Notification That Quarterly Report Will Be Submitted Late (nt 10-q)

November 15 2021 - 5:23PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 12b-25

Commission File Number: 001-39011

NOTIFICATION OF LATE FILING

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Check One):

|

|

☐ Form 10-K ☐ Form 20-F ☐ Form 11-K ☒ Form 10-Q

☐ Form 10-D ☐ Form N-SAR ☐ Form N-CSR

|

|

|

|

|

|

|

For Period Ended: September 30, 2021

|

|

|

|

|

|

|

☐ Transition Report on Form 10-K

|

|

|

|

|

|

|

☐ Transition Report on Form 20-F

|

|

|

|

|

|

|

☐ Transition Report on Form 11-K

|

|

|

|

|

|

|

☐ Transition Report on Form 10-Q

|

|

|

|

|

|

|

☐ Transition Report on Form N-SAR

|

|

|

|

|

|

|

☐ For the Transition Period Ended:

|

|

|

|

|

|

|

|

|

|

Read Instruction (on back page) Before Preparing Form. Please Print or Type.

Nothing in this form shall be construed to imply that the Commission has verified any information contained herein.

|

If the notification relates to a portion of the filing checked above, identify the Item(s) to which the notification relates:

PART I — REGISTRANT INFORMATION

EXICURE, INC.

Full Name of Registrant

Former Name if Applicable

2430 N. Halsted St.

Address of Principal Executive Office (Street and Number)

Chicago, Illinois 60614

City, State and Zip Code

PART II — RULES 12b-25(b) AND (c)

If the subject report could not be filed without unreasonable effort or expense and the Registrant seeks relief pursuant to Rule 12b-25(b), the following should be completed. (Check box if appropriate.)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

☒

|

|

(a)

|

|

The reasons described in reasonable detail in Part III of this form could not be eliminated without unreasonable effort or expense;

|

|

|

(b)

|

|

The subject annual report, semi-annual report, transition report on Form 10-K, Form 20-F, Form 11-K, Form N-SAR or Form N-CSR, or portion thereof, will be filed on or before the fifteenth calendar day following the prescribed due date; or the subject quarterly report or transition report on Form 10-Q, or subject distribution report on Form 10-D, or portion thereof, will be filed on or before the fifth calendar day following the prescribed due date; and

|

|

|

(c)

|

|

The accountant’s statement or other exhibit required by Rule 12b-25(c) has been attached if applicable.

|

PART III — NARRATIVE

State below in reasonable detail why the Forms 10-K, 20-F, 11-K, 10-Q, 10-D, N-SAR, N-CSR or the transition report portion thereof could not be filed within the prescribed time period.

Exicure, Inc. (the “Company”) is unable to file its Quarterly Report on Form 10-Q for the quarter ended September 30, 2021 (the “Q3 2021 10-Q”) with the Securities and Exchange Commission (“SEC”) within the prescribed time period without unreasonable effort or expense. On November 9, 2021, the Audit Committee of the Board of Directors of the Company was notified of a claim made by a former Company senior researcher regarding alleged improprieties that researcher claims to have committed with respect to the Company’s XCUR-FXN preclinical program for the treatment of Friedreich’s ataxia. The Audit Committee has retained external counsel to conduct an internal investigation of the claim. The Company is currently unable to predict the timing or outcome of the investigation. Despite working diligently in an effort to timely file its Q3 2021 10-Q, the Company requires additional time to complete certain disclosures and procedures, including disclosures relating to the internal investigation.

The Company expects to file its Q3 2021 10-Q with the SEC as soon as practicable, and no later than the fifth calendar day following the prescribed due date, in accordance with Rule 12b-25.

PART IV-- OTHER INFORMATION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

|

|

|

Name and telephone number of person to contact in regard to this notification

|

|

|

|

|

|

|

|

|

|

Brian C. Bock

|

|

(847)

|

|

673-1700

|

|

|

|

|

|

(Name)

|

|

|

|

(Area code)

|

|

|

|

(Telephone Number)

|

|

|

|

|

|

(2)

|

|

|

|

Have all other periodic reports required under Section 13 or 15(d) of the Securities Exchange Act of 1934 or Section 30 of the Investment Company Act of 1940 during the preceding 12 months or for such shorter period that the registrant was required to file such report(s) been filed? If answer is no, identify report(s). Yes ☒ No ☐

|

|

|

|

|

|

|

|

|

|

(3)

|

|

|

|

Is it anticipated that any significant change in results of operations from the corresponding period for the last fiscal year will be reflected by the earnings statements to be included in the subject report or portion thereof? Yes ☒ No ☐

|

|

|

|

|

If so, attach an explanation of the anticipated change, both narratively and quantitatively, and, if appropriate, state the reasons why a reasonable estimate of the results cannot be made.

It is anticipated that the Company will report that its cash, cash equivalents, short-term investments, and restricted cash as of September 30, 2021 were $62.0 million. Substantial additional financing will be needed by the Company to fund its operations. Based on this forecast, it is expected that the Company’s financial statements will include disclosures with respect to there being substantial doubt as to the Company’s ability to continue as a going concern and the Company expects to continue to incur losses until it is able to generate sufficient revenues to support its operations and offset operating costs.

In addition, it is anticipated that the Company will report collaboration revenue of $(3.7) million for the quarter ended September 30, 2021, reflecting a decrease of $6.1 million, or 251%, from collaboration revenue of $2.4 million for the quarter ended September 30, 2020. The decrease in collaboration revenue of $6.1 million for the quarter ended September 30, 2021 is due to a decrease in revenue related to the Company’s collaboration agreement with AbbVie Inc., which reflects the cumulative catchup adjustment (reduction) of revenue of $(4.5) million in connection with the change in estimate as the joint steering committee for the program made the determination during the quarter to amend its initial work plans. The Company currently estimates significant additional efforts will be required to satisfy the performance obligation under the Company’s collaboration agreement with AbbVie, Inc. It is expected that the Company will report that these increased estimated efforts in connection with the change in work plans resulted in less progress occurring relative to the increased estimate of total project hours to complete the research services during the three and nine months ended September 30, 2021 as compared to the amount of revenue recognized at both June 30, 2021 and December 31, 2020, which led to revenue reversals in each respective period.

Cautionary Note Regarding Forward-Looking Statements

This Form 12b-25 includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements are often identified by the use of words such as “believe,” “intend,” “expect,” “estimate,” “plan,” “outlook,” “project,” “anticipate,” “may,” “will,” “would” and other similar words and expressions that predict or indicate future events or trends that are not statements of historical matters. All statements in this Form 12b-25 other than statements of historical fact could be deemed forward looking including, but not limited to, statements about the Company’s preliminary results for the third quarter of 2021 and substantial doubt as to the Company’s ability to continue as a going concern, the Company’s anticipated timing for filing its Q3 2021 10-Q, statements regarding the internal investigation being conducted by the Audit Committee including, but not limited to, the timing and scope of the investigation; and the Company’s business plans and objectives.

While these forward-looking statements are based upon information presently available to the Company and assumptions that it believes to be reasonable, such forward-looking statements are inherently subject to risks and uncertainties, many of which are beyond the Company’s control. Actual results may differ materially from those projected in such statements due to various factors, including, but not limited to, the time necessary for the Audit Committee to complete its investigation and review; the diversion of management attention to the internal investigation; the final conclusions and outcome of the Audit Committee and board of directors following the completion of its investigation and review, including any related investigations or proceedings. Given these risks and uncertainties, you are cautioned not to place undue reliance on such forward-looking statements. The forward- looking statements included in this filing are made only as of the date hereof. The Company does not undertake any obligation to update any such statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments, except as required by law.

Exicure, Inc.

(Name of Registrant as Specified in Charter)

has caused this notification to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Date:

|

|

November 15, 2021

|

|

|

|

By:

|

|

|

|

/s/ Brian C. Bock

|

|

|

|

|

|

|

|

|

|

|

|

Name: Brian C. Bock

|

|

|

|

|

|

|

|

|

|

|

|

Title: Chief Financial Officer

|

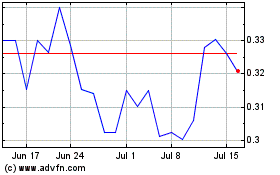

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Jun 2024 to Jul 2024

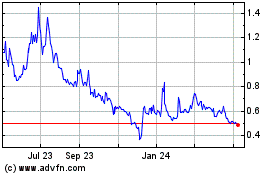

Exicure (NASDAQ:XCUR)

Historical Stock Chart

From Jul 2023 to Jul 2024