Community Trust Bancorp, Inc. (NASDAQ: CTBI): Earnings Summary (in

thousands except per share data) � 4Q 2007 � 3Q 2007 � 4Q 2006 � 12

Months 2007 � 12 Months 2006 Net income � $ 9,271 � $ 10,476 � $

9,520 � $ 36,627 � $ 39,064 Earnings per share $ 0.62 $ 0.69 $ 0.63

$ 2.42 $ 2.59 Earnings per share (diluted) $ 0.61 $ 0.68 $ 0.62 $

2.38 $ 2.55 � Return on average assets 1.26% 1.39% 1.28% 1.23%

1.33% Return on average equity 12.22% 14.04% 13.45% 12.45% 14.51%

Efficiency ratio 55.60% 52.36% 57.43% 57.62% 56.67% � Dividends

declared per share $ 0.29 $ 0.27 $ 0.27 $ 1.10 $ 1.05 Book value

per share $ 20.03 $ 19.62 $ 18.63 $ 20.03 $ 18.63 � Weighted

average shares 15,042 15,183 15,154 15,150 15,086 Weighted average

shares (diluted) � � 15,192 � � 15,342 � � 15,417 � � 15,372 � �

15,300 Community Trust Bancorp, Inc. (NASDAQ:CTBI) reports earnings

for the quarter ended December 31, 2007 of $9.3 million or $0.62

per basic share compared to $10.5 million or $0.69 per share earned

during the quarter ended September 30, 2007 and $9.5 million or

$0.63 per share earned during the fourth quarter of 2006. Earnings

for year ended December 31, 2007 were $36.6 million or $2.42 per

share compared to $39.1 million or $2.59 per share earned for the

year 2006. Fourth Quarter and Year 2007 Highlights CTBI's basic

earnings per share for the fourth quarter 2007 decreased 10.1% from

prior quarter and 1.6% from prior year fourth quarter. Year-to-date

earnings per share decreased 6.6% from the year ended December 31,

2006. Current quarter and year-to-date earnings have been impacted

by an increase in provision for loan losses of $0.4 million quarter

over quarter and $2.2 million year over year. The decrease in

earnings quarter over quarter was also impacted by the third

quarter receipt of a $1.2 million fee in relation to the

termination of the acquisition of Eagle Fidelity, Inc. and the

third quarter reversal of an employee incentive accrual in the

amount of $1.5 million. Core earnings for the year 2007 reflect the

pressure on our net interest income as CTBI operated within an

inverted yield curve through most of 2007. Net interest income year

over year decreased $1.7 million. Nonperforming loans at December

31, 2007 were $31.9 million, an increase of $0.4 million over prior

quarter and a $17.7 million increase from 2006. Our loan portfolio

was relatively flat for the fourth quarter compared to prior

quarter, but increased 2.8% from December 31, 2006. The market

remains highly competitive and CTBI is continuing to focus on asset

quality and loan yield. Our investment portfolio declined 7.2% from

prior quarter and 22.1% from prior year. The year over year decline

resulted from the payment of a $40 million FHLB advance and a

decline in deposits which were funded through the sale of auction

rate securities. Our efficiency ratio improved during the year 2007

primarily resulting from the acquisition termination fee and the

reversal of the incentive accrual in the third quarter. Net

Interest Income Our quarterly net interest margin increased 16

basis points to 4.02% from prior quarter; however, there was a 12

basis point decline year over year in the year-to-date margin. Net

interest income for the quarter of $26.9 million was a slight

increase from prior quarter and prior year fourth quarter, but

year-to-date net interest income decreased $1.7 million from prior

year. The yield on average earnings assets for the year 2007

increased 17 basis points from 2006 in comparison to the 39 basis

point increase in the cost of interest bearing funds. Average

earning assets have increased 1.6% from prior year-end. Noninterest

Income Noninterest income for the fourth quarter 2007 increased

approximately $0.5 million from prior quarter after normalizing for

the receipt of the $1.2 million fee associated with the termination

of the Eagle Fidelity, Inc. acquisition in the third quarter,

primarily a result of increased deposit service charges and loan

related fees. Year-to-date noninterest income normalized increased

8.8% from the year ended December 31, 2006, with increases in gains

on sales of loans, deposit service charges, trust revenue, and loan

related fees. Noninterest Expense Noninterest expense for the

quarter increased 5.0% from prior quarter, primarily as a result of

the reversal of an employee incentive accrual in the third quarter,

but decreased 1.0% from prior year fourth quarter. Year-to-date

noninterest expense increased 3.3% as the third quarter accrual

reversal was offset by the first quarter charge related to

unamortized debt issuance costs with the redemption of trust

preferred securities. Balance Sheet Review CTBI�s total assets

decreased $26.5 million or 0.9% from prior quarter and $67.1

million or 2.3% from prior year. The year over year decrease

resulted from the payoff of a $40 million FHLB advance and a

decline in deposits which were funded through the sale of auction

rate securities. Loans outstanding at December 31, 2007 were $2.2

billion reflecting a $6.6 million or 0.3% decrease during the

quarter, and a $60.4 million or 2.8% increase year over year.

CTBI's investment portfolio decreased $29.9 million from prior

quarter and $109.2 million from prior year-end. Deposits, including

repurchase agreements, declined $27.6 million or 1.1% during the

quarter as CTBI continued its focus on managing deposit growth and

pricing controls due to its liquidity position. Deposits have

declined $50.7 million or 2.0% year over year. Shareholders� equity

of $301.4 million on December 31, 2007 was an increase of 2.2% from

September 30, 2007 and a 6.7% increase from December 31, 2006.

CTBI's annualized dividend yield to shareholders as of December 31,

2007 was 4.21%. Asset Quality Nonperforming loans at December 31,

2007 were $31.9 million compared to $31.5 million at September 30,

2007 and $14.2 million at December 31, 2006. All nonperforming

loans are individually reviewed with specific reserves established

when appropriate. The increase in nonperforming loans is driven

primarily by the increased inventory and the number of days on the

market of residential real estate developments in Central Kentucky.

We anticipate nonperforming loans to remain higher than recent

history as the normal legal collection time period for real estate

secured assets has been slowed due to increased volumes in the

industry. Our loan portfolio management processes focus on

maintaining appropriate reserves for potential losses. Foreclosed

properties at December 31, 2007 of $7.9 million were an approximate

$1.3 million increase from the $6.6 million on September 30, 2007

and an approximate $3.4 million increase from the $4.5 million on

December 31, 2006. The year over year increase was driven by a $2.6

million increase in single family residential properties from our

Central Kentucky Region where the market has softened. The market

has not experienced deflation in residential real estate, but the

time on the market before sale has extended. Net loan charge-offs

for the quarter of $2.2 million, or 0.39% of average loans

annualized, was an increase from prior quarter's 0.30% of average

loans annualized and from the 0.31% from prior year fourth quarter.

Net loan charge-offs for the year ended December 31, 2007 of 0.27%

of average loans annualized was a decrease from the 0.29% for 2006.

Our reserve for losses on loans as a percentage of total loans

outstanding at December 31, 2007 was 1.26% compared to 1.25% at

September 31, 2007 and 1.27% at December 31, 2006. The adequacy of

our reserve for losses on loans is analyzed quarterly and adjusted

as necessary. Forward-Looking Statements Certain of the statements

contained herein that are not historical facts are forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act. CTBI�s actual results may differ materially from those

included in the forward-looking statements. Forward-looking

statements are typically identified by words or phrases such as

"believe," "expect," "anticipate," "intend," "estimate," "may

increase," "may fluctuate," and similar expressions or future or

conditional verbs such as "will," "should," "would," and "could."

These forward-looking statements involve risks and uncertainties

including, but not limited to, economic conditions, portfolio

growth, the credit performance of the portfolios, including

bankruptcies, and seasonal factors; changes in general economic

conditions including the performance of financial markets, the

performance of coal and coal related industries, prevailing

inflation and interest rates, realized gains from sales of

investments, gains from asset sales, and losses on commercial

lending activities; results of various investment activities; the

effects of competitors� pricing policies, of changes in laws and

regulations on competition and of demographic changes on target

market populations� savings and financial planning needs; industry

changes in information technology systems on which we are highly

dependent; failure of acquisitions to produce revenue enhancements

or cost savings at levels or within the time frames originally

anticipated or unforeseen integration difficulties; the adoption by

CTBI of an FFIEC policy that provides guidance on the reporting of

delinquent consumer loans and the timing of associated credit

charge-offs for financial institution subsidiaries; and the

resolution of legal proceedings and related matters. In addition,

the banking industry in general is subject to various monetary and

fiscal policies and regulations, which include those determined by

the Federal Reserve Board, the Federal Deposit Insurance

Corporation, and state regulators, whose policies and regulations

could affect CTBI�s results. These statements are representative

only on the date hereof, and CTBI undertakes no obligation to

update any forward-looking statements made. Community Trust

Bancorp, Inc., with assets of $2.9 billion, is headquartered in

Pikeville, Kentucky and has 71 banking locations across eastern,

northeast, central, and south central Kentucky, five banking

locations in southern West Virginia, and five trust offices across

Kentucky. Additional information follows. Community Trust Bancorp,

Inc.Financial Summary (Unaudited)December 31, 2007(in thousands

except per share data and # of employees) � � � � � Three Months

Ended December 31, 2007 Three Months Ended September 30, 2007 Three

Months Ended December 31, 2006 Twelve Months Ended December 31,

2007 Twelve Months Ended December 31, 2006 Interest income $ 47,881

$ 49,719 $ 49,234 $ 196,864 $ 189,305 Interest expense � 20,942 � �

23,127 � � 22,496 � � 90,832 � � 81,538 � Net interest income

26,939 26,592 26,738 106,032 107,767 Loan loss provision 2,309

1,915 1,200 6,540 4,305 � Gains on sales of loans 342 384 380 1,338

1,265 Deposit service charges 5,567 5,302 5,081 21,003 20,162 Trust

revenue 1,240 1,240 1,074 4,859 3,743 Loan related fees 702 606 700

3,196 2,473 Other noninterest income � 1,351 � � 2,402 � � 1,337 �

� 6,212 � � 4,916 � Total noninterest income 9,202 9,934 8,572

36,608 32,559 � Personnel expense 10,480 9,604 11,607 42,298 44,145

Occupancy and equipment 2,902 2,843 2,779 11,609 11,467

Amortization of core deposit intangible 158 159 158 634 634 Other

noninterest expense � 6,757 � � 6,718 � � 5,962 � � 28,514 � �

24,161 � Total noninterest expense � 20,297 � � 19,324 � � 20,506 �

� 83,055 � � 80,407 � � Net income before taxes 13,535 15,287

13,604 53,045 55,614 Income taxes � 4,264 � � 4,811 � � 4,084 � �

16,418 � � 16,550 � Net income $ 9,271 � $ 10,476 � $ 9,520 � $

36,627 � $ 39,064 � � Memo: TEQ interest income $ 48,245 $ 50,098 $

49,631 $ 198,377 $ 190,879 � Average shares outstanding 15,042

15,183 15,154 15,150 15,086 Basic earnings per share $ 0.62 $ 0.69

$ 0.63 $ 2.42 $ 2.59 Diluted earnings per share $ 0.61 $ 0.68 $

0.62 $ 2.38 $ 2.55 Dividends per share $ 0.29 $ 0.27 $ 0.27 $ 1.10

$ 1.05 � Average balances: Loans, net of unearned income $

2,233,594 $ 2,222,451 $ 2,160,249 $ 2,205,431 $ 2,131,649 Earning

assets 2,694,129 2,770,100 2,727,043 2,760,014 2,717,325 Total

assets 2,918,398 2,989,727 2,951,213 2,980,713 2,942,892 Deposits

2,317,078 2,356,589 2,328,294 2,352,902 2,294,385 Interest bearing

liabilities 2,156,633 2,233,762 2,220,325 2,231,347 2,214,162

Shareholders' equity 300,952 296,001 280,707 294,106 269,202 �

Performance ratios: Return on average assets 1.26 % 1.39 % 1.28 %

1.23 % 1.33 % Return on average equity 12.22 % 14.04 % 13.45 %

12.45 % 14.51 % Yield on average earning assets (tax equivalent)

7.10 % 7.18 % 7.22 % 7.19 % 7.02 % Cost of interest bearing funds

(tax equivalent) 3.85 % 4.11 % 4.02 % 4.07 % 3.68 % Net interest

margin (tax equivalent) 4.02 % 3.86 % 3.95 % 3.90 % 4.02 %

Efficiency ratio (tax equivalent) 55.60 % 52.36 % 57.43 % 57.62 %

56.67 % � Loan charge-offs $ 2,627 $ 2,311 $ 2,413 $ 8,432 $ 9,430

Recoveries � (439 ) � (641 ) � (733 ) � (2,420 ) � (3,145 ) Net

charge-offs $ 2,188 $ 1,670 $ 1,680 $ 6,012 $ 6,285 � Market Price:

High $ 32.50 $ 33.46 $ 42.59 $ 41.50 $ 42.59 Low 26.09 26.47 36.51

26.09 30.60 Close 27.53 30.01 41.53 27.53 41.53 � � � Community

Trust Bancorp, Inc.Financial Summary (Unaudited)December 31,

2007(in thousands except per share data and # of employees) � As of

December 31, 2007 As of September 30, 2007 As of December 31, 2006

Assets: Loans, net of unearned $ 2,227,897 $ 2,234,494 $ 2,167,458

Loan loss reserve � (28,054 ) � (27,933 ) � (27,526 ) Net loans

2,199,843 2,206,561 2,139,932 Loans held for sale 2,334 1,719 1,431

Securities AFS 324,153 352,973 425,851 Securities HTM 32,959 34,107

40,508 Other equity investments 28,060 28,041 28,027 Other earning

assets 37,689 45,993 65,043 Cash and due from banks 101,412 83,804

94,336 Premises and equipment 53,391 53,650 55,665 Goodwill and

core deposit intangible 66,976 67,134 67,610 Other assets � 55,867

� � 55,160 � � 51,358 � Total Assets $ 2,902,684 � $ 2,929,142 � $

2,969,761 � � Liabilities and Equity: NOW accounts $ 18,663 $

17,942 $ 18,107 Savings deposits 636,156 664,561 669,263 CD's

>=$100,000 442,831 436,833 438,080 Other time deposits � 745,653

� � 787,171 � � 785,723 � Total interest bearing deposits 1,843,303

1,906,507 1,911,173 Noninterest bearing deposits � 449,861 � �

426,368 � � 429,994 � Total deposits 2,293,164 2,332,875 2,341,167

Repurchase agreements 158,980 146,876 161,630 Other interest

bearing liabilities 120,611 117,762 158,526 Noninterest bearing

liabilities � 28,574 � � 36,713 � � 26,063 � Total liabilities

2,601,329 2,634,226 2,687,386 Shareholders' equity � 301,355 � �

294,916 � � 282,375 � Total Liabilities and Equity $ 2,902,684 � $

2,929,142 � $ 2,969,761 � � Ending shares outstanding 15,044 15,032

15,158 Memo: Market value of HTM securities $ 32,350 $ 33,090 $

39,015 � 90 days past due loans $ 9,622 $ 12,261 $ 4,294 Nonaccrual

loans 22,237 19,192 9,863 Restructured loans 20 61 66 Foreclosed

properties 7,851 6,624 4,524 � Tier 1 leverage ratio 10.32 % 9.87 %

9.58 % Tier 1 risk based ratio 13.24 % 12.75 % 12.21 % Total risk

based ratio 14.49 % 13.99 % 13.43 % FTE employees 1,011 999 1,021

Community Trust Bancorp, Inc.Financial Summary (Unaudited)December

31, 2007(in thousands except per share data and # of employees) �

Community Trust Bancorp, Inc. reported earnings for the three and

twelve months ending December 31, 2007 and 2006 as follows: � � � �

Three Months Ended Twelve Months Ended December 31 December 31 2007

2006 2007 2006 Net income $ 9,271 $ 9,520 $ 36,627 $ 39,064 � Basic

earnings per share $ 0.62 $ 0.63 $ 2.42 $ 2.59 � Diluted earnings

per share $ 0.61 $ 0.62 $ 2.38 $ 2.55 � Average shares outstanding

15,042 15,154 15,150 15,086 � Total assets (end of period) $

2,902,684 $ 2,969,761 � Return on average equity 12.22 % 13.45 %

12.45 % 14.51 % � Return on average assets 1.26 % 1.28 % 1.23 %

1.33 % � Provision for loan losses $ 2,309 $ 1,200 $ 6,540 $ 4,305

� Gains on sales of loans $ 342 $ 380 $ 1,338 $ 1,265

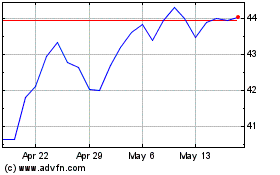

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jun 2024 to Jul 2024

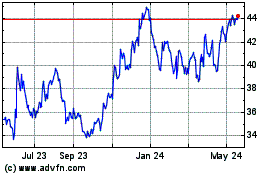

Community Trust Bancorp (NASDAQ:CTBI)

Historical Stock Chart

From Jul 2023 to Jul 2024