UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

Report of Foreign Private Issuer

Pursuant to Rules 13a-16 or 15d-16 under

the Securities Exchange Act of 1934

For the month of May 2024

Commission File Number: 001-38836

BIOCERES CROP SOLUTIONS CORP.

(Translation of registrant’s name into English)

Ocampo 210 bis, Predio CCT, Rosario

Province of Santa Fe, Argentina

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Exhibit List

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

|

BIOCERES CROP SOLUTIONS CORP. |

| |

|

(Registrant) |

| |

|

|

|

| |

|

|

|

| Dated: May 14, 2024 |

|

By: |

/s/ Federico Trucco |

| |

|

Name: |

Federico Trucco |

| |

|

Title: |

Chief Executive Officer |

Exhibit 99.1

FISCAL

THIRD

QUARTER

2024

Financial and Operating Results

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Bioceres

Crop Solutions Reports

Fiscal

Third Quarter 2024

Financial

and Operational Results

Total

revenues in 3Q24 were $84.0 million

3Q24

GAAP net income was $9.8 million and adjusted EBITDA1 was $21.1 million

ROSARIO,

Argentina – May 13, 2024 – Bioceres Crop Solutions Corp. (Bioceres) (NASDAQ: BIOX), a leader in the development

and commercialization of productivity solutions designed to regenerate agricultural ecosystems while making crops more resilient to climate

change, announced financial results for the fiscal third quarter ended March 31, 2024. Financial results are expressed in U.S. dollars

and are presented in accordance with International Financial Reporting Standards. All comparisons in this announcement are year-over-year

(YoY), unless otherwise noted.

FINANCIAL &

BUSINESS HIGHLIGHTS

| · | Total

revenues in 3Q24 were $84.0 million compared to $93.6 million in the same quarter last

year. Operational growth in the business was offset by a $15.7 million accrual of the compensatory

payment from Syngenta, in comparison to a $32.9 million accrual in 3Q23. |

| · | Operating

profit was $13.2 million with GAAP net income at $9.8 million. |

| · | Adjusted

EBITDA1 for the quarter was $21.1 million, compared to $35.8 million in

the year ago quarter. The decrease was driven by the lower compensatory payment accrual,

partially softened by improved operational performance. |

| · | Regulatory

clearance in Brazil unlocks bio-insecticidal/bio-nematicidal solutions, expanding

Bioceres’ biologicals portfolio in this geography. |

| · | HB4

Soy varieties showed satisfactory performance at farmer level in Brazil, with an average

yield improvement of 7% against non-HB4 varieties. |

MANAGEMENT

REVIEW

Mr. Federico

Trucco, Bioceres´ Chief Executive Officer, commented: “We are generally satisfied with our third quarter results, despite

some delayed sales in our bio-nutrition segment in Argentina and Brazil, which we now expect to realize in our fourth and final fiscal

quarter. As anticipated, our third quarter growth is disfavored when compared to the year before, given the disproportional weight of

the Syngenta distribution agreement, whose contribution is now more evenly distributed throughout the year. From a qualitative point

of view, we continue to see positive developments in Brazil, which we expect to translate into quantitative milestones in one or two

seasons. One of these developments was the first regulatory approval for our inactivated Burkholderia bio-control solutions, which

we announced last week. This approval creates an immediate opportunity in high value bio-insecticidal markets as well as in our Generation

HB4 channel, and — in one or two seasons — in broader row-crop markets once our lowest rate formulations are included in

the portfolio. Another positive development in Brazil comes from the performance of our first two HB4 soy varieties, where we received

favorable feedback from key farmers and expect to increase the current pace of growth. Looking ahead and despite the industry-wide headwinds

persisting from last year, we are confident on the attractiveness of our value propositions and the capabilities of our teams to achieve

the double-digit growth we are known to deliver.”

1 Adjusted

EBITDA is a non-GAAP measure. See “Use of non-IFRS financial information” for information regarding our use of Adjusted

EBITDA and its reconciliation from the most comparable financial measure.

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Mr. Enrique

Lopez Lecube, Bioceres´ Chief Financial Officer, noted: “This year’s third fiscal quarter was marked by a difficult

comparison against last year´s third quarter, in which the compensatory payment from the Syngenta agreement drove a substantial

portion of sales and explained our profits almost in full. In a scenario of slower-than-expected market dynamics for fertilizers and

inoculants in South America and persisting suboptimal conditions for crop protection in the US and Brazil, we were still able to partially

offset the $17 million year-over-year difference from the Syngenta agreement by growing the rest of our business’ top line by roughly

$8 million. As we head into the last quarter of our fiscal year, we are confident that with a normalized crop nutrition market we will

be in good shape to deliver our annual goals of achieving double-digit growth in EBITDA”.

KEY FINANCIAL METRICS

Table 1: 3Q24 Key

Financial Metrics

| (In

millions of U.S. dollars) | |

3Q23 | | |

3Q24 | | |

%

Change | |

| Revenue by Segment | |

| | |

| | |

| |

| Crop Protection | |

| 44.3 | | |

| 46.8 | | |

| 6 | % |

| Seed and Integrated Products | |

| 5.9 | | |

| 8.6 | | |

| 46 | % |

| Crop Nutrition | |

| 43.4 | | |

| 28.6 | | |

| (34 | )% |

| Total Revenue | |

| 93.6 | | |

| 84.0 | | |

| (10 | )% |

| Gross Profit | |

| 57.5 | | |

| 42.6 | | |

| (26 | )% |

| Gross Margin | |

| 61.4 | % | |

| 50.8 | % | |

| (1,062 | )bps |

| | |

3Q23 | | |

3Q24 | | |

%

Change | |

| GAAP net income or loss | |

| 27.5 | | |

| 9.8 | | |

| (64 | )% |

| Adjusted EBITDA1 | |

| 35.8 | | |

| 21.1 | | |

| (41 | )% |

3Q24 Summary:

Total revenues were $84.0 million in 3Q24, compared to $93.6 million for the same quarter last year. The decline is fully explained

by a ~$17 million decrease in the accrual of the Syngenta compensatory payment, which was $15.7 million this year, compared to $32.9

million in the year-ago quarter. Excluding these accruals, the business generated $68.3 million in revenues, compared to $60.7 million

last year, with modest growth in Crop Protection and Crop Nutrition, the two main business segments contributing material sales during

the quarter.

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Gross

profit for the quarter was $42.6 million, a decline compared to the $57.5 million in 3Q23. As with revenues, the reduction was entirely

due to the lower accrual of the compensatory payment this quarter compared to last year. Excluding this, gross profit increased —

although proportionally less than revenues due to product mix — and overall gross margin remained practically flat.

GAAP net income

and adjusted EBITDA1 for the quarter were $9.8 million and $21.1 million, respectively, compared to $27.5 million and $35.8

million, respectively. The decrease in the compensatory payment translates directly into the bottom line, partially offset by an improved

underlying business performance.

THIRD

QUARTER 2024 FINANCIAL RESULTS

Revenues

Table 2: 3Q24 Revenues by Segment

| (In

millions of U.S. dollars) | |

3Q23 | | |

3Q24 | | |

%

Change | |

| Revenue by segment | |

| | |

| | |

| |

| Crop protection | |

| 44.3 | | |

| 46.8 | | |

| 6 | % |

| Seed

and integrated products | |

| 5.9 | | |

| 8.6 | | |

| 46 | % |

| Crop

nutrition | |

| 43.4 | | |

| 28.6 | | |

| (34 | )% |

| Total

revenue | |

| 93.6 | | |

| 84.0 | | |

| (10 | )% |

Revenues in

3Q24 were $84.0 million, compared to $93.6 million in the same quarter last year, with mixed performance across segments.

In Crop Protection,

revenues were 6% higher than last year, mainly due to higher sales of third-party crop protection products whose demand was spurred by

a better moisture profile in Argentina this year. Adjuvant sales also contributed to segment growth, although their performance was limited

in Brazil, given the continuing difficulties in that country’s crop protection market. Similar to Brazil, the bioprotection market

in the U.S. continued to see some headwinds on purchase flow from distributors during the quarter.

Seed and Integrated

Products saw a 46% increase in revenues compared to the year before. Growth was driven by HB4 downstream sales in a seasonally low quarter

for other seed-related products. As mentioned in previous quarters, inventories of first-generation varieties continue to be sold into

the processing channel to reduce working capital, while developing industrial channels for HB4 grain.

In Crop Nutrition,

product sales grew in comparison to the previous year, however overall segment sales posted a 34% yearly reduction due to strong comparables

from the Syngenta payment accrual. As was previously disclosed, two thirds of the $50 million compensatory payment from Syngenta were

booked in 3Q23, and $15.7 million were recognized in the current quarter. This decline drives segment results, only partially softened

by growth in biostimulant and micro-beaded fertilizer sales. Biostimulant sales grew during the quarter, with expansion in Brazil and

Europe. Micro-beaded fertilizers also grew against last year’s drought affected levels; the increase was lower than expected given

reluctance from farmers to make pre-season fertilizer purchases ahead of winter planting. In a context of lower commodity prices, fertilizer

prices have remained comparatively high, increasing farmers´ expectations for an improvement in relative prices.

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Gross

Profit & Margin

Table

3: 3Q24 Gross Profit by Segment

| (In

millions of U.S. dollars) | |

3Q23 | | |

3Q24 | | |

%

Change | |

| Gross profit by segment | |

| | |

| | |

| |

| Crop protection | |

| 17.5 | | |

| 17.8 | | |

| 2 | % |

| Seed and integrated products | |

| 3.6 | | |

| 2.5 | | |

| (31 | )% |

| Crop nutrition | |

| 36.3 | | |

| 22.3 | | |

| (38 | )% |

| Total Gross profit | |

| 57.5 | | |

| 42.6 | | |

| (26 | )% |

| % Gross margin | |

| 61.4 | % | |

| 50.8 | % | |

| (1,062 | )bps |

Gross profit

for the quarter was $42.6 million, compared to $57.5 million the year before.

In Crop Protection,

gross profit increased by 2% on higher sales. The increase is lower than that of revenues due to changes in product mix, with increased

participation of lower-margin third party products, while higher-margin products such as adjuvants, made a weaker contribution to growth

this quarter.

Gross profit from

Seed and Integrated Products declined despite the increased sales, as profits from high-margin seed treatment products sales that migrated

into the Syngenta agreement were not fully compensated by the growth in lower-margin downstream grain sales.

In Crop Nutrition,

the gross profit decline is entirely due to the ~$17 million lower compensatory payment accrual. The decrease is mitigated by an increase

in gross profit from higher sales of fertilizers, biostimulants and inoculants.

Gross margin for

the quarter was 50.8%, a year-over-year reduction given the extraordinary comparable.

Operating

Expenses

Selling, General

and Administrative Expenses: SG&A expenses excluding D&A, transaction expenses and share-based incentives, were $22.0 million

in 3Q24, compared to $20.3 million the same quarter last year. The $1.7 million increase results from higher variable expenses and minor

increases in fixed operating expenses.

Research and

Development: total R&D expenses excluding D&A and share-based incentives were $2.0 million in 3Q24 compared with $2.5 million

in 3Q23 and represented 2% of sales for the quarter.

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

GAAP

Net Income & Adjusted EBITDA1

GAAP

net income was $9.8 million in 3Q24, compared to $27.5 million for the same quarter last year. The decrease in net income is primarily

the result of lower operating profit — as previously explained, due to the lower accrual of the compensatory payment from Syngenta

—, and lower tax income benefits in comparison to the same quarter last year. The decrease was partially offset by an improvement

in financial results on account of lower financial expenses and improved exchange variation results from Argentine peso-denominated assets

on a lower depreciation rate for the quarter.

Adjusted

EBITDA1 was $21.1 million in 3Q24, compared to $35.8 million, for the same quarter last year. The decline in Adjusted

EBITDA is fully driven by the lower accrual of the compensatory payment from Syngenta compared to the year-ago quarter, partially offset

by improved performance in the underlying business.

Financial

Income and Loss

Table

4: 3Q24 Net Financial Result

| (In

millions of U.S. dollars) | |

3Q23 | | |

3Q24 | | |

Chg. | | |

%Chg. | |

| Interest expenses | |

| (4.1 | ) | |

| (2.7 | ) | |

| 1.4 | | |

| 35 | % |

| Financial commissions | |

| (0.5 | ) | |

| (0.5 | ) | |

| (0.0 | ) | |

| (1 | )% |

| Exchange variations and other financial results | |

| (3.0 | ) | |

| (1.2 | ) | |

| 1.8 | | |

| 60 | % |

| Total financial results | |

| (7.6 | ) | |

| (4.4 | ) | |

| 3.2 | | |

| 42 | % |

Total financial

results improved by $3.2 million during the quarter due to lower interest expenses on both a lower debt position and lower average cost

of debt, as well as improved results from Argentine peso-denominated assets on a lower depreciation rate for the quarter.

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Balance

Sheet Highlights

Table

5: Capitalization and Debt

| | |

As of March, 31 | |

| (In millions of U.S. dollars) | |

2023 | | |

2024 | |

| Total Debt | |

| | | |

| | |

| Short-Term Debt | |

| 107.9 | | |

| 144.2 | |

| Long-Term Debt | |

| 142.2 | | |

| 98.6 | |

| Cash and Cash Equivalents | |

| (57.7 | ) | |

| (16.4 | ) |

| Other short-term investments | |

| (13.1 | ) | |

| (16.5 | ) |

| Debt net of cash, cash equivalents and other short-term investments | |

| 179.2 | | |

| 210.0 | |

| Equity attributable to equity holders of the parent | |

| 301.1 | | |

| 313.4 | |

| Equity attributable to non-controlling interests | |

| 33.2 | | |

| 35.2 | |

| Capitalization | |

| 513.5 | | |

| 558.5 | |

| LTM GAAP

Net Income | |

| 18.4 | | |

| 5.6 | |

| LTM

Adjusted EBITDA1 | |

| 85.2 | | |

| 72.0 | |

Total

Financial Debt stood at $242.8 million as of March 31, 2024, compared to $250.1 million on March 31, 2023.

Cash, Cash Equivalents

and Other Short-Term Investments totaled $32.8 million in 3Q24, compared to $70.9 million in 3Q23, which reflected the $50.0 million

cash payment from the Syngenta agreement received in 2Q23. Total financial debt net of cash, cash equivalents and other short-term investments

stood at $210.0 million in 3Q24.

THIRD

QUARTER 2024 EARNINGS CONFERENCE CALL

Management will

host a conference call and question-and-answer session, which will be accompanied by a presentation available during the webcast or accessed

via the investor relations section of the company’s website.

To access the call,

please use the following information:

| Date: |

Tuesday,

May 14, 2024 |

| |

|

| Time: |

8:30 a.m. ET, 5:30 a.m. PT |

| |

|

| US Toll Free dial-in number: |

1-833-470-1428 |

| |

|

| International dial-in numbers: |

Click here |

| |

|

| Conference ID: |

391060 |

| |

|

| Webcast: |

Click here |

Please dial in

5-10 minutes prior to the start time to register and join.

The conference

call will be broadcast live and available for replay here and via the investor relations section of the company’s website here.

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

A replay of the

call will be available through June 6, 2024, following the conference.

| Toll

Free Replay Number: |

1-866-813-9403 |

| |

|

| International Replay Number: |

+44 204 525 0658 |

| |

|

| Replay ID: |

206193 |

About Bioceres Crop

Solutions Corp.

Bioceres Crop Solutions

Corp. (NASDAQ: BIOX) is a leader in the development and commercialization of productivity solutions designed to regenerate agricultural

ecosystems while making crops more resilient to climate change. To do this, Bioceres’ solutions create economic incentives for

farmers and other stakeholders to adopt environmentally friendlier production practices. The company has a unique biotech platform with

high-impact, patented technologies for seeds and microbial ag-inputs, as well as next generation Crop Nutrition and Protection solutions.

Through its HB4® program, the company is bringing digital solutions to support growers’ decisions and provide end-to-end traceability

for production outputs. For more information, visit here.

Contact

Bioceres Crop Solutions

Paula Savanti

Head of Investor Relations

investorrelations@biocerescrops.com

Forward-Looking

Statements

This

communication includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the

United States Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of words such

as “forecast,” “intend,” “seek,” “target,” “anticipate,” “believe,”

“expect,” “estimate,” “plan,” “outlook,” and “project” and other similar

expressions that predict or indicate future events or trends or that are not statements of historical matters. Such forward-looking statements

include estimated financial data, and any such forward-looking statements involve risks, assumptions and uncertainties. These forward-looking

statements include, but are not limited to, whether (i) the health and safety measures implemented to safeguard employees and assure

business continuity will be successful and (ii) we will be able to coordinate efforts to ramp up inventories. Such forward-looking

statements are based on management’s reasonable current assumptions, expectations, plans and forecasts regarding the company’s

current or future results and future business and economic conditions more generally. Such forward-looking statements involve risks,

uncertainties and other factors, which may cause the actual results, levels of activity, performance or achievement of the company to

be materially different from any future results expressed or implied by such forward-looking statements, and there can be no assurance

that actual results will not differ materially from management’s expectations or could affect the company’s ability

to achieve its strategic goals, including the uncertainties relating to the other factors that are described in the sections entitled

“Risk Factors” in the company's Securities and Exchange Commission filings updated from time to time. The preceding

list is not intended to be an exhaustive list of all of our forward-looking statements. Therefore, you should not rely on any of these

forward-looking statements as predictions of future events. All forward-looking statements contained in this release are qualified in

their entirety by this cautionary statement. Forward-looking statements speak only as of the date they are or were made, and the company

does not intend to update or otherwise revise the forward-looking statements to reflect events or circumstances after the date of this

release or to reflect the occurrence of unanticipated events, except as required by law.

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Use

of non-IFRS financial information

The

company supplements the use of IFRS financial measures with non-IFRS financial measures.

The

non-IFRS measures should not be considered in isolation or as a substitute for measures of performance prepared in accordance with IFRS

and may be different from non-IFRS measures used by other companies. In addition, the non-IFRS measures are not based on any comprehensive

set of accounting rules or principles. Non-IFRS measures have limitations in that they do not reflect all of the amounts associated

with our results of operations as determined in accordance with IFRS. This non-IFRS financial measures should only be used to evaluate

the company’s results of operations in conjunction with the most comparable IFRS financial measures. In addition, other companies

may report similarly titled measures, but calculate them differently, which reduces their usefulness as a comparative measure. Management

utilizes these non-IFRS metrics as performance measures in evaluating and making operational decisions regarding our business.

Adjusted EBITDA

The

company defines adjusted EBITDA as net income/(loss) exclusive of financial income/(costs), income tax benefit/(expense), depreciation,

amortization, share-based compensation, and one-time transactional expenses.

Management

believes that adjusted EBITDA provides useful supplemental information to investors about the company and its results. Adjusted EBITDA

is among the measures used by the management team to evaluate the company’s financial and operating performance and make day-to-day

financial and operating decisions. In addition, adjusted EBITDA and similarly titled measures are frequently used by competitors, rating

agencies, securities analysts, investors and other parties to evaluate companies in the same industry. Management also believes that

adjusted EBITDA is helpful to investors because it provides additional information about trends in the company’s core operating

performance prior to considering the impact of capital structure, depreciation, amortization and taxation on results. Adjusted EBITDA

should not be considered in isolation or as a substitute for other measures of financial performance reported in accordance with IFRS.

Adjusted EBITDA has limitations as an analytical tool, including:

·

Adjusted EBITDA does not reflect changes in, including cash requirements for working capital needs or contractual commitments.

·

Adjusted EBITDA does not reflect financial expenses, or the cash requirements to service interest or principal payments on indebtedness,

or interest income or other financial income.

·

Adjusted EBITDA does not reflect income tax expense or the cash requirements to pay income taxes.

·

Although depreciation and amortization are non-cash charges, the assets being depreciated or amortized often will need to be replaced

in the future, and adjusted EBITDA does not reflect any cash requirements for these replacements.

·

Although share-based compensation is a non-cash charge, adjusted EBITDA does not consider the potentially dilutive impact of share-based

compensation; and

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

·

Other companies may calculate adjusted EBITDA and similarly titled measures differently, limiting its usefulness as a comparative measure.

The

company compensates for the inherent limitations associated with using adjusted EBITDA through disclosure of these limitations, presentation

in the combined financial statements in accordance with IFRS and reconciliation of adjusted EBITDA to the most directly comparable IFRS

measure, income/(loss) for the period or year.

Table

6: 3Q24 Adjusted EBITDA Reconciliation from Profit/(Loss) for the period

| (In millions of U.S. dollars) | |

3Q23 | | |

3Q24 | | |

LTM

3Q23 | | |

LTM

3Q24 | |

| Profit/(loss) for the period | |

| 27.5 | | |

| 9.8 | | |

| 18.4 | | |

| 5.6 | |

| Income tax | |

| (5.2 | ) | |

| (1.0 | ) | |

| 7.4 | | |

| 6.2 | |

| Financial results | |

| 7.6 | | |

| 4.4 | | |

| 33.2 | | |

| 28.7 | |

| Depreciations & amortizations | |

| 5.0 | | |

| 4.9 | | |

| 18.5 | | |

| 19.1 | |

| Stock-based compensation charges | |

| 0.6 | | |

| 3.0 | | |

| 3.0 | | |

| 12.2 | |

| Transaction expenses | |

| 0.3 | | |

| - | | |

| 4.7 | | |

| 0.2 | |

| Adjusted EBITDA | |

| 35.8 | | |

| 21.1 | | |

| 85.2 | | |

| 72.0 | |

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Unaudited

Consolidated Statement of Comprehensive Income

(Figures in million of U.S. dollars)

| | |

Three-month period

ended 03/31/2024 | | |

Three-month period

ended 03/31/2023 | |

| Revenues from contracts with customers | |

| 84.0 | | |

| 93.0 | |

| Initial recognition and changes in the fair value of biological assets at the point of harvest | |

| (0.1 | ) | |

| 0.6 | |

| Cost of sales | |

| (41.3 | ) | |

| (36.1 | ) |

| Gross profit | |

| 42.6 | | |

| 57.5 | |

| % Gross profit | |

| 51 | % | |

| 61 | % |

| Operating expenses | |

| (30.7 | ) | |

| (27.9 | ) |

| Share of profit of JV | |

| 0.9 | | |

| 0.4 | |

| Change in net realizable value of agricultural products | |

| 0.2 | | |

| (1.1 | ) |

| Other income or expenses, net | |

| 0.2 | | |

| 1.0 | |

| Operating profit | |

| 13.2 | | |

| 29.9 | |

| Financial result | |

| (4.4 | ) | |

| (7.6 | ) |

| Profit/(loss) before income tax | |

| 8.8 | | |

| 22.3 | |

| Income tax | |

| 1.0 | | |

| 5.2 | |

| Profit/(loss) for the period | |

| 9.8 | | |

| 27.5 | |

| Other comprehensive profit | |

| 0.2 | | |

| (0.1 | ) |

| Total comprehensive profit/(loss) | |

| 10.0 | | |

| 27.4 | |

| | |

| | | |

| | |

| Profit/(loss) for the period attributable to: | |

| | | |

| | |

| Equity holders of the parent | |

| 9.3 | | |

| 28.1 | |

| Non-controlling interests | |

| 0.5 | | |

| (0.7 | ) |

| | |

| 9.8 | | |

| 27.5 | |

| Total comprehensive profit/(loss) attributable to: | |

| | | |

| | |

| Equity holders of the parent | |

| 9.5 | | |

| 28.2 | |

| Non-controlling interests | |

| 0.5 | | |

| (0.8 | ) |

| | |

| 10.0 | | |

| 27.4 | |

| Weighted average number of shares | |

| | | |

| | |

| Basic | |

| 62.8 | | |

| 62.0 | |

| Diluted | |

| 66.8 | | |

| 63.1 | |

| BIOCERES CROP SOLUTIONS |

THIRD QUARTER 2024 |

|

Unaudited Consolidated Statement

of Financial Position

(Figures in million of U.S. dollars)

| ASSETS | |

03/31/2024 | | |

06/30/2023 | |

| CURRENT ASSETS | |

| | | |

| | |

| Cash and cash equivalents | |

| 16.4 | | |

| 48.1 | |

| Other financial assets | |

| 16.5 | | |

| 12.1 | |

| Trade receivables | |

| 212.1 | | |

| 158.0 | |

| Other receivables | |

| 30.7 | | |

| 28.8 | |

| Income and minimum presumed recoverable income taxes | |

| 1.4 | | |

| 9.4 | |

| Inventories | |

| 129.2 | | |

| 140.4 | |

| Biological assets | |

| 1.9 | | |

| 0.1 | |

| Total current assets | |

| 408.1 | | |

| 397.1 | |

| NON-CURRENT ASSETS | |

| | | |

| | |

| Other financial assets | |

| 0.4 | | |

| 0.4 | |

| Other receivables | |

| 2.1 | | |

| 2.5 | |

| Income and minimum presumed recoverable income taxes | |

| 0.0 | | |

| 0.0 | |

| Deferred tax assets | |

| 9.7 | | |

| 7.3 | |

| Investments in joint ventures and associates | |

| 42.3 | | |

| 39.3 | |

| Investment properties | |

| 0.6 | | |

| 3.6 | |

| Property, plant and equipment | |

| 74.6 | | |

| 67.9 | |

| Intangible assets | |

| 174.5 | | |

| 173.8 | |

| Goodwill | |

| 112.2 | | |

| 112.2 | |

| Right-of-use leased asset | |

| 12.7 | | |

| 13.9 | |

| Total non-current assets | |

| 428.9 | | |

| 420.9 | |

| Total assets | |

| 837.0 | | |

| 818.1 | |

| LIABILITIES | |

| | |

| |

| CURRENT LIABILITIES | |

| | | |

| | |

| Trade and other payables | |

| 167.5 | | |

| 150.8 | |

| Borrowings | |

| 144.2 | | |

| 107.6 | |

| Employee benefits and social security | |

| 7.8 | | |

| 9.6 | |

| Deferred revenue and advances from customers | |

| 5.5 | | |

| 24.9 | |

| Income tax payable | |

| 4.0 | | |

| 0.5 | |

| Consideration for acquisition | |

| 2.9 | | |

| 1.4 | |

| Lease liabilities | |

| 3.5 | | |

| 3.9 | |

| Total current liabilities | |

| 335.4 | | |

| 298.7 | |

| NON-CURRENT LIABILITIES | |

| | | |

| | |

| Borrowings | |

| 18.9 | | |

| 60.7 | |

| Deferred revenue and advances from customers | |

| 2.8 | | |

| 2.1 | |

| Joint ventures and associates | |

| 0.0 | | |

| 0.6 | |

| Deferred tax liabilities | |

| 39.4 | | |

| 35.8 | |

| Provisions | |

| 0.8 | | |

| 0.9 | |

| Consideration for acquisition | |

| 2.7 | | |

| 3.6 | |

| Secured notes | |

| 79.7 | | |

| 75.2 | |

| Lease liabilities | |

| 24.4 | | |

| 10.0 | |

| Total non-current liabilities | |

| 153.0 | | |

| 188.9 | |

| Total liabilities | |

| 488.5 | | |

| 487.6 | |

| EQUITY | |

| | | |

| | |

| Equity attributable to owners of the parent | |

| 313.4 | | |

| 298.6 | |

| Non-controlling interests | |

| 35.2 | | |

| 31.9 | |

| Total equity | |

| 348.5 | | |

| 330.5 | |

| Total equity and liabilities | |

| 837.0 | | |

| 818.1 | |

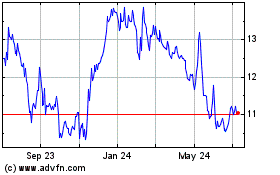

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Dec 2024 to Jan 2025

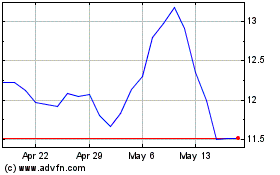

Bioceres Crop Solutions (NASDAQ:BIOX)

Historical Stock Chart

From Jan 2024 to Jan 2025