false

0001303942

0001303942

2024-11-05

2024-11-05

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): November 5, 2024

BANKFINANCIAL CORPORATION

(Exact Name of Registrant as Specified in Charter)

|

Maryland

|

0-51331

|

75-3199276

|

|

(State or Other Jurisdiction

of Incorporation)

|

(Commission

File No.)

|

(I.R.S. Employer

Identification No.)

|

|

|

|

|

| |

60 North Frontage Road, Burr Ridge, Illinois

(Address of Principal Executive Offices)

|

60527

(Zip Code)

|

| |

|

Registrant’s telephone number, including area code: (800) 894-6900

Not Applicable

(Former name, former address and former fiscal year, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

|

Trading

Symbol(s)

|

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.01 per share

|

|

BFIN

|

|

The NASDAQ Stock Market LLC

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

2.02 Results of Operations and Financial Condition.

BankFinancial Corporation (the “Company”) provides the following information with respect to operating results for the quarter ended September 30, 2024.

THIRD QUARTER 2024 OVERVIEW

We reported net income of $2.0 million, or $0.16 per common share for the three months ended September 30, 2024. At September 30, 2024, we had total assets of $1.418 billion, total loans of $923.9 million, total deposits of $1.199 billion and stockholders' equity of $159 million.

In the third quarter of 2024, interest income decreased by $769,000 primarily due to declines in commercial loans and lease balances. Interest expense increased by $146,000 due to retail depositors seeking higher-yielding account types. Our tax-equivalent net interest margin decreased to 3.47% from 3.67%.

Noninterest income increased by $206,000, primarily due to increased deposit service charges and fees and trust department income, as well as improved returns on bank-owned life insurance.

Noninterest expense decreased by $1.1 million. Compensation and benefits declined by $502,000 due to a 9% reduction in full time equivalent headcount since the end of the first quarter of 2024 and reduced incentive compensation expense. Office occupancy and information technology expense declined by $407,000 due to adjustments to estimated real estate tax accruals and reduced transaction processing software expense.

Cash & Cash Equivalent Assets

For the quarter ended September 30, 2024, cash and cash equivalent assets represented 9.8% of total assets, compared to 10.3% of total assets at June 30, 2024.

Investment Securities Portfolio

For the quarter ended September 30, 2024, total investment securities increased by $42.0 million due to $139.0 million in purchases, offset by $98.5 million of maturities and redemptions of U.S. Treasury Notes and U.S. government-sponsored agency securities. The investment securities portfolio had a weighted-average term to maturity of 1.09 years as of September 30, 2024, with an after-tax unrealized loss of $842,000 or 0.5% of Tier 1 capital.

Loan Portfolio

Our loan portfolio declined by $63.8 million in the third quarter of 2024. Multi-family residential loans decreased by $3.2 million (0.6%) due to scheduled loan repayments. Commercial finance balances decreased by $21.8 million (23.5%) primarily due to a planned $18.8 million reduction in balances within the healthcare finance portfolio and lessor finance portfolio for risk management purposes. Equipment finance balances declined by $37.2 million (15.1%) due to scheduled repayments, partially offset by modestly higher originations of corporate equipment finance transactions. The average yield on our loan portfolio decreased to 5.07%.

Loan demand for all commercial credit categories was muted for the first two months of the third quarter of 2024. Towards the end of the quarter, demand for multi-family residential loans and nonresidential real estate loans expected to fund in the fourth quarter of 2024 increased due to lower market interest rates and expanded marketing activities. Demand for new equipment finance transactions remained stagnant while the equipment finance pipeline duration extended further due to delays in delivery and installation for approved equipment finance transactions. Demand for commercial finance transactions and commercial line utilization remained sporadic, as borrowers utilized available liquidity instead of unused credit availability; however, increased marketing to small- and medium-businesses continued to produce modest improvements in new credit facility opportunities compared to previous quarters.

Asset Quality

The ratio of nonperforming assets to total assets increased to 1.71% at September 30, 2024, from 1.54% at June 30, 2024, inclusive of two U.S. Government equipment finance transactions totaling $18.9 million. Excluding these two U.S. Government transactions, our ratio of nonperforming assets to total assets would have been 0.38% at September 30, 2024. The Bank placed a $1.5 million multi-family residential borrower relationship in the Chicago MSA market on nonaccrual status until the pending receivership and sale of the collateral is consummated in the fourth quarter of 2024. Past due trends improved, and nonperforming asset resolution activity continued to accelerate during the third quarter of 2024.

Our allowance for credit losses increased to 0.85% of total loans at September 30, 2024, compared to 0.82% at June 30, 2024.

Deposit Portfolio

Total deposits decreased by $52.9 million (4.2%). Noninterest-bearing demand deposit balances declined by $35.7 million, primarily due to the withdrawal of $20.0 million deposited in connection with the acquisition of a commercial real estate property late in the second quarter of 2024, the liquidation of $4.8 million in cash collateral securing a commercial finance letter of credit drawn by the beneficiary, and typical balance volatility for certain other commercial depositors. Interest-bearing deposit balances (consisting of interest-bearing NOW accounts, money market accounts and savings deposits) declined by $22.1 million primarily due to seasonal expenses such as real estate taxes, college tuition and capital expenditures, with competition from equity markets and non-bank money market mutual funds also being a contributing factor. Certificates of deposits increased by $5.0 million due to retail depositors seeking higher long-term yields in anticipation of lower short-term market yields in the future. The cost of our total retail and commercial deposits increased to 1.94% during the third quarter of 2024 from 1.87% at June 30, 2024. Core deposits represented 81% of total deposits, with noninterest-bearing demand deposits representing 19% of total deposits at September 30, 2024. Total commercial deposits were 20% of total deposits at September 30, 2024 and 22% of total deposits at June 30, 2024. FDIC-insured deposits represented 84.42% of total deposits and collateralized public funds deposits represented 1.92% of total deposits as of September 30, 2024.

Capital Adequacy

The Company’s capital position remained strong, with a Tier 1 leverage ratio of 11.11% at September 30, 2024. The book value of the Company’s common shares increased to $12.77 at September 30, 2024 from $12.64 at June 30, 2024.

Item 7.01. Regulation FD Disclosure.

The Company provides the following information with respect to projected operations for the remainder of the year ending December 31, 2024.

FOURTH QUARTER OUTLOOK

Cash & Cash Equivalent Assets

For the fourth quarter of 2024, we expect cash and cash equivalent assets to be between 10% and 12% of total assets.

Investment Securities Portfolio

For the fourth quarter of 2024, we expect our investment securities portfolio balance to decline between 5% and 15% as we utilize maturing investment securities proceeds for commercial credit originations, commercial finance line utilization, maintaining short-term liquidity, and funding deposit withdrawals.

Loan Portfolio

Based on current loan origination pipelines, scheduled repayments and expected market conditions, we expect our loan portfolio to increase between 1% and 5% during the fourth quarter of 2024 due to improved pipelines for multi-family residential real estate loans and, to a lesser extent, commercial finance lines of credit; however, increases in prepayment rates on multi-family residential real estate loans related to project sales or delays in new loan origination closings (particularly within the equipment finance transaction pipeline) could affect these expected results. We will continue to focus on originating corporate and middle-market equipment finance transactions, commercial finance credit facilities, small business credit facilities and multi-family residential and nonresidential real estate loans to improve the yield on the loan portfolio while maintaining an appropriate balance of liquidity and interest rate risk.

Deposit Portfolio

For the fourth quarter of 2024, total deposit balances are expected to decline between 0% to 2% principally due to balance volatility by certain higher-balance commercial deposit customers and declines in public-fund deposit balances. We expect our cost of deposits to decrease by 0.05% to 0.10% during the fourth quarter of 2024.

Net Interest Income

For the fourth quarter of 2024, based on the expected activity in the loan, deposit and investment portfolios, we expect our net interest income before provision for credit losses to be consistent with the third quarter of 2024, as new loan originations late in the period will provide very limited benefit to interest income for the quarter and deposit interest expense will slowly diminish during the quarter, depending on Federal Reserve actions and market competition for deposits.

Noninterest Income

For the fourth quarter of 2024, we expect noninterest income to grow between 5% and 10% compared to the third quarter of 2024 due to higher revenues from retail deposit services, commercial/treasury services, trust services and bank-owned life insurance.

Noninterest Expense

For the fourth quarter of 2024, we expect noninterest expense to increase between 3% and 6% compared to the third quarter of 2024 due to increased seasonal fourth quarter expenses, particularly for occupancy expenses.

Item 8.01. Other Events.

On November 5, 2024, the Company filed its Quarterly Report on Form 10-Q for the third quarter ended September 30, 2024 and issued the Quarterly Financial and Statistical Supplement for the latest five quarters. The Quarterly Financial and Statistical Supplement is included as Exhibit 99.1 to this report.

This current report includes “forward-looking statements” as defined in the Private Securities Litigation Reform Act of 1995. A variety of factors could cause BankFinancial’s actual results to differ from those expected at the time of this release. For a discussion of some of the factors that may cause actual results to differ from expectations, please refer to BankFinancial’s most recent Annual Report on Form 10-K as filed with the SEC, as supplemented by subsequent filings with the SEC. Investors are urged to review all information contained in these reports, including the risk factors discussed therein. Copies of these filings are available at no cost on the SEC's web site at www.sec.gov or on BankFinancial’s web site at www.bankfinancial.com. Forward-looking statements speak only as of the date they are made, and we do not undertake to update them to reflect changes.

Item 9.01 Financial Statements and Exhibits.

| |

Exhibit No.

|

Description

|

| |

|

Quarterly Financial and Statistical Supplement

|

| |

104 |

Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

|

|

|

|

BANKFINANCIAL CORPORATION

|

|

|

|

|

|

|

|

|

|

Dated:

|

November 5, 2024 |

|

By:

|

/s/ F. Morgan Gasior

|

|

|

|

|

|

|

F. Morgan Gasior

|

|

|

|

|

|

|

Chairman of the Board, Chief Executive Officer and President

|

Exhibit 99.1

BANKFINANCIAL CORPORATION

Third QUARTER 2024

QUARTERLY FINANCIAL AND STATISTICAL SUPPLEMENT

FOR THE LATEST FIVE QUARTERS

Note: Certain reclassifications have been made in the prior period’s financial statements and reflected in the Selected Quarterly Financial and Statistical Data tables to conform to the current period’s presentation.

The information and statistical data contained herein have been prepared by BankFinancial Corporation and have been derived or calculated from selected unaudited quarterly and period–end historical financial statements prepared in accordance with accounting principles generally accepted in the United States. BankFinancial Corporation is under no obligation to update, keep current, or continue to provide the information contained herein. This information is provided solely for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any securities or establish any business relationships with BankFinancial Corporation or its subsidiary.

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

Latest Five Quarters

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2024 |

|

|

2023 |

|

| |

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

IIIQ

|

|

|

PERFORMANCE MEASUREMENTS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return on assets (ratio of net income to average total assets) (1)

|

|

|

0.56 |

% |

|

|

0.58 |

% |

|

|

0.46 |

% |

|

|

0.56 |

% |

|

|

0.63 |

% |

|

Return on equity (ratio of net income to average equity) (1)

|

|

|

5.03 |

|

|

|

5.44 |

|

|

|

4.38 |

|

|

|

5.37 |

|

|

|

6.16 |

|

|

Net interest rate spread (1)

|

|

|

2.90 |

|

|

|

3.11 |

|

|

|

3.07 |

|

|

|

3.01 |

|

|

|

3.16 |

|

|

Net interest margin (TEB) (1) (2)

|

|

|

3.47 |

|

|

|

3.67 |

|

|

|

3.59 |

|

|

|

3.48 |

|

|

|

3.57 |

|

|

Efficiency ratio (3)

|

|

|

76.73 |

|

|

|

80.39 |

|

|

|

84.11 |

|

|

|

77.39 |

|

|

|

76.02 |

|

|

Noninterest expense to average total assets (1)

|

|

|

2.82 |

|

|

|

3.03 |

|

|

|

3.17 |

|

|

|

2.92 |

|

|

|

2.86 |

|

|

Average interest–earning assets to average interest–bearing liabilities

|

|

|

133.26 |

|

|

|

134.44 |

|

|

|

135.89 |

|

|

|

136.25 |

|

|

|

136.78 |

|

|

Number of full service offices

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

|

18 |

|

|

Employees (full time equivalents)

|

|

|

198 |

|

|

|

206 |

|

|

|

217 |

|

|

|

205 |

|

|

|

200 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SUMMARY STATEMENT OF FINANCIAL CONDITION

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ASSETS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and due from other financial institutions

|

|

$ |

19,412 |

|

|

$ |

19,505 |

|

|

$ |

18,533 |

|

|

$ |

19,781 |

|

|

$ |

19,691 |

|

|

Interest-bearing deposits in other financial institutions

|

|

|

118,866 |

|

|

|

132,273 |

|

|

|

113,907 |

|

|

|

158,703 |

|

|

|

151,870 |

|

|

Interest-bearing time deposits in other financial institutions

|

|

|

22,005 |

|

|

|

34,913 |

|

|

|

30,748 |

|

|

|

29,513 |

|

|

|

2,725 |

|

|

Securities, at fair value

|

|

|

264,905 |

|

|

|

222,906 |

|

|

|

239,549 |

|

|

|

153,203 |

|

|

|

155,700 |

|

|

Loans receivable, net

|

|

|

923,939 |

|

|

|

987,745 |

|

|

|

1,007,980 |

|

|

|

1,050,761 |

|

|

|

1,105,604 |

|

|

Foreclosed assets, net

|

|

|

1,966 |

|

|

|

1,898 |

|

|

|

2,332 |

|

|

|

2,777 |

|

|

|

902 |

|

|

Stock in Federal Home Loan Bank and Federal Reserve Bank, at cost

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

Premises held-for-sale

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

523 |

|

|

|

540 |

|

|

Premises and equipment, net

|

|

|

22,674 |

|

|

|

22,765 |

|

|

|

22,614 |

|

|

|

22,950 |

|

|

|

22,914 |

|

|

Bank-owned life insurance

|

|

|

18,277 |

|

|

|

18,291 |

|

|

|

18,382 |

|

|

|

18,469 |

|

|

|

18,556 |

|

|

Deferred taxes

|

|

|

3,590 |

|

|

|

4,019 |

|

|

|

4,159 |

|

|

|

4,512 |

|

|

|

4,979 |

|

|

Other assets

|

|

|

14,536 |

|

|

|

25,885 |

|

|

|

14,364 |

|

|

|

18,702 |

|

|

|

14,483 |

|

|

Total assets

|

|

$ |

1,417,660 |

|

|

$ |

1,477,690 |

|

|

$ |

1,480,058 |

|

|

$ |

1,487,384 |

|

|

$ |

1,505,454 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND STOCKHOLDERS’ EQUITY

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposits

|

|

$ |

1,199,412 |

|

|

$ |

1,252,273 |

|

|

$ |

1,259,286 |

|

|

$ |

1,261,623 |

|

|

$ |

1,275,828 |

|

|

Borrowings

|

|

|

20,000 |

|

|

|

25,000 |

|

|

|

25,000 |

|

|

|

25,000 |

|

|

|

25,000 |

|

|

Subordinated notes, net of unamortized issuance costs

|

|

|

18,726 |

|

|

|

18,715 |

|

|

|

18,705 |

|

|

|

19,678 |

|

|

|

19,667 |

|

|

Other liabilities

|

|

|

20,414 |

|

|

|

24,224 |

|

|

|

21,036 |

|

|

|

25,700 |

|

|

|

31,204 |

|

|

Total liabilities

|

|

|

1,258,552 |

|

|

|

1,320,212 |

|

|

|

1,324,027 |

|

|

|

1,332,001 |

|

|

|

1,351,699 |

|

|

Stockholders’ equity

|

|

|

159,108 |

|

|

|

157,478 |

|

|

|

156,031 |

|

|

|

155,383 |

|

|

|

153,755 |

|

|

Total liabilities and stockholders’ equity

|

|

$ |

1,417,660 |

|

|

$ |

1,477,690 |

|

|

$ |

1,480,058 |

|

|

$ |

1,487,384 |

|

|

$ |

1,505,454 |

|

| (2) |

Calculated on a tax equivalent basis (“TEB”) assuming a federal income tax rate of 21% and an average state income tax rate of 9.5%. |

|

(3)

|

The efficiency ratio represents noninterest expense, divided by the sum of net interest income and noninterest income. |

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2024 |

|

|

2023 |

|

| |

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

IIIQ

|

|

|

SUMMARY STATEMENT OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total interest income

|

|

$ |

16,886 |

|

|

$ |

17,655 |

|

|

$ |

17,345 |

|

|

$ |

16,923 |

|

|

$ |

16,894 |

|

|

Total interest expense

|

|

|

5,225 |

|

|

|

5,079 |

|

|

|

4,818 |

|

|

|

4,491 |

|

|

|

3,940 |

|

|

Net interest income

|

|

|

11,661 |

|

|

|

12,576 |

|

|

|

12,527 |

|

|

|

12,432 |

|

|

|

12,954 |

|

|

Provision for (recovery of) credit losses

|

|

|

485 |

|

|

|

(122 |

) |

|

|

12 |

|

|

|

317 |

|

|

|

136 |

|

|

Net interest income after provision for (recovery of) credit losses

|

|

|

11,176 |

|

|

|

12,698 |

|

|

|

12,515 |

|

|

|

12,115 |

|

|

|

12,818 |

|

|

Noninterest income

|

|

|

1,482 |

|

|

|

1,276 |

|

|

|

1,461 |

|

|

|

1,625 |

|

|

|

1,240 |

|

|

Noninterest expense

|

|

|

10,084 |

|

|

|

11,135 |

|

|

|

11,766 |

|

|

|

10,879 |

|

|

|

10,790 |

|

|

Income before income tax

|

|

|

2,574 |

|

|

|

2,839 |

|

|

|

2,210 |

|

|

|

2,861 |

|

|

|

3,268 |

|

|

Income tax expense

|

|

|

581 |

|

|

|

705 |

|

|

|

500 |

|

|

|

782 |

|

|

|

899 |

|

|

Net income

|

|

$ |

1,993 |

|

|

$ |

2,134 |

|

|

$ |

1,710 |

|

|

$ |

2,079 |

|

|

$ |

2,369 |

|

|

Basic and diluted earnings per common share

|

|

$ |

0.16 |

|

|

$ |

0.17 |

|

|

$ |

0.14 |

|

|

$ |

0.17 |

|

|

$ |

0.19 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

NONINTEREST INCOME AND EXPENSE

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Income

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Deposit service charges and fees

|

|

$ |

915 |

|

|

$ |

834 |

|

|

$ |

809 |

|

|

$ |

836 |

|

|

$ |

836 |

|

|

Loan servicing fees

|

|

|

97 |

|

|

|

97 |

|

|

|

156 |

|

|

|

164 |

|

|

|

98 |

|

|

Trust insurance commissions and annuities income

|

|

|

405 |

|

|

|

349 |

|

|

|

450 |

|

|

|

347 |

|

|

|

290 |

|

|

Loss on sale of premises and equipment

|

|

|

(20 |

) |

|

|

(9 |

) |

|

|

(75 |

) |

|

|

— |

|

|

|

— |

|

|

Valuation adjustment on bank premises held-for-sale

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(17 |

) |

|

|

— |

|

|

Loss on bank-owned life insurance

|

|

|

(14 |

) |

|

|

(91 |

) |

|

|

(87 |

) |

|

|

(87 |

) |

|

|

(88 |

) |

|

Gain on repurchase of Subordinated notes

|

|

|

— |

|

|

|

— |

|

|

|

107 |

|

|

|

— |

|

|

|

— |

|

|

Other

|

|

|

99 |

|

|

|

96 |

|

|

|

101 |

|

|

|

382 |

|

|

|

104 |

|

|

Total noninterest income

|

|

$ |

1,482 |

|

|

$ |

1,276 |

|

|

$ |

1,461 |

|

|

$ |

1,625 |

|

|

$ |

1,240 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest Expense

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Compensation and benefits

|

|

$ |

5,441 |

|

|

$ |

5,943 |

|

|

$ |

6,052 |

|

|

$ |

5,679 |

|

|

$ |

5,369 |

|

|

Office occupancy and equipment

|

|

|

1,532 |

|

|

|

1,861 |

|

|

|

2,241 |

|

|

|

1,937 |

|

|

|

2,046 |

|

|

Advertising and public relations

|

|

|

117 |

|

|

|

112 |

|

|

|

90 |

|

|

|

139 |

|

|

|

171 |

|

|

Information technology

|

|

|

971 |

|

|

|

1,049 |

|

|

|

1,002 |

|

|

|

974 |

|

|

|

944 |

|

|

Professional fees

|

|

|

299 |

|

|

|

382 |

|

|

|

454 |

|

|

|

292 |

|

|

|

366 |

|

|

Supplies, telephone, and postage

|

|

|

281 |

|

|

|

292 |

|

|

|

286 |

|

|

|

289 |

|

|

|

311 |

|

|

FDIC insurance premiums

|

|

|

156 |

|

|

|

144 |

|

|

|

161 |

|

|

|

207 |

|

|

|

222 |

|

|

Other

|

|

|

1,287 |

|

|

|

1,352 |

|

|

|

1,480 |

|

|

|

1,362 |

|

|

|

1,361 |

|

|

Total noninterest expense

|

|

$ |

10,084 |

|

|

$ |

11,135 |

|

|

$ |

11,766 |

|

|

$ |

10,879 |

|

|

$ |

10,790 |

|

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2024 |

|

|

2023 |

|

| |

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

IIIQ

|

|

|

LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

15,634 |

|

|

$ |

17,707 |

|

|

$ |

18,247 |

|

|

$ |

18,945 |

|

|

$ |

19,233 |

|

|

Multi-family residential real estate

|

|

|

524,340 |

|

|

|

527,542 |

|

|

|

526,087 |

|

|

|

527,460 |

|

|

|

528,251 |

|

|

Nonresidential real estate

|

|

|

109,799 |

|

|

|

109,635 |

|

|

|

110,319 |

|

|

|

118,016 |

|

|

|

117,641 |

|

|

Commercial loans and leases

|

|

|

280,218 |

|

|

|

339,216 |

|

|

|

360,328 |

|

|

|

393,321 |

|

|

|

447,687 |

|

|

Consumer

|

|

|

1,847 |

|

|

|

1,787 |

|

|

|

1,248 |

|

|

|

1,364 |

|

|

|

1,351 |

|

| |

|

|

931,838 |

|

|

|

995,887 |

|

|

|

1,016,229 |

|

|

|

1,059,106 |

|

|

|

1,114,163 |

|

|

Allowance for credit losses

|

|

|

(7,899 |

) |

|

|

(8,142 |

) |

|

|

(8,249 |

) |

|

|

(8,345 |

) |

|

|

(8,559 |

) |

|

Loans, net

|

|

$ |

923,939 |

|

|

$ |

987,745 |

|

|

$ |

1,007,980 |

|

|

$ |

1,050,761 |

|

|

$ |

1,105,604 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN ORIGINATIONS (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

149 |

|

|

$ |

268 |

|

|

$ |

173 |

|

|

$ |

758 |

|

|

$ |

137 |

|

|

Multi-family residential real estate

|

|

|

4,837 |

|

|

|

14,177 |

|

|

|

5,561 |

|

|

|

6,226 |

|

|

|

5,902 |

|

|

Nonresidential real estate

|

|

|

2,658 |

|

|

|

34 |

|

|

|

— |

|

|

|

3,183 |

|

|

|

834 |

|

|

Commercial loans

|

|

|

149,449 |

|

|

|

171,430 |

|

|

|

158,172 |

|

|

|

145,930 |

|

|

|

172,081 |

|

|

Equipment finance

|

|

|

8,068 |

|

|

|

6,207 |

|

|

|

3,427 |

|

|

|

8,141 |

|

|

|

14,442 |

|

|

Consumer

|

|

|

722 |

|

|

|

1,184 |

|

|

|

471 |

|

|

|

617 |

|

|

|

514 |

|

| |

|

$ |

165,883 |

|

|

$ |

193,300 |

|

|

$ |

167,804 |

|

|

$ |

164,855 |

|

|

$ |

193,910 |

|

|

Weighted average interest rate

|

|

|

8.26 |

% |

|

|

8.76 |

% |

|

|

9.04 |

% |

|

|

9.09 |

% |

|

|

9.11 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

LOAN PAYMENTS and PAYOFFS (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

2,280 |

|

|

$ |

823 |

|

|

$ |

852 |

|

|

$ |

1,049 |

|

|

$ |

1,409 |

|

|

Multi-family residential real estate

|

|

|

8,094 |

|

|

|

12,387 |

|

|

|

6,931 |

|

|

|

7,336 |

|

|

|

19,784 |

|

|

Nonresidential real estate

|

|

|

2,619 |

|

|

|

711 |

|

|

|

7,684 |

|

|

|

3,278 |

|

|

|

3,253 |

|

|

Commercial loans

|

|

|

171,276 |

|

|

|

165,347 |

|

|

|

161,429 |

|

|

|

148,964 |

|

|

|

176,493 |

|

|

Equipment finance

|

|

|

44,315 |

|

|

|

33,140 |

|

|

|

34,669 |

|

|

|

55,433 |

|

|

|

56,844 |

|

|

Consumer

|

|

|

722 |

|

|

|

682 |

|

|

|

612 |

|

|

|

565 |

|

|

|

529 |

|

| |

|

$ |

229,307 |

|

|

$ |

213,090 |

|

|

$ |

212,177 |

|

|

$ |

216,625 |

|

|

$ |

258,312 |

|

|

Weighted average interest rate

|

|

|

7.69 |

% |

|

|

8.16 |

% |

|

|

8.25 |

% |

|

|

7.85 |

% |

|

|

7.86 |

% |

|

(1)

|

Loan originations include purchased loans, draws on revolving lines of credit and exclude loan renewals.

|

|

(2)

|

Loan payments and payoffs exclude loan renewals.

|

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2024 |

|

|

2023 |

|

| |

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

IIIQ

|

|

|

CREDIT QUALITY:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming Assets:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonaccrual loans:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

34 |

|

|

$ |

39 |

|

|

$ |

34 |

|

|

$ |

37 |

|

|

$ |

40 |

|

|

Multi–family residential real estate

|

|

|

1,458 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Nonresidential real estate

|

|

|

393 |

|

|

|

380 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Equipment finance

|

|

|

20,446 |

|

|

|

20,395 |

|

|

|

20,475 |

|

|

|

21,294 |

|

|

|

23,468 |

|

| |

|

|

22,331 |

|

|

|

20,814 |

|

|

|

20,509 |

|

|

|

21,331 |

|

|

|

23,508 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans past due over 90 days still accruing

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

1,007 |

|

|

|

6,245 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Foreclosed assets, net

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other real estate owned

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

405 |

|

|

|

468 |

|

|

Other foreclosed assets

|

|

|

1,966 |

|

|

|

1,898 |

|

|

|

2,332 |

|

|

|

2,372 |

|

|

|

434 |

|

| |

|

|

1,966 |

|

|

|

1,898 |

|

|

|

2,332 |

|

|

|

2,777 |

|

|

|

902 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets

|

|

$ |

24,297 |

|

|

$ |

22,712 |

|

|

$ |

22,841 |

|

|

$ |

25,115 |

|

|

$ |

30,655 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asset Quality Ratios

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Nonperforming assets to total assets

|

|

|

1.71 |

% |

|

|

1.54 |

% |

|

|

1.54 |

% |

|

|

1.69 |

% |

|

|

2.04 |

% |

|

Nonperforming loans to total loans (1)

|

|

|

2.40 |

|

|

|

2.09 |

|

|

|

2.02 |

|

|

|

2.11 |

|

|

|

2.67 |

|

|

Nonperforming commercial-related loans to total commercial-related loans (2)

|

|

|

2.44 |

|

|

|

2.13 |

|

|

|

2.05 |

|

|

|

2.15 |

|

|

|

2.72 |

|

|

Nonperforming residential and consumer loans to total residential and consumer loans

|

|

|

0.19 |

|

|

|

0.20 |

|

|

|

0.17 |

|

|

|

0.18 |

|

|

|

0.19 |

|

|

Allowance for credit losses to nonperforming loans

|

|

|

35.37 |

|

|

|

39.12 |

|

|

|

40.22 |

|

|

|

37.36 |

|

|

|

28.77 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Concentrations of Credit

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Commercial real estate for FFIEC concentration limits

|

|

$ |

616,985 |

|

|

$ |

621,628 |

|

|

$ |

620,694 |

|

|

$ |

624,575 |

|

|

$ |

624,469 |

|

|

% FFIEC total capital

|

|

|

361.51 |

% |

|

|

359.51 |

% |

|

|

364.28 |

% |

|

|

370.83 |

% |

|

|

363.55 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Multi–family mortgage loans - 50% risk based capital qualified (included above)

|

|

$ |

253,491 |

|

|

$ |

269,868 |

|

|

$ |

297,958 |

|

|

$ |

315,179 |

|

|

$ |

248,128 |

|

|

% FFIEC total capital

|

|

|

148.53 |

% |

|

|

156.07 |

% |

|

|

174.87 |

% |

|

|

187.13 |

% |

|

|

144.45 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Nonperforming loans include nonaccrual loans and loans past due 90 days and still accruing.

|

|

(2)

|

Commercial-related loans include multi-family mortgage, nonresidential real estate, and commercial loans and leases.

|

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2024 |

|

|

2023 |

|

| |

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

IIIQ

|

|

|

SUBSTANDARD PERFORMING LOANS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One–to–four family residential real estate

|

|

$ |

164 |

|

|

$ |

167 |

|

|

$ |

204 |

|

|

$ |

272 |

|

|

$ |

282 |

|

|

Multi–family residential real estate

|

|

|

686 |

|

|

|

1,421 |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Nonresidential real estate

|

|

|

449 |

|

|

|

457 |

|

|

|

465 |

|

|

|

— |

|

|

|

— |

|

|

Commercial loans and leases

|

|

|

4,700 |

|

|

|

3,154 |

|

|

|

3,606 |

|

|

|

4,056 |

|

|

|

5,685 |

|

|

Consumer

|

|

|

3 |

|

|

|

3 |

|

|

|

5 |

|

|

|

3 |

|

|

|

3 |

|

| |

|

$ |

6,002 |

|

|

$ |

5,202 |

|

|

$ |

4,280 |

|

|

$ |

4,331 |

|

|

$ |

5,970 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

ALLOWANCE FOR CREDIT LOSSES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Beginning balance

|

|

$ |

8,142 |

|

|

$ |

8,249 |

|

|

$ |

8,345 |

|

|

$ |

8,559 |

|

|

$ |

9,226 |

|

|

Charge–offs:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One-to-four family residential real estate

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(1 |

) |

|

|

— |

|

|

Commercial loans and leases

|

|

|

(731 |

) |

|

|

(10 |

) |

|

|

(158 |

) |

|

|

(570 |

) |

|

|

(889 |

) |

|

Consumer

|

|

|

(12 |

) |

|

|

(12 |

) |

|

|

(13 |

) |

|

|

(9 |

) |

|

|

(14 |

) |

| |

|

|

(743 |

) |

|

|

(22 |

) |

|

|

(171 |

) |

|

|

(580 |

) |

|

|

(903 |

) |

|

Recoveries:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

One-to-four family residential real estate

|

|

|

22 |

|

|

|

2 |

|

|

|

3 |

|

|

|

1 |

|

|

|

32 |

|

|

Multi-family residential real estate

|

|

|

6 |

|

|

|

4 |

|

|

|

6 |

|

|

|

5 |

|

|

|

4 |

|

|

Commercial loans and leases

|

|

|

— |

|

|

|

7 |

|

|

|

5 |

|

|

|

50 |

|

|

|

20 |

|

| |

|

|

28 |

|

|

|

13 |

|

|

|

14 |

|

|

|

56 |

|

|

|

56 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net charge–offs

|

|

|

(715 |

) |

|

|

(9 |

) |

|

|

(157 |

) |

|

|

(524 |

) |

|

|

(847 |

) |

|

Provision for (recovery of) credit losses - loans

|

|

|

472 |

|

|

|

(98 |

) |

|

|

61 |

|

|

|

310 |

|

|

|

180 |

|

|

Ending balance

|

|

$ |

7,899 |

|

|

$ |

8,142 |

|

|

$ |

8,249 |

|

|

$ |

8,345 |

|

|

$ |

8,559 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Allowance for credit losses to total loans

|

|

|

0.85 |

% |

|

|

0.82 |

% |

|

|

0.81 |

% |

|

|

0.79 |

% |

|

|

0.77 |

% |

|

Net charge–offs ratio (1)

|

|

|

(0.30 |

) |

|

|

— |

|

|

|

(0.06 |

) |

|

|

(0.19 |

) |

|

|

(0.30 |

) |

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2024 |

|

|

2023 |

|

| |

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

IIIQ

|

|

|

DEPOSITS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Noninterest–bearing demand

|

|

$ |

226,882 |

|

|

$ |

262,585 |

|

|

$ |

256,698 |

|

|

$ |

260,851 |

|

|

$ |

258,318 |

|

|

Interest–bearing NOW accounts

|

|

|

276,551 |

|

|

|

287,668 |

|

|

|

297,010 |

|

|

|

306,548 |

|

|

|

326,874 |

|

|

Money market accounts

|

|

|

306,679 |

|

|

|

311,276 |

|

|

|

309,695 |

|

|

|

297,074 |

|

|

|

291,154 |

|

|

Savings deposits

|

|

|

160,815 |

|

|

|

167,250 |

|

|

|

171,521 |

|

|

|

174,759 |

|

|

|

178,318 |

|

|

Certificates of deposit - retail

|

|

|

228,485 |

|

|

|

223,494 |

|

|

|

224,362 |

|

|

|

222,391 |

|

|

|

220,915 |

|

|

Certificates of deposit - wholesale

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

249 |

|

| |

|

$ |

1,199,412 |

|

|

$ |

1,252,273 |

|

|

$ |

1,259,286 |

|

|

$ |

1,261,623 |

|

|

$ |

1,275,828 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECTED AVERAGE BALANCES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total average assets

|

|

$ |

1,430,931 |

|

|

$ |

1,470,076 |

|

|

$ |

1,484,332 |

|

|

$ |

1,492,759 |

|

|

$ |

1,511,422 |

|

|

Total average interest–earning assets

|

|

|

1,359,833 |

|

|

|

1,399,280 |

|

|

|

1,415,175 |

|

|

|

1,425,504 |

|

|

|

1,444,259 |

|

|

Average loans

|

|

|

964,827 |

|

|

|

1,010,123 |

|

|

|

1,031,256 |

|

|

|

1,088,172 |

|

|

|

1,141,788 |

|

|

Average securities

|

|

|

252,735 |

|

|

|

242,591 |

|

|

|

186,339 |

|

|

|

161,772 |

|

|

|

167,046 |

|

|

Average stock in FHLB & FRB

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

|

7,490 |

|

|

Average other interest–earning assets

|

|

|

134,781 |

|

|

|

139,076 |

|

|

|

190,090 |

|

|

|

168,070 |

|

|

|

127,935 |

|

|

Total average interest–bearing liabilities

|

|

|

1,020,434 |

|

|

|

1,040,842 |

|

|

|

1,041,381 |

|

|

|

1,046,249 |

|

|

|

1,055,874 |

|

|

Average interest–bearing deposits

|

|

|

977,529 |

|

|

|

997,132 |

|

|

|

996,741 |

|

|

|

1,001,576 |

|

|

|

1,011,212 |

|

|

Average borrowings and Subordinated notes

|

|

|

42,905 |

|

|

|

43,710 |

|

|

|

44,640 |

|

|

|

44,673 |

|

|

|

44,662 |

|

|

Average stockholders’ equity

|

|

|

158,540 |

|

|

|

156,785 |

|

|

|

156,115 |

|

|

|

154,927 |

|

|

|

153,796 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SELECTED YIELDS AND COST OF FUNDS (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total average interest–earning assets

|

|

|

4.94 |

% |

|

|

5.07 |

% |

|

|

4.93 |

% |

|

|

4.71 |

% |

|

|

4.64 |

% |

|

Average loans

|

|

|

5.07 |

|

|

|

5.32 |

|

|

|

5.21 |

|

|

|

4.99 |

|

|

|

4.96 |

|

|

Average securities (TEB) (2)

|

|

|

4.45 |

|

|

|

4.09 |

|

|

|

2.96 |

|

|

|

2.12 |

|

|

|

1.95 |

|

|

Average other interest–earning assets

|

|

|

5.46 |

|

|

|

5.51 |

|

|

|

5.51 |

|

|

|

5.48 |

|

|

|

5.40 |

|

|

Total average interest–bearing liabilities

|

|

|

2.04 |

|

|

|

1.96 |

|

|

|

1.86 |

|

|

|

1.70 |

|

|

|

1.48 |

|

|

Average interest–bearing deposits

|

|

|

1.94 |

|

|

|

1.87 |

|

|

|

1.75 |

|

|

|

1.59 |

|

|

|

1.36 |

|

|

Average cost of total deposits

|

|

|

1.57 |

|

|

|

1.49 |

|

|

|

1.39 |

|

|

|

1.26 |

|

|

|

1.07 |

|

|

Average cost of retail and commercial deposits

|

|

|

1.94 |

|

|

|

1.87 |

|

|

|

1.75 |

|

|

|

1.59 |

|

|

|

1.36 |

|

|

Average cost of wholesale deposits, borrowings and Subordinated notes

|

|

|

4.18 |

|

|

|

4.19 |

|

|

|

4.34 |

|

|

|

4.18 |

|

|

|

4.18 |

|

|

Average cost of funds

|

|

|

1.66 |

|

|

|

1.58 |

|

|

|

1.49 |

|

|

|

1.36 |

|

|

|

1.18 |

|

|

Net interest rate spread

|

|

|

2.90 |

|

|

|

3.11 |

|

|

|

3.07 |

|

|

|

3.01 |

|

|

|

3.16 |

|

|

Net interest margin (TEB) (2)

|

|

|

3.47 |

|

|

|

3.67 |

|

|

|

3.59 |

|

|

|

3.48 |

|

|

|

3.57 |

|

|

(1)

|

Annualized

|

| (2) |

Calculated on a tax equivalent basis assuming a federal income tax rate of 21% and an average state income tax rate of 9.5%. |

BANKFINANCIAL CORPORATION

SELECTED QUARTERLY FINANCIAL AND STATISTICAL DATA

(Dollars in thousands; except per share) – (Unaudited)

| |

|

2024 |

|

|

2023 |

|

| |

|

IIIQ

|

|

|

IIQ

|

|

|

IQ

|

|

|

IVQ

|

|

|

IIIQ

|

|

|

CAPITAL RATIOS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

BankFinancial Corporation (1)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Equity to total assets (end of period)

|

|

|

11.22 |

% |

|

|

10.66 |

% |

|

|

10.54 |

% |

|

|

10.45 |

% |

|

|

10.21 |

% |

|

Risk–based total capital ratio

|

|

|

21.56 |

|

|

|

20.52 |

|

|

|

20.73 |

|

|

|

20.70 |

|

|

|

19.13 |

|

|

Common Tier 1 (CET1)

|

|

|

18.53 |

|

|

|

17.60 |

|

|

|

17.75 |

|

|

|

17.66 |

|

|

|

16.30 |

|

|

Risk–based tier 1 capital ratio

|

|

|

18.53 |

|

|

|

17.60 |

|

|

|

17.75 |

|

|

|

17.66 |

|

|

|

16.30 |

|

|

Tier 1 leverage ratio

|

|

|

11.11 |

|

|

|

10.75 |

|

|

|

10.59 |

|

|

|

10.54 |

|

|

|

10.38 |

|

|

Tier 1 capital

|

|

$ |

158,778 |

|

|

$ |

157,984 |

|

|

$ |

157,062 |

|

|

$ |

157,246 |

|

|

$ |

156,780 |

|

|

BankFinancial, NA (2)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Risk–based total capital ratio

|

|

|

19.96 |

% |

|

|

19.31 |

% |

|

|

19.30 |

% |

|

|

18.96 |

% |

|

|

17.90 |

% |

|

Common Tier 1 (CET1)

|

|

|

19.11 |

|

|

|

18.46 |

|

|

|

18.43 |

|

|

|

18.13 |

|

|

|

17.10 |

|

|

Risk–based tier 1 capital ratio

|

|

|

19.11 |

|

|

|

18.46 |

|

|

|

18.43 |

|

|

|

18.13 |

|

|

|

17.10 |

|

|

Tier 1 leverage ratio

|

|

|

11.48 |

|

|

|

11.32 |

|

|

|

11.03 |

|

|

|

10.85 |

|

|

|

10.93 |

|

|

Tier 1 capital

|

|

$ |

163,355 |

|

|

$ |

165,368 |

|

|

$ |

162,715 |

|

|

$ |

161,037 |

|

|

$ |

164,172 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCK AND DIVIDENDS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

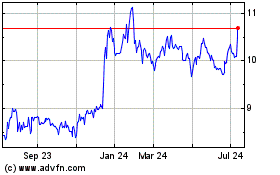

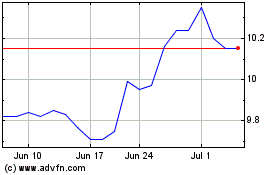

Stock Prices:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Close

|

|

$ |

12.18 |

|

|

$ |

10.29 |

|

|

$ |

10.50 |

|

|

$ |

10.26 |

|

|

$ |

8.62 |

|

|

High

|

|

|

12.56 |

|

|

|

10.70 |

|

|

|

11.12 |

|

|

|

10.76 |

|

|

|

9.11 |

|

|

Low

|

|

|

10.01 |

|

|

|

9.60 |

|

|

|

9.65 |

|

|

|

8.31 |

|

|

|

7.98 |

|

|

Common shares outstanding

|

|

|

12,460,678 |

|

|

|

12,460,678 |

|

|

|

12,460,678 |

|

|

|

12,475,881 |

|

|

|

12,547,390 |

|

|

Book value per share

|

|

$ |

12.77 |

|

|

$ |

12.64 |

|

|

$ |

12.52 |

|

|

$ |

12.45 |

|

|

$ |

12.25 |

|

|

Cash dividends declared on common stock

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

$ |

0.10 |

|

|

Dividend payout ratio

|

|

|

62.52 |

% |

|

|

58.39 |

% |

|

|

72.94 |

% |

|

|

60.33 |

% |

|

|

53.16 |

% |

|

Stock repurchases

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

156 |

|

|

$ |

676 |

|

|

$ |

471 |

|

|

Stock repurchases – shares

|

|

|

— |

|

|

|

— |

|

|

|

15,203 |

|

|

|

71,509 |

|

|

|

53,088 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

EARNINGS PER SHARE COMPUTATIONS

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

1,993 |

|

|

$ |

2,134 |

|

|

$ |

1,710 |

|

|

$ |

2,079 |

|

|

$ |

2,369 |

|

|

Weighted average basic and dilutive common shares outstanding

|

|

|

12,460,678 |

|

|

|

12,460,678 |

|

|

|

12,468,052 |

|

|

|

12,526,673 |

|

|

|

12,578,494 |

|

|

Basic and diluted earnings per common share

|

|

$ |

0.16 |

|

|

$ |

0.17 |

|

|

$ |

0.14 |

|

|

$ |

0.17 |

|

|

$ |

0.19 |

|

|

(1)

|

As a small bank holding company, the Company is exempt from the Federal Reserve Board's risk-based capital and leverage rules. BankFinancial Corporation capital data is included for informational purposes only.

|

|

(2)

|

As a qualifying community bank pursuant to Section 201 of the Economic Growth, Regulatory Relief and Consumer Protection Act of 2018, the Bank elected to adopt the Community Bank Leverage Ratio requirement in 2020. The Community Bank Leverage Ratio is equal to the Bank's Tier 1 Leverage Ratio. Other BankFinancial, NA capital data is included for informational purposes only.

|

v3.24.3

Document And Entity Information

|

Nov. 05, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

BANKFINANCIAL CORPORATION

|

| Document, Type |

8-K

|

| Entity, Incorporation, State or Country Code |

MD

|

| Entity, File Number |

0-51331

|

| Entity, Tax Identification Number |

75-3199276

|

| Entity, Address, Address Line One |

60 North Frontage Road

|

| Entity, Address, City or Town |

Burr Ridge

|

| Entity, Address, State or Province |

IL

|

| Entity, Address, Postal Zip Code |

60527

|

| City Area Code |

800

|

| Local Phone Number |

894-6900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

BFIN

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001303942

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |