Borqs Technologies, Inc. (Nasdaq: BRQS, the “Company”), a global

leader in embedded software and products for the Internet of Things

(IoT) industry, today announces management’s preliminary unaudited

financial results for the year ended December 31, 2018.

Annual 2018 Highlights:

- Unaudited revenue for the year

ended December 31, 2018, of the Company’s Connected Solutions

Business Unit, our continuing operations, was $128.4 million as

compared to $122.2 million from the year 2017, representing an

increase of 5.0%.

- Due to the sale of the MVNO

Business Unit in the year 2019, the MVNO activities for 2018 were

presented as discontinued operations. Unaudited revenue for

the MVNO in 2018 was $27.4 million as compared to $32.1 million in

2017, representing a decrease of 14.7%.

- On US-GAAP basis, the Company’s

unaudited continuing operations had a net loss of $37.4 million in

2018 as compared to a loss of $12.8 million in 2017. On

non-GAAP basis excluding certain non-operation items, the Company

had an adjusted EBITDA of $9.3 million in 2018 and $10.0 million in

2017. Please see below GAAP reconciliation table.

Revenues and gross margins

The Company announced unaudited net revenues of

$128.4 million for the year ended December 31, 2018, which included

$9.5 million recorded for software sales and $118.9 million from

hardware sales, as compared to net revenues of $122.2 million for

2017 with $11.2 million in software and $111.0 million in hardware

sales. Gross margin in 2018 for software was 64.7% and for

hardware (excluding COGS expensed in 2018 but for revenues not yet

recognized and loss on inventory) was 4.1%; resulting in a blended

adjusted gross margin of 8.6% for the year 2018. Gross margin

in 2017 for software was $35.4% and for hardware was 13.3%;

resulting in a blended gross margin of 15.3% for 2017. The

increase in software gross margin for 2018 was due to some of our

engineering costs that were directly related to particular hardware

products were included in hardware costs. The decrease in

hardware gross margin was mainly attributed to the competitive

nature of this industry in 2018.

We expect a similar level in Connected Solutions

Business Unit sales in 2019 as compared to 2018, and anticipate

moderate improvement in gross margin for 2019.

Geographic Concentration

The following table sets forth the Company’s

Connected Solutions Business Unit unaudited net revenues from

customers, in absolute amount and as a percentage of net revenues,

based on location of the customer’s headquarters. The Company’s

MVNO net revenues, which were $35.1 million, $32.1 million and

$27.4 million in 2016, 2017 and 2018, respectively, were related to

customers in China. These figures do not take into account the

geographic location of end-users of customer products:

| |

For the years ended December 31, |

|

| |

2016 |

|

|

2017 |

|

|

2018 |

|

|

Unaudited |

$ |

|

|

% |

|

|

$ |

|

|

% |

|

|

$ |

|

|

% |

|

| |

($ in thousands) |

|

| China |

|

6,076 |

|

|

|

7.1 |

% |

|

|

17,687 |

|

|

|

14.5 |

% |

|

|

4,214 |

|

|

|

3.3 |

% |

| India |

|

25,126 |

|

|

|

29.4 |

% |

|

|

70,421 |

|

|

|

57.6 |

% |

|

|

96,550 |

|

|

|

75.2 |

% |

| United States |

|

34,526 |

|

|

|

40.4 |

% |

|

|

23,312 |

|

|

|

19.1 |

% |

|

|

15,666 |

|

|

|

12.2 |

% |

| Rest of the World |

|

19,720 |

|

|

|

23.1 |

% |

|

|

10,813 |

|

|

|

8.8 |

% |

|

|

11,925 |

|

|

|

9.3 |

% |

| Net Revenues |

|

85,448 |

|

|

|

100.0 |

% |

|

|

122,233 |

|

|

|

100.0 |

% |

|

|

128,335 |

|

|

|

100.0 |

% |

The Company’s connected solutions net revenues

from customers with headquarters in the United States are

attributed to its ongoing collaboration with a prominent mobile

chipset vendor and other mobile device OEMs. From 2016 to 2018, the

Company engaged a significant customer in India during the second

half of 2016 and this customer continued to place orders with us in

2017 and 2018.

Customer Concentration for Connected

Solutions Business Unit

The Company focused on research and development

efforts for providing BorqsWare software platform solutions to

mobile device OEMs. The Company has also leveraged our deep

technology expertise to provide BorqsWare software platform

solutions to mobile chipset manufacturers. The following table sets

forth unaudited net revenues by type of customer, both in absolute

amount and as a percentage of net revenues for the periods

presented:

| |

For the years ended December 31, |

|

| |

2016 |

|

|

2017 |

|

|

2018 |

|

|

Unaudited |

$ |

|

|

% |

|

|

$ |

|

|

% |

|

|

$ |

|

|

% |

|

| |

($ in thousands) |

|

| Mobile device OEMs |

|

70,536 |

|

|

|

82.5 |

% |

|

|

111,021 |

|

|

|

90.8 |

% |

|

|

118,602 |

|

|

|

92.4 |

% |

| Mobile Chipset Vendors |

|

14,912 |

|

|

|

17.5 |

% |

|

|

11,212 |

|

|

|

9.2 |

% |

|

|

9,753 |

|

|

|

7.6 |

% |

| Connected Solutions BU Net

Revenues |

|

85,448 |

|

|

|

100.0 |

% |

|

|

122,233 |

|

|

|

100 |

% |

|

|

128,355 |

|

|

|

100 |

% |

The Company expects its net revenues from mobile

device OEMs to continue to grow as it develops more connected

devices, especially IoT products.

|

Unaudited |

|

Fiscal Years Ended December 31, |

|

|

Consolidated Statements of Income and Comprehensive Income

Data for Connected Solutions Business Unit: |

|

2016 |

|

|

2017 |

|

|

2018 |

|

| |

|

($ in thousands) |

|

| Net revenues |

|

|

85,448 |

|

|

|

122,233 |

|

|

|

128,355 |

|

| Gross profit* |

|

|

20,505 |

|

|

|

18,739 |

|

|

|

(8,147 |

) |

| Operating expenses** |

|

|

(15,538 |

) |

|

|

(29,262 |

) |

|

|

(26,123 |

) |

| Other operating income |

|

|

3,738 |

|

|

|

2,116 |

|

|

|

180 |

|

| Operating income (loss) |

|

|

8,705 |

|

|

|

(8,407 |

) |

|

|

(34,090 |

) |

| Income (loss) from continuing

operations, before income taxes |

|

|

8,676 |

|

|

|

(10,448 |

) |

|

|

(36,639 |

) |

| Income tax expense |

|

|

(3,244 |

) |

|

|

(2,342 |

) |

|

|

(807 |

) |

| Net income (loss) from

continuing operations |

|

|

5,432 |

|

|

|

(12,790 |

) |

|

|

(37,446 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Discontinued operations |

|

|

|

|

|

|

|

|

|

|

|

|

| (Loss) income from

discontinued operations, before income taxes |

|

|

(3,421 |

) |

|

|

408 |

|

|

|

(353 |

) |

| Income tax benefit

(expense) |

|

|

585 |

|

|

|

23 |

|

|

|

(1,641 |

) |

| (Loss) income from

operations of discontinued entities |

|

|

(2,836 |

) |

|

|

431 |

|

|

|

(1,994 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Net income

(loss) |

|

|

2,596 |

|

|

|

(12,359 |

) |

|

|

(39,440 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| (* |

|

Gross profit for 2018 included

$8.3 million in cost of goods for which related revenues were not

recognized in 2018, due to products delivery in transit and

extra-long payment terms.) |

| (** |

|

Operating expenses for 2017

included $14.5 million in non-cash merger related expenses.) |

| (** |

|

Operating expenses for 2018

included $5.3 million in arbitration loss, write-off and provision

for doubtful debt of $3.6 million, share based compensation of $1

million, and $4.3 million in stock offering expenses.) |

|

Unaudited |

|

Fiscal Years Ended December 31, |

|

|

Consolidated Balance Sheets Data for Connected Solutions

Business Unit: |

|

2017 |

|

|

2018 |

|

| |

|

($ in thousands) |

|

| Cash and cash equivalents |

|

|

13,009 |

|

|

|

1,931 |

|

| Accounts receivable |

|

|

63,155 |

|

|

|

25,229 |

|

| Inventories |

|

|

16,810 |

|

|

|

7,696 |

|

| Property, plant and equipment,

net |

|

|

504 |

|

|

|

305 |

|

| Total

assets |

|

|

163,011 |

|

|

|

114,343 |

|

| Total

liabilities |

|

|

116,006 |

|

|

|

104,415 |

|

| Total shareholders’

equity |

|

|

47,005 |

|

|

|

9,928 |

|

Held for sale assets and liabilities

(MVNO Business Unit)

Due to the pending sale of the MVNO Business

Unit via Consolidated VIEs, which operations was classified as

discontinued operations as of December 31, 2017 and 2018, the

assets and liabilities were classified as held for sale.

|

|

|

As of December 31, |

|

|

|

|

2017 |

|

|

2018 |

|

|

|

|

US$ |

|

|

US$ |

|

|

Unaudited |

|

|

|

|

|

|

| Carrying amounts of

major classes of assets included as part of the assets held for

sale |

|

|

|

|

|

|

| Cash and cash equivalents |

|

|

51 |

|

|

|

336 |

|

| Restricted cash |

|

|

3,459 |

|

|

|

708 |

|

| Accounts receivable |

|

|

2,565 |

|

|

|

97 |

|

| Receivable from MVNO

franchisees |

|

|

3,514 |

|

|

|

377 |

|

| Inventories |

|

|

221 |

|

|

|

154 |

|

| Prepaid expenses and other

current assets |

|

|

423 |

|

|

|

1,758 |

|

| Property and equipment,

net |

|

|

- |

|

|

|

637 |

|

| Intangible assets, net |

|

|

- |

|

|

|

7,175 |

|

| Goodwill |

|

|

- |

|

|

|

701 |

|

| Other non-current assets |

|

|

- |

|

|

|

1,908 |

|

| |

|

|

|

|

|

|

|

|

| Current assets held for

sale |

|

|

10,233 |

|

|

|

13,851 |

|

| |

|

|

|

|

|

|

|

|

| Property and equipment,

net |

|

|

858 |

|

|

|

- |

|

| Intangible assets, net |

|

|

8,330 |

|

|

|

- |

|

| Goodwill |

|

|

736 |

|

|

|

- |

|

| Deferred tax assets |

|

|

940 |

|

|

|

- |

|

| Other non-current assets |

|

|

81 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Non-current assets held for

sale |

|

|

10,945 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Total assets of the

Consolidated VIEs classified as held for sale in the Consolidated

Balance Sheets |

|

|

21,178 |

|

|

|

13,851 |

|

| |

|

|

|

|

|

|

|

|

| Unaudited Carrying

amounts of major classes of liabilities included as part of

liabilities held for sale |

|

|

|

|

|

|

|

|

| Accounts payable |

|

|

4,143 |

|

|

|

1,700 |

|

| Accrued expenses and other

payables |

|

|

4,038 |

|

|

|

4,214 |

|

| Amounts due to continuing

operations |

|

|

14,279 |

|

|

|

9,354 |

|

| Advances from customers |

|

|

- |

|

|

|

50 |

|

| Deferred revenues |

|

|

5,904 |

|

|

|

3,332 |

|

| Short-term bank

borrowings |

|

|

- |

|

|

|

36 |

|

| Deferred tax liabilities |

|

|

- |

|

|

|

1,779 |

|

| |

|

|

|

|

|

|

|

|

| Current liabilities held for

sale |

|

|

28,364 |

|

|

|

20,465 |

|

| |

|

|

|

|

|

|

|

|

| Deferred tax liabilities |

|

|

1,500 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Non-current liabilities held

for sale |

|

|

1,500 |

|

|

|

- |

|

| |

|

|

|

|

|

|

|

|

| Total liabilities of

the Consolidated VIEs classified as held for sale in the

Consolidated Balance Sheets |

|

|

29,864 |

|

|

|

20,465 |

|

Non-US-GAAP Adjustments

In the years 2018 and 2017, we had significant

amount of costs that were non-operational and non-recurring.

Adjusted EBITDA is presented as loss from continuing operations and

adding back interest expenses, taxes, depreciation and

amortization, and non-recurring items including loss on

arbitration, write-downs and provisions for doubtful accounts and

current assets, impairment of intangible assets due to sale of the

MVNO business unit, legal and consulting stock offering related

expenses, and certain additional charges to cost of goods sold,

stock based compensation, deferred income tax benefits, and results

of discontinued operations. Adjusted EBITDA for the

continuing operations for the years 2018 and 2017 were $9.3 million

and $10.0 million, respectively.

| |

|

|

|

| |

Year ended December 31, |

|

Unaudited |

2017 |

|

|

2018 |

|

| |

|

(US$,000) |

|

| |

|

|

|

| Net income (loss),

including discontinued operations |

(12,359 |

) |

|

(39,440 |

) |

| |

|

|

|

| Interest expense - net |

1,828 |

|

|

3,066 |

|

| Tax expenses |

2,342 |

|

|

2,448 |

|

| Depreciation and

amortization |

4,679 |

|

|

6,753 |

|

| Other non-operational

(income) |

(566 |

) |

|

(18 |

) |

| EBITDA |

(4,076 |

) |

|

(27,191 |

) |

| |

|

|

|

| Adjusted EBITDA: |

|

|

|

|

Write-off and provision of doubtful accounts and current

assets |

- |

|

|

3,607 |

|

|

Loss on arbitration due to over payment from customer in 2012

* |

- |

|

|

5,263 |

|

|

Extra COGs for sales not recognized in 2018 |

- |

|

|

8,257 |

|

|

Loss on historical inventory due to loss & obsolescence |

- |

|

|

10,888 |

|

|

Impairment of intangible assets due to sale of MVNO unit |

- |

|

|

750 |

|

|

Stock based compensation (non-cash) |

- |

|

|

976 |

|

|

Deferred income tax benefits (non-cash) |

- |

|

|

1,742 |

|

|

Offering expenses (including merger related) ** |

- |

|

|

2,967 |

|

|

|

|

|

|

|

Discontinued operations loss (income) |

(431 |

) |

|

1,994 |

|

| |

|

|

|

|

Non-cash 2017 merger related expenses |

|

|

|

|

Stock based compensation - options granted to employees |

5,727 |

|

|

- |

|

|

Stock based compensation - advisory fees |

8,777 |

|

|

- |

|

|

|

|

|

|

| Adjusted EBITDA for

continuing operations |

9,997 |

|

|

9,253 |

|

| |

|

|

|

| (* |

|

In 2012 Samsung claimed that it had overpaid Borqs for software

royalty. The case was handed over to arbitration and in 2018

the final arbitration decision was in favor of Samsung.) |

| (** |

|

A part of the expense was related to the merger with Pacific

Special Acquisition Corp in 2017.) |

About Borqs Technologies,

Inc.

Borqs Technologies is a global leader in

software and products for the IoT, providing customizable,

differentiated and scalable Android-based smart connected devices

and cloud service solutions. Borqs has achieved leadership and

customer recognition as an innovative end-to-end IoT solutions

provider leveraging its strategic chipset partner relationships as

well as its broad software and IP portfolio. The Company designs,

develops and provides turnkey solutions across device form factors

such as smartphones, tablets, smartwatches, trackers, automotive

IVI, and vertical application devices (for restaurants, payments

etc.). For more information, please visit the Company’s

website (www.borqs.com).

Forward-Looking Statements, Non-GAAP

Information and Additional Information

This press release includes “forward-looking

statements” that involve risks and uncertainties that could cause

actual results to differ materially from what is expected. Words

such as “expects”, “believes”, “anticipates”, “intends”,

“estimates”, “predicts”, “seeks”, “may”, “might”, “plan”,

“possible”, “should” and variations and similar words and

expressions are intended to identify such forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. Such forward-looking statements

relate to future events or future results, based on currently

available information and reflect our management’s current beliefs.

Many factors could cause actual events or results to differ

materially from the events and results discussed in the

forward-looking statements, so the reader is advised to refer to

the Risk Factors sections of the Company’s filings with the

Securities and Exchange Commission for additional information

identifying important factors that could cause actual results to

differ materially from those anticipated in the forward-looking

statements. Furthermore, the financial statements and results of

operations are based on unaudited statements which may change upon

an audit. Except as expressly required by applicable securities

law, the Company disclaims any obligation to update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

This release includes non-GAAP

presentations. These non-GAAP measures are not in accordance

with, or an alternative for, measures prepared in accordance with

generally accepted accounting principles and may be different from

non-GAAP measures used by other companies. In addition, these

non-GAAP measures are not based on any comprehensive set of

accounting rules or principles. The Company believes that non-GAAP

measures have limitations in that they do not reflect all of the

amounts associated with the Company’s results of operations as

determined in accordance with GAAP and that these measures should

only be used to evaluate the Company’s results of operations in

conjunction with the corresponding GAAP measures.

The Company believes that the presentation of

non-GAAP measures when shown in conjunction with the corresponding

GAAP measures, provides useful information to investors and

management regarding financial and business trends relating to its

financial condition and its historical and projected results of

operations.

For its internal budgeting process, the

Company’s management uses financial statements that do not include,

when applicable, share-based compensation expense, amortization of

acquisition-related intangible assets,

acquisition-related/divestiture costs, significant asset

impairments and restructurings, significant litigation settlements

and other contingencies, significant gains and losses on

investments, the income tax effects of the foregoing and

significant tax matters. The Company’s management also uses the

foregoing non-GAAP measures, in addition to the corresponding GAAP

measures, in reviewing the financial results of the Company. In

prior periods, the Company has excluded other items that it no

longer excludes for purposes of its non-GAAP financial measures.

From time to time in the future there may be other items that the

Company may exclude for purposes of its internal budgeting process

and in reviewing its financial results.

Investor Contact:

Sandra DouDirector of FinanceBorqs Technologies,

Inc.sandra.dou@borqs.net www.borqs.com

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

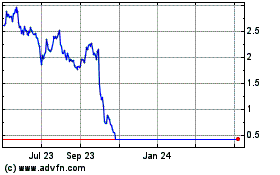

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Jul 2023 to Jul 2024