Filed by TOYO Co., Ltd

Pursuant to Rule 425 under the Securities Act of

1933,

as amended, and deemed filed pursuant to Rule 14a-12

under the Securities Exchange Act of 1934, as amended

Subject Company: Blue World Acquisition Corporation

Commission File No.: 001-41256

August 10, 2023

| |

Abalance Corporation |

| |

Representative Director |

| |

Yasuaki Mitsuyuki |

| |

|

(Code Number 3856 Tokyo Stock Exchange Standard) |

| |

Inquiries:Administration |

| |

|

| |

Ryoichi Kunimoto |

| |

TEL:+81 -3-6810-3028 (main

number) |

Notice Regarding the Execution of a Business

Combination Agreement between our subsidiary

and BLUE WORLD ACQUISITION CORPORATION.

At the Board of Directors meeting held on August

10, 2023, Abalance Corporation (hereinafter referred to as the “Company”) announced that its subsidiary, Vietnam Sunergy Cell

Company Limited (hereinafter referred to as “Cell Company”), has entered into a business combination agreement with BLUE WORLD

ACQUISITION CORPORATION (hereinafter referred to as “BWAQ”), a Special Purpose Acquisition Company (hereinafter referred to

as “SPAC”). Through a series of reorganization, TOYO Co., Ltd (hereinafter referred to as “TOYO Co”), which holds

all shares of TOYOone Limited (hereinafter referred to as “TOYOone”), has resolved to aim for listing on NASDAQ in the United

States (the transactions contemplated by the business combination agreement are hereinafter referred to as “this transaction”).

TOYO Co is a holding company wholly owned by our

subsidiary FUJI SOLAR Co., Ltd (hereinafter referred to as “Fuji”) and established for this transaction. Cell Company will

be acquired by TOYO Co through TOPTOYO INVESTMENT PTE LTD (hereinafter referred to as “TOPTOYO”), a holding company established

by FUJI for this transaction. Upon closing of this transaction, TOYO Co will become the parent company of Cell Company and aims to become

a NASDAQ-listed company.

Cell Company was

established as a wholly owned subsidiary of Vietnam Sunergy Joint Stock Company (hereinafter referred

to as “VSUN”) on November 8, 2022 in Phu Tho Province, Vietnam for the purpose of manufacturing cells, which are the main

components of solar panels. Cell Company is currently undertaking the first phase construction of the factory with an expected total capital

investment of USD 180 million (approximately 23.8 billion yen) in the aggregate. Production is scheduled after expected plant completion

in October 2023.

The expected production scale of such factory

will be 3 GW/year in the initial first phase, and up to6 GW/year after the second phase of the construction is completed. VSUN’s

sales are growing steadily, and we will stabilize parts procurement by switching from the current external procurement of cells (N-type

TOPCon), which are the main parts required to produce solar panels, to in-house production. In addition to strengthening the vertically

integrated supply chain, we will respond to market trends such as import restrictions in each country and realize the cost reductions

through mass production of major parts, thereby improving the profit margin of the group’s consolidated sales.

Through the medium-term management plan announced

on October 18, 2021 and subsequent upward revisions on September 28, 2022 and February 24, 2023, we will expand VSUN not only in the Vietnamese

market but also in other overseas markets. We have announced that we are considering raising funds VSUN not only in the Vietnamese market

but from a wide range of effective capital markets. Listing TOYO Co on NASDAQ market using SPAC will serve the purpose. We have agreed

with BWAQ that the business subject of this transaction will be the Cell Company. The main reasons for listing the Cell Company, a wholly

owned subsidiary of VSUN on the NASDAQ market using SPAC instead of VSUN are as below.

| ● | The

size of VSUN has grown significantly in recent years, increasing the complexity of the fair value assessment. |

| ● | VSUN

has a large number of trading partners across multiple countries, so the expanded need to comply with various laws and regulations will

increase the difficulty of listing VSUN through business combination with a SPAC, and as a result, the listing procedures may take significant

amount of time. Depending on the circumstances, there could be a risk that the proposed business combination with SPAC will not be consummated. |

In addition, in this transaction, we regard a

business combination with a SPAC as a method for listing TOYO Co on NASDAQ, which business combination will involve TOYO Co as the future

parent company of our consolidated subsidiaries, BWAQ as SPAC, and Cell Company as operating company. By merging BWAQ and TOYOOne, a holding

company that owns all shares of the operating company Cell Company through its subsidiary TOPTOYO, TOYO Co will effectively obtain the

substantial effects of the Cell Company listing.

As for the steps of this transaction, since the

affiliated companies are in many countries such as Japan, Vietnam, and the Cayman Islands, holding companies will be established in the

Cayman Islands and Singapore for the merger procedures. After completing TOYO Co’s acquisition of TOPTOYO and relevant capital injection,

TOYO Co will acquire all shares of Cell Company through its subsidiary TOPTOYO and is expected to be listed on NASDAQ.

After this transaction, TOYO Co and Cell Company

will continue to operate as our important subsidiaries in the solar panel manufacturing business segment to contribute to the business

growth. Also, currently, there are no plans to list VSUN on NASDAQ.

Detail

| 1. | Background and Purpose of the Transaction |

The Company has announced its medium-term management

plan up to 2024 (hereinafter referred to as the “Medium-Term Management Plan”). In the plan, the Company has been considering

more effective fundraising, including IPOs not only in Vietnam but also in other overseas markets, as one of the priority measures to

enhance corporate value.

The G7 climate, energy, and environment ministers

meeting has adopted a resolution to increase the amount of solar power generation to over 1 billion kW by 2030, more than three times

the current level. In particular, the “Spending and Revenue Act (Inflation Control Act)” signed into law in August 2022 by

President Biden includes a plan to invest approximately 400 billion dollars (approximately 56 trillion yen: as of 140 yen/USD) over the

next 10 years to reduce CO2 emissions. The U.S. government authorities have also been actively encouraging U.S. manufacturing (in-house

production) in recent years and have shown a willingness to back up solar panel production in the United States.

In this external environment surrounding renewable

energy, our consolidated subsidiary VSUN, which is engaged in the solar panel manufacturing business, has panel manufacturing plants in

Bac Giang and Bac Ninh provinces in Vietnam, and is expanding its panel production capacity, with the fourth plant in full-scale operation

since January 2023. However, the demand for panels in the U.S. and European markets continues to expand, and improving VSUN’s production

capacity is one of the most important management challenges.

In addition, to appropriately respond to various

import regulations mainly in Europe and the U.S., and to stabilize procurement of key components, we are also moving forward with the

shift from the current external procurement to in-house production of cells (N-type TOPCon), a key component required for solar panel

production. To improve the profitability through cost reduction, on February 10, 2023, we announced the construction of a cell factory

in Jinxi Industrial Park, Phu Tho Province, Vietnam in the “Announcement of Construction of VSUN Cell Factory (Phase 1) of our Group”.

In addition, we expect that the demand for funds

will increase to respond to the expanding market, such as considering the construction of factories outside of Vietnam, including the

U.S. In addition to raising the necessary funds through the listing of TOYO Co on NASDAQ, we intend to further enhance the corporate value

of VSUN and Cell Company. We intend to raise the necessary funds by listing TOYO Co on NASDAQ and to further enhance the corporate value

of VSUN and Cell Company.

| 2. | Outline of the Transaction |

In this transaction, as a method of listing TOYO

Co, a subsidiary of the Company, on NASDAQ, we envision a procedure to merge TOYOone, a wholly owned subsidiary of TOYO Co, with BWAQ.

BWAQ has already been listed on NASDAQ as a SPAC

on February 2, 2022. TOYO Co, which is expected to become a NASDAQ listed company pursuant to this transaction, owns all shares of TOYOone,

and shares of Cell Company will be held through its subsidiary TOPTOYO. By merging TOYOOne with BWAQ, Cell Company may be listed and raise

funds earlier than the schedule normally needed by going through the usual IPO procedure.

The internal reorganization of our subsidiaries,

which is part of the transaction, will involve FUJI, our subsidiary incorporated in Japan, Cell Company in Vietnam, and BWAQ in the Cayman

Islands. Therefore, we have designed each transaction step with economic rationality in mind while ensuring appropriate operation and

compliance with, among others, the laws, accounting systems, tax systems of each applicable country.

The general steps of the transaction

are as follows:

| 3. | Schedule for the Transaction |

| Resolution of the Company’s Board of Directors regarding the Agreement and Plan of Merger (hereinafter referred to as the “Merger Agreement”) |

August 10, 2023 |

| Merger Agreement signing date. |

August 10, 2023 |

| Scheduled date of BWAQ’s Board of Directors meeting to approve the Merger Agreement |

August 7, 2023 |

| Transaction closing date. |

By February 1, 2024 (expected) |

| 4. | Closing conditions of the transaction |

The closing conditions of the transaction include,

among others,

(1) receiving approval of the transaction by the

shareholders of BWAQ;

(2) receiving approval by the U.S. Securities

and Exchange Commission, and approval of the listing of TOYO Co’s shares on NASDAQ;

(3) no prohibition of the transaction under the

laws and regulations of the relevant countries (such as corporate law, securities law, tax law, foreign exchange control law, international

trade law , and other relevant laws and regulations); and

(4) satisfaction of the other closing conditions

set forth in the Merger Agreement, including but not limited to the conditions set forth above. In addition, if the above NASDAQ approval

is not granted by February 2024, the obligations to support this transaction may expire.

There are many countries, regions, and companies

involved in this transaction, and the procedures involved are very complex and time-consuming, there is a possibility that this transaction

will not be executed smoothly at all stages.

As stated in “1. Background and Purpose of this

Transaction” above, VSUN’s important management goal is to improve its production capacity. In particular, with regard to Cell

Company, a subsidiary of VSUN, the first phase of construction of a cell factory in Phu Tho Province, Vietnam (anticipated annual production

capacity: 3 GW, anticipated total investment: approximately USD 180 million (23.67 billion yen)) is already underway with completion expected

in October 2023, and the second phase of construction (anticipated annual production capacity: 3 GW, anticipated investment: approximately

USD 120 million (15.77 billion yen)) will be completed in the same month. The funds obtained from the Transaction, after deducting the

costs of the Transaction, will be used for capital investment in Cell Company.

With respect to the merger between TOYOone and BWAQ,

which is described in “Final step” in “2. Outline of the Transaction” above, shares of TOYO Co, which will eventually

become a listed company, will be issued to the shareholders of BWAQ, the non-surviving company (the so-called triangular merger procedure).

At the current valuation of USD 410 million (approximately 59 billion yen), the number of shares of TOYO Co to be held by Fuji following

this transaction will be 41 million shares, but Fuji’s ownership percentage in TOYO Co will vary depending various factors yet to

be determined at this time, such as the other financing of TOYO Co at the time of closing, SPAC’s redemption, and earn-out.

Cell Company will remain a consolidated subsidiary

of our company after this transaction. We will continue to position Cell Company as an important subsidiary of our group and strive for

the growth of our group.

| 7. | Outline of Cell Company |

| (1) Name |

Vietnam Sunergy Cell Company Limited |

| (2) Representative |

Ryu Junsei(龍 潤生) |

| (3) Location |

Kinh Creek Industrial Park, Phu Tho Province, Vietnam |

| (4) Capital |

190,000 million Vietnamese dong (1,178 million yen) |

| (5) Cut Off Date |

31 Dec 2022 |

| (6) Date of Establishment |

November 8, 2022 |

| (7) Business |

Photovoltaic panel cell manufacturing business |

| (8) Number of Employees |

242 (June 30, 2023) |

| (9) Major shareholders and their investment ratio |

Vietnam Sunergy Joint Stock Company 100%

(VSUN is a consolidated subsidiary of our company,

84.85% of which is owned by our subsidiary, FUJI.) |

| (10) Relationship with the Company |

Cell company is wholly owned by VSUN owned by Fuji Solar |

| Financial position and operating results for the immediately preceding fiscal year |

Year ending December 31, 2022 |

| Total assets |

VND 228,667 million

[1,268 million yen] |

| Net assets |

VND 188,682 million

[1,046 million yen] |

| Net sales |

VND 0 million

[0 million yen] |

| Operating income |

VND 0 million

[0 million yen] |

| Ordinary income |

VND (1,317) million

[(7) million yen] |

| Net income attributable to owners of the parent |

VND (570) million

[(3) million yen] |

| Business plan |

VND2,330,000 million [12,944 million yen] for the

December 2023 period

December 2024 sales forecast VND12,310,000 million

[68,389 million yen] |

(Note: The yen conversion of

VND (Vietnamese Dong) is based on the exchange rate at the end of each fiscal year as shown on the exchange rate org website

(https://www.exchange- rates.org/exchange-rate-history/).

| (1) Name |

Vietnam Sunergy Joint Stock Company |

| (2) Representative |

Ryu Junsei(龍 潤生) |

| (3) Location |

LotⅢ-Dong Vang,Dinh Tram Industrial Zone,Hoang Ninh Commune,Viet Yen District,Bac Giang Province,Vienam |

| (4) Capital |

VND379,892 million [1,913 million yen] |

| (5) Cut Off Date |

31 Dec 2022 |

| (5) Business |

Solar panel manufacturing business |

| (6) Number of Employees |

1,264 |

| (7) Major shareholders and their investment ratio |

FUJI 84.85% |

| (8) Relationship with the Company |

Consolidated subsidiary |

| Financial position and operating results for the immediately preceding fiscal year |

Year ending

December 31, 2020 |

Year ending

December 31, 2021 |

Year ending

December 31, 2022 |

| Consolidated total assets |

VND2,429,669 million

[10,815 million yen] |

VND5,536,223 million

[27,988 million yen)] |

VND12,565,491 million

[80,785 million yen] |

| Consolidated net assets |

VND550,225 million

[2,449 million yen] |

VND 626,855 million

[3,169 million yen] |

VND1,636,235 million

9,075 million yen |

| Consolidated net sales |

VND1,942,267 million

[8,646 million yen] |

VND7,287,368 million

[36,840 million yen] |

VND29,682,829 million

[164,630 million yen] |

| Consolidated operating income |

VND125,332 million

[558 million yen] |

VND93,302 million

[472 million yen] |

VND978,399 million

[5,427 million yen] |

| Consolidated ordinary income |

VND133,268 million

[593 million yen] |

VND88,734 million

[449 million yen] |

VND1,106,778 million

[6,139 million yen] |

| Net income attributable to owners of the parent |

VND127,161 million

[566 million yen] |

VND82,313 million

[416 million yen] |

VND996,698 million

[5,528 million yen] |

| Net income per share |

VND6,550

[29 yen] |

VND4,240

[21 yen] |

VND51,343

[285 yen] |

(Note: The yen conversion of

VND (Vietnamese Dong) is based on the exchange rate at the end of each fiscal year as shown on the exchange rate org website

(https://www.exchange- rates.org/exchange-rate-history/).

| (1) Name |

BLUE WORLD ACQUISITION CORPORATION |

| (2) Representative |

(Simon) Shi Liang |

| (3) Registered Office |

89 Nexus Way, Camana Bay , Grand Cayman KY1-9009, Cayman Islands |

| (4) Capital stock |

USD50,000 (Japanese Yen equivalent: approximately 7.2 million yen) |

| (5) Date of establishment |

July 19, 2021 |

| (6) Business |

Special purpose acquisition company |

| (7) Relationship between the Subject Company and the Company |

Capital relations |

N/A |

| Personal relations |

N/A |

| Business relations |

N/A |

| Financial position and operating results for the immediately preceding fiscal year |

Year ended June 30, 2022 |

| Total assets |

USD 93,864,631

[12,741 million yen] |

| Net assets |

USD 90,561,897

[12,292 million yen] |

| Net sales |

USD 0

[0 yen] |

| Operating income |

USD (381,305)

[(51) million yen] |

| Ordinary income |

USD (246,892)

[(33) million yen] |

| Net income attributable to owners of the parent |

USD (246,892)

[(33) million yen] |

| Net income per share |

USD (0.04)

[(0) yen] |

(Note: The yen conversion of

USD is based on the exchange rate at the end of each fiscal year as stated on the exchange rate org website

(https://www.exchange-rates.org/exchange-rate- history/).

| (1) Name |

TOPTOYO INVESTMENT PTE.LTD. |

| (2) Representative |

Ryu Junsei(龍 潤生) |

| (3) Location |

112 Robinson Road #03-01 Robinson 112 Singapore |

| (4) Capital stock |

SGD 1.00 (107 yen) |

| (5) Date of Establishment |

April 26, 2023 |

| (6) Business |

Holding company. |

| (7) Number of Employees |

0 |

| (8) Major shareholders and their investment ratio |

FUJI SOLAR 100%. |

| (9) Relationship with the Company |

Subsidiary company |

(Note: The yen conversion of

SGD is based on the exchange rate at the end of each fiscal year as shown on the exchange rate org website

(https://www.exchange-rates.org/exchange-rate-history/).

| (1) Name |

TOYO Co., Ltd |

| (2) Representative |

Ryu Junsei(龍 潤生) |

| (3) Location |

Harneys Fiduciary (Cayman) Limited of 4 th Floor, Harbour Place, 103 South Church Street, P.O.Box 10240, Grand Cayman KY1-1002, Cayman Islands |

| (4) Capital stock |

USD1.00 (141yen) |

| (5) Date of Establishment |

May 16, 2023 |

| (6) Business |

Holding company |

| (7) Number of Employees |

0 |

| (8) Major shareholders and their investment ratio |

FUJI SOLAR 100%. |

| (9) Relationship with the Company |

Subsidiary company |

(Note: The yen conversion of

USD is based on the exchange rate at the end of each fiscal year as stated on the exchange rate org website

(https://www.exchange-rates.org/exchange-rate- history/).

| (1) Name |

TOYOone Limited |

| (2) Representative |

Ryu Junsei(龍 潤生) |

| (3) Location |

Harneys Fiduciary (Cayman) Limited of 4 th Floor, Harbour Place, 103 South Church Street, P.O.Box 10240, Grand Cayman KY1-1002, Cayman Islands |

| (4) Capital stock |

USD1.00 (141yen) |

| (5) Date of Establishment |

May 26, 2023 |

| (6) Business |

Special purpose company established for this combination |

| (7) Number of Employees |

0 |

| (8) Major shareholders and their investment ratio |

TOYO Co 100% |

| (9) Relationship with the Company |

Subsidiary company |

(Note: The yen conversion of

USD is based on the exchange rate at the end of each fiscal year as stated on the exchange rate org website

(https://www.exchange-rates.org/exchange-rate- history/).

| 13. | Outlook for the future |

The impact of this transaction on the consolidated

business results for the fiscal year ending June 30, 2024, is currently under scrutiny. The Merger Agreement is an agreement between the

parties concerned at this time and is subject to change based on discussions between the parties. Should any matters arise, that should

be announced in the future, an announcement will be made promptly.

The

subject ends herewith.

Forward-Looking Statements

This communication includes

forward looking statements that involve risks and uncertainties. Forward-looking statements are statements that are not historical facts

and may be accompanied by words that convey projected future events or outcomes, such as “believe,” “may,” “will,”

“estimate,” “continue,” “anticipate,” “design,” “intend,” “expect,”

“could,” “plan,” “potential,” “predict,” “seek,” “target,” “aim,”

“plan,” “project,” “forecast,” “should,” “would,” or variations of such words

or by expressions of similar meaning. Such forward-looking statements, may include, without limitation, statements regarding anticipated

operational results, projections of market opportunity and trends, the future growth strategies, the ability of Vietnam Sunergy Cell Company

Limited (the “Company”), TOYO Co., Ltd (“PubCo”) and Blue World Acquisition Corporation (“BWAQ”)

to consummate the proposed business combination (the “Transactions”) and the timing of such consummation, are subject

to risks and uncertainties, which could cause actual results to differ from the forward-looking statements. These risks and uncertainties

include, but are not limited to, those factors described in the section entitled “Risk Factors” in BWAQ’s Annual Report

on Form 10-K initially filed with the SEC on September 16, 2022, as amended on April 7, 2023 and May 11, 2023 (the “Form 10-K”),

BWAQ’s final prospectus dated January 31, 2023 filed with the SEC (the “Final Prospectus”) related to BWAQ’s

initial public offering, and in other documents filed by BWAQ with the SEC from time to time. Important factors that could cause the combined

company’s actual results or outcomes to differ materially from those discussed in the forward-looking statements include: the Company’s

or the combined company’s limited operating history; the ability of the Company or the combined company to identify and integrate

acquisitions; general economic and market conditions impacting demand for the products of the Company or the combined company; the inability

to complete the proposed Transactions; the inability to recognize the anticipated benefits of the proposed Transactions, which may be

affected by, among other things, the amount of cash available following any redemptions by BWAQ shareholders; the ability to meet Nasdaq’s

listing standards following the consummation of the proposed Transactions; costs related to the proposed Transactions; and such other

risks and uncertainties as are discussed in the Form 10-K, the Final Prospectus and the proxy statement to be filed relating to the Transactions.

Other factors include the possibility that the proposed Transactions do not close, including due to the failure to receive required security

holder approvals, or the failure of other closing conditions.

The Company, PubCo and BWAQ

each expressly disclaims any obligations or undertaking to release publicly any updates or revisions to any forward-looking statements

contained herein to reflect any change in the expectations of Company, PubCo or BWAQ with respect thereto or any change in events, conditions

or circumstances on which any statement is based, except as required by law.

Additional Information about the Transaction

and Where to Find It

In connection with the proposed

Transactions, PubCo intends to file with the SEC a registration statement on Form F-4, which will include a preliminary proxy statement

containing information about the proposed Transactions and the respective businesses of the Company and BWAQ, as well as the prospectus

relating to the offer of the PubCo securities to be issued to in connection with the completion of the proposed Transactions. After the

registration statement is declared effective, BWAQ will mail a definitive proxy statement and other relevant documents to its shareholders

as of the record date established for voting on the proposed Transactions.

INVESTORS AND SECURITY HOLDERS

ARE ADVISED TO READ, WHEN AVAILABLE, THE REGISTRATION STATEMENT, PROXY STATEMENT/PROSPECTUS AND ANY OTHER RELEVANT DOCUMENTS FILED WITH

THE SEC CAREFULLY AND IN THEIR ENTIRETY IF AND WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE TRANSACTIONS

AND THE PARTIES TO THE TRANSACTIONS. Investors and security holders will be able to obtain copies of these documents (if and when available)

and other documents filed with the SEC free of charge at www.sec.gov. Shareholders of BWAQ will also be able to obtain copies of the proxy

statement/prospectus without charge, once available, at the SEC’s website at www.sec.gov.

Participants in the Solicitation

PubCo, the Company, BWAQ and

their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from

BWAQ’s shareholders with respect to the proposed Transactions. Information regarding BWAQ’s directors and executive officers

is available in BWAQ’s filings with the SEC. Additional information regarding the persons who may, under the rules of the SEC, be

deemed to be participants in the proxy solicitation relating to the proposed Transactions and a description of their direct and indirect

interests, by security holdings or otherwise, will be contained in the proxy statement/prospectus when it becomes available.

No Offer or Solicitation

This communication does not

constitute an offer to sell or the solicitation of an offer to buy any securities, or a solicitation of any vote or approval, nor shall

there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration

or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus

meeting the requirements of the Securities Act of 1933, as amended.

11

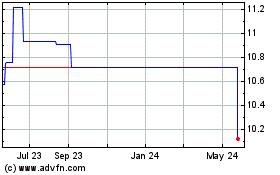

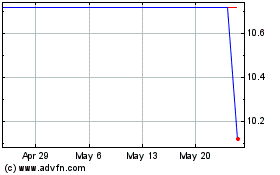

Blue World Acquisition (NASDAQ:BWAQU)

Historical Stock Chart

From Jun 2024 to Jul 2024

Blue World Acquisition (NASDAQ:BWAQU)

Historical Stock Chart

From Jul 2023 to Jul 2024