Cellectis Provides Financial Results for the Second Quarter

2024

- ODD

and RPDD granted by the FDA and ODD granted by the European

Commission to UCART22 for the treatment of ALL

- ODD

granted by the FDA to CLLS52 (alemtuzumab) for ALL

treatment

- Cash

position of $273 million as of June 30,

20241; cash runway projection into

2026

NEW YORK, Aug. 06, 2024 (GLOBE NEWSWIRE) --

Cellectis (the “Company”) (Euronext Growth: ALCLS - NASDAQ: CLLS),

a clinical-stage biotechnology company using its pioneering gene

editing platform to develop life-saving cell and gene therapies,

today provided business updates and reported financial results for

the six-month period ending June 30, 2024.

"Over the past months, we have achieved a

significant milestone with the granting of ODD designations by the

Food and Drug Administration and the European Commission,

complemented by the FDA’S Rare Pediatric Disease Designation. We

have overcome major challenges, which reflects our ongoing

commitment to innovation. Driven by an unwavering belief in our

ability to revolutionize the healthcare field, we continue our

pursuit of advancement with the confidence that our work will lead

to the launch of a life-saving drug product. Our determination is

the engine of our future success” said André Choulika, Ph.D., Chief

Executive Officer at Cellectis.

________________________

1 Cash position includes cash, cash

equivalents, restricted cash and fixed-term deposits classified as

current financial assets. Restricted cash was $5 million as of June

30, 2024. Fixed-term deposits classified as current financial

assets were $119 million as of June 30, 2024.

Pipeline Highlights

UCART Clinical Programs

- On June 4, 2024, Cellectis received Orphan Drug Designation

(ODD) from the European Commission (EC) for UCART22, for the

treatment of acute lymphoblastic leukemia (ALL). The Orphan Drug

Designation in the European Union is granted by the EC based on a

positive opinion issued by the European Medicines Agency (EMA)

Committee for Orphan Medicinal Products. This designation may allow

certain regulatory, financial, and commercial incentives to develop

medicines for rare diseases where there are no satisfactory

treatment options.

- On July 25, 2024, the FDA designated UCART22 as a drug for a

Rare Pediatric Disease (RPDD). This designation may allow to obtain

a “Priority Review Voucher” at the time of Biologics License

Application (BLA). The FDA also granted ODD to UCART22 product

candidate for ALL treatment. Receiving ODD by the FDA may help to

expedite and reduce the cost of development, approval, and

commercialization of a therapeutic agent.

- Patients with relapsed/refractory ALL have limited, if any,

treatment options, especially for those who have failed prior CD19

directed CAR T-cell therapy and allogeneic stem cell transplant.

These designations for UCART22 mark an important step towards

developing allogeneic CAR T products that would be readily

available for all patients.

- On August 1, 2024, the FDA granted ODD to Cellectis’ CLLS52

(alemtuzumab), an Investigational Medicinal Product (IMP) used as

part of the lymphodepletion regimen associated with UCART22,

evaluated in the BALLI-01 clinical trial. The importance of adding

alemtuzumab to the lymphodepletion regimen has been demonstrated in

Cellectis’ BALLI-01 study, where the addition of this

lymphodepletion agent to the fludarabine and cyclophosphamide

regimen was associated with sustained lymphodepletion and

significantly higher UCART22 cell expansion allowing for greater

clinical activity.

- Cellectis continues to focus on the enrollment of patients in

the BALLI-01 study, evaluating UCART22 in relapsed or refractory

B-cell acute lymphoblastic leukemia, in the NatHaLi-01 study,

evaluating UCART20x22 in relapsed or refractory B-cell non-Hodgkin

lymphoma, and in the AMELI-01 study, evaluating UCART123 in

relapsed or refractory acute myeloid leukemia. We expect to provide

updates in the advancements of BALLI-01 until the end of the year

2024.

Research Data & Preclinical

Programs

Non-viral Gene Therapy Approach for

Sickle Cell Disease

- On June 12, 2024, Cellectis announces the publication of a

scientific article in Nature Communications.

- Cellectis leverages TALEN® technology and a non-viral gene

repair template delivery to develop a clinically relevant gene

editing process in hematopoietic stem and progenitor cells (HSPCs).

This process enables efficient HBB gene correction with

high precision, specificity and minimal genomic adverse

events.

- Applying this HBB gene correction process to SCD patient-HSPCs

results in over 50% expression of normal adult hemoglobin in mature

red blood cells and in the correction of sickle phenotype, without

inducing β-thalassemic phenotype. Edited HSPCs engraft efficiently

in an immunodeficient murine model and maintain clinically relevant

levels of HBB gene correction events. This comprehensive

preclinical data package sets the stage for the therapeutic

application of autologous gene corrected HSPCs to address

SCD.

Partnerships

Licensed Allogeneic CAR T-cell

Development Programs

Anti-CD19 Programs

Allogene’s investigational oncology products

utilize Cellectis technologies.

We have initiated an arbitration proceeding

through the Centre de Médiation et d'Arbitrage de Paris.

We are requesting that the arbitral tribunal issue a decision (i)

terminating the Servier License Agreement, and (ii) requiring

Servier to pay us fair financial compensation for losses incurred

due to the lack of development of the licensed products and for

non-payment of milestone payments for milestones that have been

achieved under the Servier License Agreement.

In May 2024, Allogene announced the execution of

an Amendment and Settlement Agreement (the "Servier Amendment"),

which amended the license agreement between Servier and Allogene,

under which Servier exclusively sublicensed to Allogene its rights

under the License Agreement between Cellectis and Servier (the

"Servier License"), for the development and commercialization of

allogeneic anti-CD19 CAR T cell product candidates in the U.S. (the

"Allogene Sublicense"). Allogene disclosed that, pursuant to the

Servier Amendment to the Allogene Sublicense, the licensed

territory was expanded to include the European Union and the United

Kingdom, and Allogene was granted an option to further extend its

licensed territory to include China and Japan subject to certain

conditions.

Corporate Updates

Collaboration and Investment Agreements

with AstraZeneca

- On May 6, 2024, Cellectis announced the completion of the

subsequent investment of $140M in Cellectis by AstraZeneca

(LSE/STO/Nasdaq: AZN) (the “Additional Investment”).

- AstraZeneca subscribed for 10,000,000 “class A” convertible

preferred shares and 18,000,000 “class B” convertible preferred

shares, in each case at a price of $5.00 per convertible preferred

share, issued by the Board of Directors of Cellectis.

- On the completion date of the Additional Investment,

AstraZeneca owned approximately 44% of the share capital and 30% of

the voting rights of the Company (based on the number of voting

rights outstanding at the time).

- Following the Additional Investment, Mr. Marc Dunoyer and Dr.

Tyrell Rivers have been nominated members of the board of directors

of Cellectis, designated by AstraZeneca.

Annual Shareholders Meeting

- On June 28, 2024, Cellectis held a shareholders’ general

meeting at the Biopark auditorium in Paris, France.

- At the meeting, during which approximately 40% of shares were

exercised, resolutions 1 through 28 were adopted and resolution 29

was rejected, consistent with the recommendations of the

management. The detailed results of the vote and the resolutions

are available on Cellectis’ website:

https://www.cellectis.com/en/investors/general-meetings/

Financial Results

The interim condensed consolidated financial

statements of Cellectis have been prepared in accordance with

International Financial Reporting Standards, as issued by the

International Accounting Standards Board (“IFRS”).

As from June 1, 2023, and the deconsolidation of

Calyxt, which corresponded to the Plants operating segment, we view

our operations and manage our business in a single operating and

reportable segment corresponding to the Therapeutics segment. For

this reason, we are no longer presenting financial measures broken

down between our two reportable segments – Therapeutics and Plants.

In the appendices of this Q2 2024 financial results press release,

Calyxt's results are isolated under "Income (loss) from

discontinued operations" for the 6-month period ended June 30,

2023, and are no longer included for the 6-month period ended June

30, 2024, due to the deconsolidation.

Cash: As of June 30, 2024,

Cellectis had $273 million in consolidated cash, cash equivalents,

restricted cash and fixed-term deposits classified as

current-financial assets. This compares to $156 million in

consolidated cash, cash equivalents, restricted cash and fixed-term

deposits classified as current-financial assets as of December 31,

2023. This $117 million increase is mainly due to cash payments

from Cellectis to suppliers of $26 million, including $18 million

to R&D suppliers and $8 million to SG&A suppliers,

Cellectis’ wages, bonuses and social expenses paid of $24 million,

the payments of lease debts of $5 million and the repayment of the

“PGE” loan of $3 million, partially offset by the $16 million cash

received from EIB pursuant to the disbursement of the €15 million

Tranche B, $5 million of cash-in from our financial investments,

$14 million of cash-in from our revenue, $140 million cash received

from AstraZeneca as part of its equity investment in Cellectis.

With cash and cash equivalents of $149 million

and $119 million term deposit classified as current financial

assets as of June 30, 2024, the Company believes its cash and cash

equivalents and deposits will be sufficient to fund its operations

into 2026 and therefore for at least twelve months following the

unaudited interim condensed consolidated financial statements'

publication.

Revenues and Other Income:

Consolidated revenues and other income were $16.0 million for the

six months ended June 30, 2024 compared to $5.6 million for the six

months ended June 30, 2023. This $10.4 million increase between the

six months ended June 30, 2023 and 2024 was mainly attributable to

(i) recognition of a $12.3 million revenue in 2024 based (a) on the

progress of our performance obligation rendered under the first

research plan of the Joint Research and Collaboration Agreement

(the “JRCA”) signed with AstraZeneca Ireland Limited (AZ Ireland)

and (b) the reaching of a development milestone under the License

Agreement signed with Servier, while revenues recognized for the

six months ended June 30, 2023 were immaterial, (ii) a decrease of

research tax credit of $1.1 million due to a decrease of eligible

expenses, and (iii) the recognition in the six-month periods ended

June 30, 2023 of $0.8 million representing the portion of an

initial payments from BPI corresponding to a grant pursuant to our

grant and repayable advance agreement with BPI signed in March

2023.

R&D Expenses: Consolidated

R&D expenses were $45.8 million for the six months ended June

30, 2024, compared to $43.6 million for the six months ended June

30, 2023. R&D personnel expenses decreased by $0.8 million from

$20.0 million in 2023 to $19.2 million in 2024 primarily due to a

decrease in the average unit fair value of stock options and free

share awards vesting between the two periods. R&D purchases,

external expenses and other increased by $3.1 million (from $23.6

million in 2023 to $26.7 million in 2024) mainly related to

increase in manufacturing activities to support our R&D

pipeline.

SG&A Expenses: Consolidated

SG&A expenses were $9.0 million for the six months ended June

30, 2024 compared to $8.9 million for the six months ended June 30,

2023. SG&A personnel expenses decreased by $0.2 million (from

$4.0 million in 2023 to $3.8 million in 2024), with a $0.4 million

increase in salaries being offset by a $0.6 million decrease in

stock-based compensation expenses. SG&A purchases, external

expenses and other increased by $0.3 million (from $4.9 million in

2023 to $5.2 million in 2024).

Other operating income and

expenses: Other operating income and expenses were a $0.7

million net income for the six months ended June 30, 2024 compared

to a $0.1 million net expense for the six months ended June 30,

2023. Other operating income and expenses decreased by $0.8 million

primarily due to the recognition of costs related to a litigation

of $0.5 million in 2023.

Net financial gain (loss): We

had a consolidated net financial gain of $18.0 million for the six

months ended June 30, 2024, compared to a $10.2 million loss for

the six months ended June 30, 2023. This $28.3 million difference

reflects mainly (i) a $14.3 million gain in change in fair value of

SIA derivative instrument, (ii) a $3.2 million increase in gain

from our financial investments, (iii) a $4.3 million gain in change

in fair value of EIB tranche A and B, , (iv) a $5.5 million

decrease of the loss in fair value of our investment in Cibus and

(vi) the loss in fair value measurement on Cytovia convertible note

recognized in the six months period ended June 30, 2023 of $6.8

million, partially offset by (i) a $1.3 million interest expense on

EIB Tranche A and Tranche B loans and (ii) a $0.7 million increase

in foreign exchange loss, and (iii) a decrease in net foreign

exchange gain of $3.5 million.

Net income (loss) from discontinued

operations: Net income from discontinued operations of

$8.4 million for the six months ended June 30, 2023 corresponded to

Calyxt’s results. Since Calyxt has been deconsolidated since June

1, 2023, there is no longer any "Income (loss) from discontinued

operations" for the six months ended June 30, 2024.

Net Income (loss) Attributable to

Shareholders of Cellectis: Consolidated net loss

attributable to shareholders of Cellectis was $19.6 million (or a

$0.24 loss per share) for the six months ended June 30, 2024,

compared to a $41.8 million loss (or a $0.78 loss per share) for

the six months ended June 30, 2023, of which $57.6 million was

attributed to Cellectis continuing operations. The $29.5 million

change in net loss was primarily driven by (i) an increase in

revenues and other income of $10.4 million, (ii) a decrease of $1.5

million in non-cash stock based compensation expense due to a

decrease in the average unit fair value of stock options and free

share awards vesting between the two periods, (iii) a $28.3 million

change from a net financial loss of $10.2 million to a net

financial gain of $18.0 million and (iv) a decrease in net other

operating expense of $0.8 million, and (v) a $8.4 million decrease

in net income from discontinued operations attributable to

shareholders of Cellectis, partially offset by (i) an increase of

$3.3 million in purchases, external expenses and other, and a (ii)

an increase of $0.4 million in wages.

Adjusted Net Income (Loss) Attributable

to Shareholders of Cellectis: Consolidated adjusted net

loss attributable to shareholders of Cellectis was $17.9 million

(or a $0.22 loss per share) for the six months ended June 30, 2024,

compared to a net loss of $36.7 million (or a $0.68 loss per share)

for the six months ended June 30, 2023.

Please see "Note Regarding Use of Non-IFRS

Financial Measures" for reconciliation of GAAP net income (loss)

attributable to shareholders of Cellectis to adjusted net income

(loss) attributable to shareholders of Cellectis.

We currently foresee focusing our cash spending

at Cellectis for 2024 in the following areas:

- Supporting the development of our

pipeline of product candidates, including the manufacturing and

clinical trial expenses of UCART22, UCART20x22, UCART123 and

potential new product candidates, and

- Operating our state-of-the-art

manufacturing capabilities in Paris (France), and Raleigh (North

Carolina, USA); and

- Continuing strengthening our

manufacturing and clinical departments.

CELLECTIS S.A.

STATEMENT OF CONSOLIDATED FINANCIAL POSITION

(unaudited)

($ in thousands) |

| |

| |

|

As of |

| |

|

December 31, 2023 |

|

June 30, 2024 |

|

ASSETS |

|

|

|

|

| Non-current

assets |

|

|

|

|

|

Intangible assets |

|

671 |

|

|

653 |

|

| Property, plant, and

equipment |

|

54,681 |

|

|

50,370 |

|

| Right-of-use assets |

|

38,060 |

|

|

33,671 |

|

| Non-current financial

assets |

|

7,853 |

|

|

16,650 |

|

| Total non-current

assets |

|

101,265 |

|

|

101,344 |

|

| Current

assets |

|

|

|

|

| Trade receivables |

|

569 |

|

|

9,741 |

|

| Subsidies receivables |

|

20,900 |

|

|

14,958 |

|

| Other current assets |

|

7,722 |

|

|

7,587 |

|

| Current deferred tax

assets |

|

|

|

710 |

|

| Cash and cash equivalent and

Current financial assets |

|

203,815 |

|

|

272,806 |

|

| Total current

assets |

|

233,005 |

|

|

305,803 |

|

| TOTAL

ASSETS |

|

334,270 |

|

|

407,147 |

|

|

LIABILITIES |

|

|

|

|

| Shareholders’

equity |

|

|

|

|

| Share capital |

|

4,365 |

|

|

5,897 |

|

| Premiums related to the share

capital |

|

522,785 |

|

|

606,146 |

|

| Currency translation

adjustment |

|

(36,690 |

) |

|

(38,077 |

) |

| Retained earnings |

|

(304,707 |

) |

|

(405,729 |

) |

| Net income (loss) |

|

(101,059 |

) |

|

(19,627 |

) |

| Total shareholders’

equity - Group Share |

|

84,695 |

|

|

148,610 |

|

| Non-controlling interests |

|

0 |

|

|

0 |

|

| Total shareholders’

equity |

|

84,695 |

|

|

148,610 |

|

| Non-current

liabilities |

|

|

|

|

| Non-current financial

liabilities |

|

49,125 |

|

|

58,348 |

|

| Non-current lease debts |

|

42,948 |

|

|

38,362 |

|

| Non-current provisions |

|

2,200 |

|

|

2,194 |

|

| Non-current deferred tax

liabilities |

|

158 |

|

|

0 |

|

| Total non-current

liabilities |

|

94,431 |

|

|

98,904 |

|

| Current

liabilities |

|

|

|

|

| Current financial

liabilities |

|

5,289 |

|

|

5,119 |

|

| Current lease debts |

|

8,502 |

|

|

8,357 |

|

| Trade payables |

|

19,069 |

|

|

18,213 |

|

| Deferred revenues and deferred

income |

|

110,325 |

|

|

117,754 |

|

| Current provisions |

|

1,740 |

|

|

884 |

|

| Current deferred tax

liabilities |

|

|

|

122 |

|

| Other current liabilities |

|

10,219 |

|

|

9,184 |

|

| Total current

liabilities |

|

155,144 |

|

|

159,633 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

334,270 |

|

|

407,147 |

|

| |

UNAUDITED STATEMENTS OF CONSOLIDATED

OPERATIONS

For the three-month period ended June 30, 2024

($ in thousands, except per share amounts) |

| |

| |

|

For the three-month period ended June 30, |

| |

|

2023* |

|

2024 |

| |

|

|

|

| Revenues and other

income |

|

|

|

|

|

Revenues |

|

178 |

|

|

8,061 |

|

| Other income |

|

1,823 |

|

|

1,442 |

|

| Total revenues and

other income |

|

2,001 |

|

|

9,504 |

|

| Operating

expenses |

|

|

|

|

| Research and development

expenses |

|

(22,200 |

) |

|

(23,518 |

) |

| Selling, general and

administrative expenses |

|

(3,950 |

) |

|

(3,882 |

) |

| Other operating income

(expenses) |

|

528 |

|

|

686 |

|

| Total operating

expenses |

|

(25,622 |

) |

|

(26,714 |

) |

| |

|

|

|

|

| Operating income

(loss) |

|

(23,621 |

) |

|

(17,211 |

) |

| |

|

|

|

|

| Financial gain

(loss) |

|

(5,844 |

) |

|

(8,251 |

) |

| |

|

|

|

|

| Income

tax |

|

(258 |

) |

|

193 |

|

| Income (loss) from continuing

operations |

|

(29,724 |

) |

|

(25,270 |

) |

| Income (loss) from

discontinued operations |

|

13,083 |

|

|

0 |

|

| Net income

(loss) |

|

(16,641 |

) |

|

(25,270 |

) |

|

Attributable to shareholders of Cellectis |

|

(11,707 |

) |

|

(25,270 |

) |

|

Attributable to non-controlling interests |

|

(4,934 |

) |

|

0 |

|

| Basic and diluted net

income (loss) attributable to shareholders of Cellectis, per share

($/share) |

|

(0.20 |

) |

|

(0.28 |

) |

| Diluted net income

(loss) attributable to shareholders of Cellectis, per share

($/share) |

|

(0.20 |

) |

|

(0.28 |

) |

| Basic and diluted net

income (loss) attributable to shareholders of Cellectis from

discontinued operations, per share ($ /share) |

|

0.32 |

|

|

0.00 |

|

| Diluted net income

(loss) attributable to shareholders of Cellectis from discontinued

operations, per share ($ /share) |

|

0.32 |

|

|

0.00 |

|

| |

|

|

|

|

| Number of shares used for

computing |

|

|

|

|

|

Basic |

|

55,583,768 |

|

|

89,852,142 |

|

|

Diluted |

|

55,583,768 |

|

|

89,852,142 |

|

|

|

|

|

|

|

|

|

*These amounts reflect Calyxt's adjustments as presented in

Cellectis 2023 20F (Note 3)

Cellectis S.A.

UNAUDITED STATEMENTS OF CONSOLIDATED

OPERATIONS

For the six-month period ended June 30, 2024

($ in thousands, except per share amounts) |

| |

| |

|

For the six-month period ended June 30, |

| |

|

2023* |

|

2024 |

| |

|

|

|

| Revenues and other

income |

|

|

|

|

|

Revenues |

|

317 |

|

|

12,589 |

|

| Other income |

|

5,242 |

|

|

3,412 |

|

| Total revenues and

other income |

|

5,560 |

|

|

16,002 |

|

| Operating

expenses |

|

|

|

|

| Research and development

expenses |

|

(43,614 |

) |

|

(45,841 |

) |

| Selling, general and

administrative expenses |

|

(8,914 |

) |

|

(8,986 |

) |

| Other operating income

(expenses) |

|

(83 |

) |

|

721 |

|

| Total operating

expenses |

|

(52,612 |

) |

|

(54,107 |

) |

| |

|

|

|

|

| Operating income

(loss) |

|

(47,053 |

) |

|

(38,105 |

) |

| |

|

|

|

|

| Financial gain

(loss) |

|

(10,246 |

) |

|

18,023 |

|

| |

|

|

|

|

| Income

tax |

|

(258 |

) |

|

455 |

|

| Income (loss) from continuing

operations |

|

(57,557 |

) |

|

(19,627 |

) |

| Income (loss) from

discontinued operations |

|

8,392 |

|

|

0 |

|

| Net income

(loss) |

|

(49,165 |

) |

|

(19,627 |

) |

|

Attributable to shareholders of Cellectis |

|

(41,781 |

) |

|

(19,627 |

) |

|

Attributable to non-controlling interests |

|

(7,384 |

) |

|

0 |

|

| Basic net income

(loss) attributable to shareholders of Cellectis, per share

($/share) |

|

(0.78 |

) |

|

(0.24 |

) |

| Diluted net income

(loss) attributable to shareholders of Cellectis, per share

($/share) |

|

(0.78 |

) |

|

(0.24 |

) |

| Basic net income

(loss) attributable to shareholders of Cellectis from discontinued

operations, per share ($ /share) |

|

0.29 |

|

|

0.00 |

|

| |

|

|

|

|

| Diluted net income

(loss) attributable to shareholders of Cellectis from discontinued

operations, per share ($ /share) |

|

0.29 |

|

|

0.00 |

|

| |

|

|

|

|

| Number of shares used for

computing |

|

|

|

|

|

Basic |

|

53,541,010 |

|

|

80,881,026 |

|

|

Diluted |

|

53,541,010 |

|

|

80,881,026 |

|

|

|

|

|

|

|

|

|

*These amounts reflect Calyxt's adjustments as

presented in Cellectis 2023 20F (Note 3)

Note Regarding Use of Non-IFRS Financial

Measures

Cellectis S.A. presents adjusted net income

(loss) attributable to shareholders of Cellectis in this press

release. Adjusted net income (loss) attributable to shareholders of

Cellectis is not a measure calculated in accordance with IFRS. We

have included in this press release a reconciliation of this figure

to net income (loss) attributable to shareholders of Cellectis,

which is the most directly comparable financial measure calculated

in accordance with IFRS.

Because adjusted net income (loss) attributable

to shareholders of Cellectis excludes non-cash stock-based

compensation expense—a non-cash expense, we believe that this

financial measure, when considered together with our IFRS financial

statements, can enhance an overall understanding of Cellectis’

financial performance. Moreover, our management views the Company’s

operations, and manages its business, based, in part, on this

financial measure. In particular, we believe that the elimination

of non-cash stock-based expenses from Net income (loss)

attributable to shareholders of Cellectis can provide a useful

measure for period-to-period comparisons of our core businesses.

Our use of adjusted net income (loss) attributable to shareholders

of Cellectis has limitations as an analytical tool, and you should

not consider it in isolation or as a substitute for analysis of our

financial results as reported under IFRS. Some of these limitations

are: (a) other companies, including companies in our industry which

use similar stock-based compensation, may address the impact of

non-cash stock- based compensation expense differently; and (b)

other companies may report adjusted net income (loss) attributable

to shareholders or similarly titled measures but calculate them

differently, which reduces their usefulness as a comparative

measure. Because of these and other limitations, you should

consider adjusted net income (loss) attributable to shareholders of

Cellectis alongside our IFRS financial results, including Net

income (loss) attributable to shareholders of Cellectis.

RECONCILIATION OF IFRS TO NON-IFRS NET INCOME

(unaudited)

For the three-month period ended June 30, 2024

($ in thousands, except per share data) |

| |

| |

|

For the three-month period ended June 30, |

| |

|

2023* |

|

2024 |

| |

|

|

|

|

Net income (loss) attributable to shareholders of

Cellectis |

|

(11,707 |

) |

|

(25,270 |

) |

Adjustment:

|

|

|

|

|

|

|

|

Non-cash stock-based compensation expense attributable to

shareholders of Cellectis |

|

3,140 |

|

|

830 |

|

| Adjusted net income

(loss) attributable to shareholders of Cellectis |

|

(8,567 |

) |

|

(24,440 |

) |

| Basic adjusted net

income (loss) attributable to shareholders of Cellectis

($/share) |

|

(0.15 |

) |

|

(0.27 |

) |

| Basic adjusted net

income (loss) attributable to shareholders of Cellectis from

discontinued operations ($ /share) |

|

(0.04 |

) |

|

0.00 |

|

| |

|

|

|

|

| Weighted average

number of outstanding shares, basic (units) (1) |

|

55,583,768 |

|

|

89,852,142 |

|

| |

|

|

|

|

| Diluted adjusted net

income (loss) attributable to shareholders of Cellectis ($/share)

(1) |

|

(0.15 |

) |

|

(0.27 |

) |

| Diluted adjusted net

income (loss) attributable to shareholders of Cellectis from

discontinued operations ($/share) |

|

(0.04 |

) |

|

0.00 |

|

| |

|

|

|

|

| Weighted average

number of outstanding shares, diluted (units) (1) |

|

55,583,768 |

|

|

89,852,142 |

|

|

|

*These amounts reflect Calyxt's adjustments as presented in

Cellectis 2023 20F (Note 3)

RECONCILIATION OF IFRS TO NON-IFRS NET

INCOME (unaudited)

For the six-month period ended June 30, 2024

($ in thousands, except per share data)

| |

|

For the six-month period ended June 30, |

| |

|

2023* |

|

2024 |

| |

|

|

|

|

Net income (loss) attributable to shareholders of

Cellectis |

|

(41,781 |

) |

|

(19,627 |

) |

| Adjustment: |

|

|

|

|

|

|

|

Non-cash stock-based compensation expense attributable to

shareholders of Cellectis |

|

5,119 |

|

|

1,717 |

|

| Adjusted net income

(loss) attributable to shareholders of Cellectis |

|

(36,662 |

) |

|

(17,910 |

) |

| Basic adjusted net

income (loss) attributable to shareholders of Cellectis

($/share) |

|

(0.68 |

) |

|

(0.22 |

) |

| Basic adjusted net

income (loss) attributable to shareholders of Cellectis from

discontinued operations ($ /share) |

|

(0.09 |

) |

|

0.00 |

|

| |

|

|

|

|

| Weighted average

number of outstanding shares, basic (units) (1) |

|

53,541,010 |

|

|

80,881,026 |

|

| |

|

|

|

|

| Diluted adjusted net

income (loss) attributable to shareholders of Cellectis ($/share)

(1) |

|

(0.68 |

) |

|

(0.22 |

) |

| Diluted adjusted net

income (loss) attributable to shareholders of Cellectis from

discontinued operations ($/share) |

|

(0.09 |

) |

|

0.00 |

|

| |

|

|

|

|

| Weighted average

number of outstanding shares, diluted (units) (1) |

|

53,541,010 |

|

|

80,881,026 |

|

| |

*These amounts reflect Calyxt's adjustments as

presented in Cellectis 2023 20F (Note 3)

About Cellectis

Cellectis is a clinical-stage biotechnology

company using its pioneering gene-editing platform to develop

life-saving cell and gene therapies. Cellectis utilizes an

allogeneic approach for CAR-T immunotherapies in oncology,

pioneering the concept of off-the-shelf and ready-to-use

gene-edited CAR T-cells to treat cancer patients, and a platform to

make therapeutic gene editing in hemopoietic stem cells for various

diseases. As a clinical-stage biopharmaceutical company with 25

years of experience and expertise in gene editing, Cellectis is

developing life-changing product candidates utilizing TALEN®, its

gene editing technology, and PulseAgile, its pioneering

electroporation system to harness the power of the immune system in

order to treat diseases with unmet medical needs. Cellectis’

headquarters are in Paris, France, with locations in New York, New

York and Raleigh, North Carolina. Cellectis is listed on the Nasdaq

Global Market (ticker: CLLS) and on Euronext Growth (ticker:

ALCLS).

Forward-looking Statements

This press release contains “forward-looking”

statements within the meaning of applicable securities laws,

including the Private Securities Litigation Reform Act of 1995.

Forward-looking statements may be identified by words such as

”future,” “projection,” “will,” “ may,” “would,” “expect,” and

“believe” or the negative of these and similar expressions. These

forward-looking statements are based on our management’s current

expectations and assumptions and on information currently available

to management. Forward-looking statements include statements about

the advancement, timing and progress of clinical trials, the timing

of our presentation of clinical data, the potential of our

candidate products programs and CLLS52, the outcome of the

arbitration proceedings against Servier, and the sufficiency of

cash to fund operations. These forward-looking statements are made

in light of information currently available to us and are subject

to numerous risks and uncertainties, including with respect to the

numerous risks associated with biopharmaceutical product candidate

development, including the risk of losing the orphan drug

designation if it is established that the product no longer meets

the orphan drug criteria before market authorization is granted (if

any). With respect to our cash runway, our operating plans,

including product candidates development plans, may change as a

result of various factors, including factors currently unknown to

us. Furthermore, many other important factors, including those

described in our Annual Report on Form 20-F and the financial

report (including the management report) for the year ended

December 31, 2023 and subsequent filings Cellectis makes with the

Securities Exchange Commission from time to time, as well as other

known and unknown risks and uncertainties may adversely affect such

forward-looking statements and cause our actual results,

performance or achievements to be materially different from those

expressed or implied by the forward-looking statements. Except as

required by law, we assume no obligation to update these

forward-looking statements publicly, or to update the reasons why

actual results could differ materially from those anticipated in

the forward-looking statements, even if new information becomes

available in the future.

For further information on Cellectis, please

contact:

Media contacts:

Pascalyne Wilson, Director, Communications, +33 (0)7 76 99 14

33, media@cellectis.com

Patricia Sosa Navarro, Chief of Staff to the CEO, +33 (0)7 76 77 46

93

Investor Relations

contact:

Arthur Stril, Interim Chief Financial Officer, +1 (347) 809 5980,

investors@cellectis.com

- 20240805_Cellectis Reports Financial Results for Second Quarter

2024 - V0508[7]

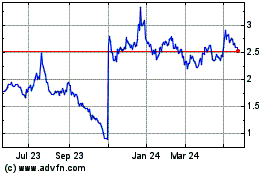

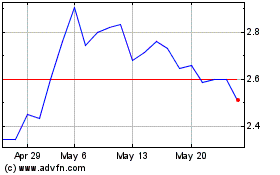

Cellectis Nom Eo 05 (EU:ALCLS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cellectis Nom Eo 05 (EU:ALCLS)

Historical Stock Chart

From Nov 2023 to Nov 2024