false000071780600007178062024-11-202024-11-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): November 20, 2024

|

|

|

|

First US Bancshares, Inc. |

|

(Exact Name of Registrant as Specified in Charter)

|

|

|

Delaware |

000-14549 |

63-0843362 |

(State or Other Jurisdiction of Incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

3291 U.S. Highway 280

Birmingham, Alabama 35243

(Address of Principal Executive Offices, including Zip Code)

Registrant’s telephone number, including area code: (205) 582-1200

N/A

(Former Name or Former Address, if Changed Since Last Report)

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, $0.01 par value |

FUSB |

The Nasdaq Stock Market LLC |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§230.405 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 1.01 Entry into a Material Definitive Agreement. |

The information set forth in Item 5.02(d)(5) of this Current Report on Form 8-K with respect to the Director Indemnification Agreement, dated as of November 20, 2024 (the “Indemnification Agreement”), by and between First US Bancshares, Inc. (the “Company”) and each of Staci M. Pierce and Tracy E. Thompson, is incorporated by reference into this Item 1.01.

|

|

Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

(d) Election of Staci M. Pierce and Tracy E. Thompson to the Board of Directors

On November 20, 2024, the Board of Directors (the “Board”) of the Company, upon the recommendation of the Board’s Nominating and Corporate Governance Committee, voted unanimously to increase the size of the Board from ten (10) to twelve (12) directors and to elect Staci M. Pierce and Tracy E. Thompson to fill the two vacancies created by the increase in the size of the Board, effective as of November 20, 2024. The Board appointed Ms. Pierce to serve on the Compensation Committee of the Board. Both Ms. Pierce and Mr. Thompson will also serve on the Board of Directors of First US Bank, the Company’s wholly owned banking subsidiary (the “Bank”). The Board of Directors of the Bank (the “Bank Board”) appointed Ms. Pierce and Mr. Thompson to serve on the Directors’ Loan Committee of the Bank Board. Additionally, the Board created the Tennessee New Business Committee of the Bank Board and appointed Mr. Thompson to serve as chair of this new committee.

There are no arrangements or understandings between either Ms. Pierce or Mr. Thompson and any other person pursuant to which either of them was appointed to the positions with the Company and the Bank described above. The Board has affirmatively determined that each of Ms. Pierce and Mr. Thompson is independent under Nasdaq listing standards and is otherwise qualified to serve on the Boards and the committees to which each of them has been appointed. Each of the new directors will receive the compensation described in Exhibit 10.1 to the Company’s Quarterly Report on Form 10-Q for the period ended June 30, 2024, filed with the Securities and Exchange Commission (the “SEC”) on August 9, 2024; provided, however, that the compensation of the Company’s directors may be adjusted by the Board from time to time. Each of the new directors will also be eligible to receive awards under the Company’s 2023 Incentive Plan.

The Bank has banking transactions in the ordinary course of the Bank’s business with Ms. Pierce, Mr. Thompson and each of their family members and entities with which they are associated. All loans by the Bank in which Ms. Pierce, Mr. Thompson or any “related person” within the meaning of Item 404(a) of Regulation S-K of the SEC has or will have a direct or indirect material interest since the beginning of fiscal year 2023 (a) were made in the ordinary course of business; (b) were made on substantially the same terms, including interest rates and collateral, as those prevailing at the time for comparable loans with persons not related to the Bank; and (c) did not involve more than the normal risk of collectability or present other unfavorable features.

(d)(5) Director Indemnification Agreement

On November 20, 2024, the Company entered into the Indemnification Agreement with each of Ms. Pierce and Mr. Thompson (each, a “Director”) in connection with the Director’s membership on the Board of the Company. The Indemnification Agreement is substantially similar to the Director Indemnification Agreements previously entered into between the Company and each of its other current directors.

In general, the Indemnification Agreement provides that the Company will, to the extent permitted by applicable law and subject to certain limitations, indemnify the Director against all expenses, judgments, fines, and penalties actually and reasonably incurred by the Director in connection with the defense or settlement of any civil, criminal, administrative, or investigative action, suit, or proceeding brought against the Director or in which the Director otherwise becomes involved by reason of the Director’s relationship with the Company. The Indemnification Agreement provides for indemnification rights regarding third-party proceedings and proceedings brought by or in the right of the Company. Additionally, the Indemnification Agreement provides for the advancement of expenses incurred by the Director in connection with any proceeding covered by the Indemnification Agreement, provided that the Director must undertake in writing to repay any such amounts to the extent that it is determined that the Director is not entitled to indemnification.

No payments pursuant to the Indemnification Agreement are available (i) to indemnify or advance expenses with respect to proceedings initiated or brought voluntarily by the Director and not by way of defense, subject to certain exceptions; (ii) to indemnify the Director for expenses, judgments, fines, or penalties sustained in any proceeding for which payment is actually made to the Director under a valid and collectible insurance policy, except in respect of any excess beyond the amount of such insurance payment; (iii) to indemnify the Director for any expenses, judgments, fines, or penalties sustained in any proceeding for an accounting of profits made from the purchase or sale by the Director of securities of the Company pursuant to the provisions of Section 16(b) of the Securities Exchange Act of 1934, as amended, the rules and regulations thereunder and amendments thereto, or similar provisions of any federal,

state, or local statutory law; (iv) to indemnify the Director for any expenses, judgments, fines, or penalties resulting from the Director’s conduct that is finally adjudged to have been willful misconduct, knowingly fraudulent, or deliberately dishonest; or (v) in the event that a court of competent jurisdiction finally determines that such payment is unlawful.

The Indemnification Agreement does not exclude any other rights to indemnification or advancement of expenses to which the Director may be entitled, including any rights arising under the Company’s Certificate of Incorporation, Bylaws, any other agreement, any vote of the Company’s stockholders or disinterested directors, the Delaware General Corporation Law, or otherwise. The Indemnification Agreement also contains various representations and covenants by the Company as to the maintenance of directors and officers liability insurance.

The foregoing description of the Indemnification Agreement does not purport to be complete and is qualified in its entirety by reference to the Form of Director Indemnification Agreement, a copy of which is attached as Exhibit 10.1 to the Company’s Current Report on Form 8-K filed with the SEC on October 30, 2009 and incorporated herein by reference.

On November 20, 2024, the Company issued a press release announcing the election of Ms. Pierce and Mr. Thompson to the Boards of Directors of the Company and the Bank, which press release contains additional biographical information about Ms. Pierce and Mr. Thompson. A copy of the press release is attached hereto as Exhibit 99.1.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

Dated: November 20, 2024 |

FIRST US BANCSHARES, INC. |

|

|

|

|

By: |

/s/ James F. House |

|

Name: |

James F. House |

|

|

President and Chief Executive Officer |

FIRST US BANCSHARES, INC. ELECTS NEW DIRECTOR

BIRMINGHAM, AL (November 20, 2024) – First US Bancshares, Inc. (the “Company”) (Nasdaq: FUSB) announced today that the Company’s Board of Directors has elected Staci M. Pierce, J. D. and Tracy E. Thompson as directors of the Company and its subsidiary, First US Bank (the “Bank”), effective immediately. Ms. Pierce will serve on the Compensation Committee of the Board of Directors of the Company and the Directors’ Loan Committee of the Board of Directors of the Bank (the “Bank Board”). Mr. Thompson will serve on the Directors’ Loan Committee and the newly-created Tennessee New Business Committee of the Bank Board.

Ms. Pierce graduated Summa Cum Laude from Birmingham Southern College with a Bachelor of Science Degree in Computer Science and Minor in Math and holds a Master of Business Administration Degree from the University of Alabama. She received her Juris Doctor Degree from the Cumberland School of Law at Samford University in Birmingham and was admitted to the Bar in Alabama in 2010 and Missouri in 2011.

Ms. Pierce currently is the Chief Executive Officer of Action Enterprise Holdings, LLC, a transportation and environmental services company headquartered in Birmingham. She has over eight years of experience in executive and leadership roles in the transportation and environmental services industries and, prior to that, practiced law for 5 years.

Ms. Pierce is actively involved with and volunteers in a number of non-profit organizations, and she holds a number of honors and leadership awards.

Mr. Thompson graduated from Berea College in Kentucky with a Bachelor of Science Degree in Business Management.

Mr. Thompson is Chief Executive Officer and co-founder of Focus Health Group, which was founded in 2002 and is based in Knoxville, Tennessee. Focus Health Group is a health services company that provides low-cost generic pharmaceutical products.

Mr. Thompson served as Chairman of the Board and Chief Executive Officer of The Peoples Bank, which was organized in 1920 and acquired by First US Bank in 2018. In addition to his extensive business experience in providing medical supplies and operating a successful bank, Mr. Thompson holds real estate for development and investments and is a partner of Crescent at Ebenezer, a luxury apartment community in the heart of West Knoxville. Since 1998, Mr. Thompson has been an entrepreneur, founder/co-founder, and investor in several successful businesses.

Actively involved in his communities, Mr. Thompson currently serves on several boards of directors.

About First US Bancshares, Inc.

First US Bancshares, Inc. is a bank holding company that operates banking offices in Alabama, Tennessee, and Virginia through First US Bank. The Company’s stock is traded on the Nasdaq Capital Market under the symbol FUSB.

James F. House

205-582-1200

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

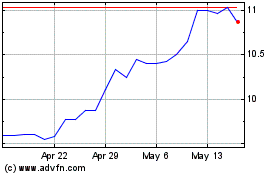

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Oct 2024 to Nov 2024

First US Bancshares (NASDAQ:FUSB)

Historical Stock Chart

From Nov 2023 to Nov 2024