CannabisNewsWire

Editorial Coverage: Investors seeking opportunities in the

cannabis market may want to turn their attention toward companies

offering solutions for a situation that could otherwise slow the

industry’s growth. A number of emerging firms are providing or

pursuing payment options that can help cannabis companies sidestep

the roadblock created by the lack of access to traditional banking

services. Among the companies honing financing, payment processing

and other business development services for the cannabis industry

are Global Payout, Inc (OTC: GOHE) (GOHE

Profile), MassRoots Retail (OTC: MSRT), iAnthus Capital

Holdings, Inc. (CSE: IAN) (OTC: ITHUF), and Glance

Technologies, Inc. (OTC: GLNNF) (GET: CNX). Meanwhile,

recent action at Canopy Growth Corp. (CC: WEED)

demonstrates that a change in bank industry policy could be on the

horizon.

In Arizona, the state Department of Health Services reported

that its dispensaries sold over 43 tons of medical marijuana

through year-end 2017, an increase of 48 percent from 2016. Capitol

Media Services estimates the quantity of medical marijuana sold in

Arizona in 2017 represented approximately $275 million in retail

sales for the year. Sales in the United States as a whole represent

a multibillion dollar market that is only expected to grow as the

legalization process continues to spread. In Canada alone, taking

into account the planned July 2018 legalization of recreational

cannabis, sales of the product are expected to reach C$6 billion by

2021.

Despite the massive sales figures, cannabis companies largely

conduct business in cash. With marijuana classified as a Schedule 1

drug at the federal level in the United States, the cannabis

industry is essentially unbankable there, creating an opportunity

for companies that can help industry participants process the

payments generated by cannabis sales.

The Struggle to Organize Necessary Elements of

Infrastructure

For the time being, cannabis businesses continue to struggle

with financing issues related to customer receipts and budget

expenditures, especially in the United States. While U.S. banks

have overwhelmingly refrained from doing business with cannabis

companies due to the federal prohibition on sales of the product,

in Canada some banks have begun to offer business accounts to

cannabis companies. Even when Canada does begin legalization in

mid-2018, however, there’s no guarantee its banks will be quick to

finance cannabis companies. The year is expected to be a landmark

period for cannabis-related businesses, yet there’s still a fair

amount of uncertainty about how they will fare. Global Payout,

Inc. (OTC: GOHE) is one company positioned to help alleviate

that uncertainty through a number of payment processing

services.

Payment Solutions for the “Unbankable”

Global Payout’s fintech payment solutions can be fully

customized for virtually any domestic and international

organization distributing money worldwide. Through its MoneyTrac

Technology (“MTRAC”) subsidiary, Global Payout is focused on

helping reduce the extensive security, accounting and overhead

costs dispensaries face from having to deal exclusively in cash.

The reliance on cash transactions by cannabis businesses leaves

these companies vulnerable to theft and facing all the

inconvenience associated with running a cash-only business. And the

problem is only expected to grow more acute as the rapidly growing

multibillion-dollar industry continues to expand, with cannabis now

recreationally available in eight states.

Addressing this opportunity in the company’s letter to

shareholders, Global Payout CEO James Hancock stated: “Recognizing

the gap between adequate financial technology solutions and the

rapidly expanding, multi-billion-dollar cannabis industry, a

collective decision was made in March to spinout our majority owned

subsidiary, MoneyTrac Technology to begin serving the underserved

businesses of the cannabis industry. … These partnerships, combined

with several other important developments throughout the year, have

effectively positioned MoneyTrac to generate revenue and become a

recognized leader of a variety of service and solution offerings

within the cannabis industry.”

MTRAC plans to launch its regulatory compliant token offering in

the first quarter of 2018 as part of an effective, decentralized

system for processing payments (http://cnw.fm/eoPQ3). The M-Token from MTRAC will

allow vulnerable businesses to migrate from a cash-only business

model by offering the basic yet essential services denied to them

by the traditional banking industry. In the process, the businesses

can improve their security and boost their operational

efficiency.

Vanessa Luna, CEO of MTRAC, stated, "MoneyTrac's primary

objective has been, and will continue to be, to serve the

legitimate and profitable businesses of the cannabis industry by

effectively addressing the financial technology and banking

challenges they are faced with. … Our regulatory compliant Token

Offering will revolutionize how these businesses operate and help

MTRAC further its objectives for identifying various partnerships

and cultivating the relationships necessary to pave the way for

alternative banking solutions."

Cannabis Compliance

To help it develop a strong foundation for the delivery of

banking solutions to the legal cannabis industry, MTRAC recently

signed a joint-venture agreement with Integrated Compliance

Solutions, LLC (“ICS”), a leading provider of financial regulatory

compliance services and solutions to the retail cannabis industry.

The partnership bolsters MTRAC’s ability to provide compliant

banking solutions with its strategic partners.

In the press release announcing the agreement, Luna emphasized

the importance in maintaining compliance in the heavily regulated

retail cannabis industry.

“The ICS team carries several years of valuable experience with

them in the field of regulatory compliance solutions and financial

technology services for banking, and their integration into the

banking solutions (that) we are dedicated to delivering to the

cannabis industry is not only significant, but essential to our

commitment of providing retail cannabis businesses with the most

compliant and regulated banking solution available,” she stated

(http://cnw.fm/xiq7H).

Exploring Expanded Marketing Opportunities

Global Payout also recently signed a Sales Partnership Agreement

with Eyeconic.tv in a move to explore the potential of creating new

revenue streams (http://cnw.fm/vnXs7) while boosting the impact of both

parties.

The companies plan to leverage the network of dispensaries and

industry-specific brands and products established through MTRAC’s

PotSaver publication in conjunction with Eyeconic.tv’s digital

media platform. Eyeconic.tv is an innovative producer and

distributor of interactive digital mediums focused mainly on

digital menus, advertising and kiosks to customers on their

business premises. PotSaver is a revenue-producing community

periodical and online advertising platform that provides listings

for discounted cannabis-related products to local dispensaries and

shops.

“Establishing this sales partnership with Eyeconic.tv is an

incredibly effective way to deliver more value to the solutions and

services we are providing to cannabis-related businesses. The

Eyeconic.tv team are true pioneers in the digital marketing and

advertisement space and have established themselves as the premier

provider of these services throughout the cannabis industry. I am

pleased they recognize the value we can bring to their brand

through the network of dispensaries we have created through our

PotSaver publication, as well as through the invaluable expertise

our team offers in developing and implementing successful sales and

marketing strategies. I am extremely confident that this will be a

partnership that is mutually beneficial to the objectives of each

of our companies,” Luna said.

Additional Cannabis Payment Solution-Related

Opportunities

In a sign that Canadian banks are beginning to change their

position about financing cannabis firms, Canopy Growth Corp

(CC: WEED), a diversified Canadian cannabis company that

offers curated cannabis in dried, oil and capsule form, has

recently announced a $175 million bought stock offering led by two

major Canadian investment banks — Bank of Montreal, through its BMO

Capital Markets division, and GMP Securities. Canopy Growth

operates on four continents where it sells cannabis products,

conducts R&D, and provides cannabis-related education for

healthcare practitioners.

While Canadian banks may be beginning to change their stance on

financing cannabis firms, it should be noted there are no signs of

such a thaw to the south where banks continue to avoid doing

business with cannabis firms because of federal regulations. Canopy

Growth’s extensive operations outside of Canada mean that the firm

can still benefit from payment solutions that enable it to reduce

the amount of cash transactions it conducts.

MassRoots (OTC: MSRT) offers one of the most

popular technology platforms for the regulated cannabis industry.

The company’s mobile apps, with more than a million users, enable

consumers to draw on community-sourced reviews to make educated

cannabis purchasing decisions. The company offers a compliance and

point-of-sale system called MassRoots Retail, which helps cannabis

businesses conduct retail operations more efficiently and manage

compliance reporting as required by state regulators. MassRoots has

recently formed a blockchain subsidiary focused on developing

solutions for the cannabis industry based on the blockchain. The

company believes that making use of the transparent digital ledger

that constitutes the blockchain can help the cannabis industry

operate with greater efficiency, accountability and

transparency.

iAnthus Capital Holdings (CSE: IAN) (OTC:

ITHUF) offers investors exposure to licensed cannabis

cultivators, processors and dispensaries located across the United

States. The company offers capital as well as hands-on operational

and management expertise. With seven investments in six states

covering an addressable market of approximately 50 million people,

the company’s dispensaries stand to benefit from access to

innovative payment processing and financial solutions that enable

them to more efficiently handle transactions.

Glance Technologies, Inc. (OTC: GLNNF) (GET:

CNX) owns Glance Pay, a mobile payment system transforming

the way smartphone users interact with merchants and buy products.

The company’s partially owned subsidiary, Cannapay Financial, is

the vehicle for Glance Technologies’ entry into the cannabis

industry through licensing agreements that leverage the Glance Pay

App and the Glance Merchant App’s data analytics. Cannapay

Financial has two apps in development — Cannapay, a

mobile-to-mobile payment system for the marijuana industry, and

SuperDope Delivery, a mobile ordering and delivery app for cannabis

consumers.

The tremendous growth being experienced by the cannabis

industry, coupled with the difficulty cannabis businesses are

experiencing in accessing banking services, especially in the

United States, have created significant opportunities for firms

that can offer these businesses effective methods of processing

transactions. Each of the companies listed above is positioned to

benefit from this evolving trend, making them worthy of further

investigation by investors looking to capitalize on the expansion

of the cannabis industry and the corresponding development of

payment solutions to facilitate that expansion.

For more information on Global Payout, visit Global Payout,

Inc. (GOHE)

About CannabisNewsWire

CannabisNewsWire (CNW) is an information service that provides

(1) access to our news aggregation and syndication servers, (2)

CannabisNewsBreaks that summarize corporate news and

information, (3) enhanced press release services, (4) social media

distribution and optimization services, and (5) a full array of

corporate communication solutions. As a multifaceted financial news

and content distribution company with an extensive team of

contributing journalists and writers, CNW is uniquely positioned to

best serve private and public companies that desire to reach a wide

audience of investors, consumers, journalists and the general

public. CNW has an ever-growing distribution network of more than

5,000 key syndication outlets across the country. By cutting

through the overload of information in today’s market, CNW brings

its clients unparalleled visibility, recognition and brand

awareness. CNW is where news, content and information converge.

Receive Text Alerts

from CannabisNewsWire: Text "Cannabis" to

21000

For more information please visit https://www.CannabisNewsWire.com and or https://CannabisNewsWire.News

Please see full terms of use and disclaimers on the

CannabisNewsWire website applicable to all content provided by CNW,

wherever published or re-published: http://CNW.fm/Disclaimer

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

DISCLAIMER: CannabisNewsWire (CNW) is the source of the Article

and content set forth above. References to any issuer other than

the profiled issuer are intended solely to identify industry

participants and do not constitute an endorsement of any issuer and

do not constitute a comparison to the profiled issuer. The

commentary, views and opinions expressed in this release by CNW are

solely those of CNW. Readers of this Article and content agree that

they cannot and will not seek to hold liable CNW for any investment

decisions by their readers or subscribers. CNW is a news

dissemination and financial marketing solutions provider and is NOT

registered broker-dealers/analysts/investment advisers, hold no

investment licenses and may NOT sell, offer to sell or offer to buy

any security.

The Article and content related to the profiled company

represent the personal and subjective views of the Author, and are

subject to change at any time without notice. The information

provided in the Article and the content has been obtained from

sources which the Author believes to be reliable. However, the

Author has not independently verified or otherwise investigated all

such information. None of the Author, CNW, or any of their

respective affiliates, guarantee the accuracy or completeness of

any such information. This Article and content are not, and should

not be regarded as investment advice or as a recommendation

regarding any particular security or course of action; readers are

strongly urged to speak with their own investment advisor and

review all of the profiled issuer’s filings made with the

Securities and Exchange Commission before making any investment

decisions and should understand the risks associated with an

investment in the profiled issuer’s securities, including, but not

limited to, the complete loss of your investment.

CNW HOLDS NO SHARES OF ANY COMPANY NAMED IN THIS RELEASE.

This release contains “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E the Securities Exchange Act of 1934, as amended and

such forward-looking statements are made pursuant to the safe

harbor provisions of the Private Securities Litigation Reform Act

of 1995. “Forward-looking statements” describe future expectations,

plans, results, or strategies and are generally preceded by words

such as “may”, “future”, “plan” or “planned”, “will” or “should”,

“expected,” “anticipates”, “draft”, “eventually” or “projected”.

You are cautioned that such statements are subject to a multitude

of risks and uncertainties that could cause future circumstances,

events, or results to differ materially from those projected in the

forward-looking statements, including the risks that actual results

may differ materially from those projected in the forward-looking

statements as a result of various factors, and other risks

identified in a company’s annual report on Form 10-K or 10-KSB and

other filings made by such company with the Securities and Exchange

Commission. You should consider these factors in evaluating the

forward-looking statements included herein, and not place undue

reliance on such statements. The forward-looking statements in this

release are made as of the date hereof and CNW undertakes no

obligation to update such statements.

Source:

CannabisNewsWire

Contact:

CannabisNewsWire (CNW)

Denver, Colorado

www.CannabisNewsWire.com

303.498.7722 Office

Editor@CannabisNewsWire.net

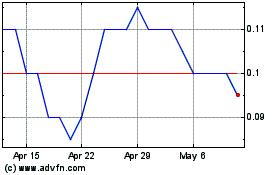

GameOn Entertainment Tec... (CSE:GET)

Historical Stock Chart

From Nov 2024 to Dec 2024

GameOn Entertainment Tec... (CSE:GET)

Historical Stock Chart

From Dec 2023 to Dec 2024