false

0001354866

0001354866

2024-12-10

2024-12-10

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 10, 2024

BYRNA TECHNOLOGIES INC.

(Exact name of registrant as specified in its charter)

Delaware

(State or other jurisdiction of incorporation)

| |

333-132456

|

|

71-1050654

|

|

| |

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

|

100 Burtt Road, Suite 115

Andover, MA 01810

(Address and Zip Code of principal executive offices)

(978) 868-5011

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| |

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

| |

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

| |

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

| |

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of exchange on which registered

|

|

Common Stock, $0.001 par value

|

BYRN

|

Nasdaq Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition

|

On December 10, 2024, Byrna Technologies Inc. (the “Company”) issued a press release announcing the Company’s preliminary revenue expectations for its fourth fiscal quarter and fiscal year ended November 30, 2024. A copy of the press release is attached as Exhibit 99.1 to this Current Report on Form 8-K. The attached Exhibit 99.1 is furnished pursuant to Item 2.02 of Form 8-K.

The information in Item 2.02 and Item 9.01, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, or otherwise subject to the liability of such section, nor shall it be deemed incorporated by reference in any filing of the Company under the Securities Act of 1933 or the Securities Exchange Act of 1934, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

| |

|

|

|

99.1*

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

|

*

|

Furnished but not filed.

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

BYRNA TECHNOLOGIES INC.

|

|

| |

|

|

|

Date: December 10, 2024

|

By:

|

/s/ Laurilee Kearnes

|

|

| |

|

Name: Laurilee Kearnes

Title: Chief Financial Officer

|

|

Exhibit 99.1

Byrna Technologies Announces Preliminary Fiscal Fourth Quarter

Record Revenues of $28.0 Million

Full Year 2024 Revenues of $85.8 Million Are Up More Than 100% From Last Year

ANDOVER, Mass., December 10, 2024 - Byrna Technologies Inc. (“Byrna” or the “Company”) (Nasdaq: BYRN), a technology company, specializing in the development, manufacture, and sale of innovative less-lethal personal security solutions, today announced select preliminary financial results for the fiscal fourth quarter ended November 30, 2024.

Preliminary Fourth Quarter Results

Based on preliminary unaudited results, the Company expects total revenue for the fiscal fourth quarter of 2024 to be $28.0 million, representing a 79% increase compared to $15.6 million in the fiscal fourth quarter of 2023. Full-year revenue is expected to be a record $85.8 million, more than doubling the $42.6 million reported in fiscal year 2023. Launcher production for the fourth quarter in Fort Wayne, Indiana exceeded 55,000 launchers.

The significant year-over-year growth in fourth quarter revenue is primarily attributable to the continued success of Byrna’s marketing strategies, bolstered by traditionally strong holiday sales in November. As a result, Byrna’s e-commerce channels were up $8.9 million over last year, representing 76% of Byrna’s total sales for the quarter. Increased production capacity, which exceeded 55,000 launchers produced in the quarter, allowed the Company to easily meet the growing demand while maintaining adequate inventory levels ahead of what is expected to be a very strong December. International sales were also up $1.0 million year-over-year, including $43,000 of royalty revenue coming from Byrna’s new agreement with Byrna LATAM.

Black Friday and Cyber Monday sales on Byrna.com are not included in the Q4 or full-year 2024 results due to the timing of these dates in relation to the Company’s fiscal year end. Orders taken from Thanksgiving, November 28, 2024, through Cyber Monday, December 2, 2024, will be included in Byrna’s Q1 2025 results. These orders have already been shipped out to customers, as Byrna’s fulfillment team has expanded and is now able to ship more than 2,000 packages to customers in a single day.

Management Commentary

“This year, we solidified our position as the leader in the personal less-lethal self-defense product category, driving awareness and adoption of Byrna launchers while normalizing the less-lethal personal security market,” said Byrna CEO Bryan Ganz. “We’ve built remarkable momentum, both growing brand awareness and normalizing less-lethal products as a viable alternative to lethal weapons. While we are still in the early innings of Byrna’s growth trajectory, we believe that the continued growth of our Direct-to-Consumer sales, the upcoming launch of several new Byrna-owned retail stores, and the much anticipated release of Byrna’s materially smaller compact launcher next summer underpins Byrna’s enormous growth potential. We’re looking forward to sustaining this momentum through the holiday season and into 2025 as we continue bringing less-lethal alternatives to individuals and law enforcement professionals.”

Preliminary Fiscal Fourth Quarter 2024 Sales Breakdown:

| |

|

Q4 2024 vs. Q4 2023

|

|

|

Sales Channel ($ in millions)

|

|

Q4 2024

|

|

|

Q4 2023

|

|

|

% Change

|

|

|

Web

|

|

$ |

21.3 |

|

|

$ |

12.4 |

|

|

|

71 |

% |

|

Byrna Dedicated Dealers

|

|

$ |

5.4 |

|

|

$ |

3.0 |

|

|

|

78 |

% |

|

Law Enforcement / Schools / Pvt Security

|

|

$ |

0.1 |

|

|

$ |

0.1 |

|

|

|

(46% |

) |

|

Retail Stores

|

|

$ |

0.3 |

|

|

$ |

0.2 |

|

|

|

59 |

% |

|

International

|

|

$ |

0.9 |

|

|

$ |

(0.1 |

) |

|

|

N/A |

|

|

Total Sales

|

|

$ |

28.0 |

|

|

$ |

15.6 |

|

|

|

79 |

% |

Conference Call

Byrna plans to report its full financial results for the fiscal fourth quarter and full year 2024 in February, which will be accompanied by a conference call to discuss the results and address questions from investors and analysts. The conference call details will be announced prior to the event.

About Byrna Technologies Inc.

Byrna is a technology company specializing in the development, manufacture, and sale of innovative non-lethal personal security solutions. For more information on the Company, please visit the corporate website here or the Company's investor relations site here. The Company is the manufacturer of the Byrna® SD personal security device, a state-of-the-art handheld CO2 powered launcher designed to provide a non-lethal alternative to a firearm for the consumer, private security, and law enforcement markets. To purchase Byrna products, visit the Company's e-commerce store.

Forward-Looking Statements

This news release contains “forward-looking statements” within the meaning of the securities laws. All statements contained in this news release, other than statements of current and historical fact, are forward-looking. Often, but not always, forward-looking statements can be identified by the use of words such as “plans,” “expects,” “intends,” “anticipates,” and “believes” and statements that certain actions, events or results “may,” “could,” “would,” “should,” “might,” “occur,” “be achieved,” or “will be taken.” Forward-looking statements include descriptions of currently occurring matters which may continue in the future. Forward-looking statements in this news release include, but are not limited to, our statements related to preliminary revenue results for the fourth fiscal quarter and fiscal year 2024, the timing of the release of full financial results for the quarter, trends regarding brand recognition and future sales potential, sales during the holiday season and during 2025, and the Company’s plans to open Company-owned retail stores. Forward-looking statements are not, and cannot be, a guarantee of future results or events. Forward-looking statements are based on, among other things, opinions, assumptions, estimates, and analyses that, while considered reasonable by the Company at the date the forward-looking information is provided, inherently are subject to significant risks, uncertainties, contingencies, and other factors that may cause actual results and events to be materially different from those expressed or implied.

Any number of risk factors could affect our actual results and cause them to differ materially from those expressed or implied by the forward-looking statements in this news release, including, but not limited to, disappointing market responses to current or future products or services; prolonged, new, or exacerbated disruption of the Company’s supply chain; the further or prolonged disruption of new product development; production or distribution or delays in entry or penetration of sales channels due to inventory constraints, competitive factors, increased shipping costs or freight interruptions; prototype, parts and material shortages, particularly of parts sourced from limited or sole source providers; determinations by third party controlled distribution channels not to carry or reduce inventory of the Company's products; determinations by advertisers to prohibit marketing of some or all Byrna products; the loss of marketing partners; potential cancellations of existing or future orders including as a result of any fulfillment delays, introduction of competing products, negative publicity, or other factors; product design defects or recalls; litigation, enforcement proceedings or other regulatory or legal developments; changes in consumer or political sentiment affecting product demand; regulatory factors including the impact of commerce and trade laws and regulations; import-export related matters or sanctions or embargos that could affect the Company's supply chain or markets; delays in planned operations related to licensing, registration or permit requirements; and future restrictions on the Company's cash resources, increased costs and other events that could potentially reduce demand for the Company's products or result in order cancellations. The order in which these factors appear should not be construed to indicate their relative importance or priority. We caution that these factors may not be exhaustive; accordingly, any forward-looking statements contained herein should not be relied upon as a prediction of actual results. Investors should carefully consider these and other relevant factors, including those risk factors in Part I, Item 1A, (“Risk Factors”) in the Company's most recent Form 10-K, should understand it is impossible to predict or identify all such factors or risks, should not consider the foregoing list, or the risks identified in the Company's SEC filings, to be a complete discussion of all potential risks or uncertainties, and should not place undue reliance on forward-looking information. The Company assumes no obligation to update or revise any forward-looking information, except as required by applicable law.

Investor Contact:

Tom Colton and Alec Wilson

Gateway Group, Inc.

949-574-3860

BYRN@gateway-grp.com

v3.24.3

Document And Entity Information

|

Dec. 10, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BYRNA TECHNOLOGIES INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Dec. 10, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

333-132456

|

| Entity, Tax Identification Number |

71-1050654

|

| Entity, Address, Address Line One |

100 Burtt Road, Suite 115

|

| Entity, Address, City or Town |

Andover

|

| Entity, Address, State or Province |

MA

|

| Entity, Address, Postal Zip Code |

01810

|

| City Area Code |

978

|

| Local Phone Number |

868-5011

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BYRN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001354866

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

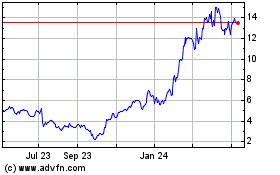

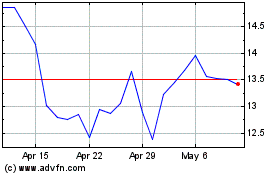

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Nov 2024 to Dec 2024

Byrna Technologies (NASDAQ:BYRN)

Historical Stock Chart

From Dec 2023 to Dec 2024