Claranova: Execution of a Liquidity Contract With Kepler Cheuvreux as Part of a Share Buyback Program

December 10 2021 - 2:00AM

Business Wire

Regulatory News:

Claranova (Paris:CLA) (the "Group" or the "Company") has entered

into a liquidity contract with Kepler Cheuvreux for its ordinary

shares admitted for trading on Euronext Paris, effective today for

a period of one year, renewable by tacit agreement. This liquidity

contract is part of a share buyback program authorized by the

Ordinary and Extraordinary General Meeting of December 1, 2021,

implemented by a decision of the Chairman-CEO on December 2, 2021,

acting under a delegation of powers granted by the Board of

Directors.

This agreement complies with the legal and regulatory framework

in force, in particular Regulation (EU) No. 596/2014 of the

European Parliament and of the European Council of 16 April 2014,

the Commission Delegated Regulation (EU) No. 2017/567, Articles L.

225-206 et seq. of the French Commercial Code and Decision No.

2021-01 of the French Financial Markets Authority (Autorité des

Marchés Financiers or AMF) of June 22, 2021 renewing the

introduction of liquidity contracts on equity securities as an

accepted market practice and any other provisions referred to

therein.

Under this contract, Kepler Cheuvreux is tasked with ensuring

the liquidity and supporting the orderly trading of Claranova’s

equity securities listed under the ISIN code FR0013426004-CLA on

the regulated market of Euronext Paris. In addition to guaranteeing

a satisfactory level of liquidity of the Claranova share, this

contract also reflects the Group's goal to reduce the share’s

volatility and to support growth in the share price.

Resources allocated to the liquidity account for this

purpose:

- own shares: 204,081, corresponding to 0.44% of the

capital;

- cash balance: €1,000,000.

The liquidity contract’s execution may be suspended:

- in the cases provided for in Article 5 of AMF Decision No.

2021-01 of June 22, 2021 ;

- if the share price falls outside the thresholds for

intervention authorized by the Company’s General Meeting; and

- at any time, at Claranova’s request, under its

responsibility.

Furthermore, the contract may also be terminated by Claranova at

any time without prior notice, or by Kepler Cheuvreux at any time

subject to one month notice.

Description of the share buyback program

The combined general meeting of the shareholders of the Company

held on December 1, 2021 (the "General Meeting") authorized the

Board of Directors to implement, for a period of 18 months from the

meeting date, a share buyback program for the Company's shares in

accordance with the provisions of Articles L. 225-206 et seq. of

the French Commercial Code, Articles L. 22-10-62 et seq. of the

French Commercial Code, Articles 241-1 to 241-7 of the AMF General

Regulation and the provisions of the European regulations

applicable to market abuse.

Purpose of the new share buyback program

- maintaining an orderly market in the company’s shares under a

liquidity contract entered into with an investment services

provider that complies with the conduct of business rules

recognized by the AMF;

- grants or sales of shares to employees and/or corporate

officers of the Company or affiliated companies, under the terms

and according to the methods provided by law, and notably with

respect to the French statutory profit-sharing scheme;

- the retention of shares and their subsequent remittance in

payment or exchange for future acquisitions, mergers, demergers or

contribution transactions, occurring at the level of the Company

or, where allowed by applicable regulation, of the companies that

it controls; their use in any transaction to hedge the Company’s

commitments involving financial instruments notably covering

changes in the Company’s share price;

- remittance of shares pursuant to the exercise of rights

attached to securities granting access, immediately or in the

future, by redemption, conversion, exchange, presentation of a

warrant or any other form of granting Company shares, and the

execution of all hedging transactions relating to the issue of such

securities, under the terms stipulated by the market authorities

and at the times the Board of Directors sees fit;

- the cancellation of some or all of the shares through a share

capital reduction (notably for the purpose of optimizing cash

management, return on equity or earnings per share);

- the implementation of any market practice accepted or that may

be accepted by the AMF and, more generally, carrying out of any

transaction complying with prevailing regulations.

Maximum number of shares that can be purchased

The maximum number of shares that may be bought back by the

Company under this resolution may not exceed 10% of the shares

comprising the Company’s share capital at any time, this percentage

being adjusted for transactions impacting the share capital and

performed after the General Meeting, it being specified that when

shares are repurchased in connection with a liquidity agreement,

the number of shares taken into account in calculating the above

10% limit will be the number of shares purchased minus the number

of shares resold during the authorization period. The number of

shares that may be purchased by the Company with a view to their

retention and subsequent remittance in payment or exchange in

connection with a merger, demerger or contribution, may not exceed

5% of its share capital.

Maximum purchase price: €20 (excluding acquisition

costs)

Maximum amount of funds able to be used for share

buybacks: €22,000,000.

Term: eighteen months from the date of the General

Meeting, i.e. until June 1, 2023.

In accordance with Article 241-2, II of the AMF General

Regulation, during the implementation of the buyback program, any

change in any of the information listed in the description must be

brought to the attention of the public as soon as possible in

accordance with the procedures set out in Article 221-3 of the said

General Regulation.

About Claranova:

As a diversified global technology company, Claranova manages

and coordinates a portfolio of majority interests in digital

companies with strong growth potential. Supported by a team

combining several decades of experience in the world of technology,

Claranova has acquired a unique know-how in successfully turning

around, creating and developing innovative companies.

With average annual growth of more than 40% over the last three

years and revenue of €472 million in FY 2020-2021, Claranova has

proven its capacity to turn a simple idea into a worldwide success

in just a few short years. Present in 15 countries and leveraging

the technology expertise of nearly 800 employees across North

America and Europe, Claranova is a truly international company,

with 95% of its revenue derived from international markets.

Claranova’s portfolio of companies is organized into three

unique technology platforms operating in all major digital sectors.

As a leader in personalized e-commerce, Claranova also stands out

for its technological expertise in software publishing and the

Internet of Things, through its businesses PlanetArt, Avanquest and

myDevices. These three technology platforms share a common vision:

empowering people through innovation by providing simple and

intuitive digital solutions that facilitate everyday access to the

very best of technology.

For more information on Claranova Group:

https://www.claranova.com or

https://twitter.com/claranova_group

CODES Ticker : CLA ISIN : FR0013426004

www.claranova.com

Disclaimer:

All statements other than statements of historical fact included

in this press release about future events are subject to (i) change

without notice and (ii) factors beyond the Company’s control.

Forward-looking statements are subject to inherent risks and

uncertainties beyond the Company’s control that could cause the

Company’s actual results or performance to be materially different

from the expected results or performance expressed or implied by

such forward-looking statements.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20211209006070/en/

ANALYSTS - INVESTORS +33 1 41 27 19 74

ir@claranova.com

FINANCIAL COMMUNICATION +33 1 75 77 54 65

ir@claranova.com

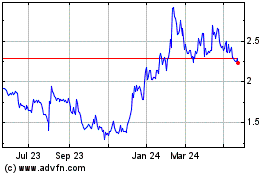

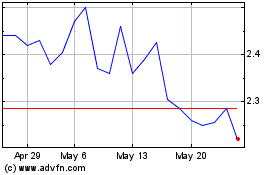

Claranova (EU:CLA)

Historical Stock Chart

From Nov 2024 to Dec 2024

Claranova (EU:CLA)

Historical Stock Chart

From Dec 2023 to Dec 2024