Alignment Healthcare Announces Private Convertible Senior Notes Transaction

November 15 2024 - 6:00AM

Alignment Healthcare, Inc. (NASDAQ: ALHC) (the “Company”) today

announced that it has entered into privately negotiated

subscription agreements with certain investors, pursuant to which

it will issue $330 million principal amount of 4.25% Convertible

Senior Notes due 2029 (the “Notes”). The issuance of the Notes is

expected to close on November 22, 2024, subject to customary

closing conditions.

The Notes will be senior, unsecured obligations of the Company,

and interest will be payable semi-annually in arrears at a rate of

4.25% per annum. The Notes will mature on November 15, 2029, unless

earlier repurchased, redeemed or converted in accordance with their

terms. The conversion price for the Notes will initially be

approximately $16.04, which represents a premium of 25% to the

closing price of the Company’s common stock on November 14,

2024.

The Company anticipates the net cash proceeds from the issuance

of the Notes will be approximately $321.05 million, after

subtracting fees, discounts, and estimated expenses in connection

with the transaction. The Company intends to use the proceeds to

lower its cost of capital by repaying the Company’s existing term

loan facility, which bears interest at SOFR + 6.5%, and for general

corporate purposes.

In connection with the issuance of the Notes, the Company has

been advised that the placement agent for the Notes intends to

purchase approximately 3.442 million shares of the Company’s common

stock in privately negotiated transactions from certain purchasers

of the Notes through a financial intermediary at a discount to the

last reported sale price of the Company’s common stock on November

14, 2024. Such purchases by the placement agent of the Company’s

common stock could increase (or reduce the size of any decrease in)

the market price of the common stock or the Notes.

Additional information regarding this announcement may be found

in a Current Report on Form 8-K that the Company intends to file

with the U.S. Securities and Exchange Commission (the “SEC”).

This announcement is neither an offer to sell nor a solicitation

of an offer to buy any of these securities (including the shares of

Company common stock, if any, issuable upon conversion of the

Notes) and shall not constitute an offer, solicitation, or sale in

any jurisdiction in which such offer, solicitation, or sale is

unlawful.

The Notes and any shares of common stock issuable upon

conversion of the Notes have not been registered under the

Securities Act of 1933, as amended, or any state securities law and

may not be offered or sold in the United States absent registration

or an applicable exemption from registration requirements.

About Alignment HealthcareAlignment Health is

championing a new path in senior care that empowers members to age

well and live their most vibrant lives. A consumer brand name of

Alignment Healthcare (NASDAQ: ALHC), Alignment Health’s

mission-focused team makes high-quality, low-cost care a reality

for its Medicare Advantage members every day. Based in California,

the company partners with nationally recognized and trusted local

providers to deliver coordinated care, powered by its customized

care model, 24/7 concierge care team and purpose-built technology,

AVA®. As it expands its offerings and grows its national footprint,

Alignment upholds its core values of leading with a serving heart

and putting the senior first

Forward-Looking StatementsThis release contains

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933, as amended, and Section 21E of the

Securities Exchange Act of 1934, as amended, and the Private

Securities Litigation Reform Act of 1995, as amended. These

forward-looking statements include statements concerning the

estimated net proceeds of the offering, the anticipated use of such

net proceeds and the expected closing of the offering.

Forward-looking statements are subject to risks and uncertainties

and are based on assumptions that may prove to be inaccurate, which

could cause actual results to differ materially from those expected

or implied by the forward-looking statements. Actual results may

differ materially from the results predicted, and reported results

should not be considered as an indication of future performance.

Important risks and uncertainties that could cause our actual

results and financial condition to differ materially from those

indicated in the forward-looking statements include, among others,

the following: our ability to attract new members and enter new

markets, including the need for certain governmental approvals; our

ability to maintain a high rating for our plans on the Five Star

Quality Rating System; our ability to develop and maintain

satisfactory relationships with care providers that service our

members; risks associated with being a government contractor;

changes in laws and regulations applicable to our business model;

risks related to our indebtedness, including the potential for

rising interest rates; changes in market or industry conditions and

receptivity to our technology and services; results of litigation

or a security incident; and the impact of shortages of qualified

personnel and related increases in our labor costs. There can be no

assurance that the Company will be able to complete the offering on

the anticipated terms, or at all. For a detailed discussion of

the risk factors that could affect our actual results, please refer

to the risk factors identified in our Annual Report on Form 10-K

for the year ended December 31, 2023, and the other periodic

reports we file with the SEC. All information provided in this

release and in the attachments is as of the date hereof, and we

undertake no duty to update or revise this information unless

required by law.

Investor Contact Harrison Zhuo

hzhuo@ahcusa.com

Media ContactPriya ShahmPR, Inc. for Alignment

Healthcare alignment@mpublicrelations.com

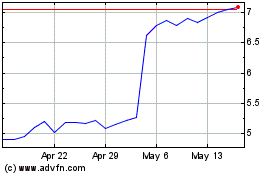

Alignment Healthcare (NASDAQ:ALHC)

Historical Stock Chart

From Oct 2024 to Nov 2024

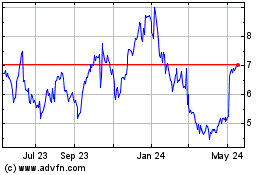

Alignment Healthcare (NASDAQ:ALHC)

Historical Stock Chart

From Nov 2023 to Nov 2024