Cimpress Successfully Completes Repricing of Term Loan B and Lowers its Cost of Capital

December 11 2024 - 1:26PM

Business Wire

Cimpress plc (Nasdaq: CMPR), the parent company of VistaPrint

and other leading print mass customization businesses, today

announced the successful repricing of its $1,032 million USD

tranche of its senior secured Term Loan B (“TLB”). In addition,

Cimpress upsized the USD TLB tranche by $49 million and used the

proceeds to prepay its entire €46 million Euro TLB tranche.

Cimpress’ USD TLB tranche outstanding will be $1,081 million upon

closing in mid December 2024.

Cimpress estimates these actions will reduce annualized cash

interest expense by approximately $5 million compared to prior

pricing. When combined with our May 2024 TLB repricing and related

actions, the total annualized cash interest expense reduction on

our TLB is approximately $11 million.

These actions are net leverage neutral and reduce the interest

rate margin applicable to the USD TLB tranche by 50 basis points to

SOFR plus 2.50% from SOFR plus 3.00%.

No other material changes were made to the terms and conditions

of the TLB. The maturity date for the U.S. tranche of the TLB

remains May 17, 2028.

About Cimpress

Cimpress plc (Nasdaq: CMPR) invests in and builds

customer-focused, entrepreneurial, print mass-customization

businesses for the long term. Mass customization is a competitive

strategy which seeks to produce goods and services to meet

individual customer needs with near mass production efficiency.

Cimpress businesses include BuildASign, druck.at, Drukwerkdeal,

easyflyer, Exaprint, National Pen, Packstyle, Pixartprinting,

Printi, Tradeprint, VistaPrint, and WIRmachenDRUCK. To learn more,

visit cimpress.com.

Cimpress and the Cimpress logo are trademarks of Cimpress plc or

its subsidiaries. All other brand and product names appearing on

this announcement may be trademarks or registered trademarks of

their respective holders.

SAFE HARBOR STATEMENT:

Some of the statements in this press release are

“forward-looking” and are made pursuant to the safe harbor

provision of the Private Securities Litigation Reform Act of 1995.

These “forward-looking” statements include statements relating to,

among other things, the cash interest expense savings we expect

from the repricing actions in 2024.

These statements involve risks and uncertainties that may cause

results to differ materially from the statements set forth in this

press release, including but not limited to flaws in the

assumptions and judgments upon which our forecasts and estimates

are based; our failure to maintain compliance with the covenants in

our debt documents and to pay our debts when due; general economic

conditions; changes in interest rates; and other factors described

in Item 1A (Risk Factors) of our Annual Report on Form 10-K for the

2024 fiscal year and subsequent documents we periodically file with

the SEC.

The Company expressly disclaims any obligation or undertaking to

release publicly any updates or revisions to such statements to

reflect any change in its expectations with regard thereto or any

changes in the events, conditions or circumstances on which any

such statement is based.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241211822184/en/

Investor Relations: Meredith Burns ir@cimpress.com

+1.781.652.6480 Media Relations: Sara Litwiller

mediarelations@cimpress.com

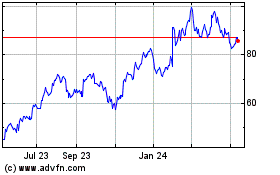

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Nov 2024 to Dec 2024

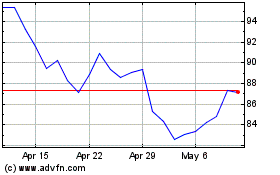

Cimpress (NASDAQ:CMPR)

Historical Stock Chart

From Dec 2023 to Dec 2024