U.S. Dollar Roughly Flat Amid Choppy Trading

February 23 2023 - 11:25AM

RTTF2

The U.S. dollar has shown a lack of direction over the course of

trading on Thursday after trending higher over the past few

days.

Currently, the U.S. dollar index is down by just 0.01 points or

less than a tenth of a percent at 104.58.

The greenback is trading at 134.72 yen versus the 134.84 yen it

fetched at the close of New York trading on Wednesday. Against the

euro, the dollar is valued at $1.0598 compared to yesterday's

$1.0605.

The choppy trading on the day comes as traders express some

uncertainty about the outlook for interest rates following

yesterday's release of the minutes of the latest Federal Reserve

meeting.

The Fed minutes offered few surprised but reiterated that the

central bank will continue to raise interest rates in its battle

against inflation.

With the Fed warning about the impact of labor market tightness,

the Labor Department released a report showing an unexpected dip in

first-time claims for U.S. unemployment benefits in the week ended

February 18th.

The report said initial jobless claims edged down to 192,000, a

decrease of 3,000 from the previous week's revised level of

195,000.

The dip surprised economists, who had expected jobless claims to

inch up to 200,000 from the 194,000 originally reported for the

previous week.

Meanwhile, revised data released by the Commerce Department

showed the U.S. economy grew by slightly less than previously

estimated in the fourth quarter of 2022.

The report said real gross domestic product jumped by 2.7

percent in the fourth quarter compared to the previously reported

2.9 percent surge. Economists had expected GDP growth to be

unrevised.

The Commerce Department said the slower than previously

estimated growth primarily reflected a downward revision to

consumer spending.

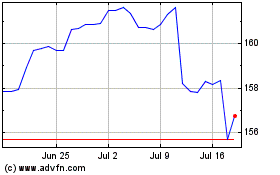

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Aug 2024 to Sep 2024

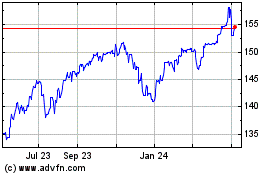

US Dollar vs Yen (FX:USDJPY)

Forex Chart

From Sep 2023 to Sep 2024