Current Report Filing (8-k)

October 25 2017 - 4:07PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM

8-K

CURRENT

REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of Earliest Event Reported): October 24, 2017

FORRESTER RESEARCH, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

Delaware

|

|

000-21433

|

|

04-2797789

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission

File Number)

|

|

(I.R.S. Employer

Identification Number)

|

60 Acorn Park Drive

Cambridge, Massachusetts 02140

(Address of principal executive offices, including zip code)

(617)

613-6000

(Registrant’s telephone number including area code)

N/A

(Former Name or

Former Address, if Changes since Last Report)

Check the appropriate box below

if the Form

8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule

14a-12

under the Exchange Act (17 CFR

240.14a-12)

|

|

☐

|

Pre-commencement

communications pursuant to Rule

14d-2(b)

under the Exchange Act (17 CFR

240.14d-2(b))

|

|

☐

|

Pre-commencement

communications pursuant to Rule

13-4(c)

under the Exchange Act (17 CFR

240.13e-4(c))

|

Indicate by check mark whether the registrant is an emerging growth company as

defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule

12b-2

of the Securities Exchange Act of 1934 (17 CFR

§240.12b-2).

Emerging growth company ☐

If an emerging

growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ☐

|

Item 2.02.

|

Results of Operations and Financial Condition.

|

The information contained in this

current report on Form

8-K

is furnished pursuant to Item 2.02 of Form

8-K

“Results of Operations and Financial Condition”. This information and the exhibits

hereto are being furnished and shall not be deemed to be “filed” for the purposes of Section 18 of, or otherwise regarded as filed under, the Securities Exchange Act of 1934, as amended. The information contained in this report shall

not be incorporated by reference into any filing of Forrester Research, Inc. with the SEC, whether made before or after the date hereof, regardless of any general incorporation language in such filings.

On October 25, 2017, Forrester Research, Inc. issued a press release announcing its financial results for the quarter ended

September 30, 2017.

Forrester believes that pro forma financial results provide investors with consistent and comparable information

to aid in the understanding of Forrester’s ongoing business. Forrester uses pro forma financial information to manage its business, including use of pro forma financial results as the basis for setting targets for various compensation

programs.

Our pro forma presentation excludes the following, as well as their related tax effects:

Amortization of

intangibles—we exclude the effect of the amortization of intangibles from our pro forma results in order to more consistently present our ongoing results of operations.

Gains and losses from investments—we have consistently excluded both gains and losses related to our investments in

non-marketable

securities and sales of marketable securities from our pro forma results in order to keep quarter-over-quarter and year-over-year comparisons consistent.

Stock-based compensation expense—we exclude stock-based compensation from our pro forma results in order to keep quarter-over-quarter and

year-over-year comparisons consistent.

Reorganization costs associated with the Company’s reductions in force are not included in

our pro forma results in order to keep quarter-over-quarter and year-over-year comparisons consistent.

However, these measures should be

considered in addition to, not as a substitute for, or superior to, operating income or other measures of financial performance prepared in accordance with generally accepted accounting principles as more fully discussed in our financial statements

and filings with the Securities and Exchange Commission.

On October 25, 2017, the Company also announced that its Board of

Directors has approved a regular quarterly cash dividend of $0.19 per share, to be paid on December 20, 2017 to shareholders of record on December 6, 2017.

|

Item 9.01.

|

Financial Statements and Exhibits

|

(d)

Exhibits

-2-

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

FORRESTER RESEARCH, INC.

|

|

|

|

|

By

|

|

/s/ Michael A. Doyle

|

|

Name:

|

|

Michael A. Doyle

|

|

Title:

|

|

Chief Financial Officer

|

Date: October 25, 2017

-3-

Exhibit Index

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

99.1

|

|

Press Release dated October 25, 2017

|

-4-

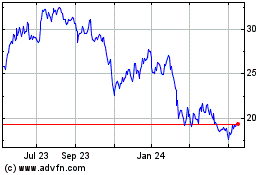

Forrester Research (NASDAQ:FORR)

Historical Stock Chart

From Dec 2024 to Jan 2025

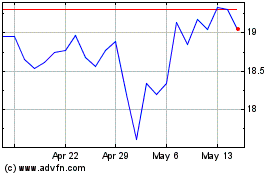

Forrester Research (NASDAQ:FORR)

Historical Stock Chart

From Jan 2024 to Jan 2025