Regulatory News:

Novacyt (EURONEXT GROWTH: ALNOV; AIM: NCYT), an international

specialist in clinical diagnostics, announces a trading update for

the half year ended 30 June 2022 and provides an update on delivery

against its strategy as announced at the time of the full year 2021

results on 28 April 2022.

H1 2022 trading update

Group revenue in H1 2022 was £16.5m (£13.0m COVID-19 related)

compared to £52.2m (£47.6m COVID-19 related) in H1 2021 (excluding

Lab21 Healthcare and Microgen Bioproducts sales, collectively known

as Lab21 Products). This shows a 73% decline in COVID-19 related

revenues for H1 2022 compared to H1 2021, which is faster than

previously anticipated by the Board. H1 2022 revenue for the

non-COVID-19 portfolio declined year-on-year by £1.1m to £3.5m,

predominantly driven by lower instrument sales compared to a strong

H1 2021 which benefited from COVID-19 demand.

As announced at the time of the full year 2021 results,

following a strategic review, Novacyt is discontinuing its Lab21

Healthcare and Microgen Bioproducts businesses. Following a further

review based on the faster than expected decline in COVID-19

revenue, the Company is taking steps to further rationalise its

cost base, targeting an additional reduction in operating costs of

£2.4m this year and a one-off cash restructuring charge of circa

£0.8m. As a result, the business is now expected to end 2022 with a

full year operating cost of £20.6m (excluding exceptional items and

Lab21 Products) and an ongoing operating cost run rate of circa

£17.0m, compared to a full year 2021 operating cost of £25.1m

(£28.4m before restating Lab21 products).

The Company's cash position at 30 June 2022 was £99.6m, compared

to £101.7m at 31 December 2021.

Strategy update

The Company continues to invest in R&D and Commercial

resources, which represents £10.0m of projected opex spend in 2022,

to execute on the vision and strategy announced earlier in the year

to develop and commercialise its non-COVID-19 portfolio. The

Company has made good progress on delivering against its strategy

during H1 2022, which is detailed below.

Portfolio development – clinical diagnostics in human health and

instrumentation

Novacyt has advanced the product design of two new polymerase

chain reaction (PCR) assays for near-patient testing in infectious

diseases. These new assays are focused on gastro-intestinal viruses

and bacteria and will run on the Company’s q32 instruments. In

addition, the Company has developed three single analyte transplant

viral panels for use on open instrument platforms. Two of the

transplant assays are complete and the final CMV assay has been

filed for regulatory approval, in line with product development

plans as outlined in 2021 full year results.

Novacyt has also strengthened its position as an integrated

reagent and instrument solution provider by signing an agreement

with a leading global health provider to supply both instruments

and reagents, for the detection of infectious diseases including

high risk HPV and HIV, over a three year period.

Lastly, the Company has launched a new lateral flow test (LFT)

reader for use in conjunction with a number of key assays within

Novacyt’s Pathflow® product portfolio. The small, lightweight LFT

reader instrument is designed to provide digital test results based

on optical imaging technology thereby removing the ambiguity of

manually interpreting a positive/negative reading. The result is

available in a matter of seconds (~10-12 secs) in a digital form

that can be exported to other systems.

Global first responder

In line with Novacyt’s strategy to maintain its position as a

global first responder, the Company launched a research-use-only

(RUO) monkeypox PCR assay and is developing an RUO assay for

adenovirus F Type 41. In addition, the Company has signed a

contract with a leading global non-governmental organisation (NGO)

to support the detection of arboviruses, including dengue, Zika and

Chikungunya, with the total value of the first order approximately

£220,000.

To ensure Novacyt is well positioned for any future COVID-19

outbreaks in both developed and developing markets, the Company is

consolidating its portfolio. To this end, Novacyt has recently

secured CE mark accreditation for its saliva based PathFlow®

COVID-19 Rapid Antigen Self-Test and an ambient version of its

PROmate® COVID-19 2G assay designed for international shipping.

Both tests complement the Company’s established genesig® COVID-19

Real-Time PCR portfolio and PROmate® COVID-19 direct to PCR 1G and

2G assays.

Business development

As detailed in the Company’s full year 2021 results, Novacyt is

seeking to drive value by deploying its capital to deliver

inorganic growth in parallel to its ongoing R&D investments.

This has included accelerating the molecular portfolio ahead of

organic R&D through a distribution agreement covering eight new

PCR assays. The assay range will focus on detecting sexually

transmitted infections and will be available for launch in Q4

2022.

In addition to the internal development of the new portfolio,

the Company continues to progress the M&A strategy to support

the inorganic growth of the business through scale and

diversification.

Outlook

The Company’s inventory balance at the end of H1 2022 is

estimated to be circa £10.5m, of which approximately 80% is

associated with COVID-19 products. Based on lower forecast COVID-19

sales, Novacyt plans to increase the stock provision by £6.5m to

cover excess, short and out of shelf-life finished goods and raw

materials. This will result in a net inventory balance circa

£4.0m.

If the rate of COVID-19 sales decline experienced in Q2 2022

continues for the remainder of 2022, the Board expects full year

revenues of circa £25.0m (previously expected full year revenues of

circa £35.0m to £45.0m) based on the expansion of non-COVID-19

revenue in H2 2022 versus H2 2021 including the relaunch of the

Company’s RUO life sciences portfolio in H2 2022, as announced in

the Company’s full year 2021 results. This would deliver an EBITDA

loss for 2022 of circa £11.0m, or £4.5m loss for the underlying

business when the impact of the additional £6.5m stock provision is

excluded.

This announcement contains inside information for the purposes

of Article 7 of Regulation (EU) 596/2014.

About Novacyt Group

The Novacyt Group is an international diagnostics business

generating an increasing portfolio of in vitro and molecular

diagnostic tests. Its core strengths lie in diagnostics product

development, commercialisation, contract design and manufacturing.

The Company supplies an extensive range of high-quality assays and

reagents worldwide. The Group directly serves microbiology,

haematology and serology markets as do its global partners, which

include major corporates.

For more information, please refer to the website:

www.novacyt.com

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220706005859/en/

Novacyt SA David Allmond, Chief Executive Officer James

McCarthy, Chief Financial Officer +44 (0)1276 600081

SP Angel Corporate Finance LLP (Nominated Adviser and

Broker) Matthew Johnson / Charlie Bouverat (Corporate Finance)

Vadim Alexandre / Rob Rees (Corporate Broking) +44 (0)20 3470

0470

Numis Securities Limited (Joint Broker) James Black /

Freddie Barnfield / Duncan Monteith +44 (0)20 7260 1000

Allegra Finance (French Listing Sponsor) Rémi Durgetto /

Yannick Petit +33 (1) 42 22 10 10 r.durgetto@allegrafinance.com;

y.petit@allegrafinance.com

FTI Consulting (International) Victoria Foster Mitchell /

Alex Shaw +44 (0)20 3727 1000

victoria.fostermitchell@fticonsulting.com /

Alex.Shaw@fticonsulting.com

FTI Consulting (France) Arnaud de Cheffontaines +33

(0)147 03 69 48 arnaud.decheffontaines@fticonsulting.com

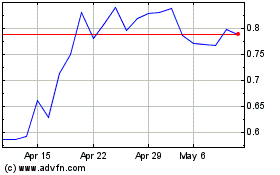

Novacyt (EU:ALNOV)

Historical Stock Chart

From Nov 2024 to Dec 2024

Novacyt (EU:ALNOV)

Historical Stock Chart

From Dec 2023 to Dec 2024