UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a - 16 or 15d -16

Under the Securities Exchange Act of 1934

For the Month of November 2024

Commission file number 001-14184

B.O.S. Better Online Solutions Ltd.

(Translation of Registrant's Name into English)

20 Freiman Street, Rishon LeZion, 7535825, Israel

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form

40-F ☐

B.O.S. Better Online Solutions Ltd.

The GAAP financial statements, included in the Press

Release that is attached to this Form 6-K, are hereby incorporated by reference into all effective Registration Statements filed by us

under the Securities Act of 1933, as amended, to the extent not superseded by documents or reports subsequently filed or furnished.

The following exhibit is attached:

Signature

Pursuant to the requirements of the Securities Exchange

Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

B.O.S. Better Online Solutions Ltd. |

| |

(Registrant) |

| |

|

|

| |

By: |

/s/ Moshe Zeltzer |

| |

|

Moshe Zeltzer |

| |

|

Chief Financial Officer |

Dated: November 27, 2024

EXHIBIT INDEX

3

Exhibit 99.1

BOS Reports Financial Results for the Third

Quarter of the

Year 2024

RISHON LE ZION, Israel, November 27, 2024 –

BOS Better Online Solutions Ltd. (“BOS” or the “Company”) (NASDAQ: BOSC) a global integrator for supply chain technologies,

reported its financial results for the third quarter of the year 2024.

Third Quarter 2024 Statements of Operations

Highlights:

| ● | Revenues for the third quarter amounted to

$9.83 million, roughly unchanged from the comparable quarter last year. |

| | | |

| ● | Gross profit margin for the third quarter

of 2024 increased to 21.9% compared to 20.9% in the comparable quarter last year. |

| | | |

| ● | Operating profit for the third quarter

of 2024 increased by 24.8% to $551,000 from $441,000 in the comparable quarter last year. |

| | | |

| ● | EBITDA for the third quarter of 2024

increased by 18.3% to $710,000 compared to $600,000 in the comparable quarter last year. |

| | | |

| ● | Financial income for the third quarter of

2024 amounted to $24,000, compared to financial expenses of $(128,000) in the comparable quarter last year. |

| | | |

| ● | Net income for the third quarter of

2024 increased by 83.1% to $574,000 compared to $313,000 in the comparable quarter last year. |

| | | |

| ● | Basic net income per share for

the third quarter of 2024 doubled to $0.10 compared to $0.05 in the comparable quarter last year. |

Eyal Cohen, BOS’ CEO, stated: “We are

pleased with our third-quarter and nine-month results, which highlight improved profitability driven primarily by enhanced operational

efficiency and higher product mix margins. However, we now anticipate falling short of our projected $46 million annual revenue target,

and expect to close 2024 with approximately $40 million in revenues. This shortfall stems largely from the delay in the delivery of customer

orders, which we had anticipated for completion before year-end.

That said, we do remain on track to achieve our net income target of

$2.2 million in 2024, demonstrating our ability to manage costs effectively and maintain profitability in spite of the interim decrease

in revenues.

Looking ahead, we are optimistic about our growth

prospects for next year, as a significant portion of our revenues is defense-oriented—an industry experiencing strong and sustained

growth. This optimism is reinforced by the 15% increase in our backlog to $23 million as of September 30, 2024, compared to $20.1 million

at the end of 2023, as well as the $2.7 million order from a defense customer that we announced earlier this month. We look forward to

sharing our financial guidance for 2025 in January.”

Ziv Dekel, BOS’ Chairman, stated: “As we look

to the future, our growth strategy is built on two key pillars: deepening our penetration in the defense sector and expanding our international

sales. We will continue to strengthen our relationships with our strategic defense customers by broadening our offerings, and ensuring

that we meet their evolving needs. In parallel, we aim to expand our sales overseas by leveraging our relationships with Israeli defense

customers that operate globally. By aligning with their international activities and providing tailored solutions, we can tap into new

opportunities within the growing global defense market.”

BOS will host a video conference call on November

27, 2024 at 8:30 a.m. EST.

To access the video conference call, please click on the following link:

https://us06web.zoom.us/j/83701495535?pwd=5rANXKpCp1hbrHYRIHIBIdKbBZSaUF.1

For those unable to listen to the live call,

a replay of the call will be available the next day on the BOS website: http://www.boscom.com

About BOS

BOS integrates cutting-edge technologies to streamline

and enhance supply chain operations across three specialized divisions:

| ● | Intelligent

Robotics Division: Automates industrial and logistics inventory processes through advanced robotics technologies, improving efficiency

and precision. |

| ● | RFID

Division: Optimizes inventory management with state-of-the-art solutions for marking and tracking, ensuring real-time visibility

and control. |

| ● | Supply

Chain Division: Integrates franchised components directly into client products, meeting their evolving needs for developing cutting-edge

products. |

For additional information,

contact: Eyal Cohen, CEO

+972-542525925 | eyalc@boscom.com

Use of Non-GAAP Financial Information

BOS reports financial results in accordance with

US GAAP and herein provides some non-GAAP measures. These non-GAAP measures are not in accordance with, nor are they a substitute for,

GAAP measures. These non-GAAP measures are intended to supplement the Company’s presentation of its financial results that are prepared

in accordance with GAAP. The Company uses the non-GAAP measures presented to evaluate and manage the Company’s operations internally.

The Company is also providing this information to assist investors in performing additional financial analysis that is consistent with

financial models developed by research analysts who follow the Company. The reconciliation set forth below is provided in accordance with

Regulation G and reconciles the non-GAAP financial measures with the most directly comparable GAAP financial measures.

Safe Harbor Regarding Forward-Looking Statements

The forward-looking statements contained herein reflect

management’s current views with respect to future events and financial performance. These forward-looking statements are subject

to certain risks and uncertainties that could cause the actual results to differ materially from those in the forward-looking statements,

all of which are difficult to predict and many of which are beyond the control of BOS. These risk factors and uncertainties include, amongst

others, the dependency of sales being generated from one or few major customers, the uncertainty of BOS being able to maintain current

gross profit margins, inability to keep up or ahead of technology and to succeed in a highly competitive industry, inability to maintain

marketing and distribution arrangements and to expand our overseas markets, uncertainty with respect to the prospects of legal claims

against BOS, the effect of exchange rate fluctuations, general worldwide economic conditions, the continued availability of financing

for working capital purposes and to refinance outstanding indebtedness; and additional risks and uncertainties detailed in BOS’

periodic reports and registration statements filed with the US Securities and Exchange Commission.

In October 2023, Hamas terrorists infiltrated Israel’s

southern border from the Gaza Strip and conducted a series of attacks on civilian and military targets. Hamas also launched extensive

rocket attacks on Israeli population and industrial centers located along Israel’s border with the Gaza Strip and in other areas

within the State of Israel. Following the attack, Israel’s security cabinet declared war against Hamas and a military campaign against

these terrorist organizations commenced in parallel to their continued rocket and terror attacks. Moreover, in response to extensive rocket

attacks by Hezbollah on Israel, Israel has launched a military campaign in Lebanon. The clash between Israel and Hezbollah in Lebanon,

may escalate in the future into a greater regional conflict. It is currently not possible to predict the duration or severity of the ongoing

conflicts or their long term effects on our business, operations and financial conditions. The ongoing conflicts are rapidly evolving

and developing, and could disrupt our business and operations, interrupt our sources and availability of supply and hamper our ability

to raise additional funds or sell our securities, among others.

BOS undertakes no obligation to publicly update or

revise any forward-looking statements to reflect any change in its expectations or in events, conditions or circumstances on which any

such statements may be based, or that may affect the likelihood that actual results will differ from those set forth in the forward-looking

statements.

CONSOLIDATED

STATEMENTS OF OPERATIONS

U.S. dollars in thousands

| | |

Nine months ended

September

30, | | |

Three months ended

September

30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

(Unaudited) | | |

(Unaudited) | |

| | |

| | |

| | |

| | |

| |

| Revenues | |

$ | 29,561 | | |

$ | 33,292 | | |

$ | 9,827 | | |

$ | 9,815 | |

| Cost of revenues | |

| 22,648 | | |

| 26,174 | | |

| 7,672 | | |

| 7,765 | |

| Gross profit | |

| 6,913 | | |

| 7,118 | | |

| 2,155 | | |

| 2,050 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating costs and expenses: | |

| | | |

| | | |

| | | |

| | |

| Research and development | |

| 125 | | |

| 114 | | |

| 41 | | |

| 36 | |

| Sales and marketing | |

| 3,276 | | |

| 3,612 | | |

| 1,063 | | |

| 1,143 | |

| General and administrative | |

| 1,457 | | |

| 1,342 | | |

| 500 | | |

| 430 | |

| Total operating costs and expenses | |

| 4,858 | | |

| 5,068 | | |

| 1,604 | | |

| 1,609 | |

| | |

| | | |

| | | |

| | | |

| | |

| Operating income | |

| 2,055 | | |

| 2,050 | | |

| 551 | | |

| 441 | |

| Financial income (expenses), net | |

| (238 | ) | |

| (471 | ) | |

| 24 | | |

| (128 | ) |

| Income before taxes on income | |

| 1,817 | | |

| 1,579 | | |

| 575 | | |

| 313 | |

| Taxes on income | |

| 2 | | |

| - | | |

| 1 | | |

| - | |

| Net income | |

$ | 1,815 | | |

$ | 1,579 | | |

$ | 574 | | |

$ | 313 | |

| | |

| | | |

| | | |

| | | |

| | |

| Basic net income per share | |

$ | 0.32 | | |

$ | 0.28 | | |

$ | 0.10 | | |

$ | 0.05 | |

| Diluted net income per share | |

$ | 0.31 | | |

$ | 0.27 | | |

$ | 0.10 | | |

$ | 0.05 | |

| Weighted average number of shares used in computing basic net income per share | |

| 5,750 | | |

| 5,720 | | |

| 5,753 | | |

| 5,747 | |

| Weighted average number of shares used in computing diluted net income per share | |

| 5,854 | | |

| 5,913 | | |

| 5,884 | | |

| 6,086 | |

| Number of outstanding shares as of September 30, 2024 and 2023 | |

| 5,761 | | |

| 5,748 | | |

| 5,761 | | |

| 5,748 | |

CONSOLIDATED

BALANCE SHEETS

(U.S. dollars

in thousands)

| | |

September 30,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| ASSETS | |

| | |

| |

| | |

| | |

| |

| CURRENT ASSETS: | |

| | |

| |

| Cash and cash equivalents | |

$ | 2,014 | | |

$ | 2,344 | |

| Restricted bank deposits | |

| 204 | | |

| 217 | |

| Trade receivables | |

| 11,449 | | |

| 12,424 | |

| Other accounts receivable and prepaid expenses | |

| 1,299 | | |

| 963 | |

| Inventories | |

| 6,527 | | |

| 6,070 | |

| | |

| | | |

| | |

| Total current assets | |

| 21,493 | | |

| 22,018 | |

| | |

| | | |

| | |

| LONG-TERM ASSETS | |

| 184 | | |

| 196 | |

| | |

| | | |

| | |

| PROPERTY AND EQUIPMENT, NET | |

| 3,360 | | |

| 3,268 | |

| | |

| | | |

| | |

| OPERATING LEASE RIGHT-OF-USE ASSETS, NET | |

| 833 | | |

| 1,026 | |

| | |

| | | |

| | |

| OTHER INTANGIBLE ASSETS, NET | |

| 935 | | |

| 1,078 | |

| | |

| | | |

| | |

| GOODWILL | |

| 4,895 | | |

| 4,895 | |

| | |

| | | |

| | |

| Total assets | |

$ | 31,700 | | |

$ | 32,481 | |

CONSOLIDATED

BALANCE SHEETS

(U.S. dollars

in thousands)

| | |

September 30,

2024 | | |

December 31,

2023 | |

| | |

(Unaudited) | | |

(Audited) | |

| | |

| | |

| |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | |

| | |

| |

| | |

| | |

| |

| CURRENT LIABILITIES: | |

| | |

| |

| Short term loan and current maturities | |

$ | 431 | | |

$ | 170 | |

| Operating lease liabilities, current | |

| 183 | | |

| 235 | |

| Trade payables | |

| 5,400 | | |

| 7,710 | |

| Employees and payroll accruals | |

| 859 | | |

| 980 | |

| Deferred revenues | |

| 657 | | |

| 600 | |

| Advances net of inventory in process | |

| 418 | | |

| 137 | |

| Accrued expenses and other liabilities | |

| 679 | | |

| 1,072 | |

| | |

| | | |

| | |

| Total current liabilities | |

| 8,627 | | |

| 10,904 | |

| | |

| | | |

| | |

| LONG-TERM LIABILITIES: | |

| | | |

| | |

| Long-term loans, net of current maturities | |

| 1,003 | | |

| 1,150 | |

| Operating lease liabilities, non-current | |

| 605 | | |

| 759 | |

| Long term deferred revenues | |

| 291 | | |

| 339 | |

| Accrued severance pay | |

| 427 | | |

| 490 | |

| | |

| | | |

| | |

| Total long-term liabilities | |

| 2,326 | | |

| 2,738 | |

| | |

| | | |

| | |

| TOTAL SHAREHOLDERS’ EQUITY | |

| 20,747 | | |

| 18,839 | |

| | |

| | | |

| | |

| Total liabilities and shareholders’ equity | |

$ | 31,

700 | | |

$ | 32,481 | |

CONDENSED

CONSOLIDATED EBITDA

(U.S. dollars

in thousands)

| | |

Nine months ended

September 30, | | |

Three months ended

September 30, | |

| | |

2024 | | |

2023 | | |

2024 | | |

2023 | |

| | |

| | |

| | |

| | |

| |

| Operating income | |

$ | 2,055 | | |

$ | 2,050 | | |

$ | 551 | | |

$ | 441 | |

| Add: | |

| | | |

| | | |

| | | |

| | |

| Amortization of intangible assets | |

| 143 | | |

| 120 | | |

| 47 | | |

| 48 | |

| Stock-based compensation | |

| 63 | | |

| 73 | | |

| 21 | | |

| 24 | |

| Depreciation | |

| 269 | | |

| 252 | | |

| 91 | | |

| 87 | |

| EBITDA | |

$ | 2,530 | | |

$ | 2,495 | | |

$ | 710 | | |

$ | 600 | |

SEGMENT INFORMATION

(U.S. dollars

in thousands)

| | |

RFID | | |

Supply Chain

Solutions | | |

Intelligent

Robotics | | |

Intercompany | | |

Consolidated | |

| | |

Nine months ended September 30, 2024 | |

| Revenues | |

$ | 9,432 | | |

$ | 19,023 | | |

$ | 1,239 | | |

$ | (133 | ) | |

$ | 29,561 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 2,382 | | |

| 4,244 | | |

| 287 | | |

| - | | |

| 6,913 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allocated operating expenses | |

| 1,669 | | |

| 2,455 | | |

| 189 | | |

| - | | |

| 4,313 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unallocated operating expenses* | |

| - | | |

| - | | |

| - | | |

| | | |

| 545 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

$ | 713 | | |

$ | 1,789 | | |

$ | 98 | | |

| - | | |

| 2,055 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial expenses and tax on income | |

| | | |

| | | |

| | | |

| | | |

| (240 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| | | |

| | | |

| | | |

| | | |

$ | 1,815 | |

| | |

RFID | | |

Supply Chain

Solutions | | |

Intelligent

Robotics | | |

Intercompany | | |

Consolidated | |

| | |

Nine months ended September 30, 2023 | |

| Revenues | |

$ | 10,091 | | |

$ | 21,827 | | |

$ | 1,463 | | |

$ | (89 | ) | |

$ | 33,292 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 2,453 | | |

| 4,588 | | |

| 77 | | |

| - | | |

| 7,118 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allocated operating expenses | |

| 1,635 | | |

| 2,700 | | |

| 187 | | |

| - | | |

| 4,522 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unallocated operating expenses* | |

| - | | |

| - | | |

| - | | |

| | | |

| 546 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

$ | 818 | | |

$ | 1,888 | | |

$ | (110 | ) | |

| - | | |

| 2,050 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial expenses and tax on income | |

| | | |

| | | |

| | | |

| | | |

| (471 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

$ | 1,579 | |

| * | Unallocated operating expenses include costs not specific to

a particular segment but are general to the group, such as expenses incurred for insurance of directors and officers, public company

fees, legal fees, and other similar corporate costs. |

SEGMENT INFORMATION

(U.S. dollars

in thousands)

| | |

RFID | | |

Supply Chain

Solutions | | |

Intelligent

Robotics | | |

Intercompany | | |

Consolidated | |

| | |

Three

months ended September 30, 2024

| |

| Revenues | |

$ | 2,770 | | |

$ | 6,336 | | |

$ | 838 | | |

$ | (117 | ) | |

$ | 9,827 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 762 | | |

| 1,256 | | |

| 137 | | |

| - | | |

| 2,155 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allocated operating expenses | |

| 566 | | |

| 771 | | |

| 67 | | |

| - | | |

| 1,404 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unallocated operating expenses* | |

| | | |

| | | |

| | | |

| - | | |

| 200 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

$ | 196 | | |

$ | 485 | | |

$ | 70 | | |

| - | | |

| 551 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial income and tax on income | |

| | | |

| | | |

| | | |

| | | |

| 23 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| | | |

| | | |

| | | |

| | | |

$ | 574 | |

| | |

RFID | | |

Supply Chain

Solutions | | |

Intelligent

Robotics | | |

Intercompany | | |

Consolidated | |

| | |

Three

months ended September 30, 2023

| |

| Revenues | |

$ | 3,143 | | |

$ | 6,476 | | |

$ | 206 | | |

$ | (10 | ) | |

$ | 9,815 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Gross profit | |

| 658 | | |

| 1,335 | | |

| 57 | | |

| - | | |

| 2,050 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Allocated operating expenses | |

| 539 | | |

| 841 | | |

| 57 | | |

| - | | |

| 1,437 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Unallocated operating expenses* | |

| | | |

| | | |

| | | |

| - | | |

| 172 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Income from operations | |

$ | 119 | | |

$ | 494 | | |

$ | - | | |

| - | | |

| 441 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Financial expenses and tax on income | |

| | | |

| | | |

| | | |

| | | |

| (128 | ) |

| | |

| | | |

| | | |

| | | |

| | | |

| | |

| Net income | |

| | | |

| | | |

| | | |

| | | |

$ | 313 | |

| * | Unallocated operating expenses include costs not specific to

a particular segment but are general to the group, such as expenses incurred for insurance of directors and officers, public company

fees, legal fees, and other similar corporate costs. |

10

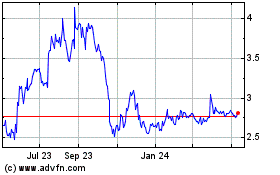

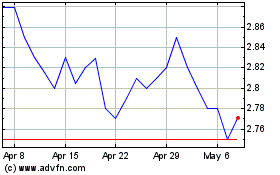

BOS Better Online Soluti... (NASDAQ:BOSC)

Historical Stock Chart

From Nov 2024 to Dec 2024

BOS Better Online Soluti... (NASDAQ:BOSC)

Historical Stock Chart

From Dec 2023 to Dec 2024