false

0001083743

0001083743

2024-08-30

2024-08-30

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): August 30, 2024

FLUX

POWER HOLDINGS, INC.

(Exact

name of registrant as specified in its charter)

| Nevada |

|

001-31543 |

|

92-3550089 |

(State

or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS

Employer

Identification No.) |

| 2685

S. Melrose Drive, Vista, California |

|

92081 |

| (Address

of Principal Executive Offices) |

|

(Zip

Code) |

877-505-3589

(Registrant’s

telephone number, including area code)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ☐ |

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ☐ |

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of each class |

|

Trading

Symbol |

|

Name

of each exchange on which registered |

| Common

Stock, $0.001 par value |

|

FLUX |

|

Nasdaq

Capital Market |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

4.02 Non-Reliance on Previously Issued Financial Statements or a Related Audit Report or Completed Interim Review.

(a) On August 30, 2024,

the Board of Directors of Flux Power Holdings, Inc. (the “Company”) including its audit committee members, concluded

that the previously issued audited consolidated financial statements as of and for the

fiscal year ended June 30, 2023 and the unaudited consolidated financial statements as of

and for the quarters ended September 30, 2023, December 31, 2023, and March 31, 2024 (collectively, the “Prior

Financial Statements”), which were filed with the Securities and Exchange Commission (“SEC”) on September

21, 2023, November 9, 2023, February 8, 2024 and May 13, 2024, respectively, should no longer be relied upon because of errors in

such financial statements relating to the improper accounting for inventory and a

restatement should be undertaken. During the Company’s preparation

of financial statements for the year ended June 30, 2024, it became aware that (i)

approximately $1.2 million of excess and obsolete inventory, primarily as a result of a

change in battery cells from a new supplier, was not properly reserved or written-off in earlier periods

resulting in an overstatement of inventory, and (ii) certain loaner service packs

were improperly accounted for as finished goods inventory as

of June 30, 2023 resulting in an overstatement of inventory of

approximately $0.5 million. As a result, the Company concluded that the errors resulted in (i) an overstatement of inventory,

current assets, total assets and accumulated deficit on its balance sheet, and (ii) an

understatement of cost of sales and net loss, and overstatement of gross profit on its statement

of operations in the Prior Financial Statements. The Company is also evaluating the impact that improper accounting for

inventory had on other historical financial statements for previous quarterly and fiscal periods which also could include the

audited consolidated financial statements as of and for the years ended June 30, 2022 and 2021, as well as the quarterly unaudited

consolidated financial statements within the years ended June 30, 2022, 2021 and 2020.

Based upon the foregoing,

the Company’s Board of Directors is evaluating

the impact of these matters on previous fiscal years and quarters to determine which financial statements in

addition to the Prior Financial Statements may

need to be restated and, as a part of this evaluation, may include additional revisions

and/or adjustments to the Prior Financial Statements other than inventory that may be identified during the restatement process.

Based on the results of the Board’s evaluation, the Company intends to file with the SEC one or more amended periodic reports

covering the impacted financial statements as soon as practicable.

Management

previously concluded that the Company’s disclosure controls and procedures and internal

control over financial reporting were not effective during the periods covered by the Prior Financial Statements due to

previously identified material weaknesses resulting from having insufficient personnel resources with technical accounting expertise

related to certain aspects of the financial reporting process. As part of its ongoing remedial efforts to strengthen

controls and procedures, the Company engaged an external financial consultant with extensive technical accounting expertise

during the quarter ended March 31, 2024. In addition, in early March of 2024, the Company strengthened its internal

financial expertise by hiring a new Chief Financial Officer with over 20 years of experience with publicly traded companies

and finance and accounting and who also served as an auditor for 10 years with Ernst & Young LLP, where he became a certified

public accountant.

After

re-evaluation, the Company’s management has concluded that considering the errors described above, this represents an additional

material weakness in the Company’s disclosure controls and procedures and the Company’s internal control over financial

reporting. To address this material weakness, management plans to continue to devote significant effort and resources to the remediation

and improvement of the Company’s internal control over financial reporting. While the Company has processes to account for

its inventory, under the leadership of the Company’s new Chief Financial Officer, the Company intends to strengthen its internal

processes and procedures over inventory management and reporting. The Company has begun updating its processes and controls around

inventory obsolescence, the timing of its internal inventory audits and implementation of other measures. In addition, the Company has also recently engaged an

external financial consultant with extensive technical accounting expertise to assist with the analysis of prior periods, along with

an independent law firm to conduct an internal review of the events and activities leading to errors in the financial statements.

The

Company’s Audit Committee and Chief Financial Officer have communicated the matters disclosed in this Current Report

on Form 8-K pursuant to this Item 4.02(a) with Baker Tilly US, LLP, the Company’s independent registered public accounting firm.

In addition, the

inventory error discussed above led to non-compliance with certain requirements under the Company’s Loan and Security

Agreement with Gibraltar Business Capital, LLC, a Delaware limited liability company (“GBC”) (the “Loan Agreement”).

The Loan Agreement provides the Company with a revolving credit facility for up to $16 million. Under the Loan Agreement, upon an

occurrence of an event of default, GBC may, at its option, declare its commitments to the Company to be terminated and all obligations

to be immediately due and payable, all without demand, notice or further action of any kind required on the part of GBC, and/or exercise

other remedies available to it among other things including its rights as a secured party. On August 29, 2024, GBC agreed to

waive the Company’s non-compliance with, and the effects of its non-compliance under, various representations, financial covenants

and non-financial covenants relating to the Company’s financial statements and inventory contained in the Loan Agreement

arising from the inventory error described under “Item 4.02 Non-Reliance on Previously Issued Financial Statements or a

Related Audit Report or Completed Interim Review” of this Current Report (the “Waiver”). As a result of the

Waiver, the Company expects that its revolving credit facility remains available

subject to meeting certain lending criteria under the Loan Agreement.

Item 7.01 Regulation FD Disclosure.

The

information contained in Item 2.02 of this Current Report on Form 8-K is incorporated herein by reference. On September 5, 2024, the

Company issued a press release announced that it has identified $1.7 million of excess and obsolete

inventory and that as a result, the Company will restate previously issued financial

statements for the fiscal year ended June 30, 2023, and quarters ended September 30, 2023, December

31, 2023 and March 31, 2024.

The

information in Item 7.01 and Exhibit 99.1 of this Current Report on Form 8-K attached hereto shall not be deemed “filed”

for purposes of Section 18 of the Securities Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities

of that Section, or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except

as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements

and Exhibits.

(d) Exhibits

Forward-Looking

Statement Disclaimer

This Current Report on Form 8-K

contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995, as amended,

and other securities law. Forward-looking statements are statements that are not historical facts. Words and phrases such as “anticipated,”

“forward,” “will,” “would,” “could,” “may,” “intend,” “remain,”

“potential,” “prepare,” “expected,” “believe,” “plan,” “seek,”

“continue,” “estimate,” “and similar expressions are intended to identify forward-looking statements. These

statements include, but are not limited to, statements with respect to: the expected adjustments to the Company’s financial statements,

including the estimated amount and impact of adjustments on the Company’s financial statements, expectations with respect to the

Company’s internal control over financial reporting and disclosure controls and procedures and related remediation, the potential

for additional adjustments to the Company’s financial statements and additional restatements, the Company’s ability

to access its revolving credit facility under the Loan Agreement, the potential actions that GBC could take to protect

and enforce its rights under the Loan Agreement, and the expected filing date of its Form 10-K. All

of such statements are subject to certain risks and uncertainties, many of which are difficult to predict and generally beyond the Company’s

control, that could cause actual results to differ materially from those expressed in, or implied or projected by, the forward-looking

information and statements. Such risks and uncertainties include, but are not limited to, the completion of the review and preparation

of the Company’s financial statements and internal control over financial reporting and disclosure controls and procedures and

the timing thereof; the discovery of additional information; delays in the Company’s financial reporting, including as a result

of unanticipated factors; the Company’s ability to obtain necessary waivers or amendments to the Loan Agreement in the future;

the risk that the Company may become subject to stockholder lawsuits or claims; the Company’s ability to remediate material

weaknesses in its internal control over financial reporting; risks inherent in estimates or judgments relating to the Company’s

critical accounting policies, or any of the Company’s estimates or projections, which may prove to be inaccurate; unanticipated

factors in addition to the foregoing that may impact the Company’s financial and business projections and guidance and may cause

the Company’s actual results and outcomes to materially differ from its estimates, projections and guidance; and those risks and

uncertainties identified in the “Risk Factors” sections of the Company’s Annual Report on Form 10-K for the year ended

June 30, 2023, and its other subsequent filings with the SEC. Readers are cautioned not to place undue reliance on these forward-looking

statements. All forward-looking statements contained in this Current Report on Form 8-K speak only as of the date on which they were

made. Except to the extent required by law, the Company undertakes no obligation to update such statements to reflect events that occur

or circumstances that exist after the date on which they were made.

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

| |

Flux

Power Holdings, Inc. |

| |

a

Nevada corporation |

| |

|

|

| |

By:

|

/s/

Ronald F. Dutt |

| |

|

Ronald

F. Dutt, |

| |

|

Chief

Executive Officer |

| |

|

|

| Dated:

September 5, 2024 |

|

|

Exhibit

99.1

Flux

Power to Write Down $1.7 Million in Obsolete Inventory, Requiring Restatement of Certain Previously Issued Financial Statements

VISTA,

Calif. – September 5, 2024 – Flux Power Holdings, Inc. (NASDAQ: FLUX), a developer of advanced lithium-ion energy

storage solutions for electrification of commercial and industrial equipment today announced that it has identified $1.7 million of excess

and obsolete inventory primarily related to product innovation and design of our products during a period of rapid growth over the

last several years. As a result, the Company will restate previously issued financial statements for fiscal year 2023 and the interim

periods of fiscal year 2024. The inventory write-down is a non-cash charge and will not impact cashflow. However, as a

part of the restatement process, the Company may include additional adjustments other than inventory that may be identified during its

review. The Company also expects that its $16 million revolving credit facility with its financing partner Gibraltar Business Capital

remains available subject to meeting certain lending criteria under the Loan Agreement.

“Flux

Power, with the leadership of our new CFO Kevin Royal, is taking all appropriate measures to rectify the inventory accounting

issues related to our transition to more advanced energy cells, including implementing enhanced procedures and quality checks to mitigate

the possibility of it recurring,” said Ron Dutt, CEO of Flux Power. “We believe that these findings will not impact

the strength of the business, our access to capital through our financing partner or the Company’s positive outlook for our future

– which will be fueled by continued innovation, maintaining a disciplined cost structure and driving organic growth.”

The

Company intends to restate its financial statements for the periods noted above as soon as practicable. Additional information related

to the restatements is available in the Company’s Form 8-K filed with the Securities and Exchange Commission today.

About

Flux Power Holdings, Inc.

Flux

Power (NASDAQ: FLUX) designs, manufactures, and sells advanced lithium-ion energy storage solutions for electrification of a range of

industrial and commercial sectors including material handling, airport ground support equipment (GSE), and stationary energy storage.

Flux Power’s lithium-ion battery packs, including the proprietary battery management system (BMS) and telemetry, provide customers

with a better performing, lower cost of ownership, and more environmentally friendly alternative, in many instances, to traditional lead

acid and propane-based solutions. Lithium-ion battery packs reduce CO2 emissions and help improve sustainability and ESG metrics for

fleets. For more information, please visit www.fluxpower.com.

Forward-Looking

Statements

This

press release contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of

1995, as amended, and other securities law. Forward-looking statements are statements that are not historical facts. Words and phrases

such as “anticipated,” “forward,” “will,” “would,” “could,” “may,”

“intend,” “remain,” “potential,” “prepare,” “expected,” “believe,”

“plan,” “seek,” “continue,” “estimate,” “and similar expressions are intended to

identify forward-looking statements. These statements include, but are not limited to, statements with respect to: the expected adjustments

to the Company’s financial statements, including the estimated amount and impact of adjustments on the Company’s financial

statements, expectations with respect to the Company’s internal control over financial reporting and disclosure controls and procedures

and related remediation, the potential for additional adjustments to the Company’s financial statements and additional restatements,

the Company’s ability to access its revolving credit facility, expected filing of its Form 10-K, and effect and impact on

Company’s business and credit facility. All of such statements are subject to certain risks and uncertainties, many of which are

difficult to predict and generally beyond the Company’s control, that could cause actual results to differ materially from those

expressed in, or implied or projected by, the forward-looking information and statements. Such risks and uncertainties include, but are

not limited to, the completion of the review and preparation of the Company’s financial statements and internal control over financial

reporting and disclosure controls and procedures and the timing thereof; the discovery of additional information resulting to additional

adjustments; delays in the Company’s financial reporting, including as a result of unanticipated factors; the Company’s ability

to obtain necessary waivers or amendments to its credit facility in the future; the risk that the Company may become subject to stockholder

lawsuits or claims; the Company’s ability to remediate material weaknesses in its internal control over financial reporting; risks

inherent in estimates or judgments relating to the Company’s critical accounting policies, or any of the Company’s estimates

or projections, which may prove to be inaccurate; unanticipated factors in addition to the foregoing that may impact the Company’s

financial and business projections and guidance and may cause the Company’s actual results and outcomes to materially differ from

its estimates, projections and guidance; and those risks and uncertainties identified in the “Risk Factors” sections of the

Company’s Annual Report on Form 10-K for the year ended June 30, 2023, and its other subsequent filings with the SEC. Readers are

cautioned not to place undue reliance on these forward-looking statements. All forward-looking statements contained in this press release

speak only as of the date on which they were made. Except to the extent required by law, the Company undertakes no obligation to update

such statements to reflect events that occur or circumstances that exist after the date on which they were made.

Flux,

Flux Power, and associated logos are trademarks of Flux Power Holdings, Inc. All other third-party brands, products, trademarks, or registered

marks are the property of and used to identify the products or services of their respective owners.

Follow

us at:

Blog:

Flux Power Blog

News

Flux Power News

Twitter:

@FLUXpwr

LinkedIn:

Flux Power

View

source version on businesswire.com:

Media

& Investor Relations:

media@fluxpower.com

info@fluxpower.com

External

Investor Relations:

Chris

Tyson, Executive Vice President

MZ

Group - MZ North America

949-491-8235

FLUX@mzgroup.us

www.mzgroup.us

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

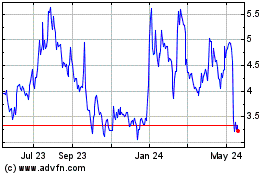

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Nov 2024 to Dec 2024

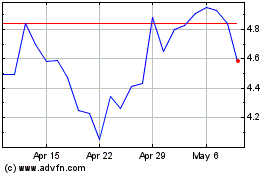

Flux Power (NASDAQ:FLUX)

Historical Stock Chart

From Dec 2023 to Dec 2024