UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No.

)*

(Name of Issuer)

(Title of Class of Securities)

(CUSIP Number)

|

|

|

|

|

Zhenyu Wang

|

|

With a copy to:

|

CDH Inservice Limited

1503 International Commerce Center,

1 Austin Road West,

Kowloon, Hong Kong

+852-3518-8000

|

|

Kathryn King Sudol

Simpson Thacher & Bartlett LLP

ICBC Tower, 3 Garden Road, 35

th

Floor

Hong Kong

+852-2514-7622

|

(Name, Address and Telephone Number of Person Authorized to

Receive Notices and Communications)

May 14, 2011

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition

that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e),

240.13d-1(f) or 240.13d-1(g), check the following box.

o

Note

: Schedules filed in paper format shall include a signed original and five copies of the

schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person’s initial filing on

this form with respect to the subject class of securities, and for any subsequent amendment

containing information which would alter disclosures provided in a prior cover page.

** This CUSIP applies to the American Depositary Shares, evidenced by American Depositary

Receipts, each representing 20 ordinary shares. No CUSIP has been assigned to the ordinary

shares.

The information required on the remainder of this cover page shall not be deemed to be “filed” for

the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to

the liabilities of that section of the Act but shall be subject to all other provisions of the Act

(however, see the Notes).

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

CDH Inservice Limited

|

|

|

|

|

|

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

|

|

(a)

o

|

|

|

(b)

þ

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

OO

|

|

|

|

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

|

|

|

|

o

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

British Virgin Islands

|

|

|

|

|

|

|

|

7

|

|

SOLE VOTING POWER

|

|

|

|

|

|

NUMBER OF

|

|

124,688,540

1

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole voting power with respect to such shares.

|

|

|

|

|

|

|

SHARES

|

8

|

|

SHARED VOTING POWER

|

|

BENEFICIALLY

|

|

|

|

OWNED BY

|

|

|

|

|

|

|

|

|

EACH

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

REPORTING

|

|

|

|

PERSON

|

|

124,688,540

1

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole dispositive power with respect to such shares.

|

|

|

|

|

|

|

WITH

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

124,688,540

1

|

|

|

|

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

|

|

|

|

o

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

12.4%

2

|

|

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

CO

|

1

Including (i) 91,600,000 ordinary shares of the issuer and (ii) 33,088,540 ordinary shares in the form of American Depositary Shares, each representing 20 ordinary shares of the issuer.

2

Based on 1,003,270,326 ordinary shares outstanding as of April 8, 2011 according to the Issuer’s annual report on Form 20-F for the fiscal year ended December 31, 2010.

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

CDH China Growth Capital Fund II, L.P.

|

|

|

|

|

|

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

|

|

(a)

o

|

|

|

(b)

þ

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

OO

|

|

|

|

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

|

|

|

|

o

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

|

7

|

|

SOLE VOTING POWER

|

|

|

|

|

|

NUMBER OF

|

|

124,688,540

3

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole voting power with respect to such shares.

|

|

|

|

|

|

|

SHARES

|

8

|

|

SHARED VOTING POWER

|

|

BENEFICIALLY

|

|

|

|

OWNED BY

|

|

|

|

|

|

|

|

|

EACH

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

REPORTING

|

|

|

|

PERSON

|

|

124,688,540

3

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole dispositive power with respect to such shares.

|

|

|

|

|

|

|

WITH

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

124,688,540

3

|

|

|

|

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

|

|

|

|

o

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

12.4%

4

|

|

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

PN

|

3

Including (i) 91,600,000 ordinary shares of the issuer and (ii) 33,088,540 ordinary shares in the form of American Depositary Shares, each representing 20 ordinary shares of the issuer.

4

Based on 1,003,270,326 ordinary shares outstanding as of April 8, 2011 according to the Issuer’s annual report on Form 20-F for the fiscal year ended December 31, 2010.

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

CDH China Growth Capital Holdings Company Limited

|

|

|

|

|

|

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

|

|

(a)

o

|

|

|

(b)

þ

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

OO

|

|

|

|

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

|

|

|

|

o

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

Cayman Islands

|

|

|

|

|

|

|

|

7

|

|

SOLE VOTING POWER

|

|

|

|

|

|

NUMBER OF

|

|

124,688,540

5

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole voting power with respect to such shares.

|

|

|

|

|

|

|

SHARES

|

8

|

|

SHARED VOTING POWER

|

|

BENEFICIALLY

|

|

|

|

OWNED BY

|

|

|

|

|

|

|

|

|

EACH

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

REPORTING

|

|

|

|

PERSON

|

|

124,688,540

5

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole dispositive power with respect to such shares.

|

|

|

|

|

|

|

WITH

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

124,688,540

5

|

|

|

|

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

|

|

|

|

o

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

12.4%

6

|

|

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

CO

|

5

Including (i) 91,600,000 ordinary shares of the issuer and (ii) 33,088,540 ordinary shares in the form of American Depositary Shares, each representing 20 ordinary shares of the issuer.

6

Based on 1,003,270,326 ordinary shares outstanding as of April 8, 2011 according to the Issuer’s annual report on Form 20-F for the fiscal year ended December 31, 2010.

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

China Diamond Holdings III Limited

|

|

|

|

|

|

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

|

|

(a)

o

|

|

|

(b)

þ

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

OO

|

|

|

|

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

|

|

|

|

o

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

British Virgin Islands

|

|

|

|

|

|

|

|

7

|

|

SOLE VOTING POWER

|

|

|

|

|

|

NUMBER OF

|

|

124,688,540

7

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole voting power with respect to such shares.

|

|

|

|

|

|

|

SHARES

|

8

|

|

SHARED VOTING POWER

|

|

BENEFICIALLY

|

|

|

|

OWNED BY

|

|

|

|

|

|

|

|

|

EACH

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

REPORTING

|

|

|

|

PERSON

|

|

124,688,540

7

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole dispositive power with respect to such shares.

|

|

|

|

|

|

|

WITH

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

124,688,540

7

|

|

|

|

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

|

|

|

|

o

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

12.4%

8

|

|

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

CO

|

7

Including (i) 91,600,000 ordinary shares of the issuer and (ii) 33,088,540 ordinary shares in the form of American Depositary Shares, each representing 20 ordinary shares of the issuer.

8

Based on 1,003,270,326 ordinary shares outstanding as of April 8, 2011 according to the Issuer’s annual report on Form 20-F for the fiscal year ended December 31, 2010.

|

|

|

|

|

|

|

|

1

|

|

NAMES OF REPORTING PERSONS

China Diamond Holdings Company Limited

|

|

|

|

|

|

|

|

|

|

2

|

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

|

|

|

(a)

o

|

|

|

(b)

þ

|

|

|

|

|

|

3

|

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

|

4

|

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

|

|

OO

|

|

|

|

|

|

5

|

|

CHECK IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEMS 2(d) OR 2(e)

|

|

|

|

|

|

o

|

|

|

|

|

|

6

|

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

|

|

British Virgin Islands

|

|

|

|

|

|

|

|

7

|

|

SOLE VOTING POWER

|

|

|

|

|

|

NUMBER OF

|

|

124,688,540

9

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole voting power with respect to such shares.

|

|

|

|

|

|

|

SHARES

|

8

|

|

SHARED VOTING POWER

|

|

BENEFICIALLY

|

|

|

|

OWNED BY

|

|

|

|

|

|

|

|

|

EACH

|

9

|

|

SOLE DISPOSITIVE POWER

|

|

REPORTING

|

|

|

|

PERSON

|

|

124,688,540

9

ordinary shares. Each of the other Reporting Persons described herein may also be deemed to have sole dispositive power with respect to such shares.

|

|

|

|

|

|

|

WITH

|

10

|

|

SHARED DISPOSITIVE POWER

|

|

|

|

|

|

|

|

|

|

|

|

|

|

11

|

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

|

|

124,688,540

9

|

|

|

|

|

|

12

|

|

CHECK IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

|

|

|

|

o

|

|

|

|

|

|

13

|

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

|

|

12.4%

10

|

|

|

|

|

|

14

|

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

|

|

CO

|

9

Including (i) 91,600,000 ordinary shares of the issuer and (ii) 33,088,540 ordinary shares in the form of American Depositary Shares, each representing 20 ordinary shares of the issuer.

10

Based on 1,003,270,326 ordinary shares outstanding as of April 8, 2011 according to the

Issuer’s annual report on Form 20-F for the fiscal year ended December 31, 2010.

Item 1. Security and Issuer

This statement on Schedule 13D (this “Schedule 13D”) relates to the ordinary shares, US$0.001

par value per share (the “Ordinary Shares”) of CNinsure Inc., a Cayman Islands exempted company

with limited liability (the “Issuer”). The Ordinary Shares are represented American Depositary

Shares (“ADSs”), each ADS representing 20 Ordinary Shares. The Issuer’s ADSs are listed on the

NASDAQ Global Select Market under the symbol “CISG.”

The principal executive offices of the Issuer are located at 9/F, Yinhai Building, No. 299

Yanjiang Zhong Road, Guangzhou, Guangdong, People’s Republic of China 510110.

Item 2. Identity and Background

This Schedule 13D is being filed jointly on behalf of CDH Inservice Limited (“CDH Inservice”),

CDH China Growth Capital Fund II, L.P. (“CDH Fund II”), CDH China Growth Capital Holdings Company

Limited (“CDH Growth Capital Holdings”), China Diamond Holdings III Limited (“China Diamond

Holdings III”) and China Diamond Holdings Company Limited (“China Diamond Holdings Company”) (each

a “Reporting Person”). The agreement among the Reporting Persons relating to the joint filing of

this Schedule 13D is attached as Exhibit 1 hereto. Information with respect to each of the

Reporting Persons is given solely by such Reporting Person, and no Reporting Person assumes

responsibility for the accuracy or completeness of the information concerning the other Reporting

Persons, except as otherwise provided in Rule 13d-1(k).

CDH Inservice has entered into a consortium agreement described under Item 4 with Yinan Hu, a

co-founder, the chief executive officer and chairman of the board of directors of the Issuer, (the

“Founder”), Kingsford Resources Limited (the “Founder Vehicle” and together with the Founder, the

“Founder Parties”) and TPG Asia V MU, Inc., (the “Sponsor”), an affiliate of TPG Capital. The

Founder Parties together with certain parties affiliated therewith reported beneficial ownership of

certain Ordinary Shares of the Issuer in a Schedule 13D filed with SEC on May 16, 2011. The

Sponsor has informed CDH Inservice that it does not beneficially own any of the Issuer’s Ordinary

Shares. As a result of the transactions described under Items 4 and 5, the Reporting Persons may be

deemed to be members of a “group” (within the meaning of Section 13(d)(3) of the Securities

Exchange Act of 1934, as amended (the “Exchange Act”)) with the Founder Parties with respect to the

matters described in Item 4 of this statement.

Each Reporting Person hereby disclaims beneficial ownership of the Ordinary Shares

beneficially owned by the Founder Parties, any other Reporting Person or any other person, and

hereby disclaims membership in a “group” (within the meaning of Section 13(d)(3) of the Exchange

Act) with any other Reporting Person, the Founder Parties or any other person. This Schedule 13D

shall not be construed as acknowledging that any of the Reporting Persons, for any or all purposes,

beneficially owns any Ordinary Shares of the Issuer that are beneficially owned by any other person

or is a member of any a group with any other person.

As of the date hereof, CDH Inservice, a British Virgin Islands company, owns 124,688,540

Ordinary Shares of the Issuer. CDH Fund II, a Cayman Islands limited partnership, owns 100% of the

total outstanding shares of CDH Inservice. CDH Growth Capital Holdings is the general partner of

CDH Fund II and by virtue of its limited partnership agreement has the power to direct CDH Fund II

as to the voting and disposition of shares directly and indirectly held by CDH Fund II. The

principal office address of CDH Inservice, CDH Fund II and CDH Growth Capital Holdings is c/o CDH

Investment Advisory Private Limited, One Temasek Avenue, #18-02, Millenia Tower, Singapore 039192.

The investment committee of CDH Growth Capital Holdings comprises Shangzhi Wu, Shuge Jiao and

Xinlai Liu, and changes to the investment committee require the approval of the directors of CDH

Growth Capital Holdings. The directors of CDH Growth Capital Holdings are nominated by the

principal shareholders of CDH Growth Capital Holdings, being (i) an affiliate of Capital Z

Partners, (ii) an affiliate of the Government of Singapore Investment Corporation, and (iii) China

Diamond Holdings III, a British Virgin Islands limited liability company and the majority

shareholder of CDH Growth Capital Holdings. Shangzhi Wu, Shuge Jiao and Xinlai Liu expressly

disclaim beneficial ownership of the Ordinary Shares held by CDH Inservice.

China Diamond Holdings III is a wholly-owned subsidiary of China Diamond Holdings Company, a

British Virgin Islands company. The principal office address of China Diamond Holdings III is

Kingston Chambers, P.O. 173, Road Town, Tortola, British Virgin Islands. The principal office

address of China Diamond Holdings Company is Trident Chambers, P.O. Box 146, Road Town, Tortola,

British Virgin Islands.

The name, business address, present principal occupation or employment and citizenship of each

of the directors and control persons of each of the Reporting Persons is set forth on

Schedule

A

.

During the last five years, none of the Reporting Persons has, and to the knowledge of the

Reporting Person, no person named in

Schedule A

, (i) has been convicted in a criminal

proceeding (excluding traffic violations or similar misdemeanors), or (ii) was a party to a civil

proceeding of a judicial or administrative body of competent jurisdiction that resulted in a

judgment, decree or final order enjoining the person from future violations of, or prohibiting or

mandating activities subject to, federal or state securities laws, or a finding of any violation of

federal or state securities laws.

Item 3. Source and Amount of Funds or Other Consideration

The information set forth in the cover pages of this 13D and in Item 4 and 5 of this Schedule

13D is incorporated by reference in this Item 3.

CDH Inservice, the Sponsor and the Founder, for himself and other entities affiliated with

him, have proposed to acquire all of the Issuer’s Ordinary Shares (including Ordinary Shares

represented by ADSs), other than the Excluded Shares (as defined in Item 4), for cash consideration

equal to US$19.00 per ADS (US$0.95 per Ordinary Share). CDH Inservice, the Sponsor and the Founder

Parties anticipate that the consideration for the Proposed Transaction (as defined in Item 4 of

this statement), plus additional amounts to cash out outstanding options to purchase Ordinary

Shares, restricted shares and restricted share units, as well as certain transaction costs to be

incurred in connection with the Proposed Transaction, will be funded in part with equity capital

contributed to Holdco (as defined in Item 4 of this statement) by CDH Inservice, Sponsor and the

Founder Parties, and that the Proposed Transaction will not be subject to any debt financing

condition. The

Excluded Shares held by CDH Inservice and the Founder Parties will be

cancelled for no consideration (subject to any exceptions to be agreed among CDH Inservice, the

Sponsor and the Founder Parties).

Item 4. Purpose of Transaction

The information set forth or incorporated by reference in Items 1 and 6 of this Schedule 13D

is hereby incorporated by reference in this Item 4.

On May 14, 2011, CDH Inservice, the Sponsor and the Founder, for himself and other entities

affiliated with him, submitted a non-binding proposal (the “Proposal”) to the Issuer’s board of

directors related to the proposed acquisition of all of the outstanding Ordinary Shares of the

Issuer, excluding Ordinary Shares held by CDH Inservice (other than such Ordinary Shares held by

CDH Inservice as would represent approximately 7.4% of the currently outstanding Ordinary Shares,

which will be cashed out in the Proposed Transaction) and Ordinary Shares held by the Founder

Parties (other than such Ordinary Shares held by the Founder Parties as would represent

approximately 5% of the currently outstanding Ordinary Shares, which will be cashed out in the

Proposed Transaction) (collectively, the “Excluded Shares”). The description of the Proposal in

this Item 4 is qualified in its entirety by reference to the complete text of the Proposal, a copy

of which has been filed as

Exhibit 2

to this Schedule 13D, and which is incorporated by

reference in its entirety into this Item 4.

To implement the Proposal, the Sponsor intends to incorporate a new company under the laws of

the Cayman Islands (“Holdco”) and cause Holdco to form a direct, wholly-owned subsidiary (“Merger

Sub”) under the laws of the Cayman Islands. CDH Inservice, the Sponsor and the Founder Parties, for

himself and other entities affiliated with him, propose to acquire, through a merger of Merger Sub with and into the

Issuer in which the Issuer will be the surviving corporation, all of the Issuer’s Ordinary Shares

(including Ordinary Shares represented by ADSs), other than the Excluded Shares (the “Proposed

Transaction”), for cash consideration equal to US$19.00 per ADS (US$0.95 per Ordinary Share). As

noted in the Proposal, CDH Inservice, the Founder Parties and the Sponsor expect that the

independent members of the Board of Directors of the Issuer will proceed to consider the Proposal

and the Proposed Transaction. Neither the Issuer nor any of CDH Inservice, the Founder

Parties or the Sponsor are obligated to complete the Proposed Transaction, and a binding commitment

with respect to the Proposed Transaction will result only from the execution of definitive

documents, and then will be on the terms provided in such documentation.

If the Proposed Transaction is completed, the ADSs would be delisted from the NASDAQ Global

Select Market and the Issuer’s obligations to filed periodic reports under the Exchange Act would

terminate. In addition, the Proposal could result in one or more of the actions specified in

clauses (a)-(j) of Item 4 of Schedule 13D, including the acquisition or disposition of securities

of the Issuer, a merger or other extraordinary transaction involving the Issuer, a change to the

board of directors of the Issuer (as the surviving company in the merger) to consist solely of

persons to be designated by the Founder Parties, the Sponsor and CDH Inservice, and a change in the

Issuer’s memorandum and articles of association to reflect that the Issuer would become a privately

held company.

Item 5. Interest in Securities of the Issuer

(a) and (b) As of May 16, 2011, CDH Inservice was the record owner of 124,688,540 Ordinary Shares

of the Issuer, consisting of (i) 91,600,000 Ordinary Shares and (ii) 33,088,540 Ordinary Shares in

the form of ADSs. The information set forth in the cover pages of this Schedule 13D and Item 2 is

incorporated herein by reference.

Neither the filing of this Schedule 13D nor any of its contents shall be deemed to constitute

an admission by any of the Reporting Persons that it is the beneficial owner of any of the Ordinary

Shares referred to herein for purposes of the Exchange Act, or for any other purpose, and such

beneficial ownership is expressly disclaimed. As noted in Item 2, except as otherwise expressly set

forth in this statement, the Reporting Persons expressly disclaim beneficial ownership of any

Ordinary Shares beneficially owned by any of the Founder Parties or any other person.

(c) Other than the transactions described in this Schedule 13D, to the best knowledge of the

Reporting Persons, no transactions in the Ordinary Shares or ADSs have been effected during the

past 60 days by any of the Reporting Persons or any of the other entities or individuals named in

response to Item 2 hereof.

(d) To the best knowledge of the Reporting Persons, except for the agreements described in this

Schedule 13D, no one other than the Reporting Persons, or the holders of interests in the Reporting

Persons, has the right to receive or the power to direct the receipt of dividends from, or the

proceeds from the sale of, the Ordinary Shares or ADSs.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

Concurrent with their delivery of the Proposal to the Issuer’s board of directors, CDH

Inservice, the Founder Parties and the Sponsor entered into a consortium agreement dated May 14,

2011 (the “Consortium Agreement”) with respect to their participation in, and the general structure

and financing of, the Proposed Transaction. Under the Consortium Agreement, the parties thereto

have agreed to, among other things, cooperate to conduct due diligence with respect to the Issuer

and its business, engage in discussions with the Issuer regarding the terms of the Proposal,

participate in the negotiation of the terms of definitive documentation with respect to the

Proposed Transaction and the documentation governing the relationship among the parties thereto,

work exclusively with the other parties thereto to implement the Proposed Transaction and share

certain costs and expenses related to the Proposed Transaction.

References to the Consortium Agreement set forth in this statement are not intended to be

complete, and the foregoing description of the material terms of the Consortium Agreement is

qualified in its entirety by reference to the full text of the Consortium Agreement, which has been

filed as

Exhibit 3

to this Schedule 13D and which is incorporated by reference in its entirety into this Item 6. In addition, the information set

forth in or incorporated by reference into Items 3 and 4 above is incorporated by reference in its

entirety into this Item 6.

Item 7. Materials to Be Filed as Exhibits

|

|

|

|

|

Exhibit 1

|

|

Joint Filing Agreement

|

|

Exhibit 2

|

|

Proposal to Issuer, dated May 14, 2011

|

|

Exhibit 3

|

|

Consortium Agreement by and among Yinan Hu, Kingsford Resources

Limited, CDH Inservice Limited and the TPG Asia V MU, Inc.,

dated May 14, 2011

|

Signatures

After reasonable inquiry and to the best of my knowledge and belief, I certify that the

information set forth in this statement is true, complete and correct.

DATED: May 16, 2011

|

|

|

|

|

|

|

|

CDH Inservice Limited

|

|

|

|

By:

|

/s/ Zhenyu Wang

|

|

|

|

|

Name:

|

Zhenyu Wang

|

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

CDH China Growth Capital Fund II, L.P.

By: CDH China Growth Capital Holdings Company Limited, its General Partner

|

|

|

|

By:

|

/s/ Shangzhi Wu

|

|

|

|

|

Name:

|

Shangzhi Wu

|

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

CDH China Growth Capital Holdings Company Limited

|

|

|

|

By:

|

/s/ Shangzhi Wu

|

|

|

|

|

Name:

|

Shangzhi Wu

|

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

China Diamond Holdings III Limited

|

|

|

|

By:

|

/s/ Shangzhi Wu

|

|

|

|

|

Name:

|

Shangzhi Wu

|

|

|

|

|

Title:

|

Director

|

|

|

|

|

|

China Diamond Holdings Company Limited

|

|

|

|

By:

|

/s/ Shangzhi Wu

|

|

|

|

|

Name:

|

Shangzhi Wu

|

|

|

|

|

Title:

|

Director

|

|

Signature

Page to Schedule 13D

Schedule A

|

|

|

|

|

Name

|

|

Present Principal Occupation or Employment and Business Address

|

|

Shangzhi Wu

(Singapore)

|

|

Director of CDH Inservice Limited

Director of CDH China Growth Capital Holdings Company Limited

Director of China Diamond Holdings III Limited

Director of China Diamond Holdings Company Limited

1503 International Commerce Center, 1 Austin Road West, Kowloon, Hong Kong

|

|

|

|

|

|

Zhenyu Wang

(People’s Republic of China)

|

|

Director of CDH Inservice Limited

1503 International Commerce Center, 1 Austin Road West, Kowloon, Hong Kong

|

|

|

|

|

|

Kiang Hua Lew

(Singapore)

|

|

Director of CDH Inservice Limited

Director of China Diamond Holdings III Limited

One Temasek Avenue #18-02, Millenia Tower, Singapore 039192

|

|

|

|

|

|

Kunna Chinniah

(Singapore)

|

|

Director of CDH China Growth Capital Holdings Company Limited

168 Robinson Road #37-01, Capital Tower, Singapore 068912

|

|

|

|

|

|

Lawrence Cheng

(Canada)

|

|

Director of CDH China Growth Capital Holdings Company Limited

142 West 57

th

Street, 3

rd

Floor, New York, NY 10019 USA

|

|

|

|

|

|

Stuart Schonberger

(United States)

|

|

Director of China Diamond Holdings III Limited

1503 International Commerce Center, 1 Austin Road West, Kowloon, Hong Kong

|

|

|

|

|

|

Shuge Jiao

(Singapore)

|

|

Director of China Diamond Holdings Company Limited

1503 International Commerce Center, 1 Austin Road West, Kowloon, Hong Kong

|

Exhibit Index

|

|

|

|

|

Exhibit 1

|

|

Joint Filing Agreement

|

|

Exhibit 2

|

|

Proposal to Issuer, dated May 14, 2011

|

|

Exhibit 3

|

|

Consortium Agreement by and among Yinan Hu, Kingsford Resources

Limited, CDH Inservice Limited and the TPG Asia V MU, Inc.,

dated May 14, 2011

|

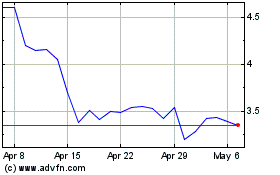

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jun 2024 to Jul 2024

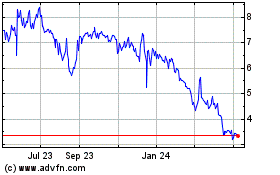

Fanhua (NASDAQ:FANH)

Historical Stock Chart

From Jul 2023 to Jul 2024