Copart, Inc. (NASDAQ: CPRT) today reported financial results for

the quarter and year ended July 31, 2024.

For the three months ended July 31, 2024, revenue, gross profit,

and net income attributable to Copart, Inc. were $1.1 billion, $454

million, and $323 million, respectively. These represent an

increase in revenue of $71.4 million, or 7.2%; a decrease in gross

profit of $(4.0) million, or (0.9)%; and a decrease in net income

attributable to Copart, Inc. of $(25.2) million, or (7.3)%,

respectively, from the same period last year. Fully diluted

earnings per share for the three months ended July 31, 2024 was

$0.33 compared to $0.36 last year, a decrease of (8.3)%.

For the year ended July 31, 2024, revenue, gross profit, and net

income attributable to Copart, Inc. were $4.2 billion, $1.9

billion, and $1.4 billion, respectively. These represent an

increase in revenue of $367.3 million, or 9.5%; an increase in

gross profit of $170.3 million, or 9.8%; and an increase in net

income attributable to Copart, Inc. of $125.3 million, or 10.1%,

respectively, from the same period last year. Fully diluted

earnings per share for the year ended July 31, 2024 was $1.40

compared to $1.28 last year, an increase of 9.4%.

On Wednesday, September 4, 2024, at 5:30 p.m. Eastern Time (4:30

p.m. Central Time), Copart, will conduct a conference call to

discuss the results for the quarter. The call will be webcast live

and can be accessed at www.copart.com/investorrelations. A replay

of the call will be available through November 2024 by visiting

www.copart.com/investorrelations.

About Copart

Copart, Inc., founded in 1982, is a global leader in online

vehicle auctions. Copart’s innovative technology and online auction

platform connect vehicle consignors to approximately 1 million

members in over 185 countries. Copart offers remarketing services

to process and sell vehicles to insurance companies, financial

institutions, dealers, rental car companies, charities, fleet

operators, and individuals, and offers vehicles via auction to

dealers, dismantlers, rebuilders, exporters, and the general

public. With operations at over 250 locations in 11 countries,

Copart sold more than 4 million units in the last year. Copart

currently operates in the United States (Copart.com), Canada

(Copart.ca), the United Kingdom (Copart.co.uk), Brazil

(Copart.com.br), the Republic of Ireland (Copart.ie), Germany

(Copart.de), Finland (Copart.fi), the United Arab Emirates, Oman

and Bahrain (Copartmea.com), and Spain (Copart.es). For more

information, or to become a Member, visit Copart.com/register.

Cautionary Note About Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws. These forward-looking

statements are subject to substantial risks and uncertainties.

These forward-looking statements are subject to certain risks,

trends and uncertainties that could cause actual results to differ

materially from those projected or implied by our statements and

comments. For a more complete discussion of the risks that could

affect our business, please review the “Management’s Discussion and

Analysis” and the other risks identified in Copart’s latest Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K, as filed with the Securities and Exchange

Commission. We encourage investors to review these disclosures

carefully. We do not undertake to update any forward-looking

statement that may be made from time to time on our behalf.

Copart, Inc.

Consolidated Statements of

Income

(In thousands, except per share

amounts)

(Unaudited)

Three Months Ended July

31,

Twelve Months Ended

July 31,

2024

2023

% Change

2024

2023

% Change

Service revenues and vehicle sales:

Service revenues

$

893,091

$

834,242

7.1

%

3,561,002

$

3,198,128

11.3

%

Vehicle sales

175,908

163,349

7.7

%

675,821

671,390

0.7

%

Total service revenues and vehicle

sales

1,068,999

997,591

7.2

%

4,236,823

3,869,518

9.5

%

Operating expenses:

Yard operations

407,044

348,332

16.9

%

1,532,484

1,369,006

11.9

%

Cost of vehicle sales

161,891

149,216

8.5

%

619,487

614,498

0.8

%

Yard depreciation and amortization

44,539

40,577

9.8

%

170,650

142,097

20.1

%

Yard stock-based compensation

1,949

1,888

3.2

%

6,950

6,926

0.3

%

Gross profit

453,576

457,578

(0.9

)%

1,907,252

1,736,991

9.8

%

General and administrative

81,377

55,522

46.6

%

287,834

200,294

43.7

%

General and administrative depreciation

and amortization

6,064

4,058

49.4

%

19,111

17,381

10.0

%

General and administrative stock-based

compensation

6,591

7,381

(10.7

)%

28,284

32,747

(13.6

)%

Total operating expenses

709,455

606,974

16.9

%

2,664,800

2,382,949

11.8

%

Operating income

359,544

390,617

(8.0

)%

1,572,023

1,486,569

5.7

%

Other income (expense):

Interest income (expense), net

43,494

29,148

49.2

%

145,673

65,928

121.0

%

Other income (expense), net

5,389

3,927

37.2

%

(3,095

)

1,831

(269.0

)%

Total other income

48,883

33,075

47.8

%

142,578

67,759

110.4

%

Income before income taxes

408,427

423,692

(3.6

)%

1,714,601

1,554,328

10.3

%

Income tax expense

86,249

75,907

13.6

%

352,254

316,587

11.3

%

Net income

322,178

347,785

(7.4

)%

1,362,347

1,237,741

10.1

%

Less: Net loss attributable to

noncontrolling interest

(389

)

—

100

%

(673

)

—

100.0

%

Net income attributable to Copart,

Inc.

$

322,567

$

347,785

(7.3

)%

$

1,363,020

$

1,237,741

10.1

%

Basic net income per common share

$

0.34

$

0.36

(5.6

)%

$

1.42

$

1.30

9.2

%

Weighted average common shares

outstanding

962,515

955,773

0.7

%

960,739

953,574

0.8

%

Diluted net income per common share

$

0.33

$

0.36

(8.3

)%

$

1.40

$

1.28

9.4

%

Diluted weighted average common shares

outstanding

976,500

970,255

0.6

%

974,798

966,647

0.8

%

Copart, Inc.

Consolidated Balance

Sheets

(In thousands)

(Unaudited)

July 31, 2024

July 31, 2023

ASSETS

Current assets:

Cash, cash equivalents, and restricted

cash

$

1,514,111

$

957,395

Investment in held to maturity

securities

1,908,047

1,406,589

Accounts receivable, net

785,877

702,038

Vehicle pooling costs

132,638

123,725

Inventories

43,639

39,973

Income taxes receivable

—

6,574

Prepaid expenses and other assets

33,872

26,310

Total current assets

4,418,184

3,262,604

Property and equipment, net

3,175,838

2,844,339

Operating lease right-of-use assets

116,301

108,139

Intangibles, net

74,088

62,702

Goodwill

513,909

394,289

Other assets

129,444

65,806

Total assets

$

8,427,764

$

6,737,879

LIABILITIES, REDEEMABLE NONCONTROLLING

INTERESTS AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable and accrued

liabilities

518,148

$

440,810

Deferred revenue

28,121

26,117

Income taxes payable

60,994

4,374

Current portion of operating and finance

lease liabilities

21,304

21,468

Total current liabilities

628,567

492,769

Deferred income taxes

93,653

89,492

Income taxes payable

59,560

69,193

Operating and finance lease liabilities,

net of current portion

97,429

88,082

Long-term debt and other liabilities, net

of discount

—

10,903

Total liabilities

879,209

750,439

Commitments and contingencies

Redeemable non-controlling interest

24,544

—

Stockholders’ equity:

Preferred stock

—

—

Common stock

96

96

Additional paid-in capital

1,120,985

938,910

Accumulated other comprehensive loss

(142,972

)

(141,006

)

Retained earnings

6,545,902

5,189,440

Total stockholders’ equity

7,524,011

5,987,440

Total liabilities, redeemable

noncontrolling interests and stockholders’ equity

$

8,427,764

$

6,737,879

Copart, Inc.

Consolidated Statements of

Cash Flows

(In thousands)

(Unaudited)

Year Ended July 31,

2024

2023

Cash flows from operating

activities:

Net Income

$

1,362,347

$

1,237,741

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization, including

debt cost

190,256

159,684

Allowance for credit losses

3,914

1,946

Gain on extinguishment of liabilities

(4,058

)

—

Equity in losses of unconsolidated

affiliates

2,241

5,347

Stock-based compensation

35,234

39,673

Gain on sale of property and equipment

(2,386

)

(1,846

)

Deferred income taxes

(847

)

9,946

Changes in operating assets and

liabilities, net of effects from acquisitions:

Accounts receivable

(145,385

)

(123,207

)

Vehicle pooling costs

(9,542

)

(10,989

)

Inventories

(3,698

)

26,549

Prepaid expenses and other current and

non-current assets

(71,067

)

(59,949

)

Operating lease right-of-use assets and

lease liabilities

1,064

350

Accounts payable and accrued

liabilities

59,528

18,010

Deferred revenue

1,867

5,896

Income taxes receivable

6,561

33,193

Income taxes payable

46,535

21,866

Net cash provided by operating

activities

1,472,564

1,364,210

Cash flows from investing

activities:

Purchases of property and equipment

(510,990

)

(516,636

)

Cash acquired in connection with

acquisition

17,662

—

Proceeds from sale of property and

equipment

4,166

33,919

Investment in held to maturity

securities

(4,087,162

)

(1,406,588

)

Proceeds from the sale of held to maturity

securities

3,645,000

—

Acquisition of investment in

unconsolidated affiliates

(8,755

)

(2,744

)

Net cash used in investing activities

(940,079

)

(1,892,049

)

Cash flows from financing

activities:

Proceeds from the exercise of stock

options

24,260

49,679

Proceeds from the issuance of Employee

Stock Purchase Plan shares

12,406

11,098

Payments for employee stock-based tax

withholdings

(6,558

)

(4,709

)

Issuance of principal on revolver

facility

—

44,494

Principal payments on revolver

facility

(10,821

)

(33,924

)

Payments of finance lease obligations

(14

)

(23

)

Net cash provided by financing

activities

19,273

66,615

Effect of foreign currency translation

4,958

34,383

Net increase (decrease) in cash, cash

equivalents, and restricted cash

556,716

(426,841

)

Cash, cash equivalents, and restricted

cash at beginning of period

957,395

1,384,236

Cash, cash equivalents, and restricted

cash at end of period

$

1,514,111

$

957,395

Supplemental disclosure of cash flow

information:

Interest paid

$

3,127

$

2,614

Income taxes paid, net of refunds

$

285,891

$

257,514

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240904605993/en/

Copart Investor Relations investor.relations@copart.com

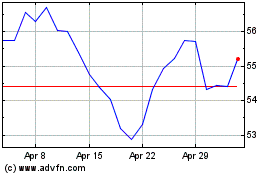

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Oct 2024 to Nov 2024

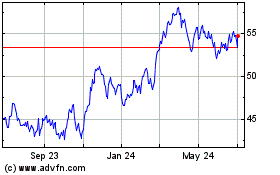

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Nov 2023 to Nov 2024