Aclaris Therapeutics Reports Second Quarter 2021 Financial Results and Provides a Corporate Update

August 05 2021 - 7:00AM

Aclaris Therapeutics, Inc. (NASDAQ: ACRS), a clinical-stage

biopharmaceutical company focused on developing novel drug

candidates for immuno-inflammatory diseases, today announced its

financial results for the second quarter of 2021 and provided a

corporate update.

“We’re very pleased with the preliminary topline data from our

Phase 2a trial of our “soft” topical JAK1/3 inhibitor, ATI-1777,

that we announced during the quarter,” said Dr. Neal Walker,

President & CEO of Aclaris. “Our recent clinical trial

successes with ATI-450 and ATI-1777 demonstrate the value and

productivity of our proprietary KINect® drug discovery platform.

With our financing in June, we are well positioned to advance our

clinical trial programs for ATI-450 and ATI-1777 and develop

compounds from our early stage pipeline.”

Research and Development Highlights:

The global COVID-19 pandemic continues to rapidly evolve

and has caused and may continue to cause Aclaris

to experience disruptions that could impact the timing

of its research and development and regulatory activities

listed below.

- MK2 Inhibitor Assets

- ATI-450, an investigational oral small

molecule MK2 inhibitor compound:

- Aclaris plans to progress ATI-450 into a Phase 2b trial in

moderate to severe rheumatoid arthritis in the fourth quarter of

2021.

- Aclaris also plans to progress ATI-450 into Phase 2 trials in

hidradenitis suppurativa and psoriatic arthritis.

- In pre-clinical studies, positive effects on MK2 inhibition

have been observed for breast cancer metastasis and

cancer-associated bone loss.

- ATI-2231, an investigational oral MK2

inhibitor compound:

- Second MK2 inhibitor generated from Aclaris’ proprietary

KINect® drug discovery platform and designed to have a long

half-life.

- Currently being explored as a potential treatment for

metastatic breast cancer and pancreatic cancer as well as use in

preventing bone loss in this patient population.

- IND-enabling studies are underway.

- “Soft” JAK Inhibitor Asset

- ATI-1777, an investigational topical “soft”

Janus kinase (JAK) 1/3 inhibitor compound:

- ATI-1777-AD-201: A Phase 2a, multicenter,

randomized, double-blind, vehicle-controlled, parallel-group

clinical trial to evaluate the efficacy, safety, tolerability and

pharmacokinetics of ATI-1777 in 50 subjects with moderate to severe

atopic dermatitis (AD). The trial consisted of a 4-week

treatment period and a 2-week follow-up period during which no

treatment was given.

- As announced in June 2021, the trial achieved its primary

endpoint, the percent change from baseline in the modified Eczema

Area and Severity Index (mEASI) score at week 4, with a high degree

of statistical significance (p<0.001) (one-sided p-value), which

corresponded to a 74.4% reduction in mEASI score from baseline at

week 4 in subjects applying ATI-1777 compared to a 41.4% reduction

in subjects applying vehicle. The preliminary topline data was

based on the full analysis set (FAS), which was comprised of 48

subjects randomized and documented to have received at least one

dose of trial medication.

- Positive trends in favor of ATI-1777 were observed in key

secondary efficacy endpoints, such as improvement in itch, percent

of mEASI-50 responders, investigator’s global assessment responder

analysis, and reduction in body surface area impacted by disease.

In addition, the FAS analysis also showed positive trends in favor

of ATI-1777 in percent of mEASI-75 responders (65.2% for ATI-1777

compared to 24.0% for vehicle) and mEASI-90 responders (30.4% for

ATI-1777 compared to 20.0% for vehicle). These secondary efficacy

endpoints were not powered for statistical significance.

- Based on an analysis of pharmacokinetic plasma samples in the

ATI-1777 arm at multiple timepoints, minimal systemic exposure was

observed which supports a “soft” topical JAK inhibitor

approach.

- ATI-1777 was generally well tolerated. No serious adverse

events were reported. The most common adverse events (AEs)

(reported in ≥2 subjects in the trial) were increased blood

creatinine phosphokinase levels and headache in subjects in the

ATI-1777 arm and urinary tract infection (one in each of the

ATI-1777 and the vehicle arm); none of these AEs in the ATI-1777

arm were determined by the clinical trial investigators to be

related to ATI-1777. One treatment-related AE, application site

pruritus, was reported in one subject in the ATI-1777 arm.

- Aclaris plans to progress ATI-1777 into a Phase 2b trial in

moderate to severe atopic dermatitis.

- Preclinical Asset

- ATI-2138, an investigational oral ITK/TXK/JAK3

(ITJ) inhibitor compound:

- Currently being developed as a potential treatment for

psoriasis and/or inflammatory bowel disease.

- Submission of Investigational New Drug Application (IND) is

expected in the second half of 2021.

- Discovery Assets

- Currently developing oral gut-restricted JAK inhibitors with

limited systemic exposure as potential treatments for inflammatory

bowel disease.

- Identification of a lead development candidate is expected by

the end of 2021.

- Central nervous system (CNS) kinase inhibitor targets

- Currently engaged in research to identify brain penetrant

kinase inhibitor candidates and their impact on neuronal

pro-inflammatory cytokine production, microglia growth and

survival, and neurodegeneration.

Financial Highlights:

Liquidity and Capital Resources

As of June 30, 2021, Aclaris had aggregate cash, cash

equivalents and marketable securities of $266.2 million compared to

$54.1 million as of December 31, 2020. The primary factors for the

change in cash, cash equivalents and marketable securities during

the six months ended June 30, 2021 included:

- Net proceeds of $134.9 million from a public offering in June

2021 in which Aclaris sold 8.1 million shares of common stock.

- Net proceeds of $103.3 million from a public offering in

January 2021 in which Aclaris sold 6.3 million shares of common

stock.

- Net cash used in operating activities of $24.5 million. This

amount was comprised of a net loss of $46.9 million and changes in

operating assets and liabilities of $5.8 million, partially offset

by non-cash charges of $21.2 million for the revaluation of

contingent consideration and $6.5 million for stock-based

compensation.

Aclaris anticipates that its cash, cash equivalents and

marketable securities as of June 30, 2021 will be sufficient to

fund its operations through the end of 2024, without giving effect

to any potential business development transactions or financing

activities.

Financial Results

Second Quarter 2021

- Net loss was $18.2 million for the second quarter of 2021

compared to $11.6 million for the second quarter of 2020.

- Total revenue was $1.8 million for the second quarter of 2021

compared to $2.0 million for the second quarter of 2020.

- Research and development (R&D)

expenses were $7.9 million for the quarter ended June 30, 2021

compared to $6.5 million for the prior year period.

- The quarter-over-quarter increase of $1.4 million was primarily

the result of continued investment in the further development of

Aclaris’ immuno-inflammatory drug development pipeline, including

ATI-450 and ATI-2138, partially offset by lower

quarter-over-quarter development costs for ATI-1777.

- General and administrative (G&A)

expenses were $5.9 million for the quarter ended June 30, 2021

compared to $5.6 million for the prior year period.

- The quarter-over-quarter increase of $0.3 million was primarily

the result of higher legal and compliance costs, partially offset

by lower compensation expenses.

- Revaluation of contingent

consideration charges related to the Confluence acquisition was

$4.8 million for the quarter ended June 30, 2021 compared to $0 for

the prior year period.

Year-to-date 2021

- Net loss was $46.9 million for the six months ended June 30,

2021 compared to $27.2 million for the six months ended June 30,

2020.

- Total revenue was $3.6 million for the six months ended June

30, 2021 compared to $3.5 million for the six months ended June 30,

2020.

- R&D expenses were $15.7 million

for the six months ended June 30, 2021 compared to $14.1 million

for the prior year period.

- The quarter-over-quarter increase of $1.6 million was primarily

the result of continued investment in the further development of

Aclaris’ immuno-inflammatory drug development pipeline, including

ATI-450 and ATI-2138, partially offset by lower

quarter-over-quarter development costs for ATI-1777 and

compensation expenses.

- G&A expenses were $10.7 million

for the six months ended June 30, 2021 compared to $11.8 million

for the prior year period.

- The quarter-over-quarter decrease of $1.1 million was primarily

the result of lower compensation expenses, partially offset by

higher legal and compliance costs.

- Revaluation of contingent

consideration charges related to the Confluence acquisition was

$21.2 million for the six months ended June 30, 2021 compared to

$1.8 million for the prior year period.

About Aclaris Therapeutics, Inc.

Aclaris Therapeutics, Inc. is a clinical-stage biopharmaceutical

company developing a pipeline of novel drug candidates to address

the needs of patients with immuno-inflammatory diseases who lack

satisfactory treatment options. The company has a multi-stage

portfolio of drug candidates powered by a robust R&D engine

exploring protein kinase regulation. For additional information,

please visit www.aclaristx.com.

Cautionary Note Regarding Forward-Looking

Statements

Any statements contained in this press release that do not

describe historical facts may constitute forward-looking statements

as that term is defined in the Private Securities Litigation Reform

Act of 1995. These statements may be identified by words such as

“believe,” “expect,” “intend,” “may,” “plan,” “potential,” “will,”

and similar expressions, and are based on Aclaris’ current beliefs

and expectations. These forward-looking statements include

expectations regarding the development of Aclaris’ drug candidates,

including the timing of its clinical trials and regulatory filings,

and its belief that its existing cash, cash equivalents and

marketable securities will be sufficient to fund its operations

through the end of 2024. These statements involve risks and

uncertainties that could cause actual results to differ materially

from those reflected in such statements. Risks and uncertainties

that may cause actual results to differ materially include

uncertainties inherent in the conduct of clinical trials, Aclaris’

reliance on third parties over which it may not always have full

control, Aclaris’ ability to enter into strategic partnerships on

commercially reasonable terms, the uncertainty regarding the

COVID-19 pandemic and other risks and uncertainties that are

described in the Risk Factors section of Aclaris’ Annual Report on

Form 10-K for the year ended December 31, 2020, and other filings

Aclaris makes with the U.S. Securities and Exchange Commission from

time to time. These documents are available under the “SEC Filings”

page of the “Investors” section of Aclaris’ website at

www.aclaristx.com. Any forward-looking statements speak only as of

the date of this press release and are based on information

available to Aclaris as of the date of this release, and Aclaris

assumes no obligation to, and does not intend to, update any

forward-looking statements, whether as a result of new information,

future events or otherwise.

Aclaris Therapeutics,

Inc.Condensed Consolidated Statements of

Operations(unaudited, in thousands, except share and per share

data)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Six Months Ended |

| |

|

June 30, |

|

June 30, |

| |

|

2021 |

|

|

2020 |

|

|

2021 |

|

|

2020 |

|

| Revenues: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Contract research |

|

$ |

1,606 |

|

|

$ |

1,853 |

|

|

$ |

3,141 |

|

|

$ |

3,042 |

|

|

Other revenue |

|

|

218 |

|

|

|

193 |

|

|

|

460 |

|

|

|

411 |

|

| Total revenues |

|

|

1,824 |

|

|

|

2,046 |

|

|

|

3,601 |

|

|

|

3,453 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Costs and expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Cost of revenue (1) |

|

|

1,263 |

|

|

|

1,389 |

|

|

|

2,465 |

|

|

|

2,658 |

|

|

Research and development (1) |

|

|

7,897 |

|

|

|

6,466 |

|

|

|

15,735 |

|

|

|

14,142 |

|

|

General and administrative (1) |

|

|

5,870 |

|

|

|

5,572 |

|

|

|

10,697 |

|

|

|

11,773 |

|

|

Revaluation of contingent consideration |

|

|

4,800 |

|

|

|

— |

|

|

|

21,239 |

|

|

|

1,767 |

|

| Total costs and expenses |

|

|

19,830 |

|

|

|

13,427 |

|

|

|

50,136 |

|

|

|

30,340 |

|

| Loss from operations |

|

|

(18,006 |

) |

|

|

(11,381 |

) |

|

|

(46,535 |

) |

|

|

(26,887 |

) |

|

Other expense, net |

|

|

(155 |

) |

|

|

(189 |

) |

|

|

(380 |

) |

|

|

(11 |

) |

| Loss from continuing

operations |

|

|

(18,161 |

) |

|

|

(11,570 |

) |

|

|

(46,915 |

) |

|

|

(26,898 |

) |

| Loss from discontinued

operations |

|

|

— |

|

|

|

(27 |

) |

|

|

— |

|

|

|

(285 |

) |

| Net loss |

|

$ |

(18,161 |

) |

|

$ |

(11,597 |

) |

|

$ |

(46,915 |

) |

|

$ |

(27,183 |

) |

| Net loss per share, basic and

diluted |

|

$ |

(0.34 |

) |

|

$ |

(0.28 |

) |

|

$ |

(0.90 |

) |

|

$ |

(0.65 |

) |

| Weighted average common shares

outstanding, basic and diluted |

|

|

53,968,405 |

|

|

|

42,133,646 |

|

|

|

52,163,136 |

|

|

|

41,876,037 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1)

Amounts include stock-based compensation expense as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| Cost of revenue |

|

$ |

335 |

|

|

$ |

252 |

|

|

$ |

582 |

|

|

$ |

512 |

|

| Research and development |

|

|

1,154 |

|

|

|

939 |

|

|

|

2,030 |

|

|

|

1,755 |

|

| General and administrative |

|

|

2,343 |

|

|

|

2,118 |

|

|

|

3,895 |

|

|

|

4,495 |

|

| Total stock-based compensation

expense |

|

$ |

3,832 |

|

|

$ |

3,309 |

|

|

$ |

6,507 |

|

|

$ |

6,762 |

|

Aclaris Therapeutics,

Inc.Selected Consolidated Balance Sheet Data(unaudited, in

thousands, except share data)

|

|

|

|

|

|

|

|

|

| |

|

June 30, 2021 |

|

December 31, 2020 |

|

| |

|

|

|

|

|

|

|

| Cash, cash equivalents and

marketable securities |

|

$ |

266,177 |

|

$ |

54,131 |

|

| Total assets |

|

$ |

288,046 |

|

$ |

70,784 |

|

| Total current liabilities |

|

$ |

14,916 |

|

$ |

14,874 |

|

| Total liabilities |

|

$ |

54,231 |

|

$ |

33,134 |

|

| Total stockholders' equity |

|

$ |

233,815 |

|

$ |

37,650 |

|

| Common stock outstanding |

|

|

61,204,987 |

|

|

45,109,314 |

|

Aclaris Contact

investors@aclaristx.com

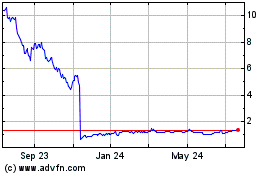

Aclaris Therapeutics (NASDAQ:ACRS)

Historical Stock Chart

From Oct 2024 to Nov 2024

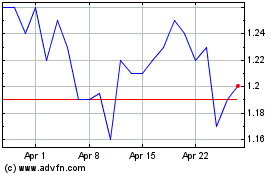

Aclaris Therapeutics (NASDAQ:ACRS)

Historical Stock Chart

From Nov 2023 to Nov 2024