UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM ABS-15G

ASSET-BACKED SECURITIZER

REPORT PURSUANT TO SECTION 15G OF

THE SECURITIES EXCHANGE ACT OF 1934

Check the appropriate box to indicate the filing obligation which this form is intended to satisfy:

☐ Rule 15Ga-1 under the Exchange Act (17 CFR 240.15Ga-1) for the reporting period: to

Date of Report (Date of earliest event reported):

Commission File Number of securitizer:

Central Index Key Number of securitizer:

| | | | | | | | | | | | | | | | | | | | |

| | |

| Name and telephone number, including area code, of the person to

contact in connection with this filing | |

Indicate by check mark whether the securitizer has no activity to report for the initial period pursuant to Rule 15Ga-1(c)(1) ☐

Indicate by check mark whether the securitizer has no activity to report for the quarterly period pursuant to Rule 15Ga-1(c)(2)(i) ☐

Indicate by check mark whether the securitizer has no activity to report for the annual period pursuant to Rule 15Ga-1(c)(2)(ii) ☐

þ Rule 15Ga-2 under the Exchange Act (17 CFR 240.15Ga-2).

Central Index Key Number of depositor: 0000885550

Credit Acceptance Auto Loan Trust 2025-1

(Exact name of issuing entity as specified in its charter)

Commission File Number of issuing entity (if applicable): Central Index Key Number of underwriter (if applicable): | | | | | | | | | | | | | | | | | | | | |

| Douglas W. Busk, Chief Treasury Officer, (248) 353-2700 (ext. 4432) | |

| Name and telephone number, including area code, of the person to

contact in connection with this filing | |

Item 2.01 Findings and Conclusions of a Third Party Due Diligence Report Obtained by the Issuer

Attached as Exhibit 99.1 hereto is a Report of Independent Certified Public Accountants, dated March 7, 2025, of Grant Thornton LLP, which report sets forth the findings and conclusions, as applicable, of Grant Thornton LLP with respect to certain agreed-upon procedures performed by Grant Thornton LLP.

EXHIBIT INDEX

| | | | | |

Exhibit No. | Description |

| Report of Independent Certified Public Accountants, dated March 7, 2025, of Grant Thornton LLP. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the reporting entity has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

CREDIT ACCEPTANCE CORPORATION

(Depositor)

| | | | | |

By: | /s/ Douglas W. Busk |

Name: | Douglas W. Busk |

Title: | Chief Treasury Officer |

Date: March 7, 2025

ITEM 4 AND ITEM 5

REPORT OF INDEPENDENT CERTIFIED PUBLIC ACCOUNTANTS

Board of Directors and Management of Credit Acceptance Corporation, Credit Acceptance Auto Loan Trust 2025-1, and BMO Capital Markets Corp.:

We have performed the procedures enumerated below, on certain information with respect to attributes of Credit Acceptance Corporation’s (the “Company”) retail installment contracts (the “Consumer Loans”) as of January 31, 2025 (the “Subject Matter”) related to Credit Acceptance Auto Loan Trust 2025-1’s (the “Issuer”) issuance of certain classes of Notes (the “Securitization Transaction”). The Company’s management is responsible for the data file accurately representing the information included in the underlying asset documents and the disclosed assumptions and methodologies.

The Company has agreed to and acknowledged that the procedures performed are appropriate to meet the intended purpose of assisting specified parties in evaluating the Subject Matter. This report may not be suitable for any other purpose. Additionally, the Issuer and BMO Capital Markets Corp. (“BMO” and together with the Company and the Issuer, the “Specified Parties”) have agreed to and acknowledged that the procedures performed are appropriate for their purposes. The procedures performed may not address all the items of interest to a user of this report and may not meet the needs of all users of this report and, as such, users are responsible for determining whether the procedures performed are appropriate for their purposes.

Consequently, we make no representation regarding the appropriateness of the procedures enumerated below either for the purpose for which this report has been requested or for any other purpose.

The procedures we performed on the automobile receivables and our findings are as follows.

1.On February 7, 2025, the Company provided an electronic file (the “Data File”) with information for certain Consumer Loans included in the Securitization Transaction, which the Company represented was as of the close of business on January 31, 2025.

2.Grant Thornton selected one hundred Consumer Loans on a random basis from the Data File. The sample of Consumer Loans are listed in Exhibit A. For each of the selected Consumer Loans we compared the following information, designated by BMO, to the related retail installment contract provided by the Company, and compared the Vehicle Identification Number (“VIN”) on the Consumer Loan to the title document (actual title, title application, VINtek, or acceptable proof of lien, as applicable). For instances where consumers changed their address subsequent to the origination of their Consumer Loan, we compared the state to other Company records.

a.Consumer Loan number

b.Original amount financed

c.First payment date (scheduled)

d.Original term to maturity

e.Monthly payment

f.Interest rate

g.State

h.VIN

We defined the term “compare” as meaning we compared to the information shown in the Data File and found it to be in agreement. Such information was deemed to be in agreement if differences were attributable to rounding. The term “rounding” was defined as meaning amounts and percentages that were within $1 and 0.1%, respectively. We noted no exceptions.

We were engaged by the Company to perform this agreed-upon procedures engagement and conducted our engagement in accordance with attestation standards established by the American Institute of Certified Public Accountants. We were not engaged to and did not conduct an examination or review, the objective of which would be the expression of an opinion or conclusion, respectively, on the Subject Matter. Accordingly, we do not express such an opinion or conclusion. Had we performed additional procedures, other matters might have come to our attention that would have been reported to you.

Our agreed-upon procedures engagement was not conducted for the purpose of the following:

•Addressing the conformity of the origination of the assets to stated underwriting or credit extension guidelines, standards, criteria, or other requirements

•Addressing the value of collateral securing any such assets being securitized

•Addressing the compliance of the originator of the assets with federal, state, and local laws and regulations

•Satisfying any criteria for due diligence published by a nationally recognized statistical rating organization

•Addressing any other factor or characteristic of the assets that would be material to the likelihood that the issuer of the asset-backed security will pay interest and principal in accordance with applicable terms and conditions

•Forming any conclusions

•Any other terms or requirements of the transaction that do not appear in this report.

We are required to be independent of the Company and to meet our other ethical responsibilities, in accordance with the relevant ethical requirements related to our agreed-upon procedures engagement.

This report is intended solely for the information and use of the Specified Parties. It is not intended to be, and should not be, used by anyone other than these specified parties, including investors and rating agencies, who are not identified as specified parties but who may have access to this report as required by law or regulation.

/s/ GRANT THORNTON LLP

Southfield, Michigan

March 7, 2025

Exhibit A

| | | | | | | | | | | | | | | | | |

| Sample | Consumer Loan Number | Sample | Consumer Loan Number | Sample | Consumer Loan Number |

| 1 | XXXXX1050 | 35 | XXXXX7397 | 69 | XXXXX1080 |

| 2 | XXXXX3869 | 36 | XXXXX6846 | 70 | XXXXX1992 |

| 3 | XXXXX5722 | 37 | XXXXX8550 | 71 | XXXXX7397 |

| 4 | XXXXX1824 | 38 | XXXXX0533 | 72 | XXXXX6539 |

| 5 | XXXXX5762 | 39 | XXXXX4777 | 73 | XXXXX1102 |

| 6 | XXXXX2800 | 40 | XXXXX6596 | 74 | XXXXX8931 |

| 7 | XXXXX4559 | 41 | XXXXX5347 | 75 | XXXXX4388 |

| 8 | XXXXX5730 | 42 | XXXXX9289 | 76 | XXXXX5907 |

| 9 | XXXXX3639 | 43 | XXXXX1567 | 77 | XXXXX7109 |

| 10 | XXXXX2705 | 44 | XXXXX7928 | 78 | XXXXX9714 |

| 11 | XXXXX3014 | 45 | XXXXX8735 | 79 | XXXXX9757 |

| 12 | XXXXX4950 | 46 | XXXXX5630 | 80 | XXXXX5691 |

| 13 | XXXXX8840 | 47 | XXXXX7335 | 81 | XXXXX6224 |

| 14 | XXXXX7902 | 48 | XXXXX3091 | 82 | XXXXX1553 |

| 15 | XXXXX4891 | 49 | XXXXX7373 | 83 | XXXXX8981 |

| 16 | XXXXX4928 | 50 | XXXXX0000 | 84 | XXXXX7273 |

| 17 | XXXXX5178 | 51 | XXXXX9674 | 85 | XXXXX8129 |

| 18 | XXXXX8873 | 52 | XXXXX7364 | 86 | XXXXX0706 |

| 19 | XXXXX1781 | 53 | XXXXX1957 | 87 | XXXXX2043 |

| 20 | XXXXX8748 | 54 | XXXXX8483 | 88 | XXXXX2593 |

| 21 | XXXXX8850 | 55 | XXXXX7277 | 89 | XXXXX4326 |

| 22 | XXXXX9211 | 56 | XXXXX9248 | 90 | XXXXX9057 |

| 23 | XXXXX2799 | 57 | XXXXX2811 | 91 | XXXXX2590 |

| 24 | XXXXX3892 | 58 | XXXXX9793 | 92 | XXXXX4500 |

| 25 | XXXXX0893 | 59 | XXXXX9804 | 93 | XXXXX4919 |

| 26 | XXXXX2929 | 60 | XXXXX6944 | 94 | XXXXX8578 |

| 27 | XXXXX1220 | 61 | XXXXX2468 | 95 | XXXXX6265 |

| 28 | XXXXX2574 | 62 | XXXXX0860 | 96 | XXXXX0196 |

| 29 | XXXXX3154 | 63 | XXXXX8210 | 97 | XXXXX0968 |

| 30 | XXXXX2485 | 64 | XXXXX4007 | 98 | XXXXX2773 |

| 31 | XXXXX2499 | 65 | XXXXX0197 | 99 | XXXXX2347 |

| 32 | XXXXX0142 | 66 | XXXXX1210 | 100 | XXXXX7568 |

| 33 | XXXXX3204 | 67 | XXXXX3181 | | |

| 34 | XXXXX9735 | 68 | XXXXX7941 | | |

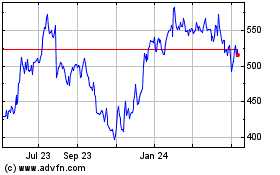

Credit Acceptance (NASDAQ:CACC)

Historical Stock Chart

From Feb 2025 to Mar 2025

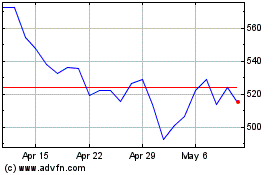

Credit Acceptance (NASDAQ:CACC)

Historical Stock Chart

From Mar 2024 to Mar 2025