UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): November 22, 2021

ADVAXIS,

INC.

(Exact

name of registrant as specified in its charter)

|

Delaware

|

|

001-36138

|

|

02-0563870

|

|

(State

or other jurisdiction

of

incorporation)

|

|

(Commission

File

Number)

|

|

(IRS

Employer

Identification

No.)

|

|

9

Deer Park Drive, Suite K-1,

Monmouth

Junction, New Jersey

|

|

08852

|

|

(Address

of principal executive offices)

|

|

(Zip

Code)

|

Registrant’s

telephone number, including area code: (609) 452-9813

(Former

name or former address, if changed since last report.)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions (see General Instruction A.2. below):

|

☒

|

Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

|

|

|

☐

|

Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

|

|

☐

|

Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities

registered pursuant to Section 12(b) of the Act:

|

Title

of each class

|

|

Trading

Symbol(s)

|

|

Name

of each exchange on which registered

|

|

Common

stock, par value $0.001 per share

|

|

ADXS

|

|

Nasdaq

Capital Market

|

|

Preferred

Stock Purchase Rights

|

|

-

|

|

Nasdaq

Capital Market

|

Indicate

by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933

(§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☐

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item

8.01 Other Events

As

previously disclosed on its Current Report on Form 8-K filed on April 10, 2020, Advaxis, Inc. (“Advaxis” or the “Company”)

received written notice from the staff (the “Staff”) of the Listing Qualifications Department of The Nasdaq Stock Market

(“Nasdaq”) indicating that Advaxis was not in compliance with Nasdaq Listing Rule 5450(a)(1) because the closing bid price

for Advaxis’ common stock had closed below $1.00 per share for the previous 30 consecutive business days (the “bid-price

requirement”). As also disclosed on its Current Report on Form 8-K filed on June 25, 2020, Advaxis received a letter (“New

Notice”) from the Staff of the Nasdaq on April 17, 2020 indicating that, due to extraordinary market conditions, Nasdaq has tolled

the compliance period for the bid-price requirement. In accordance with the April 17, 2020 notice from Nasdaq, Advaxis had until December

21, 2020 to regain compliance with the bid price requirement.

As

of December 21, 2020, Advaxis was yet to be in compliance with the bid-price requirement as discussed above. On December 22, 2020, Advaxis

received notification from Nasdaq that its application to transfer the listing of its common stock from the Nasdaq Global Select Market

to the Nasdaq Capital Market had been approved. Advaxis’s securities were transferred to the Nasdaq Capital Market at the opening

of business on December 24, 2020, and it will have an additional 180 days, or until June 21, 2021, to regain compliance with the bid-price

requirement.

On

June 22, 2021, Advaxis received notification from Nasdaq that the Company had not regained compliance with the bid-price requirement.

The notification indicated that the Company’s common stock would be subject to delisting unless the Company timely requests a hearing

before a Nasdaq Hearing Panel (“Panel”). The Company timely requested a hearing and the hearing was held on July 29, 2021.

On

August 11, 2021, Advaxis issued a press release announcing that it had received a letter indicating that following the Company’s

hearing before the Panel, the Panel determined to grant the Company an extension through November 22, 2021, to evidence compliance with

Nasdaq’s $1.00 Minimum Bid Price Rule and complete its previously announced merger transaction (the “Merger”) with

Biosight, Ltd. (“Biosight”). Pursuant to the Nasdaq Listing Rules, the combined company will be required to meet all applicable

initial listing requirements upon the closing of the merger, including the $4 per share price requirement as disclosed on its Current

Report on Form 8-K filed on August 11, 2021.

On

November 22, 2021, Advaxis issued a press release announcing that it has received a letter on November 19, 2021 indicating that the Panel

had granted an extension to the original November 22, 2021 deadline to demonstrate compliance for Nasdaq listing standards. The extension

is subject to the condition that on or before December 20, 2021, Advaxis will have completed its business combination and satisfied all

Nasdaq initial listing requirements. A copy of the press release is attached hereto as Exhibit 99.1.

Forward-Looking

Statements

Certain

of the statements made in this Form 8-K are forward looking for purposes of the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, including, but not limited to, those relating to the Merger and the completion thereof. In some cases, you can identify

these statements by forward-looking words such as “may,” “will,” “continue,” “anticipate,”

“intend,” “could,” “project,” “expect” or the negative or plural of these words or similar

expressions. Forward-looking statements are not guarantees of future performance and are subject to risks and uncertainties that could

cause actual results and events to differ materially from those anticipated, including, but not limited to, the risk that the proposed

transaction may not be completed in a timely manner or at all, which may adversely affect the Company’s business and the price

of the common stock of the Company; the failure of either party to satisfy any of the conditions to the consummation of the proposed

transaction, including the adoption of the Merger Agreement by the Company’s stockholders and the receipt of certain governmental

and regulatory approvals; uncertainties as to the timing of the consummation of the proposed transaction; the occurrence of any event,

change or other circumstance that could give rise to the termination of the Merger Agreement; the effect of the announcement or pendency

of the proposed transaction on the Company’s business relationships, operating results and business generally; risks that the proposed

transaction disrupts current plans and operations and the potential difficulties in employee retention as a result of the proposed transaction;

risks related to diverting management’s attention from the Company’s ongoing business operations; the outcome of any legal

proceedings that may be instituted against the Company related to the Merger Agreement or the proposed transaction; unexpected costs,

charges or expenses resulting from the proposed transaction; the Company’s history of net operating losses and uncertainty regarding

its ability to achieve profitability; the Company’s ability to develop and commercialize product candidates; the Company’s

ability to use and expand technology platforms to build a pipeline of product candidates; the Company’s ability to obtain and maintain

regulatory approval of product candidates; the Company’s ability to operate in a competitive industry and compete successfully

against competitors that have greater resources; the Company’s reliance on third parties; the Company’s ability to obtain

and adequately protect intellectual property rights for product candidates; and the effects of COVID-19 on clinical programs and business

operations. The Company’s discusses many of these risks in greater detail under the heading “Risk Factors” contained

in quarterly report on Form 10-Q for the quarter ended July 31, 2021, filed with the SEC on September 10, 2021, the registration statement

on Form S-4 filed by the Company, the proxy statement of the Company with respect to the vote of its stockholders to approve the transactions,

and its other filings with the SEC. Any forward-looking statements in this Form 8-K speak only as of the date of this Form 8-K. However,

while the Company and Biosight may elect to update these forward-looking statements at some point in the future, the Company and Biosight

specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s

and Biosight’s assessments as of any date subsequent to the date of this Form 8-K. Accordingly, undue reliance should not be placed

upon the forward-looking statements.

Additional

Information

This

Current Report on Form 8-K may be deemed to be solicitation material in respect of the proposed transaction. In connection with the proposed

transaction, the Company filed with the Securities and Exchange Commission (“SEC”) a registration statement on Form S-4,

declared effective on October 20, 2021, that includes a document that serves as a prospectus of the Company and a proxy statement of

the Company (the “proxy statement/prospectus/information statement”), and the Company has filed and may hereafter file other

documents regarding the proposed transaction with the SEC. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS/INFORMATION

STATEMENT AND ANY OTHER RELEVANT DOCUMENTS THAT HAVE BEEN OR ARE HEREAFTER FILED WITH THE SEC BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT

INFORMATION.

The

proxy statement/prospectus/information statement and other documents relating to the proposed transaction can be obtained free of charge

from the SEC’s website or from the Company. The documents filed by the Company with the SEC may be obtained free of charge at the

Company’s website at www.advaxis.com or at the SEC’s website at www.sec.gov. These documents may also be obtained free of

charge from the Company by contacting the Company’s external Investor Relations firm, LifeSci Advisors, LLC, at tim@lifesciadvisors.com.

This

document shall not constitute an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of

securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under

the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements

of the Securities Act of 1933, as amended.

Participants

in the Solicitation

The

Company and its respective directors and executive officers and other members of management and employees may be deemed to be participants

in the solicitation of proxies in respect of the Merger. Information about the directors and executive officers of the Company is available

in the Company’s Form 10-K/A filed with the SEC on February 26, 2021. Other information regarding the participants in the proxy

solicitation and a description of their direct and indirect interests, by security holdings or otherwise, are contained in the proxy

statement/prospectus/information statement and other relevant materials to be filed with the SEC regarding the Merger when they become

available. Investors should read the proxy statement/prospectus/information statement carefully when it becomes available before making

any voting or investment decisions. You may obtain free copies of these documents from the Company as indicated above.

Item

9.01 Exhibits.

(d)

Exhibits

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

November

22, 2021

|

ADVAXIS,

INC.

|

|

|

|

|

|

|

By:

|

/s/

Kenneth A. Berlin

|

|

|

Name:

|

Kenneth

A. Berlin

|

|

|

Title:

|

President

and Chief Executive Officer, Interim Chief Financial Officer

|

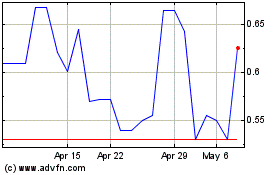

Ayala Pharmaceuticals (CE) (USOTC:ADXS)

Historical Stock Chart

From Feb 2025 to Mar 2025

Ayala Pharmaceuticals (CE) (USOTC:ADXS)

Historical Stock Chart

From Mar 2024 to Mar 2025