Cnova N.V. -

2nd Quarter 2016

Financial Results

AMSTERDAM, July 26, 2016, 07:45

CEST - Cnova N.V. (NASDAQ & Euronext in Paris: CNV, ISIN:

NL0010949392) ("Cnova" or the "Company") today announced its

unaudited financial results for the second quarter 2016. The

1st half 2016

condensed consolidated financial statements will be included in our

semi-annual report to be issued shortly.

-

Cnova N.V.:

-

GMV1: €1,035

million (-3.7% constant currency)

-

Net sales: €665 million (-14.1% constant currency)

-

Gross margin2: 12.9% (-96

bps)

-

Operating EBIT2: €(44)

million

-

Cdiscount France:

-

GMV: €638 million (+12.6%)

-

Net sales: €392 million (+9.1%)

-

Gross margin: 14.3% (+41 bps)

-

Operating EBIT: €(3) million

-

1st Half 2016:

GMV +15.6%; Operating EBIT up €11 million

-

Cnova Brazil:

-

GMV: €396 million (-19.7% constant currency)

-

Net sales: €273 million (-27.2% constant currency, ex-ICMS3)

-

Gross margin: 10.8% (-300 bps)

-

Operating EBIT: €(41) million

Cnova N.V. Key Figures

(€ million, unaudited) |

|

June 30, 2016 |

|

June 30, 2015

(restated4) |

|

|

|

|

|

|

2nd

quarter4: |

|

|

|

|

| GMV |

|

1,035 |

|

1,141 |

| Net sales |

|

665 |

|

826 |

| Gross profit |

|

86 |

|

114 |

| Gross

margin |

|

12.9% |

|

13.8% |

| SG&A |

|

(129) |

|

(123) |

| Operating EBIT |

|

(44) |

|

(9) |

| o/w:

France |

|

(3) |

|

(4) |

| Brazil |

|

(41) |

|

(1) |

| Ivory Coast &

Holding |

|

1 |

|

(4) |

| Net profit/(loss) from

continuing activities |

|

(116) |

|

(24) |

| Adjusted

EPS2

continuing |

|

(0.17) |

|

(0.04) |

| |

|

|

|

|

|

Last 12 months: |

|

|

|

|

| Net cash from

continuing operating activities |

|

(131) |

|

133 |

| o/w

Change in Operating Working Capital |

|

38 |

|

138 |

| Capex |

|

(50) |

|

(82) |

| Free cash flow |

|

(181) |

|

50 |

2nd Quarter 2016

Financial Performance

Cnova

N.V.

-

Gross merchandise volume

(GMV) of Cnova N.V. amounted to €1,035 million for the

2nd quarter

2016

(-3.7% on a constant currency basis; -9.3% on a reported basis

compared to the same period in 2015).

-

The 2nd quarter 2016

marketplace share of GMV was 26.5% (+764 basis

points year-on-year, or y-o-y).

-

As of June 30, 2016, there were more than 12,700

active marketplace vendors (compared to more than 9,200 one year

earlier).

-

Net sales totaled €665

million in the 2nd quarter 2016

(y-o-y: -14.1% constant currency; -19.4% reported).

-

Gross profit was €86

million with a corresponding margin of 12.9% (-96 basis points

y-o-y). The improvements coming from increased marketplace

contributions as well as new service revenue streams in France were

more than offset in Brazil by lower B2C activity and the change of

ICMS.

-

SG&A costs amounted to

€(129) million (19.4% of net sales) with increased marketing costs

(by 70 basis points) and Tech & Content (by 100 basis points)

in both France and Brazil.

-

As a result, operating EBIT

totaled €(44) million including €(3) million in France and €(41)

million in Brazil. The operating loss reported

during the 2nd quarter of 2016 amounted to €(86) million and

included €(31) million in costs related to the internal review at

Cnova Brazil.

-

Net financial expense was €(23)

million with overall stability y-o-y in Brazil and interest expense

associated with the in-house administration of the installment

payment plan in France.

-

Net loss excluding discontinued

operations amounted to €(116) million with an adjusted EPS of

€(0.17).

-

Cash Management

Last twelve months at June 30,

2016:

-

Net cash from continuing

operating activities at June 30, 2016, amounted to €(131)

million and included a change in operating working capital of €38

million.

-

Capex (purchase of

property, equipment and intangible assets) was €(50) million.

-

As a result, free cash flow

was €(181) million, with €11 million at Cdiscount France and €(177)

million at Cnova Brazil.

-

Net financial

debt2 position at

June 30, 2016 was €(288) million (including Cdiscount France €(91)

million and Cnova Brazil €(286) million).

Cdiscount

France

-

GMV at Cdiscount France

amounted to €638 million for the 2nd quarter of

2016 (+12.6% compared to the same period in 2015).

-

The 2nd quarter 2016

marketplace share of GMV was 32.4% (+421 basis

points y-o-y),

-

As of June 30, 2016, there were close to 9,500

active marketplace vendors,

-

The number of subscribers to the customer

loyalty program, Cdiscount à volonté, was up

142% y-o-y.

-

Net sales totaled €392

million for the 2nd quarter 2016

(y-o-y: +9.1%). Traffic growth moderated during the quarter while

fixed and mobile device conversion rates increased significantly

(e.g. smartphones: +30%). Best-selling product categories were TVs,

toys and electronic games (up more than 20% increase y-o-y). Home

appliances and furnishings grew in the high single digit

range.

-

Gross profit grew 12.2% to

€56 million (gross margin: 14.3% compared to 13.9% in the

2nd quarter of

2015) and included the impact of an increased contribution from our

marketplaces as well as new revenue coming from consumer finance

service fees.

-

SG&A costs (-€60

million) increased to -15.2% of net sales (versus -15.0% in 2Q15)

as lower fulfillment costs were offset by higher marketing expenses

(up 40 basis points), IT operating expenses and higher G&A

costs in comparison to the 2nd quarter

2015.

-

As a result, operating EBIT

was slightly improved y-o-y at €(3) million in the 2nd quarter of

2016 (compared to

-€4 million for the same period in 2015).

-

Operational

initiatives:

-

Delivery service enhancements:

-

Weekday delivery from 6:00 in the morning until

11:00 at night in the Paris metropolitan area;

-

Sunday delivery service for large items in the

Paris metropolitan and surrounding areas;

-

Small item Delivery Express (within 2 hours) by

appointment.

-

The constant improvement in the Cdiscount's Net

Promoter Score results from new initiatives designed to promote

customer satisfaction, including making the web site more

accessible to a larger range of consumers as well as increasing

call center quality.

-

The number of marketplace vendors grew more than

1,150 during the quarter and at the end of the quarter 750 vendors

were enrolled in Cdiscount's fulfillment program.

-

Cdiscount's "You are richer than you think"

advertising campaign is designed to reaffirm its price leadership

positioning while highlighting that Cdiscount offers best-in-class

delivery options and positions itself also on the medium to the

upper part of the market.

-

Perimeter changes:

-

With a view of further improving free cash flow,

Cdiscount Cameroun and Cdiscount Senegal as well as the specialty

sites MonCornerDéco and Comptoir des Parfums were closed during the

2nd quarter

2016.

-

Cdiscount Colombia is scheduled to be closed at

the end of July 2016.

Cnova

Brazil

-

GMV amounted to €396

million (R$1,567)5 for the

2nd quarter of

2016, representing a y-o-y decrease on a constant currency basis of

-19.7%.

-

During the same period, the marketplace share of GMV was 16.6% (+780 basis points

y-o-y),

-

During the 2nd quarter

2016, 850 active marketplace vendors were added to bring the total

to more than 3,500 at June 30, 2016.

-

2nd quarter 2016

net sales totaled €273 million (R$1,078

million) a y-o-y change of -27.2% on a constant currency basis and

excluding the impact of the increase in Brazilian VAT on interstate

transactions (ICMS) at the beginning of January 2016 (approximately

-4.7%).

-

Gross profit was €29

million (Gross margin 10.8% in the 2nd quarter 2016

compared to 13.8% in the 2nd quarter of

2015), strongly impacted by the competitive environment, less

favorable purchasing conditions vs 2Q15 and to a lesser extent by

the negative product mix impact.

-

SG&A costs (-€71

million) increased to 25.9% of net sales. In the context of the ERP

migration, SG&A were also negatively impacted by higher

fulfillment costs due to lower warehouse productivity levels,

higher customer service expenses and costs related to customer

claims as well as higher tech and content costs, marketing expenses

and G&A.

-

As a result, operating EBIT

was €(41) million in the 2nd quarter of

2016, compared to €(1) million for the same period in 2015.

-

Operational

initiatives:

-

ERP migration with limited operational

disruption;

-

Continued efforts to offer competitive delivery

times;

-

Strong SEO traffic increase of 50%;

-

New warehouse management system successfully

deployed in May;

-

Cajamar DC closing completed mid-July, closing

of Campo Grande initiated; and

-

Reduction of out-of-order stocks to 8% for

best-selling products.

1st Half 2016

Financial Performance

-

GMV at Cnova N.V. amounted

to €2,169 million for the 1st half 2016

(+0.1% on a constant currency basis; -8.3% on a reported basis

compared to the same period in 2015). Cdiscount France 1st half 2016

GMV was €1,370 million (+15.6%), while that of Cnova Brazil totaled

€798 million (-15.5% constant currency, -32.3% reported).

-

The 1st half 2016

marketplace share of GMV was 25.3%, an

increase of +762 basis points y-o-y (Cdiscount France: 30.5%, +380

basis points; Cnova Brazil: 16.1%, +816 basis points).

-

Net sales totaled €1,404

million in the 1st half 2016 (y-o-y: -10.5% constant currency;

-18.4% reported). For the same period, net sales at Cdiscount

France totaled €858 million (+12.4% y-o-y), while Cnova Brazil

registered a -28.8% decline on a constant currency basis (-42.9%

reported).

-

Operating EBIT totaled

€(72) million including €(1) million at Cdiscount France and €(68)

million at Cnova Brazil.

-

At Cdiscount France, in

addition to the 15.6% and 12.4% y-o-y increases in GMV and net

sales, respectively, the gross margin improved by 46 basis points

and operating EBIT increased by €11 million.

Outlook

On July 22, 2016, Cnova announced

the conclusion of the internal review at Cnova Brazil.

The Company's key focus now is to

improve operational management and actively pursue discussions with

Via Varejo regarding its potential combination of Cnova

Brazil6.

Cnova continues to target

continued improvement in reported operating EBIT for Cdiscount

France.

***

End notes:

1) Gross Merchandise Volume (GMV) is defined as product sales

+ other revenues + marketplace business volumes (calculated based

on approved and sent orders) + taxes.

2) Non-GAAP financial measure. See Non-GAAP Definitions and/or

Reconciliations sections of this press release for additional

information.

3) Beginning January 1, 2016, ICMS, the Brazilian indirect VAT

on the interstate sale of goods and services, is transitioning from

being 100% due in the state of the seller to being 100% due in the

state of the buyer. This has led to an estimated decrease in

second quarter 2016 net sales at Cnova Brazil in the amount of

approximately R$75 million (approximately €19 million).

4) Restatements, adjustments and reclassifications:

a.

1Q15 and 2Q15 have been adjusted for the

apportionment of certain adjustments previously recorded in 4Q15 -

see our 2015 annual report on form 20-F on pages iv, 95 and F13 for

more details.

b.

2Q15 figures have been adjusted to take into

account the disposal of MonShowroom in 3Q15.

c.

2Q15 figures have been adjusted for the

reclassification as discontinued activities of Cdiscount Thailand

and Cdiscount Vietnam, (which have been both sold in 1Q16),

Cdiscount Panama and Cdiscount Ecuador (both discontinued in 3Q15),

Cdiscount Cameroon and Cdiscount Senegal (both discontinued in

2Q16) and Cdiscount Colombia (scheduled to be closed at the end of

July 2016).

5) Brazilian real/Euro average exchange rate for the 2nd

quarter: 2015 = R$3.40; 2016 = R$3.96.

6) For information: based on the current status of the

discussions between the parties around the key terms of an

agreement, Cnova has considered that conditions specified under

IFRS 5 were not met at June 30, 2016, to consider the Contemplated

Proposed Transaction with Via Varejo related to Cnova Brazil as

highly probable. As a result, Cnova Brazil has been maintained as

continuing activity at June 30, 2016.

About Cnova

N.V.

Cnova N.V., one

of the world's largest e-Commerce companies, serves 14

million active customers via

state-of-the-art e-tail websites: Cdiscount in France, Brazil and

the Ivory Coast; Extra.com.br,

Pontofrio.com and Casasbahia.com.br in Brazil. Cnova N.V.'s product offering of close to 37

million items provides its clients with a wide

variety of very competitively priced goods, several fast and

customer-convenient delivery options as well as

practical payment solutions. Cnova N.V. is part of Groupe Casino, a

global diversified retailer. Cnova N.V.'s news releases are

available at www.cnova.com. Information available on, or accessible

through, the sites referenced above is not part of this press

release.

This press

release contains regulated information (gereglementeerde

informatie) within the meaning of the Dutch Financial Supervision

Act (Wet op het financieel toezicht) which must be made publicly

available pursuant to Dutch and French law. This press release is

intended for information purposes only.

Forward-Looking

Statements

In addition to

historical information, this press release contains forward-looking

statements within the meaning of the U.S. Private Securities

Litigation Reform Act of 1995, Section 27A of the U.S.

Securities Act of 1933, and Section 21E of the U.S. Securities

Exchange Act of 1934. Such forward-looking statements may include

projections regarding Cnova's future performance and, in some

cases, may be identified by words like "anticipate," "assume,"

"believe," "continue," "could," "estimate," "expect," "intend,"

"may," "plan," "potential," "predict," "project," "future," "will,"

"seek" and similar terms or phrases. The forward-looking statements

contained in this press release are based on management's current

expectations, which are subject to uncertainty, risks and changes

in circumstances that are difficult to predict and many of which

are outside of Cnova's control. Important factors that could cause

Cnova's actual results to differ materially from those indicated in

the forward-looking statements include, among others: Cnova's ability to regain compliance with the NASDAQ

Listing Rules for continued listing, the

ability to grow its customer base; the ability to maintain and

enhance its brands and reputation; the ability to manage the growth

of Cnova effectively; changes to technologies used by Cnova;

changes in global, national, regional or local economic, business,

competitive, market or regulatory conditions; ongoing regulatory inquiries regarding inventory and

accounting matters in Brazil; and other

factors discussed under the heading "Risk Factors" in the U.S.

Annual Report on the Form 20-F for the year ended December 31,

2015, filed with the U.S. Securities and Exchange Commission

on July 22, 2016, and

other documents filed with or furnished to the U.S. Securities and

Exchange Commission. Any forward-looking statement made in this

press release speaks only as of the date hereof. Factors or events

that could cause Cnova's

actual results to differ from the statements contained herein may

emerge from time to time, and it is not possible for Cnova to

predict all of them. Except as required by law, Cnova undertakes no

obligation to publicly update any forward-looking statements,

whether as a result of new information, future developments or

otherwise.

***

Cnova Investor Relations Contact:

Head of Investor Relations

investor@cnova.com

Tel: +31 20 795 06 71 |

Media contact:

Head of Communications

directiondelacommunication@cnovagroup.com

Tel: +31 20 795 06 76 |

Appendices

A. 2nd Quarter

Consolidated Financial Statements (unaudited)

|

Consolidated Income Statement |

2nd

Quarter |

Change |

|

(€ millions, unaudited) |

2016 |

2015

(restated*) |

|

|

|

|

|

| Net sales |

665.3 |

825.6 |

-19.4% |

| Cost of sales |

(579.6) |

(711.4) |

-18.5% |

| Gross

profit |

85.6 |

114.2 |

-25.0% |

| % of net sales (Gross margin) |

12.9% |

13.8% |

-96 bps |

| SG&A (Selling, General & Administrative

expenses) |

(129.3) |

(122.8) |

+5.3% |

| % of

net sales |

-19.4% |

-14.9% |

-456 bps |

| Fulfillment |

(69.1) |

(67.6) |

+2.3% |

| Marketing |

(19.5) |

(18.6) |

+5.2% |

| Technology and

content |

(23.9) |

(21.7) |

+9.9% |

| General and

administrative |

(16.8) |

(15.0) |

+12.2% |

| Operating profit/(loss) from ordinary activities (Operating

EBIT) |

(43.6) |

(8.6) |

|

| % of net sales |

-6.6% |

-1.0% |

|

| Other

expenses |

(42.1) |

(8.6) |

|

| Operating profit/(loss) |

(85.7) |

(17.3) |

|

| Net

financial income/(expense) |

(23.3) |

(15.1) |

|

| Profit/(loss) before tax |

(109.0) |

(32.3) |

|

| Income tax

gain/(expense) |

(6.5) |

8.0 |

|

| Net profit/(loss) from continuing operations |

(115.5) |

(24.4) |

|

| Net

profit/(loss) from discontinued operations |

(7.5) |

(11.8) |

|

| Net

profit/(loss) for the period |

(123.0) |

(36.2) |

|

| % of

net sales |

-18.5% |

-4.4% |

|

| Attributable to Cnova

equity holders |

(121.7) |

(32.2) |

|

|

Attributable to non-controlling interests |

(1.3) |

(4.0) |

|

| Adjusted EPS (€) from

continuing operations |

(0.17) |

(0.04) |

|

| Adjusted EPS (€) from

discontinued operations |

(0.01) |

(0.02) |

|

| Adjusted EPS (€) |

(0.18) |

(0.06) |

|

* Please see

Page 12

Consolidated Balance

Sheet

(€ million, unaudited) |

|

June 30, 2016 |

|

Dec. 31, 2015 |

|

June 30, 2015

(restated*) |

|

|

|

|

|

|

|

| ASSETS |

|

|

|

|

|

|

| |

|

|

|

|

|

|

| Cash and cash

equivalents |

|

174.7 |

|

400.8 |

|

414.0 |

| Trade receivables,

net |

|

138.7 |

|

129.7 |

|

121.4 |

| Inventories, net |

|

431.5 |

|

415.0 |

|

447.2 |

| Current income tax

assets |

|

1.2 |

|

0.8 |

|

1.4 |

| Other

current assets, net |

|

190.7 |

|

195.5 |

|

140.1 |

| Total current assets |

|

936.8 |

|

1,141.8 |

|

1,124.1 |

|

|

|

|

|

|

|

| Other non-current

assets, net |

|

58.7 |

|

23.5 |

|

81.7 |

| Deferred tax

assets |

|

11.8 |

|

11.6 |

|

60.9 |

| Property and

equipment, net |

|

38.9 |

|

33.5 |

|

45.3 |

| Intangible assets,

net |

|

120.5 |

|

116.9 |

|

139.6 |

|

Goodwill |

|

458.7 |

|

391.4 |

|

494.0 |

| Total non-current assets |

|

688.6 |

|

576.9 |

|

821.5 |

|

|

|

|

|

|

|

| TOTAL ASSETS |

|

1,625.4 |

|

1,718.7 |

|

1,945.6 |

|

|

|

|

|

|

|

| EQUITY AND LIABILITIES |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Current

provisions |

|

13.3 |

|

7.5 |

|

0.7 |

| Trade payables |

|

870.0 |

|

1,216.0 |

|

1,022.4 |

| Current financial

debt |

|

458.6 |

|

132.2 |

|

366.2 |

| Current tax

liabilities |

|

43.4 |

|

51.3 |

|

37.6 |

| Other current

liabilities |

|

198.2 |

|

178.4 |

|

88.7 |

| Liabilities held for

sale |

|

-- |

|

-- |

|

1.9 |

| Total current liabilities |

|

1,583.5

|

|

1,585.4 |

|

1,517.5 |

|

|

|

|

|

|

|

| Non-current

provisions |

|

11.0 |

|

11.8 |

|

10.3 |

| Non-current financial

debt |

|

8.6 |

|

14.8 |

|

9.9 |

| Other non-current

liabilities |

|

20.1 |

|

8.6 |

|

2.4 |

| Deferred

tax liabilities |

|

-- |

|

|

|

1.6 |

| Total non-current liabilities |

|

39.7 |

|

35.2 |

|

24.2 |

| |

|

|

|

|

|

|

| Share capital |

|

22.1 |

|

22.1 |

|

22.1 |

| Reserves, retained

earnings and additional paid-in capital |

|

(22.7) |

|

83.4 |

|

382.5 |

| Equity attributable to equity holders of Cnova |

|

(0.6) |

|

105.5 |

|

404.6 |

| Non-controlling interests |

|

2.8 |

|

(7.4) |

|

(0.7) |

| Total equity |

|

2.2 |

|

98.1 |

|

403.9 |

| |

|

|

|

|

|

|

| TOTAL EQUITY AND LIABILITIES |

|

1,625.4 |

|

1,718.7 |

|

1,945.6 |

* Please see Page 12

|

Consolidated Cash Flow Statement |

|

Last Three

Months |

|

Last

Twelve Months |

|

at June 30 (€ millions, unaudited) |

|

2016 |

2015

(restated*) |

|

2016 |

2015

(restated*) |

| Net profit/(loss) from

continuing operations |

|

(115.1) |

(24.1) |

|

(342.9) |

(88.0) |

| Net profit/(loss),

attributable to non-controlling interests |

|

(0.4) |

(0.2) |

|

(1.1) |

0.7 |

| Net profit (loss) for the period excl. discontinued

operations |

|

(115.5) |

(24.4) |

|

(344.0) |

(87.3) |

| Depreciation and

amortization expense |

|

8.3 |

9.6 |

|

35.0 |

35.6 |

| (Income) expenses on

share-based payment plans |

|

(0.0) |

0.3 |

|

0.1 |

7.9 |

| (Gains) losses on

disposal of non-current assets and impairment of assets |

|

2.6 |

0.7 |

|

20.1 |

8.8 |

| Other non-cash

items |

|

- |

- |

|

0.5 |

0.8 |

| Financial expense,

net |

|

23.3 |

15.1 |

|

84.0 |

56.7 |

| Current and deferred

tax (gains) expenses |

|

6.5 |

(8.0) |

|

38.5 |

(21.6) |

| Income tax paid |

|

(1.2) |

(1.6) |

|

(3.4) |

(6.1) |

| Change in operating

working capital |

|

76.3 |

28.9 |

|

38.1 |

137.7 |

| Inventories of products |

|

(12.9) |

23.3 |

|

(1.8) |

(110.2) |

| Trade

payables |

|

65.4 |

9.4 |

|

(35.9) |

339.2 |

| Operating payables |

|

8.8 |

3.7 |

|

24.1 |

15.0 |

| Operating receivables |

|

8.1 |

21.0 |

|

(30.2) |

(24.4) |

| Other |

|

7.1 |

(28.5) |

|

81.9 |

(81.9) |

| Net

cash from/(used in) continuing operating activities |

|

0.3 |

20.7 |

|

(131.0) |

132.5 |

| Net cash from/(used in) discontinued operating

activities |

|

(14.0) |

(13.3) |

|

3.4 |

(17.7) |

| Purchase of property,

equipment & intangible assets |

|

(14.2) |

(21.3) |

|

(50.4) |

(82.3) |

| Purchase of

non-current financial assets |

|

- |

- |

|

(1.2) |

(1.1) |

| Proceeds from disposal

of prop., equip., intangible assets |

|

0.3 |

0.1 |

|

3.0 |

0.9 |

| Proceeds from disposal

of non-current financial assets |

|

- |

0.0 |

|

(0.0) |

4.8 |

| Acquisition of an

entity net of cash acquired |

|

0.4 |

- |

|

37.8 |

0.1 |

| Investments in

associates |

|

(7.4) |

0.1 |

|

(7.2) |

(9.6) |

| Changes in

loans granted (including to related parties ) |

|

(0.2) |

(0.1) |

|

0.5 |

(8.3) |

| Net

cash from/(used in) continuing investing activities |

|

(21.3) |

(21.2) |

|

(18.6) |

(95.5) |

| Net cash from/(used in) discontinued investing

activities |

|

6.7 |

(0.6) |

|

(23.7) |

(4.2) |

| Changes in loans

received |

|

(11.3) |

101.6 |

|

(50.0) |

239.1 |

| Transaction with

owners of non-controlling interests |

|

- |

(1.6) |

|

(5.4) |

(9.6) |

| Proceeds from IPO, net

of costs |

|

- |

- |

|

- |

143.2 |

| Additions to financial

debt |

|

27.0 |

- |

|

168.2 |

61.3 |

| Repayments of

financial debt |

|

(27.9) |

0.2 |

|

(49.7) |

(0.6) |

| Interest

paid, net |

|

(6.3) |

(14.2) |

|

(75.8) |

(61.7) |

| Net

cash from/(used in) continuing financing activities |

|

(18.6) |

86.1 |

|

(12.7) |

371.7 |

| Net cash from/(used in) discontinued financing

activities |

|

7.3 |

1.8 |

|

11.1 |

0.9 |

| Effect of

changes in foreign currency translation adjustments |

|

27.8 |

(5.7) |

|

(67.1) |

(41.7) |

| Change in cash and cash equivalents from continuing

operations |

|

(10.7) |

80.6 |

|

(227.6) |

366.6 |

| Change in cash and cash equivalents from discontinued

operations |

|

(1.0) |

(12.8) |

|

(11.1) |

(20.7) |

| Cash and cash equivalents, net, at period begin |

|

185.3 |

344.5 |

|

412.3 |

66.4 |

| |

|

|

|

|

|

|

| Cash and cash equivalents, net, at period end |

|

173.6 |

412.3 |

|

173.6 |

412.3 |

* Please see Page 12

B. Additional 2nd

Quarter Financial Information (unaudited)

|

Key Figures |

2nd

Quarter |

Change |

|

(€ millions,

unaudited) |

2016 |

2015

(restated*) |

Reported |

Constant

Currency |

| Gross

merchandise volume (GMV) |

1,034.7 |

1,140.7 |

-9.3% |

-3.7% |

| Cdiscount France |

638.0 |

566.5 |

+12.6% |

|

| Cnova Brazil |

396.4 |

574.0 |

-30.9% |

-19.7% |

| Cdiscount Ivory

Coast |

0.3 |

0.3 |

+6.8% |

|

| Net sales |

665.3 |

825.6 |

-19.4% |

-14.1% |

| Cdiscount France |

392.5 |

359.9 |

+9.1% |

|

| Cnova Brazil |

272.5 |

465.4 |

-41.4% |

-31.9% |

| Cdiscount Ivory

Coast |

0.3 |

0.3 |

-3.8% |

|

| Gross profit |

85.6 |

114.2 |

-25.0% |

|

| % of net sales (Gross margin) |

12.9% |

13.8% |

|

|

| Cdiscount France |

56.3 |

50.2 |

+12.2% |

|

| Gross margin |

14.3% |

13.9% |

|

|

| Cnova

Brazil |

29.3 |

64.1 |

-54.2% |

|

| Gross margin |

10.8% |

13.8% |

|

|

| Cdiscount

Ivory Coast |

0.0 |

(0.0) |

|

|

| Gross margin |

4.6% |

-12.2% |

|

|

| SG&A |

(129.3) |

(122.8) |

+5.3% |

|

| Cdiscount France |

(59.7) |

(54.1) |

+10.3% |

|

| Cnova Brazil |

(70.6) |

(64.8) |

+9.0% |

|

| Cdiscount

Ivory Coast & Holding |

1.0 |

(4.0) |

|

|

|

Operating profit/(loss) from ordinary activities

(Operating EBIT) |

(43.6) |

(8.6) |

|

|

| % of net sales (EBIT margin) |

-6.6% |

-1.0% |

|

|

| Cdiscount France |

(3.4) |

(3.9) |

-14.5% |

|

| EBIT margin |

-0.9% |

-1.1% |

|

|

| Cnova

Brazil |

(41.2) |

(0.7) |

|

|

| EBIT margin |

-15.1% |

-0.1% |

|

|

| Cdiscount

Ivory Coast & Holding |

1.0 |

(4.0) |

|

|

| Net Financial Income/(Expense) |

(23.3) |

(15.1) |

+54.4% |

|

| Cdiscount France |

(8.4) |

(1.0) |

|

|

| Cnova Brazil |

(21.6) |

(20.7) |

+4.3% |

|

| Cdiscount

Ivory Coast & Holding |

6.7 |

6.6 |

+6.8% |

|

* Please see Page

12

C. 2nd Quarter 2015

restatement / IFRS 5 reconciliation

Cnova N.V.

(€ millions,

unaudited) |

2nd

Quarter 2015 |

Change |

| Restated* |

Original before IFRS 5 |

| (as of June 30,

2016) |

(as of June 30,

2015) |

| GMV |

1,140.7 |

1,154.1 |

-13.4 |

| Cdiscount France |

566.5 |

572.4 |

-5.9 |

| Cnova Brazil |

574.0 |

571.7 |

+2.3 |

| Net

sales |

825.6 |

836.7 |

-11.1 |

| Cdiscount France |

359.9 |

364.3 |

-4.4 |

| Cnova Brazil |

465.4 |

463.5 |

+1.9 |

| Gross

profit |

114.2 |

107.6 |

+6.6 |

| Cdiscount France |

50.2 |

50.6 |

-0.4 |

| Cnova Brazil |

64.1 |

57.9 |

+6.2 |

| SG&A |

(122.8) |

(131.3) |

+8.5 |

| Cdiscount France |

(54.1) |

(55.5) |

+1.4 |

| Cnova Brazil |

(64.8) |

(64.2) |

-0.6 |

| Cdiscount Ivory Coast

& Holding |

(4.0) |

(11.6) |

+7.6 |

| Operating profit/(loss) from ordinary activities (Operating

EBIT) |

(8.6) |

(23.7) |

+15.1 |

| Cdiscount France |

(3.9) |

(4.9) |

+1.0 |

| Cnova Brazil |

(0.7) |

(6.3) |

+5.6 |

| Cdiscount

Ivory Coast & Holding |

(4.0) |

(12.5) |

+8.5 |

*

Please see Page 12

D. Selected

1st Half

Financial Information (unaudited)

|

Key Figures |

1st

Half |

Change |

|

(€ millions,

unaudited) |

2016 |

2015

(restated*) |

Reported |

Constant

Currency |

| Gross

merchandise volume (GMV) |

2,169.1 |

2,365.3 |

-8.3% |

+0.1% |

|

| Cdiscount France |

1,370.4 |

1,185.8 |

+15.6% |

|

|

| Cnova Brazil |

798.2 |

1,179.0 |

-32.3% |

-15.5% |

|

| Cdiscount Ivory

Coast |

0.5 |

0.5 |

+14.9% |

|

|

| Net sales |

1,404.4 |

1,720.9 |

-18.4% |

-10.5% |

|

| Cdiscount France |

857.8 |

763.4 |

+12.4% |

|

|

| Cnova Brazil |

546.2 |

957.1 |

-42.9% |

-28.8% |

|

| Cdiscount Ivory

Coast |

0.5 |

0.4 |

+7.8% |

|

|

| Gross profit |

179.0 |

229.6 |

-22.1% |

|

|

| % of net sales (Gross margin) |

12.7% |

13.3% |

|

|

|

| Cdiscount France |

121.5 |

104.7 |

+16.1% |

|

|

| Gross margin |

14.2% |

13.7% |

|

|

|

| Cnova

Brazil |

57.4 |

125.1 |

-54.1% |

|

|

| Gross margin |

10.5% |

13.1% |

|

|

|

| Cdiscount

Ivory Coast |

0.0 |

(0.2) |

|

|

|

| Gross margin |

7.8% |

-44.8% |

|

|

|

| SG&A |

(250.6) |

(259.8) |

-3.5% |

|

|

| Cdiscount France |

(123.0) |

(116.7) |

+5.4% |

|

|

| Cnova Brazil |

(125.2) |

(135.3) |

-7.4% |

|

|

| Cdiscount

Ivory Coast & Holding |

(2.4) |

(7.7) |

|

|

|

|

Operating profit/(loss) from ordinary activities

(Operating EBIT) |

(71.7) |

(30.1) |

|

|

|

| % of net sales (EBIT margin) |

-5.1% |

-1.8% |

|

|

|

| Cdiscount France |

(1.5) |

(12.0) |

|

|

|

| EBIT margin |

-0.2% |

-1.6% |

|

|

|

| Cnova

Brazil |

(67.9) |

(10.2) |

|

|

|

| EBIT margin |

-12.4% |

-1.1% |

|

|

|

| Cdiscount

Ivory Coast & Holding |

(2.4) |

(7.9) |

|

|

|

| Net Financial Income/(Expense) |

(45.6) |

(21.6) |

+110.9% |

|

|

| Cdiscount France |

(18.7) |

(1.7) |

|

|

|

| Cnova Brazil |

(39.5) |

(29.9) |

+32.0% |

|

|

| Cdiscount

Ivory Coast & Holding |

12.7 |

10.0 |

+26.4% |

|

|

* Please see Page

12

E. 1st Half 2015

restatement / IFRS 5 reconciliation

Cnova N.V.

(€ millions,

unaudited) |

1st Half

2015 |

Change |

| Restated* |

Original before IFRS 5 |

| (as of June 30,

2016) |

(as of June 30,

2015) |

| GMV |

2,365.3 |

2,402.3 |

-37.0 |

| Cdiscount France |

1,185.8 |

1,197.5 |

-11.7 |

| Cnova Brazil |

1,179.0 |

1,185.5 |

-6.5 |

| Net

sales |

1,720.9 |

1,752.2 |

-31.3 |

| Cdiscount France |

763.4 |

772.3 |

-8.9 |

| Cnova Brazil |

957.1 |

962.2 |

-5.1 |

| Gross

profit |

229.6 |

220.8 |

+8.8 |

| Cdiscount France |

104.7 |

105.1 |

-0.4 |

| Cnova Brazil |

125.1 |

117.3 |

+7.8 |

| SG&A |

(259.8) |

(272.5) |

+12.7 |

| Cdiscount France |

(116.7) |

(119.5) |

+2.8 |

| Cnova Brazil |

(135.3) |

(133.3) |

-2.0 |

| Cdiscount Ivory Coast

& Holding |

(7.7) |

(19.7) |

+12.0 |

| Operating profit/(loss) from ordinary activities (Operating

EBIT) |

(30.1) |

(51.7) |

+21.6 |

| Cdiscount France |

(12.0) |

(14.3) |

+2.3 |

| Cnova Brazil |

(10.2) |

(16.0) |

+5.8 |

| Cdiscount

Ivory Coast & Holding |

(7.9) |

(21.4) |

+13.5 |

*

Restatements, adjustments and reclassifications:

-

1Q15 and 2Q15 have been

adjusted for the apportionment of certain adjustments previously

recorded in 4Q15 - see our 2015 annual report on form 20-F on pages

iv, 95 and F13 for more details.

-

2Q15 figures have been adjusted

to take into account the disposal of MonShowroom in 3Q15.

-

2Q15 figures have been adjusted

for the reclassification as discontinued activities of Cdiscount

Thailand and Cdiscount Vietnam, (which have been both sold in

1Q16), Cdiscount Panama and Cdiscount Ecuador (both discontinued in

3Q15), Cdiscount Cameroon and Cdiscount Senegal (both discontinued

in 2Q16) and Cdiscount Colombia (scheduled to be closed at the end

of July 2016).

F.

Definitions

Adjusted EPS or Adjusted earnings per share

- calculated as adjusted net profit/(loss)

divided by the weighted average number of ordinary shares

outstanding during the applicable period. See "Non-GAAP

Reconciliations" section for additional information.

Adjusted net profit/(loss) -

calculated as net profit/(loss) before Other Expenses and the

related tax impacts. See "Non-GAAP Reconciliations" section for

additional information.

Free cash flow - Net cash from/(used in) operating

activities less purchase of property and equipment and intangible

assets as presented in the consolidated cash flow statement. See

"Non-GAAP Reconciliations" section for additional information.

Gross margin - Gross profit as

a percentage of net sales. See "Non-GAAP Reconciliations" section

for additional information.

Gross merchandise volume (GMV) - Gross Merchandise

Volume (GMV) is defined as product sales + other revenues +

marketplace business volumes (calculated based on approved and sent

orders) + taxes.

Marketplace

share - Includes marketplace share of www.cdiscount.com in

France as well as extra.com.br, pontofrio.com, casasbahia.com.br

and cdiscount.com.br in Brazil.

Net Cash / (Net Financial Debt) - calculated as the

sum of (i) cash and cash equivalents and (ii) the current account

provided by Cnova or its subsidiaries to Casino pursuant to cash

pool arrangements, less financial debt. See "Non-GAAP

Reconciliations" section for additional information.

Adjusted EBITDA - calculated as operating

profit/(loss) from ordinary activities (Operating EBIT) before

depreciation and amortization expense and share based payment

expenses. See "Non-GAAP Reconciliations" section for

additional information.

Operating profit/(loss) from ordinary activities (Operating

EBIT) - calculated as operating profit/(loss) before other

expenses (restructuring, initial public offering expenses,

litigation, gain/(loss) from disposal of non-current assets and

impairment of assets).

Operating Working Capital - calculated as trade

payables less net trade receivables less net inventories as

presented in our balance sheet. This non-GAAP measure is not

being employed anymore as we prefer to rely on Change in Operating

Working Capital as presented in the Consolidated Cash Flow

Statement.

Other expenses - calculated as the sum of

restructuring, initial public offering expenses, litigation,

gain/(loss) from disposal of non-current assets and impairment of

assets.

Cash loss from activities -

calculated from entries on the cash flow statement in the following

way: net profit/(loss) for the last twelve months, plus

depreciation and amortization expense, plus (income)/expenses on

share-based payment plans, plus (gains)/losses on disposal of

non-current assets and impairment of assets, plus share of

(profits)/losses of associates, plus other non-cash items plus

financial expense, net, plus current and deferred tax

(gains)/expenses, plus income tax paid.

Unique customer - customers who have purchased at

least once over the considered period but counted as a single

customer irrespective of the number of orders placed by that

customer over the considered period.

G.

NON-GAAP RECONCILIATIONS

In addition to disclosing

financial results in accordance with International Financial

Reporting Standards, or IFRS, this earnings release contains

non-GAAP financial measures that Cnova uses as measures of its

performance. These non-GAAP measures should be viewed as a

supplement to and not a substitute for Cnova's IFRS measures of

performance and financial results in accordance with IFRS and

reconciliations from these results should be carefully

evaluated.

Restatements, adjustments and

reclassifications:

-

1Q15 and 2Q15 have been adjusted for the

apportionment of certain adjustments previously recorded in 4Q15 -

see our annual report on form 20-F on pages iv, 95 and F13 for more

details.

-

2Q15 figures have been adjusted to take into

account the disposal of MonShowroom in 3Q15.

-

2Q15 figures have been adjusted for the

reclassification as discontinued activities of Cdiscount Thailand

and Cdiscount Vietnam, (which have been both sold in 1Q16),

Cdiscount Panama and Cdiscount Ecuador (both discontinued in 3Q15),

Cdiscount Cameroon and Cdiscount Senegal (both discontinued in

2Q16) and Cdiscount Colombia (scheduled to be closed at the end of

July 2016).

For more information on the Cnova

Brazil internal review, please see Cnova press releases dated

December 18, 2015, January 12, 2016, February 24, 2016, April 12,

2016, April 26, 2016 and July 22, 2016, [available at:

www.cnova.com/en/investor-relations/press-releases/] and the

"Explanatory Note" contained in our 2015 Annual Report on Form 20-F

available at www.cnova.com and downloadable directly from the SEC's

website at www.sec.gov).

2nd quarter 2015

figures of Cnova Brazil and Cdiscount also reflect the

reclassification of warehouse costs, and this is unrelated to the

internal review at Cnova Brazil.

Adjusted net profit/(loss)

Adjusted earnings per share

(Adjusted EPS)

Adjusted net profit/(loss) is

calculated as net profit/(loss) before restructuring, initial

public offering expenses, litigation, gain/(loss) from disposal of

non-current assets and impairment of assets and the related tax

impacts.

Adjusted net profit/(loss) Cnova

is a financial measure used by Cnova's management and board of

directors to evaluate the overall financial performance of the

business. In particular, the exclusion of certain expenses in

calculating adjusted net profit/(loss) facilitates the comparison

of income on a period-to-period basis.

Adjusted EPS is calculated as

adjusted net profit/(loss) divided by the weighted average number

of outstanding ordinary shares of Cnova during the applicable

period.

The following table reflects the

reconciliation of net profit/(loss) attributable to equity holders

of Cnova to adjusted net profit/(loss) attributable to equity

holders of Cnova and presents the computation of Adjusted EPS for

each of the periods indicated.

| €

millions |

|

Q2 2016 |

|

Q2 2015 |

| Net

profit/(loss) for the period attributable to equity holders of

Cnova |

|

(115.1) |

|

(24.1) |

| Excluding: |

|

|

|

|

| Restructuring

expenses |

|

6.1 |

|

6.7 |

| Litigation

expenses |

|

33.4 |

|

0.8 |

| Initial public

offering expenses |

|

- |

|

0.3 |

| Gain/(loss) from

disposal of non-current assets |

|

0.6 |

|

0.3 |

| Asset impairment

charges |

|

1.9 |

|

0.5 |

| Income tax effect on

above adjustments |

|

(0.4) |

|

(1.0) |

| Minority

interest effect on above adjustments |

|

(0.2) |

|

(0.6) |

| Adjusted net profit/(loss) for the period attributable to

equity holders of Cnova |

|

(73.8) |

|

(17.2) |

| Weighted

average number of ordinary shares |

|

441,297,846 |

|

442,617,845 |

| Adjusted EPS (€) from continuing operations |

|

(0.17) |

|

(0.04) |

Free cash flow

Free cash flow is calculated as

net cash from/(used in) continuing operating activities less

capital expenditures (purchases of property, equipment and

intangible assets) as presented in our cash flow statement. Free

cash flow is a financial measure used by Cnova's management and

board of directors to evaluate the overall financial performance of

the business. In particular, it allows the comparison of

operational cash flow after capex on a period-to-period basis.

| €

millions |

|

June 30, 2016 (LTM) |

June30, 2015 (LTM) |

| Net

cash from/(used in) continuing operating activities |

|

(131.0) |

132.5 |

| Less purchase of

property, equipment & intangible assets |

|

(50.4) |

(82.3) |

| Free cash flow |

|

(181.5) |

50.2 |

Gross profit and

Gross margin

Gross profit is calculated as net sales less cost of sales. Gross

margin is gross profit as a percentage of net sales. Gross profit

and gross margin are included in this press release because they

are performance measures used by our management and board of

directors to determine the commercial performance of our

business.

The following tables present a

computation of gross profit and gross margin for each of the

periods indicated:

| €

millions |

|

Q2 2016 |

|

Q2 2015 |

| Net

sales |

|

665.3 |

|

825.6 |

| Less: Cost

of sales |

|

(579.6) |

|

(711.4) |

| Gross Profit |

|

85.6 |

|

114.2 |

| Gross

margin |

|

12.9% |

|

13.8% |

Net Cash/(Net Financial Debt)

Net cash/(Net financial debt) is

calculated as the sum of (i) cash and cash equivalents and (ii)

cash pool balances held in arrangements with Casino Group and

presented in other current assets, less (iii) current and (iv)

non-current financial debt. Net cash/(Net financial debt) is a

measure that provides useful information to management and

investors to evaluate our cash and cash equivalents and debt levels

and our current account position, taking into consideration the

cash pool arrangements in place among certain members of the Casino

Group, and therefore assists investors and others in understanding

our cash position and liquidity.

The following table presents a

computation of net cash/(net financial debt) for each of the

periods indicated:

| €

millions |

|

June 30, 2016 |

June 30, 2015 |

| Cash and cash

equivalents |

|

174.7 |

414.0 |

| Plus cash pool

balances with Casino presented in other current assets |

|

-- |

-- |

| Less current financial

debt |

|

(453.7) |

(366.2) |

| Less non-current

financial debt |

|

(8.6) |

(9.9) |

| Net cash/(Net financial debt) |

|

(287.6) |

38.0 |

Adjusted

EBITDA

Adjusted EBITDA is calculated as

operating profit/(loss) from ordinary activities (operating EBIT)

before depreciation and amortization expense and share based

payment expenses. We have provided a reconciliation below of this

measure to operating profit/(loss) from ordinary activities

(operating EBIT) - see definition above - the most directly

comparable GAAP financial measure, for each of the periods

indicated.

| €

millions |

|

Q2 2016 |

|

Q2 2015 |

|

Operating profit before restructuring, litigation,

gain/(loss) from disposal of non-current assets and impairment of

assets |

|

(43.6) |

|

(8.6) |

|

Excluding: Share based payment expenses |

|

- |

|

0.3 |

| Excluding:

Depreciation and amortization |

|

8.3 |

|

9.6 |

| Adjusted EBITDA |

|

(35.3) |

|

1.2 |

Cash loss from

activities

Cash loss from activities is

calculated from entries on the cash flow statement in the following

way: net profit/(loss) for the last twelve months, plus

depreciation and amortization expense, plus/(income) expenses on

share-based payment plans, plus (gains)/losses on disposal of

non-current assets and impairment of assets, plus share of

(profits)/losses of associates, plus other non-cash items plus

financial expense, net, plus current and deferred tax

(gains)/expenses, plus income tax paid.

| €

millions |

|

June 30, 2016 (LTM) |

| |

|

|

| Net profit/(loss) for

the period from continuing activities |

|

(344.0) |

| Depreciation and

amortization expense |

|

35.0 |

| (Income) expenses on

share-based payment plans |

|

0.1 |

| (Gains) losses on

disposal of non-current assets and impairment of assets |

|

20.1 |

| Share of (profits)

losses of associates |

|

- |

| Other non-cash

items |

|

0.5 |

| Financial expense,

net |

|

84.0 |

| Current and deferred

tax (gains) expenses |

|

38.5 |

| Income tax

paid |

|

(3.4) |

| Cash loss from activities |

|

(169.1) |

Upcoming

Events

Tuesday, July 26, 2016 at 16:00

CEST: Cnova Second Quarter 2016 Conference Call & Webcast

Conference Call

and Webcast connection details

Conference Call

Dial-In Numbers:

Toll-Free

Brazil 0 800 891 6221

France 0 800 912 848

UK 0

800 756 3429

USA 1 877 407 0784

Toll 1 201 689

8560

Conference Call

Replay Dial-In Numbers:

Toll-Free 1 877 870 5176

Toll 1 858 384

5517

Available From: July 26, 2016

at 13:00 EST / 19:00 CEST

To: August 9, 2016 at 00:00 EST / 06:00 CEST

Replay Pin Number: 13640597

Webcast:

http://public.viavid.com/index.php?id=120177

Presentation materials to accompany

the call will be available at cnova.com on

July 26, 2016.

An archive of the conference call

will be available for a limited time at cnova.com following its

conclusion.

Cnova 2nd Quarter 2016 Financial

Results

This

announcement is distributed by NASDAQ OMX Corporate Solutions on

behalf of NASDAQ OMX Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Cnova N.V. via Globenewswire

HUG#2030477

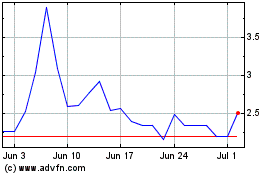

Cnova NV (EU:CNV)

Historical Stock Chart

From Jun 2024 to Jul 2024

Cnova NV (EU:CNV)

Historical Stock Chart

From Jul 2023 to Jul 2024