Belgian Ageas Says BNP Paribas Bond Tender Offer Successful

January 31 2012 - 3:39AM

Dow Jones News

Belgian insurer Ageas NV (AGN.BT) said Tuesday that a tender

offer on some bonds linked to the company's legacy from former

financial giant Fortis closed successfully on Monday.

"Ageas is pleased to announce that the tender offer launched by

BNP Paribas (BNP.FR) on 26 January 2012 was successfully closed on

Monday 30 January 2012," the Brussels-based insurer said in a

statement. "The acceptance rate reached more than 50% at an offer

price of 47.5%."

In a complex deal, BNP Paribas agreed to launch a cash tender to

buy back EUR3 billion in hybrid securities that can be converted

into Ageas stock. If at least 50% of the notes are tendered, BNP

Paribas will also redeem a EUR1 billion perpetual bond that is 95%

held by Ageas.

Ageas is the legal successor to once Belgian financial giant

Fortis, which collapsed in 2008 under the weight of buying a part

of Dutch bank ABN Amro Holding. The company was broken up and

nationalized by the Dutch and Belgian governments.

-By Alessandro Torello, Dow Jones Newswires; +32 2 741 14 88;

alessandro.torello@dowjones.com

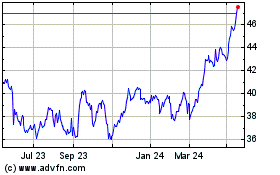

Ageas SA NV (EU:AGS)

Historical Stock Chart

From Jun 2024 to Jul 2024

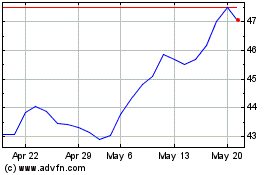

Ageas SA NV (EU:AGS)

Historical Stock Chart

From Jul 2023 to Jul 2024