Arqit Quantum Inc. (Nasdaq: ARQQ, ARQQW) (“Arqit”), a global leader

in quantum encryption technology, today announced its operational

and financial results for the full fiscal year 30 September 2022.

Recent Operational

Highlights

- Announced

separately today that, as a result of further innovation in our

technology, we no longer need to build or operate quantum

satellites. Through technical innovation we have emulated the

relevant quantum processes of creating and distributing random

numbers in software form so that the QuantumCloud™ tech stack no

longer requires satellite infrastructure.

- The security

proof of QuantumCloud™ was independently assured this year by

the GCHQ Accredited Centre of Excellence in Cyber Security at the

University of Surrey and PA Consulting. This demonstrated that

Arqit’s software uniquely produces encryption keys at mass market

scale which are provably secure and zero trust.

- The security

proof was a major determinant in the conclusion that the tech stack

no longer requires satellite hardware. We expect that these changes

to our technology strategy will result in a positive effect on our

future results, with a portion of capitalised satellite costs

recouped through the planned partial or total sale of the satellite

system currently under construction, additional revenues through

the licensing of our quantum satellite IP, and the elimination of

future capital and operating expenditures associated with use of

satellites as part of our core product offering.

- Announced a

series of major channel partner relationships which refocuses and

accelerates our go-to-market strategy and is expected to drive

growth through annual recurring revenues.

- Arqit and

Fortinet announced the integration of Arqit’s QuantumCloud™ with

the Fortinet Fortigate series of Next Generation Fire Walls. This

integrated solution enables unbreakable quantum-safe encrypted

connectivity between customer locations keeping safe data both at

rest and in transit. Fortinet has made the integrated product

available to its global customers.

- Arqit and Amazon

Web Services Partner Network announced the integration of

QuantumCloud™ with Amazon S3, an object storage service used by

millions of customers of all sizes and industries that offers

industry-leading availability, security and performance, and

virtually unlimited scalability. Today, Amazon S3 contains more

than 200 trillion objects. The integration of QuantumCloud™ with S3

will allow AWS customers to protect their data against attacks

today and the future quantum threat.

- Arqit announced

that it has signed with Dell Technologies a “Dell OEM Engineered

Solutions Pilot Agreement”. Arqit’s QuantumCloud™ software will be

preloaded on selected Dell hardware devices, enabling Dell sales

teams to sell the combined hardware and software as a single SKU to

address existing and new customer needs. The initial target market

is the US Federal Government, including the Department of Defense,

the Federal Civilian Agencies and the Intelligence Community. Dell

sales teams will be able to offer Arqit QuantumCloud™ software and

Arqit sales teams will be able to offer Dell hardware and services

in their sales portfolios.

- Arqit’s

symmetric key agreement technology has been selected as part of the

potential technology solution for two U.S. Government programs of

record. The contracts were expected to be signed in fiscal year

2022 but slipped into October. Revenue is expected to be booked in

the current fiscal year.

- Launched the

first phase of a digital asset strategy focused initially on

securing digital trade finance. Arqit has signed a contract with

Traxpay GmBH, a leader in supply chain finance, to deploy our

technology into Traxpay’s supply chain platform to secure supplier

and buyer transactions. The U.K., Singapore and other leading trade

finance nations have passed, or have pending, legislation

authorizing digital trade finance documentation for use. Trade

finance is a $17 trillion annual market which is supported by

documentation which now can be digital and must be secured. We

believe that Arqit has launched the first digital asset to be fully

compliant with these new laws which emphasize necessary “tamper

proof” cyber security.

- Announced in

partnership with Sovereign Cloud Australia Pty Ltd (“AUCloud”), a

leader in sovereign infrastructure-as-a-service, the general

availability of the Asia Pacific region’s first quantum safe

symmetric key agreement software. Powered by Arqit’s QuantumCloud™,

the service is available to governments and enterprises from

AUCloud as a platform-as-a-service, enabling quantum-safe

encryption capability for the Australian market and near-region

customers.

- Signed a

contract with Nine23 Ltd, a cyber security solutions provider for

U.K. regulated and compliant sectors, to deploy Arqit’s

QuantumCloud™ symmetric key agreement software on Nine23’s U.K.

Sovereign Secure Private Cloud infrastructure. Arqit and Nine23

will work together to address U.K. government and defence customers

looking to improve the security of their infrastructure against

cyberattacks. Service is available through the U.K. government

G-Cloud 13 digital market place.

- Arqit was

recognized with two awards: the Innovation in Cyber Award for 2022

at The National Cyber Awards and the Cyber Software Company of the

Year at the Cyber Security Awards.

Management Commentary

“In its first full year of commercial operation,

Arqit has independently validated that its software is unique in

delivering zero trust and quantum safe encryption at large scale

and with great ease of implementation and as a result has secured a

pathway to success by onboarding a number of major technology

channel partners,” said David Williams, Arqit Founder, Chairman and

Chief Executive Officer. “Through innovation and better

understanding of how customers want to consume our products, our

go-to-market strategy is maturing and we are able to enter the

scaled execution phase with confidence.

“As we separately announced today, innovation in

the delivery of replicated randomness to data centres globally has

eliminated the need for satellite distribution within our tech

stack. This development is not only expected to have a positive

impact on Arqit’s future financial results, it allowed us to

reconsider our role in building satellites for third parties,

particularly government and military customers. Going forward for

these customers, who are interested in the unique properties which

the satellite distribution method offers in sovereign, on-premises

control of key agreement and eavesdropper detection, we will

license our patented ARQ19 satellite technology to build their own

satellites and they will then purchase a QuantumCloud™ licence from

Arqit. This provides further cashflow management benefits to the

company while allowing government customers the benefit of

supporting national industrial bases by constructing satellite

assets themselves.

“The independent validation of our security

proof in May of this year was a seminal event for the company. The

security proof written by our own chief cryptographer Dr. Daniel

Shiu was independently assured by the Centre of Excellence in Cyber

Security at the University of Surrey and PA Consulting. We have

provided confidential briefs of the independent assurance report to

leading prospective customers and partners and have seen an

acceleration of interest in our product by global technology

vendors and governments as a result. Our recently announced

partnerships with leading technology vendors have occurred sooner

than we expected and we are hopeful of securing additional

significant channel global partnerships during the current fiscal

year. Although there is no certainty about the scale and timing of

revenue ramp up of our new strategy, we anticipate that generating

annual recurring revenues through channel partnerships with global

vendors will ultimately result in more consistent and predictable

results compared with selling enterprise licenses.

“The adoption and integration of our symmetric

key agreement software into the products and solutions of such

global players as Fortinet, Dell and AWS has clarified two major

strategic questions – how customers want to consume our product and

how to reach those customers. Generally, it is easier for end

customers to consume our technology through integration with

products that they already use and are now upgraded to become

quantum safe. Partnering with such leading technology vendors

allows end users to do just that. Our new technology partners have

massive installed user bases that are addressable by integrated

Arqit secured products. This represents a fast lane to reaching

large numbers of potential end users of our product and building

future annual recurring revenues.

“We prioritized a significant portion of our

finite resources to capture this go-to-market strategy in fiscal

year 2022, rather than focussing on the more tactical enterprise

licence sales. Fulfilling the opportunity with channel partners

will be a key focus for 2023. We will continue to generate

enterprise licence sales with certain defence customers but the

business model is now set for annual recurring revenue generation

from our QuantumCloud™ platform-as-a-service integrated with

major technology vendors.

“We remain excited about and committed to the

government market. We had anticipated booking several government

contracts in fiscal year 2022 which slipped into the current fiscal

year. Being named as part of two U.S. Government programs of record

points to broader adoption opportunities which we are actively

pursuing. Our partnerships with AUCloud and Nine23 represent

additional vectors for addressing government customers through

infrastructure-as-a-service vendors.

"Whilst the macro environment is tough for most,

this and the effect of war have extended sales cycles generally.

However, the commitment of governments, companies and boards to

maintain and increase cybersecurity budgets remains firm. We are

also pleased to see the National Institute of Standards and

Technology stating its belief that symmetric key agreement is the

best form of post quantum cryptography. Our symmetric key agreement

software is well positioned to deliver stronger, simpler encryption

as a fundamental part of the zero trust strategy of the world’s

biggest vendors, and the enterprises and governments that they

serve.”

Fiscal Year 2022 Financial

Highlights

Arqit commenced commercialisation and began

generating revenue in the second half of the fiscal year ended 30

September 2021. Therefore, comparison of our results for the full

fiscal year ended 30 September 2022 to prior periods may not be

meaningful for all financial metrics.

- Generated $20

million in revenue and other operating income as compared to $48

thousand in fiscal year 2021.

- QuantumCloudTM

revenue totalled $7.2 million for the period from 5 contracts,

including Virgin Orbit and AUCloud which represent the vast

majority of such revenue.

- Other operating

income of $12.8 million resulted from Arqit’s project contract with

the European Space Agency.

- Administrative

expenses1 for the period were $72.2 million versus $14.6 million

for fiscal year 2021. Employee costs represented a significant

portion of the increase due to headcount additions during the

period. Headcount increased to 145 from 73 at the beginning of the

period. $22.9 million of the increase reflects a non-cash charge

for share based compensation.

- Operating loss

for the period was $52.1 million versus a loss of $172.6 million

for fiscal year 2021.

- Profit before

tax was $65.1 million. Adjusted loss before tax was $52.3 million2

which in management’s view reflects the underlying business

performance once the non-cash change in warrant value is deducted

from profit before tax.

- During the

period, 1,852,736 warrants were exercised with cash proceeds to

Arqit of $21.3 million.

- Ended the period

with a cash balance of $49.0 million versus a cash balance of $87.0

million as of Arqit’s 30 September 2021 fiscal year end.

- During the

period restricted share units were granted under Arqit’s equity

incentive plan. A total of 2,686,071 restricted share units have

been granted to employees, officers and directors under the plan.

During the period no shares granted under the plan vested. Vesting

has commenced in the current fiscal year.

Conference Call Information

Arqit will host a conference call at 11:00 a.m.

ET / 8:00 a.m PT on 14 December 2022 with the Company’s Founder,

Chairman and CEO, David Williams, and CFO, Nick Pointon. A live

webcast of the call will be available on the “News & Events”

page of the Company’s website at ir.arqit.uk. To access the call by

phone, please go to this link (registration link) and you will be

provided with dial in details. To avoid delays, we encourage

participants to dial into the conference call fifteen minutes ahead

of the scheduled start time. A replay of the webcast will also be

available for a limited time at ir.arqit.uk.

About Arqit

Arqit supplies a unique quantum safe encryption

Platform-as-a-Service which makes the communications links or data

at rest of any networked device or cloud machine secure against

current and future forms of attack – even from a quantum computer.

Arqit’s product, QuantumCloud™, enables any device to download a

lightweight software agent, which can create encryption keys in

partnership with any number of other devices. The keys are

computationally secure, optionally one-time use and zero trust.

QuantumCloud™ can create limitless volumes of keys in limitless

group sizes and can regulate the secure entrance and exit of a

device in a group. Arqit believes it is the only company in the

market to have achieved Independent Assurance Review of its

Security Proof demonstrating that the software can produce

encryption keys which are zero trust and provably secure, i.e.

permanently safe against attack from even a full scale quantum

computer. This review was conducted by the GCHQ Accredited Centre

of Excellence in Cyber Security at the University of Surrey. The

addressable market for QuantumCloud™ is every connected device.

Arqit was recently awarded the Innovation in Cyber award at the

National Cyber Awards.

Media relations

enquiries:Arqit:

contactus@arqit.ukFTI Consulting:

scarqit@fticonsulting.com

Investor relations

enquiries:Arqit:

investorrelations@arqit.uk Gateway:

arqit@gatewayir.com

Use of Non-IFRS Financial Measures

Arqit presents adjusted loss before tax, which

is a financial measure not calculated in accordance with IFRS.

Although Arqit's management uses this measure as an aid in

monitoring Arqit's on-going financial performance, investors should

consider adjusted loss before tax in addition to, and not as a

substitute for, or superior to, financial performance measures

prepared in accordance with IFRS. Adjusted loss before tax is

defined as loss before tax excluding change in fair value of

warrants, which is non-cash. There are limitations associated with

the use of non-IFRS financial measures, including that such

measures may not be comparable to similarly titled measures used by

other companies due to potential differences among calculation

methodologies. There can be no assurance whether (i) items excluded

from the non-IFRS financial measures will occur in the future, or

(ii) there will be cash costs associated with items excluded from

the non-IFRS financial measures. Arqit compensates for these

limitations by using adjusted loss before tax as a supplement to

IFRS loss before tax and by providing the reconciliation for

adjusted loss before tax to IFRS loss before tax, as the most

comparable IFRS financial measure.

IFRS and Non-IFRS loss before tax

Arqit presents its consolidated statement of

comprehensive income according to IFRS and in line with SEC

guidance. Consequently, the changes in warrant values are included

within that statement in arriving at profit before tax. The changes

in warrant values are non-cash. After this adjustment is made to

Arqit’s IFRS profit before tax of $65.1 million, Arqit’s non-IFRS

adjusted loss before tax is $52.3 million, as shown in the

reconciliation table below.

|

|

Year end 30 September

2022$’000 |

|

Profit before tax on an IFRS basis |

$ |

65,075 |

|

|

Change in fair value of warrants |

|

(117,394 |

) |

|

Adjusted loss before tax |

$ |

(52,319 |

) |

The change in fair value of warrants arises as

IFRS requires our outstanding warrants to be carried at fair value

within liabilities with the change in value from one reporting date

to the next being reflected against profit or loss in the period.

It is non-cash and will cease when the warrants are exercised, are

redeemed, or expire.

Other Accounting Information

As of 30 September 2022, we had $45.3 million of

total liabilities, $10.6 million of which related to our

outstanding warrants, which are classified as liabilities rather

than equity according to IFRS and SEC guidance. The warrant

liability amount reflected in our consolidated statement of

financial position is calculated as the fair value of the warrants

as of 30 September 2022. Our liabilities other than warrant

liabilities were $34.7 million, and we had total assets of $123.9

million including cash of $49.0 million.

Caution About Forward-Looking

Statements

This communication includes forward-looking

statements within the meaning of the Private Securities Litigation

Reform Act of 1995. All statements, other than statements of

historical facts, may be forward-looking statements. These

forward-looking statements are based on Arqit’s expectations and

beliefs concerning future events and involve risks and

uncertainties that may cause actual results to differ materially

from current expectations. These factors are difficult to predict

accurately and may be beyond Arqit’s control. Forward-looking

statements in this communication or elsewhere speak only as of the

date made. New uncertainties and risks arise from time to time, and

it is impossible for Arqit to predict these events or how they may

affect it. Except as required by law, Arqit does not have any duty

to, and does not intend to, update or revise the forward-looking

statements in this communication or elsewhere after the date this

communication is issued. In light of these risks and uncertainties,

investors should keep in mind that results, events or developments

discussed in any forward-looking statement made in this

communication may not occur. Uncertainties and risk factors that

could affect Arqit’s future performance and cause results to differ

from the forward-looking statements in this release include, but

are not limited to: (i) the outcome of any legal proceedings that

may be instituted against the Arqit related to the business

combination, (ii) the ability to maintain the listing of Arqit’s

securities on a national securities exchange, (iii) changes in the

competitive and regulated industries in which Arqit operates,

variations in operating performance across competitors and changes

in laws and regulations affecting Arqit’s business, (iv) the

ability to implement business plans, forecasts, and other

expectations, and identify and realise additional opportunities,

(v) the potential inability of Arqit to convert its pipeline into

contracts or orders in backlog into revenue, (vi) the potential

inability of Arqit to successfully deliver its operational

technology, (vii) the risk of interruption or failure of Arqit’s

information technology and communications system, (viii) the

enforceability of Arqit’s intellectual property, and (ix) other

risks and uncertainties set forth in the sections entitled “Risk

Factors” and “Cautionary Note Regarding Forward-Looking Statements”

in Arqit’s annual report on Form 20-F (the “Form 20-F”), filed with

the U.S. Securities and Exchange Commission (the “SEC”) on 14

December 2022 and in subsequent filings with the SEC. While the

list of factors discussed above and in the Form 20-F and other SEC

filings are considered representative, no such list should be

considered to be a complete statement of all potential risks and

uncertainties. Unlisted factors may present significant additional

obstacles to the realisation of forward-looking statements.

1 Administrative expenses are equivalent to operating

expenses.

2 Adjusted loss before tax is a non-IFRS

measure. For a discussion of this measure, how its calculated and a

reconciliation to the most comparable measure calculated in

accordance with IFRS, please see “Use of Non-IFRS Financial

Measures” below.

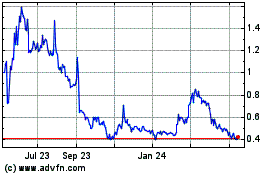

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Nov 2024 to Dec 2024

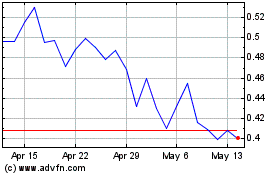

Arqit Quantum (NASDAQ:ARQQ)

Historical Stock Chart

From Dec 2023 to Dec 2024