BurgerFi International, Inc. (NASDAQ: BFI, BFIIW)

(“BurgerFi” or the “Company”), owner of the high-quality, casual

dining pizza brand under the name Anthony’s Coal Fired Pizza &

Wings (“Anthony’s”) and one of the nation’s leading fast-casual

“better burger” dining concepts through the BurgerFi brand,

announced today several key initiatives with the goal of enhancing

the Company’s prospects and ensuring stable Management as the

Company goes through the process of reviewing strategic

alternatives.

The Board of Directors of BurgerFi has formed a special

committee of Directors and retained Kroll Securities, LLC (Joshua

Benn; joshua.benn@kroll.com / Tel. 1 (212) 450-2840) as its

exclusive financial advisor to support an ongoing evaluation of

strategic alternatives.

"We are committed to considering all potential strategic

alternatives. While we are confident in the Company's current

operating strategy, we are mindful of the Company’s current

liquidity challenges and are committed to exploring strategic

alternatives that we believe would be in the best interests of the

Company and its stakeholders," said David Heidecorn, a member of

the Board of Directors who was recently appointed Chairman of the

Board. Mr. Heidecorn, a Senior Advisor to and former Partner of L

Catterton, was designated as the successor to Ophir Sternberg, who

resigned all positions with the Company on May 23, 2024, including

as Executive Chairman of the Board, effective immediately.

There can be no assurance, however, that the strategic review

process will result in an outcome favorable to the Company or its

stakeholders. The Company does not currently intend to comment

further on this strategic review process and will make further

announcements in accordance with its ongoing disclosure obligations

and pursuant to applicable laws and regulations.

The Company has entered into a Forbearance Agreement and

Seventeenth Amendment to its existing credit facilities with TREW

Capital Management Private Credit 2 LLC (“TREW”), pursuant to which

the secured parties under the credit facilities agreed to forbear

from exercising their rights under the credit documents until at

least July 31, 2024. In addition, L Catterton and TREW have

each agreed to lend up to $2 million ($4 million collectively) to

assist the Company during this strategic review process.

To demonstrate a commitment to the Company and senior

management, the Company has entered into separate retention

agreements with its CEO, Carl Bachmann, and CFO, Christopher E.

Jones, with a goal of ensuring steady leadership as the Company

proceeds with the strategic review process.

About BurgerFi International (Nasdaq: BFI,

BFIIW)

BurgerFi International, Inc. is a leading

multi-brand restaurant company that develops, markets, and acquires

fast-casual and premium-casual dining restaurant concepts around

the world, including corporate-owned stores and franchises.

BurgerFi International, Inc. is the owner and franchisor of the two

following brands with a combined 162 locations.

Anthony’s. Anthony’s is a

premium pizza and wing brand with 60 restaurants (59

corporate-owned casual restaurant locations and one dual brand

franchise location), as of April 1, 2024. Known for serving fresh,

never frozen and quality ingredients, Anthony’s is centered around

a 900-degree coal-fired oven with menu offerings including

“well-done” pizza, coal-fired chicken wings, homemade meatballs,

and a variety of handcrafted sandwiches and salads. Anthony’s was

named “The Best Pizza Chain in America" by USA Today's Great

American Bites, “Top 3 Best Major Pizza Chain” by Mashed in 2021,

“The Absolute Best Wings in the U.S.” by Mashed in 2022, and named

in “America's Favorite Restaurant Chains of 2022” by Newsweek.

BurgerFi. BurgerFi is

among the nation’s fast-casual better burger concepts with 102

BurgerFi restaurants (75 franchised and 27 corporate-owned) as of

April 1, 2024. BurgerFi is chef-founded and committed to serving

fresh, all-natural and quality food at all locations, online and

via first-party and third-party deliveries. BurgerFi uses 100%

American Angus Beef with no steroids, antibiotics, growth hormones,

chemicals or additives. BurgerFi's menu also includes high-quality

Wagyu Beef Blend Burgers, All-Natural Chicken offerings, Hand-Cut

Sides, and Frozen Custard Shakes. BurgerFi was named "The Very Best

Burger" at the 2023 edition of the nationally acclaimed SOBE Wine

and Food Festival and “Best Fast Food Burger” in USA Today’s 10Best

2023 Readers’ Choice Awards for its BBQ Rodeo Burger, "Best Fast

Casual Restaurant" in USA Today's 10Best 2023 Readers' Choice

Awards for the third consecutive year, QSR Magazine's Breakout

Brand of 2020 and Fast Casual's 2021 #1 Brand of the Year. In 2021,

Consumer Reports awarded BurgerFi an “A Grade Angus Beef” rating

for the third consecutive year. To learn more about BurgerFi or to

find a full list of locations, please visit www.burgerfi.com.

BurgerFi® is a Registered Trademark of BurgerFi IP, LLC, a

wholly-owned subsidiary of BurgerFi.

Forward-Looking Statements

This press release may contain “forward-looking

statements” as defined in the Private Securities Litigation Reform

Act of 1995, including statements relating to BurgerFi's ability to

maintain continuity of its management. Forward-looking statements

generally can be identified by words such as “anticipates,”

“believes,” “estimates,” “expects,” “intends,” “plans,” “predicts,”

“projects,” “will be,” “will continue,” “will likely result,” and

similar expressions. These forward-looking statements are based on

current expectations and assumptions that are subject to risks and

uncertainties, which could cause our actual results to differ

materially from those reflected in the forward-looking statements.

Factors that could cause or contribute to such differences include,

but are not limited to, those discussed in our Annual Report on

Form 10-K for the year ended January 1, 2024, our subsequent

Quarterly Reports on Form 10-Q, and those discussed in other

documents we file with the Securities and Exchange Commission,

including our ability to continue to access liquidity, to pursue

and enter into a strategic transaction or seek a strategic

transaction while in bankruptcy protections, to maintain our

listing on the Nasdaq Stock Exchange, and to continue as a going

concern, as well as to successfully realize the expected benefits

of the acquisition of Anthony’s, or any other factors. All

subsequent written and oral forward-looking statements attributable

to BurgerFi or persons acting on BurgerFi’s behalf are expressly

qualified in their entirety by the cautionary statements included

in this press release. We undertake no obligation to revise or

publicly release the results of any revision to these

forward-looking statements, except as required by law. Given these

risks and uncertainties, readers are cautioned not to place undue

reliance on such forward-looking statements.

Investor

Relations:ICR

Michelle

MichalskiIR-BFI@icrinc.com646-277-1224

Company

Contact:BurgerFi International

Inc.IR@burgerfi.com

Media Relations Contact:Ink

Link MarketingKim MillerKmiller@inklinkmarketing.com

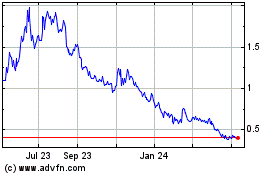

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Dec 2024 to Jan 2025

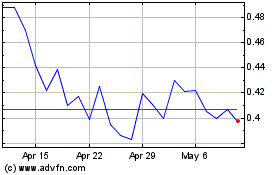

BurgerFi (NASDAQ:BFI)

Historical Stock Chart

From Jan 2024 to Jan 2025