0001505732FALSE00015057322023-04-262023-04-26

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): July 26, 2023

Bankwell Financial Group, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Connecticut | 001-36448 | 20-8251355 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

258 Elm Street

New Canaan, Connecticut 06840

(203) 652-0166

(Address of Principal Executive Officers and Telephone Number)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

Title of Each Class

| Trading Symbol(s)

| Name of Each Exchange on Which

Registered

|

Common Stock, no par value per share

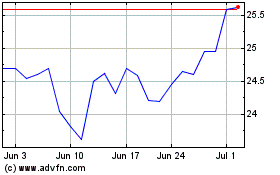

| BWFG

| NASDAQ Global Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

| | | | | |

| Emerging growth company | ☐

|

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | ☐

|

| | | | | |

| Item 2.02 | Results of Operations and Financial Condition |

| | |

| | On July 26, 2023, Bankwell Financial Group, Inc., the holding company for Bankwell Bank, issued a press release describing its results of operations for the period ended June 30, 2023. A copy of the press release is included as Exhibit 99.1 to this current report on Form 8-K and is incorporated herein by reference.

|

| |

| The information furnished under this Item 2.02, including Exhibit 99.1, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, regardless of any general incorporation language in such filing.

|

| | |

| Item 7.01 | Regulation FD Disclosure |

| | |

| | On July 26, 2023, Bankwell Financial Group, Inc., the holding company for Bankwell Bank, issued slide presentation material, which includes among other things, a review of financial results and trends through the period ended June 30, 2023. A copy of the material will also be available on the Company’s website, http://investor.mybankwell.com/CorporateProfile. A copy of the Presentation Material is included as Exhibit 99.2 to this current report on Form 8-K and is incorporated herein by reference. |

| |

| The information furnished under this Item 7.01, including Exhibit 99.2, shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or subject to the liabilities of that section. The information shall not be deemed incorporated by reference into any other filing with the Securities and Exchange Commission made by the Company, regardless of any general incorporation language in such filing.

|

| | |

| Item 8.01 | Other Events |

| | |

| | On July 26, 2023, Bankwell Financial Group, Inc., parent company of Bankwell Bank, announced its Board of Directors has voted to pay a quarterly dividend in the amount of $0.20 per share on August 24, 2023 to all shareholders of record as of August 14, 2023. |

| |

| Item 9.01 | Financial Statements and Exhibits |

| (a) | Not applicable. |

| (b) | Not applicable. |

| (c) | Not applicable. |

| (d) | Exhibits. |

| | | | | |

| Exhibit Number | Description |

| | |

| 99.1 | |

| 99.2 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

| | | | | |

| SIGNATURES |

| | |

| Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized. |

| | |

| | BANKWELL FINANCIAL GROUP, INC. |

| | Registrant |

| | |

| | |

| | |

July 26, 2023 | By: /s/ Courtney E. Sacchetti |

| | Courtney E. Sacchetti |

| | Executive Vice President |

| | and Chief Financial Officer |

BANKWELL FINANCIAL GROUP REPORTS OPERATING RESULTS FOR THE SECOND QUARTER AND DECLARES THIRD QUARTER DIVIDEND

New Canaan, CT – July 26, 2023 – Bankwell Financial Group, Inc. (NASDAQ: BWFG) reported GAAP net income of $8.0 million, or $1.02 per share for the second quarter of 2023, versus $12.0 million, or $1.55 per share, for the same period in 2022.

The Company's Board of Directors declared a $0.20 per share cash dividend, payable August 24, 2023 to shareholders of record on August 14, 2023.

We recommend reading this earnings release in conjunction with the Second Quarter 2023 Investor Presentation, located at http://investor.mybankwell.com/Presentations and included as an exhibit to our July 26, 2023 Current Report on Form 8-K.

Notes Bankwell Financial Group President and CEO, Christopher R. Gruseke:

"Against the headwinds of an inverted yield curve, the Company generated a 0.99% Return on Average Assets and a 12.91% Return on Average Shareholders' Equity this quarter. As we look to the second half of the year, we can revise our prior guidance upward regarding full year 2023 Net Interest Income (“NII”). Prior guidance had indicated a year-over-year decrease to NII of approximately 10%. We can now guide to a 5-6% decline for 2023 NII versus 2022 performance.

Future margin compression can be expected as the Federal Reserve holds short term rates higher for longer than earlier market consensus, however, our operational efficiency and increasing loan yields will provide a cushion against the uncertain policy backdrop. The Company’s year to date non-interest expense was 1.58% of average assets year for the six-month period ending June 30, 2023, while the average loan yield for the same period stood at 5.95%. The average yield on loans originated thus far in 2023 was 7.38%.

Capital and liquidity positions are strong, and we are confident in the credit quality of the loan book.

Please see the Company's recent Press Release regarding the Company’s newly appointed Executive Vice President and Chief Innovation Officer, Ryan Hildebrand. We are delighted to have Ryan join the management team."

Second Quarter 2023 Highlights:

•Total gross loans were $2.8 billion, growing $98.2 million, or 3.7%, compared to December 31, 2022.

•Deposits of $2.8 billion for the quarter ended June 30, 2023, decreasing $12.0 million, or 0.4% from December 31, 2022.

•Non-brokered deposits were $1.8 billion as of June 30, 2023, up by $48 million, or an increase of 2.7% from March 31, 2023; as of July 25, 2023, non-brokered deposits increased an additional $57 million since June 30, 2023.

•FDIC-insured deposits totaled $2.0 billion and represent 71.2% of total deposits as of June 30, 2023.

•As of June 30, 2023, the Bank has $1.7 billion immediately available liquidity, comprised of cash, AFS securities and borrowing capacity with the FHLB of Boston and FRB.

•Immediately available liquidity provides more than two times coverage of uninsured deposits.

•Average yield on 2023 funded loans was 7.38% as of June 30, 2023.

•Return on average assets was 0.99% for the quarter ended June 30, 2023.

•Return on average shareholders' equity was 12.91% for the quarter ended June 30, 2023.

•The net interest margin was 3.07% for the quarter ended June 30, 2023.

•The efficiency ratio was 49.8% for the quarter ended June 30, 2023.

•Investment securities totaled $117.8 million and represent 3.6% of total assets, with HTM securities totaling $15.9 million, or 0.5% of total assets.

Earnings and Performance

Revenues (net interest income plus noninterest income) for the quarter ended June 30, 2023 were $25.4 million, versus $25.0 million and for the quarter ended June 30, 2022. Revenues for the six months ended June 30, 2023 were $52.5 million, versus $45.4 million for the six months ended June 30, 2022. The increase in revenues for the quarter and six months ended 2023 was primarily attributable to an increase in interest and fees on loans due to loan growth and higher overall loan yields1 for the quarter ended June 30, 2023. The increase in revenues was partially offset by an increase in interest expense.

1 - The increase in overall loan yields was 111 bps and 123 bps for the quarter and six months ended June 30, 2023, respectively.

Net income for the quarter ended June 30, 2023 was $8.0 million, versus $12.0 million for the quarter ended June 30, 2022. Net income for the six months ended June 30, 2023 was $18.4 million, versus $20.2 million for the six months ended June 30, 2022. The decrease in net income for the quarter and six months ended 2023 was primarily due to an increase in the provision for credit losses and an increase in noninterest expense, primarily due to increased FDIC insurance expense, and an increase in salary and employee benefits expense, mainly due to severance costs. The decrease was partially offset by a direct result of the aforementioned increases in revenues.

Basic and diluted earnings per share were $1.02 and $1.02, respectively, for the quarter ended June 30, 2023 compared to basic and diluted earnings per share of $1.56 and $1.55, respectively, for the quarter ended June 30, 2022. Basic and diluted earnings per share were $2.36 and $2.34, respectively, for the six months ended June 30, 2023 compared to basic and diluted earnings per share of $2.61 and $2.58, respectively, for the six months ended June 30, 2022.

The net interest margin (fully taxable equivalent basis) for the quarters ended June 30, 2023 and June 30, 2022 was 3.07% and 4.01%, respectively. The net interest margin (fully taxable equivalent basis) for the six months ended June 30, 2023 and June 30, 2022 was 3.15% and 3.65%, respectively. The decrease in the net interest margin was due to an increase in funding costs partially offset by an increase in overall loan yields.

Allowance for Credit Losses (ACL)

Provision for credit losses was $2.6 million for the quarter ended June 30, 2023, bringing the ACL-Loans as a percentage of total loans to 1.11%. Provision for credit losses was $0.8 million for the quarter ended March 31, 2023. The increase in the provision for credit losses is mainly attributable to forward looking CECL macroeconomic factors.

Financial Condition

Assets totaled $3.3 billion at June 30, 2023 and remained flat compared to December 31, 2022. Gross loans totaled $2.8 billion at June 30, 2023, an increase of $98.2 million or 3.7% compared to December 31, 2022. Deposits totaled $2.8 billion at June 30, 2023, and remained flat compared to December 31, 2022.

Capital

Shareholders’ equity totaled $248.8 million as of June 30, 2023, an increase of $10.3 million compared to December 31, 2022, primarily a result of net income of $18.4 million for the six months ended June 30, 2023. The increase was partially offset by the Day 1 CECL adoption of $4.9 million, dividends paid of $3.1 million, and a $1.5 million unfavorable impact to accumulated other comprehensive income. The unfavorable impact to accumulated other comprehensive income was driven by fair value marks on the Company's Available for sale investment securities portfolio of $0.9 million and fair value marks related to hedge positions involving interest rate swaps of $0.7 million. The Company's interest rate swaps are used to hedge interest rate risk.

About Bankwell Financial Group

Bankwell is a commercial bank that serves the banking needs of residents and businesses throughout Fairfield and New Haven Counties, Connecticut. For more information about this press release, interested parties may contact Christopher R. Gruseke, President and Chief Executive Officer or Courtney E. Sacchetti, Executive Vice President and Chief Financial Officer of Bankwell Financial Group at (203) 652-0166.

For more information, visit www.mybankwell.com.

This press release may contain certain forward-looking statements about the Company. Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “anticipate,” “estimate,” and “intend” or future or conditional verbs such as “will,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the banking industry or securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged.

Non-GAAP Financial Measures

In addition to evaluating the Company's financial performance in accordance with U.S. generally accepted accounting principles ("GAAP"), management may evaluate certain non-GAAP financial measures, such as the efficiency ratio. A computation and reconciliation of certain non-GAAP financial measures used for these purposes is contained in the accompanying Reconciliation of GAAP to Non-GAAP Measures tables. We believe that providing certain non-GAAP financial measures provides investors with information useful in understanding our financial performance, our performance trends and financial position. For example, the Company believes that the efficiency ratio is useful in the assessment of financial performance, including noninterest expense control. The Company believes that tangible common equity, tangible assets, tangible common equity to tangible assets, tangible common shareholders' equity, fully diluted tangible book value per common share, adjusted noninterest expense, operating revenue, efficiency ratio, average tangible common equity, annualized return on average tangible common equity, return on average assets, return on average shareholders' equity, and the dividend payout ratio are useful to evaluate the relative strength of the Company's performance and capital position. We utilize these measures for internal planning and forecasting purposes. These non-GAAP financial measures should not be considered a substitute for GAAP basis measures and results, and we strongly encourage investors to review our consolidated financial statements in their entirety and not to rely on any single financial measure.

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED BALANCE SHEETS (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 |

| ASSETS | | | | | | | | | | | |

| Cash and due from banks | | | | | $ | 207,345 | | | $ | 249,812 | | | $ | 344,925 | | | $ | 149,522 | |

| Federal funds sold | | | | | 54,706 | | | 27,370 | | | 10,754 | | | 21,505 | |

| Cash and cash equivalents | | | | | 262,051 | | | 277,182 | | | 355,679 | | | 171,027 | |

| | | | | | | | | | | |

| Investment securities | | | | | | | | | | | |

| Marketable equity securities, at fair value | | | | | 2,017 | | | 2,028 | | | 1,988 | | | 2,126 | |

| Available for sale investment securities, at fair value | | | | | 99,938 | | | 103,171 | | | 103,663 | | | 94,907 | |

| Held to maturity investment securities, at amortized cost | | | | | 15,884 | | | 15,931 | | | 15,983 | | | 15,917 | |

| Total investment securities | | | | | 117,839 | | | 121,130 | | | 121,634 | | | 112,950 | |

| Loans receivable (net of ACL-Loans of $30,694, $27,998, $22,431, and $15,773 at June 30, 2023, March 31 2023, December 31, 2022, and June 30, 2022, respectively) | | | | | 2,736,607 | | | 2,724,514 | | | 2,646,384 | | | 2,036,626 | |

| | | | | | | | | | | |

| Accrued interest receivable | | | | | 14,208 | | | 14,261 | | | 13,070 | | | 8,047 | |

| Federal Home Loan Bank stock, at cost | | | | | 5,696 | | | 5,234 | | | 5,216 | | | 5,064 | |

| Premises and equipment, net | | | | | 27,658 | | | 27,619 | | | 27,199 | | | 27,768 | |

| Bank-owned life insurance | | | | | 50,816 | | | 50,524 | | | 50,243 | | | 49,699 | |

| Goodwill | | | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | |

| | | | | | | | | | | |

| Deferred income taxes, net | | | | | 10,014 | | | 8,692 | | | 7,422 | | | 4,768 | |

| Other assets | | | | | 25,229 | | | 20,573 | | | 23,013 | | | 17,014 | |

| Total assets | | | | | $ | 3,252,707 | | | $ | 3,252,318 | | | $ | 3,252,449 | | | $ | 2,435,552 | |

| | | | | | | | | | | |

| LIABILITIES AND SHAREHOLDERS’ EQUITY | | | | | | | | | | | |

| Liabilities | | | | | | | | | | | |

| Deposits | | | | | | | | | | | |

| Noninterest bearing deposits | | | | | $ | 367,635 | | | $ | 377,667 | | | $ | 404,559 | | | $ | 372,584 | |

| Interest bearing deposits | | | | | 2,421,228 | | | 2,420,641 | | | 2,396,259 | | | 1,660,941 | |

| Total deposits | | | | | 2,788,863 | | | 2,798,308 | | | 2,800,818 | | | 2,033,525 | |

| | | | | | | | | | | |

| Advances from the Federal Home Loan Bank | | | | | 90,000 | | | 90,000 | | | 90,000 | | | 105,000 | |

| Subordinated debentures | | | | | 69,082 | | | 69,020 | | | 68,959 | | | 34,500 | |

| Accrued expenses and other liabilities | | | | | 55,949 | | | 52,683 | | | 54,203 | | | 37,060 | |

| Total liabilities | | | | | 3,003,894 | | | 3,010,011 | | | 3,013,980 | | | 2,210,085 | |

| | | | | | | | | | | |

| Shareholders’ equity | | | | | | | | | | | |

| Common stock, no par value | | | | | 116,541 | | | 115,875 | | | 115,018 | | | 115,599 | |

| Retained earnings | | | | | 133,988 | | | 127,566 | | | 123,640 | | | 109,523 | |

| Accumulated other comprehensive (loss) income | | | | | (1,716) | | | (1,134) | | | (189) | | | 345 | |

| Total shareholders’ equity | | | | | 248,813 | | | 242,307 | | | 238,469 | | | 225,467 | |

| | | | | | | | | | | |

| Total liabilities and shareholders’ equity | | | | | $ | 3,252,707 | | | $ | 3,252,318 | | | $ | 3,252,449 | | | $ | 2,435,552 | |

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED STATEMENTS OF INCOME (unaudited)

(Dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | For the Quarter Ended | For the Six Months Ended |

| | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Interest and dividend income | | | | | | | | | | | | | | | |

| Interest and fees on loans | | | | | $ | 42,482 | | | $ | 39,723 | | | $ | 36,545 | | | $ | 25,141 | | | $ | 82,205 | | | $ | 46,569 | |

| Interest and dividends on securities | | | | | 1,002 | | | 1,000 | | | 898 | | | 774 | | | 2,002 | | | 1,494 | |

| Interest on cash and cash equivalents | | | | | 3,022 | | | 3,568 | | | 2,150 | | | 449 | | | 6,590 | | | 603 | |

| Total interest and dividend income | | | | | 46,506 | | | 44,291 | | | 39,593 | | | 26,364 | | | 90,797 | | | 48,666 | |

| | | | | | | | | | | | | | | |

| Interest expense | | | | | | | | | | | | | | | |

| Interest expense on deposits | | | | | 20,777 | | | 17,033 | | | 11,083 | | | 1,983 | | | 37,810 | | | 4,189 | |

| Interest expense on borrowings | | | | | 1,738 | | | 1,717 | | | 1,701 | | | 558 | | | 3,455 | | | 1,144 | |

| Total interest expense | | | | | 22,515 | | | 18,750 | | | 12,784 | | | 2,541 | | | 41,265 | | | 5,333 | |

| | | | | | | | | | | | | | | |

| Net interest income | | | | | 23,991 | | | 25,541 | | | 26,809 | | | 23,823 | | | 49,532 | | | 43,333 | |

| Provision (credit) for credit losses | | | | | 2,579 | | | 826 | | | 4,272 | | | (1,445) | | | 3,405 | | | (1,216) | |

| Net interest income after provision for credit losses | | | | | 21,412 | | | 24,715 | | | 22,537 | | | 25,268 | | | 46,127 | | | 44,549 | |

| | | | | | | | | | | | | | | |

| Noninterest income | | | | | | | | | | | | | | | |

| Bank owned life insurance | | | | | 292 | | | 281 | | | 273 | | | 265 | | | 573 | | | 525 | |

| Service charges and fees | | | | | 361 | | | 286 | | | 343 | | | 249 | | | 647 | | | 489 | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| Gains and fees from sales of loans | | | | | 725 | | | 931 | | | 12 | | | 608 | | | 1,656 | | | 1,239 | |

| Other | | | | | 23 | | | 28 | | | (100) | | | 30 | | | 51 | | | (143) | |

| Total noninterest income | | | | | 1,401 | | | 1,526 | | | 528 | | | 1,152 | | | 2,927 | | | 2,110 | |

| | | | | | | | | | | | | | | |

| Noninterest expense | | | | | | | | | | | | | | | |

| Salaries and employee benefits | | | | | 6,390 | | | 6,081 | | | 5,988 | | | 5,433 | | | 12,471 | | | 10,373 | |

| Occupancy and equipment | | | | | 2,204 | | | 2,084 | | | 1,919 | | | 2,193 | | | 4,288 | | | 4,343 | |

| Professional services | | | | | 692 | | | 1,322 | | | 912 | | | 1,000 | | | 2,014 | | | 1,981 | |

| Data processing | | | | | 729 | | | 671 | | | 663 | | | 689 | | | 1,400 | | | 1,343 | |

| Director fees | | | | | 453 | | | 392 | | | 378 | | | 339 | | | 845 | | | 691 | |

| FDIC insurance | | | | | 1,050 | | | 1,062 | | | 898 | | | 262 | | | 2,112 | | | 485 | |

| Marketing | | | | | 177 | | | 151 | | | 112 | | | 107 | | | 328 | | | 152 | |

| | | | | | | | | | | | | | | |

| Other | | | | | 946 | | | 928 | | | 1,601 | | | 913 | | | 1,874 | | | 1,493 | |

| Total noninterest expense | | | | | 12,641 | | | 12,691 | | | 12,471 | | | 10,936 | | | 25,332 | | | 20,861 | |

| | | | | | | | | | | | | | | |

| Income before income tax expense | | | | | 10,172 | | | 13,550 | | | 10,594 | | | 15,484 | | | 23,722 | | | 25,798 | |

| Income tax expense | | | | | 2,189 | | | 3,171 | | | 2,573 | | | 3,462 | | | 5,360 | | | 5,564 | |

| Net income | | | | | $ | 7,983 | | | $ | 10,379 | | | $ | 8,021 | | | $ | 12,022 | | | $ | 18,362 | | | $ | 20,234 | |

| | | | | | | | | | | | | | | |

| Earnings Per Common Share: | | | | | | | | | | | | | | | |

| Basic | | | | | $ | 1.02 | | | $ | 1.34 | | | $ | 1.04 | | | $ | 1.56 | | | $ | 2.36 | | | $ | 2.61 | |

| Diluted | | | | | $ | 1.02 | | | $ | 1.33 | | | $ | 1.04 | | | $ | 1.55 | | | $ | 2.34 | | | $ | 2.58 | |

| | | | | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | | | | | | | | |

| Basic | | | | | 7,593,417 | | | 7,554,689 | | | 7,507,540 | | | 7,556,645 | | | 7,574,160 | | | 7,596,639 | |

| Diluted | | | | | 7,601,562 | | | 7,616,671 | | | 7,563,116 | | | 7,614,243 | | | 7,639,828 | | | 7,683,305 | |

| Dividends per common share | | | | | $ | 0.20 | | | $ | 0.20 | | | $ | 0.20 | | | $ | 0.20 | | | $ | 0.40 | | | $ | 0.40 | |

BANKWELL FINANCIAL GROUP, INC.

CONSOLIDATED FINANCIAL HIGHLIGHTS (unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | For the Quarter Ended | | For the Six Months Ended |

| | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 | | June 30,

2023 | | June 30,

2022 |

| Performance ratios: | | | | | | | | | | | | | | | |

| Return on average assets | | | | | 0.99 | % | | 1.30 | % | | 1.07 | % | | 1.96 | % | | 1.14 | % | | 1.65 | % |

| Return on average shareholders' equity | | | | | 12.91 | % | | 17.48 | % | | 13.38 | % | | 22.09 | % | | 15.15 | % | | 19.16 | % |

| Return on average tangible common equity | | | | | 13.05 | % | | 17.67 | % | | 13.52 | % | | 22.36 | % | | 15.31 | % | | 19.40 | % |

| Net interest margin | | | | | 3.07 | % | | 3.24 | % | | 3.70 | % | | 4.01 | % | | 3.15 | % | | 3.65 | % |

Efficiency ratio(1) | | | | | 49.8 | % | | 46.9 | % | | 45.6 | % | | 43.8 | % | | 48.3 | % | | 45.9 | % |

| Net loan charge-offs as a % of average loans | | | | | — | % | | 0.02 | % | | — | % | | — | % | | 0.02 | % | | — | % |

Dividend payout ratio(2) | | | | | 19.61 | % | | 15.04 | % | | 19.23 | % | | 12.90 | % | | 17.09 | % | | 15.50 | % |

| | | | | | | | | | | | | | | |

(1)Efficiency ratio is defined as noninterest expense, less other real estate owned expenses and amortization of intangible assets, divided by our operating revenue, which is equal to net interest income plus noninterest income excluding gains and losses on sales of securities and gains and losses on other real estate owned. In our judgment, the adjustments made to operating revenue allow investors and analysts to better assess our operating expenses in relation to our core operating revenue by removing the volatility that is associated with certain one-time items and other discrete items that are unrelated to our core business.

(2)The dividend payout ratio is calculated by dividing dividends per share by earnings per share.

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | As of |

| | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 |

| Capital ratios: | | | | | | | | | | | |

Total Common Equity Tier 1 Capital to Risk-Weighted Assets(1) | | | | | 10.34 | % | | 10.17 | % | | 10.28 | % | | 11.10 | % |

Total Capital to Risk-Weighted Assets(1) | | | | | 11.41 | % | | 11.16 | % | | 11.07 | % | | 11.80 | % |

Tier I Capital to Risk-Weighted Assets(1) | | | | | 10.34 | % | | 10.17 | % | | 10.28 | % | | 11.80 | % |

Tier I Capital to Average Assets(1) | | | | | 9.41 | % | | 9.22 | % | | 9.88 | % | | 10.15 | % |

| Tangible common equity to tangible assets | | | | | 7.58 | % | | 7.38 | % | | 7.26 | % | | 9.16 | % |

| Fully diluted tangible book value per common share | | | | | $ | 31.45 | | | $ | 30.56 | | | $ | 30.51 | | | $ | 28.75 | |

(1)Represents Bank ratios. Current period capital ratios are preliminary subject to finalization of the FDIC Call Report.

BANKWELL FINANCIAL GROUP, INC.

ASSET QUALITY (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | For the Quarter Ended |

| | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 |

| ACL-Loans: | | | | | | | | | | | |

| Balance at beginning of period | | | | | $ | 27,998 | | | $ | 22,431 | | | $ | 18,167 | | | $ | 17,141 | |

| Day 1 CECL Adjustment on January 1, 2023 | | | | | — | | | 5,079 | | | — | | | — | |

| Beginning balance January 1, 2023 | | | | | 27,998 | | | 27,510 | | | 18,167 | | | — | |

| Charge-offs: | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Commercial business | | | | | — | | | (440) | | | — | | | — | |

| Consumer | | | | | (25) | | | (12) | | | (11) | | | — | |

| Total charge-offs | | | | | (25) | | | (452) | | | (11) | | | — | |

| Recoveries: | | | | | | | | | | | |

| Commercial real estate | | | | | — | | | — | | | — | | | 77 | |

| Commercial business | | | | | 32 | | | — | | | — | | | — | |

| Consumer | | | | | 10 | | | 6 | | | 3 | | | — | |

| Total recoveries | | | | | 42 | | | 6 | | | 3 | | | 77 | |

| Net loan recoveries (charge-offs) | | | | | 17 | | | (446) | | | (8) | | | 77 | |

| Provision for credit losses - loans | | | | | 2,679 | | | 934 | | | 4,272 | | | (1,445) | |

| Balance at end of period | | | | | $ | 30,694 | | | $ | 27,998 | | | $ | 22,431 | | | $ | 15,773 | |

| | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | As of |

| | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 |

| Asset quality: | | | | | | | | | | | |

| Nonaccrual loans | | | | | | | | | | | |

| Residential real estate | | | | | $ | 1,429 | | | $ | 1,443 | | | $ | 2,152 | | | $ | 2,161 | |

| Commercial real estate | | | | | 1,905 | | | 1,912 | | | 2,781 | | | 2,955 | |

| Commercial business | | | | | 2,815 | | | 1,528 | | | 2,126 | | | 787 | |

| Construction | | | | | 9,382 | | | 9,382 | | | 9,382 | | | 9,382 | |

| Total nonaccrual loans | | | | | 15,531 | | | 14,265 | | | 16,441 | | | 15,285 | |

| Other real estate owned | | | | | — | | | — | | | — | | | — | |

| Total nonperforming assets | | | | | $ | 15,531 | | | $ | 14,265 | | | $ | 16,441 | | | $ | 15,285 | |

| | | | | | | | | | | |

| Nonperforming loans as a % of total loans | | | | | 0.56 | % | | 0.52 | % | | 0.61 | % | | 0.74 | % |

| Nonperforming assets as a % of total assets | | | | | 0.48 | % | | 0.44 | % | | 0.51 | % | | 0.63 | % |

| ACL-loans as a % of total loans | | | | | 1.11 | % | | 1.01 | % | | 0.84 | % | | 0.77 | % |

| ACL-loans as a % of nonperforming loans | | | | | 197.63 | % | | 196.27 | % | | 136.43 | % | | 103.19 | % |

| Total past due loans to total loans | | | | | 1.30 | % | | 0.94 | % | | 0.60 | % | | 1.40 | % |

Total nonaccrual loans decreased $0.9 million to $15.5 million as of June 30, 2023 when compared to December 31, 2022. Nonperforming assets as a percentage of total assets decreased to 0.48% at June 30, 2023, down from 0.51% at December 31, 2022. The ACL-Loans at June 30, 2023 was $30.7 million, representing 1.11% of total loans.

Past due loans increased to $36.0 million, or 1.30% of total loans, as of June 30, 2023, compared to $16.1 million, or 0.60% of total loans, as of December 31, 2022. Of the June 30, 2023 past due loans, $9.3 million of loans were between 31 - 33 days past due and have subsequently become current.

BANKWELL FINANCIAL GROUP, INC.

LOAN & DEPOSIT PORTFOLIO (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period End Loan Composition | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | |

Current QTD

% Change | | YTD

% Change |

| Residential Real Estate | $ | 54,631 | | | $ | 58,541 | | | $ | 60,588 | | | (6.7) | % | | (9.8) | % |

Commercial Real Estate(1) | 1,930,972 | | | 1,960,712 | | | 1,921,252 | | | (1.5) | | | 0.5 | |

| Construction | 219,615 | | | 177,115 | | | 155,198 | | | 24.0 | | | 41.5 | |

| Total Real Estate Loans | 2,205,218 | | | 2,196,368 | | | 2,137,038 | | | 0.4 | | | 3.2 | |

| | | | | | | | | |

| Commercial Business | 530,913 | | | 543,457 | | | 520,447 | | | (2.3) | | | 2.0 | |

| | | | | | | | | |

| Consumer | 37,475 | | | 19,464 | | | 17,963 | | | 92.5 | | | 108.6 | |

| Total Loans | $ | 2,773,606 | | | $ | 2,759,289 | | | $ | 2,675,448 | | | 0.5 | % | | 3.7 | % |

| | | | | | | | | |

| (1) Includes owner occupied commercial real estate. |

Gross loans totaled $2.8 billion at June 30, 2023, an increase of $98.2 million or 3.7% compared to December 31, 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Period End Deposit Composition | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | |

Current QTD

% Change | | YTD

% Change |

| Noninterest bearing demand | $ | 367,635 | | | $ | 377,667 | | | $ | 404,559 | | | (2.7) | % | | (9.1) | % |

| NOW | 106,189 | | | 89,896 | | | 104,057 | | | 18.1 | | | 2.0 | |

| Money Market | 879,017 | | | 874,202 | | | 913,868 | | | 0.6 | | | (3.8) | |

| Savings | 108,625 | | | 117,986 | | | 151,944 | | | (7.9) | | | (28.5) | |

| Time | 1,327,397 | | | 1,338,557 | | | 1,226,390 | | | (0.8) | | | 8.2 | |

| Total Deposits | $ | 2,788,863 | | | $ | 2,798,308 | | | $ | 2,800,818 | | | (0.3) | % | | (0.4) | % |

Total deposits were $2.8 billion at June 30, 2023, a decrease of $12.0 million, or 0.4%, when compared to December 31, 2022.

BANKWELL FINANCIAL GROUP, INC.

NONINTEREST INCOME (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | | | | |

| Noninterest income | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 23 vs. Mar 23

% Change | | Jun 23 vs. Jun 22

% Change |

| Bank owned life insurance | $ | 292 | | | $ | 281 | | | $ | 265 | | | 3.9 | % | | 10.2 | % |

| Service charges and fees | 361 | | | 286 | | | 249 | | | 26.2 | | | 45.0 | |

| | | | | | | | | |

| | | | | | | | | |

| Gains and fees from sales of loans | 725 | | | 931 | | | 608 | | | (22.1) | | | 19.2 | |

| Other | 23 | | | 28 | | | 30 | | | (17.9) | | | (23.3) | |

| Total noninterest income | $ | 1,401 | | | $ | 1,526 | | | $ | 1,152 | | | (8.2) | % | | 21.6 | % |

| | | | | | | | | | | | | | | | | |

| For the Six Months Ended | | |

| Noninterest income | June 30, 2023 | | June 30, 2022 | | % Change |

| Bank owned life insurance | $ | 573 | | | $ | 525 | | | 9.1 | % |

| Service charges and fees | 647 | | | 489 | | | 32.3 | |

| Gains and fees from sales of loans | 1,656 | | | 1,239 | | | 33.7 | |

| | | | | |

| | | | | |

| Other | 51 | | | (143) | | | Favorable |

| Total noninterest income | $ | 2,927 | | | $ | 2,110 | | | 38.7 | % |

Noninterest income increased by $0.2 million to $1.4 million for the quarter ended June 30, 2023 compared to the quarter ended June 30, 2022. Noninterest income increased by $0.8 million to $2.9 million for the six months ended June 30, 2023 compared to the six months ended June 30, 2022. The increase in noninterest income was driven by an increase in SBA loan sales and increases in service charges and fees for the quarter and six months ended 2023.

BANKWELL FINANCIAL GROUP, INC.

NONINTEREST EXPENSE (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | | | | |

| Noninterest expense | June 30,

2023 | | March 31,

2023 | | June 30,

2022 | | June 23 vs. Mar 23

% Change | | Jun 23 vs. Jun 22

% Change |

| Salaries and employee benefits | $ | 6,390 | | | $ | 6,081 | | | $ | 5,433 | | | 5.1 | % | | 17.6 | % |

| Occupancy and equipment | 2,204 | | | 2,084 | | | 2,193 | | | 5.8 | | | 0.5 | |

| Professional services | 692 | | | 1,322 | | | 1,000 | | | (47.7) | | | (30.8) | |

| Data processing | 729 | | | 671 | | | 689 | | | 8.6 | | | 5.8 | |

| Director fees | 453 | | | 392 | | | 339 | | | 15.6 | | | 33.6 | |

| FDIC insurance | 1,050 | | | 1,062 | | | 262 | | | (1.1) | | | 300.8 | |

| Marketing | 177 | | | 151 | | | 107 | | | 17.2 | | | 65.4 | |

| Other | 946 | | | 928 | | | 913 | | | 1.9 | | | 3.6 | |

| Total noninterest expense | $ | 12,641 | | | $ | 12,691 | | | $ | 10,936 | | | (0.4) | % | | 15.6 | % |

|

| | | | | | | | | | | | | | | | | |

| For the Six Months Ended | | |

| Noninterest expense | June 30, 2023 | | June 30, 2022 | | % Change |

| Salaries and employee benefits | $ | 12,471 | | | $ | 10,373 | | | 20.2 | % |

| Occupancy and equipment | 4,288 | | | 4,343 | | | (1.3) | % |

| Professional services | 2,014 | | | 1,981 | | | 1.7 | % |

| Data processing | 1,400 | | | 1,343 | | | 4.2 | % |

| Director fees | 845 | | | 691 | | | 22.3 | % |

| FDIC insurance | 2,112 | | | 485 | | | 335.5 | % |

| Marketing | 328 | | | 152 | | | 115.8 | % |

| Other | 1,874 | | | 1,493 | | | 25.5 | % |

| Total noninterest expense | 25,332 | | | 20,861 | | | 21.4 | % |

Noninterest expense increased by $1.7 million to $12.6 million for the quarter ended June 30, 2023 compared to the quarter ended June 30, 2022. Noninterest expense increased by $4.5 million to $25.3 million for the six months ended June 30, 2023 compared to the six months ended June 30, 2022.The increase in noninterest expense was primarily driven by an increase in salaries and employee benefits expense and FDIC insurance expense.

Salaries and employee benefits expense totaled $6.4 million for the quarter ended June 30, 2023, an increase of $1.0 million when compared to the same period in 2022. Salaries and employee benefits expense totaled $12.5 million for the six months ended June 30, 2023, an increase of $2.1 million when compared to the same period in 2022. The increase in salaries and employee benefits expense was driven by an increase in full time equivalent employees, with full time equivalent employees totaling 141 at June 30, 2023 compared to 132 for the same period in 2022. The increase in salaries and employee benefits expense was also due to one-time severance costs and lower loan originations, which reduces the Bank's ability to defer expenses.

FDIC insurance expense totaled $1.1 million for the quarter ended June 30, 2023, an increase of $0.8 million when compared to the same period in 2022. FDIC insurance expense totaled $2.1 million for the six months ended June 30, 2023, an increase of $1.6 million when compared to the same period in 2022. The increase in FDIC insurance expense is attributed to the overall balance sheet growth, increased use of brokered deposits, and an increase in FDIC insurance rates.

BANKWELL FINANCIAL GROUP, INC.

RECONCILIATION OF GAAP TO NON-GAAP MEASURES (unaudited)

(Dollars in thousands, except share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | As of |

| Computation of Tangible Common Equity to Tangible Assets | | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 |

| Total Equity | | | | | $ | 248,813 | | | $ | 242,307 | | | $ | 238,469 | | | $ | 225,467 | |

| Less: | | | | | | | | | | | |

| Goodwill | | | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | |

| Other intangibles | | | | | — | | | — | | | — | | | — | |

| Tangible Common Equity | | | | | $ | 246,224 | | | $ | 239,718 | | | $ | 235,880 | | | $ | 222,878 | |

| | | | | | | | | | | |

| Total Assets | | | | | $ | 3,252,707 | | | $ | 3,252,318 | | | $ | 3,252,449 | | | $ | 2,435,552 | |

| Less: | | | | | | | | | | | |

| Goodwill | | | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | |

| Other intangibles | | | | | — | | | — | | | — | | | — | |

| Tangible Assets | | | | | $ | 3,250,118 | | | $ | 3,249,729 | | | $ | 3,249,860 | | | $ | 2,432,963 | |

| | | | | | | | | | | |

| Tangible Common Equity to Tangible Assets | | | | | 7.58 | % | | 7.38 | % | | 7.26 | % | | 9.16 | % |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | As of |

| Computation of Fully Diluted Tangible Book Value per Common Share | | | | | June 30,

2023 | | March 31,

2023 | | December 31,

2022 | | June 30,

2022 |

| Total shareholders' equity | | | | | $ | 248,813 | | | $ | 242,307 | | | $ | 238,469 | | | $ | 225,467 | |

| Less: | | | | | | | | | | | |

| Preferred stock | | | | | — | | | — | | | — | | | — | |

| Common shareholders' equity | | | | | $ | 248,813 | | | $ | 242,307 | | | $ | 238,469 | | | $ | 225,467 | |

| Less: | | | | | | | | | | | |

| Goodwill | | | | | 2,589 | | | 2,589 | | | 2,589 | | | 2,589 | |

| Other intangibles | | | | | — | | | — | | | — | | | — | |

| Tangible common shareholders' equity | | | | | $ | 246,224 | | | $ | 239,718 | | | $ | 235,880 | | | $ | 222,878 | |

| | | | | | | | | | | |

| Common shares issued and outstanding | | | | | 7,829,950 | | | 7,843,438 | | | 7,730,699 | | | 7,752,389 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Fully Diluted Tangible Book Value per Common Share | | | | | $ | 31.45 | | | $ | 30.56 | | | $ | 30.51 | | | $ | 28.75 | |

BANKWELL FINANCIAL GROUP, INC.

EARNINGS PER SHARE ("EPS") (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| 2023 | | 2022 | | 2023 | | 2022 |

| (In thousands, except per share data) |

| Net income | $ | 7,983 | | | $ | 12,022 | | | $ | 18,362 | | | $ | 20,234 | |

Dividends to participating securities(1) | (41) | | | (33) | | | (84) | | | (68) | |

Undistributed earnings allocated to participating securities(1) | (172) | | | (224) | | | (403) | | | (371) | |

| Net income for earnings per share calculation | $ | 7,770 | | | $ | 11,765 | | | $ | 17,875 | | | $ | 19,795 | |

| | | | | | | |

| Weighted average shares outstanding, basic | 7,593 | | | 7,557 | | | 7,574 | | | 7,597 | |

Effect of dilutive equity-based awards(2) | 8 | | | 57 | | | 66 | | | 86 | |

| Weighted average shares outstanding, diluted | 7,601 | | | 7,614 | | | 7,640 | | | 7,683 | |

| Net earnings per common share: | | | | | | | |

| Basic earnings per common share | $ | 1.02 | | | $ | 1.56 | | | $ | 2.36 | | | $ | 2.61 | |

| Diluted earnings per common share | $ | 1.02 | | | $ | 1.55 | | | $ | 2.34 | | | $ | 2.58 | |

| | | | | | | |

| | | | | | | |

(1) Represents dividends paid and undistributed earnings allocated to unvested stock-based awards that contain non-forfeitable rights to dividends.

(2) Represents the effect of the assumed exercise of stock options and the vesting of restricted shares, as applicable, utilizing the treasury stock method.

BANKWELL FINANCIAL GROUP, INC.

NET INTEREST MARGIN ANALYSIS ON A FULLY TAX EQUIVALENT BASIS - QTD (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended |

| June 30, 2023 | | June 30, 2022 |

| Average

Balance | | Interest | | Yield/ Rate (4) | | Average

Balance | | Interest | | Yield/ Rate (4) |

| Assets: | | | | | | | | | | | |

| Cash and Fed funds sold | $ | 227,777 | | | $ | 3,023 | | | 5.32 | % | | $ | 247,013 | | | $ | 449 | | | 0.73 | % |

Securities(1) | 128,576 | | | 955 | | | 2.97 | | | 118,534 | | | 809 | | | 2.73 | |

| Loans: | | | | | | | | | | | |

| Commercial real estate | 1,935,058 | | | 27,099 | | | 5.54 | | | 1,443,239 | | | 17,278 | | | 4.74 | |

| Residential real estate | 56,981 | | | 643 | | | 4.51 | | | 66,460 | | | 553 | | | 3.33 | |

| Construction | 206,844 | | | 3,691 | | | 7.06 | | | 106,285 | | | 1,938 | | | 7.21 | |

| Commercial business | 557,482 | | | 10,646 | | | 7.55 | | | 393,318 | | | 5,327 | | | 5.36 | |

| Consumer | 29,326 | | | 500 | | | 6.84 | | | 5,298 | | | 45 | | | 3.43 | |

| Total loans | 2,785,691 | | | 42,579 | | | 6.05 | | | 2,014,600 | | | 25,141 | | | 4.94 | |

| Federal Home Loan Bank stock | 5,610 | | | 98 | | | 7.00 | | | 3,263 | | | 15 | | | 1.79 | |

| Total earning assets | 3,147,654 | | | $ | 46,655 | | | 5.86 | % | | 2,383,410 | | | $ | 26,414 | | | 4.38 | % |

| Other assets | 96,603 | | | | | | | 79,380 | | | | | |

| Total assets | $ | 3,244,257 | | | | | | | $ | 2,462,790 | | | | | |

| | | | | | | | | | | |

| Liabilities and shareholders' equity: | | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | |

| NOW | $ | 98,048 | | | $ | 42 | | | 0.18 | % | | $ | 136,414 | | | $ | 59 | | | 0.17 | % |

| Money market | 902,225 | | | 8,083 | | | 3.59 | | | 931,101 | | | 1,146 | | | 0.49 | |

| Savings | 112,585 | | | 860 | | | 3.06 | | | 198,304 | | | 103 | | | 0.21 | |

| Time | 1,298,170 | | | 11,792 | | | 3.64 | | | 451,508 | | | 675 | | | 0.60 | |

| Total interest bearing deposits | 2,411,028 | | | 20,777 | | | 3.46 | | | 1,717,327 | | | 1,983 | | | 0.46 | |

| Borrowed Money | 163,138 | | | 1,738 | | | 4.21 | | | 85,092 | | | 558 | | | 2.59 | |

| Total interest bearing liabilities | 2,574,166 | | | $ | 22,515 | | | 3.51 | % | | 1,802,419 | | | $ | 2,541 | | | 0.57 | % |

| Noninterest bearing deposits | 375,514 | | | | | | | 407,890 | | | | | |

| Other liabilities | 46,565 | | | | | | | 34,231 | | | | | |

| Total liabilities | 2,996,245 | | | | | | | 2,244,540 | | | | | |

| Shareholders' equity | 248,012 | | | | | | | 218,250 | | | | | |

| Total liabilities and shareholders' equity | $ | 3,244,257 | | | | | | | $ | 2,462,790 | | | | | |

Net interest income(2) | | | $ | 24,140 | | | | | | | $ | 23,873 | | | |

| Interest rate spread | | | | | 2.36 | % | | | | | | 3.81 | % |

Net interest margin(3) | | | | | 3.07 | % | | | | | | 4.01 | % |

(1)Average balances and yields for securities are based on amortized cost.

(2)The adjustment for securities and loans taxable equivalency amounted to $51 thousand and $50 thousand for the quarters

ended June 30, 2023 and 2022, respectively.

(3)Annualized net interest income as a percentage of earning assets.

(4)Yields are calculated using the contractual day count convention for each respective product type.

BANKWELL FINANCIAL GROUP, INC.

NET INTEREST MARGIN ANALYSIS ON A FULLY TAX EQUIVALENT BASIS - YTD (unaudited)

(Dollars in thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Six Months Ended |

| June 30, 2023 | | June 30, 2022 |

| Average

Balance | | Interest | | Yield/ Rate (4) | | Average

Balance | | Interest | | Yield/ Rate (4) |

| Assets: | | | | | | | | | | | |

| Cash and Fed funds sold | $ | 271,328 | | | $ | 6,590 | | | 4.90 | % | | $ | 296,239 | | | $ | 603 | | | 0.41 | % |

Securities(1) | 129,225 | | | 1,912 | | | 2.96 | % | | 115,452 | | | 1,563 | | | 2.71 | % |

| Loans: | | | | | | | | | | | |

| Commercial real estate | 1,926,852 | | | 52,125 | | | 5.38 | % | | 1,393,836 | | | 32,273 | | | 4.61 | % |

| Residential real estate | 58,207 | | | 1,286 | | | 4.42 | % | | 70,125 | | | 1,224 | | | 3.49 | % |

| Construction | 186,684 | | | 6,651 | | | 7.09 | % | | 104,176 | | | 2,971 | | | 5.67 | % |

| Commercial business | 549,963 | | | 21,394 | | | 7.74 | % | | 388,249 | | | 9,954 | | | 5.10 | % |

| Consumer | 23,971 | | | 749 | | | 6.30 | % | | 5,666 | | | 147 | | | 5.25 | % |

| Total loans | 2,745,677 | | | 82,205 | | | 5.95 | % | | 1,962,052 | | | 46,569 | | | 4.72 | % |

| Federal Home Loan Bank stock | 5,442 | | | 193 | | | 7.14 | % | | 3,051 | | | 29 | | | 1.94 | % |

| Total earning assets | 3,151,672 | | | $ | 90,900 | | | 5.74 | % | | 2,376,794 | | | $ | 48,764 | | | 4.08 | % |

| Other assets | 90,427 | | | | | | | 89,866 | | | | | |

| Total assets | $ | 3,242,099 | | | | | | | $ | 2,466,660 | | | | | |

| | | | | | | | | | | |

| Liabilities and shareholders' equity: | | | | | | | | | | | |

| Interest bearing liabilities: | | | | | | | | | | | |

| NOW | $ | 95,494 | | | $ | 81 | | | 0.17 | % | | $ | 124,361 | | | $ | 106 | | | 0.17 | % |

| Money market | 905,021 | | | 14,468 | | | 3.22 | % | | 950,131 | | | 2,326 | | | 0.49 | % |

| Savings | 124,387 | | | 1,586 | | | 2.57 | % | | 196,400 | | | 204 | | | 0.21 | % |

| Time | 1,275,417 | | | 21,675 | | | 3.43 | % | | 452,676 | | | 1,553 | | | 0.69 | % |

| Total interest bearing deposits | 2,400,319 | | | 37,810 | | | 3.18 | % | | 1,723,568 | | | 4,189 | | | 0.49 | % |

| Borrowed Money | 162,215 | | | 3,454 | | | 4.24 | % | | 84,770 | | | 1,144 | | | 2.68 | % |

| Total interest bearing liabilities | 2,562,534 | | | $ | 41,264 | | | 3.25 | % | | 1,808,338 | | | $ | 5,333 | | | 0.59 | % |

| Noninterest bearing deposits | 389,608 | | | | | | | 406,707 | | | | | |

| Other liabilities | 45,494 | | | | | | | 38,683 | | | | | |

| Total liabilities | 2,997,636 | | | | | | | 2,253,728 | | | | | |

| Shareholders' equity | 244,463 | | | | | | | 212,932 | | | | | |

| Total liabilities and shareholders' equity | $ | 3,242,099 | | | | | | | $ | 2,466,660 | | | | | |

Net interest income(2) | | | $ | 49,636 | | | | | | | $ | 43,431 | | | |

| Interest rate spread | | | | | 2.49 | % | | | | | | 3.49 | % |

Net interest margin(3) | | | | | 3.15 | % | | | | | | 3.65 | % |

(1)Average balances and yields for securities are based on amortized cost.

(2)The adjustment for securities and loans taxable equivalency amounted to $102 thousand and $98 thousand for the six months

ended June 30, 2023 and 2022, respectively.

(3)Annualized net interest income as a percentage of earning assets.

(4)Yields are calculated using the contractual day count convention for each respective product type.

BWFG | LISTED | NASDAQ 2Q23 Investor Presentation July 26th, 2023

2 BWFG LISTED NASDAQ BWFG LISTED NASDAQ This presentation may contain certain forward-looking statements about Bankwell Financial Group, Inc. (the “Company”). Forward-looking statements include statements regarding anticipated future events and can be identified by the fact that they do not relate strictly to historical or current facts. They often include words such as “believe,” “expect,” “would,” “should,” “could,” or “may.” Forward-looking statements, by their nature, are subject to risks and uncertainties. Certain factors that could cause actual results to differ materially from expected results include increased competitive pressures, changes in the interest rate environment, general economic conditions or conditions within the banking industry or securities markets, and legislative and regulatory changes that could adversely affect the business in which the Company and its subsidiaries are engaged. Safe Harbor

3 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Table of Contents • 2Q23 Performance • Deposits & Liquidity • Loans • Credit Quality & Capital • Bankwell History & Overview

BWFG | LISTED | NASDAQ 2Q23 Performance

5 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 2Q23 Summary • Net Income of $7.98 million, or $1.02 earnings per share (“EPS”) • Return on Average Assets (“ROAA”) and Return on Average Equity (“ROAE”) were 0.99% and 12.91%, respectively for the quarter, and 1.14% and 15.15% year-to-date • Pre-tax, Pre-provision Net Revenue (“PPNR”)1 of $12.75 million, or 1.58% PPNR ROAA for the quarter • 1.56% Non-interest Expense as a percent of Average Assets for the quarter and 1.58% year-to-date • Year-to-date net interest margin (“NIM”) of 3.15%; 2Q23 NIM of 3.06% & June NIM of 2.95% • Net loan growth of $14 million, with new fundings at a weighted average yield of 6.96% • Non-brokered deposit growth of $48 million, with an additional $57 million growth2 since June 30, 2023 • $1.7 billion immediately available liquidity providing more than 2X coverage of uninsured deposits ‒ 25% uninsured deposits; insured deposits include 71% FDIC-insured & 4% insured by FHLB SBLOCs ‒ HTM securities represent 0.5% of total assets; unrealized net loss $384 thousand3 • AFS securities valuations hedged with interest rate swaps; net AOCI impact of $(1.7) million • The Bank remains well capitalized with an 11.41% Total Capital ratio and 7.58% Tangible Common Equity • $31.45 Tangible Book Value; 15% CAGR since year-end 2020 (including one-time CECL impact) • Addition of new EVP, Ryan Hildebrand as Chief Innovation Officer 1 Pre-tax, pre-provision net revenue per share is a non-GAAP metric & excludes provision for loan losses and income tax expense 2 As of July 25, 2023 3 HTM securities not recorded in Book Value

6 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 2Q23 Results 1 Ratios presented represent Bank ratios; presented ratios are preliminary, subject to finalization of the FDIC Call Report 2 Bankwell meets Adequate + buffer standard, which exceeds Well Capitalized thresholds Profitability Balance Sheet Capital • $2.8 billion of gross loans • $2.8 billion of deposits • 1.11% ACL-Loans • Dividend of $0.20 per share paid • $31.45 Fully Diluted Tangible Book Value • Well Capitalized1,2 Tier 1 Leverage1 9.41% Tier1/CET1 / RWA1 10.34% Total Capital / RWA1 11.41% QTR YTD • Net Income $8.0 million $18.4 million • PPNR $12.8 million $27.1 million • Return on Average Assets 0.99% 1.14% • PPNR / Average Assets 1.58% 1.69% • Return on Average Equity 12.91% 15.31%

7 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Income Statement 2Q23 1Q23 Var1 Total Interest Income $46.5 $44.3 $2.2 Total Interest Expense $22.5 $18.7 $(3.8) Net Interest Income $24.0 $25.5 $(1.5) Non-Interest Income $1.4 $1.5 $(0.1) Non-Interest Expense $12.7 $12.7 $0.0 Pre-Tax, Pre-Provision Net Revenue $12.8 $14.4 $(1.6) Provision for Credit Losses $2.6 $0.8 $(1.8) Pre-Tax Income $10.2 $13.6 $(3.4) Income Tax Expense $2.2 $3.2 $1.0 Reported Net Income $8.0 $10.4 $(2.4) EPS $1.02 $1.33 $(0.31) Pre-Tax, Pre-Provision Net Revenue per share2 $1.68 $1.89 $(0.21) 1 Variances are rounded based on actual whole dollar amounts 2 Pre-tax, pre-provision net revenue per share is a non-GAAP metric & excludes provision for loan losses and income tax expense Dollars in millions, except per share data Balance Sheet 2Q23 1Q23 Var1 Cash & Cash Equivalents $262 $277 $(15) Investment Securities $118 $121 $(3) Loans Receivable, net $2,737 $2,725 $12 All Other Assets $135 $129 $6 Total Assets $3,252 $3,252 $0 Total Deposits $2,789 $2,798 $(9) Total Borrowings $167 $159 $8 Other Liabilities $55 $53 $2 Total Liabilities $3,003 $3,010 $(7) Equity $249 $242 $7 Total Liabilities & Equity $3,252 $3,252 $0 2Q23 Consolidated Financial Statements Linked Quarter

8 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Income Statement 2Q 2023 2Q 2022 Var1 Total Interest Income $90.8 $48.7 $42.1 Total Interest Expense $41.3 $5.3 $(36.0) Net Interest Income $49.5 $43.3 $6.2 Non-Interest Income $3.0 $2.1 $0.9 Non-Interest Expense $25.3 $20.9 $(4.4) Pre-Tax, Pre-Provision Net Revenue $27.1 $24.6 $2.5 Provision (Credit) for Loan Losses $3.4 $(1.2) $(4.6) Pre-Tax Income $23.7 $25.8 $(2.1) Income Tax Expense $5.4 $5.6 $0.2 Reported Net Income $18.4 $20.2 $(1.8) EPS $2.34 $2.58 $(0.24) Pre-Tax, Pre-Provision Net Revenue per share2 $3.55 $3.20 $0.35 1 Variances are rounded based on actual whole dollar amounts 2 Pre-tax, pre-provision net revenue per share is a non-GAAP metric & excludes provision for loan losses and income tax expense Dollars in millions, except per share data YTD Consolidated Income Statement Prior Year

9 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Performance Trends $2.21 $2.31 $0.75 $3.36 $4.79 $2.34 2018 2019 2020 2021 2022 2Q23 YTD Diluted EPS 0.94% 0.97% 0.28% 1.17% 1.44% 1.14% 2018 2019 2020 2021 2022 2Q23 YTD Return on Average Assets 10.19% 10.20% 3.35% 13.86% 16.72% 15.15% 2018 2019 2020 2021 2022 2Q23 YTD Return on Average Equity $21.85 $22.82 $21.96 $25.55 $30.51 $31.45 2018 2019 2020 2021 2022 2Q23 Fully Diluted Tangible Book Value 1 Includes $0.63 impact for the 1/1/23 CECL adjustment 1

10 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 59.2% 60.2% 73.9% 53.9% 45.4% 48.3% 1.93% 1.90% 2.03% 1.75% 1.71% 1.58% 1.00% 1.20% 1.40% 1.60% 1.80% 2.00% 2.20% 2.40% 0.0% 10.0% 20.0% 30.0% 40.0% 50.0% 60.0% 70.0% 80.0% 2018 2019 2020 2021 2022 2Q23 YTD Efficiency Ratio Non-interest Expense / Average Assets 1 A non-GAAP metric 1 Efficiency Trends

BWFG | LISTED | NASDAQ Deposits & Liquidity

12 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 16.2% 15.0% 16.7% 36.7% 36.7% 34.7% 8.4% 6.1% 2.6% 2.7% 3.9% 4.8% 75.5% 78.9% 80.6% 60.5% 59.4% 60.5% $1,492 $1,827 $2,124 $2,801 $2,798 $2,789 4Q19 4Q20 4Q21 4Q22 1Q23 2Q23 Deposit Balances Core Deposits Retail CDs >$250k Brokered Deposits 2Q23: Non-Brokered deposits increas d $48 million; Wholesale ratio improved to 32.6% Deposit Balances 1 1 Core Deposits include Commercial and Consumer checking, savings and money market accounts, and retail CD under $250k 2 Wholesale Funding ratio defined as brokered deposits and FHLB borrowings to total assets Dollars in millions 20.6% 19.8% 16.4% 34.4% 34.5% 32.6% Wholesale Funding ratio2 FHLB Borrowings $150 $175 $50 $90 $90 $90

13 BWFG LISTED NASDAQ BWFG LISTED NASDAQ • NIM declining with inverted yield curve: • 6/30/2023 ‘exit rates’ of 6.04% on loans & 3.09% on deposits Net Interest Margin 3.03% 2.77% 3.17% 3.78% 3.24% 3.15% 4.85% 4.48% 4.42% 5.10% 5.87% 5.96% 1.66% 1.07% 0.54% 0.87% 2.47% 2.73% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% 4.00% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 2019 2020 2021 2022 1Q23 YTD 2Q23 YTD Net Interest Margin Loan Yield Cost of Deposits 1 Includes origination fee amortization 1 3.30% 3.75% 3.96% 3.70% 3.24% 3.06% 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Quarterly NIM

14 BWFG LISTED NASDAQ BWFG LISTED NASDAQ FDIC Insured Deposits 71% Uninsured Deposits 25% FHLB Insured Deposits 4% Liquidity 1 Bank lines, including FHLB & FRB 2 Cash held with right of offset as collateral against loans Ample coverage of uninsured deposits • $2,105 million total insured deposits, including $1,985 million FDIC-insured deposits • Uninsured deposits include restricted funds held as cash reserves against loans • Over 2X liquidity coverage on $766 million uninsured deposits: • 11% liquidity on balance sheet (Cash & AFS Securities) + Unencumbered Cash $255 + AFS Securities $105 + Borrowing Capacity1 $1,330 Immediately Available Liquidity $1,690 Total Deposits = $2,789 million Deposits Held as Cash Reserves 2%

15 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Deposit Composition • No digital currency deposits • No single depositor greater than 3% of total deposits • Average account size of $86K1 • Long-term mix shift into Business deposits Consumer 40.3% Professional, Sci & Tech Services 11.5% Real Estate and Rental/Leasing 11.2% Finance & Insurance 10.0% Public Administration 9.3% Health Care & Social Assistance 4.3% Other 13.5% Deposits by Industry 1 Excluding Brokered deposits 1 Well diversified deposit base 50% 39% 36% 31% 27% 50% 61% 64% 69% 73% Dec-19 Dec-20 Dec-21 Dec-22 Jun-23 Core Deposit Mix excluding Retail CDs Consumer Business

BWFG | LISTED | NASDAQ Loans

17 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Loan Balances Increased reliance on C&I and CRE Owner Occupied Dollars in millions C&I + CRE Owner Occupied / Total Loans 27.3% 34.9% 45.5% 45.0% $981 $976 $1,023 $1,042 $1,046 $1,051 $1,032 $1,147 $1,224 $1,225 $1,215 $167 $207 $244 $296 $310 $375 $467 $501 $697 $736 $716 $277 $268 $280 $293 $351 $370 $372 $443 $522 $543 $532 $87 $103 $83 $95 $98 $116 $111 $117 $155 $177 $220 $114 $119 $109 $99 $89 $73 $74 $79 $77 $78 $92 $1,626 $1,673 $1,738 $1,825 $1,895 $1,985 $2,057 $2,287 $2,675 $2,759 $2,774 - 500 1,000 1,500 2,000 2,500 3,000 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 CRE Investor CRE Owner Occupied C&I Construction Residential / Other

18 BWFG LISTED NASDAQ BWFG LISTED NASDAQ $1,626 $1,673 $1,738 $1,825 $1,895 $1,985 $2,057 $2,287 $2,675 $2,759 $2,774 4.18% 4.22% 4.23% 4.28% 4.30% 4.34% 4.55% 4.99% 5.56% 5.75% 5.87% 0.10% 1.10% 2.10% 3.10% 4.10% 5.10% - 500 1,000 1,500 2,000 2,500 3,000 3,500 4Q20 1Q21 2Q21 3Q21 4Q21 1Q22 2Q22 3Q22 4Q22 1Q23 2Q23 Loan Balance Loan Portfolio Yield Loan Yields Steadily Increasing 1 Weighted average yield based on active loans as of each date, an “exit" rate 1 Dollars in millions Loan portfolio yields increased 169 bps since December 31, 2020 • 68% of balances are 2021 - 2023 vintages June 2023 Yield1 by Vintage 4.83% Pre 2020 6.19% 2020 5.64% 2021 6.39% 2022 7.38% 2023

19 BWFG LISTED NASDAQ BWFG LISTED NASDAQ • No single relationship represents more than ~3% of total loans, as of June 30, 2023 • Investor CRE continues to shrink as an overall percentage of the loan portfolio: Total Loan Portfolio = $2,774 million Loan Portfolio Composition 60.4% 55.2% 45.8% 43.8% 27.3% 34.9% 45.5% 45.0% 4Q20 4Q21 4Q22 2Q23 CRE Investor CRE O/O + C&I Residential 2.0% C&I 19.1% CRE Owner Occupied 25.8% CRE Investor 43.8% Commercial Const. 7.9% Other 1.4%

20 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Total CRE Portfolio = $1,931 million 1 Includes Owner Occupied CRE, does not include Construction 2 LTVs based on original LTV values, at origination 3 Consists primarily of skilled nursing and/or assisted living facilities CRE Loan Portfolio • Portfolio weighted average LTV2 of 64.6% • ~ 65% of all CRE loan balances have recourse • CRE loan portfolio mix improving favorably with Owner Occupied growth: 1 Dollars in millions Property Type LTV2 Residential Care3 67.8% Retail 63.8% Multifamily 63.4% Office 64.1% Industrial/Warehouse 62.9% All Other 60.9% 3 Retail 22.0% Office 10.3% Residential Care 32.6% MultiFamily 10.6% Industrial Warehouse 9.1% Mixed Use 5.6% Medical Office 4.5% Other 3.7% Special Use 1.6% 85.4% 77.1% 63.7% 62.9% 14.6% 22.9% 36.3% 37.1% 4Q20 4Q21 4Q22 2Q23 Investor Owner Occupied

21 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 1 Includes Owner Occupied CRE, does not include Construction 2 Consists primarily of skilled nursing and/or assisted living facilities • Greater geographic diversity attributed to growth in Residential Care2 sector • Continued diversification by following strongest customers to attractive markets • Of the CT-based loans, ~48% are in Fairfield County 1 CRE Loan Portfolio Geography CT 29.0% NY 22.4% FL 16.5% NJ 5.4%OH 4.6% TX 3.4% PA 3.3% Other 15.3%

22 BWFG LISTED NASDAQ BWFG LISTED NASDAQ 1 Includes Owner Occupied CRE, does not include Construction 2 LTVs based on original LTV values and actual amortized loan balance CRE Loan Portfolio: Office 1 Recourse 65.5% Non- Recourse 34.5% GSA 8% Owner Occupied 11% Credit Tenants 7% Geography CT - Fairfield County 27.3% NJ 19.4% TX 14.7% NY - Westchester 11.1% MS 9.2% CT - Other 10.5% GA 6.3% FL 1.2%CA 0.5% RecourseOffice portfolio details • ~7%, or $198 million, of total loan portfolio • No exposure to New York City Office • Top 20 borrowers represent 92% of Office – Average loan size $7.9 million – Average Debt Service Coverage Ratio 1.73 • Entire portfolio is current; ~97% of loans have “Pass” rating • Amortized Weighted average LTV2 of 55% • $27 million non-recourse loans maturing in 2023 & 2024 • ~68% located in Bankwell’s primary market, mostly in suburban areas • Out of primary market loans are generally either GSA- leased, credit tenants, or owner-occupied

23 BWFG LISTED NASDAQ BWFG LISTED NASDAQ C&I Loan Portfolio Loans by Industry Type Total C&I Portfolio = $531 million 1 1 Does not Include Owner Occupied CRE • 87% of C&I portfolio has recourse • 93% of Health Care loans have recourse - Primarily consists of working capital lines secured by accounts receivable • Insurance lending primarily to brokers of home and auto insurance Finance 21% Insurance (Primarily Brokers) 25% Health Care & Social Assistance 31% Admin & Support, Waste Mgmt, Remediation Svcs 4% Construction 3% Real Estate and Rental/Leasing 4% Arts, Entertainment & Recreation 3% Manufacturing 2% Other 7%

24 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Healthcare Portfolio Healthcare Portfolio Composition CRE Skilled Nursing Facility By State • Consists primarily of skilled nursing facilities located across the US • Healthcare lending team has more than 15 years of industry experience • High touch service model attracts desirable ultra-high net worth Healthcare borrowers • 100% of Skilled Nursing Lending has recourse • Focused on originating Healthcare loans in the most desirable states with: – Higher average occupancy – Low denial of payment rates for Medicaid – Strong senior demographic trends 1 Includes CRE and C&I 2 Includes Physicians 2 1 Skilled Nursing Facilities 78% Assisted Living 11% Recovery 5% Other 6% FL 49% OH 13% NY 9% PA 4% AL 4% VA 4% NJ 4% Other 13%

25 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Commercial Construction Portfolio • Commercial construction loans comprise ~7% of total loan portfolio ($220 million) • $130 million of unfunded commitments, committed construction draws are subject to various terms and conditions, including completion of work verified by third party professional inspection Dollars in millions By Property Type # Loans $ Committed % Unfunded $ Unfunded 1Q23 Balance 37 $325 47% $153 Closures in 2Q23 -- -- 1Q23 Loans @ 2Q23 37 $325 40% $130 New 2Q23 Loans 1 $20 2Q23 Balance 38 $345 38% $130 Multifamily 50% Mixed Use 27% Land 13% Self Storage 6% Retail 2% Residential 2%

BWFG | LISTED | NASDAQ Credit Quality & Capital

27 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Credit Quality $15,285 $16,793 $16,441 $14,265 $15,531 0.74% 0.73% 0.61% 0.52% 0.56% 0.00% 0.50% 1.00% 1.50% 2.00% $0 $5,000 $10,000 $15,000 $20,000 $25,000 2Q22 3Q22 4Q22 1Q23 2Q23 NPLs NPL to gross loans Non Performing Loans (“NPL”) Dollars in thousands NPL related to COVID-19 ‒ Single loan - 57% LTV ‒ Full recourse ‒ High net worth guarantors ‒ Full repayment expected $15,773 $18,117 $22,431 $27,998 $30,694 0.77% 0.79% 0.84% 1.01% 1.11% 0.00% 0.50% 1.00% 1.50% 2.00% 2.50% 3.00% 3.50% $0 $5,000 $10,000 $15,000 $20,000 $25,000 $30,000 $35,000 2Q22 3Q22 4Q22 1Q23 2Q23 Allowance for credit losses ACL / Loans Allowance for Credit Losses (“ACL”) • Growth in 2022 ACL reflects $0.8 billion loan growth • 1Q23 ACL includes 1/1 opening entry for CECL adoption ($5.1 million) • 2Q23 ACL coverage of NPLs is 198%; excluding the COVID-19-related NPL, coverage of 499% • ACL/Loans coverage ratio up 10 bps QoQ; $2.7 million provision for credit losses; increase primarily due to forward looking CECL macroeconomic factors 0.34% 0.16% 0.10% 2Q23 0.56% SBA-guaranteed portion of NPLs All other NPLs

28 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Credit Quality Dollars in millions 2Q22 3Q22 4Q22 1Q23 2Q23 Risk Rating Balance % Balance % Balance % Balance % Balance % 1-5 “Pass” $1,994 97.0% $2,242 98.0% $2,632 98.4% $2,714 98.4% $2,710 97.7% 6 “Special Mention” $20 1.0% $2 0.1% $1 0.0% $1 0.1% $28 1.0% 7 “Substandard” $41 2.0% $43 1.9% $43 1.6% $40 1.4% $36 1.3% 8 “Doubtful” $1 0.0% $0 0.0% $0 0.0% $2 0.1% $0 0.0% Total $2,057 $2,287 $2,675 $2,757 $2,774 • 2Q23 “Special Mention” growth due to 3 distinct loans/relationships: ‒ One C&I relationship $11 million ‒ One C&I relationship $8 million ‒ One CRE loan $6 million • Of the $28 million “Special Mention”, $20 million is current; the remaining $8 million delinquency is expected to be short term

29 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Fully Diluted Tangible Book Value 1 Misc includes items such as, but not limited to, changes related to stock grants and share count • Existing interest rate swaps hedging impact of unrealized losses in AFS Securities portfolio: ‒ AFS Securities $(7.6) million ‒ Interest Rate Swaps $5.9 million • $4.9 million 1/1/23 CECL adjustment 1 $30.51 $31.45 $2.34 $0.40 $0.20 $0.63 $0.17 2022 Net Income Dividends AOCI CECL 1/1 Misc 2Q23 2023 TBV / Share Walk

30 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Capital Position 7.38% 9.22% 10.17% 11.16% 7.58% 9.41% 10.34% 11.41% 0.00% 1.00% 2.00% 3.00% 4.00% 5.00% 6.00% 7.00% 8.00% 9.00% 10.00% 11.00% 12.00% 13.00% 14.00% 15.00% T C E T ie r 1 Le ve ra g e T ie r 1 / C E T 1 T o ta l C a p it a l 2Q23 1Q23 Well Capitalized 2 Tier 1CET1 CRE concentration of 415%1 1 Current period Bank capital ratios are preliminary, subject to finalization of the FDIC Call Report 2 Tangible Common Equity (TCE) calculation is a consolidated BWFG ratio Key Bank Capital Ratios1

BWFG | LISTED | NASDAQ History & Overview

32 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Bankwell operates in an attractive core market: • Second most affluent MSA in the Nation in per capita personal income (PCPI)2 • 4 of the top 25 wealthiest towns in the U.S.3 • MSA ranked 11th most educated overall, tied for 5th with the highest percentage of bachelors degree holders4 • Headquarters of 9 Fortune 500 companies5 • Home to two of the largest hedge funds in the U.S. • $27 billion total AUM managed by 68 firms with $1 billion or less in AUM6 • 381 thousand housing units with a median value of owner-occupied units of $433 thousand7 ̶ In addition, New Haven County has 371 thousand housing units with a median value of owner-occupied units of $252 thousand7 1 Source: S&P Global Market Intelligence’s Branch Competitors & Pricing Report as of 6/30/22, excluding global money center banks (tickers BAC, WFC, JPM, TD & C) 2 Source: Bureau of Economic Analysis’ Metropolitan Area Table, contained within the Personal Income by County & Metropolitan Area, 2021 news release 11/16/22 3 Source: Bloomberg: 2020 Richest Places 4 Source: WalletHub: Most & Least Educated Cities in America, 7/18/22 5 Source: Fortune.com: 2023 Fortune 500 6 Source: US News and World Report 7 Source: US Census Bureau QuickFacts (2021 data) Branches (9) Fairfield County Profile • Connecticut-based $3.3 billion commercial bank • 9 branches in Fairfield & New Haven Counties • $204 million deposits per branch; one of the highest in Fairfield & New Haven Counties1

33 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Financial Snapshot 2018 2019 2020 2021 2022 2Q23 YTD Total assets $1,873,665 $1,882,182 $2,253,747 $2,456,264 $3,252,449 $3,252,707 Net loans $1,586,775 $1,588,840 $1,601,672 $1,875,167 $2,646,384 $2,736,607 Loan-to-deposit ratio 106.4% 107.1% 87.9% 88.8% 95.2% 99.2% Return on average assets 0.94% 0.97% 0.28% 1.17% 1.44% 1.14% Efficiency ratio1 59.2% 60.2% 73.9% 53.9% 45.4% 48.3% Non-interest expense / avg. assets 1.93% 1.90% 2.03% 1.75% 1.71% 1.58% Net interest margin 3.18% 3.03% 2.77% 3.17% 3.78% 3.15% Total capital to risk weighted assets 12.50% 13.35% 12.28% 12.00% 11.07% 11.41% Tangible common equity ratio1 9.16% 9.56% 7.73% 8.13% 7.26% 7.58% Return on average equity 10.19% 10.20% 3.35% 13.86% 16.72% 15.15% Fully diluted tangible book value per share1 $21.85 $22.82 $21.96 $25.55 $30.51 $31.45 Net interest income $56,326 $53,761 $54,835 $67,886 $94,743 $49,532 Pre-tax, pre-provision net revenue1 $24,593 $23,379 $14,907 $33,803 $53,420 $27,127 Net income $17,433 $18,216 $5,904 $26,586 $37,429 $18,362 EPS (fully diluted) $2.21 $2.31 $0.75 $3.36 $4.79 $2.34 1 A non-GAAP metric Dollars in thousands, except per share data

34 BWFG LISTED NASDAQ BWFG LISTED NASDAQ Name Years Experience Selected Professional Biography Christopher Gruseke Chief Executive Officer Director (since 2015) 30+ Mr. Gruseke was a founding investor and director of Bankwell Financial Group’s predecessors, BNC Financial Group, Inc., and The Bank of New Canaan. He brings more than 25 years of capital markets, operations, sales and finance experience to his role at the Company. Most recently, he was a member of the Executive Committee at CRT Capital, a Stamford, Connecticut-based broker/dealer. He also served as Co-Chief Operating Officer and a member of the Board of Greenwich Capital Markets. Mr. Gruseke earned a B.A. from Williams College and an M.S. from the Stern School of Business at New York University. Christine A. Chivily Chief Credit Officer (since 2013) 40+ Ms. Chivily has over 40 years of experience in banking and real estate finance. She previously served in a risk management role for the CRE and C&I loan portfolios at People's United Bank. Her prior experience also includes five years as Director of Freddie Mac’s New England region for multifamily properties and 11 years as Senior Credit Officer at RBS Greenwich Capital. She also has over 10 years of combined experience in lending, loan administration and workouts at other various banking institutions. Ms. Chivily received her B.A. from Mt. Holyoke College. Ryan J. Hildebrand Chief Innovation Officer (since 2023) 20+ Mr. Hildebrand has over 20 years of experience in fintech and banking. He led business units at Cross River Bank and LSBX, driving increased deposits and fee income. He founded Seed, a pioneering challenger bank acquired by Cross River. Previously, he served as Head of Finance and Strategy at Simple, the first consumer challenger bank, and held positions at Umpqua Bank and PricewaterhouseCoopers. Matthew McNeill Chief Banking Officer (since 2020) 20+ Mr. McNeill has more than 20 years of experience in Commercial Banking. He most recently served as Head of Commercial Lending at Metropolitan Commercial Bank. During his 8 years at Metropolitan Commercial Bank the bank grew its lending assets from $400 million to over $3 billion. Mr. McNeill has additionally held lending roles at HSBC Bank US and Banco Santander. Mr. McNeill has also served as Managing Partner at American Real Estate Lending; a Commercial Real Estate finance company. Courtney E. Sacchetti Chief Financial Officer (since 2023) 20+ Ms. Sacchetti has more than 20 years experience in Financial Services. She most recently served as Director of Financial Planning & Analysis for the Company for 6 years. She began her career at GE Capital in the Financial Management Program (FMP) and held various finance and regulatory positions of increasing responsibility over her 18-year career at GE Capital. Ms. Sacchetti earned a B.A. and an M.B.A. from Union College. Experienced Leadership Team

BWFG | LISTED | NASDAQ Thank You & Questions

v3.23.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |