UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

REPORT OF FOREIGN

PRIVATE ISSUER PURSUANT TO RULE 13A-16 OR 15D-16

OF THE SECURITIES EXCHANGE ACT OF 1934

For the month of March

2019

Commission File Number

001-37593

|

|

BORQS TECHNOLOGIES, INC.

|

|

|

|

(Translation of registrant's name into English)

|

|

|

|

Building B23-A,

Universal Business Park

No. 10 Jiuxianqiao Road

Chaoyang District, Beijing, China

|

|

|

|

(Address of principal executive offices)

|

|

Indicate by check

mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F ☒

Form 40-F ☐

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ☐.

Note

: Regulation

S-T Rule 101(b)(1) only permits the submission in paper of a Form 6-K if submitted solely to provide an attached annual report

to security holders.

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ☐.

Note

: Regulation

S-T Rule 101(b)(7) only permits the submission in paper of a Form 6-K if submitted to furnish a report or other document that the

registrant foreign private issuer must furnish and make public under the laws of the jurisdiction in which the registrant is incorporated,

domiciled or legally organized (the registrant's "home country"), or under the rules of the home country exchange on

which the registrant's securities are traded, as long as the report or other document is not a press release, is not required to

be and has not been distributed to the registrant's security holders, and, if discussing a material event, has already been the

subject of a Form 6-K submission or other Commission filing on EDGAR.

INFORMATION CONTAINED IN THIS FORM

6-K REPORT

As previously

reported by Borqs Technologies, Inc. (the “Company”), BORQS Hong Kong Limited (“BORQS HK”) an indirect,

wholly owned subsidiary of the Company, entered into a loan agreement (the “Original Loan Agreement”) with Partners

For Growth V, L.P. (“PFG5”), effective April 30, 2018, for a term loan in the maximum amount of $3 million at an interest

rate of 8.0% per annum with a maturity date of April 30, 2021 (the “Original Loan”). As also previously reported on

a Current Report on Form 8-K of the Company, on December 17, 2018, the Company, BORQS International Holding Corp. (“BORQS

International”), a wholly owned subsidiary of the Company, and BORQS HK entered into a Waiver and Modification No. 1 to

Loan and Security Agreement with PFG5 to amend the Original Loan Agreement (the “Amended Loan Agreement”) to include

a convertible term loan pursuant to which BORQS HK issued a senior secured convertible note to PFG5 (the “Note”) in

the principal amount of $1 million, at an interest rate of 12% per annum with a maturity date of December 17, 2023 (the “Convertible

Loan”, together with the Original Loan, the “Prior PFG5 Loans”). The Note is convertible into ordinary shares

of the Company at the option of PFG5 at a conversion price of $4.79, for a total of 208,768 ordinary shares (subject to certain

customary adjustments). On December 17, 2018, PFG5 funded the Note, minus a $15,000 commitment fee.

On March 8, 2019

(the “Closing Date”), BORQS HK, BORQS Technologies (HK) Limited, an indirect wholly owned subsidiary of the Company

(“BORQS Tech HK”, together with BORQS HK, the “Borrower”), the Company and BORQS International as guarantors

of the Borrower entered into an Amended and Restated Loan and Security Agreement with PFG5 (the “Restated Loan Agreement”)

to amend and restate the Amended Loan Agreement in its entirety to also provide the Borrower with a new revolving line of credit

facility (the “RLOC”, together with the Prior PFG5 Loans, the “Current PFG5 Loans”). Proceeds drawn from

the RLOC will be used by the Company: (i) to pay off all outstanding loan amounts owed by the Company and its subsidiaries to

SPD Silicon Valley Bank Co., Ltd, a PRC banking institution (“SSVB”), and (ii) for working capital purposes. PFG5’s

rights under the Restated Loan Agreement are pari passu with the rights of Partners For Growth IV, L.P. (“PFG4”),

a related party of PFG5, under that certain Loan and Security Agreement, dated August 26, 2016, by and between BORQS HK and PFG4,

as amended, which remains in full force and effect according to its terms.

Subject to advance

limits set forth under the Restated Loan Agreement, a total credit line of $12.5 million is potentially available under the RLOC

to the Borrower as follows: (i) $9,500,000 may be drawn upon request at any time on or after the Closing Date (“Tranche

1”) and (ii) so long as there is no uncured default at the time of drawdown and if the Company has received at least $10

million in cash proceeds from the sale of its equity securities to investors, then an additional $3,000,000 may be drawn (“Tranche

2”). Any outstanding amounts under the RLOC will accrue interest at a rate of 11% per annum with a maturity date of March

8, 2021 (the “Maturity Date”). The Borrower shall pay interest only on principal outstanding on the RLOC until the

Maturity Date, on which date the entire unpaid principal balance on the RLOC plus any and all accrued and unpaid interest shall

be repaid. The Borrower may repay and reborrow principal under the RLOC, and any termination of the RLOC by repayment shall be

without prepayment or termination fee or penalty of any kind. The commitment fees payable to PFG5 for Tranche 1 and Tranche 2

are $142,500 and $45,000, respectively, with a back-end fees of up to a maximum of $1,900,000 for Tranche 1 and $600,000 for Tranche

2, in each case due and payable on the Maturity Date. On the Closing Date, in connection with the execution of the Restated Loan

Agreement, the Company drew down on $9,500,000 of Tranche 1 credit available under the Restated Loan Agreement, of which $809,703

was drawn down by the Company for working capital purposes and $8,690,297 was paid by PFGV on behalf of the Company to SSVB in

full satisfaction of all amounts due to SSVB, subject to the post-closing satisfaction of certain PRC regulatory approvals.

The loan obligations

under the Restated Loan Agreement are guaranteed by the Company and BORQS International (each, a “Guarantor”, together

with the Borrowers, the “Obligors”). On the Closing Date, each Obligor executed a deed of guarantee and indemnity

agreement in favor of PFG5 (collectively, the “Guarantees”) to guarantee the payment and performance, and remedy of

any default on demand, of each Obligor’s obligations under the Restated Loan Agreement. The Current PFG5 Loans under the

Restated Loan Agreement are secured by all right, title and interest of the Obligors in and to all the tangible and intangible

assets of each Obligor, including each Obligor’s share capital and equity interests in its subsidiaries, bank accounts and

receivables and the Intellectual Property (as defined in the Restated Loan Agreement) of the Company’s subsidiaries, all

of which are pledged as collateral to secure the payment and performance of the Obligors’ obligations under the Restated

Loan Agreement. The Obligors have executed such security instruments, including pledges, debentures, mortgages, and share charges,

to reflect the “all assets” security granted to PFG5 under the Restate Loan Agreement (collectively, the “Security

Instruments”).

The Restated

Loan Agreement includes customary representations and warranties and affirmative covenants, negative covenants and financial covenants,

including the covenants to meet or exceed (i) quarterly revenues (as required to be classified as such under U.S. Generally Accepted

Accounting Principles) of $32,500,000 and (ii) a three month trailing EBITDA target of $2,000,000, with compliance for each covenant

determined as of the last day of each calendar quarter for revenues and each calendar month for EBITDA (as defined in the Restated

Loan Agreement).

1

Additionally, unless permitted under the Restated Loan Agreement or with the prior written consent of PFG5, the

Obligors are prohibited from (i) acquiring any assets, except in the ordinary course of business, (ii) making any new investments

other than certain permitted investments, (iii) transferring any part of its business or property except as permitted under the

Restated Loan Agreement, (iv) guaranteeing or otherwise becoming liable with respect to the obligations of another party or entity,

(v) making any loans of any money or other assets, other than certain permitted investments (vi) incurring any indebtedness, other

than certain permitted indebtedness and (vii) certain other actions as described in greater detail in the Restated Loan Agreement.

An event of default

under the Restated Loan Agreement includes, among other things, (i) any non-payment of monetary obligations when due, (ii) materially

untrue or misleading representations, warranties, covenants, statements, reports or certificates made or delivered to PFG5 by the

Obligors, (iii) failure by Borrower to comply with the financial covenants set forth in the Restated Loan Agreement and described

above, (iv) breach by any Obligor of any of the covenants set forth in Section 4.6 of the Restated Loan Agreement, (v) a default

or breach under the Restated Loan Agreement or any other related agreement that remains continuing after the applicable cure period,

(vi) a bankruptcy of an Obligor or other assignment for the benefit of creditors, (vii) the occurrence of a change of control of

any Obligor, and (viii) the occurrence of a “Material Adverse Change” as defined in the Restated Loan Agreement. Upon

the occurrence and during the continuance of an event of default under the Restated Loan Agreement, and at any time thereafter,

PFG5 may, among other things, without notice or demand, accelerate all outstanding amounts to become immediately due and payable.

In addition, the interest rate on each Current PFG5 Loan would become the default rate which is defined in the Restated Loan Agreement

to be the lesser of (i) the applicable interest rate set forth in the schedules to the Restated Loan Agreement, plus 6.0% per annum,

and (ii) the maximum interest rate allowed to be charged to a commercial borrower under applicable usury laws.

The summary descriptions

of the Restated Loan Agreement, Guarantees and Security Instruments do not purport to be complete and are qualified in their entirety

by reference to the complete text of such agreements, copies of which and copies of other ancillary agreements relating to the

transactions contemplated by the Restated Loan Agreement are filed as Exhibits 10.1 through 10.18 to this report and are incorporated

herein by reference.

2

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

BORQS TECHNOLOGIES INC.

|

|

|

(registrant)

|

|

|

|

|

Dated: March 14, 2019

|

By:

|

/s/ Anthony K. Chan

|

|

|

|

Anthony K. Chan

|

|

|

|

Chief Financial Officer

|

3

EXHIBIT INDEX

The following exhibits are filed as part of this Form 6-K:

|

|

|

|

|

Exhibit

|

|

Description

|

|

|

|

|

10.1

|

|

Amended and Restated Loan and Security Agreement, dated March 8, 2019, by and among the Company, PFG5, BORQS HK, BORQS Tech HK and BORQS International

|

|

|

|

|

10.2

|

|

Deed of Charge of Shares in BORQS HK

|

|

|

|

|

10.3

|

|

Deed of Debenture of BORQS Tech HK

|

|

|

|

|

10.4

|

|

Reaffirmations of Intellectual Property security Agreement and Joinder, dated March 8, 2019, by and among PFG5, BORQS HK, BORQS Tech HK and BORQS International

|

|

|

|

|

|

10.5

|

|

Share Pledge Agreement, dated March 8, 2019, by and among PFG5, BORQS HK and BORQS Tech HK

|

|

|

|

|

|

10.6

|

|

Equity Mortgage, dated March 8, 2019, by and among PFG5, BORQS International and the Company

|

|

|

|

|

|

10.7

|

|

Share Pledge Agreement, dated March 8, 2019, by and among PFG5, BORQS International, BORQS HK and BORQS Software Solutions Private Limited

|

|

|

|

|

|

10.8

|

|

Custody and Control Agreement, dated March 8, 2019, by and among PFG5, BORQS International, BORQS HK and Borqs Software Solutions Private Limited

|

|

|

|

|

|

10.9

|

|

Debenture of Undertaking of Borqs Software Solutions Private Limited

|

|

|

|

|

|

10.10

|

|

Deed of Charge of Shares of BORQS HK

|

|

|

|

|

|

10.11

|

|

Deed of Charge of Shares of BORQS International

|

|

|

|

|

|

10.12

|

|

Deed of Charge of Shares of BORQS Tech HK

|

|

|

|

|

|

10.13

|

|

Deed of Debenture of BORQS International

|

|

|

|

|

|

10.14

|

|

Deed of Debenture of the Company

|

|

|

|

|

|

10.15

|

|

Deed of Guarantee and Indemnity of BORQS HK

|

|

|

|

|

|

10.16

|

|

Deed of Guarantee and Indemnity of BORQS Tech HK

|

|

|

|

|

|

10.17

|

|

Deed of Guarantee and Indemnity of the Company

|

|

|

|

|

|

10.18

|

|

Deed of Guarantee and Indemnity of BORQS International

|

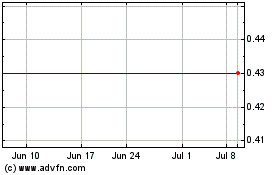

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

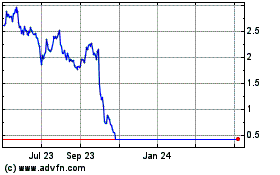

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Jul 2023 to Jul 2024