UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

6-K

REPORT

OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For

the month of November 2024

ANTELOPE

ENTERPRISE HOLDINGS LTD.

(Translation

of registrant’s name into English)

Room

1802, Block D, Zhonghai International Center,

Hi-

Tech Zone, Chengdu, Sichuan Province, PRC

(Address

of Principal Executive Office)

Indicate

by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Form

20-F ☒ Form 40-F ☐

EXPLANATORY

NOTE

On

November 5, 2024, the Company issued a press release announcing the receipt of a deficiency letter from Nasdaq, which is filed as exhibit

99.1 to this Form 6-K.

Exhibit

Index

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| Date:

November 5, 2024 |

ANTELOPE

ENTERPRISE HOLDINGS LTD. |

| |

|

| |

By: |

/s/

Hen Man Edmund |

| |

|

Hen

Man Edmund |

| |

|

Chief Financial Officer |

Exhibit

99.1

Contact

Information:

| Antelope Enterprise

Holdings Limited |

Precept Investor

Relations LLC |

| Edmund Hen, Chief Financial

Officer |

David Rudnick, Account Manager |

| Email: info@aehltd.com |

Email: david.rudnick@preceptir.com |

| |

Phone: +1 646-694-8538 |

Antelope

Enterprise Holdings Limited Receives Deficiency Letter from NASDAQ

Regarding Minimum Bid Price Deficiency

November

5, 2024 /GLOBE NEWSWIRE/ – Antelope Enterprise Holdings Limited (NASDAQ Capital

Market: AEHL) (“Antelope Enterprise”, “AEHL” or the “Company”), a provider of electricity

through natural gas power generation, and the majority interest owner of KylinCloud, a livestreaming e-commerce business in China, announced

today that on November 1, 2024, it received a deficiency letter from the Listing Qualifications

Department (the “Staff”) of the Nasdaq Stock Market (“Nasdaq”). The deficiency letter advised that for the last

30 consecutive business days the bid price for the Company’s Class A ordinary shares had

closed below the minimum $1.00 per share requirement for continued inclusion on the Nasdaq Capital Market pursuant to Nasdaq Listing

Rule 5550(a)(2) (the “Bid Price Rule”). The deficiency letter does not result in the immediate delisting of

the Company’s Class A ordinary shares from the Nasdaq Capital Market.

In

accordance with Nasdaq Listing Rule 5810(c)(3)(A) (the “Compliance Period Rule”), the Company has been provided an initial

period of 180 calendar days, or until January 22, 2024 (the “Compliance Date”), to regain compliance with the Bid Price Rule.

If, at any time before the Compliance Date, the bid price for the Company’s Class A ordinary shares closes at $1.00 or more for

a minimum of 10 consecutive business days as required under the Compliance Period Rule, the Staff will provide written notification to

the Company that it complies with the Bid Price Rule, unless the Staff exercises its discretion to extend this 10 day period pursuant

to Nasdaq Listing Rule 5810(c)(3)(H). If the Company is not in compliance with the Bid Price Rule by April 30, 2025, the Company may

be afforded a second 180 calendar day period to regain compliance. To qualify, the Company would be required to meet the continued listing

requirement for the market value of its publicly held shares and all other initial listing standards for The Nasdaq Capital Market, except

for the minimum bid price requirement. In addition, the Company would be required to notify Nasdaq of its intent to cure the minimum

bid price deficiency, which may include, if necessary, implementing a reverse stock split.

If

the Company does not regain compliance with the Bid Price Rule by the Compliance Date and is not eligible for an additional compliance

period at that time, the Staff will provide written notification to the Company that its Class A ordinary shares may be delisted.

The Company would then be entitled to appeal the Staff’s determination to a NASDAQ Listing Qualifications Panel and request a hearing.

There can be no assurance that, if the Company does appeal the delisting determination by

the Staff to the NASDAQ Listing Qualifications Panel, that such appeal would be successful.

The

Company intends to monitor the closing bid price of its Class A ordinary shares and may, if appropriate, consider available options to

regain compliance with the Bid Price Rule, which could include effecting a reverse stock split. However, there can be no assurance that

the Company will be able to regain compliance with the Bid Price Rule.

About

Antelope Enterprise Holdings Limited

Antelope

Enterprise Holdings Limited (“Antelope Enterprise”, “AEHL” or the “Company”) engages in energy infrastructure

solutions through natural gas power generation via its wholly owned subsidiary AEHL US LLC and holds a 51% ownership

position in Hainan Kylin Cloud Services Technology Co. Ltd (“Kylin Cloud”), which operates a livestreaming e-commerce business

in China. Kylin Cloud provides access to over 800,000 hosts and influencers. For more information, please visit our website at https://aehltd.com.

Safe

Harbor Statement

Certain

of the statements made in this press release are “forward-looking statements” within the meaning and protections of Section

27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements

include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions,

and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which

may cause the actual results, performance, capital, ownership or achievements of the Company to be materially different from future results,

performance or achievements expressed or implied by such forward-looking statements. Forward-looking statements in this press release

include, without limitation, the continued stable macroeconomic environment in the PRC, the PRC technology sectors continuing to exhibit

sound long-term fundamentals, and our ability to continue to grow our energy, livestreaming ecommerce, business management and information

system consulting businesses. All statements other than statements of historical fact are statements that could be forward-looking statements.

You can identify these forward-looking statements through our use of words such as “may,” “will,” “anticipate,”

“assume,” “should,” “indicate,” “would,” “believe,” “contemplate,”

“expect,” “estimate,” “continue,” “plan,” “point to,” “project,”

“could,” “intend,” “target” and other similar words and expressions of the future. Although the Company

believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations

will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results

and encourages investors to review other factors that may affect its future results in the Company’s registration statement and

other filings with the U.S. Securities and Exchange Commission.

All

written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including,

without limitation, those risks and uncertainties described in our annual report on Form 20-F for the year ended December 31, 2023 and

otherwise in our SEC reports and filings. Such reports are available upon request from the Company, or from the Securities and Exchange

Commission, including through the SEC’s Internet website at http://www.sec.gov. We have no obligation and do not undertake

to update, revise or correct any of the forward-looking statements after the date hereof, or after the respective dates on which any

such statements otherwise are made.

Source:

Antelope Enterprise Holdings, Ltd.

###

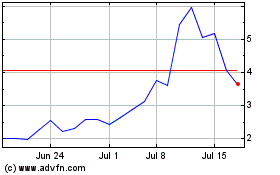

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Nov 2024 to Dec 2024

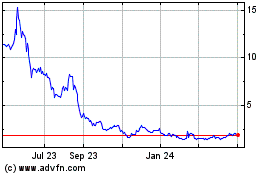

Antelope Enterprise (NASDAQ:AEHL)

Historical Stock Chart

From Dec 2023 to Dec 2024