volume gains of 30.6%.

Gross profit was $88.2 million, or 39.4% as a

percentage of net sales, for the first quarter of 2024,

compared to $50.8 million, or 30.3% as a percentage of net sales,

for the prior year period. The increase in reported gross

profit as a percentage of net sales was primarily due to improved

leverage on plant expenses, reduced quality costs, and lower input

cost as a percentage of sales. For the first quarter of 2024,

Adjusted Gross Profit was $101.5 million, or 45.3% as a percentage

of net sales, compared to $64.4 million, or 38.5% as a percentage

of net sales, for the prior year period. Adjusted Gross Profit is a

non-GAAP financial measure defined under “Non-GAAP Measures” and is

reconciled to gross profit in the financial tables that accompany

this release.

Selling, general and administrative expenses

(“SG&A”) were $79.7 million for the first quarter of

2024 compared to $72.3 million for the prior year period. As a

percentage of net sales, SG&A decreased to 35.6% for the

first quarter of 2024 compared to 43.1% for the

prior year period. The decrease of 750 basis points

in SG&A as a percentage of net sales was mainly a result

of reduced logistics costs and media as a percentage of net sales,

in addition to lower share-based compensation. Adjusted SG&A

for the first quarter of 2024 was $70.9 million, or 31.7% as a

percentage of net sales, compared to $61.5 million, or 36.7% as a

percentage of net sales, for the prior year

period. Adjusted SG&A is a non-GAAP financial measure

defined under “Non-GAAP Measures” and is reconciled to SG&A in

the financial tables that accompany this release.

Net income was $18.6 million for the

first quarter of 2024 compared to net loss of $24.8

million for the prior year period. The improvement in net income

was due to contribution from higher sales, improved gross

margin, reduced logistics costs as a percentage of net sales,

and gain on equity investment of $9.9 million, partially offset by

increased SG&A including increased media spend of $6.1

million.

1 Adjusted EBITDA, as well as certain other

measures in this release, is a non-GAAP financial measure. See

"Non-GAAP Measures" for how the Company defines these measures

and the financial tables that accompany this release for

reconciliations of these measures to the closest comparable GAAP

measures.

Adjusted EBITDA was $30.6 million for the first

quarter of 2024, compared to $3.0 million for the

prior year period. The increase in Adjusted EBITDA was a result of

increased Adjusted Gross Profit partially offset by higher Adjusted

SG&A expenses. Adjusted EBITDA is a non-GAAP financial

measure defined under “Non-GAAP Measures” and is reconciled to net

income (loss) in the financial tables that accompany this

release.

Balance Sheet

As of March 31, 2024, the Company had cash

and cash equivalents of $257.9 million with $393.6 million of debt

outstanding net of $8.9 million of unamortized debt issuance

costs. For the first quarter of 2024, cash from operations was

$5.4 million, an increase of $19.1 million compared to the

prior year period.

The Company will utilize its balance sheet

to support its ongoing capital needs in connection with its

long-term capacity plan.

Outlook

For full year 2024, the Company is updating its

guidance and now expects the following:

- Net sales of at least $950 million, an increase of at

least 24% from 2023, unchanged from the previous guidance,

- Adjusted EBITDA of at least $120 million, compared to a range

of $100 to $110 million in the previous guidance, and

- Capital expenditures of ~$210 million, unchanged from the

previous guidance.

The Company does not provide guidance for net

income, the U.S. GAAP measure most directly comparable to Adjusted

EBITDA, and similarly cannot provide a reconciliation between its

forecasted Adjusted EBITDA and net income metrics without

unreasonable effort due to the unavailability of reliable estimates

for certain components of net income and the respective

reconciliations, including the timing of and amount of costs of

goods sold and selling, general and administrative expenses. These

items are not within the Company's control and may vary greatly

between periods and could significantly impact future results.

Conference Call & Earnings

Presentation Webcast Information As previously announced,

today, May 6, 2024, the Company will host a conference call

beginning at 8:00 a.m. Eastern Time with members of its leadership

team. The conference call webcast will be available live over the

Internet through the "Investors" section of the Company's website

at www.freshpet.com. To participate on the live call, listeners in

North America may dial (877) 407-0792 and international listeners

may dial (201) 689-8263.

A replay of the conference call will be archived

on the Company's website and telephonic playback will be available

from 12:00 p.m. Eastern Time today through May 20, 2024. North

American listeners may dial (844) 512-2921 and international

listeners may dial (412) 317-6671; the passcode is 13745823.

About Freshpet

Freshpet’s mission is to improve the lives of

dogs and cats through the power of fresh, real food. Freshpet foods

are blends of fresh meats, vegetables and fruits farmed locally and

made at our Freshpet Kitchens. We thoughtfully prepare our

foods using natural ingredients, cooking them in small batches at

lower temperatures to preserve the natural goodness of the

ingredients. Freshpet foods and treats are kept refrigerated from

the moment they are made until they arrive at Freshpet Fridges in

your local market.

Our foods are available in select mass, grocery

(including online), natural food, club, and pet specialty retailers

across the United States, Canada and Europe. From the care we

take to source our ingredients and make our food, to the moment it

reaches your home, our integrity, transparency and social

responsibility are the way we like to run our business. To learn

more, visit www.freshpet.com.

Connect with Freshpet:

https://www.facebook.com/Freshpet

https://x.com/Freshpet

http://instagram.com/Freshpet

http://pinterest.com/Freshpet

https://www.tiktok.com/@Freshpet

https://en.wikipedia.org/wiki/Freshpet

https://www.youtube.com/user/freshpet400

Forward Looking Statements

Certain statements in this release constitute

“forward-looking” statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

relating to future profitability, focus on delivering

consistently strong performance, ability to create significant

shareholder value, goals and guidance with respect to 2024 net

sales, Adjusted EBITDA and capital expenditures. These

statements are based on management's current opinions,

expectations, beliefs, plans, objectives, assumptions or

projections regarding future events or future results. These

forward-looking statements, involve certain risks and uncertainties

which could cause actual results, performance, and

achievements to differ materially from those stated or implied by

such forward-looking statements including, most prominently,

the risks discussed under the heading “Risk Factors” in the

Company's latest annual report on Form 10-K and its quarterly

reports on Form 10-Q filed with the Securities and Exchange

Commission. Such forward-looking statements are made only as of the

date of this release. Freshpet undertakes no obligation to publicly

update or revise any forward-looking statement because of new

information, future events or otherwise, except as otherwise

required by law. If we do update one or more forward-looking

statements, no inference should be made that we will make

additional updates with respect to those or other forward-looking

statements.

Non-GAAP Financial Measures

Freshpet uses the following non-GAAP financial

measures in its financial communications. These non-GAAP financial

measures should be considered as supplements to the U.S. GAAP

reported measures, should not be considered replacements for, or

superior to, the U.S. GAAP measures and may not be comparable to

similarly named measures used by other companies.

- Adjusted Gross Profit

- Adjusted Gross Profit as a % of net sales (Adjusted Gross

Margin)

- Adjusted SG&A

- Adjusted SG&A as a % of net sales

- EBITDA

- Adjusted EBITDA

- Adjusted EBITDA as a % of net sales

Adjusted Gross Profit: Freshpet defines Adjusted

Gross Profit as gross profit before depreciation expense,

non-cash share-based compensation and loss on disposal of

manufacturing equipment.

Adjusted SG&A Expenses: Freshpet defines

Adjusted SG&A as SG&A expenses before depreciation and

amortization, non-cash share-based compensation, loss on disposal

of equipment, implementation and other costs associated with the

implementation of an enterprise resource planning ("ERP") system,

fees related to the capped call options purchased, and advisory

fees related to activism engagement.

EBITDA and Adjusted EBITDA: EBITDA represents

net income (loss) plus interest expense net of interest income,

income tax expense and depreciation and amortization expense, and

Adjusted EBITDA represents EBITDA plus loss on equity method

investment, gain on equity investment, loss on disposal of

property, plant and equipment, non-cash share-based compensation

expense, implementation and other costs associated with the

implementation of an ERP system, fees related to the capped

call options purchased, and advisory fees related to activism

engagement.

Management believes that the non-GAAP financial

measures are meaningful to investors because they provide a view of

the Company with respect to ongoing operating results. The non-GAAP

financial measures are shown as supplemental disclosures in this

release because they are widely used by the investment community

for analysis and comparative evaluation. They also provide

additional metrics to evaluate the Company’s operations and, when

considered with both the Company’s U.S. GAAP results and the

reconciliation to the most comparable U.S. GAAP measures, provide a

more complete understanding of the Company’s business than could be

obtained absent this disclosure. The non-GAAP measures are not and

should not be considered an alternative to the most comparable U.S.

GAAP measures or any other figure calculated in accordance with

U.S. GAAP, or as an indicator of operating performance. The

Company’s calculation of the non-GAAP financial measures may differ

from methods used by other companies. Management believes that the

non-GAAP measures are important to an understanding of the

Company's overall operating results in the periods presented. The

non-GAAP financial measures are not recognized in accordance with

U.S. GAAP and should not be viewed as an alternative to U.S. GAAP

measures of performance.

|

FRESHPET, INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED BALANCE SHEETS(Unaudited, in thousands,

except per share data) |

| |

|

March 31, |

|

|

December 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

ASSETS |

|

|

|

|

|

|

|

|

| CURRENT ASSETS: |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

257,894 |

|

|

$ |

296,871 |

|

|

Accounts receivable, net of allowance for doubtful accounts |

|

|

68,507 |

|

|

|

56,754 |

|

|

Inventories, net |

|

|

71,865 |

|

|

|

63,238 |

|

|

Prepaid expenses |

|

|

5,757 |

|

|

|

7,615 |

|

|

Other current assets |

|

|

2,935 |

|

|

|

2,841 |

|

|

Total Current Assets |

|

|

406,958 |

|

|

|

427,319 |

|

| Property, plant and equipment,

net |

|

|

1,005,759 |

|

|

|

979,164 |

|

| Deposits on equipment |

|

|

1,295 |

|

|

|

1,895 |

|

| Operating lease right of use

assets |

|

|

3,237 |

|

|

|

3,616 |

|

| Long term investment in equity

securities |

|

|

33,446 |

|

|

|

23,528 |

|

| Other assets |

|

|

29,895 |

|

|

|

28,899 |

|

| Total Assets |

|

$ |

1,480,590 |

|

|

$ |

1,464,421 |

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY |

|

|

|

|

|

|

|

|

| CURRENT LIABILITIES: |

|

|

|

|

|

|

|

|

|

Accounts payable |

|

$ |

46,591 |

|

|

$ |

36,096 |

|

|

Accrued expenses |

|

|

32,193 |

|

|

|

49,816 |

|

|

Current operating lease liabilities |

|

|

1,174 |

|

|

|

1,312 |

|

|

Current finance lease liabilities |

|

|

1,988 |

|

|

|

1,998 |

|

|

Total Current Liabilities |

|

$ |

81,946 |

|

|

$ |

89,222 |

|

| Convertible senior notes |

|

|

393,588 |

|

|

|

393,074 |

|

| Long term operating lease

liabilities |

|

|

2,333 |

|

|

|

2,591 |

|

| Long term finance lease

liabilities |

|

|

24,879 |

|

|

|

26,080 |

|

| Total Liabilities |

|

$ |

502,746 |

|

|

$ |

510,967 |

|

| Commitments and

contingencies |

|

|

— |

|

|

|

— |

|

| STOCKHOLDERS' EQUITY: |

|

|

|

|

|

|

|

|

|

Common stock — voting, $0.001 par value, 200,000 shares authorized,

48,449 issued and 48,435 outstanding on March 31, 2024, and 48,277

issued and 48,263 outstanding on December 31, 2023 |

|

|

48 |

|

|

|

48 |

|

|

Additional paid-in capital |

|

|

1,288,890 |

|

|

|

1,282,984 |

|

|

Accumulated deficit |

|

|

(310,129 |

) |

|

|

(328,731 |

) |

|

Accumulated other comprehensive loss |

|

|

(709 |

) |

|

|

(591 |

) |

|

Treasury stock, at cost — 14 shares on March 31, 2024 and on

December 31, 2023 |

|

|

(256 |

) |

|

|

(256 |

) |

| Total Stockholders'

Equity |

|

|

977,844 |

|

|

|

953,454 |

|

| Total Liabilities and

Stockholders' Equity |

|

$ |

1,480,590 |

|

|

$ |

1,464,421 |

|

|

FRESHPET, INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME

(LOSS)(Unaudited, in thousands, except per share

data) |

| |

|

For the Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

NET SALES |

|

$ |

223,849 |

|

|

$ |

167,522 |

|

| COST OF GOODS SOLD |

|

|

135,691 |

|

|

|

116,762 |

|

| GROSS PROFIT |

|

|

88,158 |

|

|

|

50,760 |

|

| SELLING, GENERAL, AND

ADMINISTRATIVE EXPENSES |

|

|

79,695 |

|

|

|

72,271 |

|

| INCOME (LOSS) FROM

OPERATIONS |

|

|

8,463 |

|

|

|

(21,511 |

) |

| OTHER INCOME (EXPENSES): |

|

|

|

|

|

|

|

|

|

Interest and Other Income, net |

|

|

3,335 |

|

|

|

946 |

|

|

Interest Expense |

|

|

(3,060 |

) |

|

|

(3,171 |

) |

|

Gain on Equity Investment |

|

|

9,918 |

|

|

|

- |

|

|

|

|

|

10,193 |

|

|

|

(2,225 |

) |

| INCOME (LOSS) BEFORE INCOME

TAXES |

|

|

18,656 |

|

|

|

(23,736 |

) |

| INCOME TAX EXPENSE |

|

|

54 |

|

|

|

70 |

|

| LOSS ON EQUITY METHOD

INVESTMENT |

|

|

- |

|

|

|

980 |

|

| INCOME (LOSS) ATTRIBUTABLE TO

COMMON STOCKHOLDERS |

|

$ |

18,602 |

|

|

$ |

(24,786 |

) |

| OTHER COMPREHENSIVE (LOSS)

INCOME: |

|

|

|

|

|

|

|

|

|

Change in Foreign Currency Translation |

|

$ |

(118 |

) |

|

$ |

6 |

|

| TOTAL OTHER COMPREHENSIVE

(LOSS) INCOME |

|

|

(118 |

) |

|

|

6 |

|

| TOTAL COMPREHENSIVE INCOME

(LOSS) |

|

$ |

18,484 |

|

|

$ |

(24,780 |

) |

| NET INCOME (LOSS) PER SHARE

ATTRIBUTABLE TO COMMON STOCKHOLDERS |

|

|

|

|

|

|

|

|

|

-BASIC |

|

$ |

0.38 |

|

|

$ |

(0.52 |

) |

|

-DILUTED |

|

$ |

0.37 |

|

|

$ |

(0.52 |

) |

| WEIGHTED AVERAGE SHARES OF

COMMON STOCK OUTSTANDING |

|

|

|

|

|

|

|

|

|

-BASIC |

|

|

48,320 |

|

|

|

48,047 |

|

|

-DILUTED |

|

|

50,049 |

|

|

|

48,047 |

|

|

FRESHPET, INC. AND SUBSIDIARIESCONDENSED

CONSOLIDATED STATEMENT OF CASH FLOWS(Unaudited, in

thousands) |

| |

|

For the Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

|

CASH FLOWS FROM OPERATING ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

18,602 |

|

|

$ |

(24,786 |

) |

|

Adjustments to reconcile net income (loss) to net cash flows

provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

|

Provision for loss (gains) on accounts receivable |

|

|

4 |

|

|

|

(2 |

) |

|

Loss on disposal of property, plant and equipment |

|

|

150 |

|

|

|

268 |

|

|

Share-based compensation |

|

|

6,221 |

|

|

|

8,415 |

|

|

Inventory obsolescence |

|

|

699 |

|

|

|

(29 |

) |

|

Depreciation and amortization |

|

|

15,902 |

|

|

|

14,492 |

|

|

Write-off and amortization of deferred financing costs and loan

discount |

|

|

514 |

|

|

|

2,478 |

|

|

Change in operating lease right of use asset |

|

|

379 |

|

|

|

357 |

|

|

Loss on equity method investment |

|

|

— |

|

|

|

980 |

|

|

Gain on equity investment |

|

|

(9,918 |

) |

|

|

— |

|

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(11,757 |

) |

|

|

9,182 |

|

|

Inventories |

|

|

(7,817 |

) |

|

|

(8,000 |

) |

|

Prepaid expenses and other current assets |

|

|

548 |

|

|

|

2,525 |

|

|

Other assets |

|

|

(691 |

) |

|

|

(3,664 |

) |

|

Accounts payable |

|

|

9,909 |

|

|

|

(10,724 |

) |

|

Accrued expenses |

|

|

(16,943 |

) |

|

|

(4,869 |

) |

|

Operating lease liability |

|

|

(396 |

) |

|

|

(363 |

) |

|

Net cash flows provided by (used in) operating activities |

|

|

5,406 |

|

|

|

(13,740 |

) |

| CASH FLOWS FROM INVESTING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Purchase of short-term investments |

|

|

— |

|

|

|

(49,326 |

) |

|

Acquisitions of property, plant and equipment, software and

deposits on equipment |

|

|

(46,473 |

) |

|

|

(58,039 |

) |

|

Net cash flows used in investing activities |

|

|

(46,473 |

) |

|

|

(107,365 |

) |

| CASH FLOWS FROM FINANCING

ACTIVITIES: |

|

|

|

|

|

|

|

|

|

Proceeds from exercise of options to purchase common stock |

|

|

2,815 |

|

|

|

834 |

|

|

Tax withholdings related to net shares settlements of restricted

stock units |

|

|

(223 |

) |

|

|

(602 |

) |

|

Purchase of capped call options |

|

|

— |

|

|

|

(66,211 |

) |

|

Proceeds from issuance of convertible senior notes |

|

|

— |

|

|

|

393,518 |

|

|

Debt issuance costs |

|

|

— |

|

|

|

(2,026 |

) |

|

Principal payments under finance lease obligations |

|

|

(502 |

) |

|

|

— |

|

|

Net cash flows provided by financing activities |

|

|

2,090 |

|

|

|

325,513 |

|

| NET CHANGE IN CASH AND CASH

EQUIVALENTS |

|

|

(38,977 |

) |

|

|

204,408 |

|

| CASH AND CASH EQUIVALENTS,

BEGINNING OF YEAR |

|

|

296,871 |

|

|

|

132,735 |

|

| CASH AND CASH EQUIVALENTS, END

OF PERIOD |

|

$ |

257,894 |

|

|

$ |

337,143 |

|

|

FRESHPET, INC. AND

SUBSIDIARIESRECONCILIATION BETWEEN GROSS PROFIT

AND ADJUSTED GROSS PROFIT |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(Dollars in thousands) |

|

|

Gross profit |

|

$ |

88,158 |

|

|

$ |

50,760 |

|

| Depreciation expense |

|

|

10,675 |

|

|

|

10,721 |

|

| Non-cash share-based

compensation (a) |

|

|

2,622 |

|

|

|

2,956 |

|

| Loss on disposal of

manufacturing equipment |

|

|

21 |

|

|

|

— |

|

| Adjusted Gross

Profit |

|

$ |

101,476 |

|

|

$ |

64,437 |

|

| Adjusted Gross Profit as a %

of Net Sales |

|

|

45.3 |

% |

|

|

38.5 |

% |

|

|

(a) |

Includes true-ups, if required, to share-based compensation expense

compared to prior periods. We have certain

outstanding share-based awards with performance-based vesting

conditions that require the achievement of certain Adjusted EBITDA

and/or Net Sales targets as a condition of vesting. At each

reporting period, we reassess the probability of achieving the

performance criteria and the performance period required to meet

those targets. When such performance conditions are deemed to be

improbable of achievement, the compensation cost previously

recorded is reversed. |

|

FRESHPET, INC. AND

SUBSIDIARIESRECONCILIATION BETWEEN SG&A

EXPENSES AND ADJUSTED SG&A EXPENSES |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(Dollars in thousands) |

|

|

SG&A expenses |

|

$ |

79,695 |

|

|

$ |

72,271 |

|

| Depreciation and amortization

expense |

|

|

5,070 |

|

|

|

3,771 |

|

| Non-cash share-based

compensation (a) |

|

|

3,600 |

|

|

|

5,459 |

|

| Loss on disposal of

equipment |

|

|

129 |

|

|

|

268 |

|

| Enterprise Resource Planning

(b) |

|

|

— |

|

|

|

801 |

|

| Capped Call Transactions fees

(c) |

|

|

— |

|

|

|

113 |

|

| Activism engagement (d) |

|

|

— |

|

|

|

389 |

|

| Adjusted SG&A

Expenses |

|

$ |

70,896 |

|

|

$ |

61,470 |

|

| Adjusted SG&A Expenses as

a % of Net Sales |

|

|

31.7 |

% |

|

|

36.7 |

% |

|

|

(a) |

Includes true-ups, if required, to share-based compensation expense

compared to prior periods. We have certain

outstanding share-based awards with performance-based vesting

conditions that require the achievement of certain Adjusted EBITDA

and/or Net Sales targets as a condition of vesting. At each

reporting period, we reassess the probability of achieving the

performance criteria and the performance period required to meet

those targets. When such performance conditions are deemed to be

improbable of achievement, the compensation cost previously

recorded is reversed. |

| |

(b) |

Represents costs associated with the implementation of an ERP

system. |

| |

(c) |

Represents fees associated with the Capped Call Transactions. |

| |

(d) |

Represents advisory fees related to activism engagement. |

|

FRESHPET, INC. AND

SUBSIDIARIESRECONCILIATION BETWEEN NET INCOME

(LOSS) AND ADJUSTED EBITDA |

| |

|

Three Months Ended |

|

| |

|

March 31, |

|

| |

|

2024 |

|

|

2023 |

|

| |

|

(Dollars in thousands) |

|

|

Net income (loss) |

|

$ |

18,602 |

|

|

$ |

(24,786 |

) |

| Depreciation and

amortization |

|

|

15,745 |

|

|

|

14,492 |

|

| Interest income, net of

interest expense |

|

|

(275 |

) |

|

|

2,225 |

|

| Income tax expense |

|

|

54 |

|

|

|

70 |

|

| EBITDA |

|

$ |

34,126 |

|

|

$ |

(7,999 |

) |

| Loss on equity method

investment |

|

|

— |

|

|

|

980 |

|

| Gain on equity investment |

|

|

(9,918 |

) |

|

|

— |

|

| Loss on disposal of property,

plant and equipment |

|

|

150 |

|

|

|

268 |

|

| Non-cash share-based

compensation (a) |

|

|

6,221 |

|

|

|

8,415 |

|

| Enterprise Resource Planning

(b) |

|

|

— |

|

|

|

801 |

|

| Capped Call Transactions fees

(c) |

|

|

— |

|

|

|

113 |

|

| Activism engagement (d) |

|

|

— |

|

|

|

389 |

|

| Adjusted

EBITDA |

|

$ |

30,579 |

|

|

$ |

2,967 |

|

| Adjusted EBITDA as a % of Net

Sales |

|

|

13.7 |

% |

|

|

1.8 |

% |

|

|

(a) |

Includes true-ups, if required, to share-based compensation expense

compared to prior periods. We have certain

outstanding share-based awards with performance-based vesting

conditions that require the achievement of certain Adjusted EBITDA

and/or Net Sales targets as a condition of vesting. At each

reporting period, we reassess the probability of achieving the

performance criteria and the performance period required to meet

those targets. When such performance conditions are deemed to be

improbable of achievement, the compensation cost previously

recorded is reversed. |

| |

(b) |

Represents costs associated with the implementation of an ERP

system. |

| |

(c) |

Represents fees associated with the Capped Call Transactions. |

| |

(d) |

Represents advisory fees related to activism engagement. |

Investor Contact:

Rachel Ulsh

Rulsh@freshpet.com

Media Contact:

Press@freshpet.com

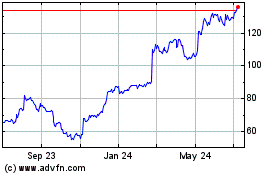

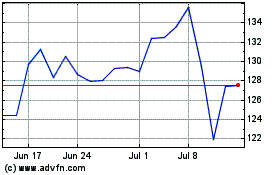

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Freshpet (NASDAQ:FRPT)

Historical Stock Chart

From Dec 2023 to Dec 2024