Quarterly Revenue was $28.3 million, Net

Loss of $2.2 millionNine-Month Revenue was $142.9

million, Net Income of $1.2 millionConference Call

on Tuesday November 20, 2018 at 8pm ET

Borqs Technologies, Inc. (Nasdaq: BRQS) (the “Company”), a global

leader in embedded software and products for the Internet of Things

(IoT), today reported financial results for the quarter ended

September 30, 2018.

Revenues

The Company reported net revenue of $28.3

million for the third quarter of 2018, including $22.3 million from

the Connected Solutions Business Unit which is engaged in the

design and manufacturing of IoT products, and $6.0 million from the

MVNO Business Unit which includes mobile virtual operator and some

traditional telephony services. Net revenue for the first nine

months of 2018 was $142.9 million which included $121.3 million

from the Connected Solutions Business Unit and $21.6 million from

the MVNO BU. Revenue for the first nine months was an increase of

46.3% from $97.7 million from the same period in 2017.

The decrease and fluctuation in the third

quarter of 2018 was primarily due to reduced hardware sales. Net

revenue from hardware projects was recognized when delivery of

products was made. Such quarterly fluctuations in hardware net

revenue may not be indicative of any pattern within this business

activity. We do not believe that the reduction in revenues in Q3

2018 was due to seasonality or a significant decline in orders from

customers.

We expect to report a higher level of Connected

Solutions Business Unit sales in the fourth quarter as evidenced by

the current delivery activities; and we also anticipate modest

growth in the MVNO mobile services in future periods as well.

Gross Margins

For the quarter ended September 30, 2018, gross

margin for the Connected Solutions Business Unit was 5.7% compared

with 14.7% from the same quarter in 2017. This decrease in gross

margin for the third quarter was primarily due to periodic

amortization from previously capitalized costs representing a

larger proportion of costs of goods during this quarterly period

when the volume of product delivery was comparatively

less.

For the quarter ended September 30, 2018, our

MVNO Business Unit (which includes some traditional telephony

businesses) returned a 43.1% gross margin versus 30.1% from 2017.

The increase in gross margin during this quarter was primarily due

to higher than usual sales of mobile phone numbers with repeating

digits (“beauty numbers”). During this period, our MVNO received

additional numbers for its customers to select and the availability

was from new phone numbers assigned from the incumbent operator and

also from the recycling of some previously expired phone

numbers.

Despite a small decrease in the third quarter

2018 in our MVNO revenue to $6.0 million from $7.8 million of the

same quarter last year, a healthy MVNO gross margin has been

maintained since 2017 and that was attributed to our activities

achieving economies of scale and also that a minimum charge by our

incumbent operator, China Unicom, had been removed since October

2016.

The resulting combined gross margin for Q3 of

2018 was 13.6% versus 17.4% from a year ago. For the first nine

months of 2018 our gross margin was 14.3% as compared to 18.0% from

the same period of last year.

Net Income

The Company has net loss of $2.2 million and net

income $1.2 million for the three and nine months ended September

30, 2018, as compared to losses of $11.6 million and $12.5 million

for the respective periods of a year ago. The larger loss in

the third quarter of 2017 was due to non-cash merger transaction

related expenditures in August 2017.

Adjusted EBITDA

Adjusted EBITDA was $0.8 million and $9.7

million for the three and nine months ended September 30, 2018, as

compared to $4.1 million and $7.8 million for the same periods in

2017. Adjusted EBITDA excluded net interest expense, income taxes,

depreciation and amortization, and other non-operational expense

(income).

Guidance from the Chief

Executive

The Company’s Chairman and CEO, Pat Chan,

commented: “We are pleased to report that our business plans are

progressing as expected. Based on the purchase orders we have

received and the business activities that have occurred so far in

the fourth quarter, we reiterate that aggregate revenues for the

full year of 2018 to come within a range from $195 million to $215

million, and net income (after taxes but excluding one-off

expenditures, if any) to be in the range of $4 million to $6

million.”

Non-US-GAAP Reconciliation

Adjusted EBITDA is a

supplemental non-GAAP financial measure exclusive of

certain items to facilitate management’s review of the

comparability of our core operating results on a period to period

basis because such items are not related to our ongoing core

operating results as viewed by management.

Adjusted EBITDA is not a measure of net income

or cash flows as determined by GAAP. We define Adjusted EBITDA as

Net Income plus income taxes, net interest expense, depreciation

and amortization, and excluding other non-operation expense

(income).

We believe Adjusted EBITDA is useful because it

allows us to more effectively evaluate our operating performance

and compare the results of our operations from period to period

without regard to our financing methods or capital structure. We

exclude the items listed above in arriving at Adjusted EBITDA

because these amounts can vary substantially from company to

company within our industry depending upon accounting methods and

book values of assets, capital structures and the method by which

the assets were acquired. Adjusted EBITDA should not be considered

as an alternative to, or more meaningful than, net income as

determined in accordance with GAAP, or as an indicator of our

operating performance or liquidity. Certain items excluded from

Adjusted EBITDA are significant components in understanding and

assessing a company’s financial performance, such as a company’s

cost of capital and tax structure, as well as the historic costs of

depreciable assets, none of which are components of Adjusted

EBITDA. In prior periods, the Company has excluded other items that

it no longer excludes for purposes of its non-GAAP financial

measure. Our computations of Adjusted EBITDA may not be comparable

to other similarly titled measures of other companies.

The following table presents a reconciliation of

the non-GAAP financial measures of EBITDA and Adjusted EBITDA to

the most directly comparable GAAP financial measure for the three

and nine months ended September 30, 2018 and 2017:

| |

|

|

3 months ended 09-30 |

|

9 months ended 09-30 |

| |

|

|

2017 |

|

|

2018 |

|

|

2017 |

|

|

2018 |

|

| |

|

|

(US$ in thousands) |

|

(US$ in thousands) |

| Net income (loss) |

|

|

(11,565 |

) |

|

(2,210 |

) |

|

(12,512 |

) |

|

1,185 |

|

| Interest expense –

net |

|

|

376 |

|

|

989 |

|

|

1,509 |

|

|

2,343 |

|

| Income tax expense |

|

|

58 |

|

|

396 |

|

|

948 |

|

|

1,433 |

|

| Depreciation and

amortization |

|

|

964 |

|

|

1,629 |

|

|

3,324 |

|

|

5,015 |

|

| EBITDA |

|

|

(10,167 |

) |

|

804 |

|

|

(6,731 |

) |

|

9,976 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Foreign exchange loss

(gain) |

|

|

54 |

|

|

(41 |

) |

|

387 |

|

|

(300 |

) |

| Other non-operation

expense (income) |

|

|

(406 |

) |

|

(7 |

) |

|

(484 |

) |

|

(13 |

) |

| Interest expense &

change in value of warrants |

|

|

134 |

|

|

- |

|

|

134 |

|

|

- |

|

| Merger related non-cash

non-recurring SBC |

|

|

14,504 |

|

|

- |

|

|

14,504 |

|

|

- |

|

| Adjusted

EBITDA |

|

|

4,119 |

|

|

756 |

|

|

7,810 |

|

|

9,663 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Other Details

The Company’s quarterly report on Form 10-Q for

the quarter ended September 30, 2018 has been filed with the U.S.

Securities and Exchange Commission, and is accessible on the SEC

website at www.sec.gov.

Conference Call ScheduleBorqs

will review the third quarter 2018 results and highlights for the

remainder of the year on Tuesday, November 20, 2018 at 8:00 pm ET

(5:00 pm Pacific). The dial-in numbers are +1-845-675-0437 or

+1-866-519-4004 in the US and +86-400-620-8038 or +86-800-819-0121

in China; and then enter the Conference ID of 9799959. A

replay of the conference call will be available through November

28, 2018. The replay dial-in numbers are +1-855-452-5696 in

the US and +86-800-870-0206 in China; and then enter the same

Conference ID.

About Borqs Technologies,

Inc.

Borqs Technologies is a leading provider of

software and products for the IoT, providing customizable,

differentiated and scalable Android-based smart connected devices

and cloud service solutions. Borqs has achieved leadership and

customer recognition as an innovative end-to-end IoT solutions

provider leveraging its strategic chipset partner relationships as

well as its broad software and IP portfolio. The Company designs,

develops and provides turnkey solutions across device form factors

such as smartphones, tablets, smartwatches, trackers, automotive

IVI, and vertical application devices (for restaurants, payments

etc.). For more information, please visit the Company’s

website (www.borqs.com).

Forward-Looking Statements and

Additional Information

This press release includes “forward-looking

statements” that involve risks and uncertainties that could cause

actual results to differ materially from what is expected. Words

such as “expects”, “anticipates” and variations and similar words

and expressions are intended to identify such forward-looking

statements, but the absence of these words does not mean that a

statement is not forward-looking. Such forward-looking statements

may include, without limitation, statements regarding the plans and

objectives of management for future operations, projections of

income or loss or other financial items, or our future financial

performance, based on currently available information and reflect

our management’s current beliefs. Many factors could cause actual

events or results to differ materially from the events and results

discussed in the forward-looking statements, including, without

limitation, market acceptance of our products and services,

competition from existing products or new products that may emerge,

the implementation of our business model and strategic plans for

our business and our products, estimates of our future revenue,

expenses, capital requirements and our need for financing, our

financial performance, and current and future government

regulations, developments relating to our competitors, so the

reader is advised to refer to the Risk Factors sections of the

Company’s filings with the Securities and Exchange Commission for

additional information identifying important factors that could

cause actual results to differ materially from those anticipated in

the forward-looking statements. Except as expressly required by

applicable securities law, the Company disclaims any obligation to

update any forward-looking statements, whether as a result of new

information, future events or otherwise.

Investor Contact:

Sandra Dou Investor Relations Sr. Manager Borqs Technologies,

Inc. sandra.dou@borqs.net www.borqs.com

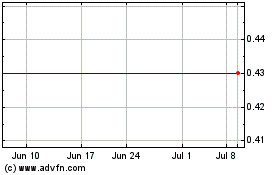

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Jun 2024 to Jul 2024

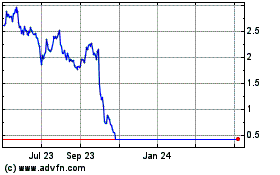

Borqs Technologies (NASDAQ:BRQS)

Historical Stock Chart

From Jul 2023 to Jul 2024