Flywire Corporation (Nasdaq: FLYW) (“Flywire” or the “Company”) a

global payments enablement and software company, today reported

financial results for its fourth quarter and fiscal-year ended

December 31, 2024.

"Our fourth quarter results capped off another strong year for

Flywire as we continued to grow the business while navigating a

complex macro environment with significant headwinds,” said Mike

Massaro, CEO of Flywire, “We continued to focus on business and

bottom line growth and generated 17% revenue growth and 680 bps

adjusted EBITDA margin growth in the quarter.”

"Looking ahead, we’re focused on driving effectiveness and

discipline throughout our global business. We will be undertaking

an operational and business portfolio review. The operational

review will help ensure we are efficient and effective, with a

focus on driving productivity and optimizing investments across all

areas. Our comprehensive business portfolio review will focus on

Flywire’s core strengths - such as complex, large-value payment

processing, our global payment network, and verticalized

software.”

“One of the efficiency measures we are undertaking is a

restructuring, which impacts approximately 10% of our workforce. It

is difficult to say goodbye to so many FlyMates, and I want to

thank them for their hard work as we endeavor to support them

throughout this transition.”

“As we refocus our teams on areas that we believe will drive

Flywire’s future growth, we are excited to announce the acquisition

of Sertifi, which is expected to accelerate the expansion of our

fast-growing Travel vertical. Sertifi augments our travel product

offering with a leading dedicated hotel property management system

integration and expands our footprint across more than 20,000 hotel

locations worldwide."

Fourth Quarter 2024 Financial Highlights:

GAAP Results

- Revenue increased 17.0% to $117.6 million in the fourth quarter

of 2024, compared to $100.5 million in the fourth quarter of

2023.

- Gross Profit increased to $74.3 million, resulting in Gross

Margin of 63.2%, for the fourth quarter of 2024, compared to Gross

Profit of $61.8 million and Gross Margin of 61.5% in the fourth

quarter of 2023.

- Net loss was ($15.9) million in the fourth quarter of 2024,

compared to net income of $1.3 million in the fourth quarter of

2023.

Key Operating Metrics and Non-GAAP Results

- Number of clients grew by 16%year-over-year, with over 180 new

clients added in the fourth quarter of 2024.

- Total Payment Volume increased 27.6% to $6.9 billion in the

fourth quarter of 2024, compared to $5.4 billion in the fourth

quarter of 2023.

- Revenue Less Ancillary Services increased 17.4% to $112.8

million in the fourth quarter of 2024, compared to $96.1 million in

the fourth quarter of 2023.

- Adjusted Gross Profit increased to $75.6 million, up 19.1%

compared to $63.5 million in the fourth quarter of 2023. Adjusted

Gross Margin was 67.0% in the fourth quarter of 2024 compared to

66.1% in the fourth quarter of 2023.

- Adjusted EBITDA increased to $16.7 million in the fourth

quarter of 2024, compared to $7.7 million in the fourth quarter of

2023. Our adjusted EBITDA margins increased 680 bps year-over-year

to 14.8% in the fourth quarter of 2024.

2024 Business Highlights:

- We signed more than 800 new clients in fiscal-year 2024

surpassing the 700 new clients signed in fiscal-year 2023.

- Our transaction payment volume grew by 23.6% year-over-year to

$29.7 billion

- Our global education

vertical, continued to strengthen in a number of core

geographies, with U.K. region outperformance driven by new clients

and net revenue retention; accompanied by growth in our network of

international recruitment agents to further

connect our ecosystem of clients, agents and payers

- Our travel vertical grew into our second

largest vertical in terms of revenue less ancillary services, and

we generated strong growth most notably with EMEA and APAC based

Tour Operators and DMC providers, particularly in our new sub

vertical of ocean experiences.

- Our business-to-business vertical continued

its strong organic growth, enhanced by the acquisition of

Invoiced.

- We further optimized our global payment

network to enable vertical growth with a focus on new

acceptance rails, market localization and expanded network

coverage. This included continued support of our strategic payer

markets like India and China, enhancing our

offerings to digitize the disbursement of student loans from India

and strengthening partnerships with India’s three largest

banks.

- We repurchased 2.3 million shares for approximately $44

million, inclusive of commissions, under our share repurchase

program announced on August 6th, 2024.

First Quarter and Fiscal-Year 2025 Outlook:

“Effective execution drove both revenue growth and margin

expansion in 2024, in spite of significant macroeconomic

challenges” said Flywire's CFO, Cosmin Pitigoi. “For our 2025

financial outlook, we project revenue less ancillary services

growth of 10-14% on an FX-neutral (constant currency) basis, and a

200-400 basis point increase in adjusted EBITDA margin. We expect

approximately 3 percentage points of headwind from FX throughout

the year. This guidance excludes the contributions from the

Sertifi acquisition, as well as any potential lessening of the

macroeconomic headwinds. We are particularly encouraged by the

anticipated performance of our combined travel vertical, as well as

the emerging B2B vertical, both of which are expected to exceed our

historical growth rate for the applicable vertical”

Based on information available as of February 25, 2025, Flywire

anticipates the following results for the first quarter and

fiscal-year 2025 excluding Sertifi.

|

|

Fiscal-Year 2025 |

|

FX-Neutral GAAP Revenue Growth |

9-13% YoY |

|

FX-Neutral Revenue Less Ancillary Services Growth |

10-14% YoY |

|

Adjusted EBITDA* Margin Growth |

+200-400 bps YoY |

|

|

|

|

|

First Quarter 2025 |

|

FX-Neutral GAAP Revenue Growth |

10-13% YoY |

|

FX-Neutral Revenue Less Ancillary Services Growth |

11-14% YoY |

|

Adjusted EBITDA* Margin Growth |

+300-600 bps YoY |

|

|

|

“Based on Sertifi’s historical financials, we currently expect

the acquisition to provide incremental revenue of $3.0-4.0 million

and $30.0-40.0 million in revenue in the first quarter and

fiscal year 2025, respectively. In addition, we currently

expect the Sertifi acquisition to have a flat to slightly positive

effect on adjusted EBITDA and positive (low single–digit million)

effect on adjusted EBITDA, in the first quarter and fiscal year

2025, respectively, as we plan to invest in the combined solution

during 2025.”

*Flywire has not provided a quantitative reconciliation of

forecasted Adjusted EBITDA Margin growth to forecasted GAAP Net

Income Margin growth within this earnings release because Flywire

is unable, without making unreasonable efforts, to calculate

certain reconciling items with confidence. These items include, but

are not limited to income taxes which are directly impacted by

unpredictable fluctuations in the market price of Flywire's stock

and in foreign currency exchange rates.

These statements are forward-looking and actual results may

differ materially. Refer to the “Safe Harbor Statement” below for

information on the factors that could cause Flywire’s actual

results to differ materially from these forward-looking

statements.

Conference Call

The Company will host a conference call to discuss fourth

quarter and fiscal-year 2024 financial results today at 5:00 pm ET.

Hosting the call will be Mike Massaro, CEO, Rob Orgel, President

and COO, and Cosmin Pitigoi, CFO. The conference call can be

accessed live via webcast from the Company's investor relations

website at https://ir.flywire.com/. A replay will be available on

the investor relations website following the call.

Note Regarding Share Repurchase Program

Repurchases under the Company’s share repurchase program (the

Repurchase Program) may be made from time to time through open

market purchases, in privately negotiated transactions or by other

means, including through the use of trading plans intended to

qualify under Rule 10b5-1 under the Securities Exchange Act of

1934, as amended, in accordance with applicable securities laws and

other restrictions, including Rule 10b-18. The timing, value and

number of shares repurchased will be determined by the Company in

its discretion and will be based on various factors, including an

evaluation of current and future capital needs, current and

forecasted cash flows, the Company’s capital structure, cost of

capital and prevailing stock prices, general market and economic

conditions, applicable legal requirements, and compliance with

covenants in the Company’s credit facility that may limit share

repurchases based on defined leverage ratios. The Repurchase

Program does not obligate the Company to purchase a specific number

of, or any, shares. The Repurchase Program does not expire

and may be modified, suspended or terminated at any time without

notice at the Company’s discretion.

Key Operating Metrics and Non-GAAP Financial

Measures

Flywire uses non-GAAP financial measures to supplement financial

information presented on a GAAP basis. The Company believes that

excluding certain items from its GAAP results allows management to

better understand its consolidated financial performance from

period to period and better project its future consolidated

financial performance as forecasts are developed at a level of

detail different from that used to prepare GAAP-based financial

measures. Moreover, Flywire believes these non-GAAP financial

measures provide its stakeholders with useful information to help

them evaluate the Company’s operating results by facilitating an

enhanced understanding of the Company’s operating performance and

enabling them to make more meaningful period to period comparisons.

There are limitations to the use of the non-GAAP financial measures

presented here. Flywire’s non-GAAP financial measures may not be

comparable to similarly titled measures of other companies. Other

companies, including companies in Flywire’s industry, may calculate

non-GAAP financial measures differently, limiting the usefulness of

those measures for comparative purposes.

Flywire uses supplemental measures of its performance which are

derived from its consolidated financial information, but which are

not presented in its consolidated financial statements prepared in

accordance with GAAP. These non-GAAP financial measures include the

following:

- Revenue Less Ancillary Services. Revenue Less Ancillary

Services represents the Company’s consolidated revenue in

accordance with GAAP after excluding (i) pass-through cost for

printing and mailing services and (ii) marketing fees. The Company

excludes these amounts to arrive at this supplemental non-GAAP

financial measure as it views these services as ancillary to the

primary services it provides to its clients.

- Adjusted Gross Profit and Adjusted Gross Margin. Adjusted

gross profit represents Revenue Less Ancillary Services less cost

of revenue adjusted to (i) exclude pass-through cost for printing

services, (ii) offset marketing fees against costs incurred and

(iii) exclude depreciation and amortization, including accelerated

amortization on the impairment of customer set-up costs tied to

technology integration. Adjusted Gross Margin represents Adjusted

Gross Profit divided by Revenue Less Ancillary Services.

Management believes this presentation supplements the GAAP

presentation of Gross Margin with a useful measure of the gross

margin of the Company’s payment-related services, which are the

primary services it provides to its clients.

- Adjusted EBITDA. Adjusted EBITDA represents EBITDA

further adjusted by excluding (i) stock-based compensation expense

and related payroll taxes, (ii) the impact from the change in fair

value measurement for contingent consideration associated with

acquisitions,(iii) gain (loss) from the remeasurement of foreign

currency, (iv) indirect taxes related to intercompany activity, (v)

acquisition related transaction costs, and (vi) employee retention

costs, such as incentive compensation, associated with acquisition

activities. Management believes that the exclusion of these amounts

to calculate Adjusted EBITDA provides useful measures for

period-to-period comparisons of the Company’s business. We

calculate adjusted EBITDA margin by dividing adjusted EBITDA by

Revenue Less Ancillary Services.

- Revenue Less Ancillary Services at Constant Currency.

Revenue Less Ancillary Services at Constant Currency represents

Revenue Less Ancillary Services adjusted to show presentation on a

constant currency basis. The constant currency information

presented is calculated by translating current period results using

prior period weighted average foreign currency exchange

rates. Flywire analyzes Revenue Less Ancillary Services

on a constant currency basis to provide a comparable framework for

assessing how the business performed excluding the effect of

foreign currency fluctuations.

- Non-GAAP Operating Expenses - Non-GAAP Operating Expenses

represents GAAP Operating Expenses adjusted by excluding (i)

stock-based compensation expense and related payroll taxes, (ii)

depreciation and amortization, (iii) acquisition related

transaction costs, if applicable, (iv) employee retention costs,

such as incentive compensation, associated with acquisition

activities and (v) the impact from the change in fair value

measurement for contingent consideration associated with

acquisitions.

These non-GAAP financial measures are not meant to be considered

as indicators of performance in isolation from or as a substitute

for the Company’s revenue, gross profit, gross margin or net income

(loss), or operating expenses prepared in accordance with GAAP and

should be read only in conjunction with financial information

presented on a GAAP basis. Reconciliations of Revenue Less

Ancillary Services, Revenue Less Ancillary Services at Constant

Currency, Adjusted Gross Profit, Adjusted Gross Margin, Adjusted

EBITDA and non-GAAP Operating Expenses to the most directly

comparable GAAP financial measure are presented below. Flywire

encourages you to review these reconciliations in conjunction with

the presentation of the non-GAAP financial measures for each of the

periods presented. In future fiscal periods, Flywire may exclude

such items and may incur income and expenses similar to these

excluded items. Flywire has not provided a quantitative

reconciliation of forecasted Adjusted EBITDA Margin growth to

forecasted GAAP Net Income growth within this earnings release

because it is unable, without making unreasonable efforts, to

calculate certain reconciling items with confidence. These items

include but are not limited to income taxes which are directly

impacted by unpredictable fluctuations in the market price of

Flywire's stock and in foreign exchange rates. For figures in

this press release reported on an "FX-Neutral basis,” Flywire

calculates the year-over-year impact of foreign currency movements

using prior period weighted average foreign currency rates.

About Flywire

Flywire is a global payments enablement and software company. We

combine our proprietary global payments network, next-gen payments

platform and vertical-specific software to deliver the most

important and complex payments for our clients and their

customers.

Flywire leverages its vertical-specific software and payments

technology to deeply embed within the existing A/R workflows for

its clients across the education, healthcare and travel vertical

markets, as well as in key B2B industries. Flywire also integrates

with leading ERP systems, such as NetSuite, so organizations can

optimize the payment experience for their customers while

eliminating operational challenges.

Flywire supports approximately 4,500** clients with diverse

payment methods in more than 140 currencies across 240 countries

and territories around the world. Flywire is headquartered in

Boston, MA, USA with global offices. For more information, visit

www.flywire.com. Follow Flywire on X (formerly known as Twitter),

LinkedIn and Facebook.

**Excludes clients from Flywire’s Invoiced and Sertifi

acquisitions

Safe Harbor Statement

This release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995,

including, but not limited to, statements regarding Flywire’s

future operating results and financial position, Flywire’s business

strategy and plans, market growth, and Flywire’s objectives for

future operations. Flywire intends such forward-looking statements

to be covered by the safe harbor provisions for forward-looking

statements contained in Section 21E of the Securities Exchange Act

of 1934 and the Private Securities Litigation Reform Act of 1995.

In some cases, you can identify forward-looking statements by terms

such as, but not limited to, “believe,” “may,” “will,”

“potentially,” “estimate,” “continue,” “anticipate,” “intend,”

“could,” “would,” “project,” “target,” “plan,” “expect,” or the

negative of these terms, and similar expressions intended to

identify forward-looking statements. Such forward-looking

statements are based upon current expectations that involve risks,

changes in circumstances, assumptions, and uncertainties. Important

factors that could cause actual results to differ materially from

those reflected in Flywire's forward-looking statements include,

among others, Flywire’s future financial performance, including its

expectations regarding FX-Neutral GAAP Revenue Growth, FX-Neutral

Revenue Less Ancillary Services Growth, and Adjusted EBITDA Margin

Growth and foreign exchange rates. Risks that may cause

actual results to differ materially from these forward looking

statements include, but are not limited to: Flywire’s ability

to execute its business plan and effectively manage its growth;

Flywire’s cross-border expansion plans and ability to expand

internationally; anticipated trends, growth rates, and challenges

in Flywire’s business and in the markets in which Flywire operates;

the sufficiency of Flywire’s cash and cash equivalents to

meet its liquidity needs; political, economic, foreign

currency exchange rate, inflation, legal, social and health risks,

that may affect Flywire’s business or the global economy; Flywire’s

beliefs and objectives for future operations; Flywire’s ability to

develop and protect its brand; Flywire’s ability to maintain and

grow the payment volume that it processes; Flywire’s ability to

further attract, retain, and expand its client base; Flywire’s

ability to develop new solutions and services and bring them to

market in a timely manner; Flywire’s expectations concerning

relationships with third parties, including financial institutions

and strategic partners; the effects of increased competition in

Flywire’s markets and its ability to compete effectively; recent

and future acquisitions or investments in complementary companies,

products, services, or technologies; Flywire’s ability to enter new

client verticals, including its relatively new

business-to-business sector; Flywire’s expectations regarding

anticipated technology needs and developments and its ability to

address those needs and developments with its solutions; Flywire’s

expectations regarding its ability to meet existing performance

obligations and maintain the operability of its solutions;

Flywire’s expectations regarding the effects of existing and

developing laws and regulations, including with respect to payments

and financial services, taxation, privacy and data protection;

economic and industry trends, projected growth, or trend analysis;

the effects of global events and geopolitical conflicts, including

without limitation the continuing hostilities in Ukraine and

involving Israel; Flywire’s ability to adapt to changes in

U.S. federal income or other tax laws or the interpretation of tax

laws, including the Inflation Reduction Act of 2022;

Flywire’s ability to attract and retain qualified employees;

Flywire’s ability to maintain, protect, and enhance its

intellectual property; Flywire’s ability to maintain the security

and availability of its solutions; the increased expenses

associated with being a public company; the future market price of

Flywire’s common stock; and other factors that are described in the

"Risk Factors" and "Management's Discussion and Analysis of

Financial Condition and Results of Operations" sections of

Flywire's Annual Report on Form 10-K for the year ended December

31, 2023, and Quarterly Report on Form 10-Q for the quarter ended

September 30, 2024, which are on file with the Securities and

Exchange Commission (SEC) and available on the SEC's website at

https://www.sec.gov/. Additional factors may be described in those

sections of Flywire’s Annual Report on Form 10-K for the year ended

December 31, 2024, expected to be filed in the first quarter of

2025. The information in this release is provided only as of the

date of this release, and Flywire undertakes no obligation to

update any forward-looking statements contained in this release on

account of new information, future events, or otherwise, except as

required by law.

Contacts

Investor Relations:Masha

Kahnir@Flywire.com

Media:Sarah

KingMedia@Flywire.com

|

Condensed Consolidated Statements of Operations and

Comprehensive Loss |

|

(Unaudited) (Amounts in thousands, except share and per

share amounts) |

| |

|

|

|

|

|

|

|

| |

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenue |

$ |

117,550 |

|

|

$ |

100,545 |

|

|

$ |

492,144 |

|

|

$ |

403,094 |

|

| Costs

and operating expenses: |

|

|

|

|

|

|

|

| Payment

processing services costs |

|

41,384 |

|

|

|

36,780 |

|

|

|

177,490 |

|

|

|

147,339 |

|

|

Technology and development |

|

17,370 |

|

|

|

16,898 |

|

|

|

66,636 |

|

|

|

62,028 |

|

| Selling

and marketing |

|

33,353 |

|

|

|

28,830 |

|

|

|

129,435 |

|

|

|

107,621 |

|

| General

and administrative |

|

31,218 |

|

|

|

28,065 |

|

|

|

125,838 |

|

|

|

107,624 |

|

| Total

costs and operating expenses |

|

123,325 |

|

|

|

110,573 |

|

|

|

499,399 |

|

|

|

424,612 |

|

| Loss

from operations |

$ |

(5,775 |

) |

|

$ |

(10,028 |

) |

|

$ |

(7,255 |

) |

|

$ |

(21,518 |

) |

| Other

income (expense): |

|

|

|

|

|

|

|

| Interest

expense |

|

(135 |

) |

|

|

(92 |

) |

|

|

(538 |

) |

|

|

(372 |

) |

| Interest

income |

|

4,872 |

|

|

|

5,638 |

|

|

|

21,440 |

|

|

|

13,349 |

|

| Gain

(loss) from remeasurement of foreign currency |

|

(13,866 |

) |

|

|

7,707 |

|

|

|

(11,787 |

) |

|

|

4,189 |

|

| Total

other income (expense), net |

|

(9,129 |

) |

|

|

13,253 |

|

|

|

9,115 |

|

|

|

17,166 |

|

| Income

(loss) before provision for income taxes |

|

(14,904 |

) |

|

|

3,225 |

|

|

|

1,860 |

|

|

|

(4,352 |

) |

|

Provision (benefit) for income taxes |

|

995 |

|

|

|

1,938 |

|

|

|

(1,040 |

) |

|

|

4,214 |

|

| Net

Income (Loss) |

$ |

(15,899 |

) |

|

$ |

1,287 |

|

|

$ |

2,900 |

|

|

$ |

(8,566 |

) |

| Foreign

currency translation adjustment |

|

(7,330 |

) |

|

|

3,731 |

|

|

|

(3,594 |

) |

|

|

3,232 |

|

|

Unrealized losses on available-for-sale debt securities, net |

$ |

(441 |

) |

|

$ |

— |

|

|

$ |

208 |

|

|

$ |

— |

|

| Total

other comprehensive income (loss) |

$ |

(7,771 |

) |

|

$ |

3,731 |

|

|

$ |

(3,386 |

) |

|

$ |

3,232 |

|

|

Comprehensive income (loss) |

$ |

(23,670 |

) |

|

$ |

5,018 |

|

|

$ |

(486 |

) |

|

$ |

(5,334 |

) |

| Net loss

attributable to common stockholders - basic and diluted |

$ |

(15,899 |

) |

|

$ |

1,287 |

|

|

$ |

2,900 |

|

|

$ |

(8,566 |

) |

| Net loss

per share attributable to common stockholders - basic |

$ |

(0.13 |

) |

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

(0.07 |

) |

| Net loss

per share attributable to common stockholders - diluted |

$ |

(0.12 |

) |

|

$ |

0.01 |

|

|

$ |

0.02 |

|

|

$ |

(0.07 |

) |

| Weighted

average common shares outstanding - basic |

|

124,463,252 |

|

|

|

121,690,938 |

|

|

|

124,269,820 |

|

|

|

114,828,494 |

|

| Weighted

average common shares outstanding - diluted |

|

128,924,166 |

|

|

|

128,877,877 |

|

|

|

129,339,462 |

|

|

|

114,828,494 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Balance Sheets |

|

(Unaudited) (Amounts in thousands, except share

amounts) |

| |

|

|

|

|

|

December 31, |

|

December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Assets |

|

|

|

| Current

assets: |

|

|

|

| Cash and

cash equivalents |

$ |

495,242 |

|

|

$ |

654,608 |

|

|

Restricted cash |

|

— |

|

|

|

— |

|

|

Short-term investments |

|

115,848 |

|

|

|

— |

|

| Accounts

receivable, net |

|

23,703 |

|

|

|

18,215 |

|

| Unbilled

receivables, net |

|

15,453 |

|

|

|

10,689 |

|

| Funds

receivable from payment partners |

|

90,110 |

|

|

|

113,945 |

|

| Prepaid

expenses and other current assets |

|

22,528 |

|

|

|

18,227 |

|

| Total

current assets |

|

762,884 |

|

|

|

815,684 |

|

|

Long-term investments |

|

50,125 |

|

|

|

— |

|

| Property

and equipment, net |

|

17,160 |

|

|

|

15,134 |

|

|

Intangible assets, net |

|

118,684 |

|

|

|

108,178 |

|

|

Goodwill |

|

149,558 |

|

|

|

121,646 |

|

| Other

assets |

|

24,035 |

|

|

|

19,089 |

|

| Total

assets |

$ |

1,122,446 |

|

|

$ |

1,079,731 |

|

|

|

|

|

|

|

Liabilities and Stockholders’ Equity |

|

|

|

| Current

liabilities: |

|

|

|

| Accounts

payable |

$ |

15,353 |

|

|

$ |

12,587 |

|

| Funds

payable to clients |

|

217,788 |

|

|

|

210,922 |

|

| Accrued

expenses and other current liabilities |

|

49,297 |

|

|

|

43,315 |

|

| Deferred

revenue |

|

7,337 |

|

|

|

6,968 |

|

| Total

current liabilities |

|

289,775 |

|

|

|

273,792 |

|

| Deferred

tax liabilities |

|

12,643 |

|

|

|

15,391 |

|

| Other

liabilities |

|

5,261 |

|

|

|

4,431 |

|

| Total

liabilities |

|

307,679 |

|

|

|

293,614 |

|

|

Commitments and contingencies (Note 16) |

|

|

|

|

Stockholders’ equity: |

|

|

|

|

Preferred stock, $0.0001 par value; 10,000,000 shares authorized as

of December 31, 2024 and 2023; and no shares issued and

outstanding as of December 31, 2024 and 2023 |

|

— |

|

|

|

— |

|

| Voting

common stock, $0.0001 par value; 2,000,000,000 shares authorized

as of December 31, 2024 and December 31, 2023; 126,853,852

shares issued and 122,182,878 shares outstanding as of

December 31, 2024; 123,010,207 shares issued and 120,695,162

shares outstanding as of December 31, 2023 |

|

13 |

|

|

|

11 |

|

|

Non-voting common stock, $0.0001 par value; 10,000,000 shares

authorized as of December 31, 2024 and December 31, 2023;

1,873,320 shares issued and outstanding as of December 31,

2024 and December 31, 2023 |

|

— |

|

|

|

1 |

|

| Treasury

voting common stock, 4,670,974 and 2,315,045 shares as of

December 31, 2024 and December 31, 2023, respectively, held at

cost |

|

(46,268 |

) |

|

|

(747 |

) |

|

Additional paid-in capital |

|

1,033,958 |

|

|

|

959,302 |

|

|

Accumulated other comprehensive income |

|

(2,066 |

) |

|

|

1,320 |

|

|

Accumulated deficit |

|

(170,870 |

) |

|

|

(173,770 |

) |

| Total

stockholders’ equity |

|

814,767 |

|

|

|

786,117 |

|

| Total

liabilities and stockholders’ equity |

$ |

1,122,446 |

|

|

$ |

1,079,731 |

|

|

|

|

|

|

|

|

|

|

|

Condensed Consolidated Statement of Cash

Flows |

|

(Unaudited) (Amounts in thousands) |

| |

|

|

|

| |

Twelve Months Ended December 31, |

|

|

|

2024 |

|

|

|

2023 |

|

|

Cash flows from operating activities: |

|

|

|

| Net

income (loss) |

$ |

2,900 |

|

|

$ |

(8,566 |

) |

|

Adjustments to reconcile net loss to net cash used in operating

activities: |

|

|

|

|

Depreciation and amortization |

|

17,363 |

|

|

|

15,764 |

|

|

Stock-based compensation expense |

|

64,933 |

|

|

|

43,726 |

|

|

Amortization of deferred contract costs |

|

972 |

|

|

|

1,789 |

|

| Change

in fair value of contingent consideration |

|

(978 |

) |

|

|

380 |

|

| Deferred

tax provision (benefit) |

|

(8,794 |

) |

|

|

72 |

|

|

Provision for uncollectible accounts |

|

(83 |

) |

|

|

326 |

|

| Non-cash

interest expense |

|

230 |

|

|

|

298 |

|

| Non-cash

interest income |

|

(1,435 |

) |

|

|

— |

|

| Changes

in operating assets and liabilities, net of acquisitions: |

|

|

|

| Accounts

receivable |

|

(5,292 |

) |

|

|

(2,082 |

) |

| Unbilled

receivables |

|

(4,764 |

) |

|

|

(5,394 |

) |

| Funds

receivable from payment partners |

|

23,835 |

|

|

|

(50,975 |

) |

| Prepaid

expenses, other current assets and other assets |

|

(5,322 |

) |

|

|

(4,279 |

) |

| Funds

payable to clients |

|

6,867 |

|

|

|

86,616 |

|

| Accounts

payable, accrued expenses and other current liabilities |

|

3,302 |

|

|

|

5,548 |

|

|

Contingent consideration |

|

(93 |

) |

|

|

(467 |

) |

| Other

liabilities |

|

(1,543 |

) |

|

|

(1,260 |

) |

| Deferred

revenue |

|

(630 |

) |

|

|

(871 |

) |

| Net cash

provided by operating activities |

|

91,468 |

|

|

|

80,625 |

|

|

|

|

|

|

|

Cash flows from investing activities: |

|

|

|

|

Acquisition of businesses, net of cash acquired |

|

(45,230 |

) |

|

|

(32,764 |

) |

| Purchase

of debt securities |

|

(193,927 |

) |

|

|

— |

|

| Sale of

debt securities |

|

29,598 |

|

|

|

— |

|

|

Capitalization of internally developed software |

|

(5,317 |

) |

|

|

(5,004 |

) |

|

Purchases of property and equipment |

|

(924 |

) |

|

|

(1,009 |

) |

| Net cash

(used in) investing activities |

|

(215,800 |

) |

|

|

(38,777 |

) |

|

Cash flows from financing activities: |

|

|

|

| Proceeds

from issuance of common stock under public offering, net of

underwriter discounts and commissions |

|

— |

|

|

|

261,119 |

|

| Payments

of costs related to public offering |

|

— |

|

|

|

(1,062 |

) |

| Payment

of debt issuance costs |

|

(783 |

) |

|

|

— |

|

|

Contingent consideration paid for acquisitions |

|

(1,032 |

) |

|

|

(1,207 |

) |

| Payments

of tax withholdings for net settled equity awards |

|

(797 |

) |

|

|

(8,483 |

) |

|

Purchases of treasury stock |

|

(43,740 |

) |

|

|

— |

|

| Proceeds

from the issuance of stock under Employee Stock Purchase Plan |

|

3,108 |

|

|

|

2,691 |

|

| Proceeds

from exercise of stock options |

|

5,613 |

|

|

|

10,360 |

|

| Net cash

provided by (used in) financing activities |

|

(37,631 |

) |

|

|

263,418 |

|

| Effect

of exchange rates changes on cash and cash equivalents |

|

2,597 |

|

|

|

(1,835 |

) |

|

Net increase (decrease) in cash, cash equivalents and

restricted cash |

|

(159,366 |

) |

|

|

303,431 |

|

|

Cash, cash equivalents and restricted cash, beginning of

year |

$ |

654,608 |

|

|

$ |

351,177 |

|

|

Cash, cash equivalents and restricted cash, end of

year |

$ |

495,242 |

|

|

$ |

654,608 |

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Financial Measures |

|

(Unaudited) (Amounts in millions, except

percentages) |

| |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

Revenue |

|

$ |

117.6 |

|

|

$ |

100.5 |

|

|

$ |

492.1 |

|

|

$ |

403.1 |

|

| Adjusted

to exclude gross up for: |

|

|

|

|

|

|

|

|

|

Pass-through cost for printing and mailing |

|

|

(4.5 |

) |

|

|

(4.0 |

) |

|

|

(15.9 |

) |

|

|

(19.4 |

) |

|

Marketing fees |

|

|

(0.3 |

) |

|

|

(0.4 |

) |

|

|

(2.0 |

) |

|

|

(2.2 |

) |

| Revenue

Less Ancillary Services |

|

$ |

112.8 |

|

|

$ |

96.1 |

|

|

$ |

474.2 |

|

|

$ |

381.5 |

|

| Payment

processing services costs |

|

|

41.4 |

|

|

|

36.8 |

|

|

|

177.5 |

|

|

|

147.3 |

|

| Hosting

and amortization costs within technology and development

expenses |

|

|

1.9 |

|

|

|

1.9 |

|

|

|

7.7 |

|

|

|

8.4 |

|

| Cost of

Revenue |

|

$ |

43.3 |

|

|

$ |

38.7 |

|

|

$ |

185.2 |

|

|

$ |

155.7 |

|

| Adjusted

to: |

|

|

|

|

|

|

|

|

| Exclude

printing and mailing costs |

|

|

(4.5 |

) |

|

|

(4.0 |

) |

|

|

(15.9 |

) |

|

|

(19.4 |

) |

| Offset

marketing fees against related costs |

|

|

(0.3 |

) |

|

|

(0.4 |

) |

|

|

(2.0 |

) |

|

|

(2.2 |

) |

| Exclude

depreciation and amortization |

|

|

(1.3 |

) |

|

|

(1.7 |

) |

|

|

(5.9 |

) |

|

|

(6.7 |

) |

| Adjusted

Cost of Revenue |

|

$ |

37.2 |

|

|

$ |

32.6 |

|

|

$ |

161.4 |

|

|

$ |

127.4 |

|

| Gross

Profit |

|

$ |

74.3 |

|

|

$ |

61.8 |

|

|

$ |

306.9 |

|

|

$ |

247.4 |

|

| Gross

Margin |

|

|

63.2 |

% |

|

|

61.5 |

% |

|

|

62.4 |

% |

|

|

61.4 |

% |

| Adjusted

Gross Profit |

|

$ |

75.6 |

|

|

$ |

63.5 |

|

|

$ |

312.8 |

|

|

$ |

254.1 |

|

| Adjusted

Gross Margin |

|

|

67.0 |

% |

|

|

66.1 |

% |

|

|

66.0 |

% |

|

|

66.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2024 |

|

Twelve Months Ended December 31, 2024 |

| |

|

Transaction |

|

Platform and Other Revenues |

|

Revenue |

|

Transaction |

|

Platform and Other Revenues |

|

Revenue |

|

Revenue |

|

$ |

95.3 |

|

|

$ |

22.3 |

|

|

$ |

117.6 |

|

|

$ |

410.2 |

|

|

$ |

81.9 |

|

|

$ |

492.1 |

|

| Adjusted

to exclude gross up for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pass-through cost for printing and mailing |

|

|

— |

|

|

|

(4.5 |

) |

|

|

(4.5 |

) |

|

|

— |

|

|

|

(15.9 |

) |

|

|

(15.9 |

) |

|

Marketing fees |

|

|

(0.3 |

) |

|

|

— |

|

|

|

(0.3 |

) |

|

|

(2.0 |

) |

|

|

— |

|

|

|

(2.0 |

) |

| Revenue

Less Ancillary Services |

|

$ |

95.0 |

|

|

$ |

17.8 |

|

|

$ |

112.8 |

|

|

$ |

408.2 |

|

|

$ |

66.0 |

|

|

$ |

474.2 |

|

|

Percentage of Revenue |

|

|

81.0 |

% |

|

|

19.0 |

% |

|

|

100.0 |

% |

|

|

83.4 |

% |

|

|

16.6 |

% |

|

|

100.0 |

% |

|

Percentage of Revenue Less Ancillary Services |

|

|

84.2 |

% |

|

|

15.8 |

% |

|

|

100.0 |

% |

|

|

86.1 |

% |

|

|

13.9 |

% |

|

|

100.0 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, 2023 |

|

Twelve Months Ended December 31, 2023 |

| |

|

Transaction |

|

Platform and Other Revenues |

|

Revenue |

|

Transaction |

|

Platform and Other Revenues |

|

Revenue |

|

Revenue |

|

$ |

81.9 |

|

|

$ |

18.6 |

|

|

$ |

100.5 |

|

|

$ |

329.7 |

|

|

$ |

73.4 |

|

|

$ |

403.1 |

|

| Adjusted

to exclude gross up for: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Pass-through cost for printing and mailing |

|

|

— |

|

|

|

(4.0 |

) |

|

|

(4.0 |

) |

|

|

— |

|

|

|

(19.4 |

) |

|

|

(19.4 |

) |

|

Marketing fees |

|

|

(0.4 |

) |

|

|

— |

|

|

|

(0.4 |

) |

|

|

(2.2 |

) |

|

|

— |

|

|

|

(2.2 |

) |

| Revenue

Less Ancillary Services |

|

$ |

81.5 |

|

|

$ |

14.6 |

|

|

$ |

96.1 |

|

|

$ |

327.5 |

|

|

$ |

54.0 |

|

|

$ |

381.5 |

|

|

Percentage of Revenue |

|

|

81.5 |

% |

|

|

18.5 |

% |

|

|

100.0 |

% |

|

|

81.8 |

% |

|

|

18.2 |

% |

|

|

100.0 |

% |

|

Percentage of Revenue Less Ancillary Services |

|

|

84.8 |

% |

|

|

15.2 |

% |

|

|

100.0 |

% |

|

|

85.8 |

% |

|

|

14.2 |

% |

|

|

100.0 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| FX Neutral

Revenue Less Ancillary Services |

|

|

|

|

|

|

|

|

|

|

|

| (unaudited) (in

millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

|

|

Twelve Months Ended December 31, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Growth Rate |

|

|

2024 |

|

|

|

2023 |

|

|

Growth Rate |

|

Revenue |

|

$ |

117.6 |

|

|

$ |

100.5 |

|

|

|

17 |

% |

|

$ |

492.1 |

|

|

$ |

403.1 |

|

|

|

22 |

% |

|

Ancillary services |

|

|

(4.8 |

) |

|

|

(4.4 |

) |

|

|

|

|

(17.9 |

) |

|

|

(21.6 |

) |

|

|

| Revenue

Less Ancillary Services |

|

|

112.8 |

|

|

|

96.1 |

|

|

|

17 |

% |

|

|

474.2 |

|

|

|

381.5 |

|

|

|

24 |

% |

| Effects

of foreign currency rate fluctuations |

|

|

(1.1 |

) |

|

|

— |

|

|

|

|

|

(2.3 |

) |

|

|

— |

|

|

|

| FX

Neutral Revenue Less Ancillary Services |

|

$ |

111.7 |

|

|

$ |

96.1 |

|

|

|

16 |

% |

|

$ |

471.9 |

|

|

$ |

381.5 |

|

|

|

24 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA and Adjusted

EBITDA |

|

|

|

|

|

|

|

|

| (Unaudited) (in

millions) |

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

| Net

loss |

|

$ |

(15.9 |

) |

|

$ |

1.3 |

|

|

$ |

2.9 |

|

|

$ |

(8.6 |

) |

| Interest

expense |

|

|

0.1 |

|

|

|

0.1 |

|

|

|

0.5 |

|

|

|

0.4 |

|

| Interest

income |

|

|

(4.8 |

) |

|

|

(5.6 |

) |

|

|

(21.4 |

) |

|

|

(13.3 |

) |

|

Provision for income taxes |

|

|

1.0 |

|

|

|

1.9 |

|

|

|

(1.0 |

) |

|

|

4.2 |

|

|

Depreciation and amortization |

|

|

5.0 |

|

|

|

4.3 |

|

|

|

18.5 |

|

|

|

16.4 |

|

|

EBITDA |

|

|

(14.6 |

) |

|

|

2.0 |

|

|

|

(0.5 |

) |

|

|

(0.9 |

) |

|

Stock-based compensation expense and related taxes |

|

|

16.8 |

|

|

|

12.9 |

|

|

|

65.8 |

|

|

|

45.2 |

|

| Change

in fair value of contingent consideration |

|

|

0.0 |

|

|

|

— |

|

|

|

(1.0 |

) |

|

|

0.4 |

|

| (Gain)

loss from remeasurement of foreign currency |

|

|

13.9 |

|

|

|

(7.7 |

) |

|

|

11.8 |

|

|

|

(4.2 |

) |

| Indirect

taxes related to intercompany activity |

|

|

0.5 |

|

|

|

— |

|

|

|

0.7 |

|

|

|

0.2 |

|

|

Acquisition related transaction costs |

|

|

0.1 |

|

|

|

0.4 |

|

|

|

0.6 |

|

|

|

0.4 |

|

|

Acquisition related employee retention costs |

|

|

— |

|

|

|

0.1 |

|

|

|

0.5 |

|

|

|

0.9 |

|

| Adjusted

EBITDA |

|

$ |

16.7 |

|

|

$ |

7.7 |

|

|

$ |

77.9 |

|

|

$ |

42.0 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of Non-GAAP Operating Expenses |

|

|

|

|

|

|

|

(Unaudited) (in millions) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

Twelve Months Ended December 31, |

|

(in millions) |

|

2024 |

|

2023 |

|

2024 |

|

2023 |

|

GAAP Technology and development |

|

$ |

17.4 |

|

|

$ |

16.9 |

|

|

$ |

66.6 |

|

|

$ |

62.0 |

|

|

(-) Stock-based compensation expense and related taxes |

|

|

(3.1 |

) |

|

|

(2.5 |

) |

|

|

(11.8 |

) |

|

|

(9.2 |

) |

|

(-) Depreciation and amortization |

|

|

(2.1 |

) |

|

|

(2.3 |

) |

|

|

(7.4 |

) |

|

|

(8.4 |

) |

|

(-) Acquisition related employee retention costs |

|

|

— |

|

|

|

0.3 |

|

|

|

— |

|

|

|

(0.5 |

) |

| Non-GAAP Technology and

development |

|

$ |

12.2 |

|

|

$ |

12.4 |

|

|

$ |

47.4 |

|

|

$ |

43.9 |

|

| |

|

|

|

|

|

|

|

| GAAP Selling and

marketing |

|

$ |

33.4 |

|

|

$ |

28.8 |

|

|

$ |

129.5 |

|

|

$ |

107.6 |

|

|

(-) Stock-based compensation expense and related taxes |

|

|

(4.8 |

) |

|

|

(3.2 |

) |

|

|

(18.3 |

) |

|

|

(12.4 |

) |

|

(-) Depreciation and amortization |

|

|

(2.2 |

) |

|

|

(1.3 |

) |

|

|

(8.2 |

) |

|

|

(5.2 |

) |

|

(-) Acquisition related employee retention costs |

|

|

— |

|

|

|

(0.2 |

) |

|

|

(0.5 |

) |

|

|

(0.4 |

) |

| Non-GAAP Selling and

marketing |

|

$ |

26.4 |

|

|

$ |

24.1 |

|

|

$ |

102.5 |

|

|

$ |

89.6 |

|

| |

|

|

|

|

|

|

|

| GAAP General and

administrative |

|

$ |

31.2 |

|

|

$ |

28.0 |

|

|

$ |

125.8 |

|

|

$ |

107.6 |

|

|

(-) Stock-based compensation expense and related taxes |

|

|

(8.9 |

) |

|

|

(7.2 |

) |

|

|

(35.7 |

) |

|

|

(23.6 |

) |

|

(-) Depreciation and amortization |

|

|

(0.8 |

) |

|

|

(0.7 |

) |

|

|

(3.0 |

) |

|

|

(2.8 |

) |

|

(-) Change in fair value of contingent consideration |

|

|

— |

|

|

|

— |

|

|

|

1.0 |

|

|

|

(0.4 |

) |

|

(-) Acquisition related transaction costs |

|

|

(0.1 |

) |

|

|

(0.4 |

) |

|

|

(0.6 |

) |

|

|

(0.4 |

) |

| Non-GAAP General and

administrative |

|

$ |

21.4 |

|

|

$ |

19.7 |

|

|

$ |

87.5 |

|

|

$ |

80.4 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net

Margin, EBITDA Margin and Adjusted EBITDA Margin |

|

(Unaudited) (Amounts in millions, except

percentages) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended December 31, |

|

|

|

Twelve Months Ended December 31, |

|

|

|

|

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

|

2024 |

|

|

|

2023 |

|

|

Change |

|

Revenue (A) |

|

$ |

117.6 |

|

|

$ |

100.5 |

|

|

$ |

17.1 |

|

|

$ |

492.1 |

|

|

$ |

403.1 |

|

|

$ |

89.0 |

|

| Revenue less ancillary

services (B) |

|

|

112.8 |

|

|

|

96.1 |

|

|

|

16.7 |

|

|

|

474.2 |

|

|

|

381.5 |

|

|

|

92.7 |

|

| Net loss

(C) |

|

|

(15.9 |

) |

|

|

1.3 |

|

|

|

(17.2 |

) |

|

|

2.9 |

|

|

|

(8.6 |

) |

|

|

11.5 |

|

| EBITDA (D) |

|

|

(14.6 |

) |

|

|

2.0 |

|

|

|

(16.6 |

) |

|

|

(0.5 |

) |

|

|

(0.9 |

) |

|

|

0.4 |

|

| Adjusted

EBITDA (E) |

|

|

16.7 |

|

|

|

7.7 |

|

|

|

9.0 |

|

|

|

77.9 |

|

|

|

42.0 |

|

|

|

35.9 |

|

| Net margin (C/A) |

|

|

-13.5 |

% |

|

|

1.3 |

% |

|

|

-14.8 |

% |

|

|

0.6 |

% |

|

|

-2.1 |

% |

|

|

2.7 |

% |

| Net margin using RLAS

(C/B) |

|

|

-14.1 |

% |

|

|

1.3 |

% |

|

|

-15.4 |

% |

|

|

0.6 |

% |

|

|

-2.3 |

% |

|

|

2.9 |

% |

| EBITDA Margin (D/A) |

|

|

-12.4 |

% |

|

|

2.0 |

% |

|

|

-14.4 |

% |

|

|

-0.1 |

% |

|

|

-0.2 |

% |

|

|

0.1 |

% |

| Adjusted EBITDA Margin

(E/A) |

|

|

14.2 |

% |

|

|

7.6 |

% |

|

|

6.6 |

% |

|

|

15.8 |

% |

|

|

10.4 |

% |

|

|

5.4 |

% |

| EBITDA Margin using RLAS

(D/B) |

|

|

-12.9 |

% |

|

|

2.1 |

% |

|

|

-15.0 |

% |

|

|

-0.1 |

% |

|

|

-0.2 |

% |

|

|

0.1 |

% |

| Adjusted EBITDA Margin using

RLAS (E/B) |

|

|

14.8 |

% |

|

|

8.0 |

% |

|

|

6.8 |

% |

|

|

16.4 |

% |

|

|

11.0 |

% |

|

|

5.4 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reconciliation of FX Neutral Revenue Growth Guidance toFX

Neutral Revenue Less Ancillary Services Growth

Guidance |

| |

|

|

|

|

|

|

|

| |

Three Months Ended March 31, 2025 |

|

Year Ended December 31, 2025 |

| |

Low |

|

High |

|

Low |

|

High |

| |

|

|

|

|

|

|

|

|

FX Neutral GAAP Revenue Growth |

|

10 |

% |

|

|

13 |

% |

|

|

9 |

% |

|

|

13 |

% |

| |

|

|

|

|

|

|

|

|

Adjustment for Ancillary Services |

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

|

|

1 |

% |

| |

|

|

|

|

|

|

|

| FX

Neutral Revenue Less Ancillary Services Growth |

|

11 |

% |

|

|

14 |

% |

|

|

10 |

% |

|

|

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

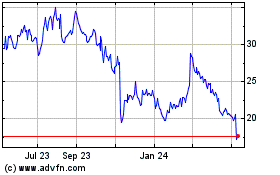

Flywire (NASDAQ:FLYW)

Historical Stock Chart

From Jan 2025 to Feb 2025

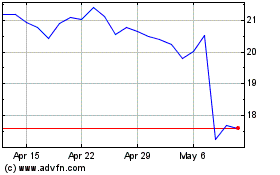

Flywire (NASDAQ:FLYW)

Historical Stock Chart

From Feb 2024 to Feb 2025