Flow Capital Corp. (TSXV: FW) (“Flow Capital” or the "Company") is

pleased to announce the appointment of Gaurav Singh as Chief

Financial Officer of the Company, effective April 1, 2020. Gaurav

succeeds Donnacha Rahill, who held the role since 2014 and has left

the Company to pursue other opportunities.

Gaurav, most recently Chief Financial Officer

and a continuing Director at GreenBank Capital Inc. (CSE:GBC |

OTCMKTS: GRNBF | FRA:2TL), brings over 15 years of experience

including several board and executive positions across a portfolio

of small-cap Canadian public and private companies. He has

undertaken leadership roles in corporate finance, strategy,

trade-policy advocacy, and start-up operations across the

Technology, Media, Mineral Resources, and Professional Services

sectors, in India, Europe, and North America. He holds an MSc. in

Finance from London Business School, U.K., and a Bachelor of

Commerce from Delhi University, India.

“We are excited to have Gaurav joining our team.

He brings a mix of entrepreneurial skills and business experience

that will help us, and our investee companies grow,” said Alex

Baluta, CEO of Flow Capital. “Donnacha has made significant

contributions to our business. I would like to thank him for his

hard work and dedication and wish him every success in the

future.”

COVID-19 Impact Assessment

Flow Capital is closely monitoring the evolving

COVID-19 developments and has established a regular cadence of

gathering updates from investee companies. All portfolio companies

have confirmed that their resources have safely transitioned to

remote-enabled operating models where possible. Only one company

has temporarily quarantined its operating facilities, for two

weeks, as a precautionary measure.

Impact on demand at portfolio companies has been

mixed. Several companies have cautioned that some of their clients

are slowing fulfillment cycles and delaying new purchases. However,

they believe it may be early to make a meaningful assessment of the

impact on revenues. One company has seen a delay in order delivery

capability primarily due to short term supply chain disruptions in

Asia.

Conversely, investee companies in fields related

to essential services (e.g. healthcare) and communications

infrastructure, or others that offer services and software rather

than physical product, are observing stable or even slightly

increasing demand.

Flow Capital has a strong balance sheet and

capital available to support our portfolio companies should they

require financial support during these uncertain times. Flow

Capital is also actively encouraging all portfolio companies to

consider availing themselves of the government sponsored support

programs that are now becoming available.

Other Business Updates

Flow Capital has received the final C$1.5M

payment relating to the sale of its LOGiQ Global Partners (“LOGiQ”)

business to Ninepoint Financial Group Inc. The LOGiQ division was

sold in April 2019 for a total consideration of $12.4M.

In addition, the Company continues to work to

recover assets from non-performing past transactions wherever

possible. In recent weeks, Flow Capital obtained default judgements

on Lattice Biologics and Compression Generation. The Company is

evaluating the options available as a result of these judgements.

Flow will continue to pursue all avenues, including legal remedies

if necessary, towards ensuring a fair return on all its

investments.

“The team at Flow Capital will continue to

monitor our portfolio companies and help them where we can. Flow

Capital is in an enviable position with a strong balance sheet,

with total cash on hand of more than C$10M. Nevertheless, we have

plans in place to control costs and reduce expenses should that be

necessary,” said Mr. Baluta. “While we will be deploying our

capital cautiously, we are seeing an increase in opportunities from

good prospects partially because the equity markets are being

substantially disrupted due to COVID-19.”

About Flow

Capital

Flow Capital Corp. is a diversified alternative

asset investor and advisor, specializing in providing minimally

dilutive capital to emerging growth businesses. To apply for

financing, visit www.flowcap.com.

For further information, please contact:

Flow Capital Corp.

Alex Baluta Chief Executive

Officeralex@flowcap.com 1 Adelaide Street East, Suite 3002,PO

Box 171,Toronto, Ontario M5C 2V9

Forward-Looking Information and

Statements

This press release contains certain

“forward-looking information” within the meaning of applicable

Canadian securities legislation and may also contain statements

that may constitute “forward-looking statements” within the meaning

of the safe harbor provisions of the U.S. Private Securities

Litigation Reform Act of 1995. Such forward-looking information and

forward-looking statements are not representative of historical

facts or information or current condition, but instead represent

only the Company’s beliefs regarding future events, plans or

objectives, many of which, by their nature, are inherently

uncertain and outside of the Company’s control. Generally, such

forward-looking information or forward-looking statements can be

identified by the use of forward-looking terminology such as

“plans”, “expects” or “does not expect”, “is expected”, “budget”,

“scheduled”, “estimates”, “forecasts”, “intends”, “anticipates” or

“does not anticipate”, or “believes”, or variations of such words

and phrases or may contain statements that certain actions, events

or results “may”, “could”, “would”, “might” or “will be taken”,

“will continue”, “will occur” or “will be achieved”. The

forward-looking information contained herein may include, but is

not limited to, the impact COVID-19 will have on the Company's

portfolio companies and the assessment of the recovery of assets

from non-performing past transactions.

An investment in securities of the Company is

speculative and subject to a number of risks including, without

limitation, risks relating to: the need for additional financing;

the relative speculative and illiquid nature of an investment in

the Company; the volatility of the Company’s share price; the

Company's ability to generate sufficient revenues; the Company's

ability to manage future growth; the limited diversification in the

Company's existing investments; the Company's ability to negotiate

additional royalty purchases from new investee companies; the

Company's dependence on the operations, assets and financial health

of its investee companies; the Company's limited ability to

exercise control or direction over investee companies; potential

defaults by investee companies and the unsecured nature of the

Company's investments; the Company's ability to enforce on any

default by an investee company; competition with other investment

entities; tax matters, including the potential impact of the

Foreign Account Tax Compliance Act on the Company; the potential

impact of the Company being classified as a Passive Foreign

Investment Company; the Company's ability to pay dividends in the

future and the timing and amount of those dividends; reliance on

key personnel, particularly the Company's founders; dilution of

shareholders’ interest through future financings; and general

economic and political conditions; as well as the risks discussed

in the Company's public filings. Although the Company has attempted

to identify important factors that could cause actual results to

differ materially from those contained in the forward-looking

information and forward-looking statements, there may be other

factors that cause results not to be as anticipated, estimated or

intended.

In connection with the forward-looking

information and forward-looking statements contained in this press

release, the Company has made certain assumptions. Assumptions

about the performance of the Canadian and U.S. economies over the

next 24 months and how that will affect the Company's business and

its ability to identify and close new opportunities with new

investees are material factors that the Company considered when

setting its strategic priorities and objectives, and its outlook

for its business.

Key assumptions include, but are not limited to:

assumptions that the Canadian and U.S. economies relevant to the

Company’s investment focus will remain relatively stable over the

next 12 to 24 months; that interest rates will not increase

dramatically over the next 12 to 24 months; that the Company's

existing investees will continue to make royalty payments to the

Company as and when required; that the businesses of the Company's

investees will not experience material negative results; that the

Company will be able to successfully integrate and grow the

businesses of its predecessor companies; that the Company will

continue to grow its portfolio in a manner similar to what has

already been established; that tax rates and tax laws will not

change significantly in Canada and the U.S.; that more small to

medium private and public companies will continue to require access

to alternative sources of capital; that the Company will have the

ability to raise required equity and/or debt financing on

acceptable terms; and that the Company will have sufficient free

cash flow to pay dividends. The Company has also assumed that

access to the capital markets will remain relatively stable, that

the capital markets will perform with normal levels of volatility

and that the Canadian dollar will not have a high amount of

volatility relative to the U.S. dollar. In determining expectations

for economic growth, the Company primarily considers historical

economic data provided by the Canadian and U.S. governments and

their agencies. Although the Company believes that the assumptions

and factors used in preparing, and the expectations contained in,

the forward-looking information and statements are reasonable,

undue reliance should not be placed on such information and

statements, and no assurance or guarantee can be given that such

forward-looking information and statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such information and

statements.

The forward-looking information and

forward-looking statements contained in this press release are made

as of the date of this press release. All subsequent written and

oral forward- looking information and statements attributable to

the Company or persons acting on its behalf is expressly qualified

in its entirety by this notice.

Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in the policies of the

TSX Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

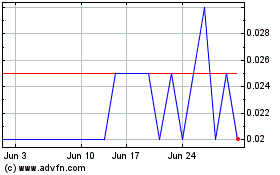

GreenBank Capital (CSE:GBC)

Historical Stock Chart

From Nov 2024 to Dec 2024

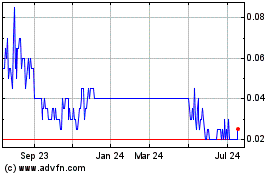

GreenBank Capital (CSE:GBC)

Historical Stock Chart

From Dec 2023 to Dec 2024