0001595097false00015950972024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): August 06, 2024 |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-37348 |

46-4348039 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

500 River Ridge Drive |

|

Norwood, Massachusetts |

|

02062 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (617) 963-0100 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, par value $0.0001 per share |

|

CRBP |

|

The Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure.

Corbus Pharmaceuticals Holdings, Inc. updated its presentation used by management to describe its business. A copy of the presentation is furnished as Exhibit 99.l and incorporated herein by reference.

The information in this Current Report on Form 8-K under Item 7.01, including the information contained in Exhibit 99.1, is being furnished to the Securities and Exchange Commission, and shall not be deemed to be “filed” for the purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that section, and shall not be deemed to be incorporated by reference into any filing under the Securities Act or the Exchange Act, except as shall be expressly set forth by a specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) The following exhibit is furnished with this report:

|

|

|

Exhibit No. |

|

Description |

99.1 |

|

Investor Presentation |

104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

Corbus Pharmaceuticals Holdings, Inc. |

|

|

|

|

Date: |

August 6, 2024 |

By: |

/s/ Yuval Cohen |

|

|

|

Name: Yuval Cohen

Title: Chief Executive Officer |

Connecting Innovation to Purpose NASDAQ: CRBP Corporate Presentation August 6, 2024 Exhibit 99.1

This presentation contains certain forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and Private Securities Litigation Reform Act, as amended, including those relating to the Company’s trial results, product development, clinical and regulatory timelines, market opportunity, competitive position, possible or assumed future results of operations, business strategies, potential growth opportunities, including timing or completion of trials and presentation of data and other statements that are predictive in nature. These forward-looking statements are based on current expectations, estimates, forecasts and projections about the industry and markets in which we operate and management’s current beliefs and assumptions. These statements may be identified by the use of forward-looking expressions, including, but not limited to, “expect,” “anticipate,” “intend,” “plan,” “believe,” “estimate,” “potential,” “predict,” “project,” “should,” “would” and similar expressions and the negatives of those terms. These statements relate to future events or our financial performance and involve known and unknown risks, uncertainties, and other factors, on our operations, clinical development plans and timelines, which may cause actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. Such factors include those set forth in the Company’s filings with the Securities and Exchange Commission. Prospective investors are cautioned not to place undue reliance on such forward-looking statements, which speak only as of the date of this presentation. The Company undertakes no obligation to publicly update any forward-looking statement, whether as a result of new information, future events or otherwise. All product names, logos, brands and company names are trademarks or registered trademarks of their respective owners. Their use does not imply affiliation or endorsement by these companies. Forward-Looking Statements

Investment Summary $147M Cash, cash equivalents and investments as of June 30, 2024. Approximately 11.5M Common Shares Outstanding (12.5M Fully-Diluted Shares) Nectin-4 targeting ADC for treatment of solid tumors Oral CB1R inverse agonist to treat obesity TGFβ blocker Anti-⍺vβ8 integrin mAb for treatment of solid tumors CRB-913 CRB-601 CRB-701

Therapy Disease Indication Sponsor Pre-Clinical Phase 1 Phase 2 Phase 3 Milestones Next-Generation Nectin-4 targeting ADC CRB-701 Next-generation Nectin-4 targeting ADC Nectin-4 positive�solid tumors CSPC�(China) Cohort 6 Expanding Corbus�(US + Europe) First Patient Dosed Anti-Integrin mAb CRB-601�Anti-⍺vβ8 mAb�(TGFβ-targeting) ⍺vβ8 enriched solid tumors Corbus FPI Expected in Q4-2024 Highly peripherally-restricted CB1R inverse agonist CRB-913 CB1R inverse agonist Obesity and related conditions Corbus FPI Expected in Q1-2025 A Diversified Pipeline with Differentiated Clinical Risk Profiles

CRB-701 Next Generation �Nectin-4 Targeting ADC

PADCEV® Projected to Reach Up to ~$5B in Global Sales by 2028 Sources: 1. SGEN press release, October 2023, 2. Evaluate Pharma PADCEV® Global Projected Revenues in UC/Bladder2 $5B Latest Padcev® Q3 revenues 1 22nd October 2023 2 ® Groundbreaking EV-302 Trial Significantly Extends Overall Survival and �Progression-Free Survival in Patients Treated with PADCEV® (enfortumab vedotin-ejfv) �and KEYTRUDA® (pembrolizumab) in First-Line Advanced Bladder Cancer 22nd October 20231

Does Tolerability for Padcev® Impact Clinical Adoption? Source(s): PADCEV® Prescribing Information as of Apr 2023. Duration of Response ~5 months 47% Rate of Serious Adverse Events (SAEs) 61% Dose Interruptions 34% Dose Reductions 17% Dose Discontinuations Revised: 4/2023 PADCEV® Prescribing Information EV-301: The safety of PADCEV was evaluated as a single agent in EV-301 in patients with locally advanced or metastatic urothelial cancer (n=296) who received at least one dose of PADCEV 1.25 mg/kg and who were previously treated with a PD-1 or PD-L1 inhibitor and a platinum-based chemotherapy ®

PADCEV® is Associated with Skin Toxicities and Peripheral Neuropathy Source(s): 1. PADCEV® Prescribing Information Dec 2023. 2.Rosenberg et al. 2020 Adverse Events (% of Patients) ® A Black Box Warning1 Greater than 25% of PADCEV® discontinuations are linked to peripheral neuropathy 2 PADCEV® + Keytruda® patients who experienced neuropathy: 13% complete resolution 87% patients had residual neuropathy (45% had Grade ≥2)1 PADCEV® monotherapy1 PADCEV® + Keytruda®1 All Grades ≥ Gr 3 All Grades ≥ Gr 3 Skin�Reactions 58% 14% 70% 17% Peripheral Neuropathy 53% 5% 67% 7%

ADC drug TAA Average DAR Skin Rash Peripheral Neuropathy Padcev® Enfortumab vedotin Nectin-4 3.8 Adcetris®�Brentuximab vedotin CD30 4 Tivdak®�Tisotumab vedotin TF 4 Polivy® Polatuzumab vedotin CD79B 3.5 Aidixi®�Disitamab vedotin HER2 4 Is the 2nd Generation Seagen® Linker the Cause? Padcev® Val-Cit linker + payload = mc-VC-PABC = Maleimidocaproyl-L-valine-L-citrulline-p-aminobenzyl alcohol p-nitrophenyl carbonate Source(s): 1. Fu et al., Science. 2023 doi: 10.1016/j.isci.2023.107778. Padcev® Prescribing information, Adcetris® Prescribing Information, Tivdak® Pescribing Information, Polivy® Prescribing Information. Shi et al., 2022 https://doi.org/10.1080/10717544.2022.2069883 Aidix® www.adcreview.com/drugmap/disitamab-vedotin Similar dose limiting toxicities seen across divergent ADCs that share same constellation of ‘linker + payload’ Val-Cit linker + vedotin (MMAE) payload All grades All grades

6 months of therapy = ~ 54 hours of total clinic time / patient Real-world use, dose intensity, �and adherence to Padcev® PADCEV® Requires Frequent Dosing and Real-world Usage Differs from Label Source(s): 1. PADCEV® Prescribing Information as of Dec 2019, 2. Redacted from Tsingas et al., ASCO 2023 Monotherapy PADCEV® Metric Results (N=416) EV use Number of cycles (median, IQR) 5 (2,8) EV dose intensity Treatments per patient month (mean [SD]) 2.6 [0.6] Dosing frequency; treatments per cycle (mean [SD]) 2.4 [0.5] Dose (mean, mg/kg [SD]) 1.1 [0.2] Change in average dose (mg) from baseline (%) -9.6 [20.2] % EV treatment adherence Received on average > 2 treatments per cycle (%) 58.8 [34.4] % Cycle length = 28 days 1.25 mg/kg 1.25 mg/kg 1.25 mg/kg Dose holiday Day 1 Day 8 Day 15 Day 22 Day 28

Nectin-4 targeting ADC for treatment of solid tumors Extend ADC half-life Reduce dosing frequency Lower DAR + longer half-life Dose higher than PADCEV® Compliance Efficacy Toxicity Designing a Nectin-4 ADC Intended to Address PADCEV® Unmet Needs

CRB-701: Next Generation Site-specific Nectin-4 Targeting ADC MMAE = Monomethyl auristatin E ADCC = antibody-dependent cellular cytotoxicity. CDC = complement dependent cytotoxicity Source(s): Modified image from Corbus data on file; Corbus data on file Novel Nectin-4 Antibody ADCC + CDC functionality Glutamine Focused Side chain conjugation Payload:MMAE Microtubule disruption Cathepsin-B Cleavage Site

CRB-701: One Dose Every 21 Days Offers Advantages Over More Frequent Dosing Source(s): Corbus data on file; PADCEV® Prescribing Information as of Dec 2019 PADCEV® CRB-701 Clinical Cycle Comparison Patient / Physician Convenience Combination Flexibility

ASCO 2024 Update: Phase 1 Dose Escalation Study (China) KEY ELIGIBILITY Age ≥ 18 years Advanced urothelial carcinoma or Nectin-4 positive Advanced solid tumors ECOG 0-1 Adequate organ function No uncontrolled diabetes No active CNS metastasis ESCALATION DESIGN Bayesian Optimal Interval (BOIN) design with accelerated titration at DL-1 IV Q3W over a 21-day cycle 0.2 mg/Kg 0.6 mg/Kg 1.2 mg/Kg 1.8 mg/Kg 2.7 mg/Kg (expanding) 3.6 mg/Kg (expanding) 4.5 mg/Kg (escalating) KEY ENDPOINTS Safety/tolerability Pharmacokinetics Anti-tumor activity NEXT STEPS Continue escalation PK expansion at 3.6 mg/kg MTD or RP2D Specific expansion

ASCO 2024 Update: Demographics & Key Characteristics Characteristic Value Median age (range) 55 (35, 76) Sex (M/F) 29.7%, 70.3% ECOG PS 0,1, missing 8.1%, 89.2%, 2.7% Weight in Kg mean (range) 59.01 (36.0, 84.9) Prior therapies median (range) 4.0 (0,10) Creatinine clearance <60μ mol/L 29.7% Visceral metastasis (Y/N/missing) 73%, 8.1%, 18.9% HbA1c <6.5% 97.3% Primary tumor type n=37 Urothelial 13 Cervical 15 TNBC/Breast 5 CRC 1 Esophageal 2 Not assigned 1 Corneal and conjunctival disease 16 out of 30 reviewed An additional 19 patients have been enrolled since January 2024 25 patients evaluable for efficacy assessment at time of ASCO data cut

ASCO 2024 Update: Safety and Dose Modifications Dose Modifications n Discontinuations 0 Reductions 0 Interruptions 1 CRB-701 continues to be well tolerated with mainly grade 1 or 2 AEs Still no DLTs or Grade 4 or 5 AEs observed to date including in the 4.5 mg/Kg cohort No additional grade 3 treatment related SAEs since ASCO-GU data (January 2024) Summary of TEAEs ≥20% as of April 2024 cut-off date-37 patients evaluated

ASCO 2024 Update: TEAEs of Special Interest (<20% incidence) AE of special interest Grade Dose (n out of 37) Notes Skin rash 3 2.7 mg/Kg (n=1) Resolved after 8 days (no dose change) Skin rash 2 3.6mg/kg (n=1) Resolved after 5 weeks (no dose change) Skin rash 1 3.6 mg/kg (n=1) Resolved after 19 days (no dose change) Peripheral neuropathy 1 3.6 mg/Kg (n=1) Associated with underlying hypokalemia Resolved after 10 days with K+ therapy No dose reduction or discontinuation Cornea 3 2.7 mg/Kg (n=1) 3.6 mg/Kg (n=1) Ocular prophylaxis recently introduced starting at 4.5 mg/Kg 53% of sampled patients at baseline had corneal or conjunctival pathology and were recruited on trial (acceptable per Chinese protocol)

ASCO 2024 Update: Pharmacokinetics Continuing to indicate differentiation from PADCEV Delivering higher amounts of ADC at the higher doses explored Consistently less free MMAE levels across all doses tested to date 21 Day PK Comparison %ADC %Free MMAE Cmax AUC0-21d Cmax AUC0-21d Enfortumab vedotin (EV) 1.25 mg/Kg Q1Wx3 EV Benchmark 100% 100% 100% 100% CRB-701 1.2 mg/Kg Q3W Matched ADC dose 78% 103% 33% 29% 2.7 mg/Kg Q3W Matched for MMAE dose (DAR) 190% 217% 67% 72% 3.6 mg/Kg Q3W 2.9-fold EV ADC dose 245% 324% 69% 79% 4.5 mg/Kg Q3W 3.6-fold EV ADC dose 287% 428% 62% 64%

Favorable Emerging Safety Profile vs. Nectin-4 ADC Competitors 1 Rosenberg, et al., JCO, 2020 Apr 1; 38(10): 1041–1049, 2. NDA/BLA Multidisciplinary Review and Evaluation BLA 761137 PADCEV™ (enfortumab vedotin-ievx), 3. BicycleTx R&D day Dec. 2023, 4. Mabwell Announces 9MW2821 Clinical Data and Latest Progress to be presented at 2024 ASCO Annual Meeting . 5 Clinical Update ASCO 2024 Jian Zhang et al Abst 3151. 6. Efficacy and safety of 9MW2821, an antibody-drug conjugate targeting Nectin-4, monotherapy in patients with recurrent or metastatic cervical cancer: A multicenter, open-label, phase I/II study. Yang et al SGO plenary Mar 2024. Limitation Padcev® BT8009 9MW-2821 CRB-701 Upper dose limit 1.25 mg/Kg1 5 mg/m3 1.25 mg/Kg4 No DLTs up to 4.5mg/Kg5 Schedule D1, D8, D15 /28 days Q1W D1, D8, D15 /28 days Q3W ≥ Grade 3 AE rate 58% (n=179 of 310)2 49% (n=55/113)3 70%6 16% (n=6/37)5 Peripheral neuropathy 49% (n=76/155)1 22% (n=25/113)3 22.5% (n=54/240)4 3% (n=1/37)5 Skin reactions 45% (n=70/155)1 10% (n=11/113)3 30% (n=72/240)4 8% (n=3/37)5 Neutropenia (Gr 3) 6.8% (21/379)2 5% (n=6/113)3 27.9% (n=67/240)4 0%5 Dose reduction 30.3% (n=94/310)2 21% (n=7/34)3 Not released 0%5 Dose interruptions 46.8% (n=145/310)2 44% (n=15/34)3 Not released 2% (n=1/37)5

ASCO 2024 Update: Phase 1 Dose Escalation Disease Responses Two of seven PRs are ongoing and unconfirmed. All of the previous (January ASCO GU data) PRs were confirmed.

ASCO 2024 Update: Disease Response-mUC & Cervical ≥ 1.2 mg/Kg ORR: 43% (3 of 7 at 2.6mg and 3.6mg/Kg) DCR: 86% ORR: 44% (4 of 9 at 3.6mg/Kg) DCR: 78% % Change by RECIST criteria Dose mg/kg NECTIN-4 3.6 3.6 2 .7 3.6 4.5 3.6 2.7 3.6 1.2 205 0 105 n.a. 271 220 190 293 175 3.6 3.6 3.6 1 .8 3.6 3.6 3.6 80 110 265 65 185 235 132

ASCO 2024 Update: Swimmer Plots

ASCO 2024 Update: Phase 1 Summary Data Objective Response Rate in mUC at doses ≥ 1.2 mg/KG 44%: 4 out of 9 patients with PR’s (1 unconfirmed, DCR-78%) Objective Response Rate in Cervical at doses≥ 1.2mg/KG 43%: 3 out of 9 patients with PR’s (1 unconfirmed, DCR-86%) Dose for first observed SD 0.2 mg/Kg Dose for first observed PR 1.2 mg/Kg Longest observed response duration to date 24 weeks for longest Partial Response =8 cycles 51 weeks for longest Stable Disease =17 cycles Participants still on CRB-701 21/37 (57%) First two expansion doses chosen 2.7 and 3.6 mg/Kg (cohorts 5 and 6)

CRB-701: A Differentiated Clinical Development Approach to Competitors Proprietary insights are driving indication selection for CRB-701 New reality of Padcev® + Keytruda® 1L therapy Under-served niche mUC populations remain and are attractive targets Emerging clinical data from current dose escalation is informative Focus on unexplored Nectin-4 solid tumors starting with cervical cancer Non-UC Nectin-4 solid tumors mUC

CRB-701-01 Study Design (Corbus) Dose escalation (Dosing underway) Project Optimus (dose optimization) Dose expansion at RP2D Randomized to �2 doses of �CRB-701 monotherapy Randomized to �2 doses of �CRB-701 +CPI 1.8 mg/Kg 2.7 mg/Kg 3.6 mg/Kg 4.5 mg/Kg Bladder cancer niche population(s) Non-UC tumors: A B C Basket of nectin-4 positive tumors

Validation of Nectin-4 as a Tumor Associated Antigen beyond mUC References: 1. https://ascopubs.org/doi/abs/10.1200/JCO.2023.41.16_suppl.6017 2. Efficacy and safety of 9MW2821, an antibody-drug conjugate targeting Nectin-4, monotherapy in patients with recurrent or metastatic cervical cancer: A multicenter, open-label, phase I/II study. SGO 2024 –source www.mabwell.com 3. NDA/BLA Multi-disciplinary review and Evaluation – BLA 761137 Parameter Patients (N=46) Patients (N=37) Confirmed ORR 11 (23.9%) 15 (40.5%) CR 1 (2.2%) 1 (2.7%) PR 10 (21.7%) 14 (37.9%) DCR 26 (55%) 33 (89.2%) PFS 3.94 months Too early Neutropenia (Grade 3+4) 4.3% 40% Skin Rash All grades: 45.7% Grade 3+4: 17.5% All grade 3+4 AEs Not disclosed 70% Elevated Nectin-4 expression: urothelial, breast, ovarian, cervical, colorectal, rectal, esophageal, gastric, lung, thyroid, prostate, cholangiocarcinoma, pancreatic cancer, testicular cancer <- Other highly expressing tumors -> UC H&NSCC (1) Cervical (2) March 2024 PADCEV® monotherapy 2019 FDA review (3) Patients (N=310) 1.25mg/Kg Skin rash (grade 3+4) 10% Any Grade 3-4 TEAE 58% June 2023

ASCO-2024 Expected Q4-2024 Expected Q1-2025 Expected Milestones Q1-2024 First patient dosed in U.S. dose escalation study Clinical data update on China dose escalation study Complete U.S. dose escalation study Present U.S. dose escalation data

Competitive Landscape in Cervical Cancer Tivdak innovaTV-301(2) N=502 Median prior Tx=2 Tivdak initial approval(1) N=101 Median prior Tx=1 Mabwell (3) N=53 Cervical N=240 safety CRB-701 N=37 ORR 17.8% (TV) vs 5.2% (Chemo) (TV: CR 2.4%, PR 15.4%) 23.8% CR 7% PR17% 35.8% (cORR30.2%) Around 40-45% Ocular adverse events 50.4% (34% Asian population) 54.5% (Asian 2% White 95%) Not reported 67% (100% Asian population). Discontinuations 5.6% Ocular and neuropathy 13% Ocular and neuropathy 2.9% 0% ASCO 2024 Dose reductions n.a. 23% overall of which 17% were Ocular (9% 'conjunctival'+ 8% 'corneal') + 6% were neuropathy and/or 'other' 7.9% (54.2% interruption rate) 0% (5.4% ocular grade 3 events would have had dose reductions under western protocol) All AEs (grade ≥3) TRAE 87.6% (29.2%) (Any ≥grade 3 =60%) Est. 70% (SAE-related 25%) 83.8% TEAE (16.2%) Coleman RL et al Lancet Oncol. 2021 May;22(5):609-619. doi: 2.Vergote, I. B., et al. "LBA9 innovaTV 301/ENGOT-cx12/GOG-3057: A global, randomized, open-label, phase III study of tisotumab vedotin vs investigator’s choice of chemotherapy in 2L or 3L recurrent or metastatic cervical cancer." Annals of Oncology 34 (2023): S1276-S1277.

Cervical Cancer: Commercial Opportunity for CRB-701 14,000 new cervical cases in U.S. annually with 4,000 deaths1 Incidence in U.S. is still growing despite effective HPV vaccination due to: Low HPV screening rates in Asian and Hispanic women, lower vaccination in rural areas and lack of access to insurance in certain patient groups2 39% of women ages 13-15 remain unvaccinated for HPV (2022 NIH data3) Incidence rate for women ages 30-44 increased by 1.7% from 2017-20191 Cervical cancer market in U.S. projected to grow to $1.8 billion by 20284 Approvals of Keytruda® +chemo with or without Avastin® as first line therapy and Tivdak ® as 2nd line driving growth Market opportunity for CRB-701 Potential for CRB-701 as a first line therapy in combination with PD-1 Favorable safety and efficacy profile emerging versus Tivdak ®-potential to compete as 2nd line monotherapy https://www.cancer.org/cancer/types/cervical-cancer/about/key-statistics.html Study reveals why cervical cancer screening rates are declining, which populations are most affected - UTHealth Houston School of Public Health HPV Vaccination | Cancer Trends Progress Report GlobalData Report-Cervical Cancer Global Drug and Market Analysis to 2030

CRB-701: Summary Emerging clinical safety appears differentiated to PADCEV Clinical activity seen in mUC and cervical cancer patients 3rd generation ADC with improved linker stability, reduces MMAE in circulation

CRB-913 Oral cannabinoid Type-1 inverse agonist for superior incretin therapy in obesity

The obesity landscape is evolving to address these issues Client asked if we could improve the style/layout of this slide Degree of weight loss Quality of weight loss Muscle loss » Single MOA Multiple orthogonal MOAs Tolerability » Injectables Oral small molecules Accessibility »

The return of a clinically-validated obesity drug class CB1 Inverse Agonism

Source(s): Targeting the endocannabinoid system in diabesity: Fact or fiction?, Drug Discovery Today, Deeba et al. Mar 2021. CB1 is a Well Understood Receptor in Metabolism >9K papers in PubMed on CB1 and metabolism

The CB1 MOA is Clinically Validated in Obesity: Data From 1st Gen Drugs Source(s): 1. Effects of rimonabant on metabolic risk factors in overweight patients with dyslipidemia, Després et al, NEJM, Nov 2005. RIO-Lipids Phase 3 study Placebo (n=342); 5 mg rimonabant (n=345); 20 mg rimonabant (n=346) Rimonabant1 -9.0% -4.4% -2.4% % weight loss

Body composition was measured with body DEXA in a subset of patients in RIO Lipids. Decreases in the rimonabant 20 mg group relative to placebo were observed in the total body mass (p<0.001), the total body fat mass (p=0.001) and the fat mass/total body mass ratio (p=0.007). There was no statistically significant difference between the 20 mg and the placebo groups in lean mass loss between groups. Total body mass Total fat mass Fat mass/body mass Lean mass Rimonabant vs. placebo Unchanged Phase 3 RIO study DEXA-scanned subgroup (n=146) Rimonabant Weight Loss was Not Associated With Reduction of Lean Mass in Obese Patients Rimonabant NDA (page 21)

Muscle-cb1 KO Leads to Increase In Muscle Mass in Obese Mice �(Gonzalez-Mariscal et al. 2019) Key finding: Muscle-CB1 KO mice… Increase in muscle mass and strength Increase in biomarkers of muscle growth Increase in mitochondrial metabolism Increase in energy expenditure Increase in calorie consumption w/o weight gain Increase in fat metabolism Enhanced insulin sensitivity in muscle tissue Reduction in body fat content Reduction in sleep

INV-202 CRB-913 Next Generation CB1 Inverse Agonists are Peripherally Restricted Rimonabant Otenabant Ibipinabant Taranabant Source(s): Cinar et al 2020 First generation (2000-2007) Next generation (2020 onwards) Designed to target the brain with high BBB penetration FDA rejection due to safety concerns (2007) Designed to be peripherally restricted with minimal BBB penetration avoid safety issues

Single-dose INV-202 (25mg QD) N = 37 Adults with metabolic syndrome Weight loss in 28 days: -3.50 kg (INV-202) vs +0.55Kg (placebo) INV-202 (Inversago) a.k.a Monlunabant (Novo) a.k.a MRI-1891(NIH) Aug. 10, 2023 Novo Nordisk Acquisition of Inversago Marks Return of CB1 as an MOA in Obesity Source(s): Inversago corporate presentation and Despres et al. 2023 Novo acquires Inversago for up to $1 billion, spotlighting troubled weight loss approach

Source: TD Cowen Research Report by Michael Nedelcovych May 8, 2024 “Novo has modeled the weight loss achieved in Phase I and expects to see 16-19% weight loss with single agent monlunabant at a mature time point (Phase Il obesity results anticipated in H2).” Monlabant (INV-202) Data Predicted for H2 2024

How Could Such a Degree of Weight Loss Be Achieved From a CB1 Inverse Agonist? Source(s): Inversago corporate presentation ClinicalTrials.gov ID: NCT05891834 Standard obesity endpoints �+ DEXA scan Standard inclusion and exclusion criteria 16 weeks once-daily tablet �50 mg/day = 2.5 pills of rimonabant RIO-Lipids Phase 3 study Placebo (n=342); 5 mg rimonabant (n=345); 20 mg rimonabant (n=346) Rimonabant1 Placebo 20 mg 50 mg ? 5 mg Projected efficacy? 10 mg 20 mg Placebo Rimonabant Monlunabant Phase 2 Study Monlunabant (projected)

Nov. 2023 CRB-913: Oral CB1 Inverse Agonist for Combination Therapy with Incretins

CRB-913: Designed to be a Best-in-class Next Generation CB1 Inverse Agonist Design Goals Best-in-class peripheral restriction Protect lean mass (muscle) Retain 1st gen efficacy Enhance efficacy of incretin analogs

Ibipinabant (2004-2008) JD-5037 (2012-2018) / CRB-4001 (2018-2021) Completed Phase IIb (Solvay/BMS) Small, lipid soluble molecule High BBB penetration Oral Same backbone as Inversago compounds (MRI/INV family) CRB-4001 (JD5037) licensed from Jenrin in 2018 Extensive pre-IND studies carried out PK didn’t support TPP Oral CRB-913 New IP published – patent coverage through 2043 PK profile optimized for TPP Favorable multi-species bioavailability (>50%) Lower mfg. cost vs. incretins Oral CRB-913 is the Outcome of a Multi-year Medicinal Chemistry Campaign

Source(s): Morningstar et al. 2023 CRB-913: Marked ↓ Brain and ↑ Peripheral Exposure Vs. Rimonabant in Both Lean and Obese Mice 10 mg/Kg Co-administration with incretin analog does not affect brain penetration for CRB-913

Source(s): *Morningstar et al 2023 and **Liu et al, 2021 Brain concentration (ng/g) single acute dose CRB-913 (lean mice) Monlunabant (lean mice) Rimonabant (lean mice) 10 mg/Kg 26* 319** 561* 1:12 1:21 CRB-913: Higher Degree of Peripheral Restriction than Monlunabant or Rimonabant

Source(s): Morningstar et al 2023 CRB-913: Similar Weight Loss vs. Rimonabant at Same Daily Doses in DIO Mice

21-fold DIO mouse model (day 28) DIO mouse model with C57BL6/N mice (n=10) fed a continuous high fat diet for 22 weeks prior and during 28 days of treatment Brain collected 1 h post final dose (Cmax) Source(s): Company data on file. CRB-913: Similar Weight Loss Despite Markedly Lower Brain Concentrations vs. Rimonabant

weight (g) Body Fat Lean Mass CRB-913 Demonstrates Significant Reduction in Body Fat Content but Not Lean Mass DIO mouse model with C57BL6/J mice (n=10) fed a continuous high fat diet for 22 weeks prior Body fat by MRI determined on Day 20 Source(s): Morningstar et al. 2023

CRB-913: Enhanced Combo Effect with Semaglutide Or Tirzepatide Source(s): Company data on file. DIO mouse model with C57BL6/J mice (n=10) fed a continuous high fat diet for 22 weeks prior and during 18 days of treatment (Similar effect also seen when CRB-913 was combined with liraglutide) Body weight change (%) at day 18 All cohorts P < 0.001 compared with vehicle 5.2

Source(s): Company data on file. Food Consumption CRB-913, semaglutide and tirzepatide each results in food intake reductions Significant further reductions in food consumption when CRB-913 is combined with semaglutide or tirzepatide (p=0.001) All cohorts P < 0.001 compared with vehicle DIO mouse model with C57BL6/J mice (n=10) fed a continuous high fat diet for 22 weeks prior CRB-913 Reduces Food Consumption Alone or in Combination with Semaglutide or Tirzepatide

CRB-913 Reverses Leptinemia Alone and in Combination with Semaglutide or Tirzepatide Source(s): 1 Leptin and the maintenance of elevated body weight, Pan and Myers, Nature Reviews, Jan 2018. Company data on file. The Role of Leptin The hormone leptin regulates food intake Normally, leptin signals satiety (feeling “full”) In obesity, resistance to leptin develops and hunger persists despite high leptin levels (“leptinemia”) A reduction in leptin levels is believed to be important for weight loss1 DIO mouse model with C57BL6/J mice (n=10) fed a continuous high fat diet for 22 weeks prior Leptin measured at Day 28 of treatment All cohorts P < 0.001 compared with vehicle

vehicle CRB-913 (2.5 mg/Kg) semaglutide (10 nmol/Kg) CRB-913 (2.5 mg/kg) + semaglutide (10 nmol/Kg) tirzepatide (5 nmol/Kg) CRB-913 (2.5 mg/Kg) + tirzepatide (5 nmol/Kg) Liver fat CRB-913 Reduces Liver Fat Alone and in Combination with Semaglutide or Tirzepatide *liver oil red stain Source(s): Company data on file.

CRB-913: Clinical Development Pathway Q4 2024 H1 2025 H2 ‘25 – H1 ‘26 H2 ‘26 – H1 ‘27 SAD MAD Monotherapy 28 days (3 doses) Co-admin with incretin analog

1. Incretin analog therapy for insensitive/intolerant/high-risk patients 2. Combination with oral incretin agonists potentially enhances efficacy OR improve tolerability 3. “Induction/maintenance” model: goal to potentially maintain weight loss post incretin analog therapy CRB-913: Potential Clinical Usage However… Implications of a 2nd gen CB1 inverse agonists that could deliver 16%-19% weight loss: Potential efficacy in line with �semaglutide or even tirzepatide Monotherapy Once-a-day pill No need for titration

Expected Milestones Produce drug for toxicology and clinical studies Q2-2024 Complete toxicology and IND enabling studies Q4-2024 FPI SAD/MAD Q1-2025

Leadership�Upcoming Catalysts�Financials

Management Team Sean Moran, CPA, MBA Chief Financial Officer Corbus co-founder and Chief Financial Officer since 2014. Prior senior financial management experience in emerging biotech and medical device companies. Christina Bertsch Head of Human Resources Accomplished senior human resource executive providing strategic HR consulting services to both large and small businesses across a variety of industries. Yuval Cohen, PhD Chief Executive Officer, Director Corbus co-founder and Chief Executive Officer since 2014. Previously the President and co-founder of Celsus Therapeutics from 2005. Dominic Smethurst, PhD Chief Medical Officer, MA MRCP Dr. Smethurst, MA MRCP, joined Corbus as our Chief Medical Officer in February 2024. He most recently served as CMO of Bicycle Therapeutics.

Board of Directors Amb. Alan Holmer Ret. Chairman of the Board More than two decades of public service in Washington, D.C. including Special Envoy to China; Former CEO of PhRMA. Avery W. (Chip) Catlin Director More than 25 years of senior financial leadership experience in life science companies; Former CFO and Secretary �of Celldex Therapeutics. Yuval Cohen, PhD Chief Executive Officer, Director Corbus co-founder and Chief Executive Officer since 2014. Previous the President and co-founder of Celsus Therapeutics from 2005. Anne Altmeyer, PhD, MBA, MPH Director 20 years of experience advancing oncology R&D programs and leading impactful corporate development transactions; currently President & CEO of TigaTx. Yong (Ben) Ben, MD, MBA Director 25 years of oncology R&D experience across industry and academia. Held two industry CMO positions, most recently at BeiGene (BGNE). Rachelle Jacques Director More than 25-year professional career, experience in U.S. and global biopharmaceutical commercial leadership, including multiple high-profile product launches in rare diseases; Former CEO of Akari Therapeutics. (NASDAQ: AKTX) John K. Jenkins, MD Director Distinguished 25-year career serving at the U.S. FDA, including 15 years of senior leadership in CDER and OND. Pete Salzmann, MD, MBA Director 20 years of industry experience and currently serves as Chief Executive Officer of Immunovant (NASDAQ: IMVT), a biopharmaceutical company focused on developing therapies for patients with autoimmune diseases.

Expected Corporate Milestones First patient dosed: Q1-2025 First patient dosed: Q4-2024 Complete U.S. dose escalation study: Q4-2024 Present U.S. dose escalation data: Q1-2025 CRB-701 CRB-913 CRB-601

Investment Summary $147M Cash, cash equivalents and investments as of June 30, 2024. Approximately 11.5M Common Shares Outstanding (12.5M Fully-Diluted Shares) Nectin-4 targeting ADC for treatment of solid tumors Oral CB1R inverse agonist to treat obesity TGFβ blocker Anti-⍺vβ8 integrin mAb for treatment of solid tumors CRB-913 CRB-601 CRB-701

Connecting Innovation to Purpose NASDAQ: CRBP Corporate Presentation August 6, 2024

Appendix

CRB-601�Potential “best-in-class” ⍺vβ8 mAb

CRB-601 has the Potential to Enhance Checkpoint Inhibition Focus on adopting a precision-targeted approach Novel mechanism to target TGFb in the tumor microenvironment Large opportunity potential if POC is validated

TGFβ predicts poor clinical outcomes in a subset of cancer patients 0 25 20 15 10 5 0.0 0.2 0.4 0.6 0.8 1.0 N = 8,461 cancers, multiple cell types Time (years) Overall survival, % Immunogenomic subtypes in cancer Source(s): Thorsson, et al. The Immune Landscape of Cancer, Immunity. 2018; 48:817 C1 C2 C3 C4 C5 C6 WOUND HEALING INF-γ DOMINANT INFLAMMATORY LYMPHOCYTE DEPLETED IMMUNOLOGICALLY QUIET TGFβ DOMINANT TGFβ predominance �gene signature Gene expression, immune cell quantification & network mapping 33 different cancer types / 8,000+ tumors

Targeting the Integrin ⍺Vβ8 Represents a Novel Approach to Regulating TGFβ Source(s): Huang et al., 2021. Recent progress in TGFβ inhibitors for cancer therapy.

CRB-601 is Targeting Latent -TGFβ by Blocking the Integrin avb8 The integrin avb8 is expressed in the tumor microenvironment (TME) Latent-TGFb is also expressed�in the TME CRB-601 is a blocking antibody preventing the interaction of these two proteins

mAbs targeting TGFβ activation in the clinic Source(s): Company websites. Clinicaltrials.gov. Internal analysis. CRB-601 PF-06940434 SRK-181 ABBV-151 RG6440 MOA ⍺vβ8 ⍺vβ8 L-TGFβ GARP�(TGFβ1) L-TGFβ Clinical Stage IND Cleared FPI Q4-2024 Phase 1/2 Phase 1 Phase 2 Phase 1 Indications Solid Tumors Solid Tumors Solid Tumors HCC Solid Tumors Type Monoclonal Antibody Monoclonal Antibody Monoclonal Antibody Monoclonal Antibody Monoclonal Antibody ROA IV IV IV IV IV

CRB-601 Enhances Anti-PD-1 Therapy in Checkpoint Inhibition Sensitive�and Resistant Murine Tumor Models CRB-601: 10 mg/kg BIW Anti-PD-1: 10 mg/kg BIW 10 animals / group Animals randomized at 50-80 mm3 Comparisons across arms *p<0.05, ***p<0.001, ****p<0.0001 % TGI MC38 EMT6 4T1 Anti-PD-1 54 -8 6 CRB-601 46 37 10 Combo 89 65 41 Resistant Checkpoint blockade sensitivity Sensitive MC38 (Inflamed Tumor) EMT6 (Excluded Tumor) 4T1 (Desert Tumor) *** **** **** *** * *** *** *** * Source(s): Corbus data on file

Blockade of ⍺vβ8 in Combination with anti-PD-1 Increased TIL Populations in Immune Excluded EMT6 Tumors Source(s): Corbus data on file **** *** **** **** **** *** **** **** Ki67+CD4 T Cells Ki67+CD8 T Cells CD4 T Cells CD8 T Cells Tumor Size * *** * **** ** *** ** *** ** **** * **** * Treatment Days -14 0 3 6 10 Anti-PD-1, 10 mg/Kg, IP CRB-601, 30 mg/Kg, IP EMT6 orthotopic implantation PD readouts Tumor volume = 200 mm3 (when treatment initiated) *p<0.05; **p<0.01; ***p<0.001; ****p<0.0001 M1/M2 Ratio NK Cells ** ** **** **** * *

CRB-601 Reshapes The Landscape Of Effector T and NK Cells in MC38 Tumors Source(s): Corbus data on file

Applying a Proprietary Algorithm To Define The Clinical Focus for CRB-601 A multi-parametric, immune-focused algorithm has refined indications for�CRB-601 The combination of immune features and gene expression profiles have identified�9 indications for clinical priority High Low Quartiles Source(s): Corbus proprietary analysis Clustered Tumor Types

Patient Selection Strategies Will Enhance the Probability of Success Source(s): Corbus proprietary analysis: Log2 fold change of Nectin-4 expression as a ratio to normal tissue Controls Ovarian Melanoma Breast Colon Prioritization of indications with differential gene expression vs. normal tissues will emphasize focus on the tumor potential of ⍺vβ8 Development of a NEW patient enrichment biomarker will assist in enriching for responses and addressing the right immune resistant patient population with CRB-601 Tumor Types (redacted)

Expected Milestones IND cleared January 2024 First patient dosed Q4-2024 Dose escalation and confirmation 1st Half of 2025

v3.24.2.u1

Document and Entity Information

|

Aug. 06, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 06, 2024

|

| Entity Registrant Name |

CORBUS PHARMACEUTICALS HOLDINGS, INC.

|

| Entity Central Index Key |

0001595097

|

| Entity File Number |

001-37348

|

| Entity Tax Identification Number |

46-4348039

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

500 River Ridge Drive

|

| Entity Address, City or Town |

Norwood

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02062

|

| City Area Code |

617

|

| Local Phone Number |

963-0100

|

| Entity Information, Former Legal or Registered Name |

Not Applicable

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

CRBP

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

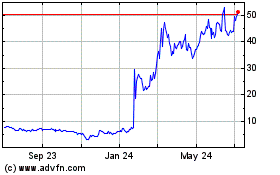

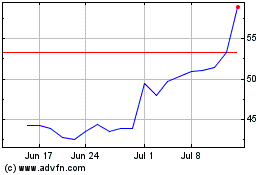

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Nov 2024 to Dec 2024

Corbus Pharmaceuticals (NASDAQ:CRBP)

Historical Stock Chart

From Dec 2023 to Dec 2024