Community Trust Bancorp, Inc. (NASDAQ:CTBI): � � � � � � � � � � �

Earnings Summary � � � � � (in thousands except per share data) �

2Q 2008 � 1Q 2008 � 2Q 2007 � 6 Months 2008 � 6 Months 2007 Net

income $ 8,620 $ 8,545 $ 8,858 $ 17,165 $ 16,880 Earnings per share

$ 0.58 $ 0.57 $ 0.58 $ 1.14 $ 1.11 Earnings per share (diluted) $

0.57 $ 0.57 $ 0.57 $ 1.13 $ 1.09 � Return on average assets 1.19%

1.18% 1.18% 1.19% 1.13% Return on average equity 11.22% 11.20%

12.16% 11.21% 11.75% Efficiency ratio 57.25% 56.39% 58.22% 56.82%

61.40% � Dividends declared per share $ 0.29 $ 0.29 $ 0.27 $ 0.58 $

0.54 Book value per share $ 20.43 $ 20.48 $ 19.17 $ 20.43 $ 19.17 �

Weighted average shares 14,989 15,000 15,216 14,995 15,203 Weighted

average shares (diluted) � � 15,152 � � 15,116 � � 15,448 � �

15,145 � � 15,421 Community Trust Bancorp, Inc. (NASDAQ:CTBI)

reports earnings for the quarter ended June 30, 2008 of $0.58 per

basic share, an increase from the $0.57 earned during the quarter

ended March 31, 2008 and flat to the $0.58 per basic share earned

during the second quarter of 2007. Earnings for the quarter

increased 0.9% to $8.6 million compared to the $8.5 million earned

during the first quarter 2008 and decreased 2.7% compared to the

$8.9 million earned during the second quarter 2007. Earnings for

the six months ended June 30, 2008 increased to $17.2 million or

$1.14 per basic share from the $16.9 million or $1.11 per basic

share earned for the first six months of 2007. Second Quarter 2008

Highlights CTBI's basic earnings per share for the second quarter

2008 increased 1.8% from prior quarter as the result of a 10.7%

increase in noninterest income. Year-to-date basic earnings per

share increased 2.7% from prior year. The total 100 basis point

decline in interest rates that occurred beginning on March 18, 2008

has negatively impacted our net interest margin during the second

quarter since 37% of our loans reprice within 30 days. Our net

interest margin decreased 12 basis points from prior quarter but

increased 2 basis points from prior year second quarter. Net

interest income decreased $0.6 million from prior quarter and $0.9

million from prior year second quarter. The decrease in net

interest income from prior year second quarter resulted from a $104

million decline in average earning assets as management continues

to manage its net interest margin. Management has utilized the

liquidity from its investment portfolio to fund loans and repay $40

million in Federal Home Loan Bank advances while allowing deposits

to decline $98.9 million during the past 12 months as loan demand

has been curtailed and other investment opportunities have been

limited by current economic conditions. Noninterest income for the

quarter increased 10.7% over prior quarter and 7.9% over prior year

second quarter with increases in deposit service charges, trust

revenue, and the fair value of mortgage servicing rights. Gains on

sales of loans increased from prior year, but decreased from prior

quarter. Noninterest expense for the first six months of 2008 has

decreased $3.0 million or 6.9% from prior year primarily due to no

accrual for the company-wide incentive-based compensation plan and

the 2007 charge from unamortized debt issuance costs with the

redemption of trust preferred securities. Nonperforming loans

increased $1.6 million at June 30, 2008 to $44.2 million compared

to $42.6 million at prior quarter-end and $23.9 million for prior

year quarter ended June 30, 2007. CTBI experienced a decline in

nonperforming loans in its Eastern and Northeastern Regions while

nonperforming loans remained relatively flat in the South Central

Region and increased in the Central Kentucky Region. The increase

in the Central Kentucky Region is primarily attributable to two

borrowers adversely impacted by the continuing weakness in the

housing market and the resulting increase in time required by the

legal process for movement from foreclosure to liquidation. Our

loan portfolio increased an annualized 3.9% during the quarter with

$21.8 million in growth. Loan growth from prior year second quarter

was $58.6 million. Our investment portfolio, which is a source of

liquidity to fund loan growth, increased an annualized 6.3% from

prior quarter but declined 27.2% from prior year second quarter.

Management has utilized this liquidity in lieu of increased deposit

costs (deposits have declined $98.9 million year over year) to

support loan growth and for margin management. Our efficiency ratio

was 57.25% for the quarter ended June 30, 2008 compared to 56.39%

and 58.22% for the quarters ended March 31, 2008 and June 30, 2007,

respectively. Return on average assets for the quarter was 1.19%

compared to 1.18% for both the first quarter 2008 and the quarter

ended June 30, 2007. Return on average equity for the quarter was

11.22% compared to 11.20% for the first quarter 2008 and 12.16% for

the quarter ended June 30, 2007. Net Interest Income Our quarterly

net interest margin decreased 12 basis points from prior quarter;

however, the margin increased 2 basis points from prior year second

quarter. Net interest income for the quarter of $25.7 million was a

2.4% decrease from prior quarter and a 3.5% decrease from prior

year second quarter. The yield on average earnings assets decreased

50 basis points from prior quarter and 96 basis points from prior

year second quarter in comparison to the 44 basis point and 113

basis point decreases in the cost of interest bearing funds during

the same periods. Average earning assets increased 0.7% from prior

quarter but decreased 3.7% from prior year second quarter.

Noninterest Income Noninterest income for the second quarter 2008

increased 10.7% over prior quarter and 7.9% over prior year second

quarter with increases in deposit service charges, trust revenue,

and loan related fees. Gains on sales of loans increased from prior

year, but decreased from prior quarter. The increase in loan

related fees resulted from the increase in the fair value of

mortgage servicing rights of $0.7 million quarter over quarter and

$0.2 million year over year resulting from decreased prepayment

speeds and increased interest rates. Year-to-date noninterest

income increased 5.5% over prior year. Noninterest Expense

Noninterest expense for the quarter increased 2.2% from prior

quarter but decreased 2.4% from prior year second quarter.

Year-to-date noninterest expense has decreased 6.9% from prior year

primarily due to the 2007 charge from unamortized debt issuance

costs with the redemption of trust preferred securities and no

accrual for the company-wide incentive-based compensation plan.

Balance Sheet Review CTBI�s total assets at $2.9 billion declined

an annualized 3.6% from prior quarter and 4.1% from the $3.0

billion at June 30, 2007. Loans outstanding at June 30, 2008 were

$2.3 billion reflecting an annualized 3.9% growth during the

quarter and a 2.6% growth from June 30, 2007. CTBI's investment

portfolio increased an annualized 6.3% from prior quarter but

decreased 27.2% from June 30, 2007 with the majority of the decline

consisting of auction rate securities. Deposits, including

repurchase agreements, at $2.4 billion decreased an annualized 5.5%

from prior quarter and 3.9% from prior year second quarter as

management continued our focus on net interest margin management.

Shareholders� equity at June 30, 2008 was $306.2 million compared

to $306.8 million at March 31, 2008 and $291.7 at June 30, 2007.

CTBI's annualized dividend yield to shareholders as of June 30,

2008 was 4.42%. Asset Quality Economic conditions continue to be

challenging for both our business and individual customers.

Nonperforming loans increased during the second quarter by $1.6

million. Nonperforming loans decreased in our Eastern and

Northeastern Regions, remained relatively flat in our South Central

Region, but increased in our Central Kentucky Region. Nonperforming

loans in this region increased $4.3 million during the second

quarter 2008. The increase in nonperforming loans in the Central

Kentucky Region is primarily attributable to two borrowers

adversely impacted by the weak real estate market in Central

Kentucky which continues to experience the most stress from the

current housing crisis. We are experiencing a cumulative effect in

the increase in nonperforming loans as the legal system has

increased the time required for movement from foreclosure to sale.

CTBI's total nonperforming loans at June 30, 2008 were $44.2

million compared to $42.6 million at March 31, 2008 and $23.9

million at June 30, 2007, while our 30-89 days past due loans

declined 12.4% from $20.0 million to $17.6 million. All

nonperforming commercial loans in excess of $100 thousand are

individually reviewed with specific reserves established when

appropriate. We anticipate nonperforming loans to remain higher

than recent history as the normal legal collection time period for

real estate secured assets has been slowed due to increased volumes

in the industry. Our loan portfolio management processes focus on

maintaining appropriate reserves for potential losses. Foreclosed

properties increased during the second quarter 2008 to $9.1 million

from the $7.4 million at March 31, 2008 and the $3.9 million at

June 30, 2007. Sales of foreclosed properties during the first six

months of 2008 totaled $3.0 million while new foreclosed properties

totaled $4.2 million. Net loan charge-offs for the quarter of $2.2

million, or 0.38% of average loans annualized, was an increase from

prior quarter's 0.33% of average loans annualized and the 0.23% for

prior year second quarter. Allocations to loan loss reserve were

$2.6 million for the quarter ended June 30, 2008 compared to $2.4

million for the quarter ended March 31, 2008 and $1.8 million for

the quarter ended June 30, 2007. Our loan loss reserve as a

percentage of total loans outstanding at June 30, 2008 increased to

1.28% compared to 1.27% at March 31, 2008 and 1.25% at June 30,

2007. The adequacy of our loan loss reserve is analyzed quarterly

and adjusted as necessary. Forward-Looking Statements Certain of

the statements contained herein that are not historical facts are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act. CTBI�s actual results may differ

materially from those included in the forward-looking statements.

Forward-looking statements are typically identified by words or

phrases such as "believe," "expect," "anticipate," "intend,"

"estimate," "may increase," "may fluctuate," and similar

expressions or future or conditional verbs such as "will,"

"should," "would," and "could." These forward-looking statements

involve risks and uncertainties including, but not limited to,

economic conditions, portfolio growth, the credit performance of

the portfolios, including bankruptcies, and seasonal factors;

changes in general economic conditions including the performance of

financial markets, the performance of coal and coal related

industries, prevailing inflation and interest rates, realized gains

from sales of investments, gains from asset sales, and losses on

commercial lending activities; results of various investment

activities; the effects of competitors� pricing policies, of

changes in laws and regulations on competition and of demographic

changes on target market populations� savings and financial

planning needs; industry changes in information technology systems

on which we are highly dependent; failure of acquisitions to

produce revenue enhancements or cost savings at levels or within

the time frames originally anticipated or unforeseen integration

difficulties; the adoption by CTBI of an FFIEC policy that provides

guidance on the reporting of delinquent consumer loans and the

timing of associated credit charge-offs for financial institution

subsidiaries; and the resolution of legal proceedings and related

matters. In addition, the banking industry in general is subject to

various monetary and fiscal policies and regulations, which include

those determined by the Federal Reserve Board, the Federal Deposit

Insurance Corporation, and state regulators, whose policies and

regulations could affect CTBI�s results. These statements are

representative only on the date hereof, and CTBI undertakes no

obligation to update any forward-looking statements made. Community

Trust Bancorp, Inc., with assets of $2.9 billion, is headquartered

in Pikeville, Kentucky and has 71 banking locations across eastern,

northeast, central, and south central Kentucky, six banking

locations in southern West Virginia, and five trust offices across

Kentucky. Additional information follows. Community Trust Bancorp,

Inc. Financial Summary (Unaudited) June 30, 2008 (in thousands

except per share data and # of employees) � � � � �

ThreeMonthsEndedJune 30, 2008 ThreeMonthsEndedMarch 31, 2008

ThreeMonthsEndedJune 30, 2007 SixMonthsEndedJune 30, 2008

SixMonthsEndedJune 30, 2007 Interest income $ 41,670 $ 44,680 $

50,085 $ 86,350 $ 99,264 Interest expense � 15,988 � 18,372 �

23,474 � 34,360 � 46,763 Net interest income 25,682 26,308 26,611

51,990 52,501 Loan loss provision 2,648 2,369 1,846 5,017 2,316 �

Gains on sales of loans 494 546 316 1,040 612 Deposit service

charges 5,503 5,099 5,330 10,602 10,134 Trust revenue 1,298 1,191

1,180 2,489 2,379 Loan related fees 1,079 299 867 1,378 1,888

Securities gains - (50) - (50) - Other noninterest income � 1,307 �

1,658 � 1,281 � 2,965 � 2,459 Total noninterest income 9,681 8,743

8,974 18,424 17,472 � Personnel expense 10,600 10,711 11,100 21,311

22,214 Occupancy and equipment 2,822 2,679 2,875 5,501 5,864

Amortization of core deposit intangible 159 158 158 317 317 Other

noninterest expense � 6,862 � 6,453 � 6,805 � 13,315 � 15,039 Total

noninterest expense � 20,443 � 20,001 � 20,938 � 40,444 � 43,434 �

Net income before taxes 12,272 12,681 12,801 24,953 24,223 Income

taxes � 3,652 � 4,136 � 3,943 � 7,788 � 7,343 Net income $ 8,620 $

8,545 $ 8,858 $ 17,165 $ 16,880 � Memo: TEQ interest income $

42,015 $ 45,047 $ 50,463 $ 87,062 $ 100,034 � Average shares

outstanding 14,989 15,000 15,216 14,995 15,203 Basic earnings per

share $ 0.58 $ 0.57 $ 0.58 $ 1.14 $ 1.11 Diluted earnings per share

$ 0.57 $ 0.57 $ 0.57 $ 1.13 $ 1.09 Dividends per share $ 0.29 $

0.29 $ 0.27 $ 0.58 $ 0.54 � Average balances: Loans, net of

unearned income $ 2,264,175 $ 2,239,608 $ 2,199,233 $ 2,251,892 $

2,182,465 Earning assets 2,697,670 2,679,069 2,801,966 2,688,369

2,788,376 Total assets 2,915,382 2,900,533 3,020,931 2,907,957

3,007,806 Deposits 2,301,477 2,288,910 2,379,683 2,295,194

2,369,237 Interest bearing liabilities 2,137,503 2,142,185

2,275,637 2,139,844 2,268,097 Shareholders' equity 308,969 306,961

292,096 307,965 289,664 � Performance ratios: Return on average

assets 1.19% 1.18% 1.18% 1.19% 1.13% Return on average equity

11.22% 11.20% 12.16% 11.21% 11.75% Yield on average earning assets

(tax equivalent) 6.26% 6.76% 7.22% 6.51% 7.23% Cost of interest

bearing funds (tax equivalent) 3.01% 3.45% 4.14% 3.23% 4.16% Net

interest margin (tax equivalent) 3.88% 4.00% 3.86% 3.94% 3.85%

Efficiency ratio (tax equivalent) 57.25% 56.39% 58.22% 56.82%

61.40% � Loan charge-offs $ 2,818 $ 2,410 $ 1,843 $ 5,228 $ 3,494

Recoveries � (667) � (586) � (608) � (1,253) � (1,340) Net

charge-offs $ 2,151 $ 1,824 $ 1,235 $ 3,975 $ 2,154 � Market Price:

High $ 31.96 $ 30.87 $ 37.98 $ 31.96 $ 41.50 Low 26.25 23.38 31.40

23.38 31.40 Close 26.26 29.30 32.30 26.26 32.30 Community Trust

Bancorp, Inc. Financial Summary (Unaudited) June 30, 2008 (in

thousands except per share data and # of employees) � � As ofJune

30, 2008 � As ofMarch 31, 2008 � As ofJune 30, 2007 Assets: Loans,

net of unearned $ 2,273,646 $ 2,251,846 $ 2,215,057 Loan loss

reserve � (29,096 ) � (28,599 ) � (27,688 ) Net loans 2,244,550

2,223,247 2,187,369 Loans held for sale 1,494 1,310 3,899

Securities AFS 306,869 299,831 425,058 Securities HTM 29,296 31,137

36,689 Other equity investments 28,703 28,064 28,038 Other earning

assets 10,994 62,049 69,072 Cash and due from banks 84,169 85,414

78,214 Premises and equipment 52,448 52,823 54,369 Goodwill and

core deposit intangible 66,658 66,817 67,293 Other assets � 53,163

� � 53,792 � � 50,829 � Total Assets $ 2,878,344 � $ 2,904,484 � $

3,000,830 � � Liabilities and Equity: NOW accounts $ 17,939 $

18,691 $ 16,470 Savings deposits 625,574 650,686 669,598 CD's

>=$100,000 434,352 439,430 445,725 Other time deposits � 752,581

� � 762,727 � � 796,443 � Total interest bearing deposits 1,830,446

1,871,534 1,928,236 Noninterest bearing deposits � 447,677 � �

434,033 � � 436,702 � Total deposits 2,278,123 2,305,567 2,364,938

Repurchase agreements 142,453 148,739 154,531 Other interest

bearing liabilities 120,030 110,710 157,871 Noninterest bearing

liabilities � 31,587 � � 32,619 � � 31,833 � Total liabilities

2,572,193 2,597,635 2,709,173 Shareholders' equity � 306,151 � �

306,849 � � 291,657 � Total Liabilities and Equity $ 2,878,344 � $

2,904,484 � $ 3,000,830 � � Ending shares outstanding 14,989 14,979

15,217 Memo: Market value of HTM securities $ 29,157 $ 31,384 $

35,314 � 90 days past due loans $ 15,651 $ 14,365 $ 7,684

Nonaccrual loans 28,501 28,239 16,159 Restructured loans - - 43

Foreclosed properties 9,076 7,425 3,898 � Tier 1 leverage ratio

10.52 % 10.49 % 9.71 % Tier 1 risk based ratio 13.40 % 13.33 %

12.32 % Total risk based ratio 14.65 % 14.58 % 13.52 % FTE

employees 1,006 996 1,012 Community Trust Bancorp, Inc. Financial

Summary (Unaudited) June 30, 2008 (in thousands except per share

data and # of employees) � Community Trust Bancorp, Inc. reported

earnings for the three and six months ending June 30, 2008 and 2007

as follows: � � � � Three Months Ended Six Months Ended June 30

June 30 2008 2007 2008 2007 Net income $ 8,620 $ 8,858 $ 17,165 $

16,880 � Basic earnings per share $ 0.58 $ 0.58 $ 1.14 $ 1.11 �

Diluted earnings per share $ 0.57 $ 0.57 $ 1.13 $ 1.09 � Average

shares outstanding 14,989 15,216 14,995 15,203 � Total assets (end

of period) $ 2,878,344 $ 3,000,830 � Return on average equity 11.22

% 12.16 % 11.21 % 11.75 % � Return on average assets 1.19 % 1.18 %

1.19 % 1.13 % � Provision for loan losses $ 2,648 $ 1,846 $ 5,017 $

2,316 � Gains on sales of loans $ 494 $ 316 $ 1,040 $ 612

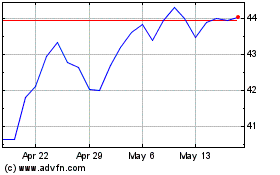

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

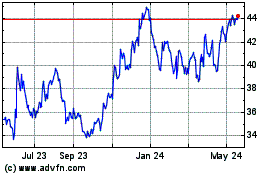

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024