false000151336300015133632024-10-312024-10-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

|

|

Date of Report (Date of Earliest Event Reported): |

|

October 31, 2024 |

Fidus Investment Corporation

__________________________________________

(Exact name of registrant as specified in its charter)

|

|

|

Maryland |

814-00861 |

27-5017321 |

_____________________

(State or other jurisdiction |

_____________

(Commission |

______________

(I.R.S. Employer |

of incorporation) |

File Number) |

Identification No.) |

|

|

|

1603 Orrington Avenue, Suite 1005, Evanston, Illinois |

|

60201 |

_________________________________

(Address of principal executive offices) |

|

___________

(Zip Code) |

|

|

|

|

|

|

Registrant’s telephone number, including area code: |

|

847-859-3940 |

Not Applicable

______________________________________________

Former name or former address, if changed since last report

________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

[ ] Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

[ ] Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

[ ] Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

[ ] Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

Common Stock, par value $0.001 per share |

FDUS |

The NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On October 31, 2024, Fidus Investment Corporation (the "Company") issued a press release announcing its financial results for the quarter ended September 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information disclosed under this Item 2.02, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing made by the Company under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as expressly set forth by specific reference in such filing.

|

|

Item 7.01. |

Regulation FD Disclosure. |

The Company issued a press release, filed herewith as Exhibit 99.1, on October 31, 2024 announcing the declaration of a base dividend of $0.43 per share and a supplemental dividend of $0.18 per share, which are payable on December 27, 2024, to stockholders of record as of December 17, 2024.

The information disclosed under this Item 7.01, including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed incorporated by reference into any filing made under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

The following Exhibit 99.1 is being furnished herewith to this Current Report on Form 8-K:

Exhibit

No. Description

99.1 Press Release dated October 31, 2024 of Fidus Investment Corporation

104 Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: October 31, 2024 Fidus Investment Corporation

By: /s/ Shelby E. Sherard

Shelby E. Sherard

Chief Financial Officer and Secretary

FIDUS INVESTMENT CORPORATION ANNOUNCES

Third QUARTER 2024 FINANCIAL RESULTS

Board of Directors Declared Total Dividends of $0.61 per Share for Fourth Quarter 2024

Base Dividend of $0.43 and Supplemental Dividend of $0.18 Per Share

EVANSTON, Ill., October 31, 2024 – Fidus Investment Corporation (NASDAQ:FDUS) (“Fidus” or the “Company”), a provider of customized debt and equity financing solutions, primarily to lower middle-market companies based in the United States, today announced its financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Financial Highlights

•Total investment income of $38.4 million

•Net investment income of $21.4 million, or $0.64 per share

•Adjusted net investment income of $20.4 million, or $0.61 per share(1)

•Invested $65.9 million in debt and equity securities, including three new portfolio companies

•Received proceeds from repayments and realizations of $50.8 million

•Paid total dividends of $0.57 per share: regular quarterly dividend of $0.43 and a supplemental dividend of $0.14 per share on September 26, 2024

•Net asset value (“NAV”) of $658.8 million, or $19.42 per share, as of September 30, 2024

•Estimated spillover income (or taxable income in excess of distributions) as of September 30, 2024 of $43.1 million, or $1.27 per share

Management Commentary

“For the third quarter, our debt investments generated a 8.4% increase in interest income year-over-year. We continued to carefully grow total assets under management while maintaining a healthy portfolio structured to deliver recurring income and the potential for enhanced returns from the monetization of equity investments. We expect investment activity to remain at reasonable levels for the rest of the year, providing us opportunities to advance our long-term goals of generating attractive risk-adjusted returns for our shareholders, preserving capital and growing NAV over time,” said Edward Ross, Chairman and CEO of Fidus Investment Corporation.

(1)Supplemental information regarding adjusted net investment income:

On a supplemental basis, we provide information relating to adjusted net investment income, which is a non-GAAP measure. This measure is provided in addition to, but not as a substitute for, net investment income. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses. The management agreement with our investment adviser provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses. In addition, we accrue, but do not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. As such, we believe that adjusted net investment income is a useful indicator of operations exclusive of any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. Reconciliations of net investment income to adjusted net investment income are set forth in Schedule 1.

Third Quarter 2024 Financial Results

The following table provides a summary of our operating results for the three months ended September 30, 2024, as compared to the same period in 2023 (dollars in thousands, except per share data):

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended September 30, |

|

|

|

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

$ Change |

|

|

% Change |

|

Interest income |

|

$ |

31,857 |

|

|

$ |

28,313 |

|

|

$ |

3,544 |

|

|

|

12.5 |

% |

Payment-in-kind interest income |

|

|

1,851 |

|

|

|

2,789 |

|

|

|

(938 |

) |

|

|

(33.6 |

%) |

Dividend income |

|

|

1,384 |

|

|

|

262 |

|

|

|

1,122 |

|

|

|

428.2 |

% |

Fee income |

|

|

2,693 |

|

|

|

2,255 |

|

|

|

438 |

|

|

|

19.4 |

% |

Interest on idle funds |

|

|

597 |

|

|

|

566 |

|

|

|

31 |

|

|

|

5.5 |

% |

Total investment income |

|

$ |

38,382 |

|

|

$ |

34,185 |

|

|

$ |

4,197 |

|

|

|

12.3 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income |

|

$ |

21,411 |

|

|

$ |

16,660 |

|

|

$ |

4,751 |

|

|

|

28.5 |

% |

Net investment income per share |

|

$ |

0.64 |

|

|

$ |

0.63 |

|

|

$ |

0.01 |

|

|

|

1.6 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted net investment income (1) |

|

$ |

20,424 |

|

|

$ |

18,188 |

|

|

$ |

2,236 |

|

|

|

12.3 |

% |

Adjusted net investment income per share (1) |

|

$ |

0.61 |

|

|

$ |

0.68 |

|

|

$ |

(0.07 |

) |

|

|

(10.3 |

%) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net increase (decrease) in net assets resulting from operations |

|

$ |

16,477 |

|

|

$ |

24,299 |

|

|

$ |

(7,822 |

) |

|

|

(32.2 |

%) |

Net increase (decrease) in net assets resulting from operations per share |

|

$ |

0.49 |

|

|

$ |

0.91 |

|

|

$ |

(0.42 |

) |

|

|

(46.2 |

%) |

The $4.2 million increase in total investment income for the three months ended September 30, 2024, as compared to the same period in 2023, was primarily attributable to (i) a $2.6 million increase in total interest income (which includes payment-in-kind interest income) resulting from an increase in average debt investment balances outstanding, partially offset by a decrease in weighted average yield on debt investment balances outstanding, (ii) a $1.1 million increase in dividend income due to an increase in distributions received from equity investments and (iii) a $0.4 million increase in fee income resulting from an increase in amendment fees.

For the three months ended September 30, 2024, total expenses, including the base management fee waiver and income tax provision, were $17.0 million, a decrease of $0.5 million, or (3.2%) from the $17.5 million of total expenses, including the base management fee waiver and income tax provision, for the three months ended September 30, 2023. The decrease was primarily attributable to (i) a $2.5 million decrease in capital gains incentive fee accrued, partially offset by (ii) a $0.7 million net increase in base management fee, including the base management fee waiver, due to higher average total assets, (iii) a $0.6 million increase in the income incentive fee, and (iv) a $0.6 million increase in income tax provision (benefit).

Net investment income increased by $4.7 million, or 28.5%, to $21.4 million during the three months ended September 30, 2024 as compared to the same period in 2023, as a result of the $4.2 million increase in total investment income and the $0.5 million decrease in total expenses, including base management fee waiver and income tax provision. Adjusted net investment income,(1) which excludes the capital gains incentive fee accrual, was $0.61 per share compared to $0.68 per share in the prior year.

For the three months ended September 30, 2024, the total net realized gain/(loss) on investments, net of income tax (provision)/benefit on realized gains, was $(0.4) million, as compared to total net realized gain/(loss) on investments, net of income tax (provision)/benefit on realized gains, of $9.7 million for the same period in 2023.

Portfolio and Investment Activities

As of September 30, 2024, the fair value of our investment portfolio totaled $1,090.7 million and consisted of 85 active portfolio companies and five portfolio companies that have sold their underlying operations. Our total portfolio investments at fair value were approximately 101.5% of the related cost basis as of September 30, 2024. As of September 30, 2024, the debt investments of 49 portfolio companies bore interest at a variable rate, which represented $702.0 million, or 73.2%, of our debt investment portfolio on a fair value basis, and the remainder of our debt investment portfolio was comprised of fixed rate investments. As of September 30, 2024, our average active portfolio company investment at amortized cost was $12.6 million, which excludes investments in five portfolio companies that have sold their underlying operations. The weighted average yield on debt investments was 13.8% as of September 30, 2024. The weighted average yield was computed using the effective interest rates for debt investments at cost as of September 30, 2024, including the accretion of original issue discounts and loan origination fees, but excluding investments on non-accrual status and investments recorded as a secured borrowing.

Third quarter 2024 investment activity included the following new portfolio company investment:

•Jumo Health, Inc., a developer of creative, patient-centric educational solutions that improve health literacy to accelerate clinical trial enrollment and increase participant retention. Fidus invested $6.0 million in first lien debt and $0.8 million in preferred equity.

•Thrust Flight LLC, a provider of professional flight training services. Fidus invested $9.8 million in first lien debt, $1.1 million in common equity and made additional commitments up to $2.6 million in first lien debt.

•InductiveHealth Informatics, LLC, a leading provider of disease and syndromic surveillance solutions for health agencies. Fidus invested $20.0 million in first lien debt and $0.4 million in preferred equity.

Liquidity and Capital Resources

As of September 30, 2024, we had $54.4 million in cash and cash equivalents and $100.0 million of unused capacity under our senior secured revolving credit facility (the “Credit Facility”). For the three months ended September 30, 2024, we received net proceeds of $14.1 million from the equity at-the-market program (the “ATM Program”). As of September 30, 2024, we had SBA debentures outstanding of $175.0 million, $125.0 million outstanding of our 4.75% notes due January 2026 (the “January 2026 Notes”) and $125.0 million outstanding of our 3.50% notes due November 2026 (the “November 2026 Notes” and collectively with the January 2026 Notes the “Notes”). As of September 30, 2024, the weighted average interest rate on total debt outstanding was 4.6%.

Fourth Quarter 2024 Dividends Totaling $0.61 Per Share Declared

On October 28, 2024, our board of directors declared a base dividend of $0.43 per share and a supplemental dividend of $0.18 per share for the fourth quarter. The dividends will be payable on December 27, 2024, to stockholders of record as of December 17, 2024.

When declaring dividends, our board of directors reviews estimates of taxable income available for distribution, which differs from consolidated income under GAAP due to (i) changes in unrealized appreciation and depreciation, (ii) temporary and permanent differences in income and expense recognition, and (iii) the amount of undistributed taxable income carried over from a given year for distribution in the following year. The final determination of 2024 taxable income, as well as the tax attributes for 2024 dividends, will be made after the close of the 2024 tax year. The final tax attributes for 2024 dividends will generally include ordinary taxable income but may also include capital gains, qualified dividends and return of capital.

Fidus has adopted a dividend reinvestment plan (“DRIP”) that provides for reinvestment of dividends on behalf of its stockholders, unless a stockholder elects to receive cash. As a result, when we declare a cash dividend, stockholders who have not “opted out” of the DRIP at least two days prior to the dividend payment date will have their cash dividends automatically reinvested in additional shares of our common stock. Those stockholders whose shares are held by a broker or other financial intermediary may receive dividends in cash by notifying their broker or other financial intermediary of their election.

Subsequent Events

On October 1, 2024, we invested $6.3 million in first lien debt and common equity in Estex Manufacturing Company, LLC, a branded manufacturer of sewn products used in the utility, airline / aerospace, sports, and military end markets.

On October 11, 2024, we exited our debt investment in US Fertility Enterprises, LLC. We received payment in full of $15.2 million on our subordinated debt, which included a prepayment fee.

On October 24, 2024, we exited our debt investment in Sonicwall US Holdings, Inc. We received payment of $3.3 million on our second lien debt, resulting in a realized loss of $0.1 million.

On October 25, 2024, we invested $14.8 million in first lien debt and common equity in Axis Medical Technologies LLC (dba Movemedical), a leading provider of last-mile supply chain software solutions to medical device OEMs.

Third Quarter 2024 Financial Results Conference Call

Management will host a conference call to discuss the operating and financial results at 9:00am ET on Friday, November 1, 2024. To participate in the conference call, please dial (844) 808-7136 approximately 10 minutes prior to the call. International callers should dial (412) 317-0534. Please ask to be joined into the Fidus Investment Corporation call.

A live webcast of the conference call will be available at http://investor.fdus.com/news-events/events-presentations. Please access the website 15 minutes prior to the start of the call to download and install any necessary audio software. An archived replay of the conference call will also be available in the investor relations section of the Company’s website.

ABOUT FIDUS INVESTMENT CORPORATION

Fidus Investment Corporation provides customized debt and equity financing solutions to lower middle-market companies, which management generally defines as U.S. based companies with revenues between $10 million and $150 million. The Company’s investment objective is to provide attractive risk-adjusted returns by generating both current income from debt investments and capital appreciation from equity related investments. Fidus seeks to partner with business owners, management teams and financial sponsors by providing customized financing for change of ownership transactions, recapitalizations, strategic acquisitions, business expansion and other growth initiatives.

Fidus is an externally managed, closed-end, non-diversified management investment company that has elected to be treated as a business development company under the Investment Company Act of 1940, as amended. In addition, for tax purposes, Fidus has elected to be treated as a regulated investment company under Subchapter M of the Internal Revenue Code of 1986, as amended. Fidus was formed in February 2011 to continue and expand the business of Fidus Mezzanine Capital, L.P., which commenced operations in May 2007 and was licensed by the U.S. Small Business Administration as a Small Business Investment Company (SBIC).

FORWARD-LOOKING STATEMENTS

This press release may contain certain forward-looking statements which are based upon current expectations and are inherently uncertain, including, but not limited to, statements about the future performance and financial condition of the Company, the prospects of our existing and prospective portfolio companies, the financial condition and ability of our existing and prospective portfolio companies to achieve their objectives, and the timing, form and amount of any distributions or supplemental dividends in the future. Any such statements, other than statements of historical fact, are likely to be affected by other unknowable future events and conditions, including elements of the future that are or are not under the Company’s control, such as changes in the financial and lending markets, the impact of the general economy (including an economic downturn or recession), and the impact of interest rate volatility; accordingly, such statements cannot be guarantees or assurances of any aspect of future performance. Actual developments and results are highly likely to vary materially from these estimates and projections of the future as a result of a number of factors related to changes in the markets in which the Company invests, changes in the financial, capital, and lending markets, and other factors described from time to time in the Company’s filings with the Securities and Exchange Commission. Such statements speak only as of the time when made, and are based on information available to the Company as of the date hereof and are qualified in their entirety by this cautionary statement. The Company undertakes no obligation to update any such statement now or in the future, except as required by applicable law.

FIDUS INVESTMENT CORPORATION

Consolidated Statements of Assets and Liabilities

(in thousands, except shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

September 30, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

ASSETS |

|

|

|

|

|

|

|

|

Investments, at fair value: |

|

|

|

|

|

|

|

|

Control investments (cost: $6,832 and $6,832, respectively) |

|

$ |

|

— |

|

|

$ |

|

— |

|

Affiliate investments (cost: $48,019 and $46,485, respectively) |

|

|

|

85,827 |

|

|

|

|

83,876 |

|

Non-control/non-affiliate investments (cost: $1,019,953 and $883,312, respectively) |

|

|

|

1,004,848 |

|

|

|

|

874,030 |

|

Total investments, at fair value (cost: $1,074,804 and $936,629, respectively) |

|

|

|

1,090,675 |

|

|

|

|

957,906 |

|

Cash and cash equivalents |

|

|

|

54,443 |

|

|

|

|

119,131 |

|

Interest receivable |

|

|

|

14,317 |

|

|

|

|

11,965 |

|

Prepaid expenses and other assets |

|

|

|

1,618 |

|

|

|

|

1,896 |

|

Total assets |

|

$ |

|

1,161,053 |

|

|

$ |

|

1,090,898 |

|

LIABILITIES |

|

|

|

|

|

|

|

|

SBA debentures, net of deferred financing costs |

|

$ |

|

170,472 |

|

|

$ |

|

204,472 |

|

Notes, net of deferred financing costs |

|

|

|

248,081 |

|

|

|

|

247,243 |

|

Borrowings under Credit Facility, net of deferred financing costs |

|

|

|

38,853 |

|

|

|

|

(1,082 |

) |

Secured borrowings |

|

|

|

14,025 |

|

|

|

|

15,880 |

|

Accrued interest and fees payable |

|

|

|

3,544 |

|

|

|

|

5,924 |

|

Base management fee payable, net of base management fee waiver – due to affiliate |

|

|

|

4,784 |

|

|

|

|

4,151 |

|

Income incentive fee payable – due to affiliate |

|

|

|

5,059 |

|

|

|

|

4,570 |

|

Capital gains incentive fee payable – due to affiliate |

|

|

|

14,914 |

|

|

|

|

17,509 |

|

Administration fee payable and other, net – due to affiliate |

|

|

|

619 |

|

|

|

|

789 |

|

Taxes payable |

|

|

|

751 |

|

|

|

|

1,227 |

|

Accounts payable and other liabilities |

|

|

|

1,190 |

|

|

|

|

741 |

|

Total liabilities |

|

$ |

|

502,292 |

|

|

$ |

|

501,424 |

|

Commitments and contingencies |

|

|

|

|

|

|

|

|

NET ASSETS |

|

|

|

|

|

|

|

|

Common stock, $0.001 par value (100,000,000 shares authorized, 33,914,652 and 30,438,979 shares |

|

|

|

|

|

|

|

|

issued and outstanding at September 30, 2024 and December 31, 2023, respectively) |

|

$ |

|

34 |

|

|

$ |

|

31 |

|

Additional paid-in capital |

|

|

|

572,159 |

|

|

|

|

504,298 |

|

Total distributable earnings |

|

|

|

86,568 |

|

|

|

|

85,145 |

|

Total net assets |

|

|

|

658,761 |

|

|

|

|

589,474 |

|

Total liabilities and net assets |

|

$ |

|

1,161,053 |

|

|

$ |

|

1,090,898 |

|

Net asset value per common share |

|

$ |

|

19.42 |

|

|

$ |

|

19.37 |

|

FIDUS INVESTMENT CORPORATION

Consolidated Statements of Operations (unaudited)

(in thousands, except shares and per share data)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

September 30, |

|

|

September 30, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Investment Income: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

|

|

|

|

|

|

|

|

|

|

Control investments |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

Affiliate investments |

|

|

870 |

|

|

|

1,011 |

|

|

|

2,603 |

|

|

|

3,168 |

|

Non-control/non-affiliate investments |

|

|

30,987 |

|

|

|

27,302 |

|

|

|

88,899 |

|

|

|

77,268 |

|

Total interest income |

|

|

31,857 |

|

|

|

28,313 |

|

|

|

91,502 |

|

|

|

80,436 |

|

Payment-in-kind interest income |

|

|

|

|

|

|

|

|

|

|

|

|

Control investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Affiliate investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Non-control/non-affiliate investments |

|

|

1,851 |

|

|

|

2,789 |

|

|

|

5,745 |

|

|

|

4,661 |

|

Total payment-in-kind interest income |

|

|

1,851 |

|

|

|

2,789 |

|

|

|

5,745 |

|

|

|

4,661 |

|

Dividend income |

|

|

|

|

|

|

|

|

|

|

|

|

Control investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Affiliate investments |

|

|

1,328 |

|

|

|

(1 |

) |

|

|

1,830 |

|

|

|

519 |

|

Non-control/non-affiliate investments |

|

|

56 |

|

|

|

263 |

|

|

|

308 |

|

|

|

431 |

|

Total dividend income |

|

|

1,384 |

|

|

|

262 |

|

|

|

2,138 |

|

|

|

950 |

|

Fee income |

|

|

|

|

|

|

|

|

|

|

|

|

Control investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

Affiliate investments |

|

|

5 |

|

|

|

5 |

|

|

|

15 |

|

|

|

60 |

|

Non-control/non-affiliate investments |

|

|

2,688 |

|

|

|

2,250 |

|

|

|

6,559 |

|

|

|

5,868 |

|

Total fee income |

|

|

2,693 |

|

|

|

2,255 |

|

|

|

6,574 |

|

|

|

5,928 |

|

Interest on idle funds |

|

|

597 |

|

|

|

566 |

|

|

|

2,738 |

|

|

|

1,824 |

|

Total investment income |

|

|

38,382 |

|

|

|

34,185 |

|

|

|

108,697 |

|

|

|

93,799 |

|

Expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

Interest and financing expenses |

|

|

6,026 |

|

|

|

5,985 |

|

|

|

18,100 |

|

|

|

16,761 |

|

Base management fee |

|

|

4,848 |

|

|

|

4,161 |

|

|

|

13,986 |

|

|

|

12,066 |

|

Incentive fee - income |

|

|

5,059 |

|

|

|

4,478 |

|

|

|

14,072 |

|

|

|

11,959 |

|

Incentive fee (reversal) - capital gains |

|

|

(987 |

) |

|

|

1,528 |

|

|

|

942 |

|

|

|

507 |

|

Administrative service expenses |

|

|

688 |

|

|

|

581 |

|

|

|

1,894 |

|

|

|

1,672 |

|

Professional fees |

|

|

567 |

|

|

|

587 |

|

|

|

2,469 |

|

|

|

2,044 |

|

Other general and administrative expenses |

|

|

266 |

|

|

|

269 |

|

|

|

764 |

|

|

|

773 |

|

Total expenses before base management fee waiver |

|

|

16,467 |

|

|

|

17,589 |

|

|

|

52,227 |

|

|

|

45,782 |

|

Base management fee waiver |

|

|

(64 |

) |

|

|

(72 |

) |

|

|

(200 |

) |

|

|

(216 |

) |

Total expenses, net of base management fee waiver |

|

|

16,403 |

|

|

|

17,517 |

|

|

|

52,027 |

|

|

|

45,566 |

|

Net investment income before income taxes |

|

|

21,979 |

|

|

|

16,668 |

|

|

|

56,670 |

|

|

|

48,233 |

|

Income tax provision (benefit) |

|

|

568 |

|

|

|

8 |

|

|

|

682 |

|

|

|

66 |

|

Net investment income |

|

|

21,411 |

|

|

|

16,660 |

|

|

|

55,988 |

|

|

|

48,167 |

|

Net realized and unrealized gains (losses) on investments: |

|

|

|

|

|

|

|

|

|

|

|

|

Net realized gains (losses): |

|

|

|

|

|

|

|

|

|

|

|

|

Control investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(11,458 |

) |

Affiliate investments |

|

|

— |

|

|

|

1 |

|

|

|

— |

|

|

|

100 |

|

Non-control/non-affiliate investments |

|

|

(366 |

) |

|

|

9,749 |

|

|

|

12,161 |

|

|

|

15,625 |

|

Total net realized gain (loss) on investments |

|

|

(366 |

) |

|

|

9,750 |

|

|

|

12,161 |

|

|

|

4,267 |

|

Income tax (provision) benefit from realized gains on investments |

|

|

— |

|

|

|

(31 |

) |

|

|

(1,523 |

) |

|

|

(1,569 |

) |

Net change in unrealized appreciation (depreciation): |

|

|

|

|

|

|

|

|

|

|

|

|

Control investments |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

11,083 |

|

Affiliate investments |

|

|

2,075 |

|

|

|

(4,507 |

) |

|

|

417 |

|

|

|

(9,109 |

) |

Non-control/non-affiliate investments |

|

|

(6,643 |

) |

|

|

2,450 |

|

|

|

(5,823 |

) |

|

|

(2,113 |

) |

Total net change in unrealized appreciation (depreciation) on investments |

|

|

(4,568 |

) |

|

|

(2,057 |

) |

|

|

(5,406 |

) |

|

|

(139 |

) |

Net gain (loss) on investments |

|

|

(4,934 |

) |

|

|

7,662 |

|

|

|

5,232 |

|

|

|

2,559 |

|

Realized losses on extinguishment of debt |

|

|

— |

|

|

|

(23 |

) |

|

|

(521 |

) |

|

|

(23 |

) |

Net increase (decrease) in net assets resulting from operations |

|

$ |

16,477 |

|

|

$ |

24,299 |

|

|

$ |

60,699 |

|

|

$ |

50,703 |

|

Per common share data: |

|

|

|

|

|

|

|

|

|

|

|

|

Net investment income per share-basic and diluted |

|

$ |

0.64 |

|

|

$ |

0.63 |

|

|

$ |

1.74 |

|

|

$ |

1.89 |

|

Net increase in net assets resulting from operations per share — basic and diluted |

|

$ |

0.49 |

|

|

$ |

0.91 |

|

|

$ |

1.89 |

|

|

$ |

1.99 |

|

Dividends declared per share |

|

$ |

0.57 |

|

|

$ |

0.72 |

|

|

$ |

1.81 |

|

|

$ |

2.08 |

|

Weighted average number of shares outstanding — basic and diluted |

|

|

33,380,480 |

|

|

|

26,618,973 |

|

|

|

32,138,865 |

|

|

|

25,490,379 |

|

Schedule 1

Supplemental Information Regarding Adjusted Net Investment Income

On a supplemental basis, we provide information relating to adjusted net investment income, which is a non-GAAP measure. This measure is provided in addition to, but not as a substitute for, net investment income. Adjusted net investment income represents net investment income excluding any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses. The management agreement with our investment advisor provides that a capital gains incentive fee is determined and paid annually with respect to cumulative realized capital gains (but not unrealized capital gains) to the extent such realized capital gains exceed realized and unrealized losses for such year, less the aggregate amount of any capital gains incentive fees paid in all prior years. In addition, we accrue, but do not pay, a capital gains incentive fee in connection with any unrealized capital appreciation, as appropriate. As such, we believe that adjusted net investment income is a useful indicator of operations exclusive of any capital gains incentive fee expense or (reversal) attributable to realized and unrealized gains and losses. The presentation of this additional information is not meant to be considered in isolation or as a substitute for financial results prepared in accordance with GAAP. The following table provides a reconciliation of net investment income to adjusted net investment income for the three and nine months ended September 30, 2024 and 2023.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

($ in thousands) |

|

|

($ in thousands) |

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net investment income |

|

|

|

|

$ |

21,411 |

|

|

$ |

16,660 |

|

|

$ |

55,988 |

|

|

$ |

48,167 |

|

Capital gains incentive fee expense (reversal) |

|

|

|

|

|

(987 |

) |

|

|

1,528 |

|

|

|

942 |

|

|

|

507 |

|

Adjusted net investment income (1) |

|

|

|

|

$ |

20,424 |

|

|

$ |

18,188 |

|

|

$ |

56,930 |

|

|

$ |

48,674 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Per share) |

|

|

(Per share) |

|

|

|

|

|

|

Three Months Ended |

|

|

Nine Months Ended |

|

|

|

|

|

|

September 30, |

|

|

September 30, |

|

|

|

|

|

|

(unaudited) |

|

|

(unaudited) |

|

|

|

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Net investment income |

|

|

|

|

$ |

0.64 |

|

|

$ |

0.63 |

|

|

$ |

1.74 |

|

|

$ |

1.89 |

|

Capital gains incentive fee expense (reversal) |

|

|

|

|

|

(0.03 |

) |

|

|

0.05 |

|

|

|

0.03 |

|

|

|

0.02 |

|

Adjusted net investment income (1) |

|

|

|

|

$ |

0.61 |

|

|

$ |

0.68 |

|

|

$ |

1.77 |

|

|

$ |

1.91 |

|

|

|

(1) |

Adjusted net investment income per share amounts are calculated as adjusted net investment income dividend by weighted average shares outstanding for the period. Due to rounding, the sum of net investment income per share and capital gains incentive fee expense (reversal) amounts may not equal the adjusted net investment income per share amount presented here. |

|

|

Company Contact: |

Investor Relations Contact: |

Shelby E. Sherard |

Jody Burfening |

Chief Financial Officer |

LHA |

(847) 859-3940 |

(212) 838-3777 |

ssherard@fidusinv.com |

jburfening@lhai.com |

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

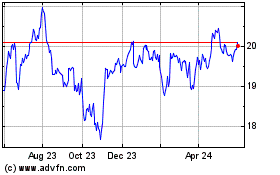

Fidus Investment (NASDAQ:FDUS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Fidus Investment (NASDAQ:FDUS)

Historical Stock Chart

From Nov 2023 to Nov 2024