Amended Statement of Ownership (sc 13g/a)

February 14 2020 - 2:09PM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

SCHEDULE

13G

Under

the Securities Exchange Act of 1934(Amendment No. 1)*

China

SXT Pharmaceuticals, Inc.

(Name

of Issuer)

Ordinary

Shares, $0.001 par value per share

(Title

of Class of Securities)

G2161P108

(CUSIP

Number)

December

31, 2019

(Date

of Event Which Requires Filing of this Statement)

Check

the appropriate box to designate the rule pursuant to which this Schedule is filed:

[ ]

Rule 13d-1(b)

[X]

Rule 13d-1(c)

[ ]

Rule 13d-1(d)

*The

remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the

subject class of securities, and for any subsequent amendment containing information which would alter the disclosures provided

in a prior cover page.

The

information required in the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section

18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act

but shall be subject to all other provisions of the Act (however, see the Notes).

|

1.

|

NAME

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Ayrton Capital LLC

|

|

2.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

[ ]

(b) [ ]

|

|

3.

|

SEC

USE ONLY

|

|

4.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Delaware, U.S.A

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5.

|

SOLE

VOTING POWER

2,667,999*

|

|

6.

|

SHARED

VOTING POWER

0

|

|

7.

|

SOLE

DISPOSITIVE POWER

2,667,999*

|

|

8.

|

SHARED

DISPOSITIVE POWER

0

|

|

9.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,667,999*

|

|

10.

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

[ ]

|

|

11.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99%*

|

|

12.

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS)

OO

|

|

1.

|

NAME

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Alto Opportunity Master Fund, SPC – Segregated Master Portfolio B

|

|

2.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

[ ]

(b) [ ]

|

|

3.

|

SEC

USE ONLY

|

|

4.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Cayman Islands

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5.

|

SOLE

VOTING POWER

2,667,999*

|

|

6.

|

SHARED

VOTING POWER

0

|

|

7.

|

SOLE

DISPOSITIVE POWER

2,667,999*

|

|

8.

|

SHARED

DISPOSITIVE POWER

0

|

|

9.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,667,999*

|

|

10.

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

[ ]

|

|

11.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99%*

|

|

12.

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS)

CO

|

|

1.

|

NAME

OF REPORTING PERSONS

I.R.S. IDENTIFICATION NOS. OF ABOVE PERSONS (ENTITIES ONLY)

Waqas Khatri

|

|

2.

|

CHECK

THE APPROPRIATE BOX IF A MEMBER OF A GROUP (SEE INSTRUCTIONS)

(a)

[ ]

(b) [ ]

|

|

3.

|

SEC

USE ONLY

|

|

4.

|

CITIZENSHIP

OR PLACE OF ORGANIZATION

Pakistan

|

NUMBER

OF

SHARES

BENEFICIALLY

OWNED BY

EACH

REPORTING

PERSON WITH

|

5.

|

SOLE

VOTING POWER

2,667,999*

|

|

6.

|

SHARED

VOTING POWER

0

|

|

7.

|

SOLE

DISPOSITIVE POWER

2,667,999*

|

|

8.

|

SHARED

DISPOSITIVE POWER

0

|

|

9.

|

AGGREGATE

AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

2,667,999*

|

|

10.

|

CHECK

BOX IF THE AGGREGATE AMOUNT IN ROW (9) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

[ ]

|

|

11.

|

PERCENT

OF CLASS REPRESENTED BY AMOUNT IN ROW (9)

9.99%*

|

|

12.

|

TYPE

OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

|

Item

1.

|

(a).

|

Name

of Issuer:

|

|

|

|

|

|

|

|

China

SXT Pharmaceuticals, Inc. (the “Issuer”)

|

|

|

|

|

|

|

(b).

|

Address

of issuer’s principal executive offices:

|

|

|

|

|

|

|

|

178

Taidong RD North

|

|

|

|

Taizhou,

Jiangsu, China

|

|

|

|

|

|

Item

2.

|

(a).

|

Name

of person filing:

|

|

|

|

|

|

|

|

Ayrton

Capital LLC

|

|

|

|

Alto

Opportunity Master Fund SPC -Segregated Master Portfolio B

Waqas

Khatri

|

|

|

|

|

|

|

|

Address

or principal business office or, if none, residence:

|

|

|

|

|

|

|

(b).

|

Ayrton

Capital, LLC

|

|

|

|

222

Broadway, 19th Floor

|

|

|

|

New

York, New York 10038

|

|

|

|

|

|

|

|

Alto

Opportunity Master Fund, SPC – Segregated Master Portfolio B

|

|

|

|

222

Broadway, 19th Floor

|

|

|

|

New

York, New York 10038

|

|

|

|

Waqas

Khatri

c/o

222 Broadway, 19th Floor

New

York, New York 10038

|

|

|

|

|

|

|

(c).

|

Citizenship:

|

|

|

|

|

|

|

|

Ayrton

Capital LLC – Delaware

Alto

Opportunity Master Fund SPC – Segregated Master Portfolio B – Delaware

|

|

|

|

Waqas

Khatri – Pakistan

|

|

|

|

|

|

|

(d)

|

Title

of class of securities:

|

|

|

|

|

|

|

|

Ordinary

Shares, $0.001 Par Value

|

|

|

|

|

|

|

|

CUSIP

No.:

|

|

|

|

|

|

|

(e).

|

G2161P108

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Item

3.

|

If

This Statement is filed pursuant to §§.240.13d-1(b) or 240.13d-2(b), or (c), check whether the person filing

is a

N/A

|

Provide

the following information regarding the aggregate number and percentage of the class of securities of the issuer identified in

Item 1.

|

|

(a)

|

Amount

beneficially owned:

|

Ayrton

Capital LLC – 2,667,999*

Alto

Opportunity Master Fund SPC – Segregated Master Portfolio B – 2,667,999*

Waqas

Khatri – 2,667,999*

Ayrton

Capital LLC – 9.99%*

Alto

Opportunity Master Fund SPC – Segregated Master Portfolio B – 9.99%*

Waqas

Khatri – 9.99 %*

|

|

(c)

|

Number

of shares as to which Ayrton Capital LLC has:

|

|

|

(i)

|

Sole

power to vote or to direct the vote

|

|

2,667,999*

|

,

|

|

|

|

|

|

|

|

|

|

(ii)

|

Shared

power to vote or to direct the vote

|

|

0

|

*,

|

|

|

|

|

|

|

|

|

|

(iii)

|

Sole

power to dispose or to direct the disposition of

|

|

2,667,999*

|

,

|

|

|

|

|

|

|

|

|

|

(iv)

|

Shared

power to dispose or to direct the disposition of

|

|

0

|

.

|

|

|

|

|

|

|

|

|

|

Number

of shares as to which has: Alto Opportunity Master Fund SPC – Segregated Master Portfolio B

|

|

|

|

|

|

|

|

|

|

|

|

|

(i)

|

Sole

power to vote or to direct the vote

|

|

2,667,999*

|

,

|

|

|

|

|

|

|

|

|

|

(ii)

|

Shared

power to vote or to direct the vote

|

|

0

|

,

|

|

|

|

|

|

|

|

|

|

(iii)

|

Sole

power to dispose or to direct the disposition of

|

|

2,667,999*

|

,

|

|

|

|

|

|

|

|

|

|

(iv)

|

Shared

power to dispose or to direct the disposition of

|

|

0

|

.

|

|

|

|

|

|

|

|

|

|

Number

of shares as to which Waqas Khatri has:

|

|

|

|

|

|

|

|

|

|

|

|

|

(i)

|

Sole

power to vote or to direct the vote

|

|

2,667,999*

|

,

|

|

|

|

|

|

|

|

|

|

(ii)

|

Shared

power to vote or to direct the vote

|

|

0

|

,

|

|

|

|

|

|

|

|

|

|

(iii)

|

Sole

power to dispose or to direct the disposition of

|

|

2,667,999*

|

,

|

|

|

|

|

|

|

|

|

|

(iv)

|

Shared

power to dispose or to direct the disposition of

|

|

0

|

.

|

|

*

The ordinary shares, $0.001 par value (the “Shares”) of China SXT Pharmaceuticals, Inc. (the “Company”),

reported herein are held by Alto Opportunity Master Fund SPC – Segregated Master Portfolio B (the “Fund”), which

are managed by Ayrton Capital LLC (the “Adviser”) and consist of (a) 2,000,000 ordinary shares plus (b) 667,999 warrants

and convertible notes, which are exercisable and convertible into ordinary shares on a one-for-one basis. Accordingly, for purposes

of Reg. Section 240.13d-3, the Adviser may be deemed to beneficially own an aggregate of 2,667,999 Shares, or 9.99% of the Shares

issued and outstanding as of November 5, 2019. Waqas Khatri is the Managing member of the Adviser. The beneficial ownership percentage

reported herein is based on 26,706,701 Shares issued and outstanding as of November 5, 2019, as disclosed in the Company’s

Prospectus as filed with the Securities and Exchange Commission on November 5, 2019, and includes 667,999 warrants and convertible

notes, exercisable/convertible into ordinary shares on a one-for-one basis and are exercisable/convertible within 60 days of December

31, 2019. This report shall not be deemed an admission that the Adviser, the Funds or any other person is the beneficial owner

of the securities reported herein for purposes of Section 13 of the Securities Exchange Act of 1934, as amended, or for any other

purpose. Each of the reporting persons herein disclaims beneficial ownership of the Shares reported herein except to the extent

of the reporting person’s pecuniary interest therein.

|

|

Item

5.

|

Ownership

of Five Percent or Less of a Class.

|

If

this statement is being filed to report the fact that as of the date hereof the reporting person has ceased to be the beneficial

owner of more than five percent of the class of securities, check the following.

N/A

|

Item

6.

|

Ownership

of More Than Five Percent on Behalf of Another Person.

|

If

any other person is known to have the right to receive or the power to direct the receipt of dividends from, or the proceeds from

the sale of, such securities, a statement to that effect should be included in response to this item and, if such interest relates

to more than 5 percent of the class, such person should be identified. A listing of the shareholders of an investment company

registered under the Investment Company Act of 1940 or the beneficiaries of employee benefit plan, pension fund or endowment fund

is not required.

N/A

|

Item

7.

|

Identification

and Classification of the Subsidiary Which Acquired the Security Being Reported on by the Parent Holding Company or Control

Person.

|

If

a parent holding company or control person has filed this schedule, pursuant to Rule 13d-1(b)(1)(ii)(G), so indicate under Item

3(g) and attach an exhibit stating the identity and the Item 3 classification of the relevant subsidiary. If a parent holding

company or control person has filed this schedule pursuant to Rule 13d-1(c) or Rule 13d-1(d), attach an exhibit stating the identification

of the relevant subsidiary.

N/A

|

Item

8.

|

Identification

and Classification of Members of the Group.

|

If

a group has filed this schedule pursuant to §240.13d-1(b)(1)(ii)(J), so indicate under Item 3(j) and attach an exhibit stating

the identity and Item 3 classification of each member of the group. If a group has filed this schedule pursuant to Rule 13d- 1(c)

or Rule 13d-1(d), attach an exhibit stating the identity of each member of the group.

N/A

|

Item

9.

|

Notice

of Dissolution of Group.

|

Notice

of dissolution of a group may be furnished as an exhibit stating the date of the dissolution and that all further filings with

respect to transactions in the security reported on will be filed, if required, by members of the group, in their individual capacity.

See Item 5.

N/A

By

signing below I certify that, to the best of my knowledge and belief, the securities referred to above were not acquired and are

not held for the purpose of or with the effect of changing or influencing the control of the issuer of the securities and were

not acquired and are not held in connection with or as a participant in any transaction having that purpose or effect, other than

activities solely in connection with a nomination under § 240.14a-11.

SIGNATURE

After

reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true,

complete and correct.

|

Dated:

February 14, 2020

|

Ayrton

Capital LLC

|

|

|

|

|

|

|

By:

|

/s/

Waqas Khatri

|

|

|

Name:

|

Waqas

Khatri

|

|

|

Title:

|

Managing

Member

|

|

|

|

|

|

|

Alto

Opportunity Master Fund SPC – Segregated Master Portfolio B

|

|

|

|

|

|

|

By:

|

/s/

Waqas Khatri

|

|

|

Name:

|

Waqas

Khatri

|

|

|

Title:

|

Managing

Member

|

|

|

|

|

|

|

Ayrton

Capital LLC

|

|

|

|

|

|

By

|

Waqas

Khatri

|

|

|

|

|

|

|

By:

|

/s/

Waqas Khatri

|

|

|

Name:

|

Waqas

Khatri

|

|

|

Title:

|

Managing

Member

|

The

original statement shall be signed by each person on whose behalf the statement is filed or his authorized representative. If

the statement is signed on behalf of a person by his authorized representative other than an executive officer or general partner

of the filing person, evidence of the representative’s authority to sign on behalf of such person shall be filed with the

statement, provided, however, that a power of attorney for this purpose which is already on file with the Commission may be incorporated

by reference. The name and any title of each person who signs the statement shall be typed or printed beneath his signature.

Note.

Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See s.240.13d-7

for other parties for whom copies are to be sent.

Attention.

Intentional misstatements or omissions of fact constitute Federal criminal violations (see 18 U.S.C. 1001).

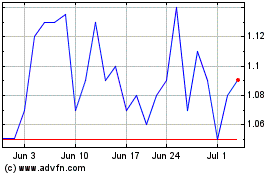

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Jan 2025 to Feb 2025

China SXT Pharmaceuticals (NASDAQ:SXTC)

Historical Stock Chart

From Feb 2024 to Feb 2025