false000109355700010935572024-02-132024-02-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): February 13, 2024

DEXCOM, INC.

(Exact Name of the Registrant as Specified in Its Charter)

| | | | | | | | |

| Delaware | 000-51222 | 33-0857544 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

| | | | | | | | |

6340 Sequence Drive, San Diego, CA | | 92121 |

(Address of Principal Executive Offices) | | (Zip Code) |

(858) 200-0200

(Registrant’s Telephone Number, Including Area Code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol(s) | | Name of Each Exchange on Which Registered |

| Common Stock, $0.001 Par Value Per Share | | DXCM | | Nasdaq Global Select Market |

| | | | | | | | | | | | | | |

| Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). | |

| | Emerging growth company | ☐ |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐ |

| | | | | |

Item 1.01. | Entry into a Material Definitive Agreement. |

On February 13, 2024, DexCom, Inc. (the “Company”) entered into a warrant termination agreement (the “Termination Agreement”) with Bank of America, N.A., (“BofA”), to terminate outstanding warrants to purchase shares of the Company’s common stock (the “Common Stock”) that were issued to BofA pursuant to confirmation agreements between the Company and BofA, dated as of November 27, 2018, and November 29, 2018 (the “BofA Warrant Transactions”).

The BofA Warrant Transactions were entered into in connection with: (i) the Company's issuance of 0.75% Convertible Senior Notes due 2023 that matured on December 1, 2023; (ii) the Company entering into convertible note hedge transactions with respect to its Common Stock with each of BofA and JPMorgan Chase Bank, National Association (“JPM”) that expired on December 1, 2023; and (iii) the Company entering into warrant transactions with JPM (the “JPM Warrant Transactions”) on substantially the same terms as the BofA Warrant Transactions (the BofA Warrant Transactions and the JPM Warrant Transactions collectively being the “Warrant Transactions”). Pursuant to the terms of the Warrant Transactions, the Company agreed to sell to BofA and JPM warrants (the “Warrants”) to acquire, subject to anti-dilution adjustments, up to approximately 20.7 million shares of Common Stock (as adjusted to reflect the four-for-one stock split effected in June 2022). Pursuant to the terms of the Warrant Transactions, the Warrants are scheduled to expire no later than the second quarter of 2024.

Pursuant to the terms of the Termination Agreement, the BofA Warrant Transactions with respect to an aggregate of 10.3 million shares of Common Stock will be terminated. In consideration of the termination of these warrants, the Company will deliver shares of Common Stock to BofA, the number of which will be determined based on the daily volume-weighted average price of the Common Stock during an averaging period consisting of a number of trading days determined in accordance with the Termination Agreement. The averaging period contemplated by the Termination Agreement is expected to be completed in the first quarter of 2024. The shares of Common Stock issuable under the Termination Agreement are being issued in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act of 1933, as amended.

The foregoing description of the Termination Agreement with BofA is qualified in its entirety by reference to the full text of the Termination Agreement, attached as Exhibit 10.1 to this Current Report on Form 8-K, and is incorporated herein by reference.

| | | | | |

Item 1.02. | Termination of a Material Definitive Agreement. |

The information required by Item 1.02 is contained in Item 1.01 of this Form 8-K and is incorporated herein by reference.

| | | | | |

Item 3.02. | Unregistered Sales of Equity Securities. |

The information required by Item 3.02 is contained in Item 1.01 of this Form 8-K and is incorporated herein by reference.

| | | | | |

Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | | | | |

| | |

Number | | Description |

| |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | | | | |

* | Portions of this exhibit have been omitted pursuant to Item 601(b)(10)(iv) of Regulation S-K. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| | |

| DEXCOM, INC. |

| |

| By: | | /s/ JEREME M. SYLVAIN Jereme M. Sylvain Executive Vice President and Chief Financial Officer (Principal Financial and Accounting Officer) |

| | |

Date: | | February 15, 2024 |

Exhibit 10.1

CERTAIN CONFIDENTIAL INFORMATION CONTAINED IN THIS DOCUMENT, MARKED BY [***], HAS BEEN OMITTED BECAUSE IT IS NOT MATERIAL AND IS THE TYPE THAT THE REGISTRANT TREATS AS PRIVATE AND CONFIDENTIAL.

WARRANT TERMINATION AGREEMENT

dated as of February 13, 2024

DexCom, Inc. and Bank of America, N.A.

THIS WARRANT TERMINATION AGREEMENT (this “Agreement”) with respect to the Warrants Confirmations (as defined below) is made effective February 13, 2024, between DexCom, Inc. (“Company”) and Bank of America, N.A. (“Dealer”).

WHEREAS, Dealer and Company entered into a Base Warrants Transaction (the “Base Warrants Transaction”) pursuant to a confirmation dated effective November 27, 2018, which supplements, forms a part of, and is subject to an agreement in the form of the ISDA 2002 Master Agreement, pursuant to which Dealer purchased from Company 2,282,588 warrants (as amended, modified, terminated or unwound from time to time, the “Base Warrants Confirmation”);

WHEREAS, Dealer and Company entered into an Additional Warrants Transaction (the “Additional Warrants Transaction” and, together with the Base Warrants Transaction, the “Warrants Transactions”) pursuant to a confirmation dated effective November 29, 2018, which supplements, forms a part of, and is subject to an agreement in the form of the 2002 ISDA Master Agreement, pursuant to which Dealer purchased from Company 304,345 warrants (as amended, modified, terminated or unwound from time to time, the “Additional Warrants Confirmation” and, together with the Base Warrants Confirmation, the “Warrants Confirmations”); and

WHEREAS, the Company has requested full termination of the Warrants Transactions;

NOW, THEREFORE, in consideration of their mutual covenants herein contained, the parties hereto, intending to be legally bound, hereby mutually covenant and agree as follows:

1.Defined Terms. Any capitalized term not otherwise defined herein shall have the meaning set forth for such term in the Warrants Confirmations. In the event of any inconsistency between the definitions set forth in the Warrant Confirmations and this Agreement, this Agreement shall govern.

2.Termination. Notwithstanding anything to the contrary in the Warrants Confirmations, Company and Dealer agree that, effective on the date hereof, the Warrants Transactions shall terminate and all of the respective rights and obligations of the parties under the Warrants Confirmations shall be terminated, cancelled and extinguished, and in connection therewith Company shall be required to deliver to Dealer the Share Settlement Amount on the Settlement Date pursuant to Section 3 below.

3.Deliveries. On the second Scheduled Trading Day following the final Averaging Date (as defined below) or, if such day is not a Clearance System Business Day, on the next Clearance System Business Day immediately following such day (the “Settlement Date”), Company shall deliver to Dealer through the facilities of DTC in book-entry form a number of Shares in an amount equal to the Share Settlement Amount. The “Share Settlement Amount” shall mean a number of Shares determined by Dealer as Calculation Agent according to the table set forth in Schedule A attached hereto (using linear interpolation or commercially reasonable extrapolation by Dealer as Calculation Agent, as applicable, to determine the Share Settlement Amount for any Average VWAP not specifically appearing in Schedule A).

4.Valuation. “Averaging Date” means the First Averaging Date and each of the 11 Exchange Business Days thereafter; provided that if any such date is a Disrupted Day in whole, such date shall not constitute an Averaging Date. “First Averaging Date” means February 13, 2024. “Average VWAP” means the arithmetic average of the VWAP Prices for all Averaging Dates. “VWAP Price” for any Averaging Date means the Rule 10b-18 volume-weighted average price per Share for such day based on transactions executed during such day, as reported on Bloomberg page DXCM <equity> AQR SEC (or any successor thereto) or, in the event such price is not so reported on such day for any reason or is manifestly incorrect, as reasonably determined by Dealer as Calculation Agent using a volume weighted method. Notwithstanding the foregoing, if (i) any Averaging Date is a Disrupted Day in part or (ii) Dealer concludes in its reasonable judgment discretion based on advice of counsel, that it is appropriate with respect to any legal, regulatory or self-regulatory requirements, or with related policies and procedures (whether or not such requirements, policies, or procedures are imposed by the law or have been voluntarily adopted by Dealer, but so long as such policies or procedures are applied to the transactions contemplated by this Agreement by Dealer in a non-discriminatory manner), for it to refrain from or decrease any market activity on any Averaging Date. Dealer may by written notice to the Company elect to deem that a Market Disruption Event has occurred and will be continuing on such Averaging Date, and the VWAP Price for such Averaging Date(s) shall be the Rule 10b-18 volume-weighted average

price per Share on such Averaging Date(s), as determined by Dealer as Calculation Agent based on such sources as it deems appropriate using a volume-weighted methodology, for the portion of such Averaging Date(s) for which Dealer determines there is no Market Disruption Event with respect to the Shares (if any) and the Average VWAP and the Share Settlement Amount shall be adjusted by Dealer as Calculation Agent in its good faith, commercially reasonable discretion to account for such disruption and/or extension.

5.Representations and Warranties of Company. Company represents and warrants to Dealer (and agrees with Dealer in the case of Sections 5(g), 5(h), 5(i) and 5(j)) on the date hereof that:

(a)it has the power to execute this Agreement and any other documentation relating to this Agreement to which it is a party, to deliver this Agreement and to perform its obligations under this Agreement and has taken all necessary action to authorize such execution, delivery and performance;

(b)such execution, delivery and performance do not violate or conflict with any law applicable to it, any provision of its constitutional documents, any order or judgment of any court or other agency of government applicable to it or any of its assets or any material contractual restriction binding on or affecting it or any of its assets;

(c)all governmental and other consents that are required to have been obtained by it with respect to this Agreement have been obtained and are in full force and effect and all conditions of any such consents have been complied with;

(d)its obligations under this Agreement constitute its legal, valid and binding obligations, enforceable in accordance with their respective terms (subject to applicable bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability, to equitable principles of general application (regardless of whether enforcement is sought in a proceeding in equity or at law));

(e)it is not in possession of any material nonpublic information regarding Company or the Shares;

(f)it is not entering into this Agreement to create actual or apparent trading activity in the Shares (or any security convertible into or exchangeable for the Shares) or to manipulate the price of the Shares (or any security convertible into or exchangeable for the Shares) or otherwise in violation of the Securities Exchange Act of 1934, as amended (the “Exchange Act”);

(g)neither Company nor any of its affiliates or agents shall take any action that would cause Regulation M under the Exchange Act (“Regulation M”) to be applicable to any purchases of Shares, or any security for which the Shares are a reference security (as defined in Regulation M), by Company or any of its affiliated purchasers (as defined in Regulation M) on any Averaging Date;

(h)There have been no Shares purchased in Rule 10b-18 purchases of blocks pursuant to the once-a-week block exception contained in Rule 10b-18(b)(4) by or for Company or any of its affiliated purchasers during each of the four calendar weeks preceding the first Averaging Date and during the calendar week in which the first Averaging Date occurs (“Rule 10b-18 purchase”, “blocks” and “affiliated purchaser” each being used as defined in Rule 10b-18);

(i)Company shall (i) notify Dealer prior to the opening of trading in the Shares on any Averaging Date on which Company makes, or expects to be made, any public announcement (as defined in Rule 165(f) under the Securities Act of 1933, as amended (the “Securities Act”) of any merger, acquisition, or similar transaction involving a recapitalization relating to Company (other than any such transaction in which the consideration consists solely of cash and there is no valuation period), (ii) promptly notify Dealer following any such announcement that such announcement has been made, and (iii) promptly deliver to Dealer following the making of any such announcement a certificate indicating (A) Company’s average daily Rule 10b-18 purchases (as defined in Rule 10b-18) during the three full calendar months preceding the date of the announcement of such transaction and (B) Company’s block purchases (as defined in Rule 10b-18) effected pursuant to paragraph (b)(4) of Rule 10b-18 during the three full calendar months preceding the date of the announcement of such transaction, and Company shall promptly notify Dealer of the earlier to occur of the completion of such transaction and the completion of the vote by target shareholders; Company acknowledges that any such public announcement may result in a Regulatory Disruption; accordingly, Company acknowledges that its actions in relation to any such announcement or transaction must comply with the standards set forth in Section 10;

(j)without the prior written consent of Dealer, Company shall not, and shall cause its affiliated purchasers (as defined in Rule 10b-18) not to, directly or indirectly (including, without limitation, by means of a cash-settled or other derivative instrument) purchase, offer to purchase, place any bid or limit order that would effect a purchase of, or commence any tender offer relating to, any Shares (or an equivalent interest, including a unit of beneficial interest in a trust or limited partnership or a depository share) or any security convertible into or exchangeable for Shares during the Relevant Period (as defined below), and no warrant termination agreement

substantially similar to this Agreement entered into by Company with any other counterparty shall have averaging dates (however defined) that overlap with the Relevant Period; and

6.Representations and Warranties of Dealer. Dealer represents and warrants to Company on the date hereof that:

(a)it has the power to execute this Agreement and any other documentation relating to this Agreement to which it is a party, to deliver this Agreement and to perform its obligations under this Agreement and has taken all necessary action to authorize such execution, delivery and performance;

(b)such execution, delivery and performance do not violate or conflict with any law applicable to it, any provision of its constitutional documents, any order or judgment of any court or other agency of government applicable to it or any of its assets or any material contractual restriction binding on or affecting it or any of its assets;

(c)all governmental and other consents that are required to have been obtained by it with respect to this Agreement have been obtained and are in full force and effect and all conditions of any such consents have been complied with; and

(d)its obligations under this Agreement constitute its legal, valid and binding obligations, enforceable in accordance with their respective terms (subject to applicable bankruptcy, reorganization, insolvency, moratorium or similar laws affecting creditors’ rights generally and subject, as to enforceability, to equitable principles of general application (regardless of whether enforcement is sought in a proceeding in equity or at law)).

7.Governing Law. This Agreement and any dispute arising hereunder shall be governed by and construed in accordance with the laws of the State of New York (without reference to choice of law doctrine).

8.Counterparts. This Agreement may be signed in any number of counterparts, each of which shall be an original, with the same effect as if all of the signatures thereto and hereto were upon the same instrument.

9.No Reliance, etc. Company confirms that it has relied on the advice of its own counsel and other advisors (to the extent it deems appropriate) with respect to any legal, tax, accounting, or regulatory consequences of this Agreement, that it has not relied on Dealer or its affiliates in any respect in connection therewith, and that it will not hold Dealer or its affiliates accountable for any such consequences.

10.Additional Acknowledgements and Agreements. Company acknowledges and agrees that Dealer may, during the period from the First Averaging Date to the final Averaging Date (the “Relevant Period”), purchase Shares in connection with this Agreement. Such purchases will be conducted independently of Company. The timing of such purchases by Dealer, the number of Shares purchased by Dealer on any day, the price paid per Share pursuant to such purchases and the manner in which such purchases are made, including without limitation whether such purchases are made on any securities exchange or privately, shall be within the absolute discretion of Dealer. It is the intent of the parties that this Agreement comply with the requirements of Rule 10b5-1(c)(1)(i)(B) of the Exchange Act, and the parties agree that this Agreement shall be interpreted to comply with the requirements of Rule 10b5-1(c), and Company shall not take any action that results in this Agreement not so complying with such requirements. Without limiting the generality of the preceding sentence, Company acknowledges and agrees that (A) Company does not have, and shall not attempt to exercise, any influence over how, when or whether Dealer effects any purchases of Shares in connection with this Agreement, (B) during the period beginning on (but excluding) the date hereof and ending on (and including) the last day of the Relevant Period, neither Company nor its officers or employees shall, directly or indirectly, communicate any information regarding Company or the Shares to any employee of Dealer or its Affiliates responsible for trading the Shares in connection with the transactions contemplated hereby, (C) Company is entering into this Agreement in good faith and not as part of a plan or scheme to evade compliance with federal securities laws including, without limitation, Rule 10b-5 promulgated under the Exchange Act and (D) Company will not alter or deviate from this Agreement or enter into or alter a corresponding hedging transaction with respect to the Shares. Company also acknowledges and agrees that any amendment, modification, waiver or termination of this Agreement must be effected in accordance with the requirements for the amendment or termination of a “plan” as defined in Rule 10b5-1(c) under the Exchange Act. Without limiting the generality of the foregoing, any such amendment, modification, waiver or termination shall be made in good faith and not as part of a plan or scheme to evade the prohibitions of Rule 10b-5 under the Exchange Act, and no such amendment, modification or waiver shall be made at any time at which Company or any officer or director of Company is aware of any material nonpublic information regarding Company or the Shares.

11.Agreements and Acknowledgements Regarding Hedging. Company acknowledges and agrees that:

(a)during the Relevant Period, Dealer and its Affiliates may buy or sell Shares or other securities or buy or sell options or futures contracts or enter into swaps or other derivative securities in order to adjust its hedge position with respect to the Warrant Confirmations and this Agreement;

(b)Dealer and its Affiliates also may be active in the market for Shares other than in connection with hedging activities in relation to the Warrant Confirmations and this Agreement;

(c)Dealer shall make its own determination as to whether, when or in what manner any hedging or market activities in Company’s securities shall be conducted and shall do so in a manner that it deems appropriate to hedge its price and market risk with respect to the Average VWAP and/or the VWAP Price; and

(d)any market activities of Dealer and its Affiliates with respect to Shares may affect the market price and volatility of Shares, as well as the Average VWAP and/or the VWAP Price, each in a manner that may be adverse to Company.

[Signature Page Follows]

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be duly executed as of the date first written above.

| | | | | | | | | | | | | | |

| Bank of America, N.A. | |

By: | /s/ Eric Coghlin | |

| Name: Eric Coghlin Title: Managing Director | | |

| | | | |

DexCom, Inc. | |

By: | /s/ Leslie Ludtke | |

| Name: Leslie Ludtke Title: Treasurer | | |

[Signature Page to Settlement Agreement]

Schedule A

[***]

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

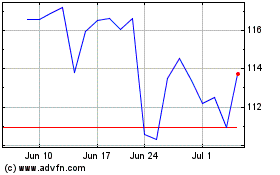

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Mar 2024 to Apr 2024

DexCom (NASDAQ:DXCM)

Historical Stock Chart

From Apr 2023 to Apr 2024