0001622229False00016222292023-08-082023-08-08

2i

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of The Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): August 8, 2023

COGENT BIOSCIENCES, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Delaware |

|

001-38443 |

|

46-5308248 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

275 Wyman Street, 3rd Floor

Waltham, Massachusetts |

|

02451 |

(Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code (617) 945-5576

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

|

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

|

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each

exchange on which

registered |

Common stock, $0.001 Par Value |

|

COGT |

|

The Nasdaq Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities Exchange Act of 1934.

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☒

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2023, Cogent Biosciences, Inc., a Delaware corporation (the “Company”), issued a press release announcing its financial results for the quarter ended June 30, 2023. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference in its entirety.

The information in this Item 2.02 and Exhibit 99.1 attached hereto is intended to be furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933 or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

Date: August 8, 2023 |

|

|

|

COGENT BIOSCIENCES, INC. |

|

|

|

|

|

|

|

|

By: |

|

/s/ John Green |

|

|

|

|

|

|

John Green |

|

|

|

|

|

|

Chief Financial Officer |

Exhibit 99.1

Cogent Biosciences Reports Recent Business Highlights and

Second Quarter 2023 Financial Results

Initial clinical results from Phase 2 SUMMIT trial in NonAdvSM along with updated data from Phase 2 APEX trial in AdvSM on track for 2H 2023

Enrollment for Phase 3 PEAK trial in GIST continues on track

Selective FGFR2 inhibitor nominated as first Cogent-discovered clinical candidate; additional preclinical data planned for presentation in 2H 2023

Ended 2Q 2023 with $350.9 million, sufficient to fund operations into 2026

WALTHAM, Mass. And BOULDER, Colo., August 8, 2023 – Cogent Biosciences, Inc. (Nasdaq: COGT), a biotechnology company focused on developing precision therapies for genetically defined diseases, today reported financial results for the second quarter ended June 30, 2023.

“Cogent continues to deliver on our mission to bring best-in-class therapies to patients with genetically defined diseases,” said Andrew Robbins, the Company’s President and Chief Executive Officer. “During the second quarter we presented positive data from the lead-in portion of our ongoing Phase 3 PEAK study reinforcing our belief that the combination of bezuclastinib and sunitinib has the potential to become a new treatment option for second-line GIST patients. With great support from new and existing investors, we completed a public equity offering that has put us in a very strong financial position, extending our cash runway into 2026. As we turn to the second half of 2023, we look forward to presenting initial results from the SUMMIT trial with bezuclastinib in patients with non-advanced systemic mastocytosis as well as presenting updated APEX data with bezuclastinib in patients with advanced systemic mastocytosis. Finally, we are excited to announce the selection of our FGFR2 clinical candidate, which we believe has a best-in-class potency and selectivity profile. We plan to present additional preclinical data later this year and are on track to initiate clinical trials in 2024.”

Recent Business Highlights

•Presented positive lead-in data from the ongoing Phase 3 PEAK trial evaluating bezuclastinib in combination with sunitinib in patients with Gastrointestinal Stromal Tumors (GIST) at the 2023 ASCO annual meeting.

oAs of the cutoff date of March 29, 2023, data demonstrated a 55% Disease Control Rate (DCR) in heavily pre-treated GIST patients, including 100% DCR and 17% overall response rate (ORR) in efficacy evaluable 2nd-line GIST patients.

oThe combination of bezuclastinib and sunitinib was generally well-tolerated with an encouraging safety profile.

•Selected a potent, selective, reversible FGFR2 kinase inhibitor as the first internally developed clinical candidate from the Cogent Research Team.

oIn vivo characterization of the candidate shows a novel, selective, reversible FGFR2 inhibitor that has potency against molecular brake and gatekeeper mutations, with potential advantages over current covalent approaches.

•Presented preclinical data describing a novel EGFR-sparing, brain-penetrant ErbB2 inhibitor with potency across key oncogenic ErbB2 mutations at the American Association of Cancer Research (AACR) annual meeting.

•Closed an underwritten public offering of 14,375,000 shares of common stock at a public offering price of $12.00 per share, including an additional 1,875,000 shares of common stock related to the underwriters’ option, which was exercised in full. Cogent received estimated net proceeds of approximately $161.8 million, after deducting underwriting discounts and commissions and estimated offering expenses.

Upcoming Milestones

•Present initial clinical data from SUMMIT, a randomized, double-blind, placebo-controlled, global, multicenter, Phase 2 clinical trial of bezuclastinib in patients with non-advanced systemic mastocytosis (NonAdvSM) in the second half of 2023. Data will include safety/tolerability and measures of clinical activity.

•Present updated clinical data from approximately 30 patients in Part 1 of APEX, a global, multicenter Phase 2 clinical trial of bezuclastinib in patients with advanced systemic mastocytosis (AdvSM) at a scientific meeting in the second half of 2023.

Upcoming Investor Conference

•Cogent will participate in the Morgan Stanley 21st Annual Global Healthcare Conference on Wednesday, September 13, 2023 at 8:10 a.m. ET.

oA live webcast of the event can be accessed on the Investors & Media page of Cogent’s website at investors.cogentbio.com/events. A replay will be available approximately two hours after completion of the event and will be archived for up to 30 days.

Second Quarter 2023 Financial Results

Cash Position: As of June 30, 2023, cash, cash equivalents and marketable securities were $350.9 million, as compared to $220.3 million as of March 31, 2023. The company expects its existing cash, cash equivalents and marketable securities will be sufficient to fund its operating expenses and capital expenditure requirements into 2026.

R&D Expenses: Research and development expenses were $38.9 million for the second quarter of 2023 as compared to $29.5 million for the second quarter of 2022. The increase was primarily due to costs associated with the on-going APEX, SUMMIT and PEAK clinical trials and costs related to development of the research pipeline. R&D expenses include non-cash stock compensation expense of $3.6 million for the second quarter of 2023 compared to $2.1 million for the second quarter of 2022.

G&A Expenses: General and administrative expenses were $8.2 million for the second quarter of 2023 as compared to $6.4 million for the second quarter of 2022. The increase was primarily due to the growth of the organization. G&A expenses include non-cash stock compensation expense of $3.6 million for the second quarter of 2023 compared to $2.4 million for the second quarter of 2022.

Net Loss: Net loss was $44.1 million for the second quarter of 2023 as compared to a net loss of $34.9 million for the same period of 2022.

About Cogent Biosciences, Inc.

Cogent Biosciences is a biotechnology company focused on developing precision therapies for genetically defined diseases. The most advanced clinical program, bezuclastinib, is a selective tyrosine kinase inhibitor that is designed to potently inhibit the KIT D816V mutation as well as other mutations in KIT exon 17. KIT D816V is responsible for driving systemic mastocytosis, a serious disease caused by unchecked proliferation of mast cells. Exon 17 mutations are also found in patients with advanced gastrointestinal stromal tumors (GIST), a type of cancer with strong dependence on oncogenic KIT signaling. In addition to bezuclastinib, the Cogent Research Team is developing a portfolio of novel targeted therapies to help patients fighting serious, genetically driven diseases initially targeting FGFR2 and ErbB2. Cogent Biosciences is based in Waltham, MA and Boulder, CO. Visit our website for more information at www.cogentbio.com. Follow Cogent Biosciences on social media: Twitter and LinkedIn. Information that may be important to investors will be routinely posted on our website and Twitter.

Forward Looking Statements

This press release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995, including, but not limited to, statements regarding the potential for the combination of bezuclastinib and sunitinib to become a new treatment option for second-line GIST patients, the company’s plan to present initial clinical data from SUMMIT in the second half of 2023, the company’s plan to present updated clinical data from APEX in the second half of 2023, the company’s plan to present additional preclinical data on its FGFR2 candidate in the second half of 2023 and to initiate clinical trials in 2024, the company’s anticipated cash runway into 2026, and the company’s plan to participate in the Morgan Stanley 21st Annual Global Healthcare Conference in September 2023. The use of words such as, but not limited to, "anticipate," "believe," "continue," "could," "estimate," "expect," "intend," "may," "might," "plan," "potential," "predict," "project," "should," "target," "will," or "would" and similar words expressions are intended to identify forward-looking statements. Forward-looking statements are neither historical facts nor assurances of future performance. Instead, they are based on our current beliefs, expectations and assumptions regarding the future of our business, future plans and strategies, our clinical results, the rate of enrollment in our clinical trials and other future conditions. New risks and uncertainties may emerge from time to time, and it is not possible to predict all risks and uncertainties. No representations or warranties (expressed or implied) are made about the accuracy of any such forward-looking statements. We may not actually achieve the forecasts or milestones disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking statements. Such forward-looking statements are subject to a number of material risks and uncertainties including but not limited to those set forth under the caption "Risk Factors" in Cogent's most recent Quarterly Report on Form 10-Q filed with the SEC. Any forward-looking statement speaks only as of the date on which it was made. Neither we, nor our affiliates, advisors or representatives, undertake any obligation to publicly update or revise any forward-looking statement, whether as result of new information, future events or otherwise, except as required by law. These forward-looking statements should not be relied upon as representing our views as of any date subsequent to the date hereof.

COGENT BIOSCIENCES, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands, except share and per share amounts)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended June 30, |

|

|

Six Months Ended June 30, |

|

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

38,871 |

|

|

|

29,479 |

|

|

|

74,909 |

|

|

|

54,949 |

|

General and administrative |

|

8,214 |

|

|

|

6,376 |

|

|

|

15,413 |

|

|

|

12,324 |

|

Total operating expenses |

|

47,085 |

|

|

|

35,855 |

|

|

|

90,322 |

|

|

|

67,273 |

|

Loss from operations |

|

(47,085 |

) |

|

|

(35,855 |

) |

|

|

(90,322 |

) |

|

|

(67,273 |

) |

Other income: |

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

2,741 |

|

|

|

272 |

|

|

|

5,009 |

|

|

|

379 |

|

Other income, net |

|

268 |

|

|

|

656 |

|

|

|

950 |

|

|

|

1,333 |

|

Change in fair value of CVR liability |

|

— |

|

|

|

— |

|

|

|

1,700 |

|

|

|

— |

|

Total other income, net |

|

3,009 |

|

|

|

928 |

|

|

|

7,659 |

|

|

|

1,712 |

|

Net loss |

$ |

(44,076 |

) |

|

$ |

(34,927 |

) |

|

$ |

(82,663 |

) |

|

$ |

(65,561 |

) |

Net loss per share attributable to common stockholders, basic and diluted |

$ |

(0.59 |

) |

|

$ |

(0.71 |

) |

|

$ |

(1.14 |

) |

|

$ |

(1.39 |

) |

Weighted average common shares outstanding, basic and diluted |

|

74,753,269 |

|

|

|

49,388,936 |

|

|

|

72,755,210 |

|

|

|

47,259,261 |

|

COGENT BIOSCIENCES, INC.

SELECTED CONDENSED CONSOLIDATED

BALANCE SHEET DATA

(in thousands)

(unaudited)

|

|

|

|

|

|

|

|

|

|

|

June 30, |

|

|

December 31, |

|

|

|

2023 |

|

|

2022 |

|

Cash, cash equivalents and marketable securities |

|

$ |

350,911 |

|

|

$ |

259,276 |

|

Working capital |

|

$ |

308,762 |

|

|

$ |

238,117 |

|

Total assets |

|

$ |

392,369 |

|

|

$ |

300,810 |

|

Total liabilities |

|

$ |

43,941 |

|

|

$ |

45,075 |

|

Total stockholders’ equity |

|

$ |

348,428 |

|

|

$ |

255,735 |

|

Contact:

Christi Waarich

Sr. Director, Investor Relations

christi.waarich@cogentbio.com

617-830-1653

v3.23.2

Document and Entity Information

|

Aug. 08, 2023 |

| Document Information [Line Items] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001622229

|

| Document Type |

8-K

|

| Document Period End Date |

Aug. 08, 2023

|

| Entity Registrant Name |

COGENT BIOSCIENCES, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Securities Act File Number |

001-38443

|

| Entity Tax Identification Number |

46-5308248

|

| Entity Address, Address Line One |

275 Wyman Street

|

| Entity Address, Address Line Two |

3rd Floor

|

| Entity Address, City or Town |

Waltham

|

| Entity Address, State or Province |

MA

|

| Entity Address, Postal Zip Code |

02451

|

| City Area Code |

(617)

|

| Local Phone Number |

945-5576

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Security 12b Title |

Common stock, $0.001 Par Value

|

| Trading Symbol |

COGT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

true

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

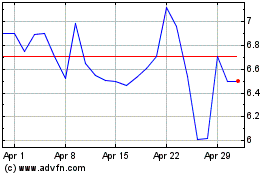

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Nov 2024 to Dec 2024

Cogent Biosciences (NASDAQ:COGT)

Historical Stock Chart

From Dec 2023 to Dec 2024