- Net sales of $794 million

- Net income per diluted share of $2.20

- Net cash balance of $1.4 billion

- Maintain full-year 2024 P&L guidance

- YTD net bookings of 2.7 GW with an average selling price

(“ASP”) of 31.3 cents per watt, excluding adjusters

- Expected sales backlog of 78.3 GW

First Solar, Inc. (Nasdaq: FSLR) (the “Company”) today announced

financial results for the first quarter ended March 31, 2024.

Net sales for the first quarter were $794 million, a decrease of

$0.4 billion from the prior quarter. The decrease was primarily

driven by an expected historical seasonal reduction in volume of

modules sold.

The Company reported first quarter net income per diluted share

of $2.20, compared to net income per diluted share of $3.25 in the

fourth quarter of 2023.

Cash, cash equivalents, restricted cash, restricted cash

equivalents, and marketable securities, less debt at the end of the

first quarter, decreased to $1.4 billion from $1.6 billion at the

end of the prior quarter. The decrease was primarily a result of

capital expenditures related to manufacturing capacity expansions

in Alabama, Louisiana, and Ohio.

“We are pleased with our start to 2024, with good operating

performance, selective bookings with a year to date ASP over 31

cents per watt excluding adjusters, and solid financial results,”

said Mark Widmar, CEO of First Solar. “Our differentiated

technology and balanced business model are enabling us to drive

growth, navigate industry volatility and deliver enduring

shareholder value.”

Our 2024 guidance has been updated as follows:

Prior

Current

Net Sales (1)

$4.4B to $4.6B

Unchanged

Gross Margin (1) (2)

$2.0B to $2.1B

Unchanged

Operating Expenses (1) (3)

$455M to $485M

Unchanged

Operating Income (1) (4)

$1.5B to $1.6B

Unchanged

Earnings per Diluted Share (1)

$13.00 to $14.00

Unchanged

Net Cash Balance (5)

$0.9B to $1.2B

$600M to $900M

Capital Expenditures

$1.7B to $1.9B

$1.8B to $2.0B

Volume Sold (1)

15.6GW to 16.3GW

Unchanged

——————————

(1)

From an earnings cadence perspective, we

anticipate our net sales and cost of sales profile, excluding the

advanced manufacturing production credit available to us under

Section 45X of the Internal Revenue Code (“Section 45X tax

credit”), to be approximately 35-40% in the first half of the year

and 60-65% in the second half of the year. We forecast Section 45X

tax credits of approximately $400 million in the first half of the

year and $620 million in the second half of the year. With an

operating expenses profile roughly evenly split across the year,

this results in a forecasted earnings per share profile of

approximately 35-40% in the first half of the year and 60-65% in

the second half of the year.

(2)

Assumes $40 million to $60 million of ramp

costs and $1.0 billion to $1.05 billion of Section 45X tax

credits

(3)

Assumes $85 million to $95 million of

production start-up expense

(4)

Assumes $125 million to $155 million of

production start-up expense and ramp costs, and $1.0 billion to

$1.05 billion of Section 45X tax credits

(5)

Defined as cash, cash equivalents,

restricted cash, restricted cash equivalents, and marketable

securities, less expected debt at the end of 2024

The guidance figures presented above are forward-looking

statements that are subject to a variety of assumptions and

estimates, including with respect to certain factors related to the

Inflation Reduction Act of 2022 (the “IRA”). Among other things,

such factors include (i) the total Section 45X tax credit and (ii)

the timing and ability to monetize such credit. Investors are

encouraged to listen to the conference call and to review the

accompanying materials, which contain more information about First

Solar’s first quarter 2024 financial results, 2024 guidance, and

financial outlook.

Conference Call Details

First Solar has scheduled a conference call for today, May 1,

2024 at 4:30 p.m. ET, to discuss this announcement. A live webcast

of this conference call and accompanying materials are available at

investor.firstsolar.com. An audio replay of the conference call

will be available through Friday, May 31, 2024 and can be accessed

by dialing +1 (800) 770-2030 if you are calling from within the

United States or +1 (647) 362-9199 if you are calling from outside

the United States and entering the replay passcode 99681. A replay

of the webcast will also be available on the Investors section of

the Company’s website approximately two hours after the conclusion

of the call and remain available for 30 days.

About First Solar, Inc.

First Solar is a leading American solar technology company and

global provider of responsibly-produced eco-efficient solar modules

advancing the fight against climate change. Developed at research

and development labs in California and Ohio, the Company’s advanced

thin film photovoltaic (“PV”) modules represent the next generation

of solar technologies, providing a competitive, high-performance,

lower-carbon alternative to conventional crystalline silicon PV

panels. From raw material sourcing and manufacturing through

end-of-life module recycling, First Solar’s approach to technology

embodies sustainability and a responsibility towards people and the

planet. For more information, please visit www.firstsolar.com.

For First Solar Investors

This release contains forward-looking statements which are made

pursuant to safe harbor provisions of the Private Securities

Litigation Reform Act of 1995. All statements in this release,

other than statements of historical fact, are forward-looking

statements. These forward-looking statements include, but are not

limited to, statements concerning: demand for our technology;

increased research and development investment; new domestic and

international capacity coming online; production and delivery of

our new Series 7 modules; our financial guidance for 2024,

including future financial results, net sales, gross margin,

operating expenses, operating income, earnings per diluted share,

net cash balance, capital expenditures, expected earnings cadence,

volume sold, shipments, bookings, products and our business and

financial objectives for 2024; the availability of benefits under

certain production linked incentive programs, and the impact of the

IRA including the total advanced manufacturing production credit

available to us under Section 45X of the Internal Revenue Code.

These forward-looking statements are often characterized by the use

of words such as “estimate,” “expect,” “anticipate,” “project,”

“plan,” “intend,” “seek,” “believe,” “forecast,” “foresee,”

“likely,” “may,” “should,” “goal,” “target,” “might,” “will,”

“could,” “predict,” “continue,” “contingent” and the negative or

plural of these words and other comparable terminology.

Forward-looking statements are only predictions based on our

current expectations and our projections about future events and

therefore speak only as of the date of this release. You should not

place undue reliance on these forward-looking statements. We

undertake no obligation to update any of these forward-looking

statements for any reason, whether as a result of new information,

future developments or otherwise. These forward-looking statements

involve known and unknown risks, uncertainties and other factors

that may cause our actual results, levels of activity, performance

or achievements to differ materially from those expressed or

implied by our forward-looking statements. These factors include,

but are not limited to: structural imbalances in global supply and

demand for PV solar modules; our competitive position and other key

competitive factors; the reduction, elimination, expiration or

introduction of government subsidies, policies, and support

programs for solar energy projects; the impact of public policies,

such as tariffs or other trade remedies imposed on solar cells and

modules; the passage of legislation intended to encourage renewable

energy investments through tax credits, such as the IRA; the impact

of the IRA on our expected results of operations in future periods,

which may be affected by technical guidance, regulations,

subsequent amendments or interpretations of the law; interest rate

fluctuations and both our and our customers’ ability to secure

financing; changes in the exchange rates between the functional

currencies of our subsidiaries and other currencies in which assets

and liabilities are denominated; our ability to execute on our

long-term strategic plans; the loss of any of our large customers,

or the ability of our customers and counterparties to perform under

their contracts with us; our ability to execute on our solar module

technology and cost reduction roadmaps; our ability to improve the

wattage of our solar modules; our ability to incorporate technology

improvements into our manufacturing process, including the

production of bifacial solar modules and the implementation of our

Copper Replacement (“CuRe”) program; the satisfaction of conditions

precedent in our sales agreements; our ability to attract new

customers and to develop and maintain existing customer and

supplier relationships; general economic and business conditions,

including those influenced by U.S., international, and geopolitical

events; environmental responsibility, including with respect to

cadmium telluride (“CdTe”) and other semiconductor materials;

claims under our limited warranty obligations; changes in, or the

failure to comply with, government regulations and environmental,

health, and safety requirements; effects arising from and results

of pending litigation; future collection and recycling costs for

solar modules covered by our module collection and recycling

program; supply chain disruptions, including demurrage and

detention charges; our ability to protect our intellectual

property; our ability to prevent and/or minimize the impact of

cyber-attacks or other breaches of our information systems; our

continued investment in research and development; the supply and

price of components and raw materials, including CdTe; our ability

to construct new production facilities to support new product lines

in line with anticipated timing; evolving corporate governance and

public disclosure regulations and expectations, including with

respect to environmental, social and governance matters; our

ability to avoid manufacturing interruptions, including during the

ramp of our Series 7 modules manufacturing facilities; our ability

to attract and retain key executive officers and associates; the

severity and duration of public health threats, including the

potential impact on our business, financial condition, and results

of operations; and the matters discussed under the captions “Risk

Factors” and “Management’s Discussion and Analysis of Financial

Condition and Results of Operations” of our most recent Annual

Report on Form 10-K, as supplemented by our other filings with the

Securities and Exchange Commission.

FIRST SOLAR, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(In thousands, except share

data)

(Unaudited)

March 31, 2024

December 31,

2023

ASSETS

Current assets:

Cash and cash equivalents

$

1,682,081

$

1,946,994

Marketable securities

308,016

155,495

Accounts receivable trade, net

669,745

660,776

Government grants receivable, net

184,761

659,745

Inventories

970,871

819,899

Other current assets

425,919

391,900

Total current assets

4,241,393

4,634,809

Property, plant and equipment, net

4,915,686

4,397,285

Deferred tax assets, net

169,767

142,819

Restricted marketable securities

194,482

198,310

Government grants receivable

347,845

152,208

Goodwill

28,735

29,687

Intangible assets, net

61,889

64,511

Inventories

265,034

266,899

Other assets

535,751

478,604

Total assets

$

10,760,582

$

10,365,132

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

239,237

$

207,178

Income taxes payable

52,060

22,134

Accrued expenses

528,060

524,829

Current portion of debt

200,907

96,238

Deferred revenue

692,675

413,579

Other current liabilities

45,778

42,200

Total current liabilities

1,758,717

1,306,158

Accrued solar module collection and

recycling liability

134,250

135,123

Long-term debt

418,695

464,068

Deferred revenue

1,375,407

1,591,604

Other liabilities

170,999

180,710

Total liabilities

3,858,068

3,677,663

Commitments and contingencies

Stockholders’ equity:

Common stock, $0.001 par value per share;

500,000,000 shares authorized; 107,041,246 and 106,847,475 shares

issued and outstanding at March 31, 2024 and December 31, 2023,

respectively

107

107

Additional paid-in capital

2,878,330

2,890,427

Accumulated earnings

4,207,682

3,971,066

Accumulated other comprehensive loss

(183,605

)

(174,131

)

Total stockholders’ equity

6,902,514

6,687,469

Total liabilities and stockholders’

equity

$

10,760,582

$

10,365,132

FIRST SOLAR, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(In thousands, except per

share amounts)

(Unaudited)

Three Months Ended

March 31, 2024

December 31,

2023

March 31, 2023

Net sales

$

794,108

$

1,158,553

$

548,286

Cost of sales

448,105

656,520

436,235

Gross profit

346,003

502,033

112,051

Operating expenses:

Selling, general and administrative

45,827

57,094

44,028

Research and development

42,742

43,862

30,510

Production start-up

15,408

9,847

19,494

Total operating expenses

103,977

110,803

94,032

Gain on sales of businesses, net

1,115

6,554

(17

)

Operating income

243,141

397,784

18,002

Foreign currency loss, net

(2,858

)

(9,947

)

(5,947

)

Interest income

27,245

23,565

25,822

Interest expense, net

(9,210

)

(7,068

)

(748

)

Other expense, net

(2,799

)

(27,653

)

(1,456

)

Income before taxes

255,519

376,681

35,673

Income tax (expense) benefit

(18,903

)

(27,442

)

6,888

Net income

$

236,616

$

349,239

$

42,561

Net income per share:

Basic

$

2.21

$

3.27

$

0.40

Diluted

$

2.20

$

3.25

$

0.40

Weighted-average number of shares used in

per share calculations:

Basic

106,910

106,844

106,675

Diluted

107,407

107,558

107,154

FIRST SOLAR, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(In thousands)

(Unaudited)

Three Months Ended

March 31,

2024

2023

Cash flows from operating

activities:

Net income

$

236,616

$

42,561

Adjustments to reconcile net income to

cash provided by (used in) operating activities:

Depreciation, amortization and

accretion

90,584

68,855

Share-based compensation

6,791

6,600

Deferred income taxes

(29,033

)

(55,282

)

Gain on sales of businesses, net

(1,115

)

17

Other, net

(814

)

(698

)

Changes in operating assets and

liabilities:

Accounts receivable, trade

17,499

33,933

Inventories

(149,470

)

(122,996

)

Government grants receivable

281,889

(70,114

)

Other assets

(89,610

)

(60,394

)

Income tax receivable and payable

26,239

43,646

Accounts payable and accrued expenses

(160,939

)

(61,552

)

Deferred revenue

37,978

139,713

Other liabilities

1,108

1,113

Net cash provided by (used in) operating

activities

267,723

(34,598

)

Cash flows from investing

activities:

Purchases of property, plant and

equipment

(413,456

)

(370,961

)

Purchases of marketable securities and

restricted marketable securities

(569,446

)

(1,470,600

)

Proceeds from maturities of marketable

securities

416,971

1,196,334

Other investing activities

(2,697

)

—

Net cash used in investing activities

(568,628

)

(645,227

)

Cash flows from financing

activities:

Proceeds from borrowings under debt

arrangements, net of issuance costs

105,420

136,000

Repayment of debt

(45,771

)

—

Payments of tax withholdings for

restricted shares

(18,952

)

(28,314

)

Net cash provided by financing

activities

40,697

107,686

Effect of exchange rate changes on cash,

cash equivalents, restricted cash, and restricted cash

equivalents

(1,938

)

1,495

Net decrease in cash, cash equivalents,

restricted cash, and restricted cash equivalents

(262,146

)

(570,644

)

Cash, cash equivalents, restricted cash,

and restricted cash equivalents, beginning of the period

1,965,069

1,493,462

Cash, cash equivalents, restricted cash,

and restricted cash equivalents, end of the period

$

1,702,923

$

922,818

Supplemental disclosure of noncash

investing and financing activities:

Property, plant and equipment acquisitions

funded by liabilities

$

445,963

$

330,830

Proceeds to be received from asset-based

government grants

$

154,754

$

—

Acquisitions funded by contingent

consideration

$

18,500

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240501530430/en/

First Solar Investors investor@firstsolar.com

First Solar Media media@firstsolar.com

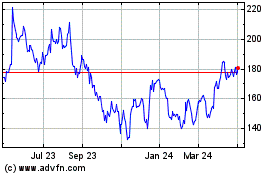

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Nov 2024 to Dec 2024

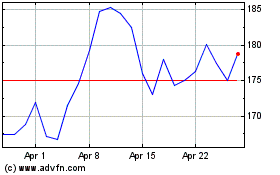

First Solar (NASDAQ:FSLR)

Historical Stock Chart

From Dec 2023 to Dec 2024