UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. )*

(Name of Issuer)

|

|

|

Common Stock, par value $0.01 per share

|

(Title of Class of Securities)

(CUSIP

Number)

|

|

|

Mill Road Capital, L.P.

Attn: Thomas E. Lynch

382 Greenwich Avenue

Suite One

Greenwich, CT 06830

203-987-3500

With a copy to:

Peter M. Rosenblum, Esq.

Foley Hoag LLP

155 Seaport Blvd.

Boston, MA 02210

617-832-1151

|

(Name, Address and Telephone Number of Person Authorized to Receive Notices and Communications)

(Date of Event which Requires Filing of this Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of

§§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box.

¨

Note:

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7

for other parties to whom copies are sent.

|

*

|

|

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for

any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

|

The information

required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

|

|

|

|

|

|

|

|

CUSIP No. 228309100

|

|

1.

|

|

Names of Reporting

Persons.

Thomas E. Lynch

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

USA

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

|

|

|

8.

|

|

Shared Voting Power

605,267

|

|

|

9.

|

|

Sole Dispositive Power

|

|

|

10.

|

|

Shared Dispositive Power

605,267

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

605,267

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

6.3%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

HC; IN

|

|

|

|

|

|

|

|

|

|

CUSIP No. 228309100

|

|

1.

|

|

Names of Reporting

Persons.

Scott P. Scharfman

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

USA

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

|

|

|

8.

|

|

Shared Voting Power

605,267

|

|

|

9.

|

|

Sole Dispositive Power

|

|

|

10.

|

|

Shared Dispositive Power

605,267

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

605,267

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

6.3%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

HC; IN

|

|

|

|

|

|

|

|

|

|

CUSIP No. 228309100

|

|

1.

|

|

Names of Reporting

Persons

Mill Road Capital GP LLC

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

OO

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Delaware

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

605,267

|

|

|

8.

|

|

Shared Voting Power

|

|

|

9.

|

|

Sole Dispositive Power

605,267

|

|

|

10.

|

|

Shared Dispositive Power

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

605,267

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

6.3%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

HC; OO

|

|

|

|

|

|

|

|

|

|

CUSIP No. 228309100

|

|

1.

|

|

Names of Reporting

Persons.

Mill Road Capital, L.P.

|

|

2.

|

|

Check the Appropriate Box if a

Member of a Group (See Instructions)

(a)

¨

(b)

¨

|

|

3.

|

|

SEC Use Only

|

|

4.

|

|

Source of Funds (See

Instructions)

WC

|

|

5.

|

|

Check if Disclosure of Legal

Proceedings Is Required Pursuant to Items 2(d) or 2(e)

¨

|

|

6.

|

|

Citizenship or Place of

Organization

Delaware

|

|

Number of

Shares

Beneficially

Owned by

Each

Reporting

Person

With

|

|

7.

|

|

Sole Voting Power

605,267

|

|

|

8.

|

|

Shared Voting Power

|

|

|

9.

|

|

Sole Dispositive Power

605,267

|

|

|

10.

|

|

Shared Dispositive Power

|

|

11.

|

|

Aggregate Amount Beneficially

Owned by Each Reporting Person

605,267

|

|

12.

|

|

Check if the Aggregate Amount in

Row (11) Excludes Certain Shares (See Instructions)

¨

|

|

13.

|

|

Percent of Class Represented by

Amount in Row (11)

6.3%

|

|

14.

|

|

Type of Reporting Person (See

Instructions)

PN

|

|

|

|

|

|

CUSIP No. 228309100

|

|

Page

6

of 10 Pages

|

|

Item 1.

|

Security and Issuer

|

This joint statement

on Schedule 13D relates to the Common Stock, par value $0.01 per share (the “

Common Stock

”), of Crown Crafts, Inc., a Delaware corporation (the “

Issuer

”). The address of the Issuer’s principal executive offices

is 916 South Burnside Avenue, Gonzales, Louisiana 70737.

|

Item 2.

|

Identity and Background

|

(a) This joint statement on Schedule 13D is being filed by Thomas E. Lynch, Scott P. Scharfman, Mill Road Capital GP LLC, a Delaware

limited liability company (the “

GP

”), and Mill Road Capital, L.P., a Delaware limited partnership (the “

Fund

”). Each of the foregoing is referred to in this Schedule 13D as a “

Reporting Person

” and,

collectively, as the “

Reporting Persons

.” Messrs. Lynch and Scharfman, Charles M. B. Goldman and Justin C. Jacobs are the management committee directors of the GP and, in this capacity, are referred to in this Schedule 13D as the

“

Managers

.” The GP is the sole general partner of the Fund. Each of Messrs. Lynch and Scharfman has shared authority to vote and dispose of the shares of Common Stock reported in this Schedule 13D.

The Reporting Persons have entered into a Joint Filing Agreement dated January 31, 2011, a copy of which is filed as

Exhibit 1

to this

Schedule 13D, pursuant to which they have agreed to file this Schedule 13D jointly in accordance with Rule 13d-1(k) under the Exchange Act.

(b) The business address of each of the Managers, and the address of the principal business and the principal office of the GP and the Fund, is 382 Greenwich Avenue, Suite One, Greenwich, CT 06830.

(c) The principal business of the GP is acting as the sole general partner of the Fund. The principal business of the Fund is

investing in securities. The present principal occupation or employment of each Manager is as a management committee director of the GP and of Mill Road Capital Management LLC, a Delaware limited liability company (the “

Management

Company

”), which provides advisory and administrative services to the GP and is located at 382 Greenwich Avenue, Suite One, Greenwich, CT 06830.

(d) None of the Managers, the GP and the Fund has, during the last five years, been convicted in a criminal proceeding (excluding traffic violations or similar misdemeanors).

(e) None of the Managers, the GP and the Fund was, during the last five years, a party to a civil proceeding of a judicial or

administrative body of competent jurisdiction and, as a result of such proceeding, was or is subject to a judgment, decree or final order (1) enjoining future violations of, or prohibiting or mandating activities subject to, federal or state

securities laws, or (2) finding any violation with respect to such laws.

(f) Each Manager is a citizen of the United

States.

|

|

|

|

|

CUSIP No. 228309100

|

|

Page

7

of 10 Pages

|

|

Item 3.

|

Source and Amount of Funds or Other Consideration

|

The Reporting Persons acquired beneficial ownership of an aggregate of 605,267 shares of Common Stock for $2,253,436.91 using working capital from the Fund and the proceeds of margin loans under margin

loan facilities maintained in the ordinary course of business by the Fund with a broker on customary terms and conditions.

|

Item 4.

|

Purpose of Transaction

|

The Reporting

Persons acquired shares of the Common Stock based on their belief that the Common Stock represents an attractive investment opportunity, and such purchases have been made in the Reporting Persons’ ordinary course of business.

The Reporting Persons intend to review continuously their equity interest in the Issuer. Depending upon their evaluation of the factors described below,

one or more of the Reporting Persons may from time to time purchase additional securities of the Issuer, dispose of all or a portion of the securities then held by such Reporting Persons, or cease buying or selling such securities; any such

additional purchases or sales of securities of the Issuer may be in the open market, in privately negotiated transactions or otherwise.

The

Reporting Persons may wish to engage in a constructive dialogue with officers, directors and other representatives of the Issuer, as well as the Issuer’s shareholders; topics of discussion may include, but are not limited to, the Issuer’s

markets, operations, competitors, prospects, strategy, personnel, directors, ownership and capitalization. The Reporting Persons may also enter into confidentiality or similar agreements with the Issuer and, subject to such an agreement or

otherwise, exchange information with the Issuer. The factors that the Reporting Persons may consider in evaluating their equity interest in the Issuer’s business include the following: (i) the Issuer’s business and prospects;

(ii) the performance of the Common Stock and the availability of the Common Stock for purchase at particular price levels; (iii) the availability and nature of opportunities to dispose of the Reporting Persons’ interests;

(iv) general economic conditions; (v) stock market conditions; (vi) other business and investment opportunities available to the Reporting Persons; and (vii) other plans and requirements of the Reporting Persons.

Depending on their assessment of the foregoing factors, the Reporting Persons may, from time to time, modify their present intention as stated in this

Item 4.

Except as set forth above, the Reporting Persons intend to continuously review their options but do not have at this time any

specific plans that would result in (a) the acquisition of additional securities of the Issuer or the disposition of securities of the Issuer; (b) any extraordinary corporate transactions such as a merger, reorganization or liquidation

involving the Issuer or any of its subsidiaries; (c) any sale or transfer of a material amount of the assets of the Issuer or of any of its subsidiaries; (d) any change in the present management or Board of Directors of the Issuer,

including any plans or proposals to change the number or term of directors or to fill any existing vacancies on the Issuer’s Board of Directors; (e) any material change in the present capitalization or dividend policy of the Issuer;

(f) any other material change in the Issuer’s business or corporate structure; (g) any change in the Issuer’s charter or by-laws that may impede the acquisition of control of the Issuer by any person; (h) the Issuer’s

Common Stock

|

|

|

|

|

CUSIP No. 228309100

|

|

Page

8

of 10 Pages

|

being delisted from a national securities exchange or ceasing to be authorized to be quoted in an inter-dealer quotation system or a registered national securities association; (i) causing a

class of equity securities of the Issuer to become eligible for termination of registration pursuant to Section 12(g)(4) of the Securities Exchange Act of 1934, as amended; or (j) any action similar to those enumerated above.

|

Item 5.

|

Interest in Securities of the Issuer

|

(a, b) The percentages of beneficial ownership reported in this Item 5, and on each Reporting Person’s cover page to this Schedule 13D, are based on a total of 9,554,424 shares of the Common

Stock issued and outstanding as of October 28, 2010, as reported in the most recent quarterly report of the Issuer on Form 10-Q for the fiscal quarter ended September 26, 2010. All of the share numbers reported below, and on each Reporting

Person’s cover page to this Schedule 13D, are as of January 31, 2011, unless otherwise indicated. The cover page to this Schedule 13D for each Reporting Person is incorporated by reference in its entirety into this Item 5(a, b).

The Fund directly holds, and thus has sole voting and dispositive power over, 605,267 shares of Common Stock. The GP, as sole

general partner of the Fund, also has sole voting and dispositive power over these shares, and each of Messrs. Lynch and Scharfman has the shared authority to vote and dispose of these shares on behalf of the Fund. Accordingly, each of the Reporting

Persons beneficially owns 605,267 shares of Common Stock, or approximately 6.3% of the outstanding shares of Common Stock, and the Reporting Persons beneficially own, in the aggregate, 605,267 shares of Common Stock, or approximately 6.3% of the

outstanding shares of Common Stock.

(c) No Reporting Person, other than the Fund as set forth in the table below, effected

any transaction in shares of the Common Stock from December 2, 2010 (the date 60 days prior to the filing of this Schedule 13) to January 31, 2011:

|

|

|

|

|

|

|

|

|

|

|

Date of

Purchase /

Sale

|

|

Shares

Purchased /

(Sold) (#)

|

|

|

Avg.

Purchase /

Sale Price

per Share

($)

|

|

|

1/7/2011

|

|

|

4,905

|

|

|

$

|

4.3999

|

|

|

1/10/2011

|

|

|

10,000

|

|

|

$

|

4.4193

|

|

|

1/11/2011

|

|

|

5,000

|

|

|

$

|

4.6000

|

|

|

1/20/2011

|

|

|

4,500

|

|

|

$

|

4.7687

|

|

|

1/21/2011

|

|

|

6,000

|

|

|

$

|

4.8439

|

|

|

1/24/2011

|

|

|

66,100

|

|

|

$

|

4.9499

|

|

|

1/25/2011

|

|

|

31,800

|

|

|

$

|

4.9500

|

|

|

1/26/2011

|

|

|

1,460

|

|

|

$

|

4.9848

|

|

|

1/27/2011

|

|

|

16,300

|

|

|

$

|

4.9484

|

|

|

1/28/2011

|

|

|

1,000

|

|

|

$

|

4.8395

|

|

|

1/31/2011

|

|

|

1,100

|

|

|

$

|

4.7682

|

|

|

|

|

|

|

CUSIP No. 228309100

|

|

Page

9

of 10 Pages

|

Each of the above listed transactions was conducted in the ordinary course of business on the open market for cash. Purchases have been aggregated daily, and purchase prices do not reflect brokerage

commissions paid.

(d) No person other than the Reporting Persons is known to have the right to receive or the power to direct the receipt of

dividends from or the proceeds from the sale of shares of the Common Stock.

(e) Not applicable.

|

Item 6.

|

Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer

|

Except as otherwise described in this Schedule 13D, including the Exhibits attached hereto, there are no contracts, arrangements, understandings, or

relationships (legal or otherwise) among the Reporting Persons, or between any Reporting Person(s) and any third party, with respect to any securities of the Issuer, including, but not limited to, those involving the transfer or voting any of the

securities, finder’s fees, joint ventures, loan or option arrangements, put or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

|

Item 7.

|

Material to be Filed as Exhibits

|

Exhibit 1

Joint Filing Agreement by and among Thomas E. Lynch, Scott P. Scharfman, Mill Road Capital

GP LLC and Mill Road Capital, L.P. dated as of January 31, 2011.

Exhibit

2

Confirming Statement of Thomas E. Lynch dated January 31, 2011.

Exhibit

3

Confirming Statement of Scott P. Scharfman dated January 31, 2011.

[signature pages follow]

|

|

|

|

|

CUSIP No. 228309100

|

|

Page

10

of 10 Pages

|

Signature

After reasonable inquiry and to the best of my knowledge and

belief, I certify that the information set forth in this statement is true, complete and correct.

|

|

|

|

|

MILL ROAD CAPITAL, L.P.

|

|

|

|

|

By:

|

|

Mill Road Capital GP LLC,

|

|

|

|

its General Partner

|

|

|

|

|

By:

|

|

/s/ Thomas E. Lynch

|

|

|

|

Thomas E. Lynch

|

|

|

|

Management Committee Director and Chairman

|

|

|

|

MILL ROAD CAPITAL GP LLC

|

|

|

|

|

By:

|

|

/s/ Thomas E. Lynch

|

|

|

|

Thomas E. Lynch

|

|

|

|

Management Committee Director and Chairman

|

|

|

|

THOMAS E. LYNCH

|

|

|

|

/s/ Thomas E. Lynch

|

|

Thomas E. Lynch

|

|

|

|

SCOTT P. SCHARFMAN

|

|

|

|

/s/ Scott P. Scharfman

|

|

Scott P. Scharfman

|

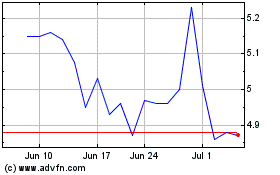

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Crown Crafts (NASDAQ:CRWS)

Historical Stock Chart

From Nov 2023 to Nov 2024