0001304492FALSE00013044922024-08-062024-08-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 6, 2024

Anterix Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36827 | | 33-0745043 |

| (State or other jurisdiction | | (Commission File Number) | | (IRS Employer |

| of incorporation) | | | | Identification No.) |

| | | | | | | | | | | |

| 3 Garret Mountain Plaza | | |

| Suite 401 | | 07424 |

Woodland Park, NJ | | |

| (Address of principal executive offices) | | (Zip Code) |

(973) 771-0300

Registrant’s telephone number, including area code

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12(b))

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of Each Exchange on which registered |

| Common Stock, $0.0001 par value | ATEX | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On August 6, 2024, Anterix Inc. (the “Company”) announced its first quarter fiscal 2025 financial results for the three months ended June 30, 2024.

Item 7.01 Regulation FD Disclosure.

On August 6, 2024 the Company released on its website at www.investors.anterix.com/Q12025, an update on its Demonstrated Intent key performance indicator. The contents of that site are not incorporated by reference in, or otherwise a part of, this filing.

Copies of the Earnings Release and the Demonstrated Intent Update are attached as Exhibit 99.1 and Exhibit 99.2, respectively, to this Current Report on Form 8-K and are incorporated herein by reference.

The information in this Current Report and in Exhibits 99.1 and Exhibit 99.2 of Item 9.01 below is being “furnished” pursuant to Item 2.02 and Item 7.01 of Form 8-K, and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section. Accordingly, the information in Item 2.02 and Item 7.01 will not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or under the Exchange Act, unless specifically identified therein as being incorporated therein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Anterix Inc. Earnings Release, dated August 6, 2024. |

| | Demonstrated Intent Update, dated August 6, 2024. |

| 104 | | Cover Page Interactive Data File (formatted as Inline XBRL). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | |

| | Anterix Inc. |

| | |

| Date: August 6, 2024 | /s/ Timothy A. Gray |

| | Timothy A. Gray |

| | Chief Financial Officer |

Anterix Inc. Reports

First Quarter Fiscal Year 2025 Results

Woodland Park, NJ – August 6, 2024 – Anterix (NASDAQ: ATEX) today announced its first quarter fiscal 2025 results and filed its Form 10-Q for the three months ended June 30, 2024. The Company also issued an update on its Demonstrated Intent metric which can be found on Anterix’s website at www.investors.anterix.com/Q12025.

First quarter fiscal 2025 Financial Highlights

–Executed a new spectrum sale agreement with Oncor Electric Delivery Company for a total of $102.5 million, of which $10 million was received in June 2024

–Cash and cash equivalents of $51.7 million as of June 30, 2024

–Returned $2.0 million to stockholders through share repurchases

–Spectrum clearing investment of $5.4 million

–Exchanged narrowband for a broadband license in 1 county and recorded a gain on exchange of a narrowband license for a broadband license of $0.1 million

Conference Call Information

Anterix senior management will hold an analyst and investor conference call to provide a business update at 9:00 A.M. ET on Wednesday, August 7, 2024. Interested parties can participate in the call by dialing 1-888-999-6281 and asking the operator to be joined into the Anterix call. International callers should dial 1-848-280-6550. A replay of the call will be accessible on the Investor Relations section of Anterix's website at https://www.anterix.com/events/.

About Anterix Inc.

At Anterix, we work with leading utilities and technology companies to harness the power of 900 MHz broadband for modernized grid solutions. Leading an ecosystem of more than 100 members, we offer utility-first solutions to modernize the grid and solve the challenges that utilities are facing today. As the largest holder of licensed spectrum in the 900 MHz band (896-901/935-940 MHz) throughout the contiguous United States, plus Hawaii, Alaska, and Puerto Rico, we are uniquely positioned to enable private LTE solutions that support cutting-edge advanced communications capabilities for a cleaner, safer, and more secure energy future. To learn more and join the 900 MHz movement, please visit www.anterix.com.

Forward-Looking Statements

Certain statements contained in this press release constitute forward-looking statements within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future events or achievements such as statements in this press release related to the Anterix’s business or financial results or outlook. Actual events or results may differ materially from those contemplated in this press release. Forward-looking statements speak only as of the date they are made and readers are cautioned not to put undue reliance on such statements, as they are subject to a number of risks and uncertainties that could cause Anterix’s actual future results to differ materially from results indicated in the forward-looking statement. Such statements are based on assumptions that could cause actual results to differ materially from those in the forward-looking statements, including: (i) the timing of payments under customer agreements, (ii) Anterix’s ability to clear the 900 MHz Broadband Spectrum on a timely basis and on commercially reasonable terms; and (iii) Anterix’s ability to qualify for and timely secure broadband licenses. Actual events or results may differ materially from those contemplated in this press release. Anterix’s filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www.sec.gov, discuss some of the important risk factors that may affect the Company’s financial outlook, business, results of operations and financial condition. Anterix undertakes no obligation to update publicly or revise any forward-looking statements contained herein.

Shareholder Contact

Natasha Vecchiarelli

Vice President, Investor Relations & Corporate Communications

Anterix

973-531-4397

nvecchiarelli@anterix.com

Anterix Inc.

Earnings Release Tables

Consolidated Balance Sheets

(in thousands, except share and per share data)

| | | | | | | | | | | |

| June 30, 2024 | | March 31, 2024 |

| (Unaudited) | | |

| ASSETS | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 51,715 | | $ | 60,578 |

| Spectrum receivable | 10,999 | | 8,521 |

| Prepaid expenses and other current assets | 2,972 | | 3,912 |

| Total current assets | 65,686 | | 73,011 |

| Escrow deposits | 7,577 | | 7,546 |

| Property and equipment, net | 1,836 | | 2,062 |

| Right of use assets, net | 4,493 | | 4,432 |

| Intangible assets | 219,776 | | 216,743 |

| Deferred broadband costs | 20,458 | | 19,772 |

| Other assets | 1,312 | | 1,328 |

| Total assets | $ | 321,138 | | $ | 324,894 |

| LIABILITIES AND STOCKHOLDERS’ EQUITY | | | |

| Current liabilities | | | |

| Accounts payable and accrued expenses | $ | 7,748 | | $ | 8,631 |

| | | |

| Operating lease liabilities | 1,807 | | 1,850 |

| Contingent liability | 1,000 | | 1,000 |

| Deferred revenue | 5,968 | | 6,470 |

| Total current liabilities | 16,523 | | 17,951 |

| Operating lease liabilities | 3,453 | | 3,446 |

| Contingent liability | 25,000 | | 15,000 |

| Deferred revenue | 114,719 | | 115,742 |

| Deferred gain on sale of intangible assets | 4,911 | | 4,911 |

| Deferred income tax | 7,338 | | 6,281 |

| Other liabilities | 411 | | 531 |

| Total liabilities | 172,355 | | 163,862 |

| Commitments and contingencies | | | |

| Stockholders’ equity | | | |

Preferred stock, $0.0001 par value per share, 10,000,000 shares authorized and no shares outstanding at June 30, 2024 and March 31, 2024 | — | | — |

Common stock, $0.0001 par value per share, 100,000,000 shares authorized and 18,581,297 shares issued and outstanding at June 30, 2024 and 18,452,892 shares issued and outstanding at March 31, 2024 | 2 | | 2 |

| Additional paid-in capital | 538,505 | | 533,203 |

| Accumulated deficit | (389,724) | | (372,173) |

| Total stockholders’ equity | 148,783 | | 161,032 |

| Total liabilities and stockholders’ equity | $ | 321,138 | | $ | 324,894 |

Anterix Inc.

Earnings Release Tables

Consolidated Statements of Operations

(Unaudited, in thousands, except share and per share data)

| | | | | | | | | | | |

| Three months ended June 30, |

| 2024 | | 2023 |

| | | |

| Spectrum revenue | $ | 1,525 | | | $ | 608 | |

| | | |

| | | |

| | | |

| Operating expenses | | | |

| | | |

| General and administrative | 12,851 | | | 11,673 | |

| Sales and support | 1,850 | | | 1,275 | |

| Product development | 1,750 | | | 1,069 | |

| Depreciation and amortization | 179 | | | 246 | |

| | | |

| Operating expenses | 16,630 | | | 14,263 | |

| Gain from disposal of intangible assets, net | (93) | | | (10,785) | |

| | | |

| Gain from disposal of long-lived assets, net | — | | | (31) | |

| Loss from operations | (15,012) | | | (2,839) | |

| Interest income | 694 | | | 386 | |

| Other income | 16 | | | 95 | |

| | | |

| Loss before income taxes | (14,302) | | | (2,358) | |

| Income tax expense (benefit) | 1,222 | | | (240) | |

| Net loss | $ | (15,524) | | | $ | (2,118) | |

| Net loss per common share basic and diluted | $ | (0.84) | | | $ | (0.11) | |

| Weighted-average common shares used to compute basic and diluted net loss per share | 18,486,964 | | | 18,951,046 | |

Anterix Inc.

Earnings Release Tables

Consolidated Statements of Cash Flows

(Unaudited, in thousands)

| | | | | | | | | | | |

| Three months ended June 30, |

| 2024 | | 2023 |

| CASH FLOWS FROM OPERATING ACTIVITIES | | | |

| Net loss | $ | (15,524) | | | $ | (2,118) | |

| Adjustments to reconcile net loss to net cash used in operating activities | | | |

| Depreciation and amortization | 179 | | | 246 | |

| Stock compensation expense | 4,346 | | | 4,265 | |

| Deferred income taxes | 1,057 | | | (272) | |

| Right of use assets | 434 | | | 283 | |

| Gain on disposal of intangible assets, net | (93) | | | (10,785) | |

| | | |

| Gain on disposal of long-lived assets, net | — | | | (31) | |

| Changes in operating assets and liabilities | | | |

| | | |

| Prepaid expenses and other assets | 974 | | | 563 | |

| Accounts payable and accrued expenses | (1,558) | | | 1,169 | |

| Due to related parties | — | | | (533) | |

| | | |

| Operating lease liabilities | (531) | | | (388) | |

| Contingent liability | 10,000 | | | — | |

| Deferred revenue | (1,525) | | | (608) | |

| Other liabilities | (120) | | | — | |

| Net cash used in operating activities | (2,361) | | | (8,209) | |

| CASH FLOWS FROM INVESTING ACTIVITIES | | | |

| Purchases of intangible assets, including refundable deposits, retuning costs and swaps | (5,400) | | | (5,170) | |

| | | |

| Purchases of equipment | — | | | (25) | |

| Net cash used in investing activities | (5,400) | | | (5,195) | |

| CASH FLOWS FROM FINANCING ACTIVITIES | | | |

| Proceeds from stock option exercises | 1,617 | | | 7 | |

| Repurchases of common stock | (2,027) | | | — | |

| Payments of withholding tax on net issuance of restricted stock | (661) | | | (752) | |

| Net cash used in financing activities | (1,071) | | | (745) | |

| Net change in cash and cash equivalents and restricted cash | (8,832) | | | (14,149) | |

| CASH AND CASH EQUIVALENTS AND RESTRICTED CASH | | | |

| Cash and cash equivalents and restricted cash at beginning of the period | 68,124 | | | 43,182 | |

| Cash and cash equivalents and restricted cash at end of the period | $ | 59,292 | | | $ | 29,033 | |

| SUPPLEMENTAL DISCLOSURE OF CASH FLOW INFORMATION | | | |

| Cash paid during the period: | | | |

| Taxes paid | $ | — | | | $ | 1 | |

| Operating leases paid | $ | 593 | | | $ | 574 | |

| Non-cash investing activity: | | | |

| Network equipment provided in exchange for wireless licenses | $ | 47 | | | $ | 438 | |

| Right of use assets new leases | $ | 248 | | | $ | 65 | |

| Right of use assets modifications and renewals | $ | 247 | | | $ | — | |

| | | | | | | | | | | | | | |

| The following tables provide a reconciliation of cash and cash equivalents and restricted cash reported on the Consolidated Balance Sheets that sum to the total of the same such amounts on the Consolidated Statements of Cash Flows: |

| | June 30, 2024 | | March 31, 2024 |

| Cash and cash equivalents | | $ | 51,715 | | $ | 60,578 |

| Escrow deposits | | 7,577 | | | 7,546 | |

| Total cash and cash equivalents and restricted cash | | $ | 59,292 | | $ | 68,124 |

| | | | |

| | June 30, 2023 | | March 31, 2023 |

| Cash and cash equivalents | | $ | 29,033 | | $ | 43,182 |

| Escrow deposits | | — | | | — | |

| Total cash and cash equivalents and restricted cash | | $ | 29,033 | | $ | 43,182 |

Anterix Inc.

Earnings Release Tables

Other Financial Information

(Unaudited, in thousands except per share data)

| | | | | | | | | | | |

| | Three months ended June 30, |

| | 2024 | | 2023 |

| | | |

| Number of shares repurchased and retired | 63 | | | — | |

| Average price paid per share* | $ | 32.47 | | | $ | — | |

| Total cost to repurchase | $ | 2,027 | | | $ | — | |

*Average price paid per share includes costs associated with the repurchases.

As of June 30, 2024, $234.0 million is remaining under the share repurchase program.

First quarter fiscal year 2025 marked continued maturation of our pipeline as well as additional activity across our Demonstrated Intent (DI) Scorecard. The following are the key updates since our June 2024 report. ANTERIX DEMONSTRATED INTENT SCORECARD UPDATE • 18 utilities remain above the DI threshold, a point at which we believe indicates a high degree of confidence that a customer has demonstrated intent to move forward with Anterix on a 900 MHz contract at some point in the future. This is not meant to indicate these contracts are imminent. • These 18 utilities represent approximately $1B in potential contracted proceeds. • Estimated contracted proceeds both above and below the DI threshold remain consistent with the June 2024 report. Three indicators were added to utilities’ scorecards that sit below the DI threshold. ANTERIX PIPELINE UPDATE As of this update, we have signed approximately $375M in contracts and have remaining in our pipeline approximately $3B of prospective contract opportunities. Approximately $500M in potential contracted proceeds resides in Phase 3. DEMONSTRATED INTENT OVERVIEW Since February 2023, we have committed to share with our investors data regarding both the three phases of our pipeline as well as updates on our DI scorecard, a fact-based analysis that allows investors to understand how we assess utilities’ intent to move forward with 900 MHz private wireless broadband. Utilities’ passage through the phases of our pipeline does not provide a sufficiently full picture of customer progress nor does it represent our basis for confidence in the market. As we reported last year, there is a complementary, clearer, more transparent way to show investors the progress we are making in achieving our goal of being the de facto provider of private wireless broadband to utilities. The analysis behind our DI scorecard includes tracking of 20 individual pre-determined indicators for each customer in our pipeline; scoring each indicator based on our fixed assessment of its relative importance; and then calculating a combined “Demonstrated Intent” score for each prospective customer. The 20 individual indicators do not change from quarter to quarter. If the sum of the analysis places a utility over a certain threshold, we conclude that we have high confidence that a customer has demonstrated an intent to move forward with Anterix on a 900 MHz contract. A number of these indicators are based on publicly available information, while others are based on the information utilities have shared with us pursuant to a Non-Disclosure Agreement. August 6, 2024 Examples of the data and information that is publicly available include categories such as “regulatory or rate case filings” or “public statements of intent made through participation on panels or in interviews and articles,” “membership in our Utility Strategic Advisory Board,” “active participation in the Utility Broadband Alliance,” and “filing for 900 MHz Experimental Licenses.” For those indicators supported by private data, many are definitive and measurable, such as “whether the utility has requested and received 900 MHz spectrum pricing,” “whether the utility has issued an RFP where 900 MHz is defined as the primary spectrum band,” “whether there is a verbal agreement on deal terms,” “whether the utility has pursued BIL funding to support a private LTE project,” or one of the top indicators, “whether we have engaged in contract negotiations.” While the significance of the indicators does vary, several are highly validating all on their own but in isolation don’t confirm a contract is highly likely with Anterix. It is the totality of activity that lets us know whether the DI threshold has been crossed and, in turn, informs our confidence level that a utility is demonstrating its intent to proceed with deploying 900 MHz spectrum. The DI scorecard enables us to quantify and weigh the tangible investments of time and resources our target customers make well before entering into a contract. Collectively, the indicators of customer investment of time and resources in 900 MHz broadband, as reflected in our DI scorecard, are the signs that we regularly see, and that you hear us referencing when we say that we see momentum increasing. The attached graphic provides a high-level summary of both the pipeline and the DI scorecard. Forward Looking Statements Certain statements contained in this fact sheet constitute forward- looking statements within the meaning of the federal securities laws that involve risks and uncertainties. Forward-looking statements include, without limitation, any statement that may predict, forecast, indicate or imply future events or achievements such as statements in this fact sheet related to Anterix’s business or financial results or outlook. Actual events or results may differ materially from those contemplated in this fact sheet. Forward-looking statements speak only as of the date they are made and readers are cautioned not to put undue reliance on such statements, as they are subject to a number of risks and uncertainties that could cause Anterix’s actual future results to differ materially from results indicated in the forward-looking statement. Such statements are based on assumptions that could cause actual results to differ materially from those in the forward-looking statements, including: (i) the significance of Demonstrated Intent Scores and our ability to measure Demonstrated Intent, (ii) the timing of payments under customer agreements, (iii) Anterix’s ability to clear the 900 MHz Broadband Spectrum on a timely basis and on commercially reasonable terms; and (iv) Anterix’s ability to qualify for and timely secure broadband licenses. Actual events or results may differ materially from those contemplated in this fact sheet. Anterix’s filings with the Securities and Exchange Commission (“SEC”), which you may obtain for free at the SEC’s website at http://www. sec.gov, discuss some of the important risk factors that may affect the company’s financial outlook, business, results of operations and financial condition. Anterix undertakes no obligation to update publicly or revise any forward-looking statements contained herein.

C p H D C August 6, 2024 900 MHz Private Wireless Broadband: A HIGHLY VALUABLE OPPORTUNITY ~$3B potential contracted proceeds in phased pipeline, in addition to ~$375M contracted proceeds from signed deals Demonstrated Intent (DI) measures customers from the pipeline demonstrating their intent to move forward with Anterix 900 MHz. A quantitative and fact-based scorecard that combines public and private data to measure Anterix’s relative confidence of each potential customer securing an agreement with Anterix for 900 MHz spectrum. ~$1.1B ~$3B Pipeline Customer DI Threshold Contracted Proceeds Customers in the pipeline with the Highest Demonstrated Intent Score ~$1.4B ~$500M ~$375M Contracted Proceeds Customers in the pipeline with graduated scores of Demonstrated Intent but not yet at the DI threshold ~$1.4B Phase 1 Prospecting & Qualification Phase 2 Pursuit & Proposal Phase 3 Negotiation & Commitment ~$2.0B ~$1.0B ~$375M

Demonstrated Intent is a key performance indicator used by Anterix management to track and score business development. Customers with a high DI score have not contractually committed to doing business with Anterix. Anticipated contracted proceeds are derived from Anterix benchmarking of spectrum lease transactions of similar size to anticipated customer contracts. There can be no assurance that Anterix will enter into agreements with any customer in its pipeline, including customers who have some level of DI or those customers with the highest DI, or realize the potential contracted proceeds indicated herein.

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

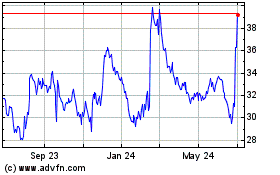

Anterix (NASDAQ:ATEX)

Historical Stock Chart

From Nov 2024 to Dec 2024

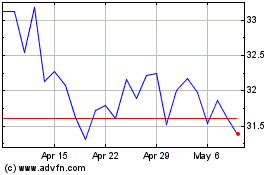

Anterix (NASDAQ:ATEX)

Historical Stock Chart

From Dec 2023 to Dec 2024