Current Report Filing (8-k)

April 08 2013 - 4:25PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 8, 2013 (April 8, 2013)

AMC Networks Inc.

(Exact name of registrant as specified in its charter)

|

| | | | |

| | | | |

Delaware | 1-35106 | | 27-5403694 |

(State or other jurisdiction of incorporation) | (Commission file number) | | (I.R.S. Employer Identification No.) |

| |

11 Penn Plaza, New York, NY | | | | 10001 |

(Address of principal executive offices) | | | | (Zip Code) |

(212) 324-8500

(Registrant’s telephone number, including area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

| |

¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

|

| |

¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

|

| |

¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

As previously disclosed, on October 21, 2012, Cablevision Systems Corporation (“Cablevision”) and AMC Networks Inc. (the “Company” or “AMC”) settled the lawsuit (the “Settlement”) entitled VOOM HD Holdings LLC against EchoStar Satellite LLC, predecessor-in-interest to DISH Network L.LC (“DISH”). On April 8, 2013, Cablevision and the Company entered into an agreement (the “DISH Proceeds Allocation Agreement”) to allocate the proceeds, including the $700,000,000 in cash (the “Settlement Funds”) received from DISH pursuant to the Settlement. As previously disclosed, the parties had previously entered into a Letter Agreement dated as of June 6, 2011 (the "VOOM Litigation Agreement"), with respect to the allocation of any proceeds received pursuant to the Settlement.

The principal terms of the DISH Proceeds Allocation Agreement are as follows:

| |

1) | Cablevision will receive $525,000,000 of the Settlement Funds and AMC will receive $175,000,000 of the Settlement Funds in connection with the allocation of cash and non-cash proceeds (including the value of the DISH affiliation agreement attributable to the Settlement) received in the Settlement in accordance with Section 4 of the VOOM Litigation Agreement. |

| |

2) | AMC shall promptly pay to Cablevision $175,000,000 of the $350,000,000 that was previously disbursed to it pending a final determination of the allocation of the Settlement Funds. |

| |

3) | AMC shall be entitled to retain the remaining balance of Settlement Funds previously disbursed to it in the amount of $175,000,000. |

| |

4) | Cablevision shall be entitled to retain all of the Settlement Funds previously disbursed to it in the amount of $350,000,000. |

In accordance with the Company's Related Party Transaction Approval Policy, the final allocation of the proceeds from the Settlement was approved by an independent committee of the Company's Board of Directors, as well as an independent committee of Cablevision's Board of Directors.

The DISH Proceeds Allocation Agreement is in full and final settlement of the allocation between Cablevision and the Company of cash and non-cash proceeds (including the value of the DISH affiliation agreement attributable to the Settlement) received in the Settlement in accordance with the VOOM Litigation Agreement, except for legal fees and expenses incurred in connection with the DISH litigation not yet paid or shared between the parties as required under Section 5 of the VOOM Litigation Agreement. The DISH Proceeds Allocation Agreement further provides that Cablevision and the Company have agreed to release all of their claims relating to this matter. The disclosure above updates the disclosure in the Company's report on Form 10-K for the fiscal year ended December 31, 2012, in Note 11. Commitments and Contingencies to the Company's Consolidated Financial Statements.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

| | | | |

| | | | AMC Networks Inc. |

| | | | (Registrant) |

| | | | |

Dated: | April 8, 2013 | | By: | /s/ Anne G. Kelly |

| | | | Name: Anne G. Kelly |

| | | | Title: Senior Vice President and Secretary |

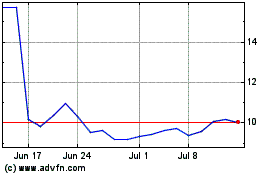

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Oct 2024 to Nov 2024

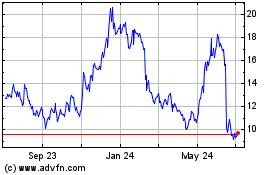

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Nov 2023 to Nov 2024