false

0000033488

0000033488

2023-10-26

2023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

| Date of report (Date of earliest event reported) |

October 26, 2023 |

|

ESCALADE, INCORPORATED

(Exact Name of Registrant as Specified in Its Charter)

Indiana

(State or Other Jurisdiction of Incorporation)

| 0-6966 |

13-2739290 |

| (Commission File Number) |

(IRS Employer Identification No.) |

| |

|

| 817 Maxwell Avenue, Evansville, Indiana |

47711 |

| (Address of Principal Executive Offices) |

(Zip Code) |

(812) 467-1358

(Registrant’s Telephone Number, Including Area Code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

Trading Symbol |

Name of Exchange on which registered |

|

Common Stock, No Par Value

|

ESCA

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 – Financial Information

Item 2.02 Results of Operations and Financial Condition.

On October 26, 2023, Escalade, Incorporated ("Escalade") issued the press release attached hereto as Exhibit 99.1 announcing financial information regarding Escalade's third quarter and year to date results for 2023.

The information under this Item 2.02 shall not be deemed to be "filed" for the purposes of Section 18 of the Securities Exchange Act of 1934 (the "Exchange Act") or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into a filing under the Securities Act of 1933 or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Section 8 – Other Events

Item 8.01 Other Events.

On October 26, 2023, the Board of Directors of Escalade announced that a quarterly dividend of fifteen cents $0.15 per share would be paid to all shareholders of record on January 5, 2024 and disbursed on January 12, 2024.

Item 9.01 Financial Statements and Exhibits

| |

Exhibit

|

Description

|

| |

|

|

| |

99.1

|

|

| |

104

|

Cover Page Interactive Data File, formatted in Inline Extensible Business Reporting Language (iXBRL).

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, Escalade, Incorporated has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| Date: October 26, 2023 |

ESCALADE, INCORPORATED

By: /s/ STEPHEN R. WAWRIN

Stephen R. Wawrin, Vice President and Chief Financial Officer

|

EXHIBIT 99.1

Escalade Reports Third Quarter 2023 and Year to Date 2023 Results

EVANSVILLE, IN, October 26, 2023 – Escalade, Inc. (NASDAQ: ESCA, or the “Company”), a leading manufacturer and distributor of sporting goods and indoor/outdoor recreational equipment, today announced third quarter and year to date results for 2023.

THIRD QUARTER 2023

(As compared to the third quarter 2022)

|

●

|

Net sales decreased 2.1% to $73.4 million

|

|

●

|

Gross margin improved 652 basis points, to 24.7%

|

|

●

|

Operating income increased 52.7% to $6.4 million

|

|

●

|

EBITDA totaled $7.9 million, an increase of 35.7%

|

|

●

|

Net income of $4.3 million, or $0.31 per diluted share vs. $3.0 million, or $0.22 per diluted share for 2022

|

|

●

|

Cash provided by operations of $14.8 million vs. cash used of $5.5 million

|

THREE QUARTERS ENDED SEPTEMBER 30, 2023

(As compared to three quarters ended October 1, 2022)

|

●

|

Net sales decreased 18.0% to $198.1 million

|

|

●

|

Gross margin declined 70 basis points, to 23.1%

|

|

●

|

Operating income decreased 40.0% to $12.9 million

|

|

●

|

EBITDA totaled $17.1 million, a decrease of 35.9%

|

|

●

|

Net income of $7.0 million, or $0.50 per diluted share vs. $15.3 million, or $1.12 per diluted share for 2022

|

|

●

|

Cash provided by operations of $27.7 million vs. cash used of $5.7 million

|

For the third quarter ended September 30, 2023, Escalade reported net income of $4.3 million, or $0.31 per diluted share, versus net income of $3.0 million, or $0.22 per diluted share for the third quarter in 2022. Total net sales declined 2.1% on a year-over-year basis in the third quarter, primarily due to softer consumer demand across the majority of the Company’s product categories, partially offset by improved demand in our basketball and pickleball product categories and the impact of the change in the Company’s reporting calendar which resulted in eight more business days during the third quarter of 2023. Excluding the impact of the change in the Company’s reporting calendar, net sales declined 11.6%.

For the three quarters ended September 30, 2023, Escalade reported net income of $7.0 million, or $0.50 per diluted share, versus $15.3 million, or $1.12 per diluted share for the three quarters ended October 1, 2022. Total net sales declined 18.0% on a year-over-year basis in 2023 due to softer consumer demand and the impact of the change in the Company’s reporting calendar, which has resulted in seven fewer days in the first three quarters of 2023 compared to the first three quarters of 2022. Excluding the impact of the change in the Company’s reporting calendar, net sales declined 15.5%.

Escalade reported third quarter gross margin of 24.7%, an increase of 652 basis points versus the prior-year quarter, due to favorable product mix, lower costs associated with supply chain disruption and nonrecurring product recall expenses in the prior year quarter that did not recur in the third quarter of 2023.

The Company generated $14.8 million of cash flow from operations in the third quarter 2023, compared to cash use from operations of $5.5 million for the same quarter in 2022. Earnings before interest, taxes, depreciation, and amortization (“EBITDA”) increased 35.7% to $7.9 million in the third quarter 2023, versus $5.8 million in the prior-year period.

As of September 30, 2023, the Company had total cash and equivalents of $0.9 million, together with $47.5 million of availability on its senior secured revolving credit facility maturing in 2027. At the end of the third quarter 2023, net debt (total debt less cash) was 3.1x trailing twelve-month EBITDA.

Escalade’s Board of Directors has declared a quarterly dividend of $0.15 per share of common stock. The dividend is payable on January 12, 2024 to all shareholders of record at the close of business on January 5, 2024.

Effective January 1, 2023, Escalade transitioned to a conventional twelve-month reporting calendar. Please see the accompanying table in our footnotes for a comparison of the days in each quarter for 2022 and 2023.

MANAGEMENT COMMENTARY

“We delivered strong third quarter results highlighted by significant year-over-year-growth in gross margins, operating income and operating cash flow resulting in substantial debt reduction,” stated Walter P. Glazer, Jr., President and CEO of Escalade. “The wholesale inventory destocking cycle that began earlier this year progressed favorably for many of our categories. Order activity also improved within our mass merchant channel, which includes our big box and sporting goods retailers, during the third quarter driven by demand for our basketball and pickleball product categories. We’ve remained highly focused on reducing fixed overhead expenses, while continuing to reduce inventory levels, consistent with our focus on improved working capital efficiency,” stated Glazer.

“During a period of higher interest rates and persistent inflationary headwinds, consumer demand for many of our categories has so far remained resilient,” continued Glazer. “These economic headwinds will likely continue for some time and may further erode consumer confidence and have a greater impact on discretionary spending in our categories. We also believe our retail partners will continue to closely manage their inventory levels and be more promotional in this uncertain economic environment,” stated Glazer. “Our diverse portfolio of recreational brands has resonated with consumers in this current environment, particularly within our basketball and pickleball assortment,” continued Glazer. “The sales improvement we are seeing in these categories results from innovative product introductions, our strong brand support and our continued investment in our direct-to-consumer (DTC) sales platform, which has grown over 50% year-to-date. We continue to invest in both our DTC initiatives and new product development within our brand portfolio.”

“Third quarter gross margin improved substantially to the best levels since the second quarter of last year,” continued Glazer. “The improvement is the result of favorable product mix, expense reductions, and price discipline. We believe that this gross margin level is sustainable as we continue to identify opportunities for fixed cost reductions amid raw material and freight tailwinds. We also continue to focus on the divestiture of our underutilized facility in Mexico.”

“Debt reduction remains our top capital allocation priority at this time,” stated Glazer. “Strong free cash generation in the third quarter supported approximately $12 million in debt reduction, bringing net leverage down to 3.1x at the end of the quarter,” stated Glazer. “Looking ahead, we remain focused on closely managing our capital expenditures as well as further reducing outstanding borrowings and reinvesting in our market-leading portfolio of high-quality brands.”

CONFERENCE CALL

A conference call will be held Thursday, October 26, 2023, at 11:00 a.m. ET to review the Company’s financial results, discuss recent events and conduct a question-and-answer session.

A webcast of the conference call and accompanying presentation materials will be available in the Investor Relations section of Escalade’s website at www.escaladeinc.com. To listen to a live broadcast, go to the site at least 15 minutes prior to the scheduled start time in order to register, download, and install any necessary audio software.

To participate in the live teleconference:

| Domestic Live: |

1-877-300-8521 |

|

International Live:

|

1-412-317-6062 |

To listen to a replay of the teleconference, which subsequently will be available through November 9, 2023:

| Domestic Replay: |

1-844-512-2921 |

| International Replay: |

1-412-317-6671 |

| Conference ID: |

10183197 |

USE OF NON-GAAP FINANCIAL MEASURES

In addition to disclosing financial statements in accordance with U.S. generally accepted accounting principles (“GAAP”), this release contains the non-GAAP financial measure known as “EBITDA.” A reconciliation of this non-GAAP financial measure is contained at the end of this press release. EBITDA is a non-GAAP financial measure that Escalade uses to facilitate comparisons of operating performance across periods. Escalade believes the disclosure of EBITDA provides useful information to investors regarding its financial condition and results of operations. Non-GAAP measures should be viewed as a supplement to and not a substitute for the Company’s U.S. GAAP measures of performance and the financial results calculated in accordance with U.S. GAAP and reconciliations from these results should be carefully evaluated. Non-GAAP measures have limitations as an analytical tool and should not be considered in isolation or in lieu of an analysis of the Company’s results as reported under U.S. GAAP and should be evaluated only on a supplementary basis.

ABOUT ESCALADE

Founded in 1922, and headquartered in Evansville, Indiana, Escalade designs, manufactures, and sells sporting goods, fitness, and indoor/outdoor recreation equipment. Our mission is to connect family and friends creating lasting memories. Leaders in our respective categories, Escalade’s brands include Brunswick Billiards®; STIGA® table tennis; Accudart®; RAVE Sports® water recreation; Victory Tailgate® custom games; Onix® pickleball; Goalrilla™ basketball; Lifeline® fitness; Woodplay® playsets; and Bear® Archery. Escalade’s products are available online and at leading retailers nationwide. For more information about Escalade’s many brands, history, financials, and governance please visit www.escaladeinc.com.

INVESTOR RELATIONS CONTACT

Patrick Griffin

Vice President - Corporate Development & Investor Relations

812-467-1358

FORWARD-LOOKING STATEMENTS

This report contains forward-looking statements relating to present or future trends or factors that are subject to risks and uncertainties. These risks include, but are not limited to: specific and overall impacts of the COVID-19 global pandemic on Escalade’s financial condition and results of operations; the impact of competitive products and pricing; product demand and market acceptance; new product development; Escalade’s ability to achieve its business objectives; Escalade’s ability to successfully achieve the anticipated results of strategic transactions, including the integration of the operations of acquired assets and businesses and of divestitures or discontinuances of certain operations, assets, brands, and products; the continuation and development of key customer, supplier, licensing and other business relationships; Escalade’s ability to develop and implement our own direct to consumer e-commerce distribution channel; Escalade’s ability to successfully negotiate the shifting retail environment and changes in consumer buying habits; the financial health of our customers; disruptions or delays in our business operations, including without limitation disruptions or delays in our supply chain, arising from political unrest, war, labor strikes, natural disasters, public health crises such as the coronavirus pandemic, and other events and circumstances beyond our control; Escalade’s ability to control costs; Escalade’s ability to successfully implement actions to lessen the potential impacts of tariffs and other trade restrictions applicable to our products and raw materials, including impacts on the costs of producing our goods, importing products and materials into our markets for sale, and on the pricing of our products; general economic conditions, including inflationary pressures; fluctuation in operating results; changes in foreign currency exchange rates; changes in the securities markets; continued listing of the Company’s common stock on the NASDAQ Global Market; the Company’s inclusion or exclusion from certain market indices; Escalade’s ability to obtain financing and to maintain compliance with the terms of such financing; the availability, integration and effective operation of information systems and other technology, and the potential interruption of such systems or technology; the potential impact of actual or perceived defects in, or safety of, our products, including any impact of product recalls or legal or regulatory claims, proceedings or investigations involving our products; risks related to data security of privacy breaches; the potential impact of regulatory claims, proceedings or investigations involving our products; and other risks detailed from time to time in Escalade’s filings with the Securities and Exchange Commission. Escalade’s future financial performance could differ materially from the expectations of management contained herein. Escalade undertakes no obligation to release revisions to these forward-looking statements after the date of this report.

Escalade, Incorporated and Subsidiaries

Consolidated Statements of Operations

(Unaudited, In Thousands Except Per Share Data)

| |

|

Third Quarter Ended

|

|

|

Three Quarters Ended

|

|

|

All Amounts in Thousands Except Per Share Data

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

73,358 |

|

|

$ |

74,904 |

|

|

|

198,060 |

|

|

$ |

241,621 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Costs and Expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of products sold

|

|

|

55,222 |

|

|

|

61,273 |

|

|

|

152,225 |

|

|

|

184,147 |

|

|

Selling, administrative and general expenses

|

|

|

11,071 |

|

|

|

8,769 |

|

|

|

31,123 |

|

|

|

33,975 |

|

|

Amortization

|

|

|

620 |

|

|

|

642 |

|

|

|

1,860 |

|

|

|

2,067 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating Income

|

|

|

6,445 |

|

|

|

4,220 |

|

|

|

12,852 |

|

|

|

21,432 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Income (Expense)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

(1,325 |

) |

|

|

(954 |

) |

|

|

(4,280 |

) |

|

|

(2,462 |

) |

|

Other income (expense)

|

|

|

5 |

|

|

|

(22 |

) |

|

|

30 |

|

|

|

50 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income Before Income Taxes

|

|

|

5,125 |

|

|

|

3,244 |

|

|

|

8,602 |

|

|

|

19,020 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Provision for Income Taxes

|

|

|

850 |

|

|

|

286 |

|

|

|

1,637 |

|

|

|

3,735 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income

|

|

$ |

4,275 |

|

|

$ |

2,958 |

|

|

$ |

6,965 |

|

|

$ |

15,285 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings Per Share Data:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic earnings per share

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

|

$ |

0.51 |

|

|

$ |

1.13 |

|

|

Diluted earnings per share

|

|

$ |

0.31 |

|

|

$ |

0.22 |

|

|

$ |

0.50 |

|

|

$ |

1.12 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Dividends declared

|

|

$ |

0.15 |

|

|

$ |

0.15 |

|

|

$ |

0.45 |

|

|

$ |

0.45 |

|

Consolidated Balance Sheets

(Unaudited, In Thousands)

|

All Amounts in Thousands Except Share Information

|

|

September 30,

2023

|

|

|

December

31, 2022

|

|

|

October 1,

2022

|

|

| |

|

(Unaudited)

|

|

|

(Audited)

|

|

|

(Unaudited)

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

919 |

|

|

$ |

3,967 |

|

|

$ |

4,000 |

|

|

Receivables, less allowance of $367; $492; and $729; respectively

|

|

|

63,378 |

|

|

|

57,419 |

|

|

|

65,258 |

|

|

Inventories

|

|

|

105,267 |

|

|

|

121,870 |

|

|

|

134,957 |

|

|

Prepaid expenses

|

|

|

4,303 |

|

|

|

4,942 |

|

|

|

4,143 |

|

|

Prepaid income tax

|

|

|

2,080 |

|

|

|

-- |

|

|

|

1,075 |

|

|

TOTAL CURRENT ASSETS

|

|

|

175,947 |

|

|

|

188,198 |

|

|

|

209,433 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Property, plant and equipment, net

|

|

|

23,949 |

|

|

|

24,751 |

|

|

|

27,618 |

|

|

Assets held for sale

|

|

|

2,823 |

|

|

|

2,823 |

|

|

|

-- |

|

|

Operating lease right-of-use assets

|

|

|

8,645 |

|

|

|

9,100 |

|

|

|

9,074 |

|

|

Intangible assets, net

|

|

|

29,260 |

|

|

|

31,120 |

|

|

|

34,712 |

|

|

Goodwill

|

|

|

42,326 |

|

|

|

42,326 |

|

|

|

39,226 |

|

|

Other assets

|

|

|

423 |

|

|

|

400 |

|

|

|

261 |

|

|

TOTAL ASSETS

|

|

$ |

283,373 |

|

|

$ |

298,718 |

|

|

$ |

320,324 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Current portion of long-term debt

|

|

$ |

7,143 |

|

|

$ |

7,143 |

|

|

$ |

7,143 |

|

|

Trade accounts payable

|

|

|

24,050 |

|

|

|

9,414 |

|

|

|

22,684 |

|

|

Accrued liabilities

|

|

|

11,991 |

|

|

|

21,320 |

|

|

|

19,060 |

|

|

Income tax payable

|

|

|

-- |

|

|

|

71 |

|

|

|

-- |

|

|

Current operating lease liabilities

|

|

|

1,037 |

|

|

|

993 |

|

|

|

816 |

|

|

TOTAL CURRENT LIABILITIES

|

|

|

44,221 |

|

|

|

38,941 |

|

|

|

49,703 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Liabilities:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Long‑term debt

|

|

|

64,896 |

|

|

|

87,738 |

|

|

|

99,568 |

|

|

Deferred income tax liability

|

|

|

4,516 |

|

|

|

4,516 |

|

|

|

4,759 |

|

|

Operating lease liabilities

|

|

|

8,163 |

|

|

|

8,641 |

|

|

|

8,557 |

|

|

Other liabilities

|

|

|

407 |

|

|

|

407 |

|

|

|

448 |

|

|

TOTAL LIABILITIES

|

|

|

122,203 |

|

|

|

140,243 |

|

|

|

163,035 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Stockholders' Equity:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized 1,000,000 shares; no par value, none issued

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Common stock:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Authorized 30,000,000 shares; no par value, issued and outstanding – 13,736,800; 13,594,407; and 13,590,407; shares respectively

|

|

|

13,737 |

|

|

|

13,594 |

|

|

|

13,590 |

|

|

Retained earnings

|

|

|

147,433 |

|

|

|

144,881 |

|

|

|

143,699 |

|

|

TOTAL STOCKHOLDERS' EQUITY

|

|

|

161,170 |

|

|

|

158,475 |

|

|

|

157,289 |

|

|

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY

|

|

$ |

283,373 |

|

|

$ |

298,718 |

|

|

$ |

320,324 |

|

Reconciliation of GAAP Net Income to Non-GAAP EBITDA

(Unaudited, In Thousands)

| |

|

Third Quarter Ended

|

|

|

Three Quarters Ended

|

|

|

All Amounts in Thousands

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

|

September

30, 2023

|

|

|

October

1, 2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Income (GAAP)

|

|

$ |

4,275 |

|

|

$ |

2,958 |

|

|

$ |

6,965 |

|

|

$ |

15,285 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense

|

|

|

1,325 |

|

|

|

954 |

|

|

|

4,280 |

|

|

|

2,462 |

|

|

Income tax expense

|

|

|

850 |

|

|

|

286 |

|

|

|

1,637 |

|

|

|

3,735 |

|

|

Depreciation and amortization

|

|

|

1,423 |

|

|

|

1,604 |

|

|

|

4,221 |

|

|

|

5,207 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EBITDA (Non-GAAP)

|

|

$ |

7,873 |

|

|

$ |

5,802 |

|

|

$ |

17,103 |

|

|

$ |

26,689 |

|

Comparison of Fiscal Calendar Days for 2023 and 2022 Quarters

| |

|

2023 Days

|

|

|

2022 Days

|

|

| |

|

|

|

|

|

|

|

|

|

First Fiscal Quarter

|

|

|

90 |

|

|

|

84 |

|

|

Second Fiscal Quarter

|

|

|

91 |

|

|

|

112 |

|

|

Third Fiscal Quarter

|

|

|

92 |

|

|

|

84 |

|

|

Fourth Fiscal Quarter

|

|

|

92 |

|

|

|

91 |

|

|

Total Days

|

|

|

365 |

|

|

|

371 |

|

v3.23.3

Document And Entity Information

|

Oct. 26, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

ESCALADE, INCORPORATED

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 26, 2023

|

| Entity, Incorporation, State or Country Code |

IN

|

| Entity, File Number |

0-6966

|

| Entity, Tax Identification Number |

13-2739290

|

| Entity, Address, Address Line One |

817 Maxwell Avenue

|

| Entity, Address, City or Town |

Evansville

|

| Entity, Address, State or Province |

IN

|

| Entity, Address, Postal Zip Code |

47711

|

| City Area Code |

812

|

| Local Phone Number |

467-1358

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

ESCA

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000033488

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

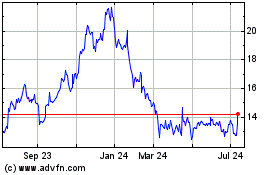

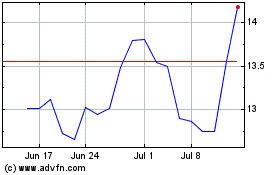

Escalade (NASDAQ:ESCA)

Historical Stock Chart

From Mar 2024 to Apr 2024

Escalade (NASDAQ:ESCA)

Historical Stock Chart

From Apr 2023 to Apr 2024