Cnova N.V.

announces reorganization of its Brazilian activities

within Via Varejo

AMSTERDAM, August 8, 2016, 23:25

CEST - Cnova N.V. (NASDAQ and Euronext Paris: CNV; ISIN:

NL0010949392) ("Cnova" or the "Company") announced that it has

entered into a binding Reorganization Agreement (the "Agreement"),

dated August 8, 2016, with Via Varejo S.A. ("Via Varejo"),

regarding the reorganization of the Company's Brazilian subsidiary,

Cnova Comércio Eletrônico S.A. ("Cnova Brazil") within Via Varejo

(the "Reorganization").

Pursuant to the Agreement, in

exchange for all of its ownership interest in Cnova Brazil, Cnova

will receive approximately 97 million of its own ordinary shares

currently held by Via Varejo (representing approximately 22% of its

share capital) and cash consideration of approximately USD 5

million, subject to customary adjustment at closing as set forth in

the Agreement. In addition, Cnova will receive the repayment

of a shareholder loan granted by Cnova to Cnova Brazil, valued

approximately at USD 157 million as at June 30, 2016.

These financial terms, including

the total cash consideration of both the shareholder loan plus the

cash consideration, are in line with those communicated on May 12,

2016.

In connection with the Agreement,

Cnova's parent company, Casino, Guichard-Perrachon ("Casino"), has

agreed to launch tender offers to purchase any and all outstanding

ordinary shares of Cnova listed on NASDAQ and on Euronext Paris at

a price of $5.50 per share (or, with respect to the tender offer on

the shares listed on Euronext Paris, the equivalent in euros),

subject only to completion of the Reorganization. Pursuant to a

separate letter agreement, Companhia Brasileira de Distribuição (a

Cnova minority shareholder) has agreed not to participate in

Casino's tender offer or otherwise transfer its Cnova shares prior

to the completion of the tender offers.

As a result of the Reorganization,

Cnova will focus entirely on Cdiscount, which enjoys strong market

positions, an efficient and proven business model, satisfactory

commercial momentum as well as significant growth prospects. Via

Varejo will become the sole shareholder of Cnova Brazil, which

operates Extra.com.br, Pontofrio.com and Casasbahia.com.br

websites, and will no longer be a shareholder of Cnova.

Next Steps

Cnova expects that the

Reorganization will be completed during the fourth quarter of 2016,

promptly following satisfaction of the conditions set forth in the

Agreement, including, among others, approval of the Agreement by

the shareholder meetings of Via Varejo and Cnova.

Casino has agreed to launch the

tender offers following the completion of the

Reorganization.

Cnova Advisors

Cnova has been advised by BNP

Paribas. Eight Advisory has served as independent expert to the

Transaction Committee.

***

Cnova Investor Relations

Contact:

Head of Investor Relations

investor@cnova.com

Tel: +31 20 795 06 71 |

Media contact:

Head of Communication

directiondelacommunication@cnovagroup.com

Tel: +31 20 795 06 76 |

***

About Cnova

N.V.

Cnova N.V., one of the world's largest e-Commerce

companies, serves 14 million active customers via state-of-the-art

e-tail websites: Cdiscount in France, Brazil and the Ivory Coast;

Extra.com.br, Pontofrio.com and Casasbahia.com.br in Brazil. Cnova

N.V.'s product offering of close to 37 million items provides its

clients with a wide variety of very competitively priced goods,

several fast and customer-convenient delivery options as well as

practical payment solutions. Cnova N.V. is part of Groupe Casino, a

global diversified retailer. Cnova N.V.'s news releases are

available at www.cnova.com. Information available on, or accessible

through, the sites referenced above is not part of this press

release.

This press release contains regulated information

(gereglementeerde informatie) within the meaning of the Dutch

Financial Supervision Act (Wet op het financieel toezicht) which

must be made publicly available pursuant to Dutch and French law.

This press release is intended for information purposes

only.

Forward-Looking

Statements

This press release contains forward-looking

statements. Such forward-looking statements may generally be

identified by words like "anticipate," "assume," "believe,"

"continue," "could," "estimate," "expect," "intend," "may," "plan,"

"potential," "predict," "project," "future," "will," "seek" and

similar terms or phrases. Examples of forward-looking

statements include, but are not limited to, statements made herein

regarding the possibility, timing and other terms and conditions of

the proposed transaction described herein and the related offer by

Casino for the outstanding shares of Cnova. The

forward-looking statements contained in this press release are

based on management's current expectations, which are subject to

uncertainty, risks and changes in circumstances that are difficult

to predict and many of which are outside of Cnova's control.

Important factors that could cause Cnova's actual results to differ

materially from those indicated in the forward-looking statements

include, among others: the ability to obtain required shareholder

approvals for closing of the Reorganization described herein; the

ability to complete the Reorganization and other transactions

discussed herein and the timing of completion of the Reorganization

and such other transactions; changes in global, national, regional

or local economic, business, competitive, market or regulatory

conditions; and other factors discussed under the heading "Risk

Factors" in the U.S. Annual Report on the Form 20-F for the year

ended December 31, 2015 filed with the U.S. Securities and

Exchange Commission on July 22, 2016 and other documents filed with

or furnished to the U.S. Securities and Exchange Commission. Any

forward-looking statements made in this press release speak only as

of the date hereof. Factors or events that could cause Cnova's

actual results to differ from the statements contained herein may

emerge from time to time, and it is not possible for Cnova to

predict all of them. Except as required by law, Cnova undertakes no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future developments or

otherwise.

Important

Information for Investors and Security Holders

This press release is neither an

offer to purchase nor a solicitation of an offer to sell

securities. Investors are advised to read Casino's tender

offer statement if and when it becomes available because it will

contain important information.

The potential tender offer for Cnova's outstanding

ordinary shares, par value €0.05 per share, described in this press

release has not commenced and may never commence. If and when the

offer is commenced, Casino will file a tender offer statement on

Schedule TO with the U.S. Securities and Exchange Commission (the

"SEC"), Cnova will timely file a solicitation/recommendation

statement on Schedule 14D-9, with respect to the offer, Casino will

file a draft tender offer memorandum (projet de note d'information)

with the French Autorité des marchés financiers ("AMF") and

Cnova will timely file a draft memorandum in response (projet de

note d'information en réponse) including the recommendation of its

board of directors, with respect to the offer. Casino and Cnova

intend to mail these documents to the shareholders of Cnova.

Any tender offer document and any document containing a

recommendation with respect to the offer statement (including any

offer to purchase, any related letter of transmittal and other

offer documents) and the solicitation/recommendation statement will

contain important information that should be read carefully before

any decision is made with respect to any tender offer. Those

materials, as amended from time to time, will be made available to

Cnova's shareholders at no expense to them at www.cnova.com.

In addition, any tender offer materials and other documents that

Casino and/or Cnova may file with the SEC and the AMF will be made

available to all investors and shareholders of Cnova free of charge

at www.groupe-casino.fr and www.cnova.com. Unless otherwise

required by law, all of those materials (and all other offer

documents filed with the SEC and the AMF) will be available at no

charge on the SEC's website: www.sec.gov and on the AMF's

website: www.amf-france.org. Documents may also be obtained

from Cnova upon written request to the Investor Relations

Department, WTC Schiphol Airport, Tower D, 7th Floor, Schiphol

Boulevard 273, 1118 BH Schiphol, The Netherlands, telephone number

+31 20 795 06 71.

Cnova N.V. announces reorganization

of Cnova Brazil within Via Varejo

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Cnova N.V. via Globenewswire

HUG#2033899

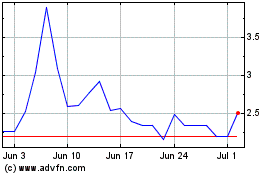

Cnova NV (EU:CNV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cnova NV (EU:CNV)

Historical Stock Chart

From Jul 2023 to Jul 2024